Unicoin Markets 2025 Review: Everything You Need to Know

Executive Summary

This unicoin markets review presents a comprehensive analysis of a broker that raises significant concerns within the forex trading community. Unicoin Markets was established in 2020 and has its headquarters in Malaysia. The company operates under the Labuan Financial Services Authority with license number MB/21/0068. However, multiple sources indicate this broker has been flagged as a suspicious clone, which severely undermines its credibility and reliability.

The broker offers multiple trading account types with a minimum deposit requirement of $100. It targets traders seeking high leverage and diverse asset classes. Unicoin Markets provides access to forex, indices, stocks, precious metals, base metals, energy products, and agricultural commodities with leverage up to 1:100. Despite these seemingly attractive features, the overwhelming consensus from industry analysts and user feedback suggests this platform operates as a typical scam. The platform lacks proper customer support, transparency, and trustworthy business practices.

According to available reports, users consistently report poor customer service experiences. They also report inadequate problem resolution capabilities and questionable business practices that align with fraudulent operations. The broker's classification as a suspicious clone by regulatory watchers significantly impacts its trustworthiness rating. This makes it unsuitable for most traders, particularly beginners seeking reliable trading environments.

Important Disclaimers

This review is based on publicly available information and user reports gathered from various sources as of 2025. Readers should note that regulatory standards and broker operations may vary significantly across different jurisdictions and regions. The information presented here reflects the current understanding of Unicoin Markets' operations under the Labuan Financial Services Authority jurisdiction.

This assessment has not involved direct testing or first-hand experience with the platform. All evaluations are derived from available documentation, user feedback, regulatory information, and industry reports. Potential traders are strongly advised to conduct their own due diligence and consult with financial advisors before engaging with any broker. This is particularly important for those flagged with regulatory concerns or negative industry reputation.

Rating Framework

Broker Overview

Unicoin Markets entered the forex brokerage market in 2020. It positions itself as a Malaysia-based trading platform offering access to multiple financial markets. The company operates under a business model that emphasizes diverse trading account types and claims to cater to traders seeking exposure to various asset classes including traditional forex pairs, commodities, and equity indices.

Despite its relatively recent establishment, the broker has quickly gained attention within the trading community, though unfortunately for predominantly negative reasons. The platform's operational framework appears designed to attract traders with competitive minimum deposit requirements and high leverage offerings. These are typical characteristics that appeal to retail forex traders seeking accessible entry points into financial markets.

The broker's regulatory status under the Labuan Financial Services Authority presents a complex picture. While LFSA provides some level of oversight, the jurisdiction's regulatory framework is generally considered less stringent compared to major financial centers like the UK's FCA or Cyprus's CySEC. More concerning, however, are the widespread reports identifying Unicoin Markets as a suspicious clone operation. This suggests potential fraudulent activities that significantly undermine any regulatory legitimacy the platform might claim.

According to available information, Unicoin Markets offers trading across multiple asset categories. These include forex currency pairs, stock indices, individual equity securities, precious metals such as gold and silver, base metals, energy commodities, and agricultural products. This diverse offering, while appearing attractive on paper, lacks the detailed specifications and transparent pricing structures typically expected from legitimate brokerage operations.

Regulatory Jurisdiction: Unicoin Markets operates under the Labuan Financial Services Authority with license number MB/21/0068. However, this regulatory status is overshadowed by widespread industry reports classifying the broker as a suspicious clone operation.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available sources. This represents a significant transparency gap that raises additional concerns about the platform's operational legitimacy.

Minimum Deposit Requirements: The broker sets its minimum deposit threshold at $100. This positions it as accessible to entry-level traders and those with limited initial capital.

Promotional Offers: Available sources do not provide specific information about bonus promotions or incentive programs offered by Unicoin Markets. This suggests either limited marketing initiatives or inadequate disclosure of terms and conditions.

Available Trading Assets: The platform offers access to forex currency pairs, stock indices, individual stocks, precious metals including gold and silver, base metals, energy products such as crude oil and natural gas, and agricultural commodities. This provides a seemingly comprehensive range of trading opportunities.

Cost Structure and Fees: Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current sources. This represents another significant transparency concern for potential traders.

Leverage Options: Maximum leverage is advertised as 1:100. This falls within reasonable ranges for retail forex trading but may vary depending on asset class and account type.

Trading Platform Options: Specific information about trading platforms, whether proprietary or third-party solutions like MetaTrader, is not detailed in available sources. This indicates insufficient technical transparency.

Geographic Restrictions: Current sources do not specify particular geographic limitations or restricted jurisdictions for the broker's services.

Customer Support Languages: Information regarding supported languages for customer service is not detailed in available materials. This further highlights communication and support concerns.

This unicoin markets review reveals significant information gaps that legitimate brokers typically address transparently. These gaps contribute to overall reliability concerns.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Unicoin Markets' account structure presents a mixed picture with significant information gaps that impact overall assessment. The broker advertises multiple trading account types, though specific details about tier differences, features, and benefits remain unclear in available documentation. This lack of transparency immediately raises concerns about the platform's commitment to clear communication with potential clients.

The minimum deposit requirement of $100 appears competitive and accessible for entry-level traders. It potentially attracts those with limited initial capital. However, this low threshold, while appearing beneficial, often characterizes brokers targeting inexperienced traders who may be more susceptible to questionable business practices. Legitimate brokers typically provide comprehensive account comparison charts, detailed feature explanations, and clear progression paths between account tiers.

Available sources do not provide information about the account opening process, required documentation, verification procedures, or timeframes for account activation. This absence of procedural transparency represents a significant red flag. Reputable brokers typically maintain detailed, publicly available information about onboarding requirements and processes.

Special account features such as Islamic accounts, professional trader classifications, or institutional offerings are not mentioned in current sources. The lack of diverse account options suggests either limited service offerings or inadequate disclosure of available features. Both are concerning for potential clients seeking specific trading arrangements.

User feedback regarding account conditions consistently highlights dissatisfaction with transparency and available choices. This reinforces concerns about the broker's commitment to serving diverse trader needs effectively.

The trading tools and resources offered by Unicoin Markets represent one of the most significant weaknesses in the platform's overall proposition. Available sources provide virtually no specific information about trading tools, analytical resources, or educational materials. This suggests either extremely limited offerings or concerning lack of transparency about platform capabilities.

Professional forex trading typically requires access to advanced charting tools, technical indicators, economic calendars, market analysis, and real-time news feeds. The absence of detailed information about these essential trading resources raises serious questions about the platform's ability to support serious trading activities. Legitimate brokers typically showcase their analytical tools, research capabilities, and educational resources prominently as key differentiators.

Market research and analysis support, crucial for informed trading decisions, appears to be either non-existent or inadequately disclosed. Professional traders rely on fundamental analysis, technical research, and market commentary to make informed decisions. The lack of information about research teams, analytical reports, or market insights suggests significant deficiencies in this critical area.

Educational resources for developing trading skills and knowledge are not mentioned in available sources. Reputable brokers typically invest heavily in trader education through webinars, tutorials, market analysis, and educational articles. The absence of such resources indicates either minimal commitment to trader development or inadequate disclosure of available educational support.

Automated trading support, including expert advisor compatibility, algorithmic trading tools, or copy trading features, is not addressed in current documentation. Modern forex trading increasingly relies on automated solutions. The lack of information about such capabilities suggests platform limitations that could significantly impact trading effectiveness.

