Questh X 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive questh x review reveals significant concerns about the legitimacy and safety of Questh X as a forex broker. Questh X operates under two entities: Questh X S.A and Questh X Ltd. The trading community has raised serious questions about this broker's regulatory status and business practices. Multiple sources indicate that users have expressed major concerns about the broker's legitimacy. Discussions focus on potential fraudulent activities and deceptive tactics that may harm traders.

The broker targets investors seeking forex trading opportunities but lacks transparent regulatory information. This represents a critical red flag for potential clients who want to protect their investments. According to available reports, Questh X operates without proper licensing verification. There are documented concerns about broken promises and questionable business practices that should worry potential traders. The company's website and trading platform exist, but the absence of clear regulatory oversight and negative user feedback suggest that traders should exercise extreme caution. Anyone considering this broker for their trading activities should think twice before proceeding.

Important Notice

This review examines the operational differences between Questh X S.A and Questh X Ltd. These two entities appear to operate under similar branding but may have different regulatory frameworks. Available information suggests significant regulatory discrepancies that raise serious concerns. Some license numbers may be misrepresented or belong to entirely different companies such as Quest Corporate Finance Limited rather than the actual Questh X entities.

Our evaluation methodology is based on comprehensive analysis of user feedback, regulatory database searches, and market intelligence reports. All assessments reflect publicly available information and documented user experiences as of the review date.

Rating Framework

Broker Overview

Questh X operates as a forex broker through its corporate entities Questh X S.A and Questh X Ltd. Specific establishment dates and detailed company background information remain unclear from available sources. The broker presents itself as offering professional trading conditions and forex services. Critical information about its operational history, founding team, and business development remains notably absent from public documentation.

According to WikiBit reports, the broker operates primarily through its website questhx.com and claims to provide forex trading services. The company's actual business model, operational structure, and service delivery mechanisms lack the transparency typically expected from legitimate financial service providers. The absence of detailed corporate information, combined with regulatory concerns, raises significant questions about the broker's operational legitimacy. These transparency issues should concern any trader considering this platform.

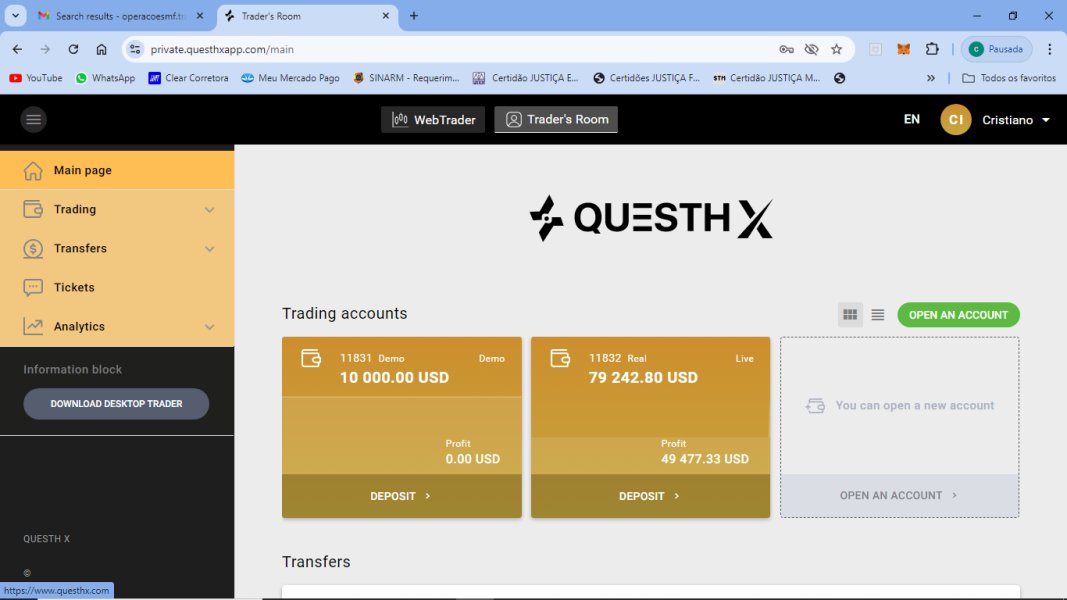

The broker utilizes the Questh X trading platform. Comprehensive details about platform features, technological infrastructure, and trading capabilities are not readily available in public sources. The lack of detailed information about asset classes, trading instruments, and service offerings further compounds concerns about the broker's transparency. This missing information suggests the broker may not be committed to client education and transparency.

