Sunac 2025 Review: Everything You Need to Know

Summary

This Sunac review shows a big gap between what people expect and what is real. Sunac China Holdings Limited was established in 2003 and founded by Sun Hongbin. It is mainly a real estate development company based in Tianjin, China, not a traditional forex or trading broker. The company has worked as China's third-largest property developer for many years.

Its main money comes from real estate sales across mainland China. Some sources mention Sunac in trading contexts, especially about stock purchases with ticker 1918. However, the available information shows limited direct forex brokerage services.

The company has faced big challenges in recent years. These include credit rating downgrades and liquidity concerns that have hurt investor confidence. Employee feedback on platforms like Glassdoor shows a moderate satisfaction rating of 3.9 out of 5.

This means that internal stakeholders keep a relatively positive view of the organization. This review aims to provide clarity for potential retail traders, especially those in mainland China, who may be thinking about Sunac for their trading needs.

Important Notice

Regional Entity Differences: Potential traders should know that Sunac works mainly as a real estate development company. Specific forex trading services may vary a lot across different regions or may not be available at all.

The lack of detailed regulatory information and trading conditions in available sources suggests problems. Users in different geographical locations may experience very different service offerings, if any trading services are provided.

Review Methodology: This evaluation uses publicly available information and limited user feedback. The absence of comprehensive third-party regulatory information and detailed trading condition disclosures creates issues.

This means that this assessment may not reflect the complete picture of any potential trading services offered by Sunac.

Rating Framework

Broker Overview

Company Background and Foundation

Sunac China Holdings Limited was founded in 2003 by Sun Hongbin. It has built itself as a major player in China's real estate sector.

Based in Tianjin, the company has traditionally focused on property development and real estate sales throughout mainland China. As China's third-largest real estate developer, Sunac has built a large portfolio of residential and commercial properties.

Its primary business model centers around real estate development, sales, and property management services. The company's core operations have historically made revenue through property sales, land development, and related real estate services.

However, the connection between Sunac's primary real estate business and forex trading services remains unclear based on available information. This raises questions about the nature and scope of any trading-related offerings.

Trading Platform and Service Offerings

Available information does not give clear details about specific trading platform types or comprehensive service offerings related to forex trading. Some sources mention the ability to purchase Sunac shares listed as 1918 on stock exchanges.

This appears to relate to investing in the company itself rather than using Sunac as a trading platform for forex or other financial instruments. The absence of detailed information about trading platforms, asset classes, and regulatory oversight suggests problems.

Traditional forex brokerage services may not be a primary focus of the company's current business model.

Regulatory Status: Available sources do not provide specific information about forex trading regulatory oversight or licensing from recognized financial authorities.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options for trading accounts is not detailed in available materials.

Minimum Deposit Requirements: Concrete minimum deposit amounts for potential trading accounts are not specified in accessible sources.

Bonuses and Promotions: Information about trading bonuses, promotional offers, or incentive programs is not available in current documentation.

Tradeable Assets: The range and types of tradeable financial instruments are not clearly outlined in available sources, though stock trading appears to be referenced.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not provided in accessible materials. This Sunac review cannot provide specific cost analysis without this crucial information.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available sources.

