VNF Review 1

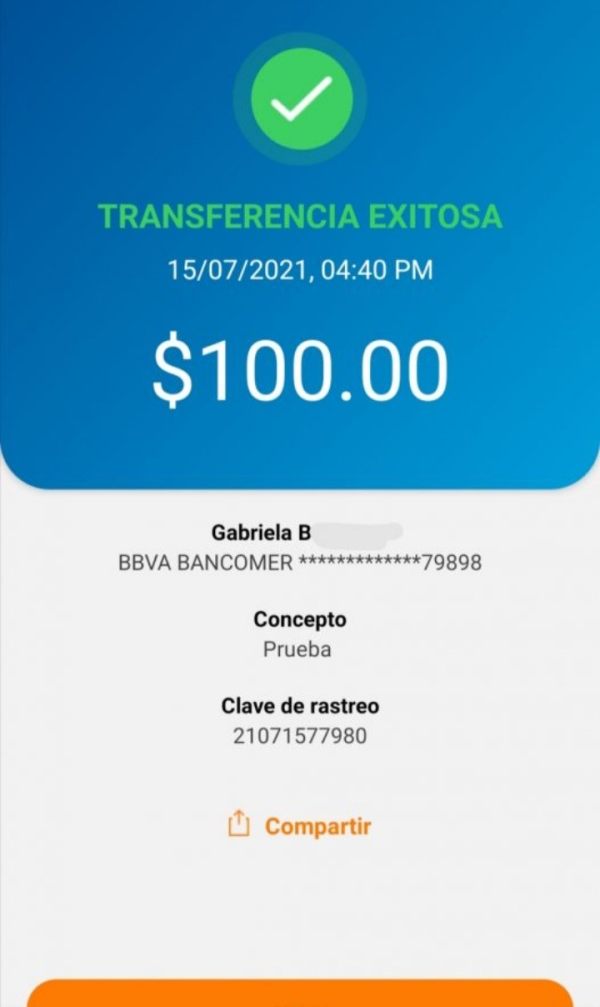

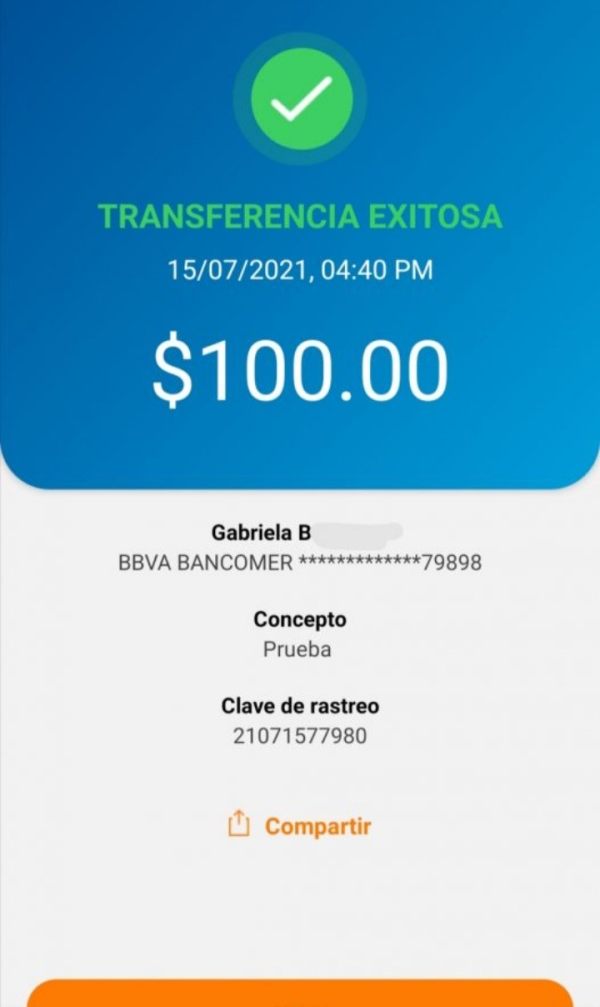

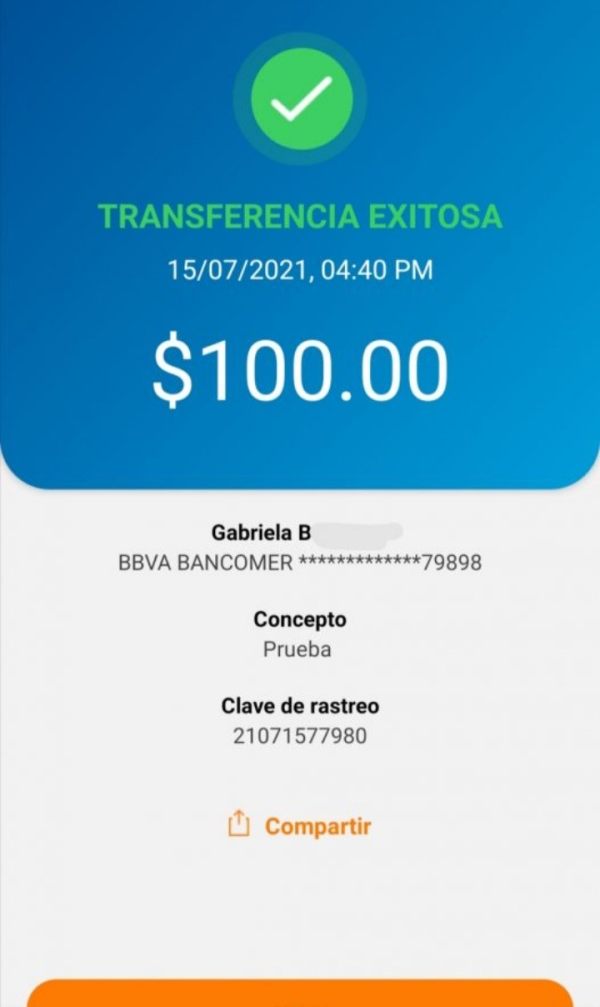

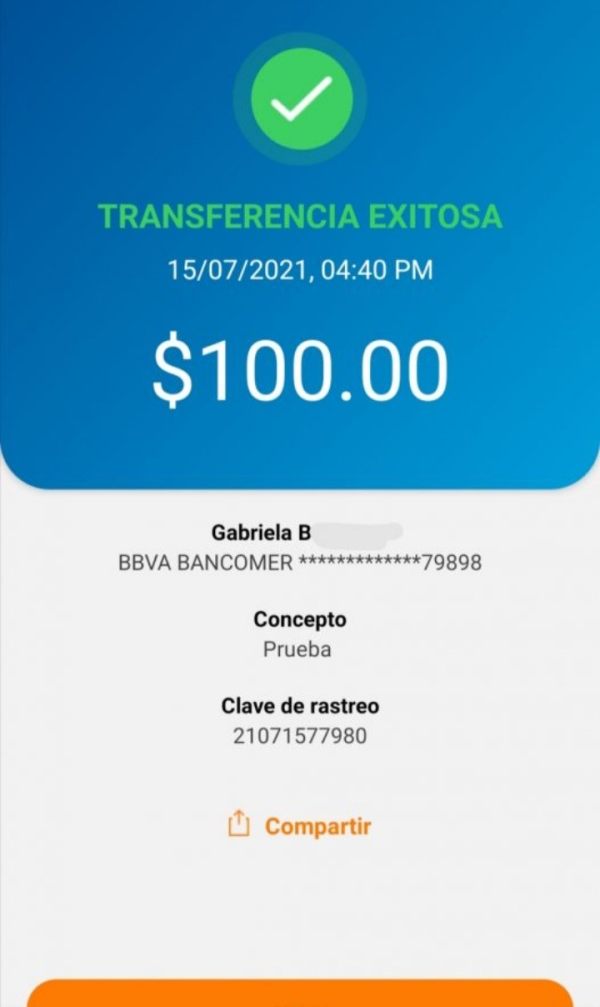

They do not have any sincerity. I deposited 100 US dollars to them and they transfered the money into my account, but my money disappeared after a few days. All this is an illusion. I want a solution for this.

