HTX 2025 Review: Everything You Need to Know

Executive Summary

HTX used to be called Huobi. This cryptocurrency trading platform has been in the digital asset market since 2013, building its presence over more than a decade. This htx review shows a platform that offers flexibility in how it works, especially through its adaptable commission structure, but it lacks the clear regulatory transparency that many traders want in today's market.

The platform stands out through its flexible trading commission model. It offers broker partners commissions up to 65% and supports multiple digital asset trading functions including buying, selling, staking, and lending services. HTX serves users who want flexible trading opportunities in the digital asset space. It also helps broker partners who look for competitive commission structures.

However, our analysis shows big information gaps about regulatory oversight, customer support infrastructure, and detailed trading conditions. The platform's user trust score of 64 means moderate risk levels, which suggests traders should be careful and do thorough research before using the platform.

Important Notice

This review uses publicly available information and user feedback as of 2025. HTX's regulatory status changes across different regions, and the platform may face compliance risks in certain areas due to unclear regulatory positioning. Traders should know that cryptocurrency trading involves substantial risk. The lack of clear regulatory information for HTX may present additional considerations for risk management.

Our evaluation method includes analysis of publicly available data, user feedback where available, and industry standard assessment criteria. This review aims to provide comprehensive market analysis while acknowledging information limitations where they exist.

Rating Framework

Broker Overview

HTX came from the rebranding of Huobi, a cryptocurrency exchange that originally launched in 2013. The change to HTX represents the platform's growth in the rapidly changing digital asset landscape, positioning itself as a complete cryptocurrency trading solution. The company has kept its focus on providing flexible trading solutions, adapting to market demands while expanding its service offerings beyond simple buy-and-sell operations.

The platform's main business model centers on digital asset trading. It covers a broad range of services including cryptocurrency trading, staking, and lending functions. HTX operates as a centralized exchange, helping transactions between users while maintaining custody of digital assets. The recent upgrade to its Broker Program shows the platform's commitment to expanding its partner network and providing competitive commission structures that can reach up to 65% for qualifying partners.

HTX supports multiple digital asset categories, though specific details about the exact number of supported cryptocurrencies and trading pairs remain limited in available documentation. The platform operates mainly through its proprietary HTX trading platform, offering users access to various cryptocurrency markets and related financial services.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing HTX operations. This presents a significant transparency concern for potential users seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. However, the platform supports fiat-to-crypto transactions as indicated by its "Quick Trade" and "Fiat Deposit" features.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in available documentation. This makes it difficult for potential users to assess entry barriers.

Bonuses and Promotions: The platform mentions "Activities" and promotional features, but specific bonus structures and promotional offers are not detailed in current available information.

Tradeable Assets: HTX supports multiple digital assets for trading, staking, and lending. However, the exact range and number of available cryptocurrencies require further investigation through direct platform access.

Cost Structure: The platform offers flexible commission models, with broker partners eligible for commissions up to 65%. However, detailed information about spreads, trading fees for regular users, and other cost components is not fully available in current materials.

Leverage Ratios: Specific leverage ratios and margin trading capabilities are not detailed in available documentation.

Platform Options: Users access trading services through the HTX platform, which appears to offer both web-based and mobile application interfaces. However, detailed platform specifications require further investigation.

Regional Restrictions: Specific geographical limitations and restricted jurisdictions are not detailed in available materials.

Customer Support Languages: Available customer service languages are not specified in current documentation.

This htx review highlights the need for more comprehensive information disclosure to better serve potential users' decision-making processes.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

HTX's account conditions present a mixed picture for potential traders. The platform offers flexibility through its broker program with competitive commission structures reaching up to 65%, but the lack of detailed information about standard account types, minimum deposit requirements, and specific account features significantly impacts the overall assessment.

The absence of clear information about account opening procedures, verification requirements, and different account tiers makes it challenging for users to understand what to expect when registering with the platform. This transparency gap is particularly concerning for traders who need to plan their trading capital and understand the requirements for accessing different platform features.

