Silwana Brokerage 2025 Review: Everything You Need to Know

Executive Summary

Silwana Brokerage shows a complex picture in the forex trading world. Mixed signals come from different user review websites, creating confusion for potential traders. While the broker gets some good feedback on Trustpilot, where users call it "a trustworthy company" with "real projects" and "growing passive income" opportunities, WikiFX raises serious concerns about whether it's safe and legitimate. This silwana brokerage review looks at a broker that works as an offshore company, started in 2018, and offers automated trading platforms across many types of investments including farming projects, digital money, and forex trading.

The broker focuses on giving different investment choices through modern trading methods. It puts special attention on automation and alternative investment areas that go beyond traditional trading. However, the lack of clear rules and mixed user reviews make it hard to judge this broker properly. Information from 2022 shows that Silwana Brokerage works mainly as an offshore broker, which brings extra risks for traders who want regulated trading environments. This review gives a complete analysis for traders who want different investment options and automated trading solutions, while pointing out the big risk factors that potential clients should think about carefully.

Important Notice

Silwana Brokerage works as an offshore broker. This means it doesn't have the oversight that major financial authorities usually provide. This status may put traders at different levels of legal and financial risks depending on where they live.

The broker's offshore nature means that client protections and ways to solve disputes may be limited compared to regulated companies. This complete review uses available user feedback, industry data, and public information. Given the limited regulatory information and mixed user reviews, potential clients should do careful research before working with this broker.

Rating Framework

Broker Overview

Silwana Brokerage started in 2018 as an offshore brokerage firm. It positions itself in the competitive world of alternative investment providers. The company has built a business model that goes beyond traditional forex trading to include farming investments and digital currency trading, according to available information.

The broker emphasizes its use of modern methods and automated trading platforms. This suggests a technology-focused approach to investment management. The company's offshore status lets it operate with fewer regulatory limits, which can provide flexibility in offering different investment products but also raises questions about client protection and following regulations.

Silwana Brokerage markets itself as offering "real projects" with potential for "growing passive income." It particularly highlights opportunities in farming investments alongside more traditional forex and cryptocurrency trading options. The broker's approach to combining multiple asset types under one platform reflects a trend toward diversified trading environments, though this silwana brokerage review notes that such diversity requires careful evaluation of the broker's expertise across different market areas.

The emphasis on automated trading suggests the platform may appeal to traders seeking systematic trading approaches. It may also attract those with limited time for active market monitoring.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Silwana Brokerage's operations. This is consistent with its offshore broker classification.

