Prime Fx 2025 Review: Everything You Need to Know

Executive Summary

This Prime Fx review shows concerning findings about a trading platform that raises red flags for potential investors. Based on information from multiple sources, Prime Fx appears to be an unregulated entity with questionable legitimacy. The platform claims to offer forex, commodities, indices, and stock CFDs trading through MetaTrader 4 and Sirix platforms. However, it lacks transparency in crucial areas such as trading conditions, regulatory compliance, and company background.

According to various forex industry sources, Prime Fx has been flagged as potentially fraudulent, with multiple warnings about its unregulated status. The broker fails to provide essential information about spreads, commissions, minimum deposits, or leverage ratios. These are standard disclosures for legitimate brokers. User feedback indicates extremely poor experiences, with widespread complaints about the platform's safety and legitimacy. Potential investors should exercise extreme caution when considering this platform, as the lack of regulatory oversight and negative user reports suggest significant risks to capital and personal information.

Important Disclaimer

This review is based on publicly available information and user feedback collected from various sources as of 2025. Prime Fx operates without apparent regulatory oversight in multiple jurisdictions. Investors should be aware that the broker's legal status may vary significantly across different regions. The information presented here has not been verified through direct trading experience with the platform.

Given the unregulated nature of Prime Fx and the numerous safety concerns raised by industry observers, this review should be considered alongside official regulatory warnings and independent verification of any claims made by the broker. Potential clients are strongly advised to conduct their own due diligence and consider regulated alternatives before making any investment decisions.

Rating Framework

Broker Overview

Prime Fx presents itself as a trading platform offering access to various financial instruments. Critical information about the company's establishment date, corporate background, and operational history remains absent from available sources. The broker claims to provide trading services for forex, commodities, indices, and stock CFDs, positioning itself as a comprehensive trading solution. However, the lack of transparency regarding company ownership, headquarters location, and corporate structure raises immediate concerns about the platform's legitimacy and operational credibility.

The business model appears to follow the standard CFD broker framework, where clients trade derivative products rather than owning underlying assets. Prime Fx allegedly offers access to major currency pairs, precious metals, energy commodities, stock indices, and individual equity CFDs. Despite these claims, the broker fails to provide essential details about trading conditions, market access quality, or execution standards. This prevents potential clients from making informed decisions about the platform's suitability for their trading needs.

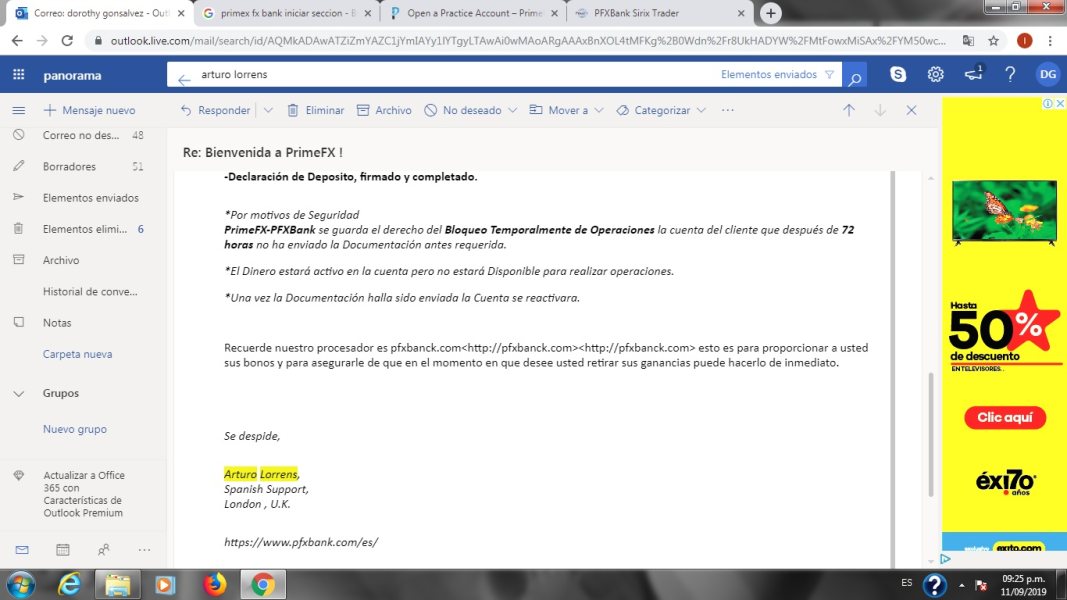

According to multiple industry sources, Prime Fx operates without regulatory authorization from recognized financial authorities. The platform offers MetaTrader 4 and Sirix as its primary trading environments, which are legitimate third-party platforms used by many brokers worldwide. However, the availability of these platforms does not validate the broker's credibility or operational integrity. Any entity can potentially license these technologies regardless of their regulatory status or business practices.