Customer Service and Support Analysis (Score: 2/10)

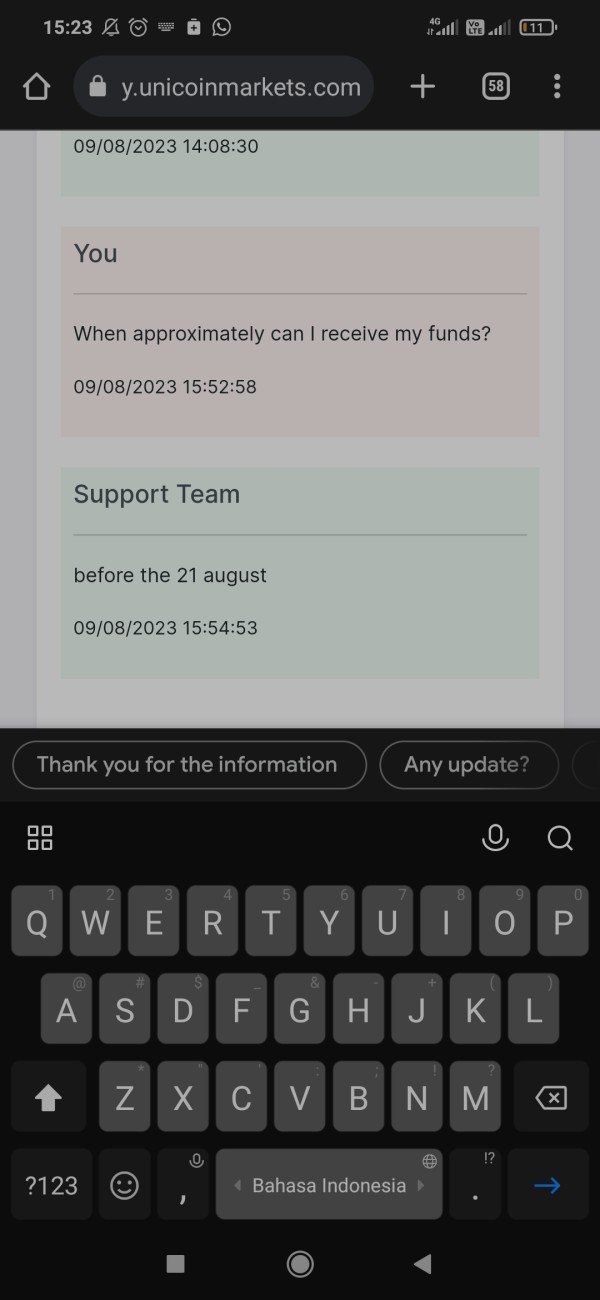

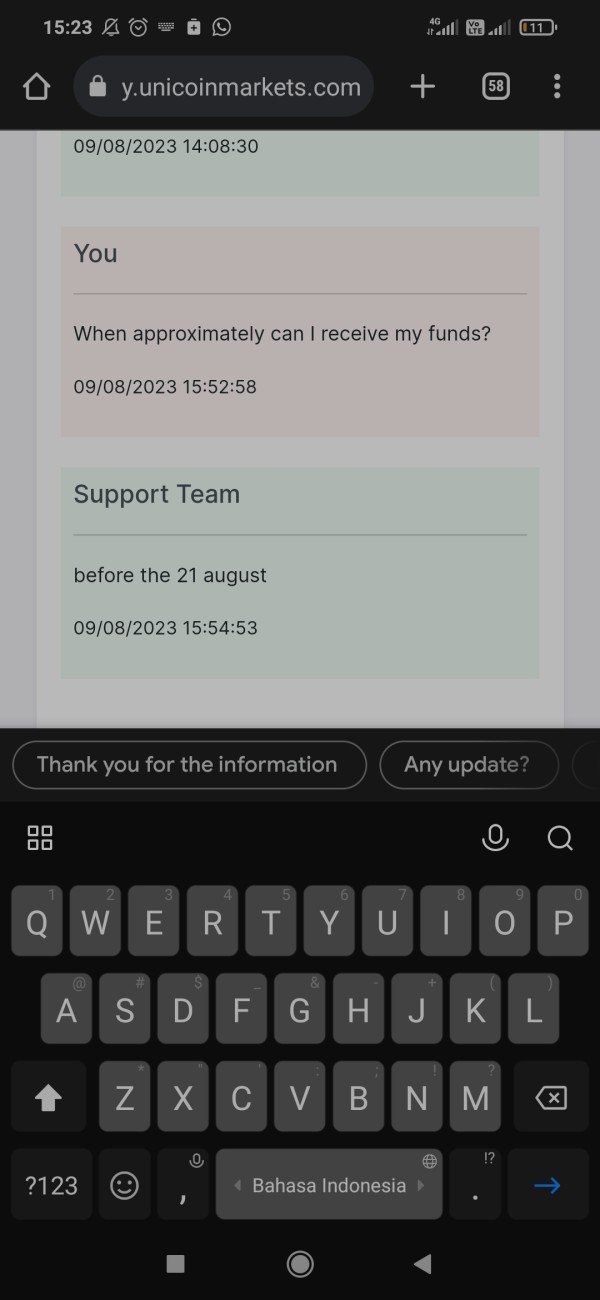

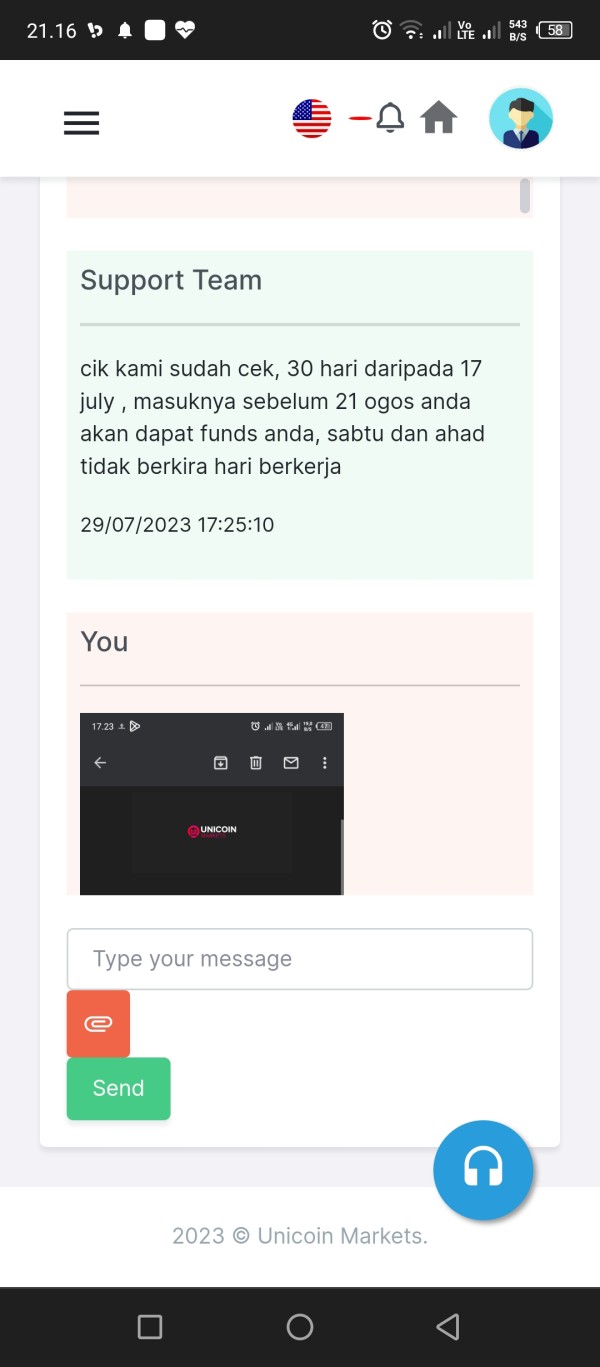

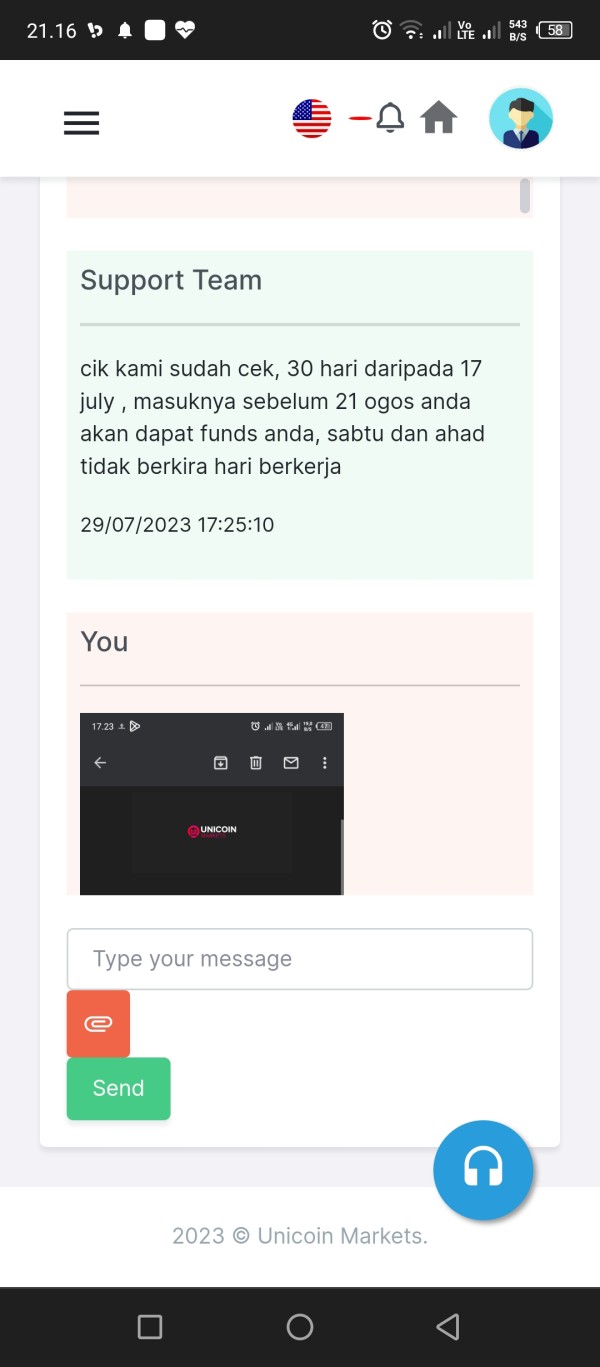

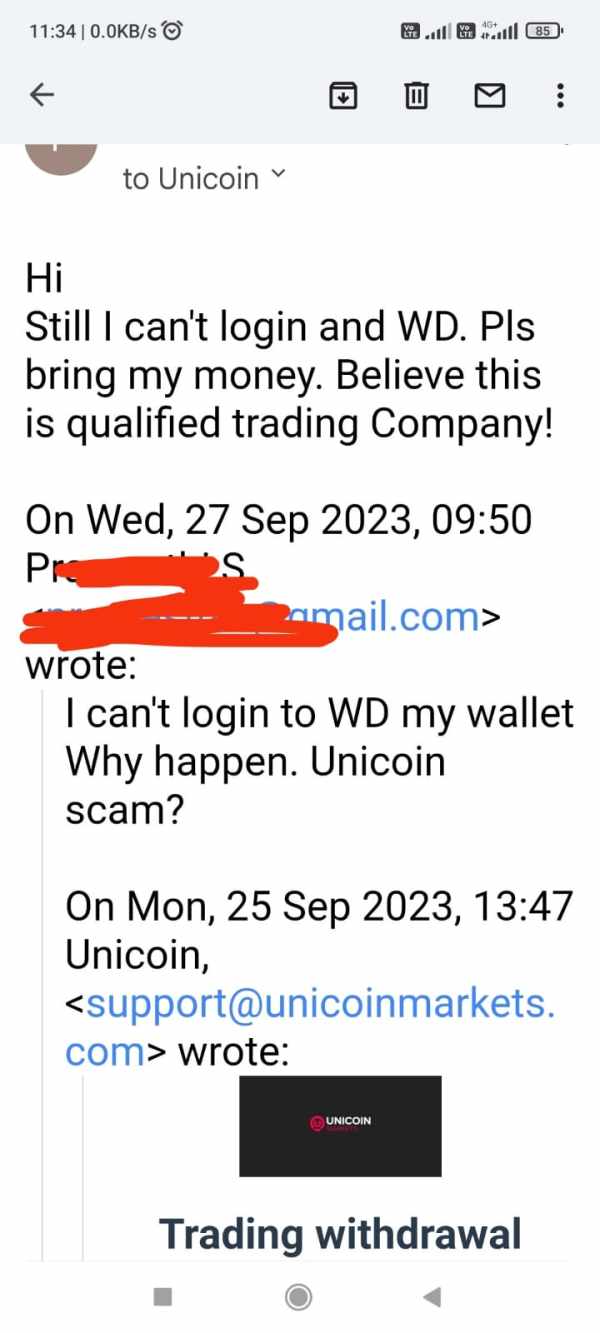

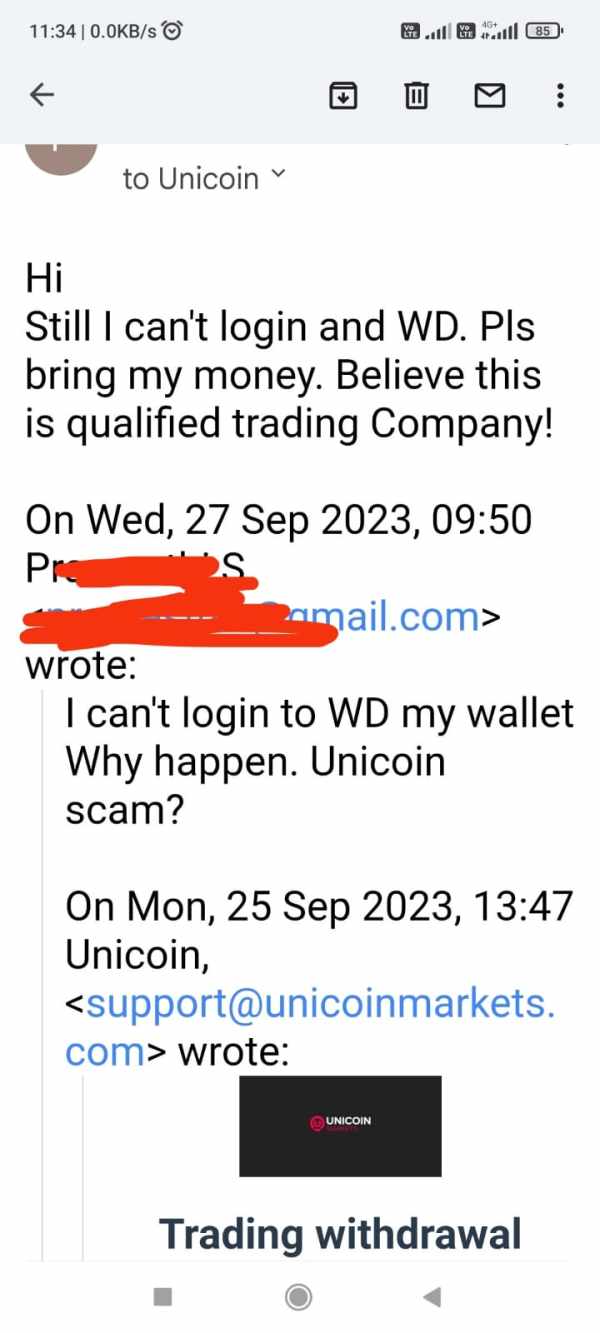

Customer service represents perhaps the most critically deficient aspect of Unicoin Markets' operations. Available reports show consistently negative user feedback highlighting inadequate support quality and responsiveness. Users experience significant difficulties obtaining timely, professional assistance when encountering problems or requiring account support.

