SafeGold FX 2025 Review: Everything You Need to Know

Executive Summary

SafeGold FX is an online trading broker based in Belize. This broker presents a mixed profile for potential traders in 2025. This safegold fx review reveals a broker with limited regulatory transparency and unclear trading conditions. These issues warrant careful consideration. The company was established in 2017 and operates primarily through the MT4 trading platform. However, it notably lacks mobile and web application support, which significantly limits trading flexibility in today's mobile-first environment.

The broker's key characteristics include exclusive reliance on the MetaTrader 4 platform. Customer service operates only in English, potentially restricting accessibility for non-English speaking traders. According to WikiBit's assessment, SafeGold FX receives a D rating. This rating indicates concerns about the broker's overall reliability and transparency. The main target audience appears to be traders specifically seeking MT4 platform access for forex trading. These traders particularly prioritize traditional desktop trading environments over modern mobile solutions.

However, the lack of comprehensive regulatory information raises significant concerns. Limited transparency regarding trading conditions, fees, and account structures also creates problems about the broker's suitability for serious traders seeking reliable and well-regulated trading environments.

Important Notice

Regional Entity Differences: SafeGold FX's regulatory status remains unclear across different jurisdictions. This may significantly impact trading safety and legal protections for users in various regions. The broker's base in Belize, combined with the absence of detailed regulatory information, suggests potential limitations. These limitations affect investor protection schemes that are typically available with more established regulatory frameworks.

Review Methodology: This evaluation is based on publicly available information and user feedback accessible through various forex review platforms. No direct testing or on-site investigation has been conducted. Prospective users are strongly advised to conduct their own thorough research and due diligence before engaging with this broker.

Rating Framework

Broker Overview

SafeGold FX emerged in the competitive forex brokerage landscape in 2017. The company positioned itself as a Belize-based online trading service provider. The company has focused its business model around providing access to foreign exchange markets and CFD trading opportunities through established trading infrastructure. Despite operating for several years, the broker maintains a relatively low profile in the industry. Limited public information exists about its management team, corporate structure, or strategic partnerships that could enhance its credibility.

The broker's operational approach centers on delivering online trading services through traditional channels. It emphasizes the MetaTrader 4 platform as its primary technological offering. This safegold fx review indicates that the company has chosen to maintain a simplified service structure. The company focuses on core forex and CFD trading rather than expanding into newer asset classes or innovative trading technologies that many contemporary brokers are adopting.

SafeGold FX's business model appears to target traders who prefer established, familiar trading environments over cutting-edge technological solutions. The broker's service portfolio includes forex trading and CFD instruments. However, specific details about the range of available assets, trading conditions, and account structures remain notably absent from publicly available materials, raising questions about operational transparency.

Regulatory Jurisdiction: SafeGold FX operates from Belize. Specific regulatory oversight details are not clearly disclosed in available materials. This lack of regulatory transparency represents a significant concern for traders seeking well-regulated trading environments.