The platform does not provide clear information about special account types such as Islamic accounts or professional trader accounts. This limits its appeal to diverse trading communities. Additionally, the lack of detailed terms and conditions regarding account maintenance, inactivity fees, or account closure procedures represents a significant information deficit that potential users should consider.

User feedback specifically related to account conditions is not readily available in current documentation. This makes it difficult to assess real-world experiences with HTX's account management processes. This htx review emphasizes the importance of obtaining comprehensive account information before committing to the platform.

HTX demonstrates reasonable capability in providing trading tools and resources, particularly in the cryptocurrency trading space. The platform offers comprehensive digital asset services including trading, staking, and lending functions, which indicates a broader toolkit beyond basic buy-and-sell operations.

The platform's "Activities" section suggests the availability of various trading-related features and potentially educational resources. However, specific details about research tools, market analysis resources, or educational materials are not fully outlined in available documentation. The mention of "Launchpool" and "$HTX Zone" indicates additional platform features that may provide users with diverse engagement opportunities.

However, the analysis reveals gaps in information about advanced trading tools such as technical analysis indicators, automated trading support, or comprehensive market research resources. The absence of detailed information about charting capabilities, order types, and analytical tools represents a limitation in fully assessing the platform's trading infrastructure.

The platform's mobile application availability, indicated by QR code access options, suggests multi-device support. However, specific mobile platform capabilities and features require further investigation. User feedback regarding tool effectiveness and resource quality is not available in current documentation, limiting the ability to assess real-world utility.

Customer Service and Support Analysis (Score: 5/10)

