SDIC SECURITIES Review 2

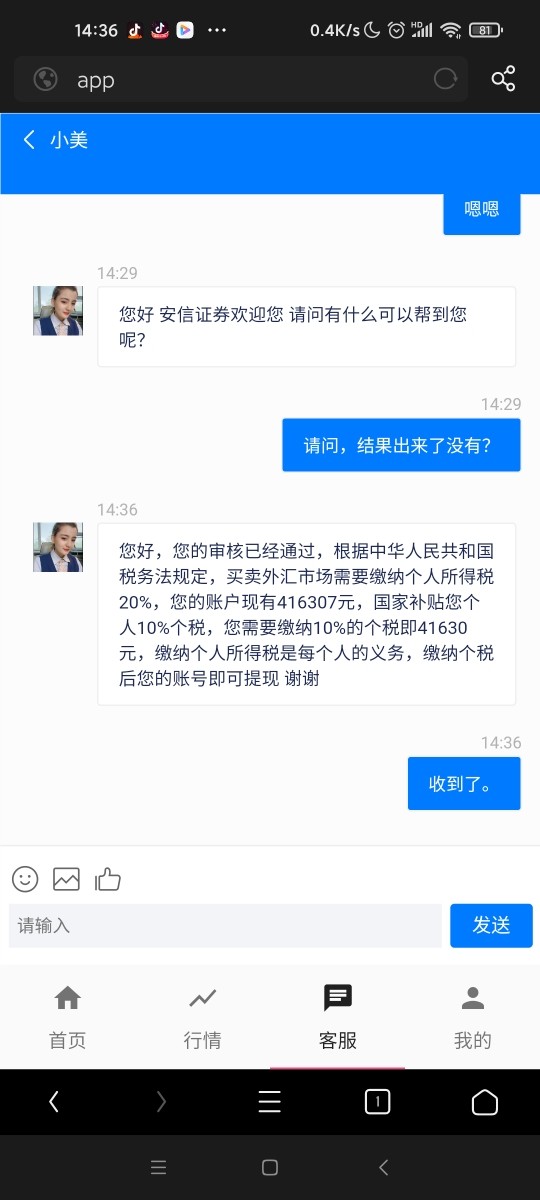

There is a website faking Essence securities. Everyone pays attention. APP.ax008.net

Pay? Induce deposit step by step Verification fee, margin, tax?

SDIC SECURITIES Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

There is a website faking Essence securities. Everyone pays attention. APP.ax008.net

Pay? Induce deposit step by step Verification fee, margin, tax?

In 2025, Essence Securities is facing significant scrutiny due to its lack of regulatory oversight and concerning user experiences. Many sources label it as high-risk, particularly for investors in the Chinese market, and caution against engaging with the broker. Notably, it operates without valid regulation, raising alarms about potential scams and the safety of client funds.

Note: It is crucial to consider the different entities operating under the Essence brand, as they may have varying levels of legitimacy and regulatory compliance. This review aims for fairness and accuracy by analyzing multiple sources.

| Criteria | Rating (out of 10) |

|---|---|

| Account Conditions | 3 |

| Tools and Resources | 4 |

| Customer Service and Support | 5 |

| Trading Experience | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

We evaluate brokers based on a comprehensive analysis of user reviews, expert opinions, and regulatory standings.

Founded in 2006, Essence Securities has established itself as a significant player in the Chinese securities market, focusing on securities brokerage, investment consulting, and financial advisory services. The broker primarily operates in China and offers trading on the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust trading tools. However, Essence Securities lacks regulation from any reputable authority, which raises red flags for potential investors.

Essence Securities operates without any valid regulatory oversight, which is a major concern for potential investors. According to multiple sources, it does not fall under any of the three regulatory levels, including high-trust jurisdictions like the USA, UK, or Australia. This absence of regulation indicates a high-risk environment for investors, as there are no safeguards for client funds.

The broker primarily operates in Chinese Yuan (CNY) for deposits and withdrawals, but it is unclear whether they support cryptocurrencies. The minimum deposit required to open an account is relatively low, making it accessible for new traders. However, the details regarding withdrawal methods and associated fees remain vague, which could lead to complications when attempting to access funds.

While some brokers offer enticing bonuses to attract new clients, the specifics regarding promotions at Essence Securities are not well-documented. This lack of transparency could be a tactic to obscure potentially unfavorable terms tied to bonuses.

Essence Securities provides a range of tradable assets, including stocks, bonds, and various securities. However, the limited information available makes it difficult to assess the full extent of their offerings.

The cost structure at Essence Securities appears to be less competitive compared to other brokers. Reports indicate that spreads can average around 2 pips for major currency pairs, which is not ideal when compared to industry standards of 1.0 to 1.5 pips. Additionally, the absence of clear information about commissions and fees raises concerns about hidden costs.

Leverage options at Essence Securities are not explicitly detailed in the sources reviewed, which adds another layer of uncertainty for traders. The lack of clarity around leverage can significantly impact trading strategies and risk management.

The primary trading platform offered by Essence Securities is MetaTrader 4 (MT4), known for its advanced charting capabilities and automated trading features. However, the lack of additional platforms may limit options for traders who prefer alternative solutions.

While Essence Securities primarily targets the Chinese market, it is unclear whether they accept clients from other regions, which could limit their global reach. This restriction may also indicate a focus on a specific demographic, potentially excluding a broader audience.

Customer service options appear to be limited, with a primary focus on Mandarin. This language barrier could pose challenges for non-Chinese speakers seeking assistance, further diminishing the user experience.

In summary, the Essence Securities review highlights significant concerns regarding the broker's regulatory status, user experiences, and overall trustworthiness. While it offers a range of services and a familiar trading platform, the risks associated with trading through an unregulated broker cannot be overlooked. Potential investors are strongly advised to exercise caution and consider alternative, well-regulated brokers for their trading needs. Given the current landscape, it is prudent to approach Essence Securities with skepticism and to prioritize safety and security in investment decisions.

FX Broker Capital Trading Markets Review