iProMarkets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive ipromarkets review reveals significant concerns about this Cyprus-based forex broker. It should give potential investors serious pause. Multiple independent sources have identified iProMarkets as a potentially fraudulent operation with numerous red flags. These signs indicate that this platform may not be operating in traders' best interests. Despite claiming to be a registered brand of Trinity Capital LLC, iProMarkets lacks approval or oversight from any recognized financial regulatory authority, which represents a major warning sign for potential clients.

The broker does offer some attractive features on paper. These include access to over 40 forex currency pairs and a diverse range of asset classes encompassing CFDs, commodities, precious metals like gold and silver, energy products including oil, various indices, stocks, bonds, and cryptocurrency options including Bitcoin. The platform utilizes the popular MetaTrader 4 trading platform across PC, web, and mobile versions. This provides familiar functionality for experienced traders.

However, these potential positives are significantly overshadowed by the overwhelming evidence of problematic practices and the complete absence of regulatory protection. The platform appears to target small to medium-sized investors seeking diversified investment opportunities. But the lack of proper licensing and numerous fraud allegations make it an extremely risky choice for any trader, regardless of experience level.

Important Notice

This ipromarkets review is based on publicly available information and user feedback compiled from various online sources. iProMarkets claims to operate as a registered brand of Trinity Capital LLC and is reportedly headquartered in Cyprus as of 2020. However, it's crucial to note that the company has not obtained approval or supervision from any reputable financial regulatory authority, including major regulators like the FCA, CySEC, or other recognized oversight bodies.

The evaluation presented in this review has not been independently verified through direct testing or official regulatory filings. Potential investors should conduct their own due diligence and consider the significant risks associated with using an unregulated broker before making any investment decisions.

Rating Framework

Broker Overview

iProMarkets entered the online forex brokerage market in 2020. It positioned itself as a Cyprus-based trading platform under the Trinity Capital LLC brand registration. The company has attempted to establish itself in the competitive forex market by offering access to a broad range of financial instruments and utilizing established trading technology. However, the broker's short operational history and lack of regulatory credentials have raised significant concerns within the trading community.

The platform's business model focuses on providing online forex and CFD trading services to retail investors. It emphasizes accessibility through popular trading platforms and diverse asset offerings. Despite these apparent advantages, the company's operational transparency remains questionable, with limited publicly available information about its management team, financial backing, or operational procedures.

The broker offers the widely-used MetaTrader 4 trading platform across multiple device types. These include PC desktop applications, web-based trading interfaces, and mobile applications for iOS and Android devices. This platform choice provides traders with familiar charting tools, technical indicators, and automated trading capabilities that are standard in the industry. The asset selection includes more than 40 forex currency pairs covering major, minor, and exotic combinations, along with CFDs on commodities such as gold, silver, and oil, various stock indices, individual stocks, bonds, and cryptocurrency options including Bitcoin and other digital assets.

Most critically, iProMarkets operates without approval or supervision from any recognized financial regulatory authority. This represents a fundamental risk factor that potential clients must carefully consider before engaging with the platform.

Regulatory Status: iProMarkets operates without approval or supervision from any reputable financial regulatory authority such as the FCA, CySEC, ASIC, or other recognized oversight bodies. This lack of regulatory protection means traders have no recourse through official channels if disputes arise.

Available Assets: The platform provides access to over 40 forex currency pairs, CFDs on commodities including gold, silver, and oil, various stock indices, individual stocks, bonds, and cryptocurrency trading options including Bitcoin and other digital currencies.

Trading Platform: iProMarkets offers MetaTrader 4 across PC, web, and mobile versions. This provides traders with familiar charting tools, technical analysis capabilities, and automated trading support through Expert Advisors.