VNF Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They do not have any sincerity. I deposited 100 US dollars to them and they transfered the money into my account, but my money disappeared after a few days. All this is an illusion. I want a solution for this.

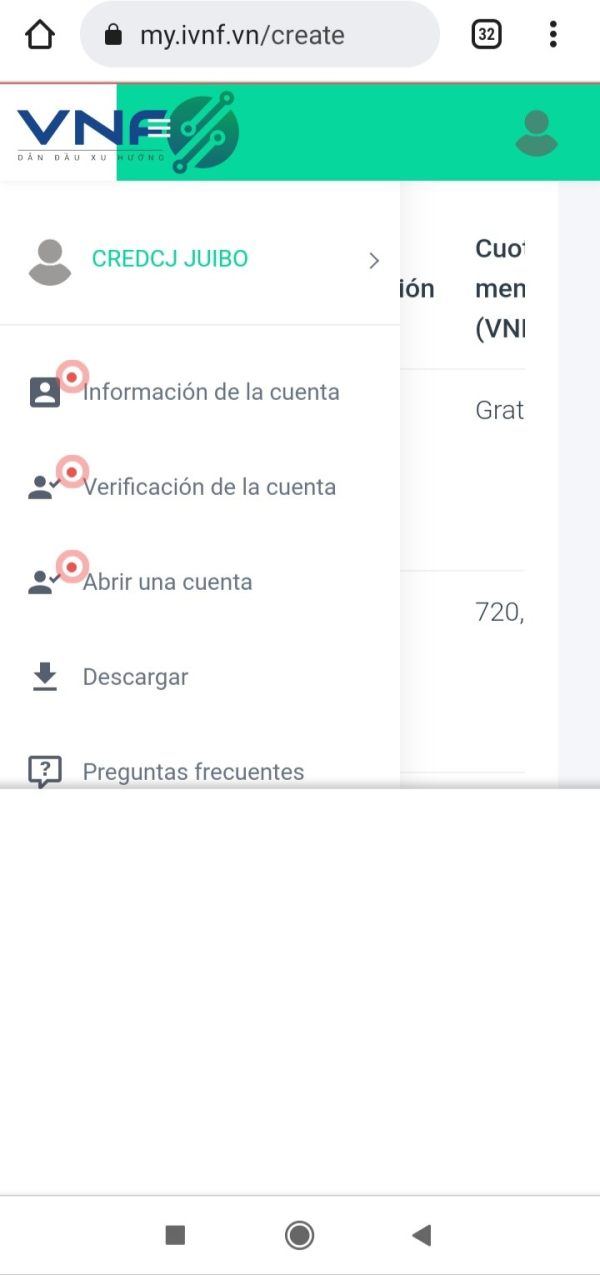

This comprehensive vnf review examines a trading platform that operates in the competitive forex brokerage landscape. Based on available information, VNF positions itself as a broker offering Meta Trader 4/5 platforms to forex traders. The platform appears to target traders who have some familiarity with technical analysis and prefer established trading software solutions.

However, our analysis reveals significant information gaps regarding regulatory oversight, specific trading conditions, and operational transparency. While the broker supports widely-used MT4/5 platforms, which represents a positive aspect for technical traders, the lack of detailed regulatory information and comprehensive trading terms raises concerns about overall reliability and transparency. The platform seems most suitable for traders who prioritize platform familiarity over regulatory transparency, though we recommend potential users conduct additional due diligence before committing funds.

This vnf review will explore all available aspects of the broker's offerings while clearly identifying areas where information remains insufficient for a complete assessment.

Regional Entity Differences: Due to the absence of comprehensive regulatory information in available sources, users should exercise particular caution when considering VNF services. Different countries maintain varying legal and regulatory frameworks for forex trading, and the lack of clear regulatory disclosure makes it difficult to determine which protections may apply to traders in specific jurisdictions.