Regulatory Status: Multiple sources confirm that Prime Fx operates without regulatory oversight from recognized financial authorities. This unregulated status means the broker is not subject to standard industry protections, capital requirements, or operational standards that legitimate brokers must maintain.

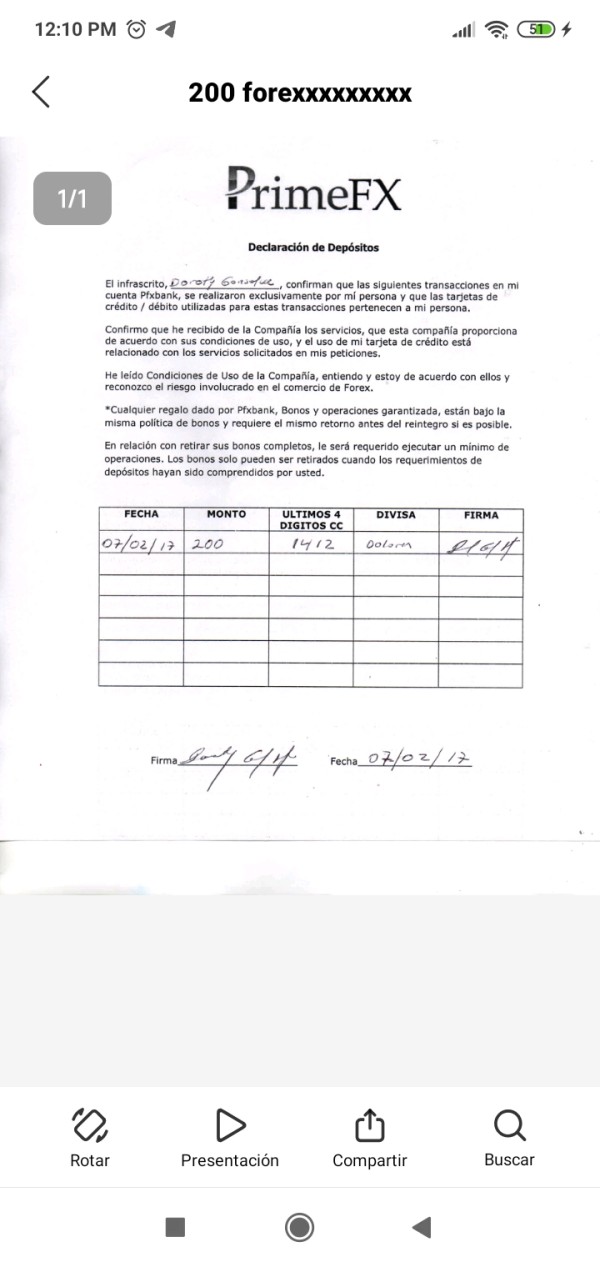

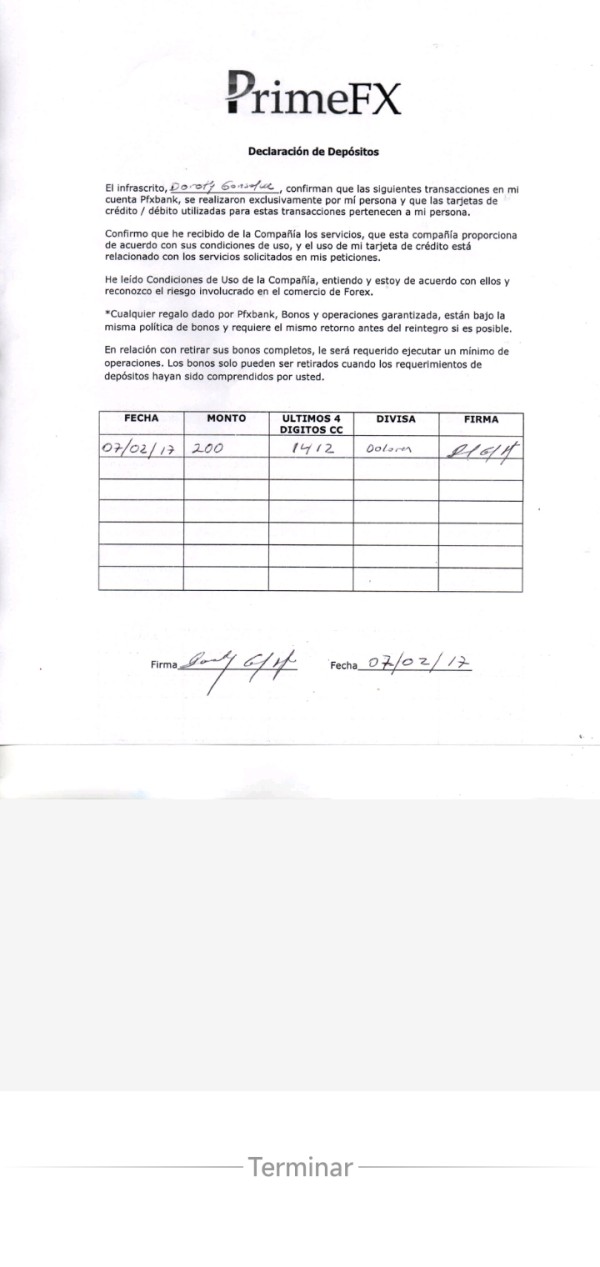

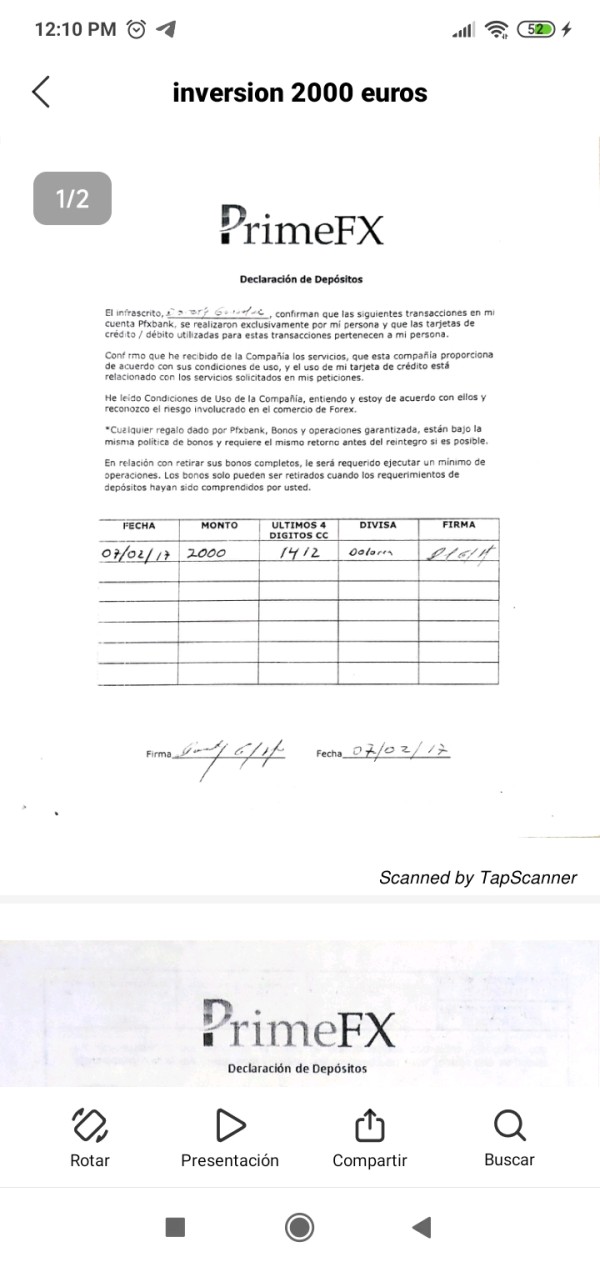

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. The lack of transparency regarding payment processing, withdrawal procedures, and associated fees represents a significant concern for potential clients seeking clarity about fund management.

Minimum Deposit Requirements: Available sources do not specify minimum deposit requirements for opening accounts with Prime Fx. This absence of basic account information further demonstrates the platform's lack of transparency in providing essential trading details.

Bonuses and Promotions: No information about bonuses, promotions, or special offers is mentioned in available sources. The absence of promotional details may indicate either a lack of marketing initiatives or insufficient disclosure of terms and conditions.

Tradeable Assets: Prime Fx claims to offer forex pairs, commodities, indices, and stock CFDs. However, specific details about the number of instruments, major currency pairs available, or specific commodities and indices are not provided in accessible sources.

Cost Structure: Critical information about spreads, commissions, overnight financing charges, and other trading costs remains undisclosed in available sources. This lack of cost transparency makes it impossible for traders to evaluate the platform's competitiveness or calculate potential trading expenses accurately.

Leverage Ratios: Specific leverage ratios offered by Prime Fx are not mentioned in available sources. This represents another significant gap in essential trading information that legitimate brokers typically disclose prominently.

Platform Options: The broker reportedly offers MetaTrader 4 and Sirix trading platforms. Both are established third-party solutions used throughout the forex industry.

Geographic Restrictions: Information about geographic restrictions or prohibited jurisdictions is not specified in available sources.

