Tongda International 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive tongda international review examines a broker that operates without regulatory oversight. It presents significant concerns for potential traders. Based on available information, Tongda International appears to be an unregulated forex broker offering various trading instruments including futures, options, swaps, forwards, and warrants. However, the platform has received mixed user feedback with an overall rating of 3 out of 10, indicating substantial issues that traders should carefully consider.

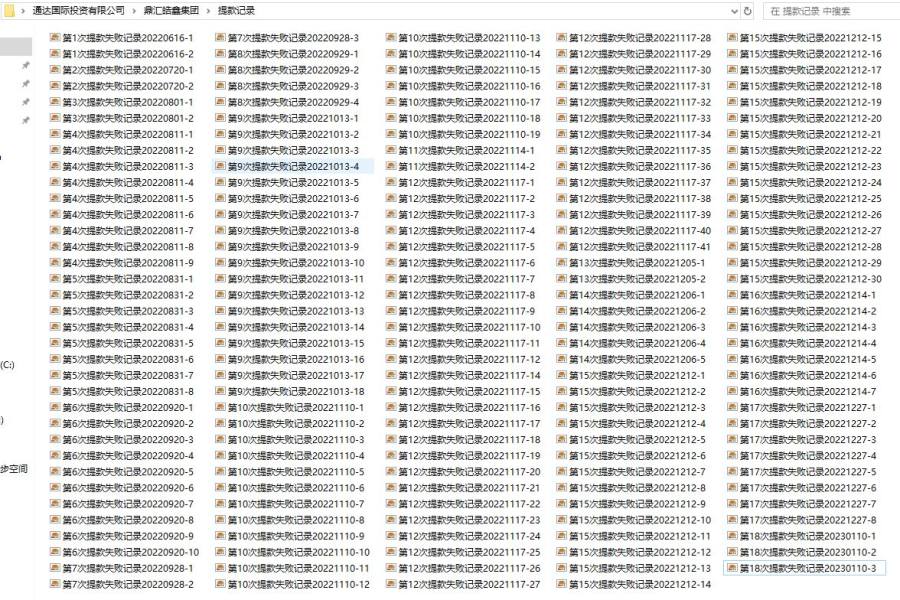

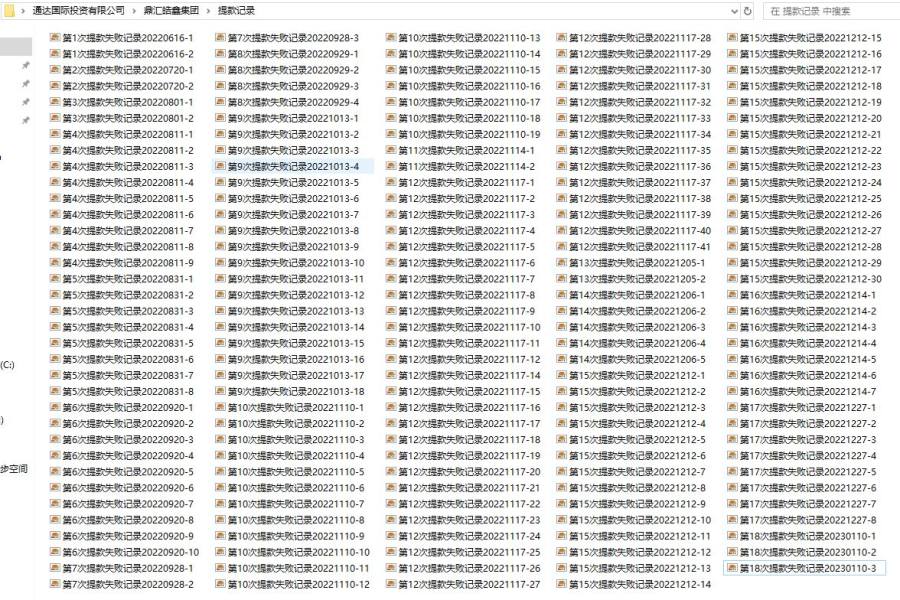

The broker has accumulated concerning user reviews. It has 1 positive review, 1 neutral review, and 2 negative reviews, suggesting potential operational problems. Most notably, several sources indicate that Tongda International may pose fraud risks, with reports suggesting it operates as a fake platform used for training new recruits in questionable schemes. The company appears to be based in China and has been operating for 5-10 years according to some sources, though specific regulatory compliance information remains unavailable.