Review Methodology: This evaluation is based on limited available information sources. Significant gaps exist in crucial areas including regulatory status, detailed trading conditions, and customer feedback. Potential users should independently verify all information and seek additional sources before making trading decisions.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 5/10 | Insufficient information available regarding account types, minimum deposits, and specific terms |

| Tools and Resources | 8/10 | Strong offering with MT4/5 platform support, suitable for various trading strategies |

| Customer Service | 5/10 | No specific information available about support channels, response times, or service quality |

| Trading Experience | 8/10 | Benefits from established MT4/5 platforms known for stability and comprehensive features |

| Trust and Reliability | 5/10 | Lack of regulatory information significantly impacts trustworthiness assessment |

| User Experience | 5/10 | Limited feedback and interface information available for comprehensive evaluation |

VNF operates as a forex trading platform in an increasingly competitive market where traders demand both technological sophistication and regulatory security. The broker's primary distinguishing feature appears to be its integration with the widely-adopted Meta Trader 4 and Meta Trader 5 platforms, which have become industry standards for retail forex trading. According to available sources, VNF positions itself within the broader ecosystem of forex brokers offering MT4/5 solutions.

However, specific details about the company's founding date, corporate structure, and operational history remain undisclosed in accessible materials. This lack of background information represents a significant gap for traders who prioritize transparency and corporate accountability. The broker appears to focus on serving traders who value technical analysis capabilities and prefer established platform ecosystems.

The MT4/5 integration suggests VNF targets users comfortable with advanced charting tools, automated trading capabilities, and the extensive indicator libraries these platforms provide. However, without detailed information about asset offerings, pricing structures, or regulatory compliance, it becomes challenging to position VNF definitively within the competitive landscape. This vnf review will examine each available aspect while acknowledging these information limitations.

Regulatory Jurisdictions: Specific regulatory information was not detailed in available sources, which represents a significant concern for potential traders seeking regulated broker relationships.

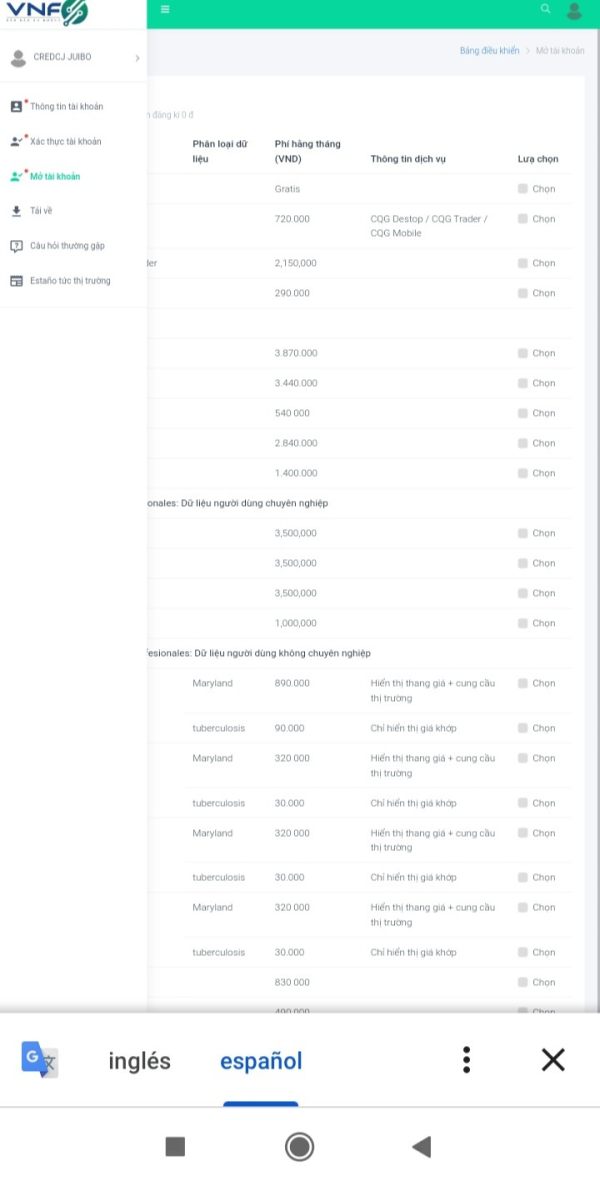

Deposit and Withdrawal Methods: Available sources do not specify the payment methods, processing times, or associated fees for funding accounts or withdrawing profits. Exact minimum deposit amounts for different account types are not specified in available materials.