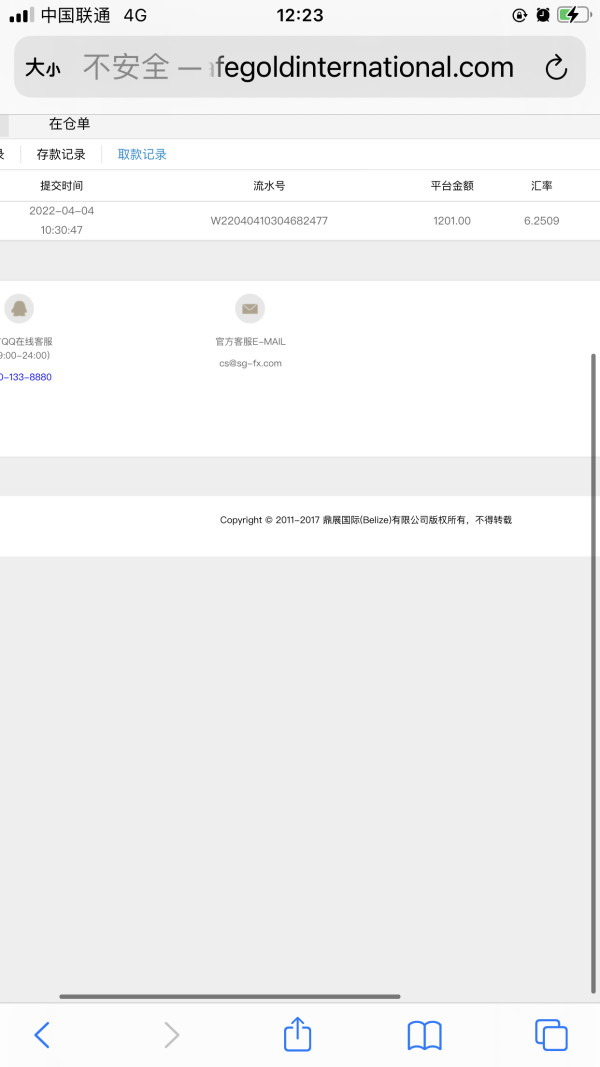

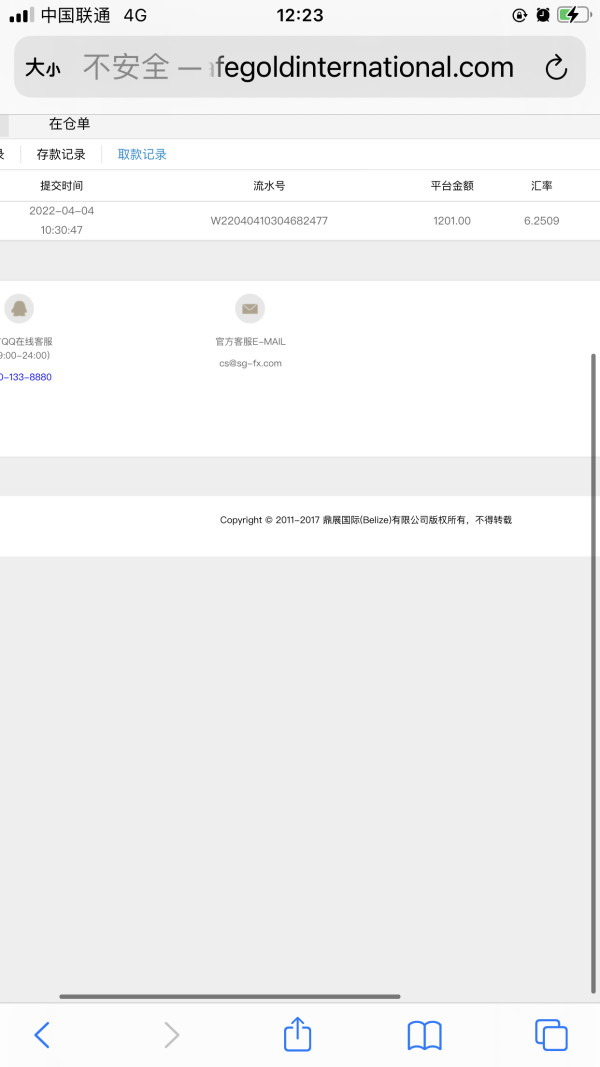

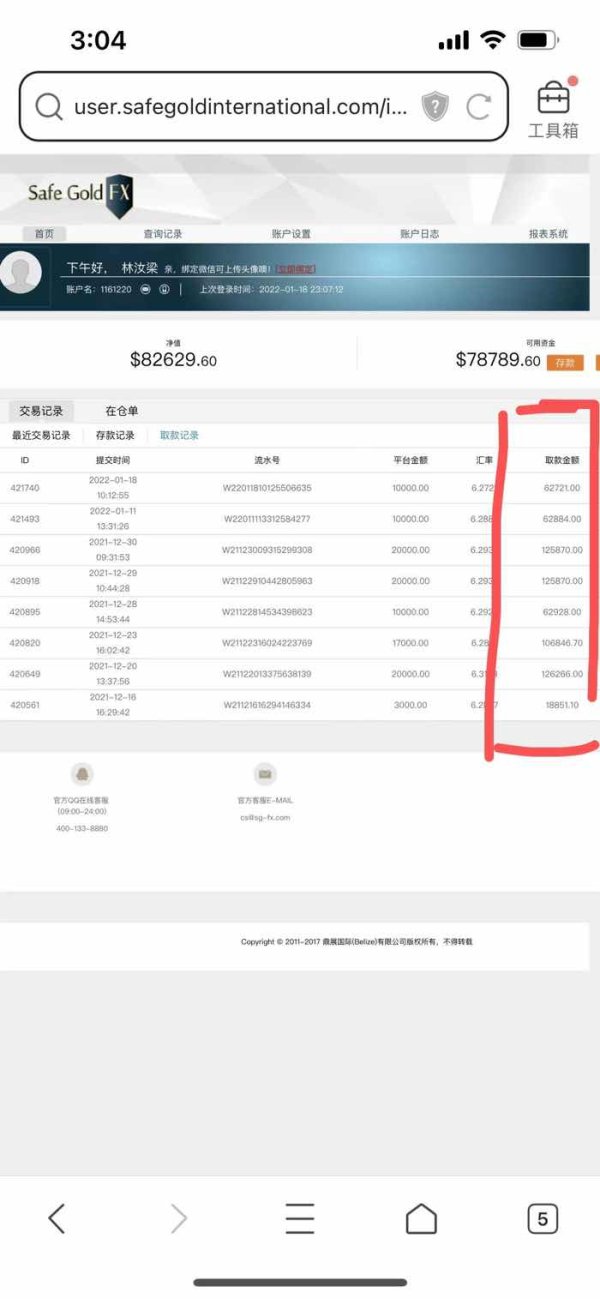

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options is not detailed in available sources. This makes it difficult for potential clients to assess the convenience and security of fund management processes.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not mentioned in available documentation. This prevents prospective traders from understanding the financial commitment required to begin trading.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in accessible materials. This suggests either limited promotional activities or insufficient transparency in marketing communications.

Tradeable Assets: The broker primarily offers forex and CFD trading opportunities. The specific range of currency pairs, commodities, indices, and other CFD instruments remains unclear from available information.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not transparently provided in available materials. This makes cost comparison with other brokers challenging for potential clients.

Leverage Ratios: Specific leverage offerings are not detailed in accessible sources. This prevents traders from understanding the risk management parameters available.

