raze markets 2025 Review: Everything You Need to Know

Abstract

Raze Markets is a new forex broker that started in 2023. The company is registered in Saint Lucia under Raze Global Markets Ltd with License No. 2023-00261. This raze markets review shows a broker that offers very low entry barriers with just a $10 minimum deposit and spreads starting from 0. The broker mainly serves beginners and traders who don't have much money to invest.

Raze Markets provides high leverage up to 1:1000 and supports well-known platforms like MetaTrader 5, with cTrader coming soon. The broker wants to create a clear trading environment using both ECN and STP models. But even with these good trading conditions, there are big concerns about whether users can trust this broker.

Client feedback often points to problems like high overnight fees and possible scam warnings, which hurts the broker's reputation. This review uses public information and user feedback to give a fair view of the broker's good points and problems.

Cautions

Raze Markets is registered in Saint Lucia under Raze Global Markets Ltd, but traders should know that different legal rules may apply in other places. This review comes from public information and user feedback, so it might not cover every detail about regional differences or how the company really works inside.

People thinking about investing should do more research about how to deposit and withdraw money, bonus offers, and other client services since these details are mostly missing from available information. The rules provided by Saint Lucia might not give the same level of protection for investors in other regions. The way we evaluated this broker involved checking multiple sources and user reviews, which might give only a partial picture of how the broker really operates.

Rating Framework

Broker Overview

Raze Markets started in 2023 as a new forex broker under Raze Global Markets Ltd. The company is based in Rodney Bay, Gros-Islet in Saint Lucia and uses both ECN and STP trading models to make sure trades are handled clearly. This setup is made to help many different types of traders, especially beginners who are just starting in forex trading with small amounts of money.

The broker keeps the entry cost very low with just a $10 minimum deposit requirement, which makes trading available to more people. But the mixed reviews and ongoing trust concerns show that while the pricing and spread benefits are clear, users might need to be extra careful when dealing with this broker.

Raze Markets also offers different trading platforms to give traders a good experience. The main platform is MetaTrader 5 , which many forex traders know well, and they plan to add the cTrader platform soon. The broker offers many types of assets like forex, precious metals, energy, indices, and cryptocurrencies.

Saint Lucia provides regulatory oversight through registration License No. 2023-00261, which gives some credibility but hasn't removed the concerns many users have. This raze markets review uses various public sources and customer reviews to give a balanced look at what the broker does well and what problems it might have.

Regulatory Region:

Raze Markets works under Raze Global Markets Ltd and is registered in Saint Lucia with License No. 2023-00261. This regulatory oversight aims to ensure basic market fairness and transparency, though it may not meet the strictest international standards.

Deposit and Withdrawal Methods:

The provided information doesn't mention specific details about deposit and withdrawal methods. Traders should note that this is missing information in the current overview.

Minimum Deposit Requirement:

Raze Markets needs a minimum deposit of just $10, making it one of the easiest brokers to access for people new to trading and those who want to start with less money.

Bonus Promotions:

No detailed information is available about bonus promotions or incentive programs, so potential traders should ask the broker directly about any current offers.

Tradable Assets:

The broker gives access to many different tradable assets. This includes major and minor forex pairs, precious metals, energy, indices, and cryptocurrencies, giving traders many ways to diversify their portfolios.

Cost Structure:

Raze Markets offers starting spreads of 0, which is a big advantage for traders who care about costs. However, several users have reported high overnight fees; for example, gold trades may have fees equal to 4-5 pips and $45 per lot as the overnight fee. This mixed cost structure means that while getting started is cheap, keeping positions overnight can become expensive.

Leverage Ratio:

The broker advertises maximum leverage of 1:1000, though some reports suggest the maximum leverage might be closer to 1:500. Traders should check the exact leverage available for different account types.

Platform Options:

Raze Markets currently supports MetaTrader 5 , a platform that forex traders really like. The broker is also getting ready to launch the cTrader platform, which should provide better functionality and a modern trading interface. This two-platform approach aims to meet different trader preferences.

Regional Restrictions:

No detailed information is available about any regional restrictions on trader accounts, which is an area that needs more clarification.

Customer Service Languages:

There is no specific mention of what languages are available for customer service, leaving an information gap that potential clients should know about when thinking about communication needs.

This section of the raze markets review brings together key operational aspects of the broker, letting potential investors understand both the strengths and limitations of the trading environment provided.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

Raze Markets provides both ECN and STP account types made for many different types of traders. The $10 minimum deposit is a big advantage, especially for beginner traders who want to test things out without putting in large amounts of money. The broker's starting spread of 0 looks good in terms of cost-efficiency, but the lack of detailed commission information leaves a gap in pricing transparency.

Also, while opening an account reportedly isn't as hard as it might be with some other brokers, many user reviews point out that the registration process is too complex and sometimes unclear. According to various user reviews, this part of account management creates concerns about how clear the broker is with information. Even though the low deposit and spread conditions are good, the mixed feedback and unclear information about important things like commissions have led to a moderate score in this category.

In conclusion, while the broker's low entry cost is good, the lack of complete details and the complicated account setup process contribute to a score of 6/10 in account conditions as noted in this raze markets review.

