Is Unicoin Markets safe?

Business

License

Is Unicoin Markets A Scam?

Introduction

Unicoin Markets, a relatively new player in the forex trading sphere, has garnered attention for its promise of diverse trading opportunities across various financial instruments. Established in 2022 and headquartered in Labuan, Malaysia, the broker claims to offer competitive trading conditions and a user-friendly platform. However, the forex market is rife with scams, making it imperative for traders to conduct thorough evaluations of brokers before committing their funds. This article seeks to analyze whether Unicoin Markets is a legitimate trading platform or merely another scam in the crowded forex industry. Our investigation draws upon various online sources, customer feedback, regulatory databases, and expert reviews to provide a comprehensive assessment of Unicoin Markets' safety and reliability.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for safeguarding traders' interests. Unicoin Markets claims to be regulated by the Labuan Financial Services Authority (LFSA) in Malaysia, presenting a license number (MB/21/0068) as proof of its regulatory compliance. However, the effectiveness of this regulatory body is often questioned, as it operates under less stringent standards compared to top-tier regulators such as the UK‘s FCA or the US’s SEC.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan FSA | MB/21/0068 | Malaysia | Suspicious Clone Status |

Despite its claims, multiple sources have flagged Unicoin Markets as a suspected clone broker, indicating that it may not be operating under legitimate regulatory oversight. This lack of robust regulation raises significant concerns about the safety of client funds and the potential for fraudulent activities.

The quality of regulation is paramount; brokers under the supervision of reputable authorities are subject to rigorous compliance checks, ensuring they adhere to fair trading practices. In contrast, Unicoin Markets does not benefit from such oversight, leading to a higher risk profile for traders. The absence of a solid regulatory framework coupled with its dubious claims of legitimacy suggests that traders should exercise extreme caution when considering this broker.

Company Background Investigation

Unicoin Markets is operated by Unicoin DCX Limited, a company that lacks a transparent history and clear ownership structure. The broker's establishment in 2022 raises questions about its experience and track record in the industry. Furthermore, information regarding the management team is sparse, which is often a red flag for potential investors. A competent management team with a robust background in finance and trading is essential for the reliable operation of a brokerage.

The company's transparency is questionable, as it provides limited information about its operations, financial health, and the individuals behind the scenes. In an industry where trust is paramount, the lack of clear disclosures can lead to skepticism about the broker's intentions and reliability.

Trading Conditions Analysis

Unicoin Markets offers various trading accounts with minimum deposits starting at $100, which is relatively low compared to industry standards. However, the overall cost structure raises concerns. The broker claims to provide competitive spreads and commissions, but the actual trading conditions may not be as favorable as advertised.

Core Trading Costs Comparison Table

| Cost Type | Unicoin Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 0.8 pips |

| Commission Structure | $15 per lot | $5 per lot |

| Overnight Interest Range | Not Specified | Varies by broker |

The spreads offered by Unicoin Markets are significantly higher than the industry average, which can eat into traders' profits. Additionally, the commission structure appears to be on the higher side, making it less competitive. Traders should be wary of any hidden fees or unusual policies that may not be clearly disclosed.

Client Fund Safety

The safety of client funds is a critical aspect that potential traders must evaluate. Unicoin Markets claims to segregate client funds in accordance with the Labuan Financial Services and Securities Act, which is a standard practice among regulated brokers. However, the lack of robust regulatory oversight raises questions about the effectiveness of such measures.

There are no clear indications of investor protection mechanisms such as compensation funds or negative balance protection policies. This lack of safety nets leaves traders vulnerable, especially in volatile market conditions. Furthermore, any historical controversies surrounding fund safety or client complaints could be indicative of deeper issues within the brokerage.