Customer Support Languages: Available sources do not detail the languages supported by Prime Fx customer service teams.

This comprehensive Prime Fx review reveals substantial information gaps that raise serious questions about the platform's transparency and commitment to client disclosure standards expected from legitimate brokers.

Account Conditions Analysis

The account conditions offered by Prime Fx remain largely mysterious due to the broker's failure to provide transparent information about account types, features, and requirements. Available sources do not specify whether the platform offers multiple account tiers, such as basic, premium, or VIP accounts that are standard among legitimate brokers. This lack of account structure clarity makes it impossible for potential clients to understand what services and conditions they would receive based on their deposit levels or trading volumes.

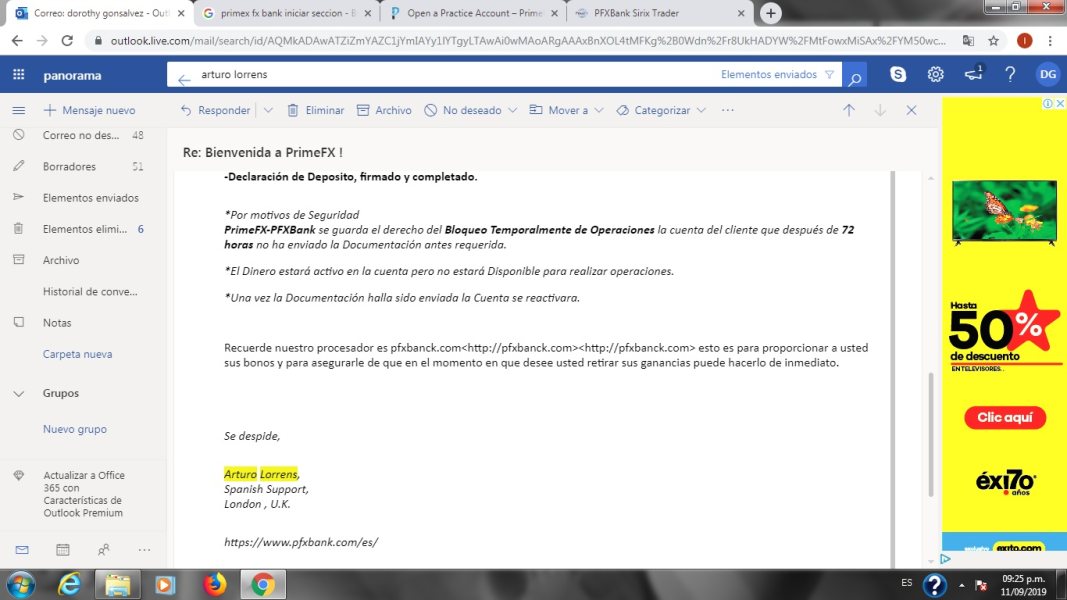

Minimum deposit requirements, which represent fundamental information for any trading platform, are not disclosed in accessible sources. Legitimate brokers typically provide clear information about initial funding requirements, allowing traders to determine whether the platform aligns with their available capital. The absence of this basic information suggests either poor business practices or intentional opacity that could indicate fraudulent intentions.

Account opening procedures and verification requirements are not detailed in available sources. This raises questions about the platform's compliance with standard know-your-customer and anti-money laundering procedures. Legitimate brokers maintain strict verification processes to comply with regulatory requirements, while unregulated entities may either lack proper procedures or implement insufficient safeguards for client protection.

Special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in available information. The absence of such details further demonstrates the platform's lack of comprehensive service disclosure and potential disregard for diverse client needs that professional brokers typically address.

User feedback regarding account conditions is overwhelmingly negative, with multiple sources indicating serious concerns about the platform's safety and legitimacy. These warnings suggest that even if account conditions were favorable, the underlying risks associated with an unregulated platform would likely outweigh any potential benefits for traders seeking secure and reliable trading environments.

Prime Fx reportedly provides access to MetaTrader 4 and Sirix trading platforms. These are legitimate and widely-used third-party solutions in the forex industry. MetaTrader 4 offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. Sirix provides social trading features and user-friendly interfaces that can benefit both novice and experienced traders. However, the availability of these platforms does not validate the broker's overall credibility or operational integrity.

Research and analysis resources that legitimate brokers typically provide, such as market commentary, economic calendars, technical analysis reports, and fundamental research, are not detailed in available sources. Professional trading platforms usually offer comprehensive market insights, daily market reviews, and expert analysis to help clients make informed trading decisions. The apparent absence of such resources suggests either inadequate service offerings or poor disclosure of available tools.