Platform Options: The broker exclusively supports the MT4 trading platform. It notably lacks mobile applications and web-based trading solutions that have become industry standards.

Geographic Restrictions: Specific information about regional trading restrictions or prohibited jurisdictions is not clearly outlined in available materials.

Customer Support Languages: Customer service operations are conducted exclusively in English. This potentially limits accessibility for traders who prefer support in other languages.

This safegold fx review highlights significant information gaps. Prospective traders should consider these gaps when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

SafeGold FX's account conditions receive a below-average rating due to significant transparency issues and lack of detailed information about account structures. The broker fails to provide clear information about different account types, their specific features, or the benefits associated with various account tiers. This lack of transparency makes it extremely difficult for potential clients to make informed decisions about which account structure might best suit their trading needs and financial capabilities.

The absence of clearly stated minimum deposit requirements represents another significant shortcoming in the broker's account offering. Most reputable brokers provide transparent information about initial funding requirements. This allows traders to plan their financial commitments appropriately. SafeGold FX's failure to disclose these basic requirements raises concerns about operational transparency and customer communication standards.

Account opening procedures and verification requirements are not detailed in available materials. This leaves potential clients uncertain about the onboarding process, required documentation, and timeframes for account activation. Additionally, there is no mention of specialized account features such as Islamic accounts for Muslim traders or other accommodations that many modern brokers routinely offer.

The overall assessment suggests that SafeGold FX has not prioritized transparency in its account structure communication. This significantly impacts the user experience and decision-making process for potential clients. This safegold fx review emphasizes the importance of clear account information for trader confidence and regulatory compliance.

SafeGold FX's tools and resources offering receives an average rating. This rating is primarily anchored by its provision of the MT4 trading platform, which remains a solid choice for many traders despite its age. MetaTrader 4 offers comprehensive charting capabilities, technical analysis tools, and support for automated trading through Expert Advisors. This provides users with a familiar and functional trading environment that has proven reliable over many years.

However, the broker's tool offering is significantly limited by the absence of mobile and web-based trading applications. In today's trading environment, mobile accessibility has become essential for active traders who need to monitor positions and execute trades while away from their desktop computers. The lack of mobile applications represents a substantial limitation that affects the broker's competitiveness and user convenience.

Research and analysis resources are not detailed in available materials. This suggests either limited provision of market analysis, economic calendars, trading signals, or educational content that many traders rely on for informed decision-making. Modern brokers typically provide comprehensive research tools, daily market analysis, and educational resources to support trader development and success.

The absence of information about automated trading support, advanced order types, or integration with third-party analysis tools further limits the assessment of the broker's technological capabilities. While MT4 provides basic functionality, the lack of additional tools and resources suggests a minimal approach to trader support and platform enhancement.

Customer Service and Support Analysis (6/10)

SafeGold FX's customer service receives an above-average rating despite notable limitations. This rating is primarily due to the English-only support structure. While providing customer service exclusively in English may be sufficient for many traders, it significantly limits accessibility for non-English speaking clients who might prefer support in their native languages. This language limitation could impact the broker's ability to serve diverse international markets effectively.