Specific information about customer service channels, including phone support, live chat availability, email response systems, or ticket-based support, is not detailed in available sources. This lack of transparency about support accessibility immediately raises concerns about the broker's commitment to customer assistance and problem resolution.

Response times, according to user feedback, are consistently described as slow and inadequate. Professional forex trading often requires immediate support for technical issues, account problems, or trading-related questions. Delayed responses can result in significant financial losses, making responsive customer support essential for legitimate brokerage operations.

Service quality feedback consistently indicates poor professionalism, limited problem-solving capabilities, and inadequate knowledge among support staff. Users report frustrating experiences attempting to resolve account issues, withdrawal problems, or technical difficulties. This pattern of poor service quality aligns with characteristics typically associated with fraudulent operations.

Multilingual support capabilities are not specified in available documentation. This potentially limits accessibility for international traders. Professional brokers typically maintain support teams capable of assisting clients in multiple languages, particularly when operating across diverse geographic markets.

Customer service hours and availability are not clearly disclosed, representing another transparency gap that impacts user confidence. Legitimate brokers typically provide clear information about support availability. This includes weekend and holiday coverage for global trading activities.

Trading Experience Analysis (Score: 4/10)

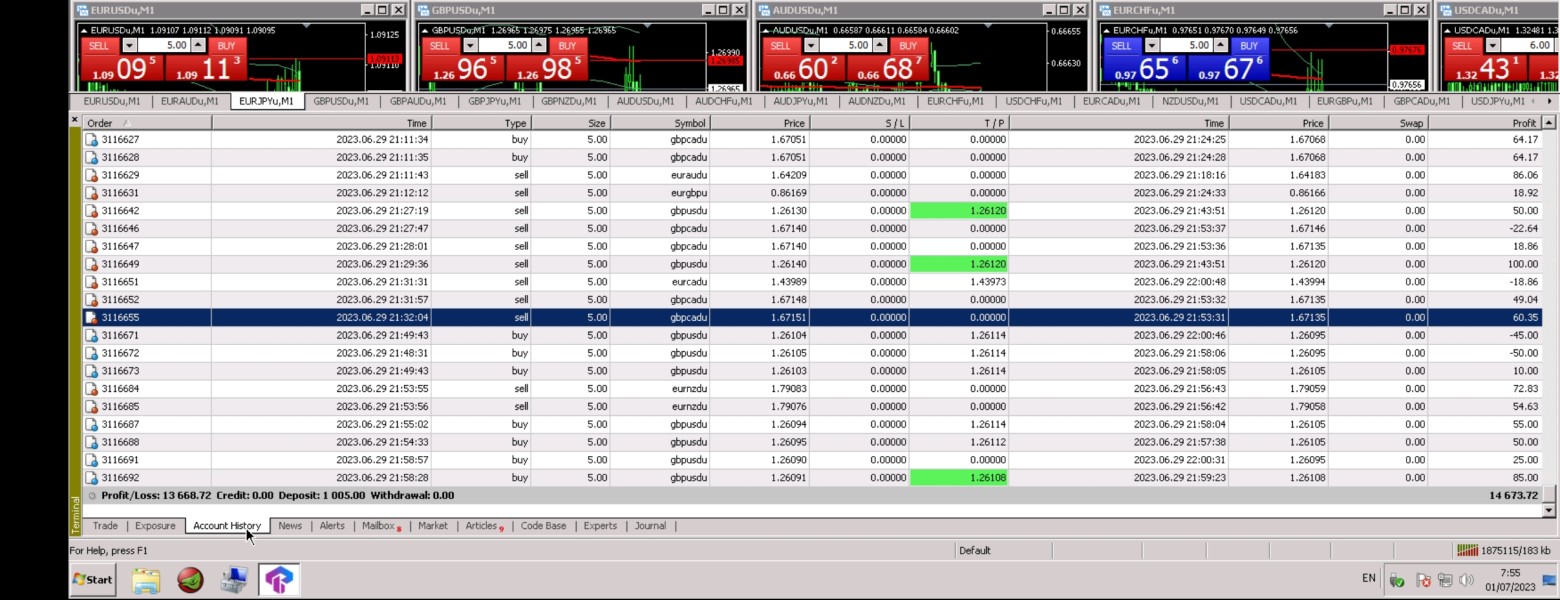

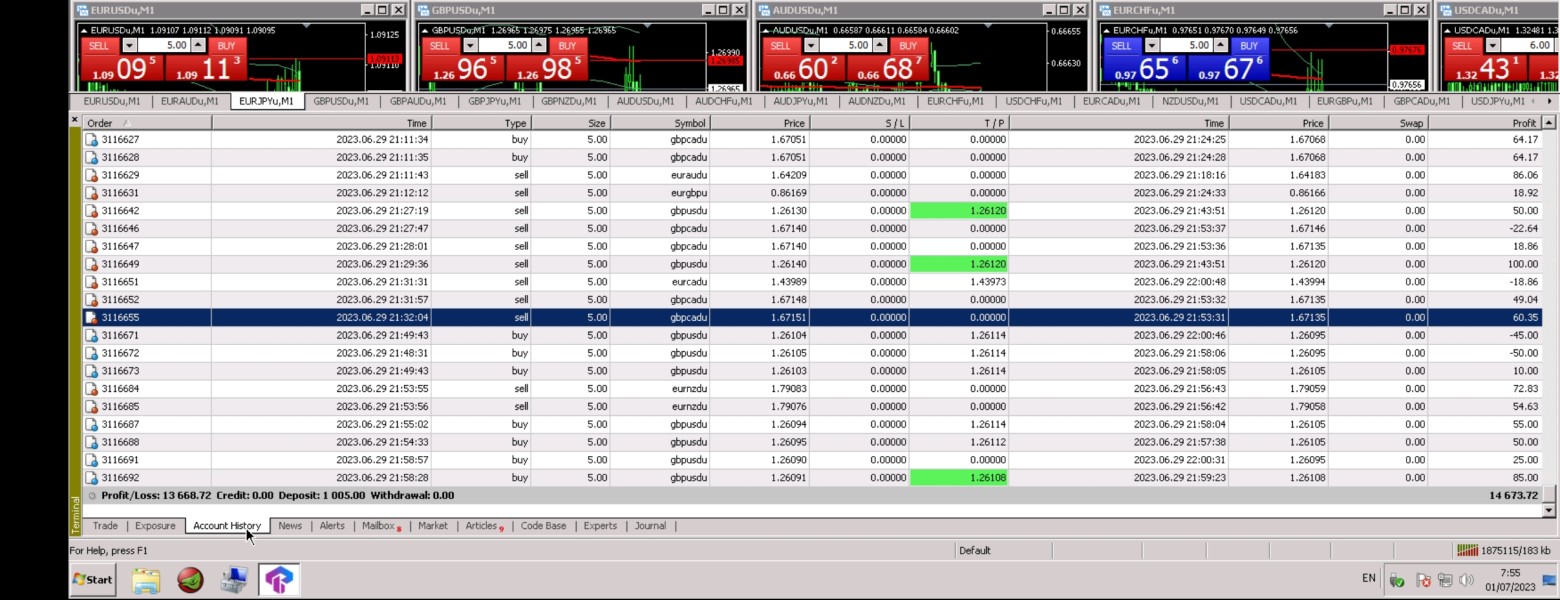

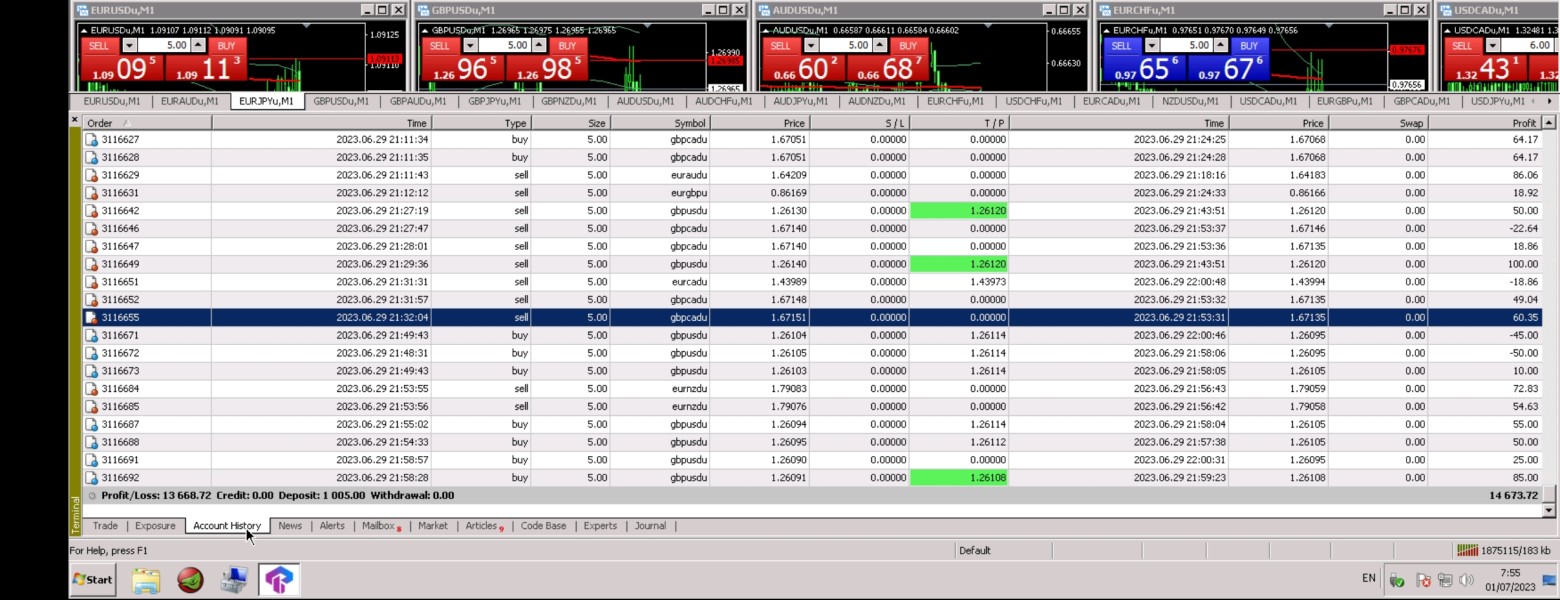

The trading experience offered by Unicoin Markets suffers from significant information gaps and concerning user feedback. These factors undermine confidence in platform performance and reliability. Available sources provide insufficient detail about platform stability, execution quality, or technical performance characteristics essential for professional trading activities.

Platform stability and execution speed, critical factors for successful forex trading, are not adequately documented in available sources. User feedback suggests potential issues with platform reliability, though specific technical performance data is not available. Professional trading requires consistent platform availability and rapid order execution, particularly during volatile market conditions.

Order execution quality, including information about slippage rates, requote frequency, and execution speeds, is not detailed in current documentation. These factors significantly impact trading profitability and user satisfaction. Legitimate brokers typically provide transparent execution statistics and performance data to demonstrate platform reliability and fair execution practices.

Platform functionality and feature completeness cannot be adequately assessed due to insufficient information about specific trading platforms used by Unicoin Markets. Whether the broker offers proprietary platforms, established solutions like MetaTrader, or web-based trading interfaces remains unclear. This makes it difficult to evaluate trading capabilities.

Mobile trading experience, increasingly important for modern forex traders, is not addressed in available sources. Professional traders require reliable mobile access for monitoring positions, executing trades, and managing accounts while away from desktop platforms. The absence of mobile trading information suggests potential limitations in platform accessibility.