Educational resources, including trading guides, video tutorials, webinars, and market education materials, are not mentioned in accessible information about Prime Fx. Legitimate brokers invest significantly in client education, providing comprehensive learning materials to help traders develop their skills and understanding of financial markets. The lack of educational resource disclosure raises questions about the platform's commitment to client development and long-term trading success.

Automated trading support, while potentially available through MetaTrader 4's Expert Advisor functionality, lacks specific documentation about the broker's policies, restrictions, or additional tools for algorithmic trading. Professional brokers typically provide detailed information about automated trading capabilities, VPS services, and API access for advanced traders seeking systematic trading solutions.

User feedback regarding tools and resources is predominantly negative, with concerns raised about platform reliability and overall service quality. These reports suggest that even if the claimed platforms are available, the underlying infrastructure and support may be inadequate for serious trading activities. This could potentially lead to execution problems, technical difficulties, or other operational issues that could negatively impact trading performance.

Customer Service and Support Analysis

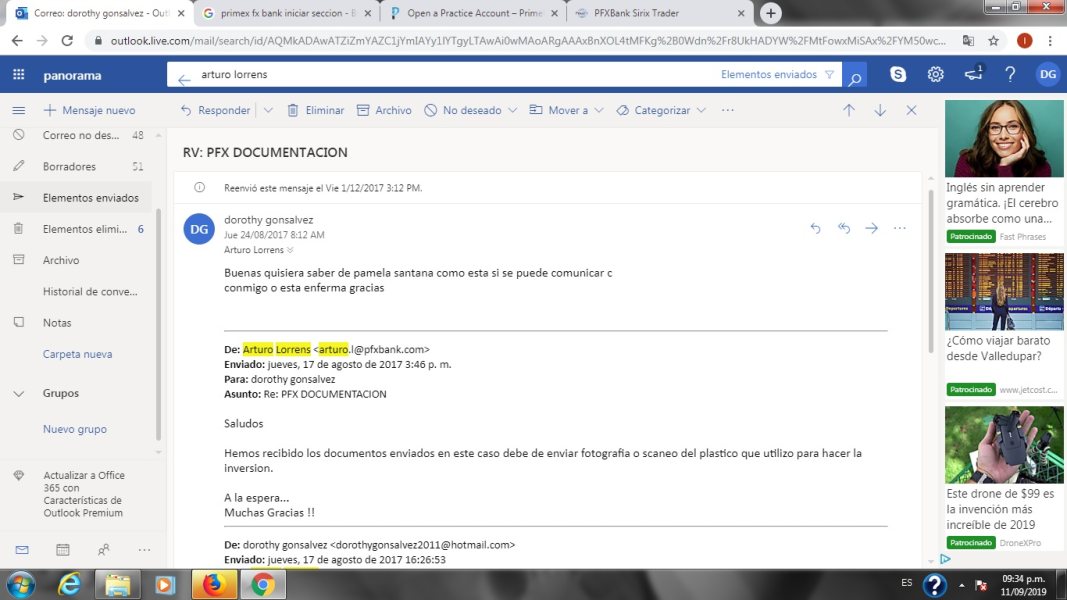

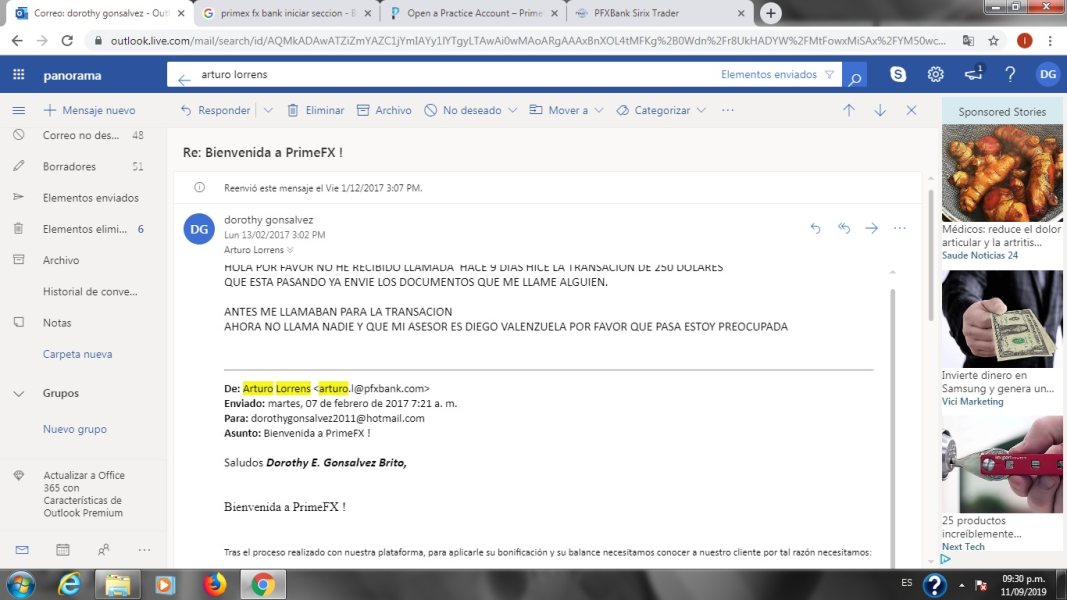

Customer service information for Prime Fx remains largely undisclosed. Available sources provide no specific details about support channels, availability hours, or service quality standards. Legitimate brokers typically offer multiple contact methods, including phone support, live chat, email assistance, and sometimes callback services to ensure clients can access help when needed. The absence of clear customer service information represents a significant red flag for potential clients seeking reliable support.

Response times and service quality metrics are not documented in available sources. This makes it impossible to evaluate the platform's commitment to client assistance. Professional brokers usually provide service level agreements or at least general information about expected response times for different inquiry types. The lack of such information suggests either inadequate service standards or intentional opacity about support capabilities.

Multilingual support capabilities are not specified in accessible information. This could indicate limited international service capacity or poor disclosure practices. Global brokers typically highlight their language support capabilities to attract international clients and demonstrate their ability to serve diverse markets effectively.

Customer service hours and availability across different time zones are not detailed in available sources. Given the 24-hour nature of forex markets, legitimate brokers usually provide extended support hours or around-the-clock assistance to serve clients trading in different global sessions. The absence of such information raises questions about the platform's operational capacity and client service commitment.