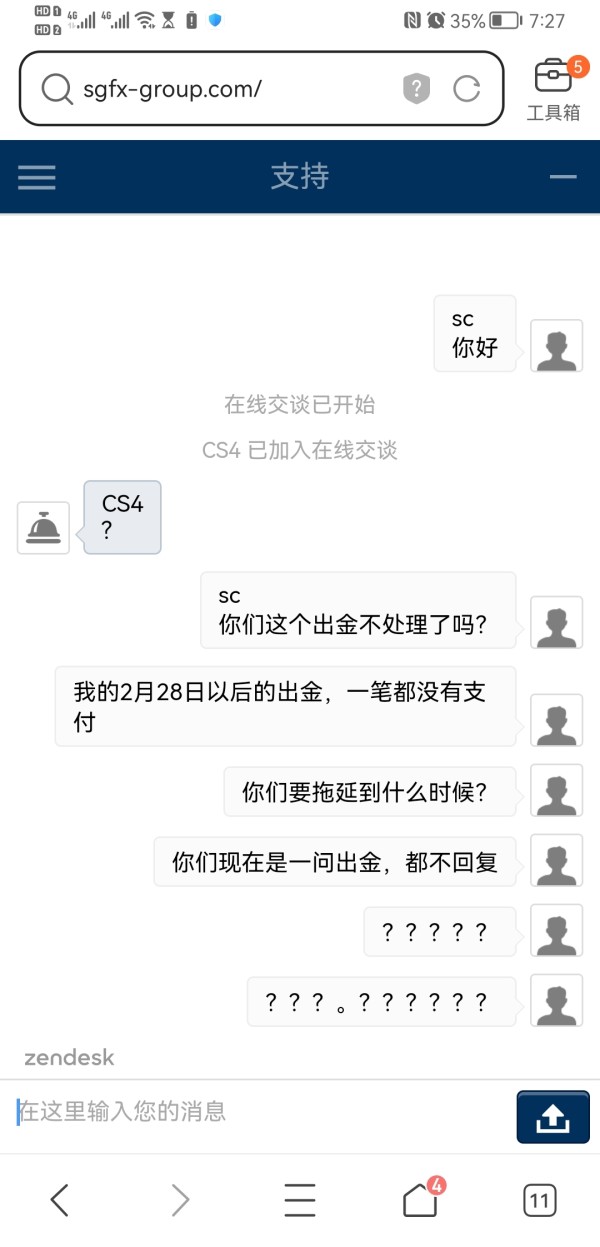

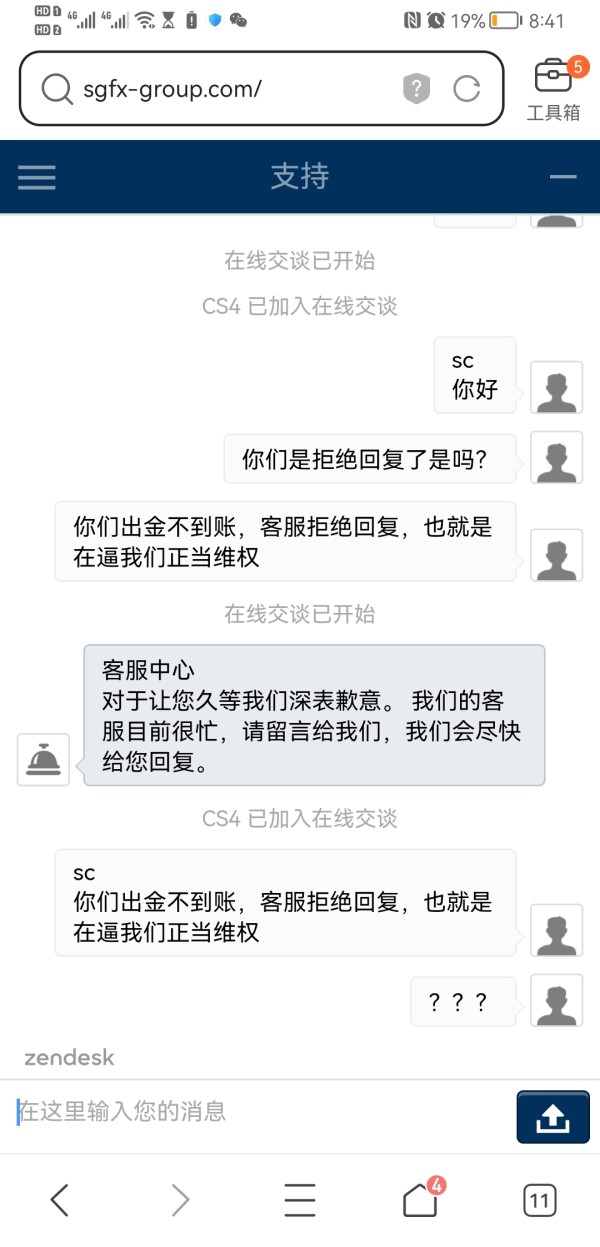

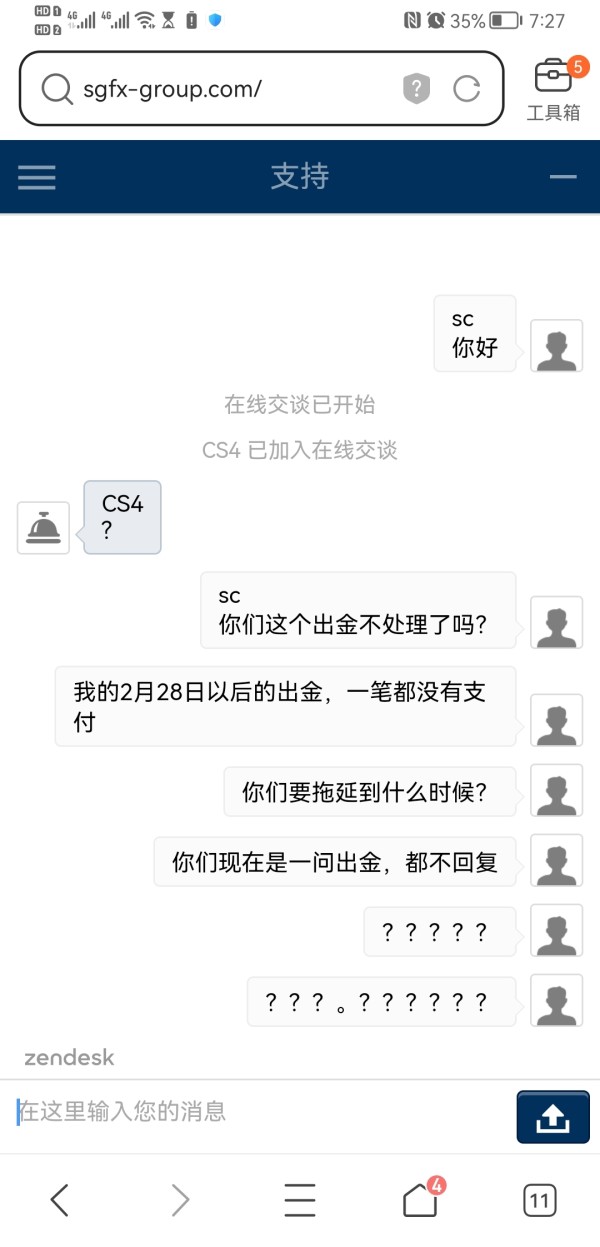

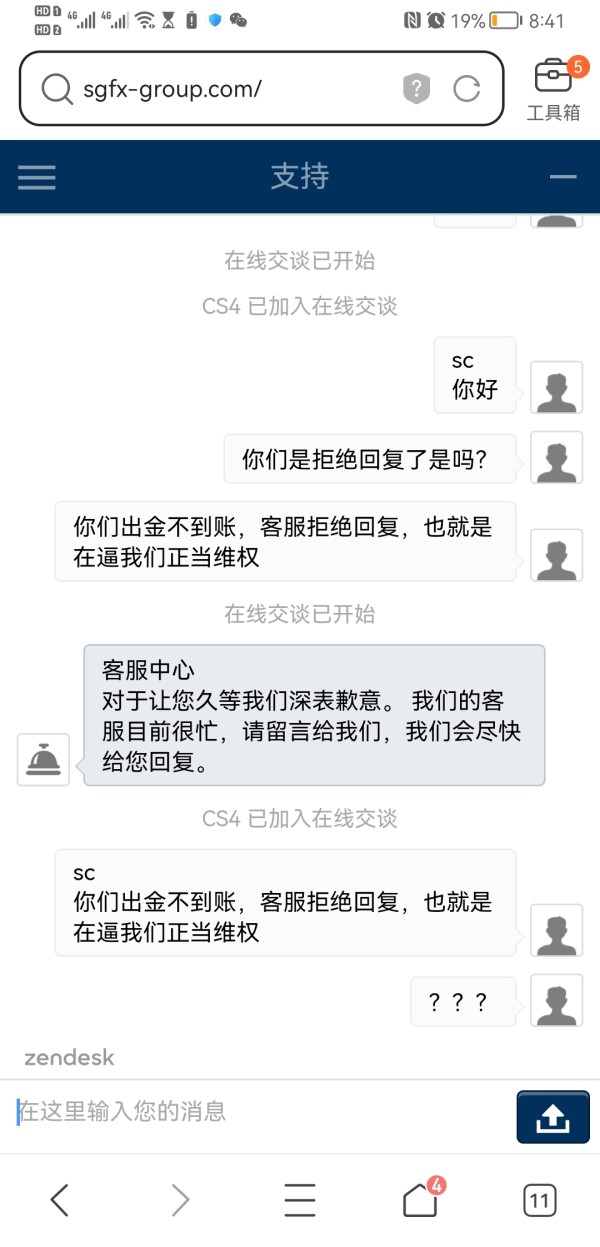

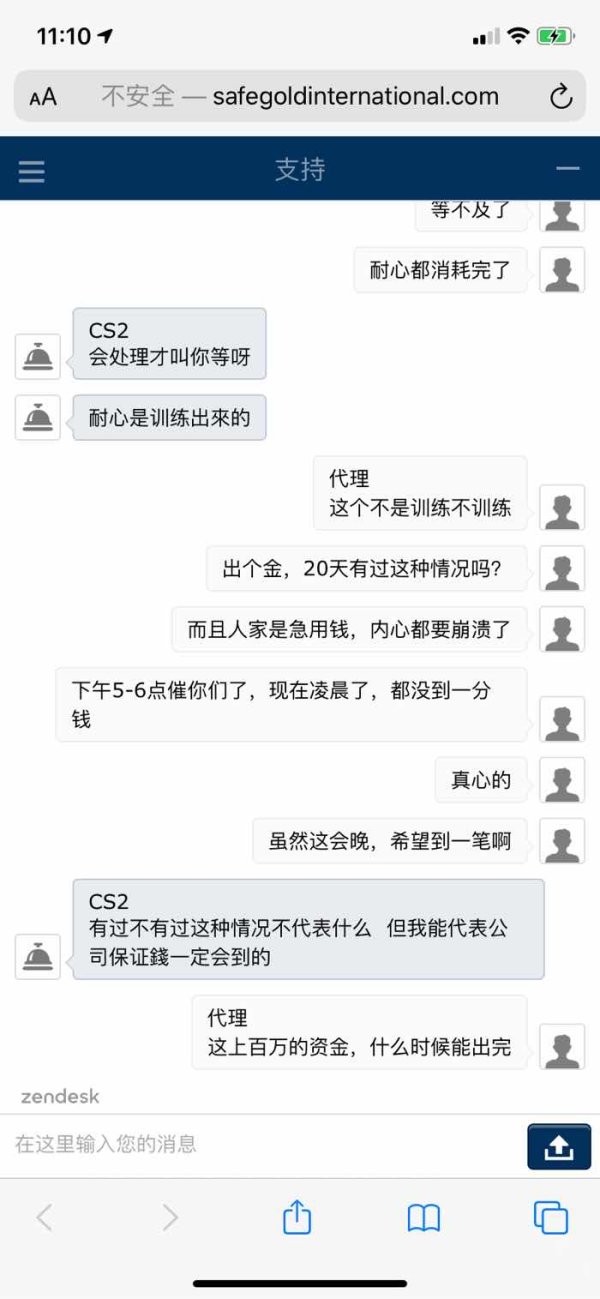

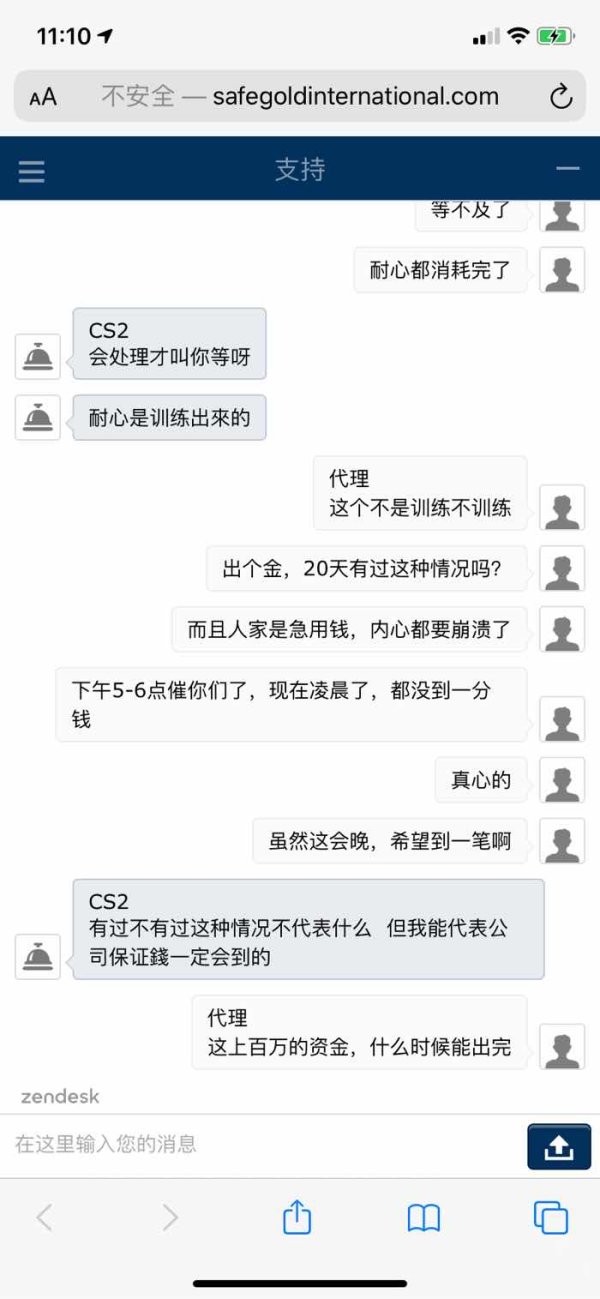

The available information does not specify the customer service channels offered. These might include live chat, telephone support, email assistance, or support ticket systems. Modern traders expect multiple communication options and quick response times, particularly during active trading hours when urgent assistance may be required for technical issues or account-related queries.

Response times and service quality metrics are not detailed in available materials. This makes it difficult to assess the efficiency and effectiveness of the support team. Professional customer service typically includes specified response time commitments, escalation procedures for complex issues, and quality assurance measures to ensure consistent service delivery.

Operating hours for customer support are not clearly stated. This is crucial information for traders operating in different time zones or those who trade during extended market hours. The absence of 24/7 support capability could be particularly limiting for forex traders who operate in global markets that function around the clock.