For traders seeking diversified trading instruments, Tongda International might initially appear attractive due to its range of financial products. However, the lack of regulatory oversight, combined with negative user experiences and fraud allegations, makes this broker unsuitable for most serious traders who prioritize safety and reliability in their trading activities.

Important Disclaimer

This review is based on available information from multiple sources. Traders should be aware that regulatory status and operational conditions may vary significantly across different regions. Due to the broker's unregulated status, legal protections for traders may be limited or non-existent depending on jurisdiction.

The evaluation methodology relies on publicly available information, user reviews, and industry reports. However, specific details regarding trading conditions, regulatory compliance, and operational procedures remain limited in available documentation. Traders are strongly advised to conduct additional due diligence before considering any engagement with this platform.

Rating Framework

Broker Overview

Tongda International operates as an unregulated forex broker. It has been active in the financial markets for approximately 5-10 years. The company appears to be headquartered in China and operates under the full name "Tongda International Investment Limited." Despite its years of operation, the broker has failed to secure proper regulatory authorization from recognized financial authorities, which immediately raises red flags about its legitimacy and operational standards.

The broker's business model centers around providing access to various financial instruments. These include futures, options, swaps, forward contracts, and warrants. However, the lack of regulatory oversight means that traders have limited recourse in case of disputes or operational issues. According to available sources, the platform has been associated with fraudulent activities, with some reports indicating it serves as a training ground for new recruits in questionable financial schemes.

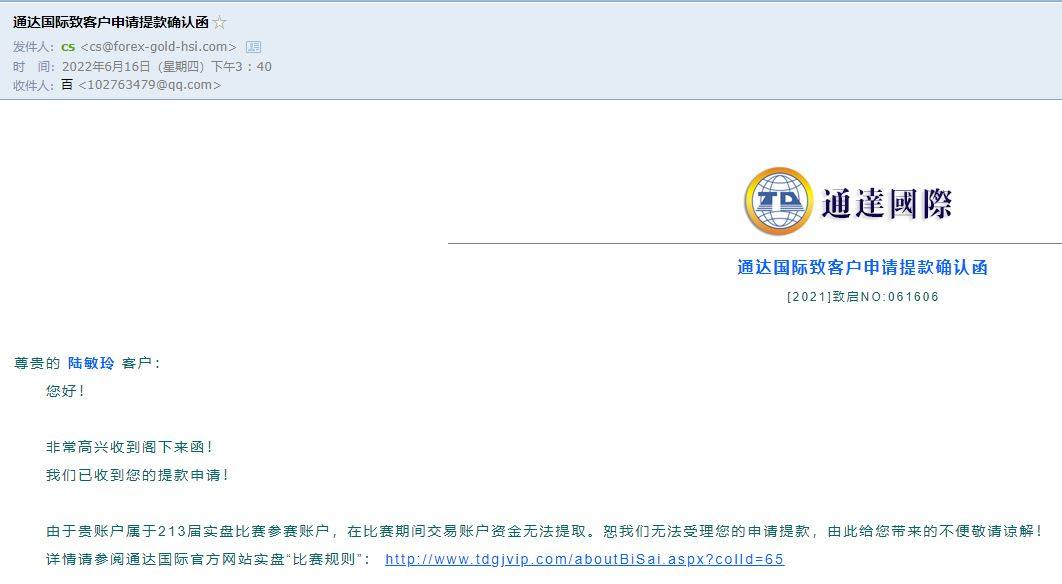

This tongda international review reveals that while the broker offers a range of trading instruments, the fundamental lack of regulatory compliance overshadows any potential benefits. The company's customer service email is listed as cs@forex-gold-hsi, though response quality and availability remain questionable based on user feedback. The overall operational transparency falls well below industry standards expected from legitimate forex brokers.

Regulatory Status: Available information indicates that Tongda International operates without proper regulatory oversight from recognized financial authorities. This unregulated status poses significant risks to trader funds and legal protections.

