Is Roden safe?

Pros

Cons

Is Roden Safe or Scam?

Introduction

Roden is a forex broker that has recently garnered attention in the trading community. With claims of offering a wide range of financial instruments and a user-friendly trading platform, it positions itself as a viable option for both novice and experienced traders. However, the need for traders to carefully evaluate forex brokers cannot be overstated. The forex market is rife with unregulated entities that may pose significant risks to investors. This article aims to provide a thorough investigation into the safety and legitimacy of Roden by analyzing its regulatory status, company background, trading conditions, and customer experiences.

To conduct this analysis, we sourced information from various online platforms, including user reviews, regulatory databases, and financial news outlets. The evaluation framework will focus on key aspects such as regulation, company history, trading conditions, client fund safety, and overall user experience.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its reliability. A properly regulated broker is typically subject to stringent oversight, which helps protect investors from fraud and malpractice. In the case of Roden, several sources indicate that it operates without a valid license. This is a significant red flag, as it suggests that the broker is not subject to regulatory scrutiny.

Here is a summary of Roden's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unregistered |

| NFA | N/A | USA | Unregistered |

The absence of registration with reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK is alarming. According to UK regulations, any firm offering financial services must be registered with the FCA. Roden's failure to do so raises serious concerns about its legitimacy and operational practices. Furthermore, the lack of oversight means that investors' funds are not protected by any legal framework, making it imperative for traders to question is Roden safe.

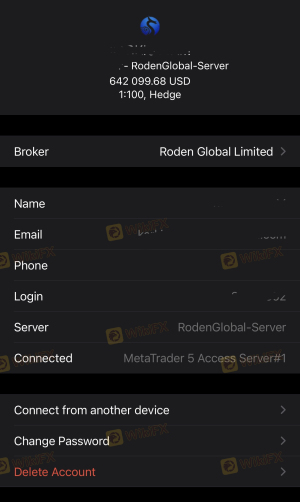

Company Background Investigation

Roden claims to have been established in 1993; however, domain checks reveal that its website was created only in 2021. This discrepancy raises questions about the company's legitimacy and operational history. The ownership structure and management team behind Roden are also shrouded in mystery, which further complicates the assessment of its credibility.

A transparent company should provide clear information about its ownership and operational history. Unfortunately, Roden lacks this transparency, making it difficult for potential clients to gauge the broker's reliability. A company with a well-documented history and experienced management team tends to inspire more confidence among traders. In contrast, Roden's opaque background leaves much to be desired, leading many to wonder is Roden safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Roden claims to provide competitive spreads and a variety of trading instruments, including forex pairs, CFDs, and commodities. However, the absence of clear information regarding its fee structure raises concerns.

Here‘s a comparison of Roden’s trading costs against industry averages:

| Fee Type | Roden | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2.5% |

The lack of transparency regarding spreads, commissions, and overnight fees is troubling. It is essential for brokers to provide clear and accessible information about their trading costs. This not only helps traders make informed decisions but also reflects the broker's commitment to transparency. Without such information, potential clients may question whether is Roden safe for their trading activities.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Brokers are expected to implement robust measures to protect clients' investments, including fund segregation, investor protection schemes, and negative balance protection. Unfortunately, Roden does not appear to offer any such guarantees.

The absence of legal documents and terms on its website raises further alarms. Traders have a right to know how their funds will be managed and what protections are in place. The lack of information regarding fund safety measures suggests that Roden may not prioritize the security of its clients' investments. This lack of transparency leads to the conclusion that is Roden safe is a question that remains unanswered.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. A review of user experiences with Roden reveals a pattern of complaints regarding withdrawal issues, lack of customer support, and overall dissatisfaction with trading conditions.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Inconsistent |

| Lack of Transparency | High | None |

In particular, several users have reported difficulties in withdrawing their funds, which is a significant concern for any trader. A broker that does not facilitate smooth withdrawals can be seen as untrustworthy. The overall negative sentiment surrounding Roden reinforces the notion that potential clients should carefully consider whether is Roden safe before proceeding.

Platform and Execution

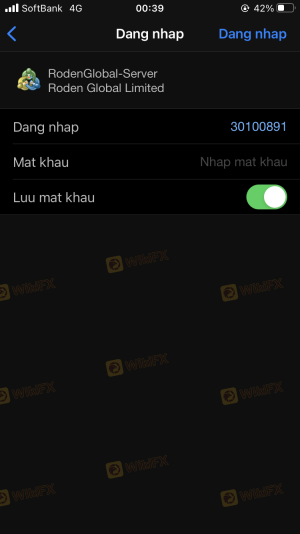

The performance and reliability of a trading platform are critical for a positive trading experience. Roden claims to offer a user-friendly platform, but many users have reported issues with execution quality, including slippage and order rejections.

An analysis of the platform's performance indicates that it may not meet the standards expected by professional traders. Any signs of platform manipulation or execution delays can severely impact trading results. Given these concerns, traders must question whether is Roden safe for executing their trades effectively.

Risk Assessment

Using Roden as a trading platform comes with several inherent risks. The lack of regulation, transparency, and customer support creates a precarious environment for traders.

Heres a summary of the key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | No information on fund protection policies. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Roden. It is advisable to explore other regulated brokers that offer better transparency and protections for clients.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Roden operates without the necessary regulatory oversight, raising significant concerns about its legitimacy. The lack of transparency regarding its trading conditions, fund safety measures, and customer experiences further reinforces the notion that is Roden safe is a question that remains unanswered.

For traders considering their options, it is recommended to seek out brokers that are fully regulated and have a proven track record of reliability. Some reputable alternatives include brokers that are registered with the FCA or other recognized regulatory bodies. By opting for a broker with robust oversight, traders can better protect their investments and enjoy a more secure trading environment.

Is Roden a scam, or is it legit?

The latest exposure and evaluation content of Roden brokers.

Roden Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Roden latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.