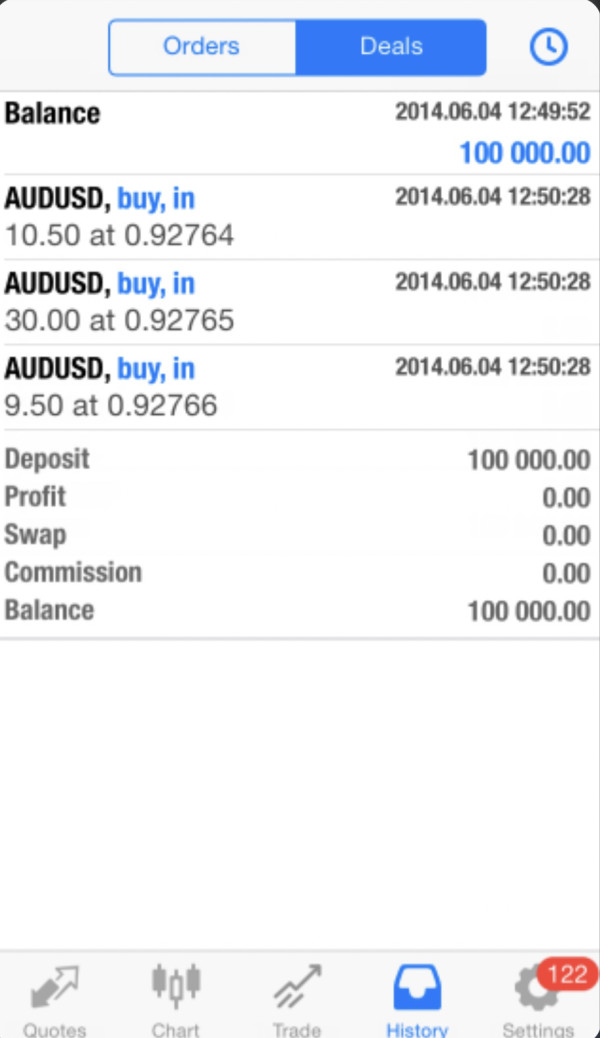

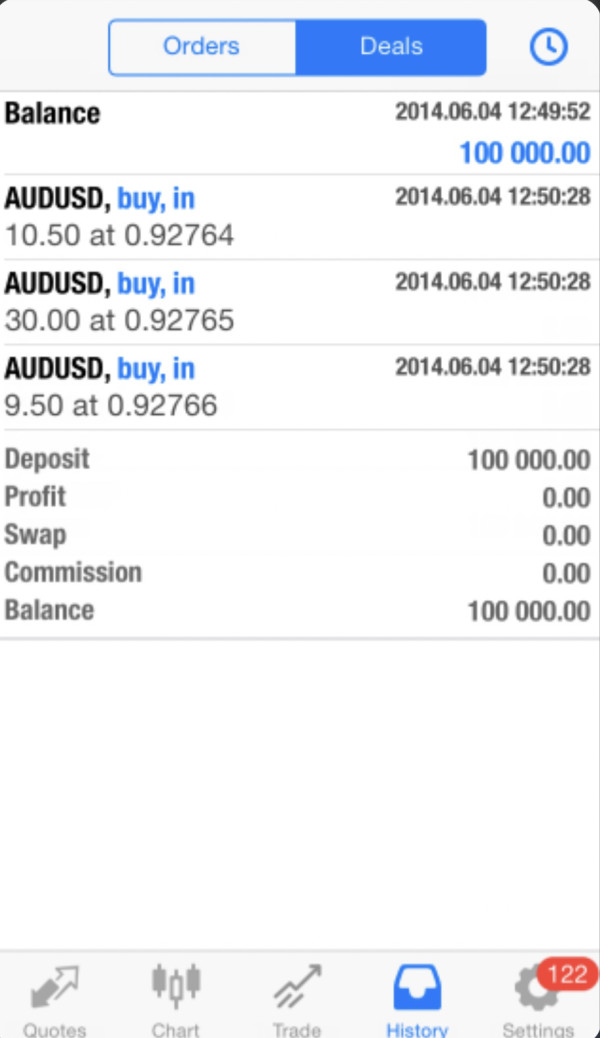

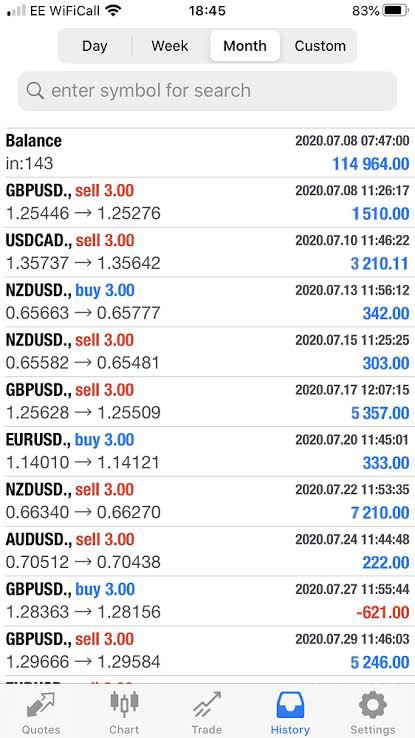

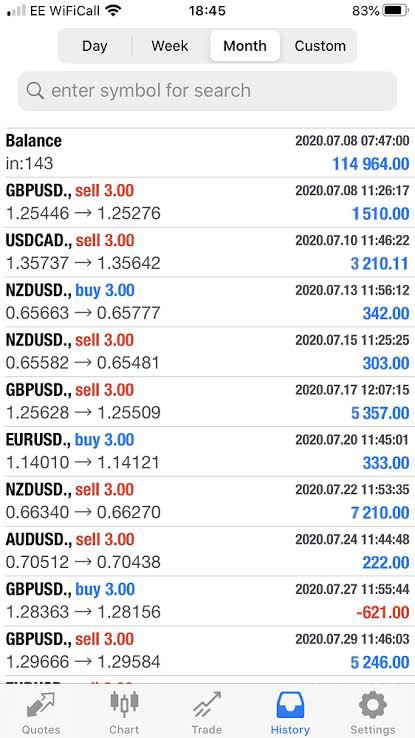

Platform Choices: Information about available trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified.

Geographic Restrictions: Specific regional limitations or service availability by country is not clearly outlined.

Customer Support Languages: Available customer service languages are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The evaluation of account conditions for this Sunac review shows big information gaps that impact the overall assessment. Available sources do not provide specific details about account types, their distinctive features, or the range of options available to potential traders.

Without clear information about standard, premium, or professional account tiers, it becomes hard to assess how competitive Sunac's offerings are against industry standards. Minimum deposit requirements, which are crucial for trader decision-making, are not specified in accessible documentation.

This lack of transparency about entry-level investment requirements makes it difficult for potential clients to plan their trading journey effectively. Additionally, the account opening process, verification procedures, and required documentation are not detailed.

This leaves prospective traders without clear guidance on what to expect during onboarding. The absence of information about special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the appeal to diverse trading communities.