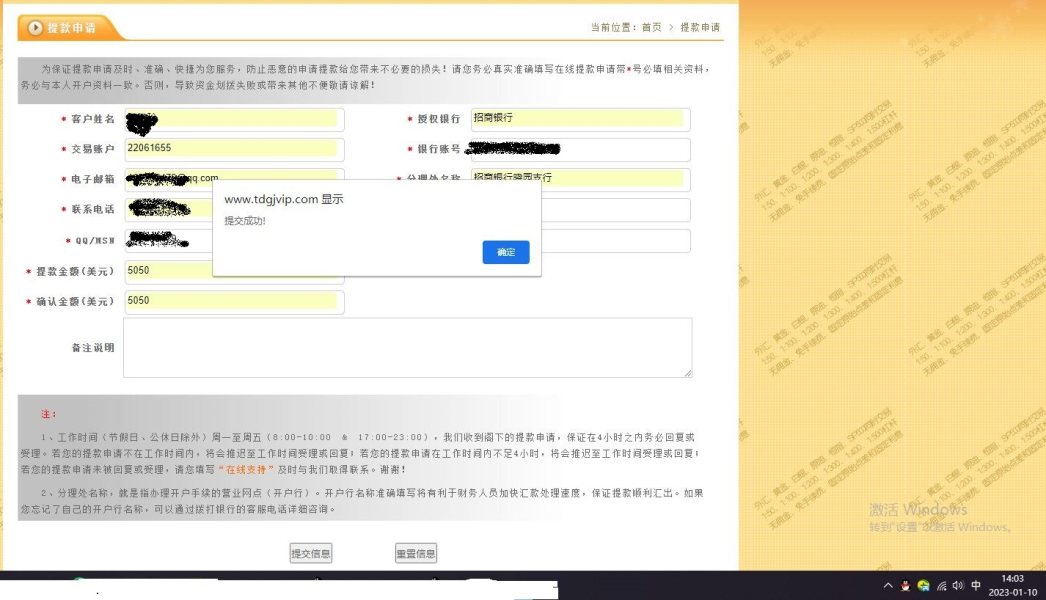

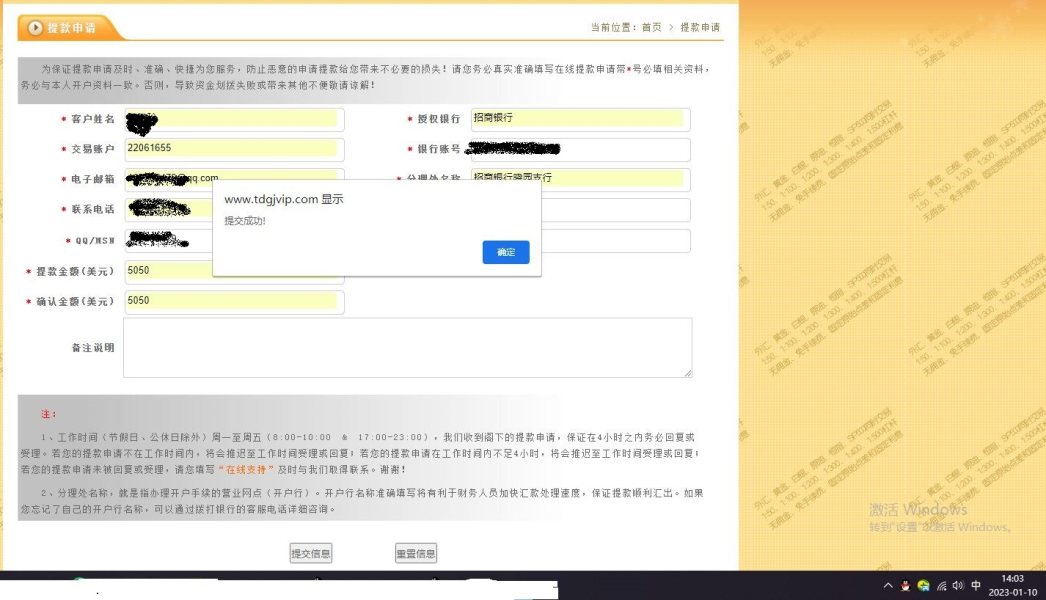

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available sources. This lack of transparency itself is concerning for potential users.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. This represents another area where the broker fails to provide essential trading information.

Bonuses and Promotions: No specific information about promotional offers or bonus structures is available in current sources. This suggests limited marketing transparency.

Tradeable Assets: The broker offers futures, options, swaps, forward contracts, and warrants. This provides some diversity in trading instruments despite other operational concerns.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current sources. This makes it impossible for traders to accurately assess the total cost of trading.

Leverage Ratios: Specific leverage offerings are not detailed in available documentation. This is essential information that legitimate brokers typically provide prominently.

Platform Options: The specific trading platforms offered by Tongda International are not clearly detailed in available sources. This limits assessment of technological capabilities.

This tongda international review highlights significant information gaps that legitimate brokers typically address transparently.

Account Conditions Analysis

The account conditions offered by Tongda International remain largely unclear due to insufficient publicly available information. This lack of transparency represents a significant concern for potential traders who require clear understanding of account terms, minimum deposit requirements, and available account types before making trading decisions.