Despite these limitations, the provision of English-language support suggests basic customer service infrastructure. However, the lack of detailed information about service scope and quality prevents a more comprehensive assessment.

Trading Experience Analysis (5/10)

The trading experience with SafeGold FX receives an average rating. This rating is largely influenced by the reliability of the MT4 platform but significantly limited by the lack of modern trading conveniences. MetaTrader 4 provides a stable trading environment with proven order execution capabilities, comprehensive charting tools, and support for automated trading strategies that many experienced traders value.

However, the absence of mobile trading applications severely impacts the overall trading experience in today's market environment. Mobile trading has become essential for active traders who need to monitor positions, respond to market movements, and execute trades while away from their desktop computers. This limitation significantly restricts trading flexibility and responsiveness to market opportunities.

Platform stability and execution speed information is not detailed in available materials. This makes it difficult to assess the technical performance that traders can expect. Key performance metrics such as order execution speeds, slippage rates, server uptime, and connection reliability are crucial factors that impact trading success but are not transparently communicated.

The trading environment details are not clearly specified in available documentation. These include spread competitiveness, liquidity provision, and market depth. These factors significantly impact trading costs and execution quality but remain unclear for potential clients. This safegold fx review emphasizes that the lack of detailed trading condition information makes it challenging for traders to evaluate whether the platform meets their performance requirements.

Trustworthiness Analysis (3/10)

SafeGold FX receives a poor trustworthiness rating due to several significant concerns about regulatory transparency and operational credibility. The broker's WikiBit rating of D indicates substantial concerns about the company's reliability and regulatory standing within the forex industry. This low rating suggests potential issues with regulatory compliance, customer protection measures, or operational transparency that serious traders should carefully consider.

The absence of clear regulatory information represents the most significant trustworthiness concern. Reputable forex brokers typically provide detailed information about their regulatory licenses, oversight authorities, and compliance measures. SafeGold FX's failure to transparently communicate its regulatory status raises important questions about customer protection, fund security, and legal recourse availability for traders.

