Is Questh X safe?

Business

License

Is Questh X A Scam?

Introduction

Questh X is an online brokerage that claims to offer a variety of trading services in the foreign exchange (forex) market, including access to commodities and cryptocurrencies. As a relatively new player in the financial landscape, Questh X has attracted attention from both potential investors and regulatory bodies. However, with the rise of online trading platforms, there has been an increase in fraudulent schemes, making it essential for traders to carefully assess the legitimacy of any brokerage before committing their funds. This article aims to provide a comprehensive evaluation of Questh X, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risks. Our investigation draws on various online reviews, regulatory warnings, and user feedback to offer a balanced perspective on whether Questh X is a safe trading option or a potential scam.

Regulatory Status and Legitimacy

The regulatory environment is a critical factor in determining the safety and reliability of a brokerage. A regulated broker is subject to oversight by financial authorities that enforce strict compliance with industry standards, thereby protecting investors' interests. In the case of Questh X, the Swiss Financial Market Supervisory Authority (FINMA) has issued warnings against the broker, indicating that it operates without the necessary licenses and regulatory oversight. This lack of regulation raises significant concerns about the safety of investor funds and the legitimacy of the trading services offered by Questh X.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINMA | N/A | Switzerland | Blacklisted |

The absence of a valid license from recognized regulatory bodies such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) suggests that Questh X does not adhere to the compliance standards typically expected of legitimate brokers. This lack of oversight is a major red flag for potential investors, as it increases the risk of fraud and financial mismanagement. Moreover, the warnings issued by FINMA indicate a history of dubious practices associated with Questh X, further emphasizing the need for caution.

Company Background Investigation

Understanding the company behind a brokerage is crucial for assessing its legitimacy. Questh X claims to operate from various locations, including Switzerland and Turkey, but the lack of verifiable information about its ownership structure and management team raises questions about its transparency. The company's website provides limited details about its history, operational practices, and regulatory affiliations, which is a common tactic among fraudulent brokers to obscure their true nature.

The management teams background is another critical aspect to consider. A reputable brokerage typically has a team of experienced professionals with a proven track record in the financial industry. However, Questh X does not provide sufficient information about its leadership, making it difficult to assess their qualifications and expertise. This lack of transparency can be indicative of a broker that may not prioritize investor protection or ethical business practices.

Overall, the opacity surrounding Questh X's operations and ownership structure suggests that potential investors should exercise extreme caution. The absence of clear and reliable information is a significant warning sign that the broker may not be operating in good faith.

Trading Conditions Analysis

When evaluating a brokerage, understanding its trading conditions is essential for determining whether it is a viable option for investors. Questh X advertises various trading instruments and competitive spreads; however, the lack of transparency regarding its fee structure raises concerns. Traders should be wary of any hidden fees or unusual cost policies that could impact their profitability.

| Fee Type | Questh X | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The available information suggests that Questh X may impose fees that are not clearly disclosed, which is a common practice among unregulated brokers. Traders often report issues with withdrawal processes, unexpected charges, and high-pressure sales tactics designed to encourage additional deposits. If traders encounter such practices, it is a strong indicator that the broker may not be operating transparently.

Given the potential for hidden fees and unclear commission structures, it is crucial for traders to thoroughly investigate and understand the cost implications before engaging with Questh X. The absence of clear and competitive trading conditions is another factor to consider when assessing whether Questh X is a safe trading platform.

Client Funds Security

The security of client funds is paramount when choosing a brokerage. A reputable broker typically implements robust security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, Questh X does not provide sufficient information regarding its client fund security measures.

Traders should be particularly concerned about the lack of segregated accounts, as this practice ensures that client funds are kept separate from the broker's operating capital. Without this safeguard, investors risk losing their entire investment in the event of the broker's insolvency or mismanagement. Furthermore, the absence of investor protection mechanisms raises alarms about the potential for significant financial losses.

