Is SafeGold FX safe?

Business

License

Is SafeGold FX A Scam?

Introduction

SafeGold FX is a forex broker based in Belize, which has been operating since 2017. Positioned in a competitive market, it offers various trading instruments, including forex currency pairs, commodities, and CFDs. However, the legitimacy of SafeGold FX has come under scrutiny, raising concerns among potential traders. This article aims to provide an objective analysis of whether SafeGold FX is a scam or a trustworthy trading platform. Given the complexities and risks associated with forex trading, it is crucial for traders to conduct thorough evaluations of brokers before committing their capital. To assess SafeGold FX, this investigation will focus on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

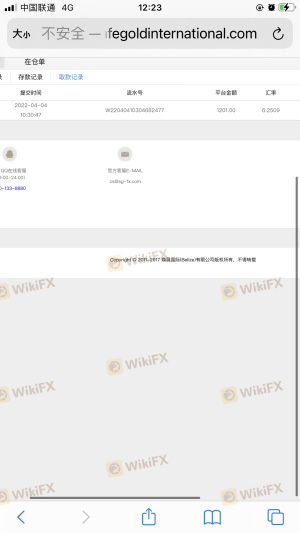

The regulatory framework within which a broker operates is vital for ensuring the safety and security of traders' funds. SafeGold FX claims to be regulated by the International Financial Services Commission (IFSC) of Belize. However, it is important to note that the broker's license has been revoked, which raises significant red flags about its operational legitimacy. The following table summarizes the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | ifsc/60/431/ts/17 | Belize | Revoked |

The revocation of its IFSC license indicates that SafeGold FX is no longer under the oversight of a recognized regulatory body, which typically provides a level of protection for traders. This lack of regulation can expose traders to potential risks, including fraudulent activities and mismanagement of funds. Given the absence of a regulatory safety net, it is crucial for traders to approach SafeGold FX with caution.

Company Background Investigation

SafeGold FX was established in 2017 and is operated by Safe Gold International (Belize) Limited. However, the company's ownership structure and management team lack transparency, which is concerning for potential investors. A broker's credibility is often linked to the experience and reputation of its management team. Unfortunately, there is little publicly available information regarding the backgrounds of the individuals behind SafeGold FX. This lack of transparency can lead to questions about the broker's reliability and overall operational integrity.

Moreover, the company's website is currently non-functional, which further complicates the assessment of its legitimacy. A professional and accessible online presence is crucial for building trust with potential clients. The absence of a functioning website may suggest negligence or a lack of commitment to providing quality service, reinforcing concerns about whether SafeGold FX is a scam.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall cost-effectiveness. SafeGold FX employs a fixed spread model, which is set at 5 pips for major currency pairs, alongside a commission fee of $50 per standard lot. This fee structure is relatively high compared to industry averages, which can impact traders' profitability. The following table compares the core trading costs:

| Fee Type | SafeGold FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 5 pips | 1-2 pips |

| Commission Model | $50/lot | $10-20/lot |

| Overnight Interest Range | Unknown | Varies widely |

The high spread and commission costs may deter cost-sensitive traders seeking more favorable trading conditions. Additionally, the lack of clarity surrounding overnight interest fees raises further questions about the broker's transparency. Traders should carefully consider these costs before engaging with SafeGold FX, especially since higher fees can significantly reduce potential profits.

Customer Fund Security

The safety of customer funds is a paramount concern when choosing a forex broker. SafeGold FX claims to implement measures for fund security; however, specific details regarding fund segregation, investor protection, and negative balance protection are not readily available. This lack of information is concerning, as it suggests that the broker may not prioritize the safety of its clients' funds.

The absence of a robust regulatory framework further exacerbates these concerns, as traders may have limited recourse in the event of financial disputes or mismanagement. Historical complaints regarding withdrawal issues and fund accessibility add another layer of risk. Traders must weigh these factors carefully before deciding to invest with SafeGold FX, as the potential for financial loss is heightened without adequate safety measures in place.

Customer Experience and Complaints

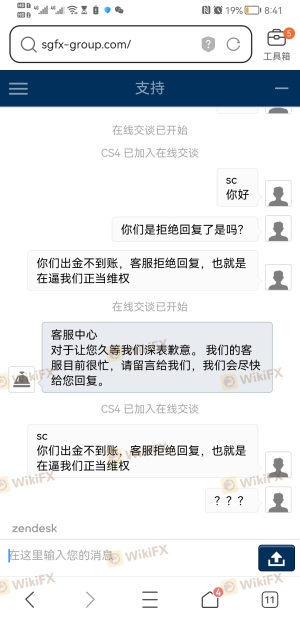

Customer feedback is a critical aspect of evaluating any broker's reliability. Reports from various sources indicate a pattern of negative experiences among SafeGold FX users. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and issues related to account management. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Response | Medium | Slow |

| Account Management Problems | High | Unresponsive |

One notable case involved a trader who reported being unable to withdraw funds after multiple attempts, leading to frustration and claims of fraud. Such experiences highlight the importance of reliable customer service and efficient withdrawal processes, both of which appear to be lacking at SafeGold FX. The accumulation of negative feedback raises significant concerns about the broker's trustworthiness and operational practices.

Platform and Trade Execution

The trading platform is a crucial element of a broker's service offering. SafeGold FX utilizes the widely recognized MetaTrader 4 (MT4) platform, which is favored for its user-friendly interface and robust trading features. However, reports of execution issues, including slippage and order rejections, have surfaced among users. These issues can severely impact trading performance and profitability.

Traders should be aware of any potential manipulation or irregularities in trade execution, as these can be indicative of a broker's overall integrity. The lack of transparency regarding order execution quality at SafeGold FX raises further concerns about whether it is a safe platform for trading.

Risk Assessment

Engaging with any trading platform carries inherent risks, and SafeGold FX is no exception. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | High fees can erode profits. |

| Customer Service Risk | Medium | Negative feedback regarding responsiveness. |

| Operational Risk | High | Non-functional website raises concerns. |

To mitigate these risks, traders should conduct thorough due diligence and consider alternative brokers with strong regulatory oversight and positive user feedback.

Conclusion and Recommendations

Based on the evidence presented, it is clear that SafeGold FX raises multiple red flags. The revocation of its regulatory license, coupled with a lack of transparency and numerous negative user experiences, strongly suggests that this broker may not be a safe option for trading. Potential traders should exercise extreme caution and consider seeking alternative, regulated brokers that prioritize accountability and transparency.

For those looking for reliable trading platforms, brokers such as Forex.com, TD Ameritrade, and TigerWit offer robust regulatory frameworks and positive user experiences that may better suit the needs of traders. Ultimately, the decision to engage with SafeGold FX should be approached with skepticism, and thorough research is essential to avoid potential financial pitfalls.

Is SafeGold FX a scam, or is it legit?

The latest exposure and evaluation content of SafeGold FX brokers.

SafeGold FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SafeGold FX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.