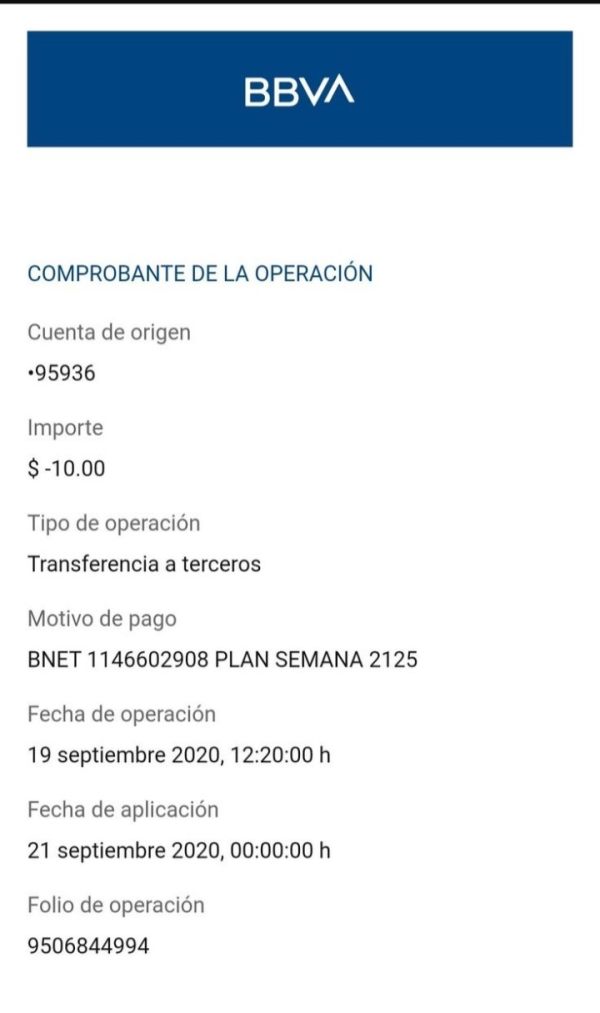

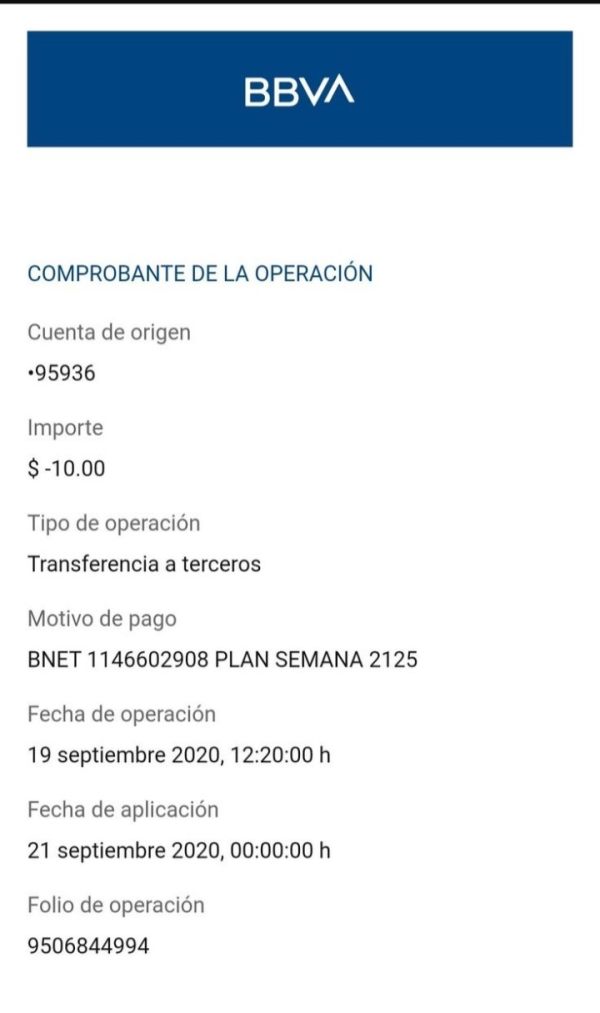

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This raises additional transparency concerns for potential clients.