Trading environment characteristics, including spread stability, liquidity provision, and market depth, lack adequate documentation. These factors significantly impact trading costs and execution quality. Their absence from available information is concerning for potential users considering this unicoin markets review.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most critically compromised aspects of Unicoin Markets' operations. Multiple sources identify the broker as a suspicious clone operation potentially engaged in fraudulent activities. This classification fundamentally undermines any credibility the platform might otherwise claim through regulatory registration or service offerings.

The broker's regulatory status under the Labuan Financial Services Authority, while providing some technical oversight, is significantly overshadowed by widespread industry reports. These reports flag Unicoin Markets as a suspicious clone. This designation suggests the broker may be impersonating legitimate financial institutions or operating under false pretenses, representing extreme risks for potential clients.

Client fund security measures, essential for legitimate brokerage operations, are not detailed in available sources. Professional brokers typically maintain segregated client accounts, provide deposit insurance, and implement robust security protocols to protect client funds. The absence of such information, combined with fraud allegations, raises serious concerns about fund safety.

Company transparency regarding ownership, management, operational procedures, and business practices appears severely limited. Legitimate brokers typically provide comprehensive information about company leadership, business history, and operational transparency. The lack of such disclosure aligns with patterns typically associated with fraudulent operations.

Industry reputation and recognition are predominantly negative. Multiple sources warn potential traders about the risks associated with Unicoin Markets. The absence of positive industry recognition, awards, or professional endorsements further reinforces concerns about the platform's legitimacy and operational integrity.

Negative event handling and crisis management capabilities cannot be assessed due to the broker's classification as a suspicious operation. However, the widespread negative feedback and fraud allegations suggest significant deficiencies in addressing client concerns and maintaining operational integrity.

User Experience Analysis (Score: 2/10)

User experience with Unicoin Markets consistently receives negative feedback across multiple evaluation criteria. There are widespread reports characterizing the platform as a typical scam operation unsuitable for legitimate trading activities. Overall user satisfaction appears extremely low, with multiple sources recommending traders avoid the platform entirely.

Interface design and platform usability cannot be adequately assessed due to insufficient information about specific trading platforms and user interfaces. However, user feedback suggests significant deficiencies in platform functionality and ease of use. Professional trading platforms require intuitive design, comprehensive functionality, and reliable performance characteristics.

Registration and account verification processes are not detailed in available sources. This represents transparency gaps that impact user confidence. Legitimate brokers typically provide clear information about account opening procedures, required documentation, and verification timeframes. The absence of such information raises concerns about operational transparency.