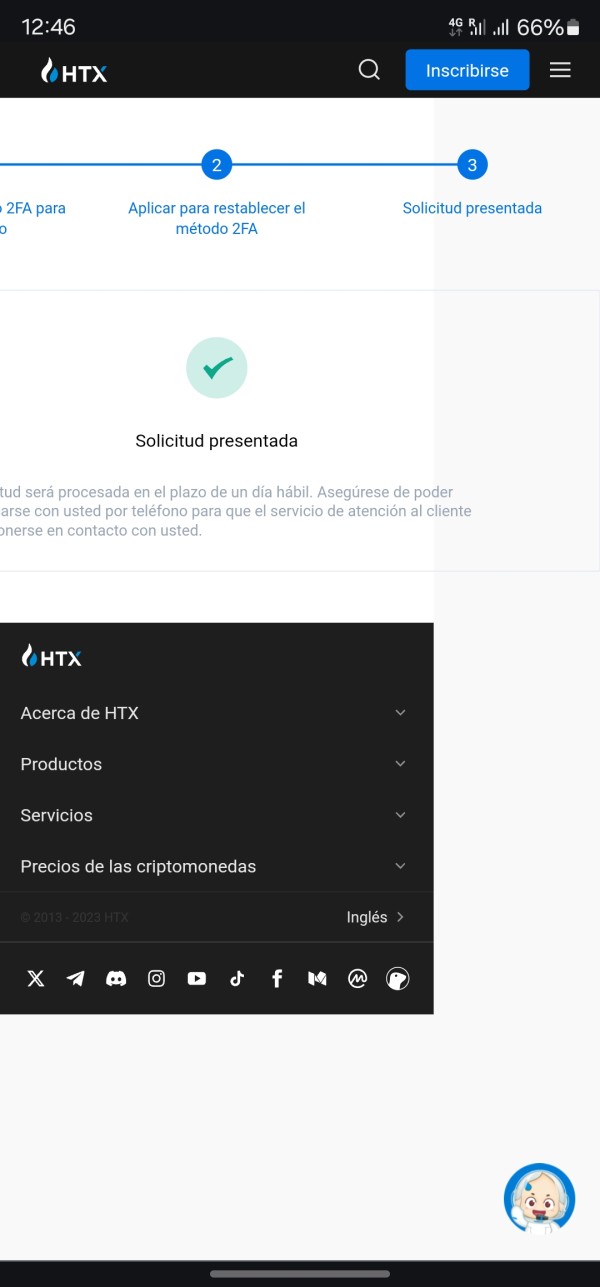

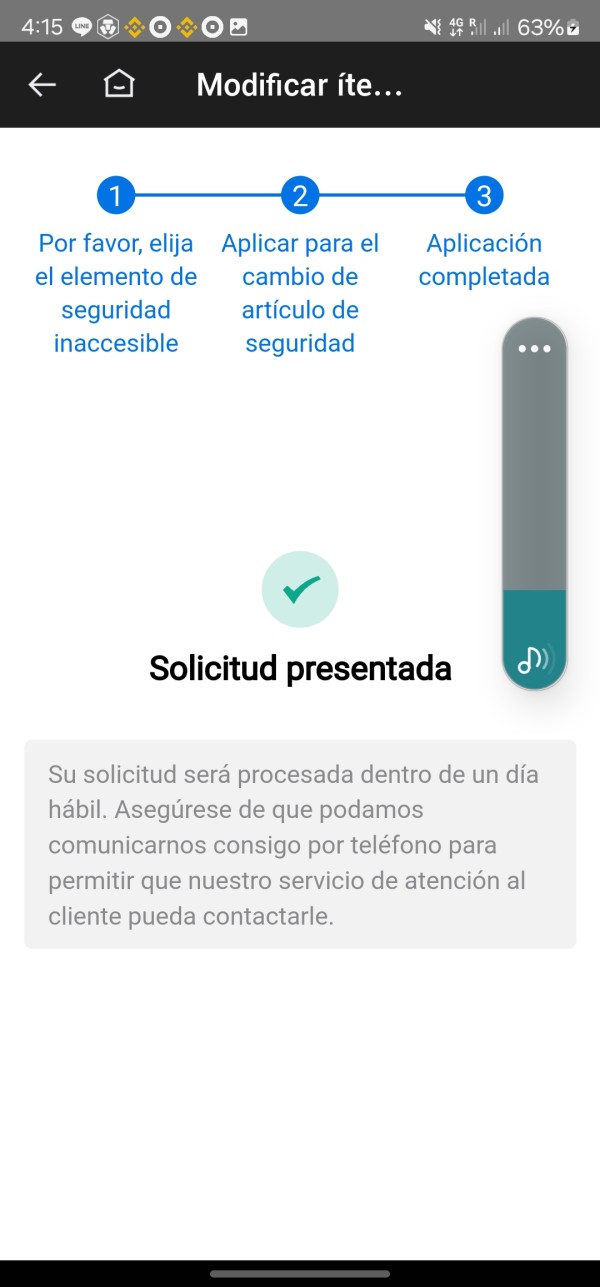

Customer service and support represent a significant area of concern for HTX. This is mainly due to the lack of available information about support infrastructure, response times, and service quality. The absence of clear customer service contact methods, available support hours, and supported languages creates uncertainty for potential users who may require assistance.