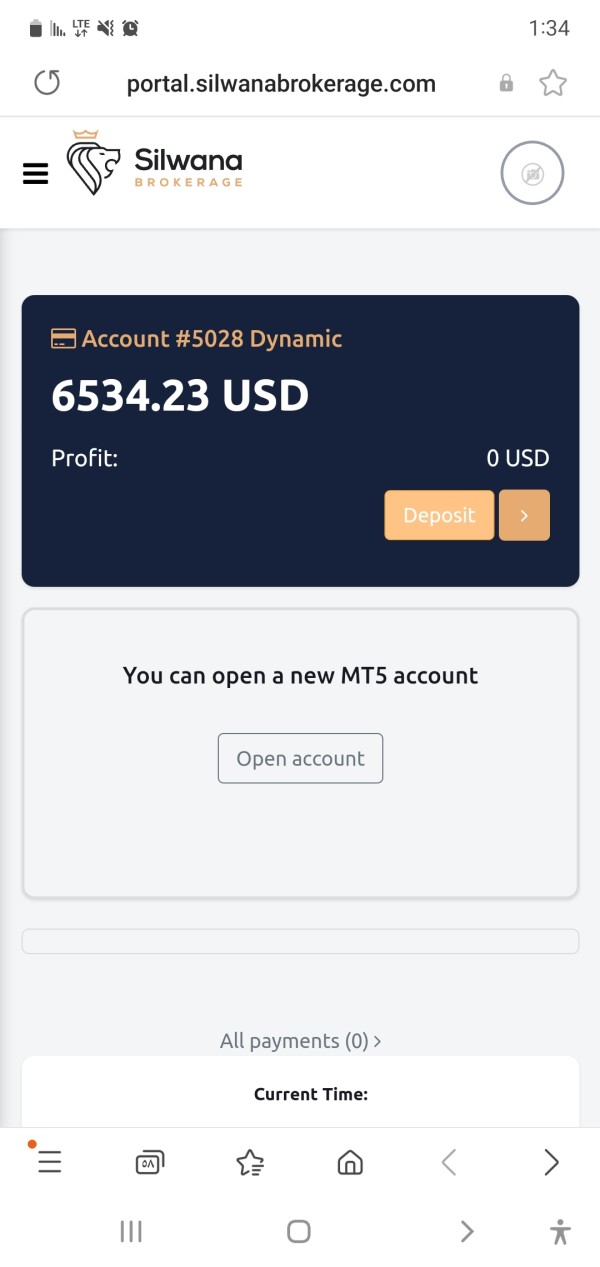

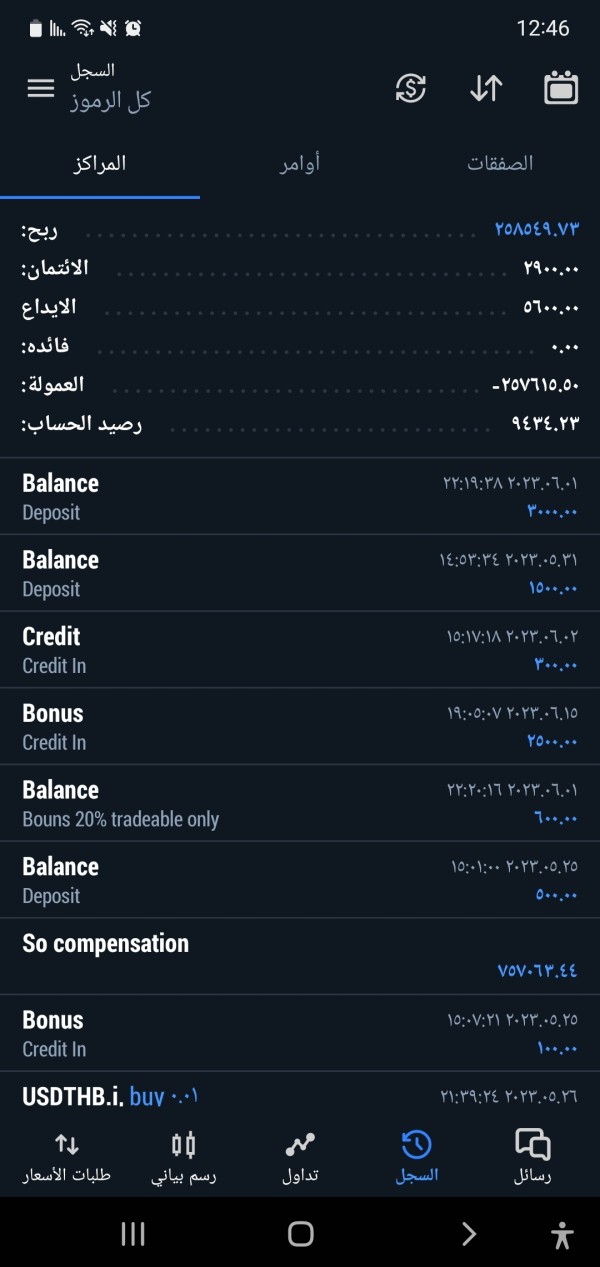

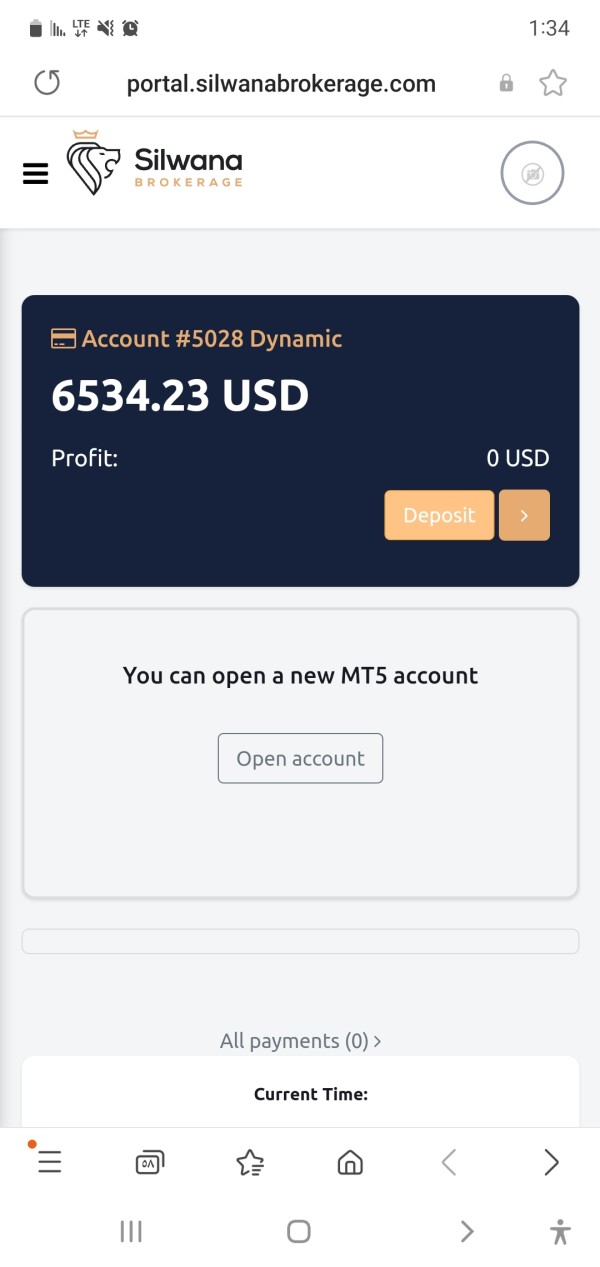

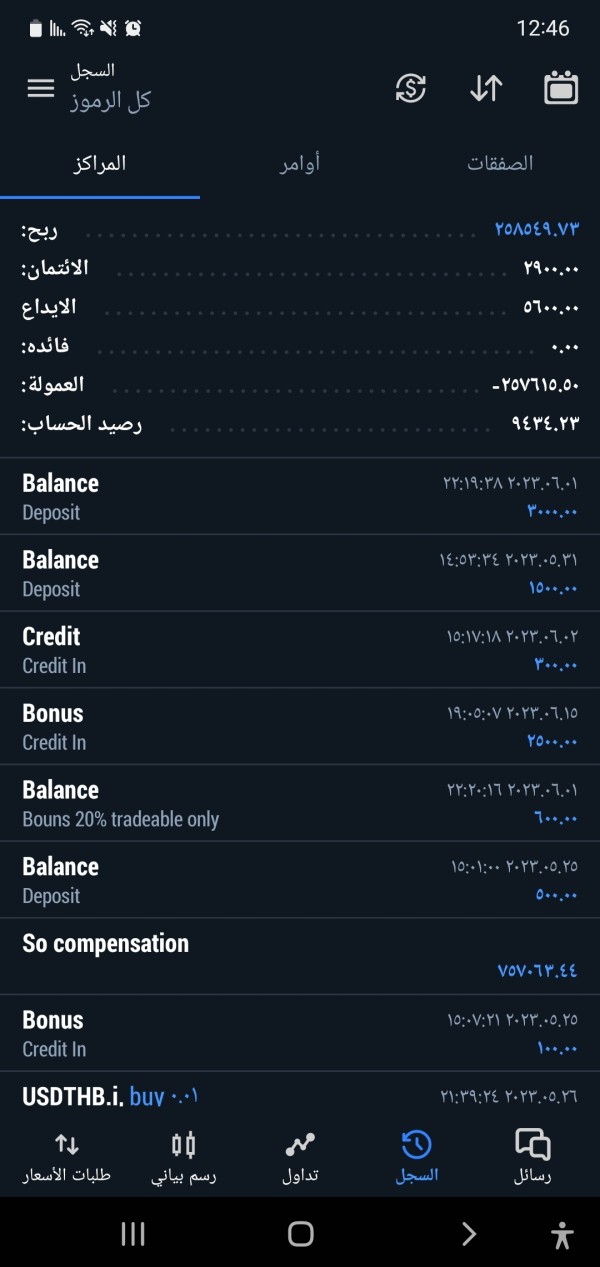

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been detailed in accessible sources. This represents a significant information gap for potential clients.

Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with Silwana Brokerage are not specified in available documentation.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in the available information sources.

Tradeable Assets: The broker offers access to forex markets, digital currencies, and agricultural investment opportunities. This represents a diversified asset portfolio that extends beyond traditional trading instruments.

Cost Structure: Specific information about spreads, commissions, and other trading costs has not been made available in the reviewed sources. This makes cost comparison challenging.

Leverage Options: Leverage ratios and margin requirements are not specified in the available documentation.

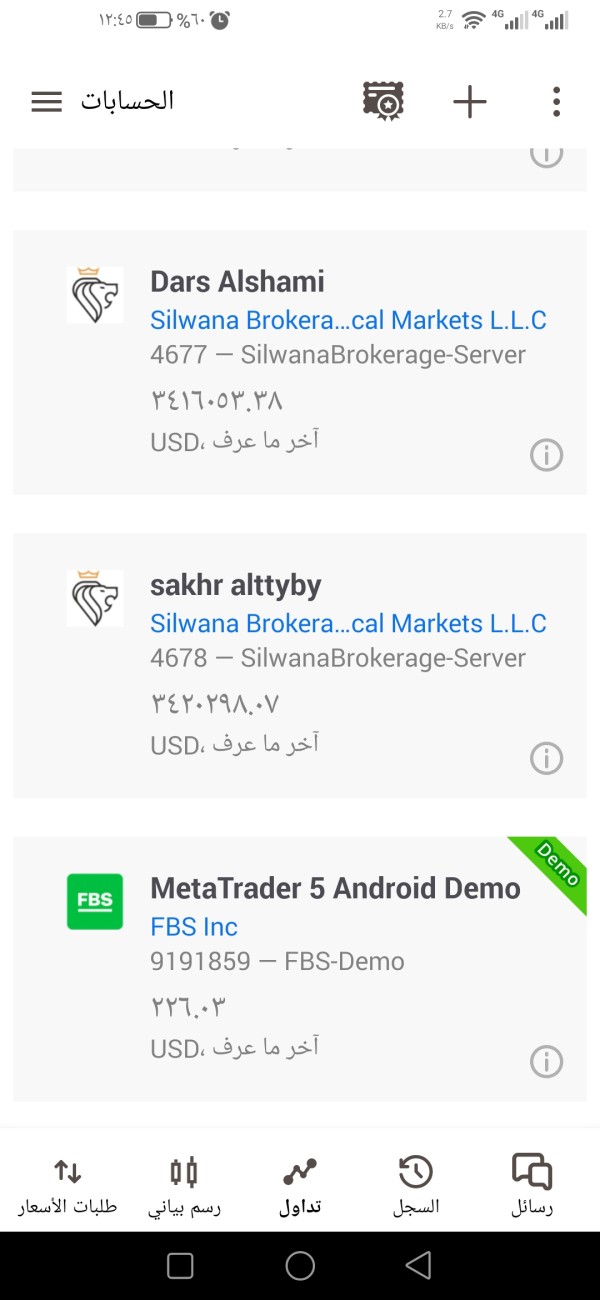

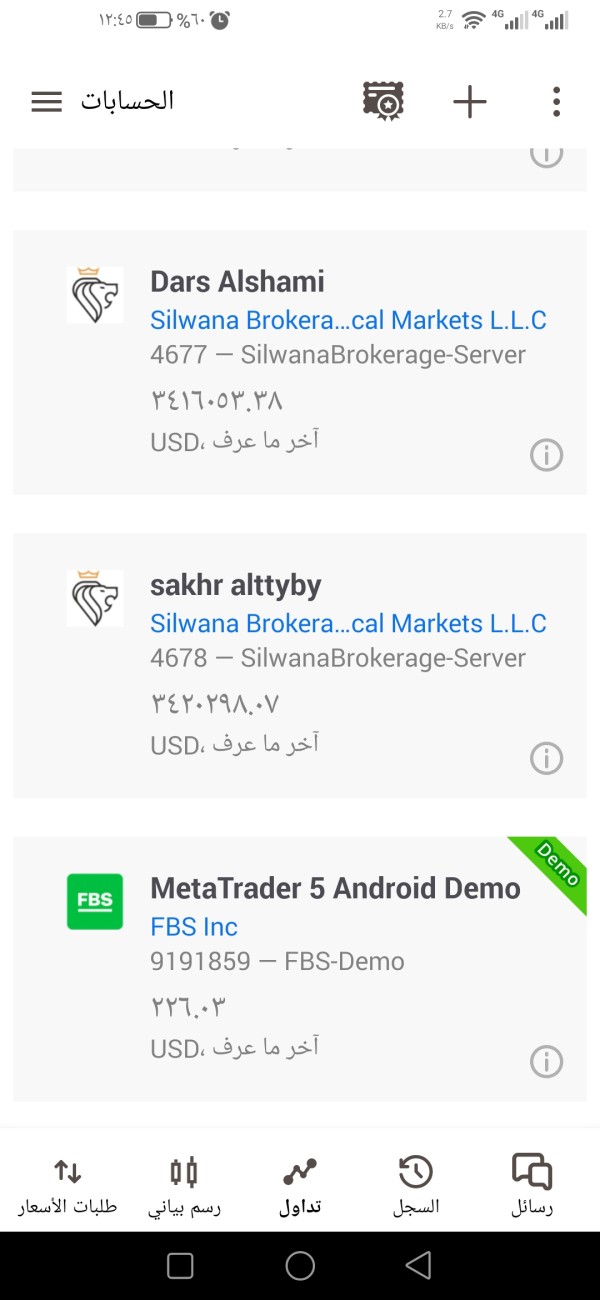

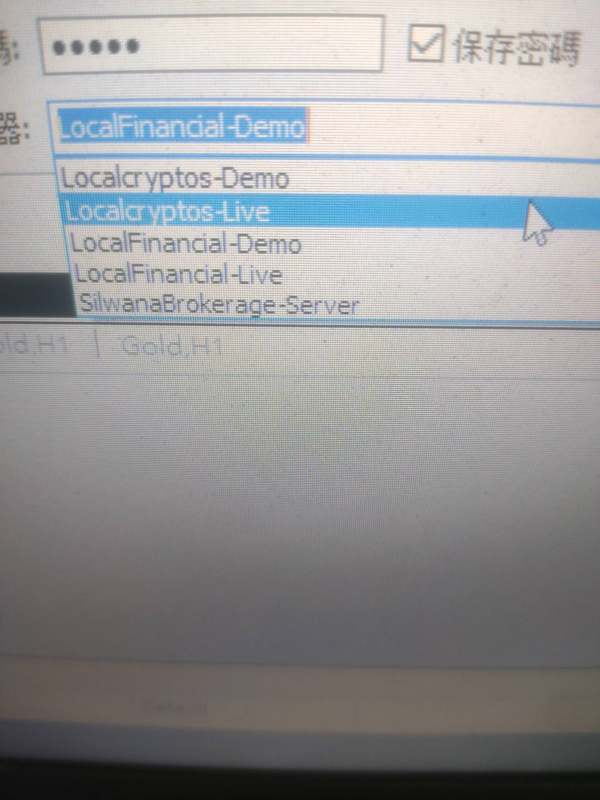

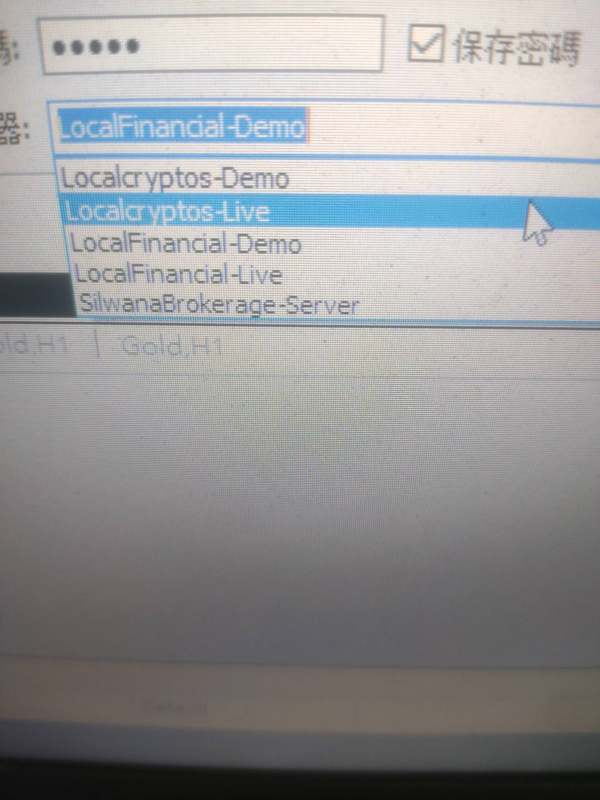

Platform Options: While the broker mentions providing automated trading platforms, specific platform details and software specifications are not elaborated upon in accessible sources.