Regulatory Jurisdiction: Available information does not specify clear regulatory oversight. Reports suggest potential misrepresentation of licensing credentials that could indicate fraudulent behavior.

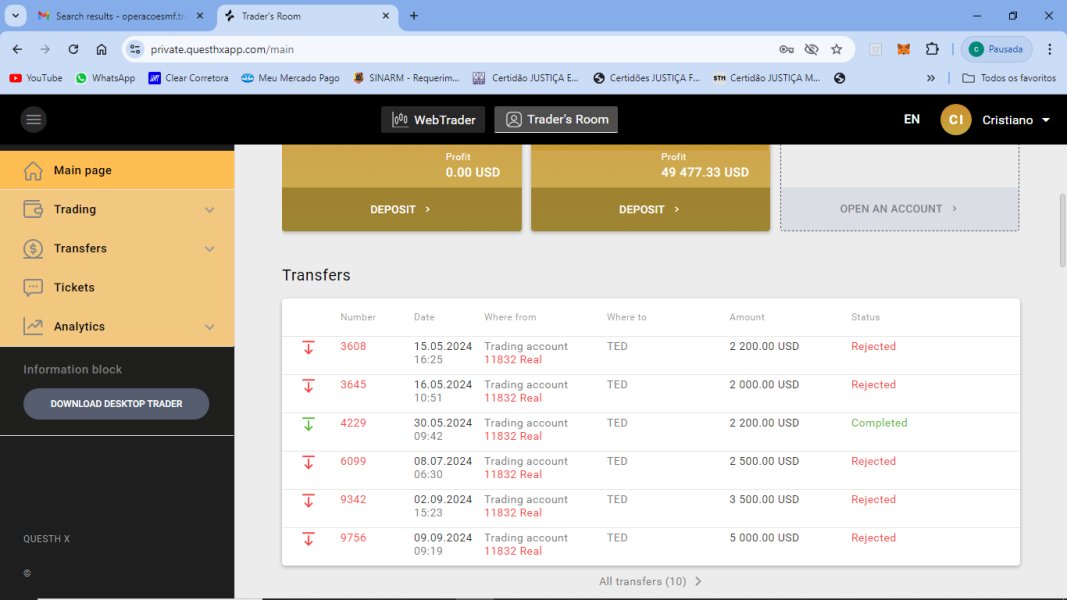

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes is not detailed in available sources. This represents a significant transparency concern that should worry potential clients.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in available documentation. This makes it difficult for potential clients to assess accessibility and plan their trading investments.

Bonus and Promotions: No specific information about promotional offers or bonus structures is available in current sources. Legitimate brokers typically provide clear details about their promotional programs and terms.

Tradeable Assets: The range of available trading instruments and asset classes is not clearly outlined in available materials. This lack of information makes it impossible to assess whether the broker meets specific trading needs.

Cost Structure: Details about spreads, commissions, and trading fees are not transparently disclosed in accessible sources. Traders need this information to calculate their potential trading costs and profitability.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation. This information is crucial for risk management and trading strategy development.

Platform Options: The broker operates the Questh X platform. Detailed features and capabilities are not comprehensively documented in available sources.

Geographic Restrictions: Specific information about regional availability and trading restrictions is not clearly stated in available sources. Traders need to know if they can legally access the platform from their location.

Customer Support Languages: Available support languages and communication options are not detailed in current documentation. This questh x review highlights the concerning lack of comprehensive information across all critical trading parameters.

Account Conditions Analysis

The account conditions offered by Questh X present significant transparency concerns that potential traders should carefully consider. Available sources do not provide clear information about account types, tier structures, or specific features that distinguish different account categories. This lack of detailed account information is particularly concerning for a financial services provider. Legitimate brokers typically offer comprehensive documentation about their account structures, minimum balance requirements, and associated benefits.