Without comprehensive account condition details, potential traders cannot make informed comparisons with other brokers in the market.

The analysis of trading tools and resources shows a concerning lack of detailed information about the technological infrastructure and analytical support provided to traders. Available sources do not specify the range or quality of trading tools, which are essential components of modern forex trading platforms.

Without information about charting capabilities, technical indicators, or automated trading support, it's impossible to assess whether Sunac provides the necessary tools for effective trading analysis. Research and analytical resources, which are fundamental for informed trading decisions, are not detailed in accessible materials.

The absence of market analysis, economic calendars, news feeds, or expert commentary suggests a potential gap in the support structure that successful traders typically require. Educational resources, including tutorials, webinars, or trading guides, are also not mentioned in available documentation.

The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities indicates that Sunac may not cater to traders who rely on systematic trading approaches. This limitation could significantly impact the platform's appeal to more sophisticated trading strategies.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation is hampered by the limited availability of specific information about support channels, response times, and service quality metrics. Available sources do not detail the various ways clients can contact support teams, whether through live chat, email, phone, or ticket systems.

This lack of clarity about communication channels raises concerns about accessibility and convenience for traders who may need immediate assistance. Response time expectations and service level agreements are not specified in available documentation.

This makes it impossible to assess the efficiency of problem resolution. The quality of support interactions, staff expertise levels, and problem-solving capabilities cannot be evaluated without more detailed information or user testimonials about actual support experiences.

Multi-language support availability, which is crucial for international traders, is not clearly outlined. Given Sunac's Chinese origins, it's unclear whether support is available in languages other than Chinese, potentially limiting accessibility for international clients.

Operating hours and timezone coverage for customer support are also not specified.

Trading Experience Analysis (Score: 4/10)

The trading experience assessment is significantly limited by the absence of detailed information about platform performance, stability, and functionality. Available sources do not provide insights into execution speeds, platform uptime, or the overall reliability of the trading infrastructure.

Without this fundamental information, it's challenging to evaluate whether Sunac can provide the consistent, high-quality trading environment that active traders require. Order execution quality, including fill rates, slippage statistics, and requote frequency, is not documented in accessible materials.

These metrics are crucial for traders to understand the practical costs and efficiency of their trading activities. Platform functionality, including the availability of advanced order types, one-click trading, or customizable interfaces, remains unclear.

Mobile trading capabilities, which are increasingly important for modern traders who need flexibility and mobility, are not detailed in available sources. The absence of information about mobile app features, compatibility, or user experience suggests potential limitations in serving traders who require on-the-go access to their accounts.

This Sunac review cannot provide a comprehensive trading experience assessment without these critical details.

Trust and Reliability Analysis (Score: 3/10)

The trust and reliability assessment shows significant concerns that impact the overall confidence rating. Available information indicates that Sunac has experienced credit rating downgrades from agencies like Fitch, which specifically noted concerns about the company's liquidity safety margins.

These financial stability concerns are particularly relevant for potential traders who need assurance about the security of their deposited funds. Regulatory oversight information is notably absent from available sources, which raises questions about the level of financial authority supervision and consumer protection measures in place.

The lack of clear regulatory licensing information makes it difficult to assess the legal framework under which any trading services might operate. This potentially exposes clients to higher risks.

Fund security measures, including segregated account policies, deposit insurance, or compensation schemes, are not detailed in accessible documentation. Company transparency about financial statements, operational procedures, and business practices is limited, which further impacts the trust assessment.

The absence of comprehensive information about negative event handling and crisis management procedures adds to the reliability concerns.

User Experience Analysis (Score: 5/10)

User experience evaluation shows mixed signals based on available information. The Glassdoor employee rating of 3.9 out of 5 suggests that internal stakeholders maintain a moderately positive view of the company.

This could translate to better service delivery for external clients. However, this internal satisfaction metric may not directly correlate with trader satisfaction or trading platform user experience.

Interface design, ease of use, and platform navigation details are not provided in available sources. This makes it impossible to assess the user-friendliness of any trading interfaces.

The registration and account verification process, which forms the first impression for new users, is not detailed. This leaves questions about the efficiency and simplicity of getting started with the platform.

Fund operation experiences, including deposit and withdrawal processes, processing times, and associated fees, are not documented in accessible materials. Common user complaints, feedback trends, or satisfaction surveys are not available.

This limits the ability to identify recurring issues or areas of strength in the user experience.

Conclusion

This Sunac review concludes with a measured assessment that reflects the significant information limitations encountered during the evaluation process. Sunac appears to operate primarily as a real estate development company rather than a dedicated forex broker.

This explains the lack of comprehensive trading-related information typically expected in brokerage evaluations. The absence of clear regulatory oversight, detailed trading conditions, and transparent service offerings makes it challenging to recommend Sunac as a primary choice for serious forex traders.

The evaluation suggests that Sunac may be more suitable for investors interested in real estate market exposure through stock investments rather than active forex trading. While the company maintains moderate employee satisfaction ratings, the lack of trading-specific infrastructure and regulatory clarity presents significant limitations.

These issues affect potential forex market participants seeking reliable, well-regulated trading environments.