Geographic Restrictions: Detailed information about geographic restrictions and availability by region has not been comprehensively outlined.

Customer Support Languages: The specific languages supported by customer service teams are not detailed in available materials.

This silwana brokerage review highlights significant information gaps. Potential clients should address these through direct inquiry with the broker before making investment decisions.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Silwana Brokerage remain largely hidden in publicly available information. This presents a significant challenge for potential clients seeking to understand their trading environment. Without specific details about account types, minimum deposit requirements, or account features, traders cannot properly assess whether the broker's offerings match their trading needs and capital requirements.

The absence of information regarding account opening procedures, verification requirements, and account management features suggests either limited transparency or insufficient public documentation. For a broker established in 2018, the lack of detailed account condition information is concerning, particularly when compared to industry standards where such information is typically shown prominently. Potential clients should be aware that the unavailability of specific account terms may indicate either a customized approach to account setup or insufficient standardization of services.

The broker's offshore status may contribute to this information gap. Offshore brokers sometimes operate with less standardized documentation than their regulated counterparts. This silwana brokerage review emphasizes that without clear account conditions, traders cannot make informed decisions about the suitability of this broker for their trading objectives.

The lack of transparency in this fundamental area contributes to the overall uncertainty surrounding the broker's operations.

Silwana Brokerage promotes its automated trading platform capabilities. This suggests a focus on technology-driven trading solutions. However, the specific tools, analytical resources, and educational materials available to traders are not fully detailed in available sources.

The mention of "modern methods" in agricultural investment and digital currency trading implies some level of technological sophistication. But concrete details about trading tools remain unclear. The broker's emphasis on automation suggests that traders may have access to algorithmic trading capabilities or systematic trading tools, which could appeal to those seeking hands-off investment approaches.

However, without specific information about the quality, reliability, or range of these automated systems, it's difficult to assess their effectiveness or suitability for different trading strategies. Research and analysis resources, which are crucial for informed trading decisions, are not detailed in available documentation. Similarly, educational resources that could help traders understand the broker's unique approach to agricultural and digital currency investments are not specified.

This lack of information about supporting tools and resources creates uncertainty about the broker's commitment to trader education and support. The absence of detailed tool specifications may reflect either a customized approach to providing resources based on individual client needs or insufficient development of comprehensive trading support systems.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection. Yet specific information about Silwana Brokerage's support infrastructure is not detailed in available sources. The lack of information about customer service channels, response times, and service quality creates uncertainty about the level of support traders can expect when issues arise.

Without details about available communication methods such as phone support, live chat, email response times, or help desk availability, potential clients cannot assess whether the broker provides adequate support for their trading activities. The absence of information about multilingual support capabilities is particularly relevant given the broker's international offshore status. Customer service quality often becomes crucial during account issues, technical problems, or withdrawal requests.

The lack of user feedback specifically addressing support experiences means that this silwana brokerage review cannot provide insights into how effectively the broker handles client concerns or resolves technical issues. The offshore nature of the broker may impact customer service accessibility and effectiveness, particularly for clients in different time zones or those requiring support in specific languages. Without clear information about support infrastructure, traders face uncertainty about assistance availability when needed.