Available sources do not specify the variety of account types offered, minimum deposit requirements, or special account features. The absence of clear account opening procedures and verification requirements further compounds concerns about the broker's operational transparency and compliance standards.

The limited information available suggests that account holders may face significant challenges in understanding their rights and obligations when trading with this platform. Without proper regulatory oversight, account protection measures that traders typically expect from legitimate brokers may not be available or adequately enforced.

This tongda international review emphasizes that the lack of clear account condition information alone should serve as a warning sign for potential traders. Legitimate brokers typically provide comprehensive account information as part of their commitment to transparency and regulatory compliance.

Tongda International offers a range of financial instruments including futures, options, swaps, forward contracts, and warrants. This provides some diversity for traders seeking exposure to different market segments. However, the quality and execution of these trading tools remain questionable given the broker's unregulated status and negative user feedback.

The availability of research and analysis resources is not clearly documented in available sources. This is concerning for traders who rely on market analysis and educational materials to make informed trading decisions. Professional traders typically expect access to market research, technical analysis tools, and educational resources as standard offerings from their brokers.

Automated trading support and advanced trading features are not specifically mentioned in available documentation. This limits assessment of the platform's technological capabilities. The absence of detailed information about trading tools and analytical resources suggests that the broker may not prioritize providing comprehensive support for serious traders.

The overall assessment of tools and resources receives a moderate score primarily due to the variety of financial instruments offered. However, the lack of supporting resources and questionable operational reliability significantly limit the practical value of these offerings.

Customer Service and Support Analysis

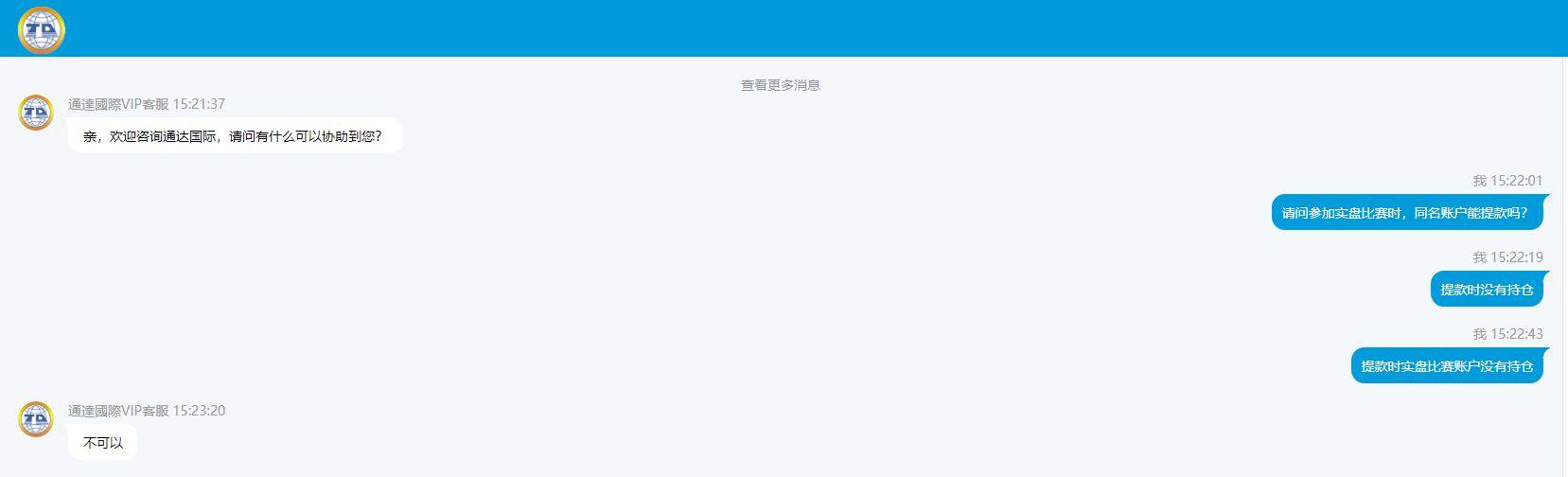

Customer service quality at Tongda International appears to be problematic based on available user feedback and the broker's overall operational approach. The company provides a customer service email address, though response times, service quality, and problem resolution capabilities remain unclear from available sources.

User reviews indicate mixed experiences with customer support. This contributes to the overall neutral to negative assessment of the broker's services. The lack of detailed information about customer service channels, availability hours, and multilingual support suggests limited commitment to customer satisfaction and support infrastructure.