Fund security measures and client money protection protocols are not detailed in available materials. This leaves potential clients uncertain about how their deposits are safeguarded. Established brokers typically provide clear information about segregated client accounts, deposit insurance, and fund protection schemes that provide security for trader capital.

Company transparency regarding management team, corporate structure, ownership, and operational history is notably limited. This lack of corporate transparency makes it difficult for potential clients to assess the company's stability, experience, and commitment to long-term operations in the forex industry.

The absence of information about negative event handling, dispute resolution procedures, or regulatory action history further impacts the trustworthiness assessment. Traders cannot evaluate how the broker manages challenges or regulatory concerns.

User Experience Analysis (4/10)

SafeGold FX's user experience receives a below-average rating due to several limitations that impact overall client satisfaction and operational convenience. The lack of detailed user feedback and satisfaction metrics makes it challenging to assess how well the broker meets client expectations and addresses common user concerns that arise in forex trading operations.

Interface design and platform usability information is not comprehensively detailed in available materials. The use of MT4 suggests access to a familiar trading interface that many traders understand. However, the absence of modern web-based and mobile interfaces significantly limits user experience flexibility and convenience in today's trading environment.

Registration and account verification processes are not clearly outlined. This leaves potential clients uncertain about onboarding procedures, required documentation, timeframes for account activation, and potential complications that might arise during the setup process. Streamlined onboarding procedures are essential for positive initial user experiences.