Minimum Deposit Requirements: The minimum deposit requirement for opening an account with iProMarkets is not specified in available documentation. This represents another area where the broker lacks transparency.

Promotional Offers: Information about bonus programs or promotional offers is not available in current sources. However, unregulated brokers often use unsustainable bonus schemes as marketing tools.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available. This makes it difficult for traders to accurately assess the true cost of trading with this ipromarkets review subject.

Leverage Ratios: Specific leverage offerings are not detailed in available sources. However, unregulated brokers often offer excessive leverage that can increase trader risk significantly.

Geographic Restrictions: Information about regional restrictions or prohibited territories is not specified in available documentation.

Customer Support Languages: Details about multi-language support options are not available in current sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by iProMarkets remain largely opaque. Limited publicly available information exists about account types, features, or specific terms and conditions. This lack of transparency represents a significant red flag for potential traders who need clear information about trading conditions before committing funds to any platform.

Available sources do not specify whether the broker offers multiple account tiers, Islamic accounts for Muslim traders, or any specialized account features that might differentiate it from competitors. The absence of clear minimum deposit requirements, account maintenance fees, or inactivity charges makes it impossible for traders to make informed decisions about the true cost of maintaining an account with the platform.

User feedback consistently indicates dissatisfaction with overall service quality. This suggests that even basic account management functions may not meet industry standards. The combination of limited transparency and negative user experiences significantly undermines confidence in the broker's account conditions.

The lack of regulatory oversight means that account terms and conditions are not subject to external review or consumer protection standards. This potentially leaves traders vulnerable to unfavorable changes or disputes. This ipromarkets review strongly emphasizes that the absence of clear, transparent account conditions represents a major warning sign for potential clients.

iProMarkets receives a relatively higher score in this category primarily due to its adoption of the MetaTrader 4 platform. This provides traders with access to professional-grade trading tools and functionality. MT4 offers comprehensive charting capabilities, over 30 technical indicators, multiple timeframes, and support for automated trading through Expert Advisors, which are essential tools for serious forex traders.

The platform's asset diversity is another positive aspect. Over 40 forex currency pairs provide adequate coverage of major, minor, and some exotic currency combinations. The inclusion of CFDs on commodities, precious metals, energy products, indices, stocks, bonds, and cryptocurrencies offers traders opportunities for portfolio diversification across multiple asset classes.

However, the positive aspects of the platform's tools and resources are significantly undermined by user reports indicating that the platform may not be operating legitimately. Multiple reviews explicitly identify iProMarkets as a fraudulent operation. This calls into question whether traders can actually access and utilize these tools effectively in practice.

The absence of detailed information about additional research resources, market analysis, educational materials, or advanced trading tools beyond the standard MT4 offering suggests that the broker may not provide the comprehensive support that serious traders require. Without regulatory oversight, there are also no guarantees that the platform's tools and resources will remain available or function as advertised.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents one of the most concerning aspects of iProMarkets' operations. Multiple user reports indicate significant problems with support quality and responsiveness. The broker's customer service capabilities are severely undermined by widespread allegations of fraudulent behavior, which fundamentally compromises the credibility of any support interactions.

Available sources do not provide specific information about customer service channels, operating hours, response times, or multi-language support capabilities. This lack of transparency regarding support infrastructure raises additional concerns about the broker's commitment to client service and problem resolution.

Multiple independent sources have identified iProMarkets as a potentially fraudulent operation. User feedback consistently warns others to avoid the platform entirely. These reports suggest that customer service interactions may be designed to facilitate fraudulent activities rather than provide legitimate support to traders.

The absence of regulatory oversight means that there are no external standards governing customer service quality or dispute resolution procedures. Traders who experience problems with the platform have no recourse through regulatory channels. This leaves them dependent on the broker's internal processes, which user feedback suggests are inadequate or potentially malicious.