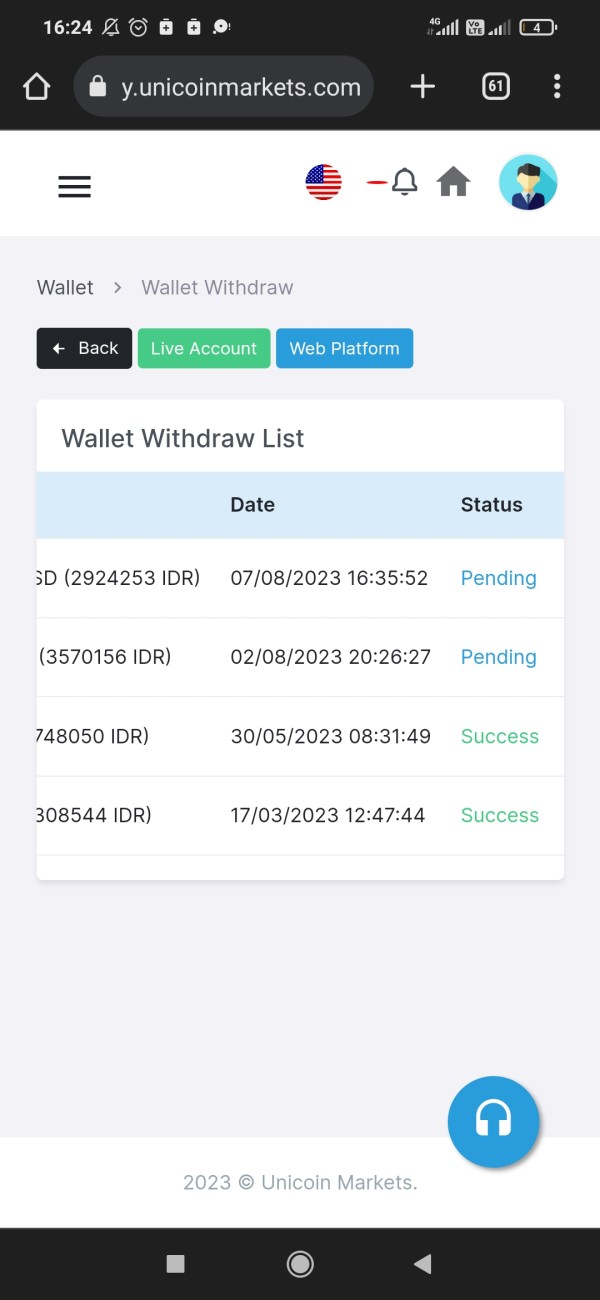

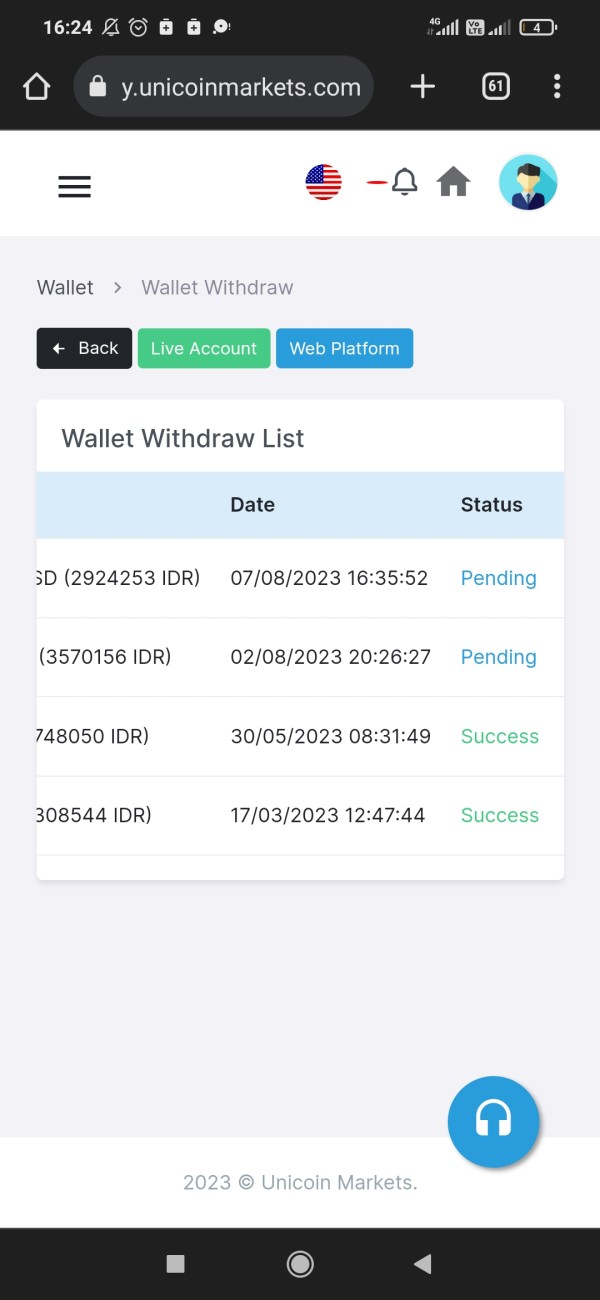

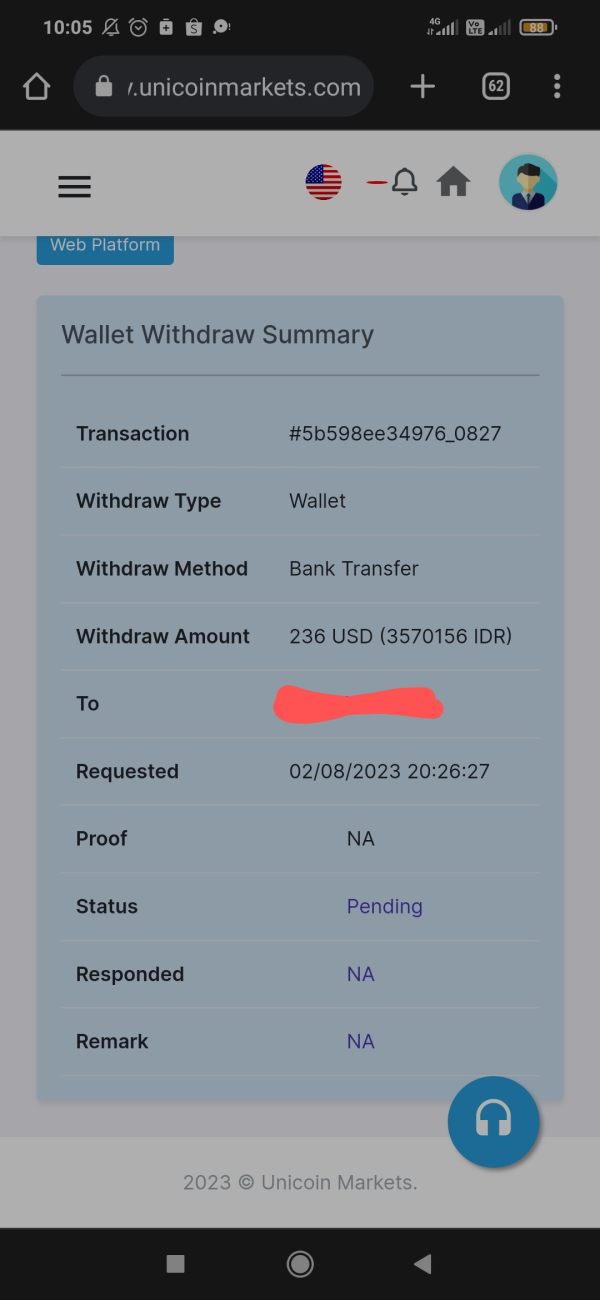

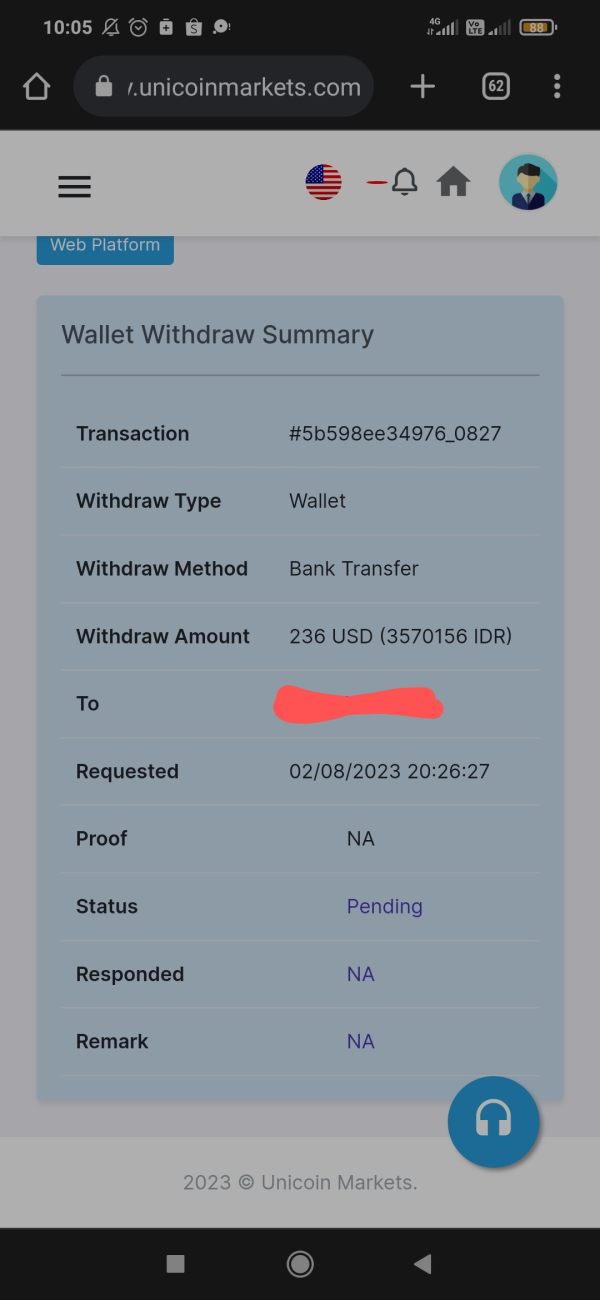

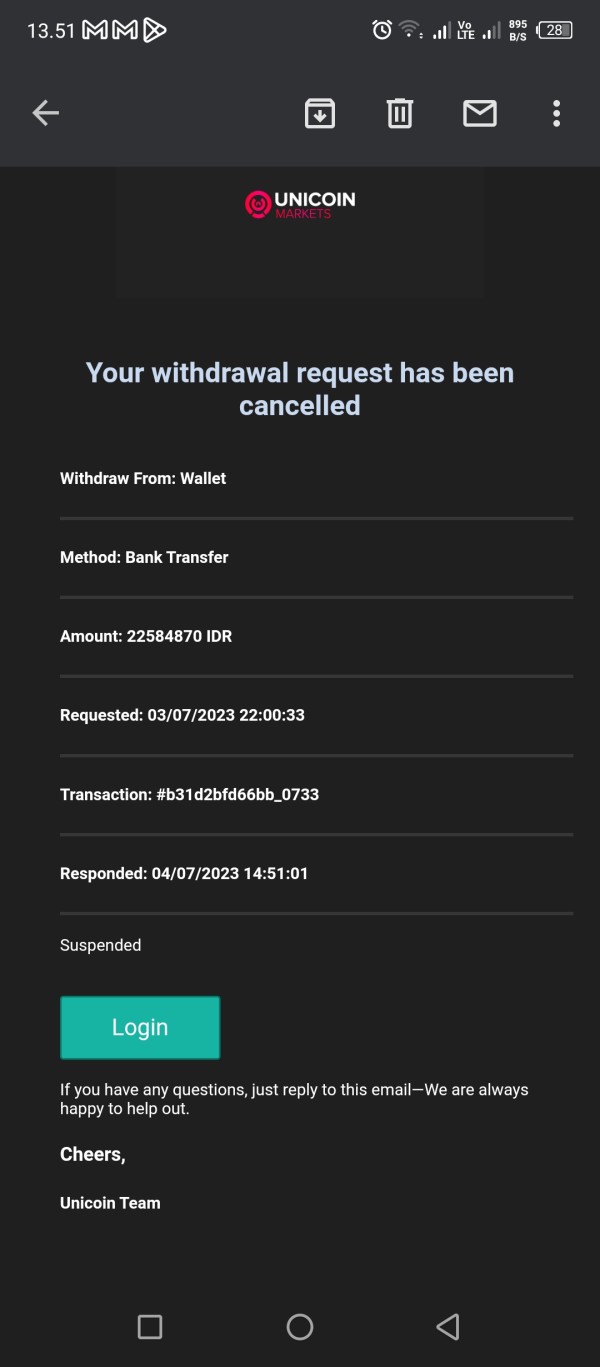

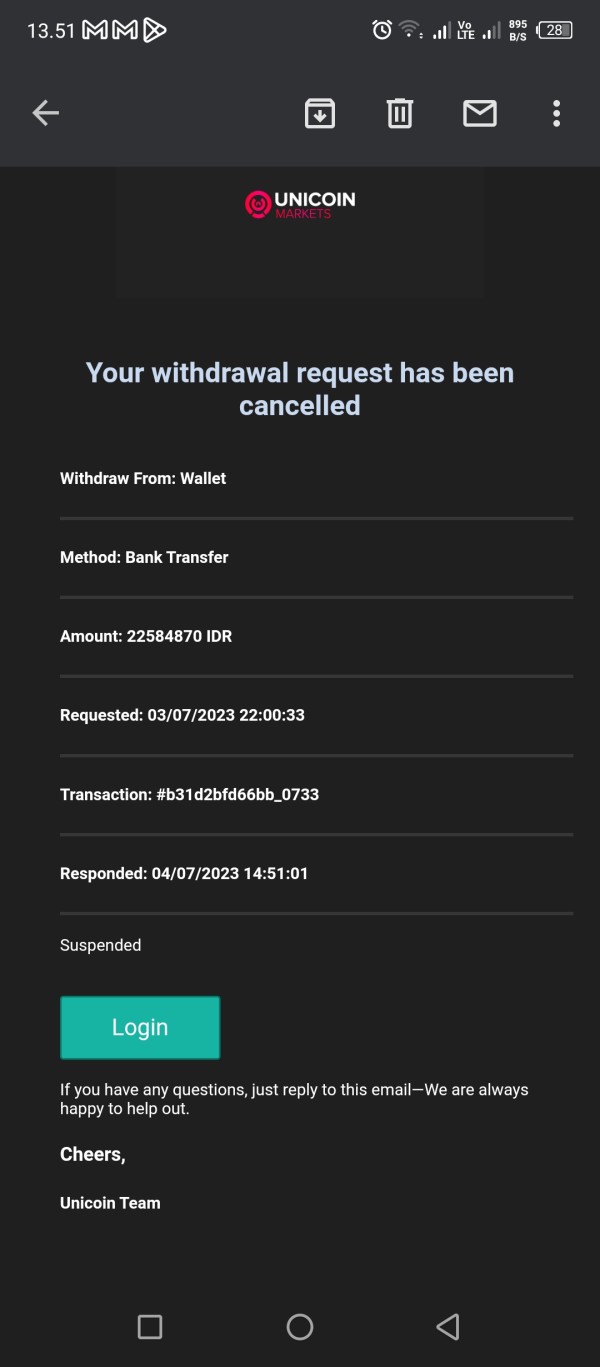

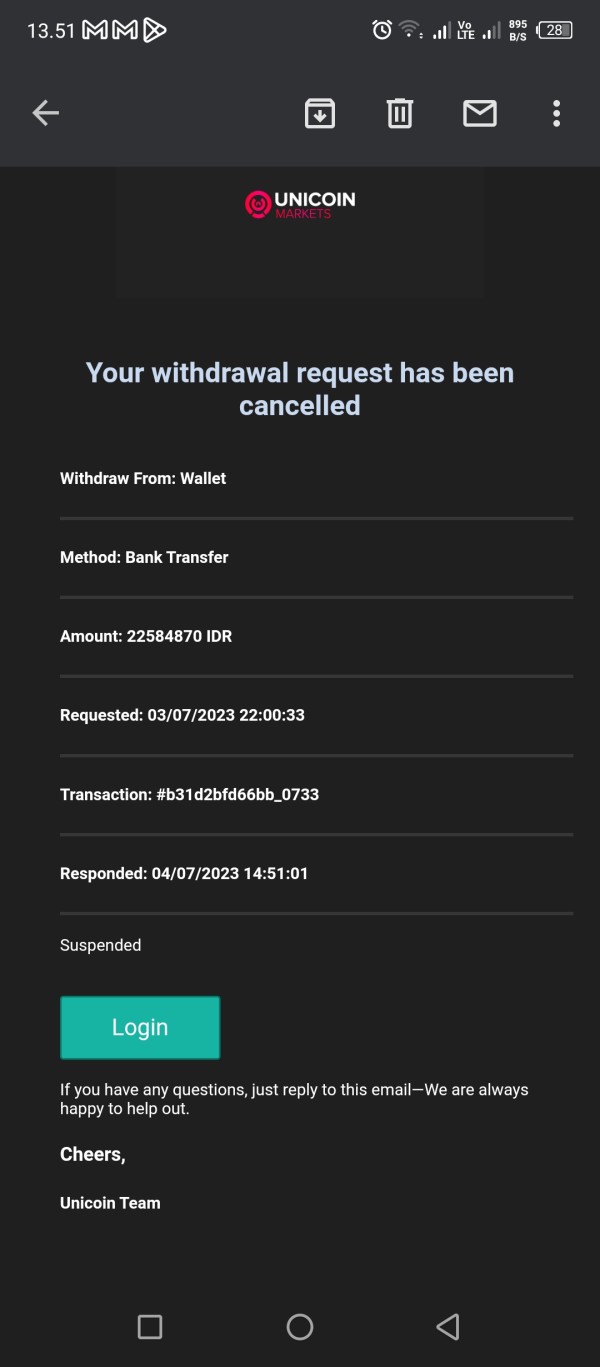

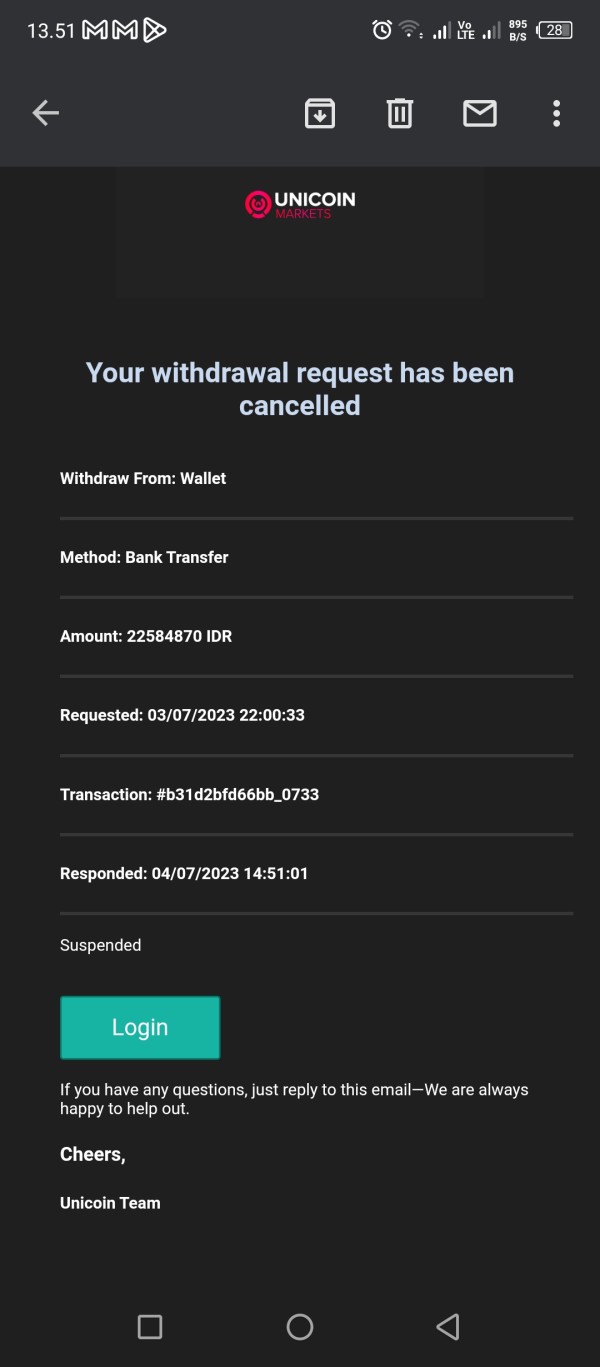

Fund management experience, including deposit and withdrawal procedures, processing times, and associated fees, receives negative feedback from users. They report difficulties accessing funds and poor communication about financial transactions. These issues represent significant red flags typically associated with fraudulent operations.

Common user complaints consistently focus on poor customer support, platform reliability issues, difficulty withdrawing funds, and lack of transparency in business operations. This pattern of negative feedback aligns with characteristics typically associated with scam operations rather than legitimate brokerage services.