When looking at the tools and resources offered by Raze Markets, it's clear that the broker provides access to industry-standard trading platforms like MetaTrader 5, with plans to launch cTrader soon. These platforms are known for being reliable and having strong functionality. But even with these popular platforms available, there's a clear lack of additional resources like complete educational materials and detailed market analysis, which are important for trader development and decision-making.

The absence of automated trading support or advanced order systems further limits how useful the tools are. Investors have said that while the basic functions meet trading needs, specialized features and additional research resources remain underdeveloped compared to other competitive brokers. This limitation becomes a big drawback for traders looking for an all-in-one solution.

So, although including MT5 and the upcoming cTrader are positive points, the overall assessment of the broker's tools and resource offerings remains moderate, justifying a score of 5/10 based on user feedback and the observed service offerings in this raze markets review.

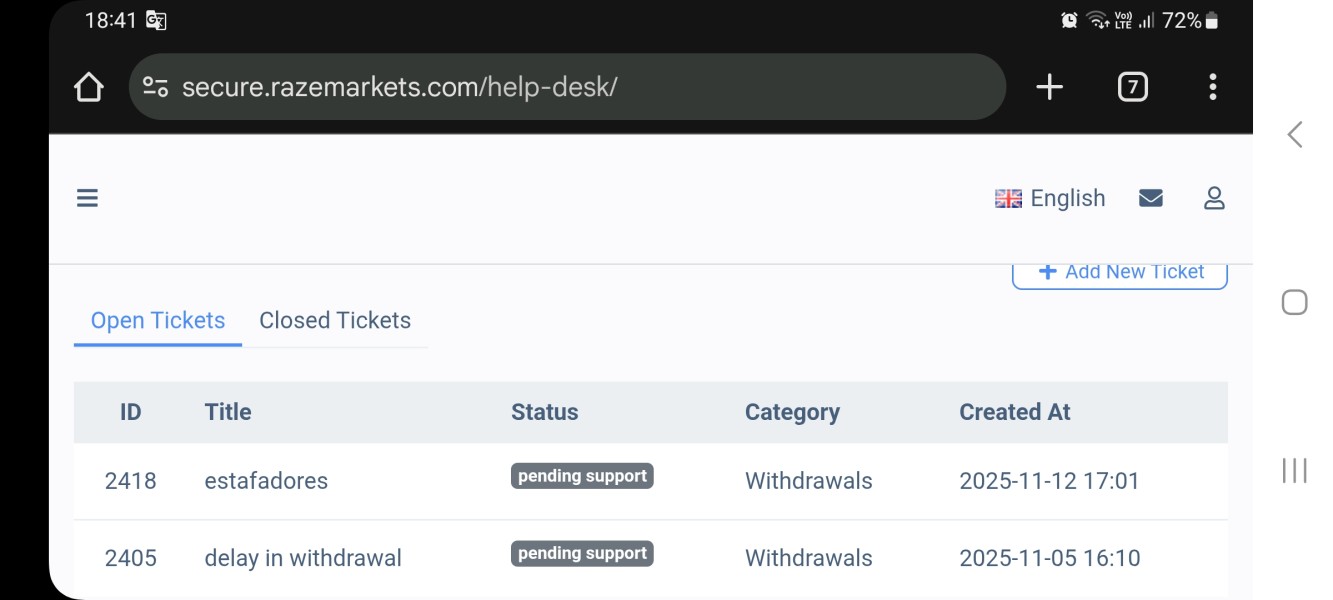

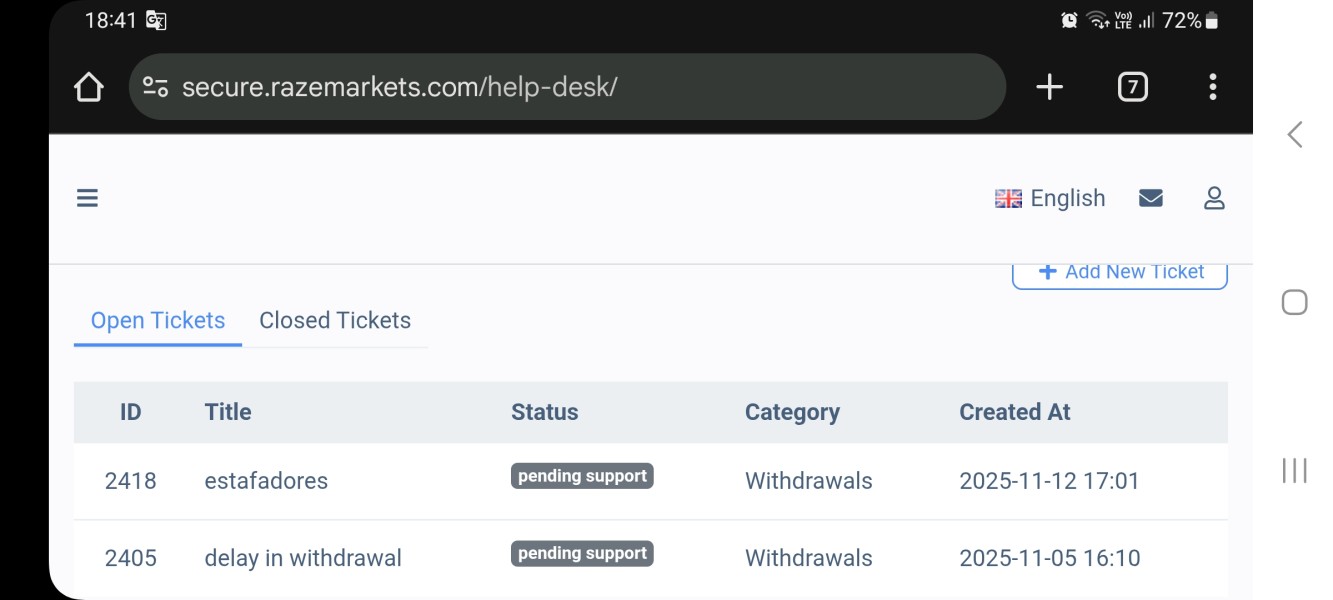

2.6.3 Customer Service and Support Analysis

Customer service is important for trader satisfaction, and with Raze Markets, this area needs improvement. Users have consistently reported slow response times along with general inefficiency in solving problems. Even though the broker supposedly offers multiple support channels, the actual performance in service delivery has been disappointing.

Many reviews point out that the quality of support is below industry expectations, especially during times of trading uncertainty, where quick and accurate help is essential. The lack of detailed information about specific contact channels or multi-language support makes these service issues even worse. In a sector where timely troubleshooting can significantly impact trading outcomes, the fact that several customers have raised concerns about the difficulty of getting effective support negatively affects the broker's overall credibility.

These issues, along with inconsistent customer feedback, have resulted in a rating of 4/10 for customer service and support in this raze markets review, showing that significant improvements are needed to match industry standards.

2.6.4 Trading Experience Analysis

The trading experience at Raze Markets has both positive features and significant limitations. On one hand, having top-tier platforms like MT5 and the expected cTrader gives traders a stable and familiar trading environment. But traders have noted that order execution is sometimes hurt by issues like slippage and instances of requotes, which prevent optimal trade outcomes.

Another concern is the relatively high overnight fees, which some users have reported to be particularly burdensome, especially on positions held for long periods. Such fees can reduce the overall profitability of trades, particularly in volatile markets. Even though the broker promises a technologically sound trading platform, these execution-related challenges contribute to a moderately mixed trading experience.