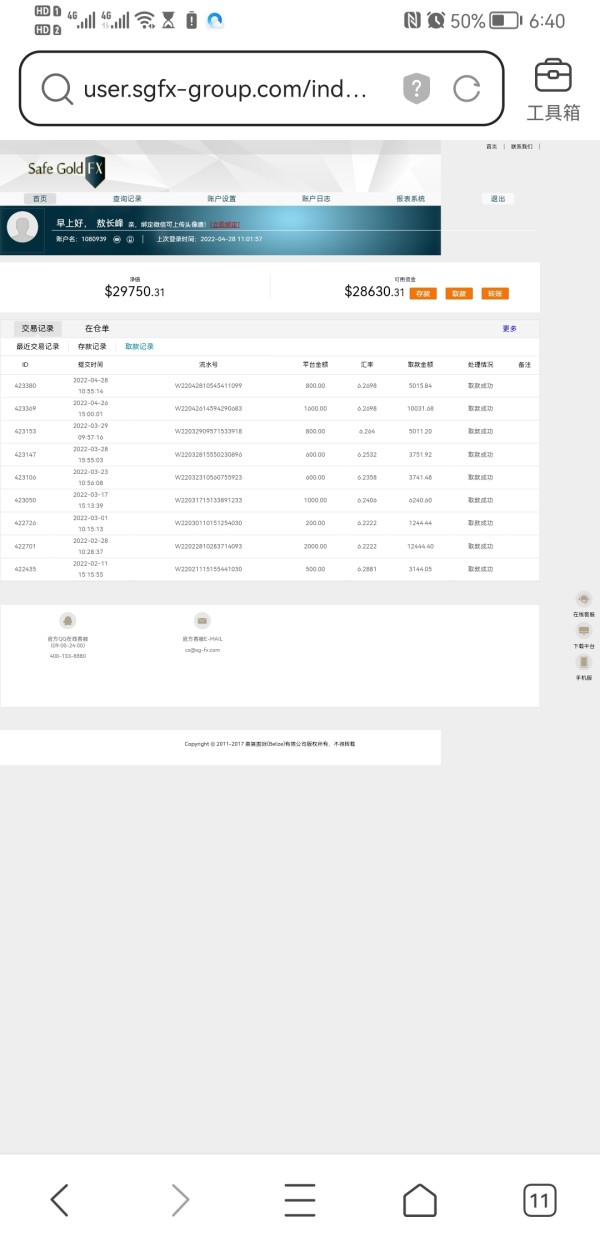

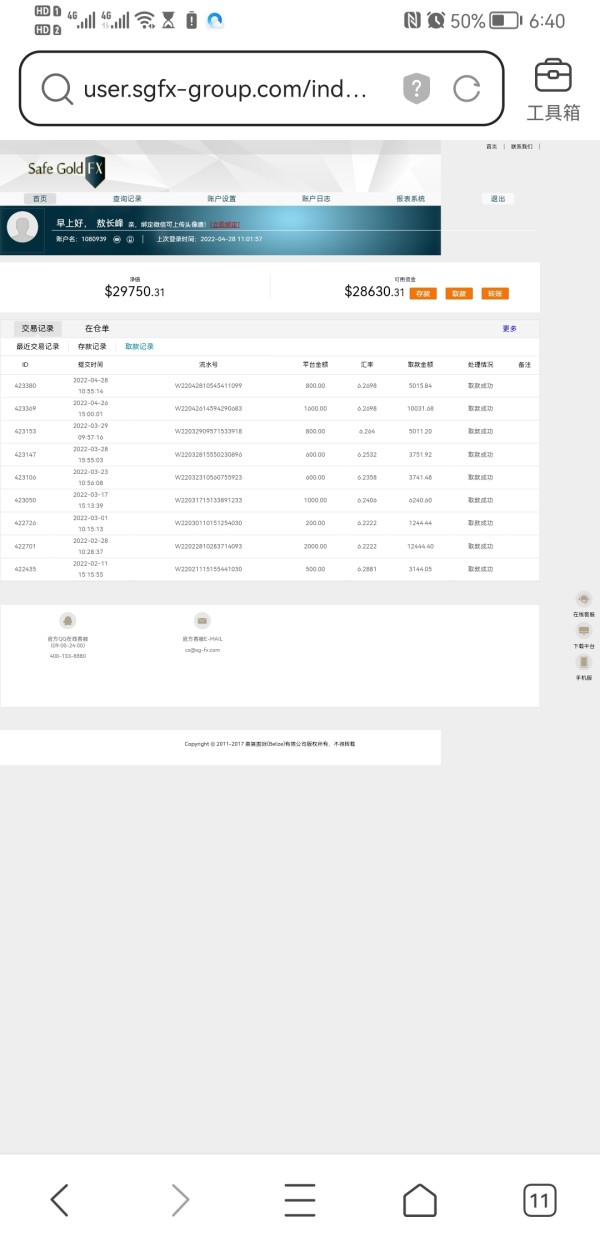

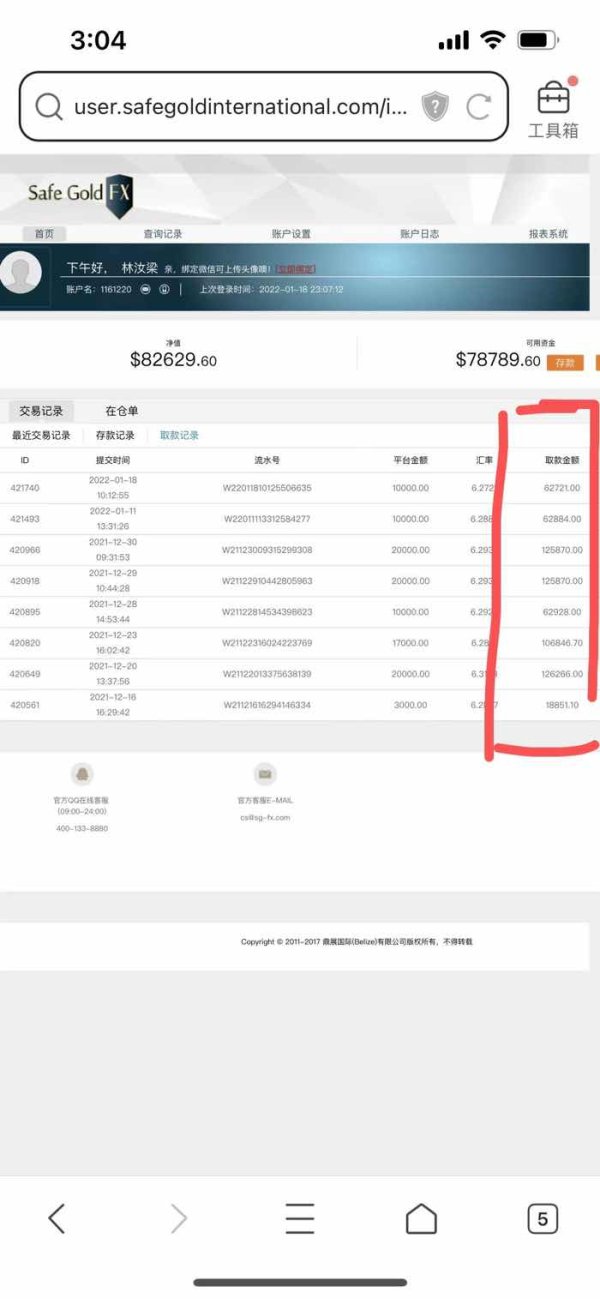

Fund management experience is not detailed in available information. This includes deposit and withdrawal convenience, processing times, and associated fees. Efficient fund management processes are crucial for user satisfaction, as traders need reliable and convenient access to their capital for both funding trading activities and withdrawing profits.

The broker appears to target traders who specifically prefer MT4 platform environments and are comfortable with traditional desktop-based trading approaches. However, the lack of modern conveniences and limited information about user support services suggests that the overall user experience may not meet contemporary trader expectations for comprehensive service and support.

Conclusion

SafeGold FX presents a mixed profile as a Belize-based forex broker with significant limitations that potential traders should carefully evaluate. The broker's primary strength lies in providing access to the reliable MT4 trading platform, which offers comprehensive trading functionality for experienced users. However, substantial concerns about regulatory transparency, limited trading conveniences, and insufficient operational information disclosure significantly impact its overall attractiveness.

The broker appears most suitable for traders who specifically require MT4 platform access and are comfortable with basic trading services. The absence of mobile trading capabilities represents a significant limitation in today's market environment. The English-only customer support may be adequate for some users but limits accessibility for international traders seeking multilingual assistance.

The main advantages include the established MT4 platform and basic forex trading access. Significant disadvantages encompass the lack of regulatory transparency, absence of mobile trading solutions, limited operational information disclosure, and poor industry ratings that raise trustworthiness concerns for serious traders seeking reliable and well-regulated trading environments.