The absence of clear minimum deposit requirements makes it impossible for potential clients to properly assess the accessibility and suitability of the broker's services. Professional forex brokers typically provide transparent information about entry-level deposits, premium account thresholds, and any special requirements for accessing advanced trading features. The lack of this fundamental information in Questh X's available documentation raises serious questions about their commitment to client transparency. This missing information could indicate deliberate concealment of important terms and conditions.

Account opening procedures and verification processes are not clearly outlined in available sources. This represents another significant concern that could impact the client experience. Legitimate brokers typically provide detailed information about required documentation, verification timelines, and account activation procedures. The absence of clear guidance about these processes suggests potential operational deficiencies that could impact client experience and regulatory compliance.

Special account features such as Islamic accounts, demo accounts, or institutional services are not mentioned in available documentation. This questh x review finds that the broker's failure to provide comprehensive account information significantly undermines confidence in their service quality. The lack of transparency about account conditions represents a major red flag for potential traders.

The trading tools and resources available through Questh X are poorly documented. This raises significant concerns about the broker's commitment to providing comprehensive trading support. Available sources do not detail specific analytical tools, charting capabilities, or technical analysis resources that traders can access through the platform. Professional forex brokers typically offer extensive tool suites including advanced charting packages, economic calendars, market analysis tools, and automated trading capabilities.

Research and analysis resources appear to be minimal or non-existent based on available information. Legitimate brokers usually provide market commentary, economic analysis, trading signals, and educational content to support client decision-making. The absence of documented research capabilities suggests that Questh X may not offer the analytical support that serious traders require for informed trading decisions. This lack of research support could significantly handicap traders who rely on fundamental and technical analysis.

Educational resources and training materials are not mentioned in available sources. This represents a significant service gap that could harm new traders. Professional brokers typically offer comprehensive educational programs including webinars, tutorials, trading guides, and market analysis training. The lack of educational support indicates potential deficiencies in client development and trading education services.

Automated trading support, API access, and third-party integration capabilities are not documented in available sources. These features are increasingly important for modern traders who rely on algorithmic trading strategies and automated execution systems. The absence of information about these capabilities suggests limited platform sophistication and technological development. This could make the platform unsuitable for advanced traders who need sophisticated tools.

Customer Service and Support Analysis

Customer service capabilities and support infrastructure for Questh X are not clearly documented in available sources. This raises serious concerns about client support quality and accessibility. Legitimate forex brokers typically provide multiple communication channels including phone support, live chat, email assistance, and comprehensive FAQ sections. The absence of clear customer service information suggests potential deficiencies in client support infrastructure.

Response time commitments and service level agreements are not specified in available documentation. Professional brokers usually publish their support availability hours, average response times, and escalation procedures for complex issues. The lack of this information makes it impossible for potential clients to assess the quality and reliability of support services they can expect. This could leave traders without adequate support when they need help with urgent trading issues.

Service quality metrics and client satisfaction data are not available in public sources. This limits the ability to assess actual support performance. Reputable brokers often publish client satisfaction scores, response time statistics, and service improvement initiatives. The absence of performance data suggests either poor service quality or lack of transparency in service delivery.

Multilingual support capabilities and regional service availability are not detailed in current sources. International brokers typically specify supported languages, regional support teams, and local contact options. The lack of this information raises questions about the broker's ability to serve diverse international client bases effectively. This could create communication barriers for non-English speaking traders.

Trading Experience Analysis

The trading experience offered by Questh X is difficult to assess comprehensively due to limited available information about platform performance, execution quality, and user interface design. Available sources do not provide detailed information about platform stability, order execution speeds, or system reliability metrics. Professional trading platforms typically publish performance statistics including uptime percentages, execution speeds, and system capacity information. This lack of transparency makes it impossible to evaluate whether the platform can handle serious trading activities.

Order execution quality and trade processing capabilities are not documented in available sources. This represents a significant transparency concern for active traders. Legitimate brokers usually provide information about execution models, order types supported, slippage statistics, and fill rate data. The absence of execution quality information makes it impossible for traders to assess whether the platform can meet their trading requirements. Poor execution quality could result in significant trading losses and missed opportunities.