Also, while the interface works, it lacks some advanced tools that could enhance strategic trade management. As a result, the overall trading experience has been rated a 6/10, as reflected in this raze markets review, emphasizing a need for improvements to balance the appeal of low entry conditions with consistent, reliable order execution and fee management.

2.6.5 Trust Analysis

Trust is crucial in the relationship between a broker and its clients, and with Raze Markets, significant concerns have been raised by the trading community. The broker is registered in Saint Lucia under Raze Global Markets Ltd , which on paper provides some regulatory oversight. But this regulatory framework doesn't inspire as much confidence as regulators in other regions might.

Several users have flagged potential issues, including scam warnings and a notable absence of strong client fund protection measures like segregated accounts. Also, there is limited transparency about the broker's financial health and key management information. These gaps have led to general mistrust among traders.

Even with the seemingly attractive account features like low deposit requirements and zero spreads, the persistent negative sentiment surrounding the broker's trustworthiness has resulted in a lower reliability score. This is further made worse by unresolved user complaints about excess fees and poor support responsiveness. So, the trust score stands at 3/10 in this raze markets review, reflecting the overall sentiment among the user base and the prevailing concerns about the broker's operational transparency and regulatory strength.

2.6.6 User Experience Analysis

The overall user experience with Raze Markets can be described as average, characterized by both good and bad observations. Interface design and platform usability are cited as being functional yet unimpressive, with many users noting that the interface lacks the polish and ease of use seen in more established brokers. The registration and account verification procedures have been reported by several users as too complex and time-consuming, taking away from the otherwise accessible trading conditions like the low deposit requirement.

Also, there is limited information about how easy it is to conduct deposit and withdrawal transactions, which adds uncertainty to the user experience. While some traders appreciate having multiple trading platforms available, the overall satisfaction is reduced by high overnight fees and poor customer support interactions. Together, the mixed feedback about ease of use, along with technical and procedural challenges, supports a user experience score of 5/10 in this raze markets review.

Improvements in interface design, account onboarding, and transaction efficiency would be essential to elevate the overall user experience to higher industry benchmarks.

Conclusion

In summary, Raze Markets is an emerging broker that offers attractive low-cost entry conditions with its $10 minimum deposit and zero starting spreads. But issues like high overnight fees, a complex account opening process, and particularly low trust levels due to scam warnings and limited regulatory safeguards raise serious concerns. Although the broker appeals to beginners and low-capital traders, those considering trading with Raze Markets should proceed with caution and conduct further research.

This raze markets review underlines both the potential benefits and significant drawbacks that must be carefully weighed before making any investment decisions.