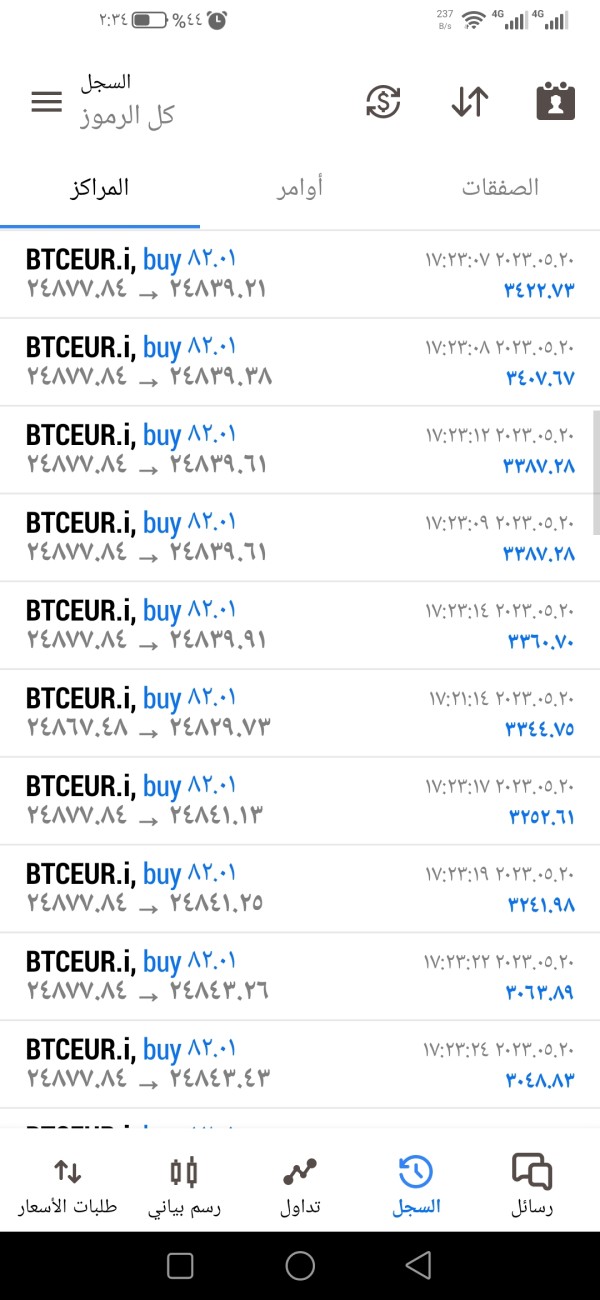

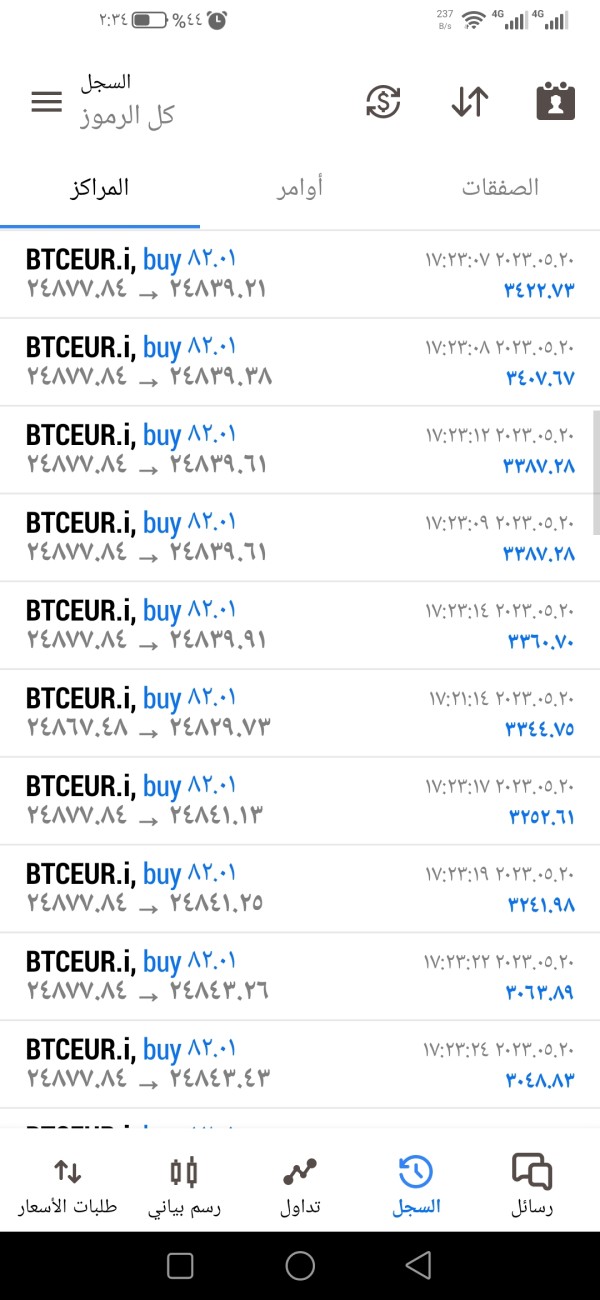

Trading Experience Analysis

The trading experience offered by Silwana Brokerage remains largely undefined due to insufficient detailed information about platform performance, execution quality, and trading environment characteristics. While the broker emphasizes automated trading capabilities and modern methods, specific data about platform stability, execution speeds, and order processing quality are not available in reviewed sources. Platform functionality and reliability are crucial factors affecting trading success, yet specific information about the broker's trading infrastructure, server stability, or platform features is not detailed.

The mention of automated trading suggests some level of technological capability. But without performance data or user experience feedback, it's difficult to assess the quality of the trading environment. Mobile trading capabilities and platform accessibility across different devices are not specified, which is increasingly important for modern traders who require flexibility in accessing their accounts.

Similarly, information about platform customization options, charting capabilities, and analytical tools integrated into the trading interface is not available. The lack of specific trading experience data makes it challenging for potential clients to understand what they can expect from the platform's performance and functionality. This silwana brokerage review notes that without detailed trading environment information, traders cannot adequately assess whether the platform meets their technical and functional requirements.

Trust and Security Analysis

Trust and security concerns represent the most significant challenges identified in this evaluation of Silwana Brokerage. WikiFX has raised specific concerns about the broker's legitimacy and safety, questioning whether the operation might involve fraudulent activities. These concerns contrast sharply with positive feedback found on Trustpilot, creating a confusing landscape for potential clients attempting to assess the broker's reliability.

The absence of clear regulatory oversight compounds security concerns, as offshore brokers typically operate with less stringent oversight than regulated entities. Without specific information about client fund protection measures, segregated account policies, or regulatory compliance procedures, traders face uncertainty about the safety of their investments. The broker's offshore status inherently carries additional risks related to dispute resolution and legal recourse in case of problems.

