Is Tongda International safe?

Business

License

Is Tongda International Safe or Scam?

Introduction

Tongda International is a forex broker that has garnered attention in the trading community for its offerings in the foreign exchange market. As with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it also harbors risks, particularly when it comes to choosing a broker. Traders must be cautious, as some platforms may lack the necessary regulatory oversight or have questionable business practices. In this article, we will investigate whether Tongda International is a legitimate trading platform or a potential scam. Our analysis will be based on a comprehensive review of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most significant factors in determining its legitimacy. Brokers that operate without proper regulation expose their clients to various risks, including potential fraud and mismanagement of funds. In the case of Tongda International, the broker has been identified as lacking valid regulatory oversight, raising serious concerns about its operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license means that Tongda International is not subject to the same stringent oversight as regulated brokers. This lack of regulation can lead to a myriad of issues, including fund misappropriation and unfair trading practices. Furthermore, the company has been flagged as a suspicious clone by the National Futures Association (NFA), which further complicates its credibility. Traders should be aware that engaging with unregulated brokers can lead to significant financial losses and a lack of recourse in case of disputes.

Company Background Investigation

Tongda International Investment Limited claims to have been established between 5 to 10 years ago, primarily operating out of Russia. However, the companys ownership structure and management team are not well-documented, which raises transparency concerns. A broker's history and the experience of its management team are critical indicators of its reliability. Unfortunately, the lack of information regarding Tongda International's ownership and management leaves potential clients in the dark.

The company's website is reported to be inaccessible, further complicating efforts to gather essential information about its operations. Transparency is a fundamental aspect of any trading platform, and the inability to access critical information about Tongda International's history and management team is a significant red flag. Traders are encouraged to seek out brokers with clear and accessible information regarding their operations to ensure they are making informed decisions.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. This includes examining the fee structure, spreads, and any additional costs that may be associated with trading. Tongda International has set a high minimum deposit requirement of $30,000 for its standard account, which may deter many retail traders.

| Fee Type | Tongda International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads and commissions raises concerns about the overall cost of trading with Tongda International. Traders may find themselves facing unexpected charges, which can significantly impact their profitability. Additionally, the absence of competitive spreads and a well-defined fee structure could indicate that the broker is not operating in the best interests of its clients.

Customer Funds Safety

The safety of client funds is paramount when choosing a forex broker. A reputable broker should implement robust security measures to protect client deposits. Unfortunately, Tongda International's lack of regulation raises serious concerns about its ability to safeguard client funds. There is no information available regarding whether the broker employs segregated accounts to keep client funds separate from its operational funds.

Moreover, the absence of investor protection measures and negative balance protection policies amplifies the risks associated with trading on this platform. Traders should be cautious and consider the potential consequences of engaging with a broker that does not prioritize the safety of its clients funds.

Customer Experience and Complaints

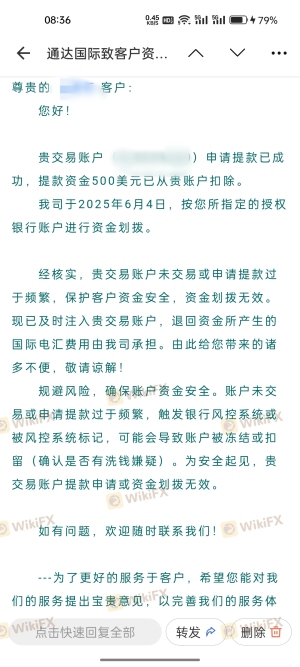

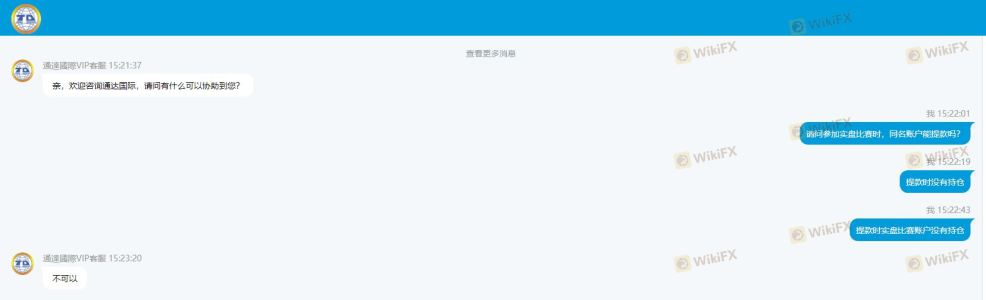

Customer feedback is an essential component in assessing a broker's reliability. Reviews and complaints about Tongda International indicate a troubling trend. Many users have reported difficulties in withdrawing funds, which is a common complaint among traders dealing with unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

Several traders have shared experiences of being unable to withdraw their funds, with some claiming their accounts were manipulated without their consent. This pattern of complaints is alarming and suggests that Tongda International may not be responsive to customer concerns. The quality of customer support is another area of concern, as many users have reported long wait times and inadequate responses to their inquiries.

Platform and Trade Execution

The trading platform's performance is another critical factor when evaluating a broker. A reliable platform should offer stability, fast execution speeds, and a user-friendly interface. However, there are reports of issues related to order execution on Tongda International's platform, including slippage and rejected orders. These issues can severely hinder a trader's ability to capitalize on market opportunities.

Traders have also expressed concerns about the overall user experience on the platform, with many finding it less intuitive compared to other brokers. The lack of transparency regarding the platform's functionality and performance is another indication that traders should approach Tongda International with caution.

Risk Assessment

Engaging with Tongda International carries several risks that traders should carefully consider. The following risk rating card summarizes the key risks associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation, increasing potential for fraud. |

| Fund Security Risk | High | Lack of investor protection and fund segregation. |

| Customer Service Risk | Medium | Poor responsiveness to customer complaints. |

| Platform Reliability | Medium | Reports of execution issues and platform instability. |

To mitigate these risks, traders are advised to conduct thorough research and consider using regulated brokers with a proven track record. Opening a small account to test the waters before committing larger funds is also a prudent strategy.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tongda International may not be a safe option for traders. The lack of regulatory oversight, high minimum deposit requirements, and numerous complaints regarding fund withdrawals raise significant red flags. Traders should exercise extreme caution when considering this broker, as the potential for fraud and financial loss is considerable.

For those seeking reliable alternatives, it is advisable to explore brokers that are well-regulated and have a strong reputation in the industry. Brokers with transparent operations, competitive trading conditions, and robust customer support are essential for ensuring a positive trading experience. Ultimately, ensuring the safety of your funds and the quality of your trading experience should be the top priority when selecting a forex broker.

Is Tongda International a scam, or is it legit?

The latest exposure and evaluation content of Tongda International brokers.

Tongda International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tongda International latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.