Platform functionality and feature completeness are not comprehensively detailed in available documentation. Modern trading platforms typically offer advanced charting tools, multiple order types, risk management features, and portfolio analysis capabilities. The lack of detailed feature information suggests either limited platform capabilities or poor documentation standards. This could indicate that the platform lacks essential features that serious traders need.

Mobile trading experience and cross-platform compatibility are not addressed in available sources. Given the importance of mobile trading for modern forex participants, the absence of mobile platform information represents a significant service gap. This questh x review notes that the lack of comprehensive trading experience documentation significantly undermines confidence in the platform's capabilities. Traders who need mobile access may find this platform unsuitable for their needs.

Trust and Safety Analysis

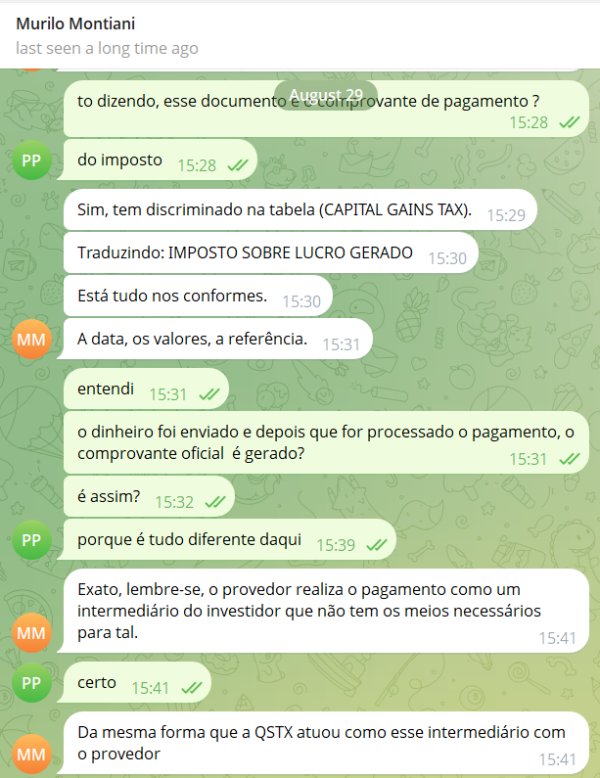

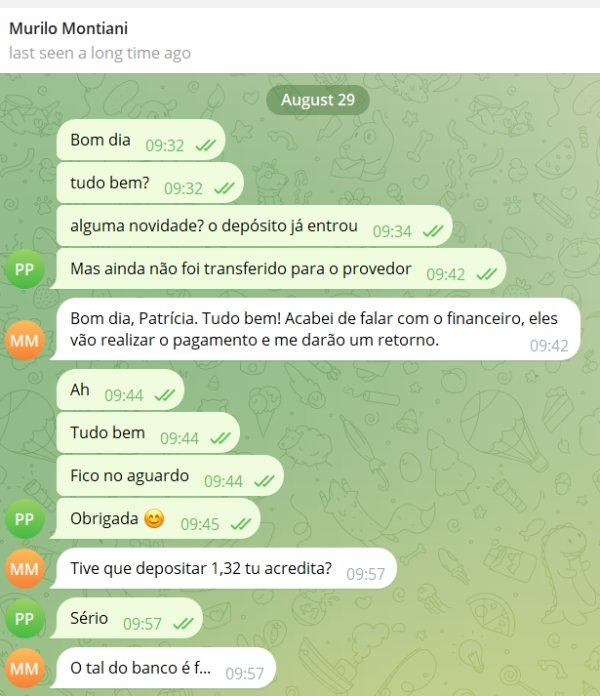

Trust and safety concerns represent the most significant issues identified in this evaluation of Questh X. Available sources indicate serious questions about the broker's regulatory status and licensing credentials. Reports suggest that license numbers claimed by the broker may actually belong to different entities such as Quest Corporate Finance Limited, rather than Questh X S.A or Questh X Ltd. This type of license misrepresentation represents a major regulatory violation and fraud indicator that should alarm potential clients.