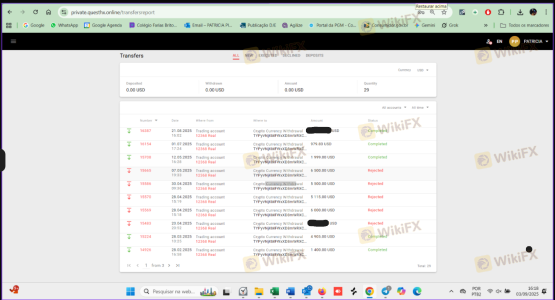

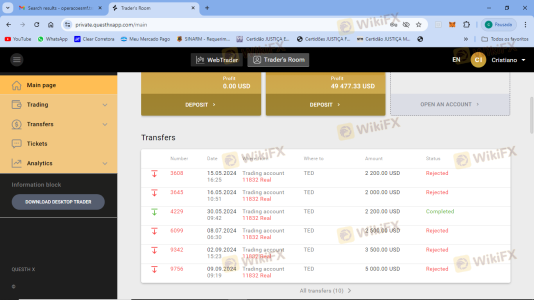

Historically, there have been reports of fund security issues associated with Questh X, including difficulties with withdrawals and unresponsive customer support. These problems further highlight the need for caution when dealing with this broker, as they indicate a lack of accountability and transparency in managing client funds.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of traders with a brokerage. Questh X has received a considerable amount of negative reviews, with many users reporting issues related to withdrawals, customer service, and misleading marketing practices. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Misleading Advertising | Medium | Inadequate |

| Poor Customer Support | High | Unresolved |

Many traders have expressed frustration over their inability to withdraw funds, citing unexplained delays and excessive fees. Additionally, users have reported aggressive sales tactics and pressure to deposit more funds, which are common red flags associated with fraudulent brokers. The lack of effective customer support further exacerbates these issues, leaving traders feeling abandoned and vulnerable.

One notable case involved a trader who attempted to withdraw funds after experiencing initial profits. After several requests, the trader was met with unresponsive customer service and ultimately found their account inaccessible. Such experiences are indicative of the potential risks associated with engaging with Questh X.

Platform and Execution Quality

The performance and reliability of a trading platform can significantly impact a trader's experience. Questh X claims to offer a user-friendly interface and fast trade execution; however, numerous reviews suggest that the platform may not deliver on these promises. Traders have reported issues with order execution quality, including slippage and rejected orders, which can hinder trading performance.

Moreover, there are concerns about potential platform manipulation, as some users have alleged that their trades were not executed as expected. This raises serious questions about the integrity of the trading environment provided by Questh X, making it essential for traders to be cautious when considering this broker.

Risk Assessment

Engaging with an unregulated broker like Questh X carries inherent risks that traders must consider. The absence of regulatory oversight increases the likelihood of financial mismanagement and fraudulent practices. Below is a risk scorecard summarizing the key risk areas associated with Questh X:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Security Risk | High | Lack of segregated accounts |

| Customer Support Risk | Medium | Poor responsiveness and service |

| Trading Execution Risk | High | Reports of slippage and rejections |

To mitigate these risks, traders should prioritize engaging with regulated brokers that adhere to industry standards and demonstrate transparency in their operations. Conducting thorough research and remaining vigilant about potential red flags can help protect investors from falling victim to scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that Questh X exhibits several characteristics typical of a potentially fraudulent broker. The lack of regulation, insufficient transparency, and numerous negative customer experiences raise significant concerns about the safety and legitimacy of this trading platform. Traders are strongly advised to exercise caution and consider alternative options that offer robust regulatory oversight and a proven track record of reliability.

For those seeking safer trading environments, consider exploring well-regulated brokers such as IG, OANDA, or Forex.com, which are known for their commitment to investor protection and transparent practices. Ultimately, prioritizing safety and due diligence is crucial for successful trading in the forex market.

Is Questh X a scam, or is it legit?

The latest exposure and evaluation content of Questh X brokers.

Questh X Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Questh X latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.