User demographic analysis suggests the platform is unsuitable for traders of all experience levels. It is particularly dangerous for beginners who may be more susceptible to fraudulent schemes. Professional traders typically avoid platforms with such negative reputations and regulatory concerns.

The overwhelming consensus from user feedback and industry analysis indicates that Unicoin Markets fails to meet basic standards for legitimate brokerage operations. This makes it unsuitable for serious trading activities.

Conclusion

This comprehensive unicoin markets review reveals a broker that fails to meet basic standards for legitimate forex trading operations. It poses significant risks to potential clients. The overwhelming evidence suggests Unicoin Markets operates as a suspicious clone potentially engaged in fraudulent activities, making it unsuitable for traders seeking reliable, professional brokerage services.

The platform's classification as a potential scam operation, combined with consistently negative user feedback, inadequate customer support, and significant transparency gaps, creates an environment unsuitable for legitimate trading activities. While the broker advertises competitive features such as low minimum deposits and diverse asset offerings, these apparent benefits are overshadowed by fundamental reliability and trustworthiness concerns.

This broker is particularly unsuitable for beginning traders who may be attracted by low minimum deposits and high leverage offerings. They lack the experience to recognize warning signs of fraudulent operations. Experienced traders typically avoid platforms with such negative industry reputations and regulatory concerns, focusing instead on established brokers with proven track records and robust regulatory oversight.