Fund security measures and client money protection protocols are not clearly documented in available sources. Legitimate brokers typically provide detailed information about segregated accounts, deposit insurance, compensation schemes, and regulatory capital requirements. The absence of clear fund protection information raises serious concerns about client money safety and regulatory compliance. Traders could lose their entire investment if the broker fails or engages in fraudulent activities.

Company transparency and operational disclosure standards appear to be significantly below industry norms. Professional brokers usually publish detailed company information including management teams, financial statements, regulatory filings, and operational updates. The lack of comprehensive corporate disclosure suggests potential transparency deficiencies that could indicate operational irregularities. This opacity makes it impossible to verify the broker's legitimacy and financial stability.

Industry reputation and third-party verification present significant concerns based on available sources. Reports indicate user discussions about potential fraudulent activities and deceptive business practices. The presence of scam allegations and legitimacy questions in multiple sources represents a major trust and safety red flag that potential clients should carefully consider. These allegations suggest that the broker may not be operating in clients' best interests.

User Experience Analysis

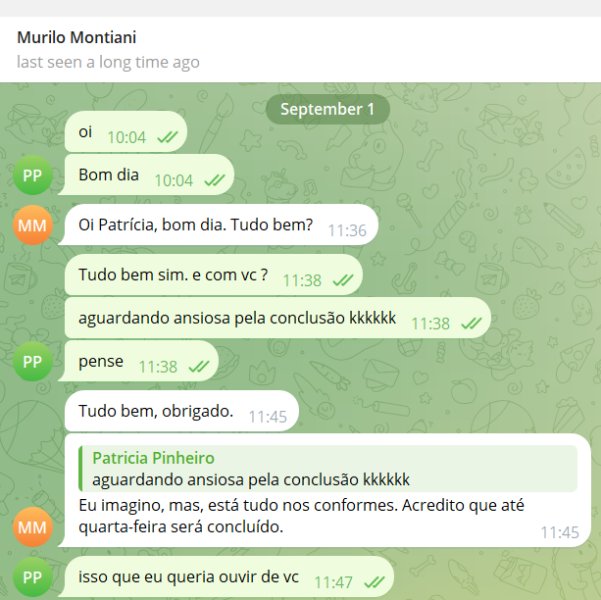

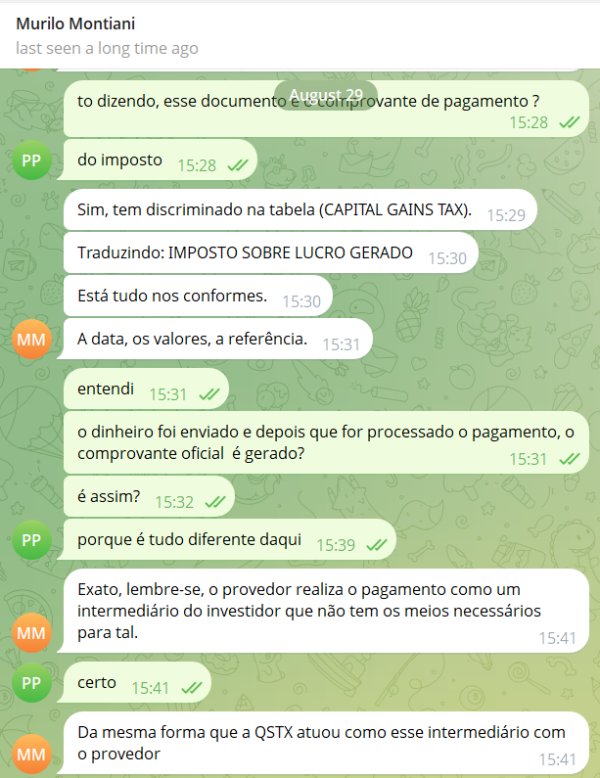

User experience feedback for Questh X indicates significant concerns about overall satisfaction and service quality. Available sources suggest that users have raised serious questions about the broker's legitimacy and operational practices. User discussions appear to focus on concerns about potential fraudulent activities, which represents extremely negative sentiment from the trading community. This type of feedback should serve as a strong warning to potential clients.