Response times and problem resolution effectiveness are not documented in available sources. This is concerning for traders who may need urgent assistance with account or trading issues. Professional forex brokers typically provide multiple contact methods, extended support hours, and documented response time commitments.

The absence of comprehensive customer service information, combined with the broker's unregulated status, suggests that traders may face significant challenges when seeking support or resolution for trading-related issues. This represents a major operational weakness that affects the overall trading experience and safety of funds.

Trading Experience Analysis

The trading experience at Tongda International is difficult to assess comprehensively due to limited specific information about platform stability, execution speed, and overall functionality. Available sources do not provide detailed insights into order execution quality, platform reliability, or the technological infrastructure supporting trading operations.

Platform stability and execution speed are critical factors for successful trading. Yet specific performance data is not available in current documentation. This lack of transparency makes it impossible for potential traders to evaluate whether the platform can meet their technical requirements and performance expectations.

Mobile trading capabilities and platform functionality details are not specified in available sources. This limits assessment of the broker's commitment to providing modern trading technology. Contemporary traders expect robust mobile platforms and comprehensive trading tools as standard offerings.

User feedback regarding trading experience is limited in available sources, though the overall negative sentiment toward the broker suggests that trading experience may not meet professional standards. The combination of unregulated status and limited platform information indicates that traders should expect substandard trading conditions compared to regulated alternatives.

This tongda international review concludes that trading experience assessment is hindered by lack of transparency. This itself represents a significant concern for potential users.

Trust and Safety Analysis

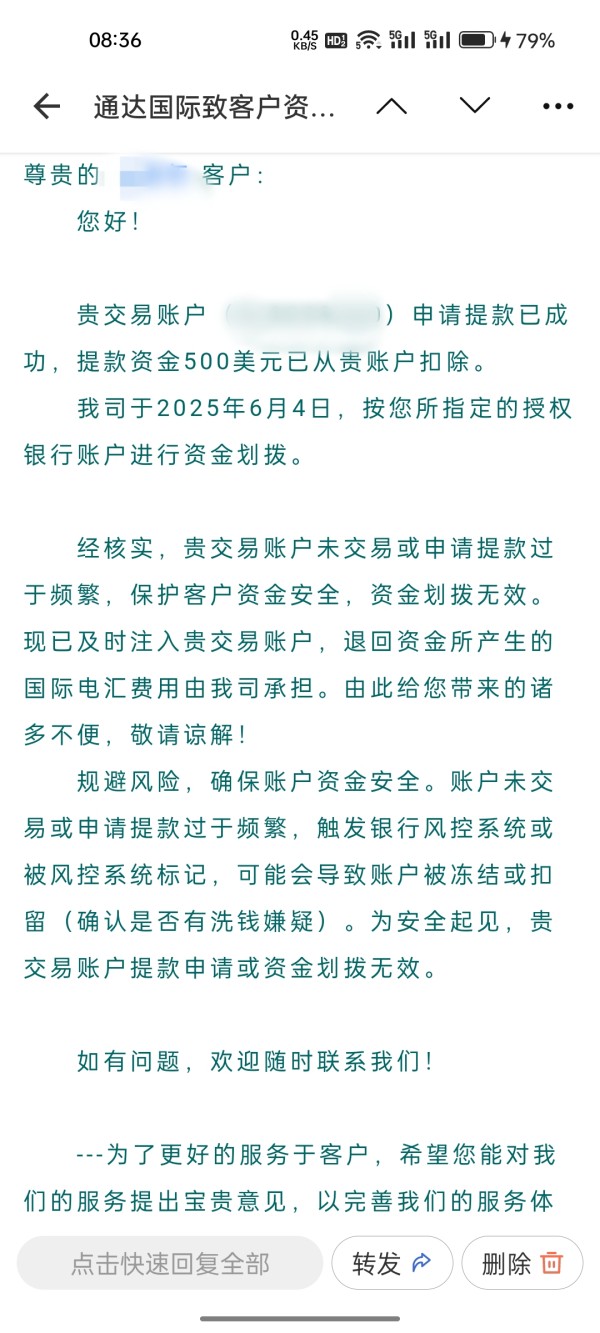

Trust and safety represent the most concerning aspects of Tongda International's operations. The broker operates without regulatory oversight from recognized financial authorities, which immediately eliminates many standard protections that traders expect when depositing funds and executing trades.