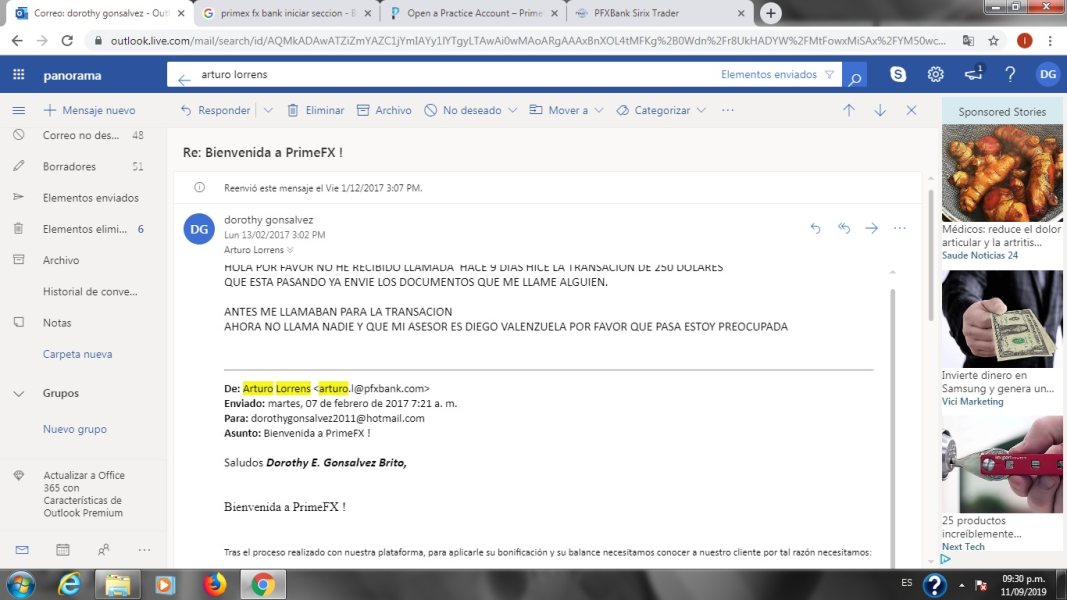

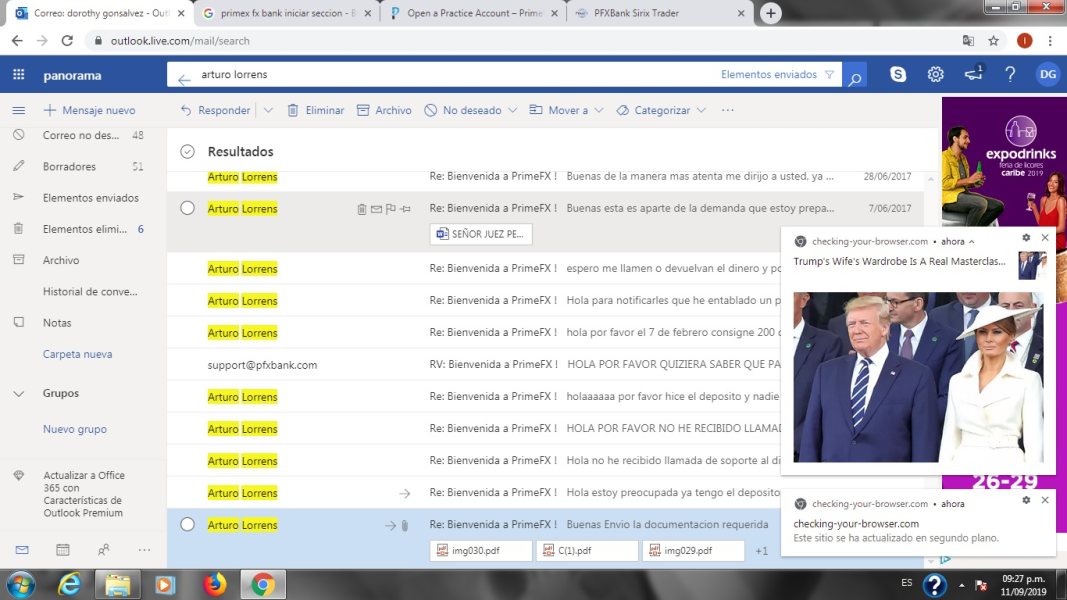

User feedback regarding customer service experiences is overwhelmingly negative, with multiple sources indicating poor service quality and unresponsiveness. These reports suggest that clients may face significant difficulties when seeking assistance, resolving issues, or accessing their accounts. The negative service feedback, combined with the platform's unregulated status, creates substantial risks for traders who may need prompt assistance during critical trading situations or account-related problems.

Trading Experience Analysis

The trading experience offered by Prime Fx remains questionable due to limited reliable information about platform performance, execution quality, and operational standards. While the broker claims to offer MetaTrader 4 and Sirix platforms, user feedback suggests significant concerns about platform stability and overall trading environment quality. These reports indicate potential issues with order execution, platform connectivity, or other technical problems that could negatively impact trading performance.

Order execution quality, including fill rates, slippage levels, and execution speeds, is not documented in available sources. Professional brokers typically provide transparency about their execution statistics, average execution times, and order processing capabilities to help clients understand what to expect during trading. The absence of such information makes it impossible to evaluate whether the platform can provide reliable execution during normal and volatile market conditions.

Platform functionality and feature completeness lack detailed documentation, despite claims of offering established trading software. Even if legitimate platforms are available, the underlying infrastructure, server quality, and technical support may be inadequate to ensure smooth trading operations. User reports suggest potential problems with platform reliability that could interfere with trading activities and risk management procedures.