Without clear regulatory frameworks or established complaint procedures, clients may find limited options for addressing issues if they arise. The conflicting assessments from different evaluation platforms highlight the importance of conducting thorough due diligence before engaging with this broker. The trust and security concerns raised by WikiFX represent serious considerations that potential clients should carefully evaluate against their risk tolerance and investment objectives.

User Experience Analysis

User experience evaluation for Silwana Brokerage is complicated by the contrasting feedback available from different sources. While Trustpilot reviews describe positive experiences with "real projects" and "growing passive income," WikiFX's concerns about legitimacy create uncertainty about the overall user experience quality. The lack of detailed information about user interface design, account management processes, and overall platform usability makes it difficult to assess the day-to-day experience of working with this broker.

Without specific feedback about registration procedures, verification processes, or account management functionality, potential clients cannot understand what to expect from the user experience. Fund management experiences, including deposit and withdrawal processes, are not detailed in available sources, representing a significant information gap for potential clients. The efficiency and reliability of financial transactions are crucial components of user experience that remain unclear.

The absence of comprehensive user feedback about common issues, platform performance, or service quality means that this evaluation cannot provide insights into typical user satisfaction levels. The conflicting assessments available suggest that user experiences may vary significantly, though specific reasons for this variation are not clear from available information.

Conclusion

This silwana brokerage review reveals a broker operating in a challenging environment of mixed signals and limited transparency. Silwana Brokerage's emphasis on automated trading and diversified investment opportunities, including agricultural and digital currency investments, may appeal to traders seeking alternative investment approaches. However, significant concerns about regulatory oversight, legitimacy questions raised by WikiFX, and substantial information gaps create a high-risk environment for potential clients.

The broker may be suitable for experienced traders who are comfortable with offshore brokers and can conduct thorough due diligence. But it appears unsuitable for novice traders or those seeking regulated trading environments. The main advantages include access to automated trading platforms and diversified investment opportunities, while the primary disadvantages center on regulatory concerns, limited transparency, and potential security risks identified by industry evaluation platforms.