Multiple sources indicate potential fraud risks associated with this broker. Specific reports suggest that Tongda International may operate as a fake platform used for training purposes in questionable schemes. These allegations are particularly serious and should be carefully considered by any potential users.

Fund security measures are not detailed in available sources. This is extremely concerning given the regulated broker industry standard of segregated client accounts and deposit insurance. Without proper regulatory oversight, trader funds may not receive adequate protection against operational risks or potential misconduct.

Company transparency falls well below industry standards. It shows limited publicly available information about company structure, operational procedures, and compliance measures. Legitimate brokers typically provide comprehensive information about their regulatory status, company background, and operational safeguards as part of building trust with potential clients.

The overall trust and safety assessment receives the lowest possible rating due to the combination of unregulated status, fraud allegations, and lack of transparency that characterizes this broker's operations.

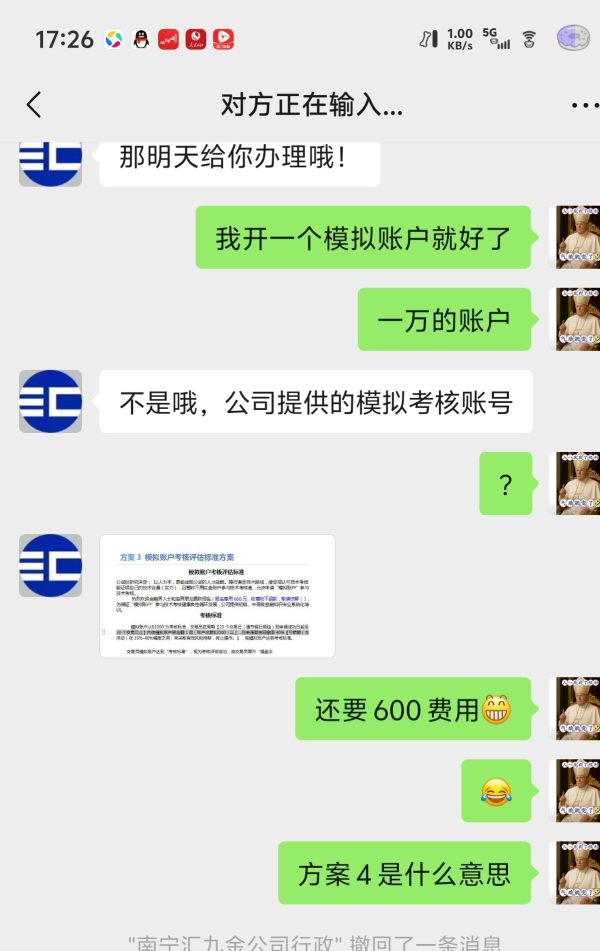

User Experience Analysis

User experience at Tongda International appears to be significantly below industry standards based on available feedback and operational characteristics. The overall user rating of 3 out of 10 indicates substantial dissatisfaction among traders who have engaged with this platform.

Available user feedback includes 1 positive review, 1 neutral review, and 2 negative reviews. This suggests that most users encounter problems with this broker's services. The predominance of negative and neutral feedback indicates systematic issues with the broker's operational approach and service delivery.

Interface design and ease of use information is not available in current sources. The lack of detailed platform information suggests that user experience may not be a priority for this broker. Modern traders expect intuitive interfaces, comprehensive functionality, and reliable performance as basic requirements.

Registration and verification processes are not clearly documented. This creates additional uncertainty for potential users. The absence of clear onboarding information represents another area where the broker fails to meet contemporary standards for user experience and operational transparency.

Common user complaints appear to center around the broker's reliability and legitimacy concerns. This aligns with the fraud risk allegations found in multiple sources. The overall user experience assessment reflects these fundamental operational problems that affect every aspect of trader interaction with the platform.

Conclusion

This tongda international review reveals a broker that presents significant risks and operational concerns that make it unsuitable for most traders. While Tongda International offers various trading instruments including futures, options, and other derivatives, the fundamental lack of regulatory oversight and associated fraud risks far outweigh any potential benefits.

The broker is most unsuitable for any trader who prioritizes fund safety, regulatory protection, and reliable customer service. The combination of unregulated status, negative user feedback, and fraud allegations creates an environment where traders face substantial risks without corresponding protections or recourse mechanisms.

The main advantages are limited to the variety of trading instruments offered. The disadvantages include unregulated operations, potential fraud risks, poor customer feedback, lack of transparency, and absence of fund protection measures. These significant drawbacks make Tongda International a poor choice for serious traders seeking reliable and safe trading conditions.