Interface design and platform usability information is not comprehensively available in current sources. This makes it difficult to assess the quality of user interaction design and navigation efficiency. Professional trading platforms typically receive detailed user feedback about interface quality, feature accessibility, and overall usability metrics. The absence of this feedback suggests either limited user adoption or poor platform design.

Registration and verification processes are not clearly documented. This can create confusion and frustration for potential clients. Legitimate brokers usually provide clear guidance about account opening procedures, required documentation, and verification timelines. The absence of clear process information suggests potential operational deficiencies that could delay account activation.

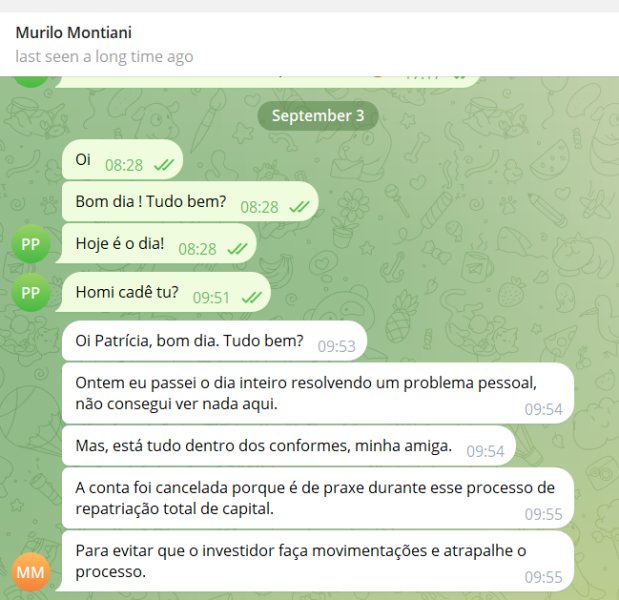

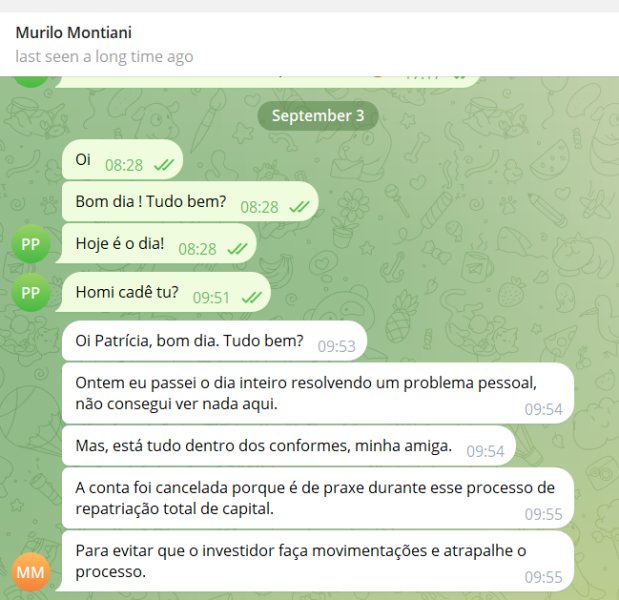

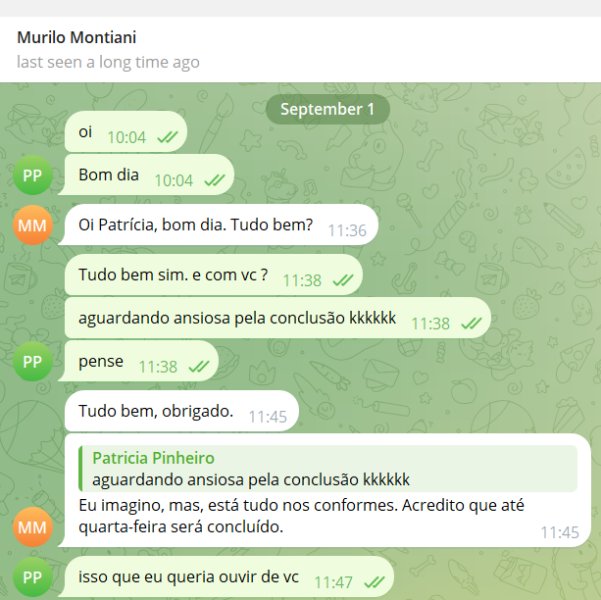

Common user complaints appear to center on legitimacy concerns and trust issues rather than specific service problems. This indicates fundamental operational concerns rather than minor service deficiencies. The presence of scam allegations and safety questions represents the most serious type of user feedback that financial service providers can receive. These concerns suggest that users may have experienced actual harm from interacting with this broker.