Promotional Offers: Information regarding welcome bonuses, trading incentives, or promotional programs was not found in source materials.

Tradeable Assets: While the platform appears to focus on forex trading, specific details about currency pairs, CFDs, or other available instruments are not comprehensively outlined in available sources. Detailed information about spreads, commissions, overnight fees, and other trading costs was not available in source materials, making cost comparison difficult.

Leverage Ratios: Specific leverage offerings and their variations across different account types or asset classes are not detailed in available information.

Platform Options: VNF supports Meta Trader 4 and Meta Trader 5 platforms, providing traders with access to advanced charting, automated trading, and comprehensive technical analysis tools. Available sources do not specify which countries or regions may be restricted from accessing VNF services.

Customer Support Languages: Information about multilingual support options was not available in source materials.

This vnf review highlights the significant information gaps that potential traders should consider when evaluating the broker's suitability for their trading needs.

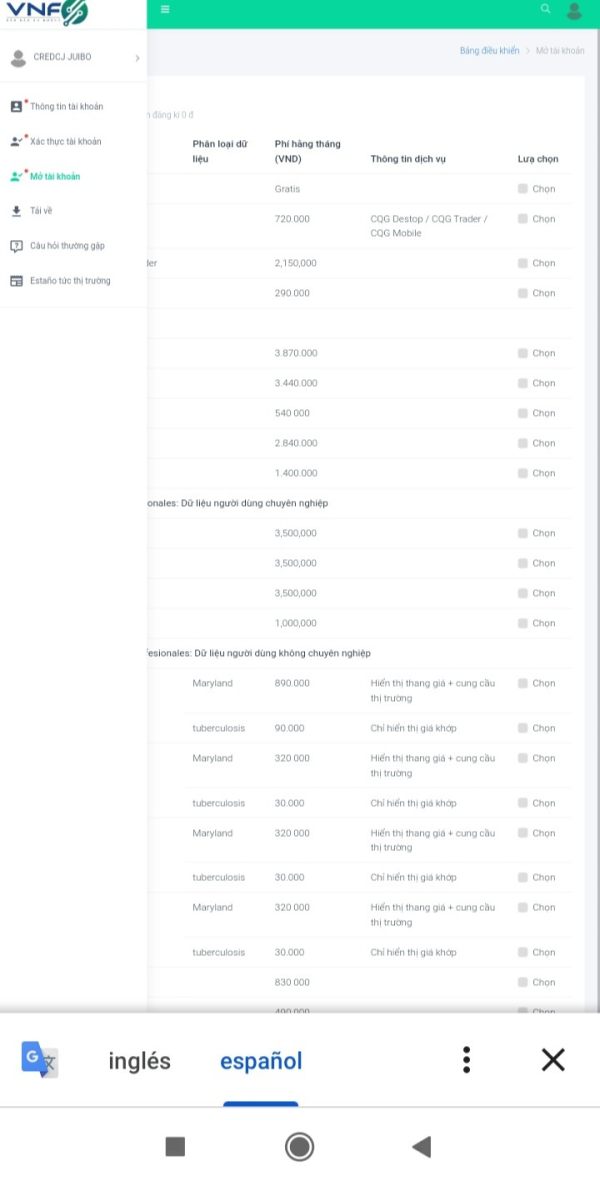

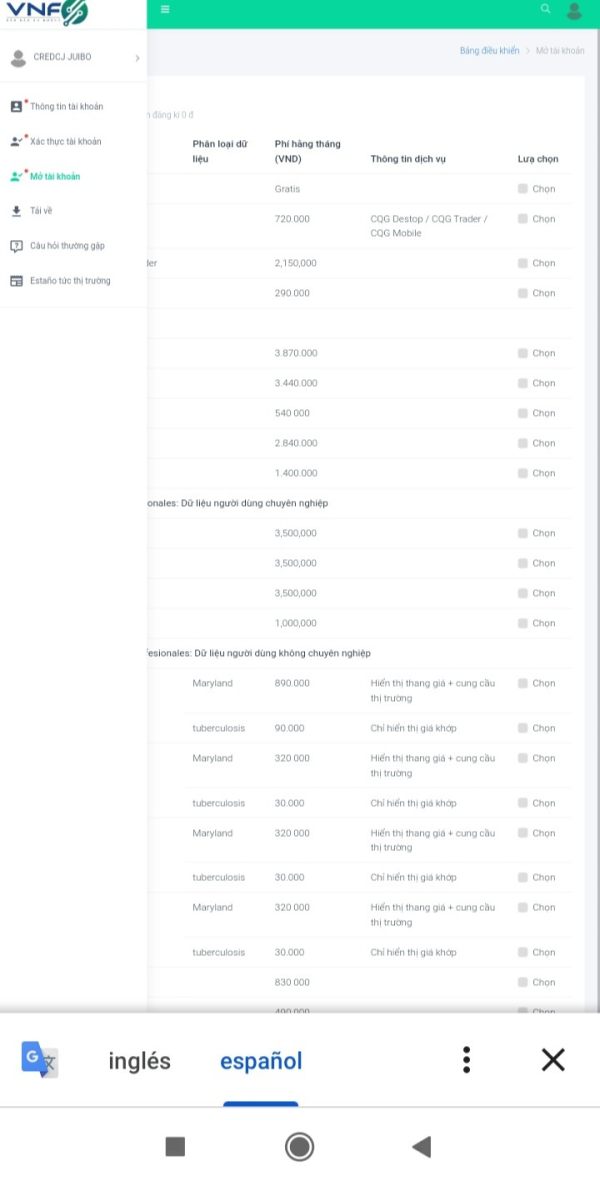

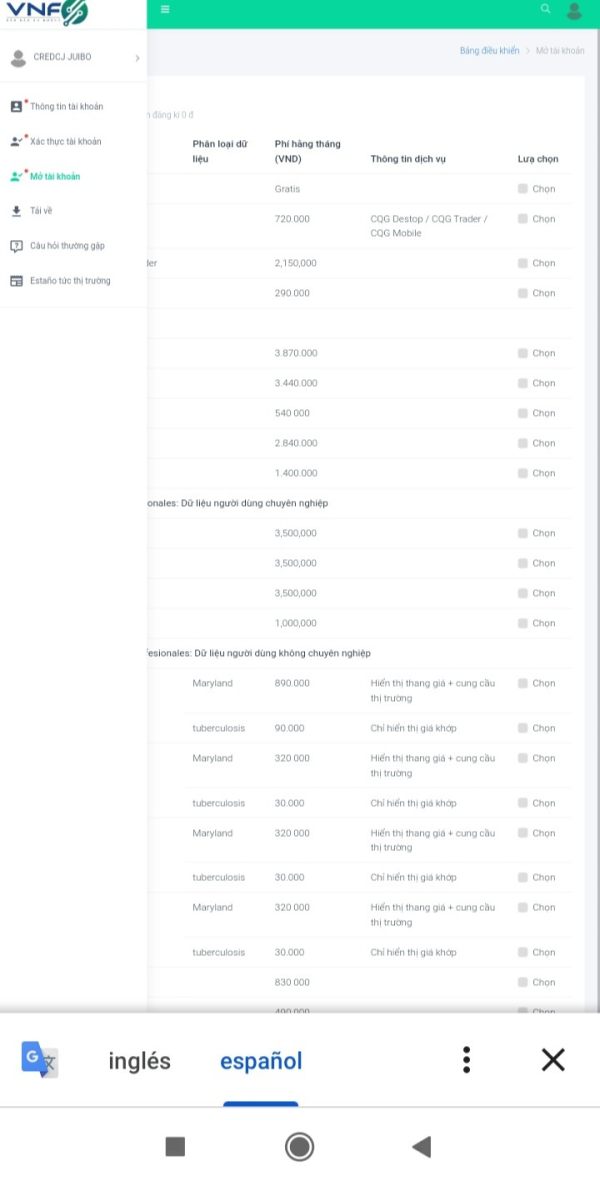

The account conditions evaluation for VNF faces substantial limitations due to insufficient available information. Traditional forex broker assessments examine account type variety, minimum deposit requirements, account features, and special provisions such as Islamic accounts for Muslim traders. Unfortunately, none of these critical details are specified in available source materials.

Professional traders typically evaluate brokers based on account tier structures that offer different spreads, commissions, and service levels. Without knowing VNF's account options, potential users cannot determine whether the broker caters to beginners with smaller deposits or focuses primarily on high-volume traders. The absence of minimum deposit information makes it impossible to assess accessibility for traders with varying capital levels.