Customer Experience and Complaints

Customer feedback is an essential component in assessing a broker's reliability. Reviews of Unicoin Markets reveal a mixed bag of experiences, with some users praising customer service while others report significant issues.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

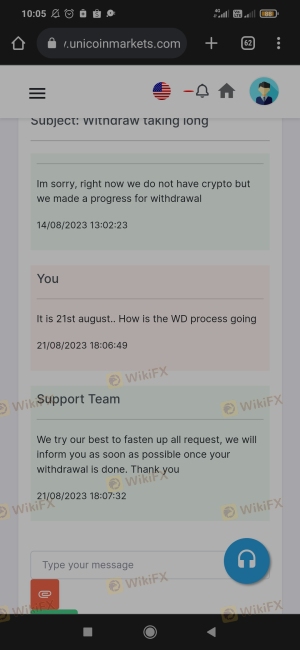

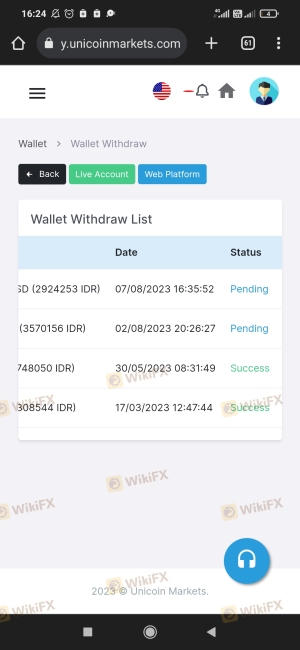

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent Support |

| Misleading Information | High | Unresolved Complaints |

Common complaints include withdrawal delays, poor customer support, and misleading information regarding trading conditions. The company's response to these complaints has been inconsistent, leading to dissatisfaction among traders.

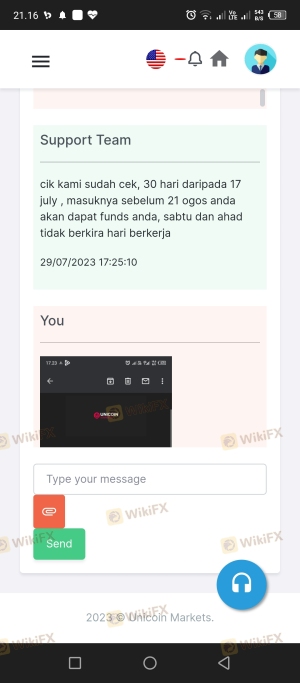

Two notable cases involved users who faced prolonged delays in withdrawing their funds, with the company providing vague explanations for the holdups. Such experiences raise significant concerns about the broker's operational integrity and commitment to customer satisfaction.

Platform and Trade Execution

The trading platform provided by Unicoin Markets is said to be user-friendly, offering both the popular MetaTrader 4 and an in-house developed platform. However, the performance of these platforms is crucial for traders.

Issues such as order execution quality, slippage, and order rejections can significantly impact trading outcomes. Reports of platform manipulation are concerning, as they can mislead traders into believing they are making profitable trades when, in reality, they may be losing money due to unfavorable conditions.

Risk Assessment

Using Unicoin Markets presents several risks that traders should consider carefully. The absence of regulatory oversight, combined with high trading costs and customer complaints, indicates a heightened risk profile.

Risk Rating Summary Table

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises fraud concerns |

| Financial Risk | Medium | High trading costs can erode profits |

| Operational Risk | High | Reports of withdrawal issues and complaints |

To mitigate these risks, traders should only invest what they can afford to lose and consider using a regulated broker with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence suggests that Unicoin Markets raises significant red flags regarding its legitimacy and safety. The lack of robust regulation, combined with high trading costs and a history of customer complaints, indicates that traders should approach this broker with caution.

For those looking to engage in forex trading, it is advisable to consider alternative brokers that are well-regulated and have a solid reputation in the industry. Trusted options include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater security and transparency for traders.

In summary, is Unicoin Markets safe? The answer leans towards skepticism, given the multiple warning signs associated with this broker. Traders should prioritize their safety and financial well-being by choosing reputable and regulated brokers for their trading activities.

Is Unicoin Markets a scam, or is it legit?

The latest exposure and evaluation content of Unicoin Markets brokers.

Unicoin Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Unicoin Markets latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.