Mobile trading capabilities are not specifically addressed in available sources. This represents a significant gap in modern trading service expectations. Most traders require reliable mobile access to manage positions, monitor markets, and execute trades while away from desktop computers. The lack of mobile trading information suggests either inadequate service offerings or poor disclosure of available features.

Overall trading environment quality appears compromised based on user feedback and the platform's unregulated status. Multiple sources indicate serious concerns about the broker's legitimacy and operational integrity, suggesting that traders may face significant risks beyond normal market exposure. These concerns include potential issues with fund security, platform manipulation, or other problems that could result in substantial losses unrelated to market movements.

This Prime Fx review reveals substantial deficiencies in trading experience transparency and quality that should concern any serious trader considering the platform for their trading activities.

Trust and Safety Analysis

Prime Fx operates without regulatory authorization from recognized financial authorities. This represents the most significant trust and safety concern for potential clients. Regulatory oversight provides essential protections including segregated client funds, minimum capital requirements, operational standards, and dispute resolution mechanisms. The absence of such protections means clients have limited recourse if problems arise with their accounts, funds, or trading activities.

Fund security measures are not detailed in available sources, raising serious questions about how client deposits are handled, whether funds are segregated from company operating capital, and what protections exist against misappropriation. Legitimate brokers typically maintain client funds in segregated accounts at tier-one banks, providing transparency about fund handling procedures and protection mechanisms.

Company transparency is severely lacking, with essential corporate information such as ownership structure, management team, headquarters location, and operational history remaining undisclosed or unclear. This opacity prevents potential clients from conducting proper due diligence and understanding who they would be entrusting with their trading capital.