Account opening procedures, verification requirements, and documentation processes also remain unspecified. Modern traders expect streamlined digital onboarding with clear timelines and requirements. Additionally, the availability of demo accounts for strategy testing and platform familiarization cannot be confirmed from available sources.

The lack of information about special account features, such as Islamic accounts that comply with Sharia law, suggests either limited service diversity or inadequate information disclosure. This vnf review must assign a neutral rating due to these significant information gaps, though the actual account conditions could potentially rate higher or lower once full details become available.

VNF demonstrates strength in its platform offerings by supporting both Meta Trader 4 and Meta Trader 5, which represent industry-leading trading software solutions. These platforms provide comprehensive technical analysis capabilities, including extensive charting tools, multiple timeframe analysis, and access to hundreds of technical indicators that professional traders rely upon daily. The MT4/5 integration suggests VNF users can access automated trading through Expert Advisors, which allows for strategy automation and algorithmic trading approaches.

These platforms also support custom indicator development and strategy backtesting, valuable features for traders developing sophisticated trading approaches. However, available sources do not detail additional research resources, market analysis, economic calendars, or educational materials that many brokers provide to support trader decision-making. Professional-grade brokers often supplement platform tools with proprietary research, daily market commentary, and educational webinars that enhance the trading experience.

The absence of information about mobile trading applications, web-based platforms, or platform customization options represents another limitation in this assessment. Modern traders expect seamless cross-device functionality and platform accessibility regardless of location or device preferences. Despite these information gaps, the confirmed MT4/5 support provides substantial value for technically-oriented traders who prioritize platform sophistication over additional broker-provided resources.

