Is Silwana Brokerage safe?

Business

License

Is Silwana Brokerage Safe or Scam?

Introduction

Silwana Brokerage is a relatively new player in the forex market, having been established in 2018. Operating primarily from Saint Vincent and the Grenadines, it offers various trading instruments, including forex, precious metals, indices, and commodities. However, with the rise of online trading platforms, traders must exercise caution and conduct thorough evaluations of brokers to ensure their safety and reliability. The absence of proper regulation can often be a red flag, leading to potential scams. This article investigates Silwana Brokerage's legitimacy by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial for traders as it serves as a safeguard against potential fraud. Silwana Brokerage operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. The lack of regulation means that clients have no recourse if the broker engages in unethical practices or fails to honor withdrawal requests. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation from reputable authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) places Silwana Brokerage in a high-risk category. The financial landscape is fraught with unregulated entities that can easily disappear, taking clients' funds with them. Therefore, it is essential for traders to be cautious when dealing with unregulated brokers like Silwana Brokerage.

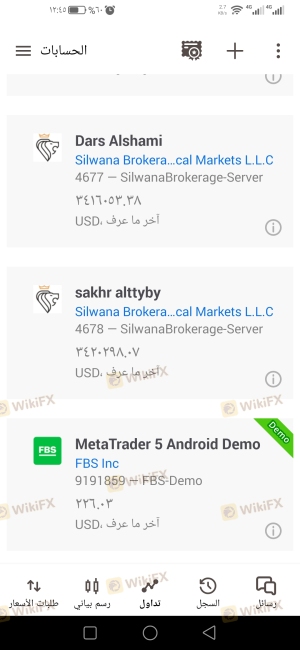

Company Background Investigation

Silwana Brokerage's history and ownership structure are essential factors in assessing its credibility. Founded in 2018, the broker claims to be based in Dubai, but its registration in Saint Vincent and the Grenadines raises questions about its operational transparency. The management team behind Silwana Brokerage is not well-documented, which further complicates the assessment of its reliability. Transparency in ownership and management is vital for trust, as it allows clients to know who is handling their funds.

The company has not provided sufficient information about its operational history, which is another red flag for potential investors. A lack of transparency can often indicate that the broker may not have the best interests of its clients at heart. Without a clear understanding of the management team's qualifications and experience, traders are left in the dark regarding the broker's operational integrity.

Trading Conditions Analysis

Understanding the trading conditions offered by Silwana Brokerage is critical for evaluating its overall value proposition. The broker claims to offer competitive spreads and various account types, but the lack of clarity regarding fees and commissions raises concerns. Below is a comparison of key trading costs:

| Cost Type | Silwana Brokerage | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.6 - 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Unspecified | Varies |

While the broker advertises a minimum deposit requirement of $100, the spreads offered are not competitive compared to other regulated brokers. The absence of a clear commission structure can also lead to unexpected costs for traders. This lack of transparency in trading conditions raises questions about whether Silwana Brokerage is truly a safe option for traders.

Client Fund Security

The safety of client funds is a paramount concern for any trading platform. Silwana Brokerage has not provided adequate information regarding its fund security measures. There is no indication of segregated accounts, which are essential for protecting client funds from being misappropriated. Furthermore, the absence of investor protection schemes means that traders are at risk of losing their entire investment if the broker encounters financial difficulties.

Historically, unregulated brokers have been known to engage in practices that jeopardize client funds, such as using deposits for operational expenses. This lack of accountability highlights the importance of choosing a broker that adheres to strict regulatory standards. Without these protections, traders must exercise extreme caution when considering Silwana Brokerage as a trading platform.

Customer Experience and Complaints

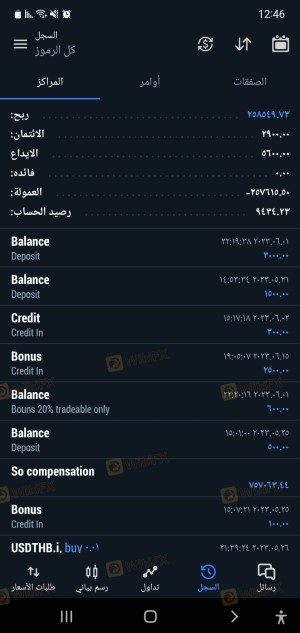

Customer feedback is invaluable in assessing the reliability of a brokerage. Reviews and complaints about Silwana Brokerage reveal a pattern of dissatisfaction among clients. Common complaints include difficulty withdrawing funds, lack of responsive customer service, and unfulfilled promises regarding trading conditions. Below is a summary of the primary complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inadequate |

| Misleading Information | High | Unaddressed |

One notable case involved a trader who reported being unable to withdraw their funds for several months, despite repeated requests. This type of experience is alarming and indicative of potential scams, highlighting the need for traders to be vigilant when dealing with Silwana Brokerage.

Platform and Trade Execution

The trading platform provided by Silwana Brokerage is another critical aspect of its overall evaluation. The broker offers the MetaTrader 5 (MT5) platform, which is widely regarded for its advanced features and user-friendly interface. However, concerns arise regarding the execution quality, including instances of slippage and order rejections. If traders experience frequent issues with trade execution, it can lead to significant financial losses.

Additionally, any signs of platform manipulation should raise red flags for potential investors. A reliable broker should ensure that their trading platform operates smoothly and transparently, providing clients with the tools necessary for successful trading.

Risk Assessment

Engaging with Silwana Brokerage comes with inherent risks that potential traders must consider. The following risk assessment summarizes the primary concerns associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | Lack of segregated accounts and protections |

| Customer Service Risk | Medium | Poor responsiveness to client issues |

| Transparency Risk | High | Insufficient information on management |

To mitigate these risks, traders should conduct thorough research before investing and consider using regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Silwana Brokerage poses significant risks to potential traders. The absence of regulation, coupled with numerous complaints and a lack of transparency, raises serious concerns about its legitimacy. Traders should exercise extreme caution and consider the potential for scams when engaging with this broker.

For those seeking reliable alternatives, it is advisable to explore regulated brokers that provide robust protections and a transparent trading environment. Some reputable options include brokers regulated by the FCA or ASIC, which offer a higher level of security and trustworthiness. Ultimately, the decision to engage with Silwana Brokerage should be made with careful consideration of the associated risks.

Is Silwana Brokerage a scam, or is it legit?

The latest exposure and evaluation content of Silwana Brokerage brokers.

Silwana Brokerage Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Silwana Brokerage latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.