Regarding the legitimacy of Raze Markets forex brokers, it provides FSCA and WikiBit, .

Is Raze Markets safe?

Pros

Cons

Is Raze Markets markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

WHITEROCK BROKERS (PTY) LTD

Effective Date:

2023-12-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

48 DAN PIENAAR CYCLEPLUMSTEADCAPE TOWN7800Phone Number of Licensed Institution:

021 141 2062Licensed Institution Certified Documents:

Is Raze Markets A Scam?

Introduction

Raze Markets positions itself as a global online brokerage, offering access to various financial instruments, including forex, cryptocurrencies, and CFDs. As the forex market continues to grow, traders must exercise caution when selecting a broker. The potential for scams is significant, with many unregulated entities operating under the guise of legitimate brokers. This article aims to provide a comprehensive assessment of Raze Markets, examining its regulatory status, company background, trading conditions, and customer experiences. The evaluation is based on a thorough analysis of multiple sources, including user reviews, expert assessments, and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. A regulated broker is subject to oversight by recognized financial authorities, which helps protect investors and ensures compliance with industry standards. In the case of Raze Markets, the broker claims to operate under the jurisdiction of Saint Lucia and mentions having a presence in South Africa. However, there is a lack of verifiable regulatory credentials.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Lucia | Unverified |

| N/A | N/A | South Africa | Unverified |

The absence of a valid license from reputable regulators such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) raises significant concerns. Without regulatory oversight, Raze Markets operates in a high-risk environment where investor protection is minimal. Furthermore, the broker's claims of having a license from the Financial Sector Conduct Authority (FSCA) in South Africa are not substantiated by documented evidence. The lack of regulatory history and oversight suggests that potential investors should approach Raze Markets with caution.

Company Background Investigation

Raze Markets is registered as Raze Global Markets Ltd in Saint Lucia. However, detailed information about the company's history and ownership structure is scarce. The broker's website lacks transparency regarding its management team and operational history. Furthermore, the domain for Raze Markets was registered in November 2023, indicating that the platform is relatively new and has not had sufficient time to establish a solid reputation in the competitive forex market.

The management team behind Raze Markets is not publicly disclosed, which raises questions about their qualifications and experience in the financial industry. Transparency is crucial for building trust with clients, and the absence of clear information about the company's leadership is a red flag. Overall, the limited information available about Raze Markets suggests a lack of accountability and raises concerns about the broker's credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. Raze Markets presents several account types, each with varying minimum deposits and trading conditions. The overall fee structure appears competitive at first glance; however, there are several concerning aspects that potential traders should be aware of.

| Fee Type | Raze Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | Zero | Varies |

| Overnight Interest Range | Unspecified | Varies |

The spread for major currency pairs is reported to start at 1.5 pips, which is higher than the industry average of 1.0 pips. While Raze Markets claims to offer zero commissions on certain accounts, the lack of clarity regarding overnight interest rates and potential hidden fees is concerning. Traders should be aware of the potential for unexpected costs, particularly when using high leverage, which can amplify both gains and losses.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. Raze Markets claims to implement various security measures, but there is little information available regarding the specifics of their fund protection policies. The absence of client fund segregation and investor protection schemes raises serious concerns about the safety of deposits.

Historically, many unregulated brokers have faced issues related to fund security, including allegations of misappropriating client funds. Raze Markets does not provide sufficient information on its website regarding how it safeguards client assets or whether it participates in any compensation schemes. This lack of transparency is alarming and highlights the risks associated with trading through an unregulated broker.

Customer Experience and Complaints

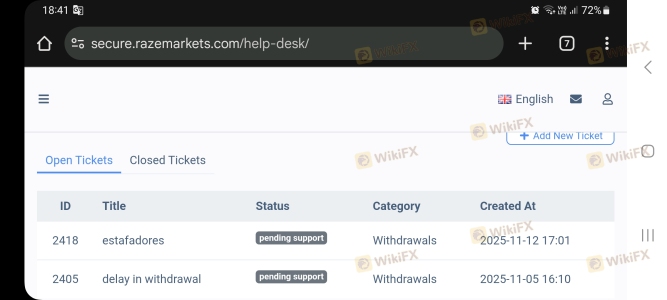

Customer feedback is a vital component of assessing a broker's reliability. Reviews of Raze Markets reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| High-Pressure Sales Tactics | Medium | Poor |

| Account Blocking | High | Unresponsive |

Common complaints include delayed withdrawals, aggressive marketing tactics, and unresponsive customer support. Many users report difficulties in accessing their funds after making deposits, which is a significant red flag. Notably, some clients have expressed frustration over their accounts being blocked without explanation. These issues highlight a pattern of negative experiences that potential traders should consider before engaging with Raze Markets.

Platform and Trade Execution

A broker's trading platform is critical for ensuring a smooth trading experience. Raze Markets claims to utilize the popular MetaTrader 5 (MT5) platform; however, user feedback suggests that the platform may not function as expected. Concerns have been raised regarding order execution quality, including issues with slippage and rejected orders.

The platform's performance is crucial for traders, as any delays or failures in execution can lead to significant financial losses. Users have reported instances of high slippage during volatile market conditions, which is concerning given the broker's claims of providing a reliable trading environment. Additionally, any indication of platform manipulation would further undermine trust in Raze Markets.

Risk Assessment

Engaging with Raze Markets involves several risks that potential traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from recognized authorities. |

| Fund Safety Risk | High | Absence of fund segregation and protection schemes. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Service Risk | High | Unresponsive support and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, Raze Markets exhibits several warning signs that suggest it may not be a trustworthy broker. The lack of regulatory oversight, limited transparency regarding company operations, and numerous customer complaints raise significant concerns about the platform's legitimacy. Potential traders should approach Raze Markets with caution and consider alternative options.

For those seeking reliable trading experiences, it is advisable to explore brokers with established regulatory credentials and positive user reviews. Recommended alternatives include brokers regulated by the FCA or ASIC, which provide robust investor protections and transparent trading conditions. Ultimately, the safety of your funds and the quality of your trading experience should be the top priority when choosing a forex broker.

Is Raze Markets a scam, or is it legit?

The latest exposure and evaluation content of Raze Markets brokers.

Raze Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Raze Markets latest industry rating score is 1.89, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.89 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.