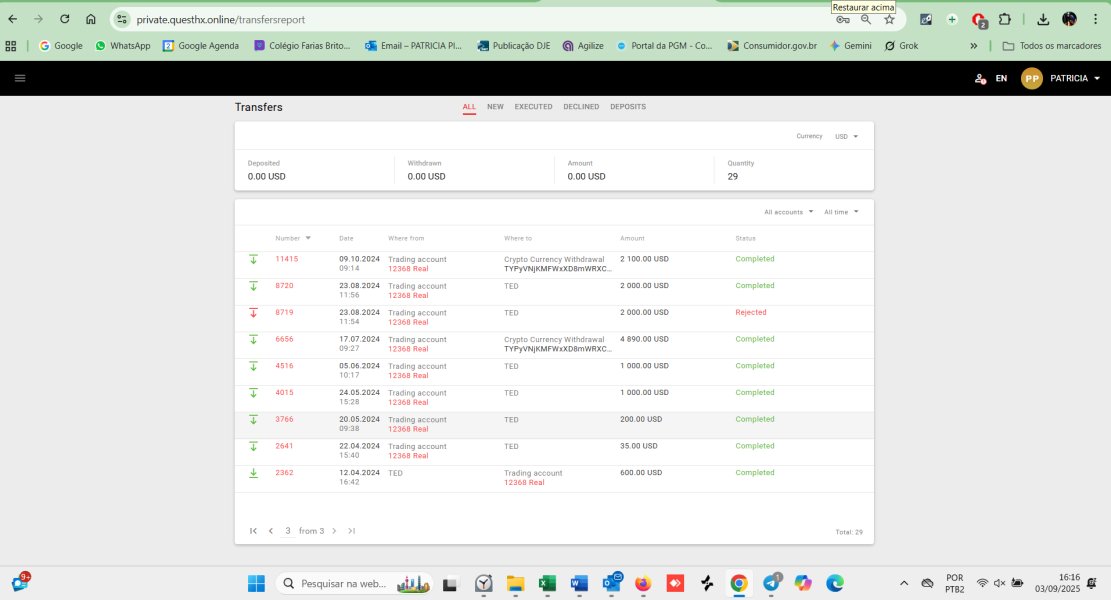

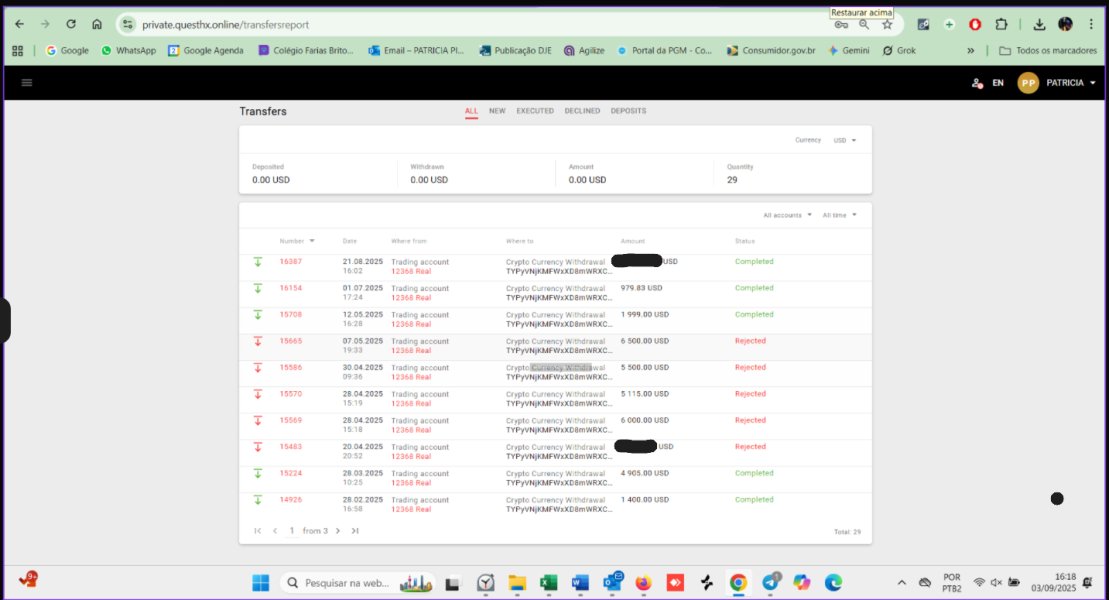

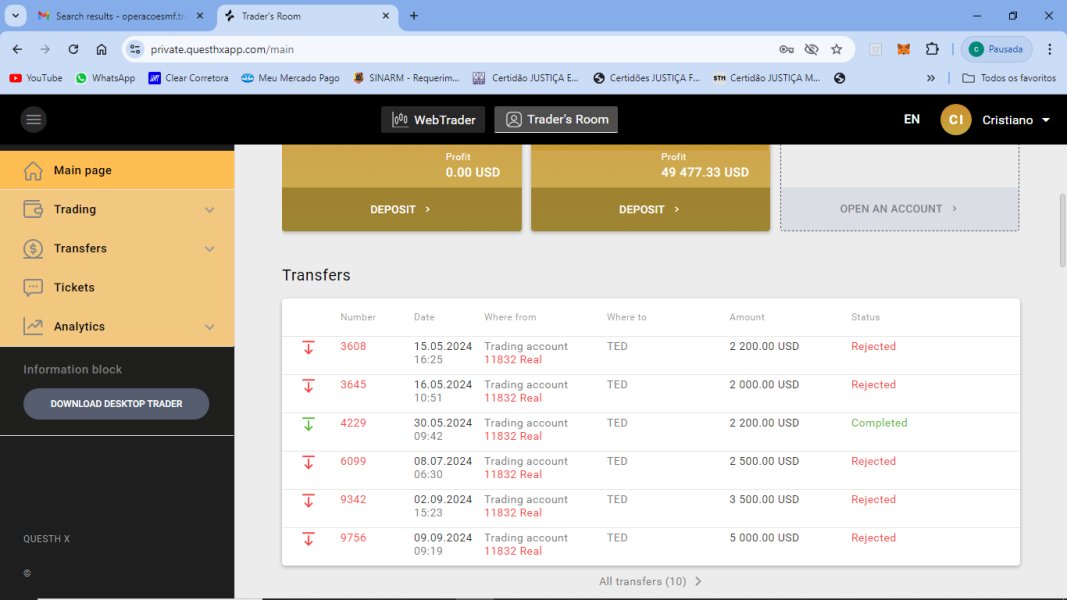

Fund management and withdrawal experiences are not well documented in available sources. The presence of fraud allegations suggests potential issues with client money handling and withdrawal processing capabilities. Traders may face difficulties accessing their funds or may lose money entirely if the broker engages in fraudulent practices.

Conclusion

This comprehensive questh x review reveals significant concerns that strongly suggest potential traders should avoid this broker entirely. The evaluation identifies multiple red flags including questionable regulatory status, potential license misrepresentation, lack of transparency across all service areas, and serious user concerns about legitimacy and fraudulent activities. These issues create unacceptable risks for traders who want to protect their investments.

Questh X is not recommended for any category of trader seeking safe and legitimate trading environments. The broker's failure to provide transparent information about account conditions, trading costs, regulatory compliance, and operational procedures indicates either poor business practices or deliberate concealment of important information. The presence of scam allegations and legitimacy questions from multiple sources represents unacceptable risk levels for serious traders. Potential clients should look elsewhere for their trading needs.

The primary disadvantages include absence of verified regulatory oversight, lack of comprehensive service documentation, concerning user feedback about potential fraudulent activities, and overall transparency deficiencies that fall far below professional industry standards. These issues make it impossible to recommend this broker to any trader. Potential traders should seek properly regulated alternatives with demonstrated track records of client protection and service quality.