Customer service evaluation for VNF cannot be completed comprehensively due to the absence of specific support information in available sources. Effective forex broker customer service typically encompasses multiple communication channels including live chat, email, telephone support, and potentially social media responsiveness. Professional traders require reliable support during market hours, particularly during volatile trading periods when technical issues or account questions demand immediate attention.

The availability of 24/5 support during forex market hours, weekend support for urgent issues, and multilingual assistance for international clients all factor into service quality assessments. Response time expectations vary by communication method, with live chat typically requiring near-immediate responses, email support within several hours, and telephone support providing immediate human interaction. Without specific information about VNF's support infrastructure, potential users cannot gauge whether the broker meets professional service standards.

The quality of support staff training, their understanding of trading-related issues, and their authority to resolve account problems also remain unknown. Additionally, the availability of dedicated account managers for higher-tier clients, educational support for new traders, and technical assistance for platform-related issues cannot be confirmed from available sources. This neutral rating reflects the complete absence of customer service information rather than any negative service experiences, though actual service quality could significantly impact user satisfaction once evaluated.

The trading experience assessment benefits significantly from VNF's confirmed support for Meta Trader 4 and Meta Trader 5 platforms. These industry-standard platforms provide stable, reliable trading environments that millions of traders worldwide use daily. The platforms offer sophisticated order management, multiple order types, and reliable trade execution capabilities that professional traders require.