Trading Experience Analysis (Score: 5/10)

The trading experience with iProMarkets presents a complex picture where technical capabilities are overshadowed by fundamental trust and reliability issues. While the MetaTrader 4 platform provides familiar functionality and professional trading tools, user feedback indicates significant problems with the overall trading environment and platform reliability.

The MT4 platform itself offers robust order execution capabilities, real-time pricing, and comprehensive chart analysis tools that are industry standards. However, the effectiveness of these features depends entirely on the broker's operational integrity and technical infrastructure. Both of these have been called into question by user reports and fraud allegations.

User feedback consistently advises potential traders to exercise extreme caution before investing with iProMarkets. This suggests that the practical trading experience may not meet expectations despite the platform's technical capabilities. Reports of fraudulent behavior indicate that traders may face significant obstacles when attempting to execute trades or access their funds.

The lack of regulatory oversight means that there are no external standards governing order execution quality, price transparency, or platform stability. This ipromarkets review emphasizes that while the technical trading tools may appear adequate, the underlying operational concerns make the overall trading experience highly risky for potential clients.

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most critical weaknesses in iProMarkets' offering. Multiple independent sources identify the platform as potentially fraudulent. The complete absence of regulatory approval or supervision from any recognized financial authority represents a fundamental breach of industry standards and investor protection norms.

The broker's lack of transparency regarding regulatory status, operational procedures, and corporate governance creates an environment where traders have no external protections or recourse mechanisms. Without regulatory oversight, there are no independent audits of client fund segregation, no compensation schemes for investor protection, and no external monitoring of business practices.

Multiple user reviews explicitly identify iProMarkets as a fraudulent operation. They provide consistent warnings advising potential investors to avoid the platform entirely. These reports suggest systematic problems with the broker's operations that go beyond typical service quality issues and indicate potential criminal activity.

The company's short operational history since 2020, combined with the absence of verifiable regulatory credentials and widespread fraud allegations, creates a perfect storm of risk factors. This should disqualify the broker from consideration by any serious trader. Independent verification of the broker's regulatory claims reveals no approval from recognized authorities, confirming the legitimacy concerns raised by user reports.

User Experience Analysis (Score: 3/10)

The overall user experience with iProMarkets is characterized by widespread dissatisfaction and serious concerns about the platform's legitimacy and operational integrity. User feedback consistently indicates that the broker fails to meet basic expectations for service quality, transparency, and trustworthiness. These are fundamental to a positive trading experience.

Available user reviews and feedback sources paint a consistently negative picture of interactions with the platform. Multiple reports explicitly identify iProMarkets as a fraudulent operation. These reports suggest that users who attempt to engage with the platform may face significant risks including potential loss of funds and inability to withdraw investments.

The lack of transparency regarding basic operational information such as deposit and withdrawal procedures, customer service contact information, and regulatory compliance creates additional friction in the user experience. Potential traders cannot easily access the information they need to make informed decisions about using the platform.

The absence of regulatory protection means that users have no external recourse if they experience problems with the platform. This leaves them entirely dependent on the broker's internal processes. Given the widespread allegations of fraudulent behavior, this represents an unacceptable level of risk for any trader seeking a reliable and trustworthy trading environment.

Conclusion

This comprehensive ipromarkets review reveals that despite some potentially attractive features such as MetaTrader 4 platform access and diverse asset offerings, the broker presents unacceptable risks that far outweigh any potential benefits. The combination of zero regulatory oversight, widespread fraud allegations, and consistently negative user feedback creates a risk profile that should disqualify iProMarkets from consideration by any prudent investor.

The broker is not recommended for any category of trader, from beginners to experienced professionals. This is due to fundamental issues with trust, reliability, and operational integrity. Traders seeking a secure and transparent trading environment should focus on properly regulated brokers with established track records and positive user feedback.

The primary advantages of asset diversity and MT4 platform access are completely overshadowed by the critical disadvantages of regulatory absence, fraud allegations, and poor user experiences. Potential investors are strongly advised to conduct thorough due diligence and consider only properly regulated alternatives that offer genuine investor protection and operational transparency.