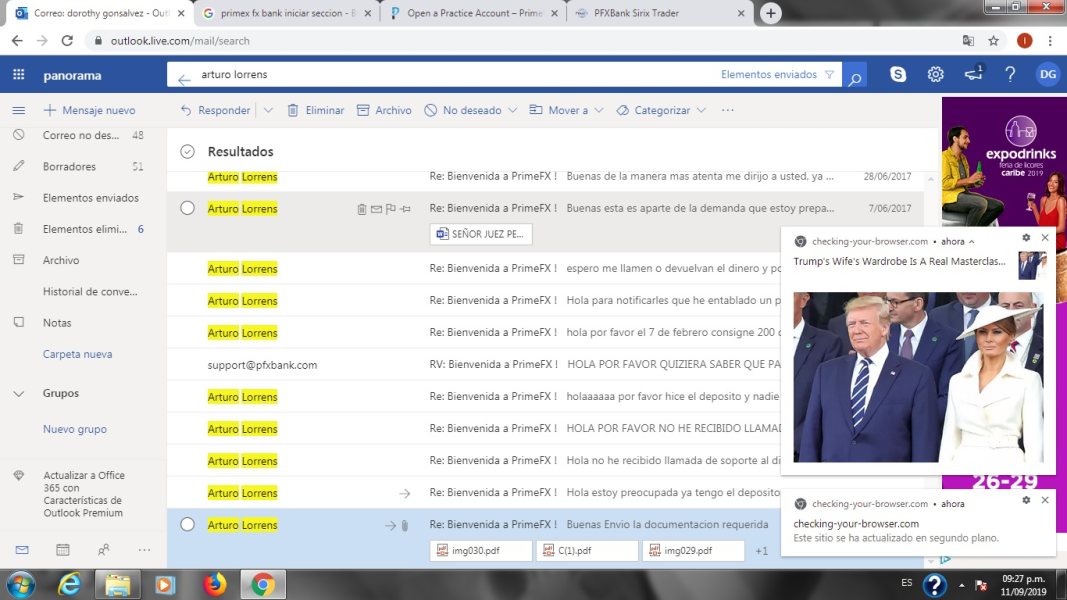

Industry reputation is overwhelmingly negative, with multiple sources flagging Prime Fx as potentially fraudulent. These warnings come from forex industry observers, review platforms, and regulatory authorities who monitor broker activities and alert traders about suspicious entities. The consistent negative assessment across multiple independent sources represents a clear warning signal for potential clients.

Negative event handling capabilities are questionable given the platform's unregulated status and lack of established dispute resolution procedures. When problems arise with legitimate brokers, clients can escalate issues to regulatory authorities, ombudsman services, or compensation schemes. The absence of such protections with Prime Fx means clients may have limited options for resolving disputes or recovering funds if issues occur.

User Experience Analysis

Overall user satisfaction with Prime Fx is extremely poor based on available feedback from multiple sources. Users consistently report negative experiences, safety concerns, and warnings about the platform's legitimacy. These reports span across different aspects of the trading experience, from account management to platform functionality, suggesting systemic problems rather than isolated issues.

Interface design and usability information is limited, though the claimed availability of MetaTrader 4 and Sirix platforms could provide familiar interfaces for experienced traders. However, user feedback suggests that even if recognizable platforms are available, the overall service quality and support infrastructure may be inadequate to provide satisfactory trading experiences.

Registration and verification processes are not detailed in available sources. This makes it unclear how the platform handles new account applications, identity verification, or compliance procedures. The lack of transparent onboarding information could indicate either poor process documentation or intentionally vague procedures that may not meet standard industry practices.

Fund management experiences appear problematic based on user reports and the platform's lack of regulatory oversight. Clients express concerns about deposit and withdrawal procedures, fund security, and the platform's ability to process financial transactions reliably. These concerns are particularly serious given the unregulated nature of the entity.

Common user complaints center on safety concerns, platform legitimacy questions, and warnings about potential fraudulent activities. The consistency of these negative reports across multiple sources suggests genuine problems rather than isolated complaints or competitor interference.

User demographic analysis suggests that Prime Fx is unsuitable for any trader seeking secure, transparent, and reliable trading services. The platform appears particularly inappropriate for novice traders who may lack the experience to identify warning signs, as well as professional traders who require institutional-quality services and regulatory protections for their trading capital.

Conclusion

This comprehensive Prime Fx review reveals a trading platform that poses significant risks to potential clients and fails to meet basic standards expected from legitimate brokers. The combination of unregulated status, lack of transparency, negative user feedback, and industry warnings creates a clear picture of a platform that traders should avoid.

Prime Fx is not suitable for any type of trader, whether novice or experienced, given the fundamental safety and legitimacy concerns identified throughout this analysis. While the platform claims to offer popular trading software and various financial instruments, these potential advantages are completely overshadowed by the substantial risks associated with an unregulated entity that lacks basic transparency and accountability measures.

The primary disadvantages include complete absence of regulatory protection, lack of transparent trading conditions, poor user feedback, and serious questions about fund security and operational integrity. The minimal advantages of claimed platform availability and asset variety are insufficient to offset these critical deficiencies. Traders seeking reliable forex and CFD trading services should consider regulated alternatives that provide appropriate client protections and transparent business practices.