MT4/5 platforms typically provide excellent stability with minimal downtime, comprehensive charting capabilities with multiple timeframes, and extensive customization options for traders to configure their preferred trading environment. The platforms also support one-click trading, trailing stops, and advanced order types that enhance trading efficiency. However, this vnf review cannot assess crucial trading experience factors including order execution speed, slippage rates, requote frequency, or server reliability during high-volatility periods.

These technical performance metrics significantly impact actual trading results and user satisfaction but require specific data or user feedback to evaluate properly. The absence of information about mobile trading applications limits the assessment of cross-platform trading experience. Modern traders expect seamless transitions between desktop, web, and mobile trading environments with synchronized account information and consistent functionality.

Additionally, without details about trading conditions such as spreads, commissions, or execution models, it becomes difficult to assess the complete trading environment that users would experience.

Trust and reliability assessment for VNF faces significant challenges due to the absence of regulatory information in available sources. Regulatory oversight represents the foundation of broker trustworthiness, providing legal frameworks for client fund protection, operational standards, and dispute resolution mechanisms. Established forex brokers typically maintain licenses with recognized regulatory bodies such as the FCA, ASIC, CySEC, or other respected financial authorities.

These regulators enforce capital requirements, segregated client fund storage, and operational standards that protect trader interests. Without confirmed regulatory status, potential users cannot verify these essential protections. Client fund security measures, including segregated accounts, deposit insurance, and audit procedures, remain unspecified in available materials.

Professional traders require assurance that their deposits are protected from broker insolvency and maintained separately from operational funds. Corporate transparency factors such as company ownership, financial statements, operational history, and management team information are also unavailable. Reputable brokers typically provide comprehensive corporate information to demonstrate stability and accountability.

The absence of information about negative regulatory actions, customer complaints, or industry recognition makes it impossible to assess VNF's reputation within the forex community. Third-party reviews, regulatory warnings, and industry awards often provide valuable insights into broker reliability that cannot be confirmed from available sources.

User experience evaluation for VNF must rely heavily on the known MT4/5 platform integration, as specific user interface information and customer feedback are not available in source materials. The Meta Trader platforms generally provide intuitive interfaces that traders can customize according to their preferences, suggesting a potentially positive user experience for those familiar with these platforms. The MT4/5 platforms typically offer user-friendly navigation, comprehensive help documentation, and extensive online communities where traders can find support and educational resources.

These platforms also provide multiple language options and can accommodate traders with varying experience levels from beginners to professionals. However, crucial user experience factors including account registration processes, verification procedures, deposit and withdrawal experiences, and customer service interactions cannot be assessed due to insufficient information. These operational aspects significantly impact overall user satisfaction and trading efficiency.

The absence of user testimonials, satisfaction surveys, or independent user reviews makes it impossible to gauge actual client experiences with VNF's services. Modern traders often rely on peer feedback and community discussions to evaluate broker performance, but such information is not available for this assessment. Website usability, educational resources, research tools, and additional services that enhance the trading experience also remain unspecified.

The complete user journey from initial research through account funding, trading, and profit withdrawal cannot be evaluated comprehensively without additional information sources.

This vnf review reveals a broker with limited publicly available information that makes comprehensive evaluation challenging. While VNF's support for Meta Trader 4 and Meta Trader 5 platforms represents a significant strength for technically-oriented traders, substantial information gaps in regulatory status, trading conditions, and operational details raise concerns about transparency and reliability. The broker appears most suitable for experienced traders who prioritize platform familiarity and technical analysis capabilities over comprehensive broker disclosure.

However, the absence of regulatory information, detailed trading terms, and customer feedback suggests that potential users should exercise considerable caution and conduct additional due diligence before committing funds. Major advantages include access to industry-standard MT4/5 platforms with their comprehensive technical analysis tools and automated trading capabilities. Primary disadvantages encompass the lack of regulatory transparency, insufficient information about trading costs and conditions, and absence of customer service details that professional traders typically require for informed broker selection.

FX Broker Capital Trading Markets Review