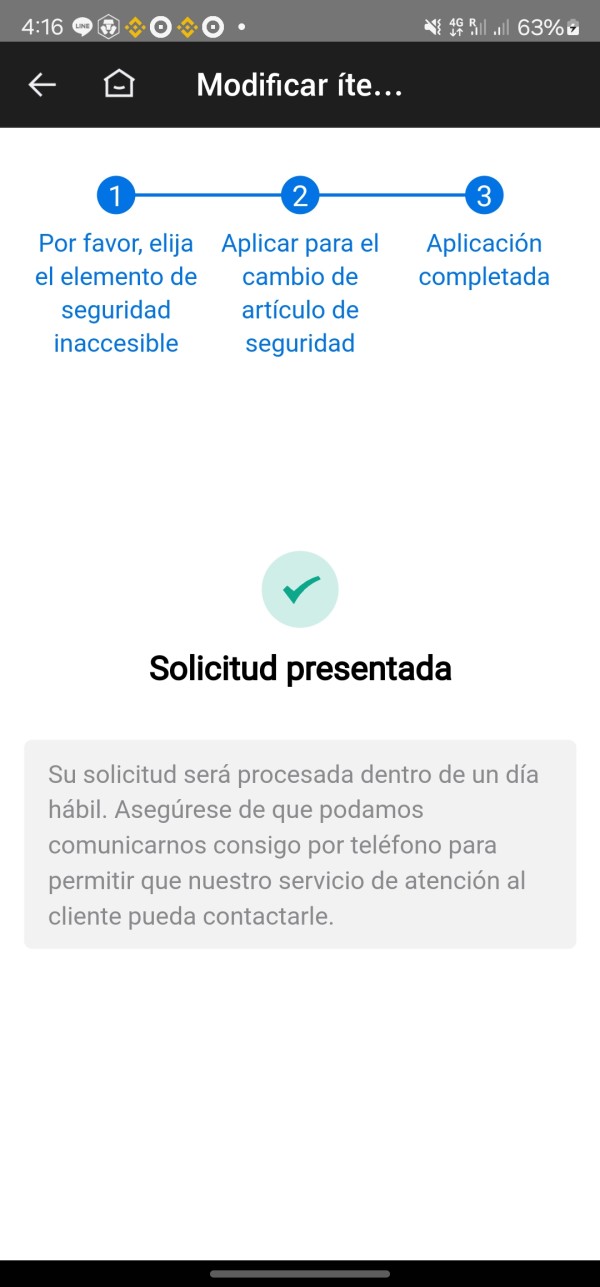

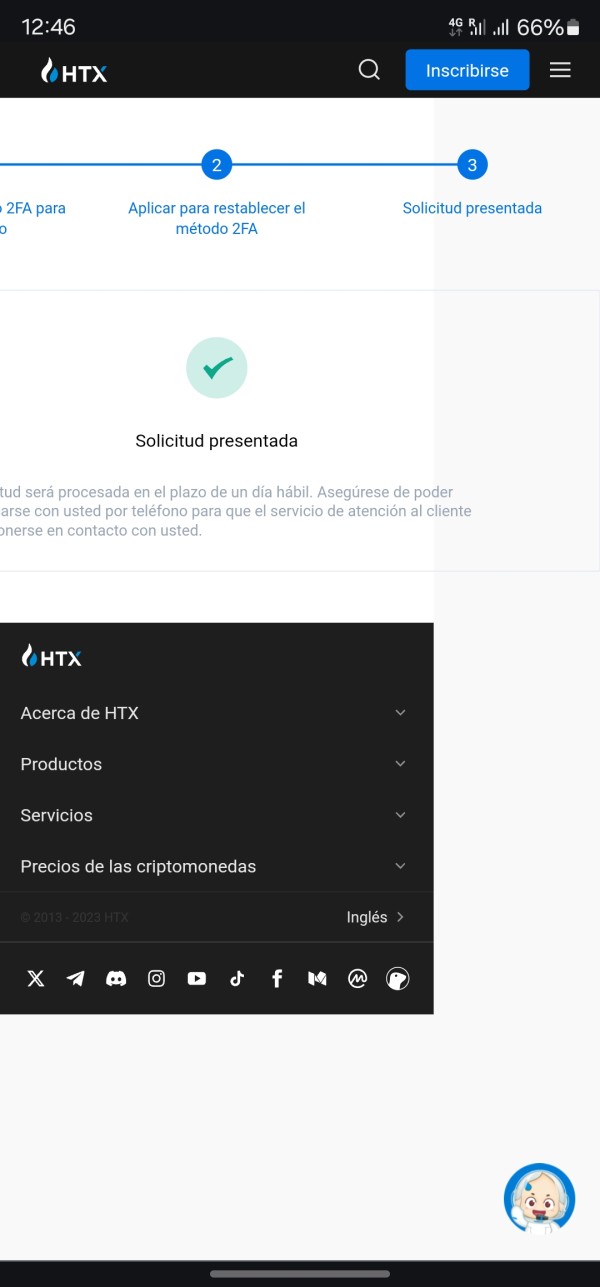

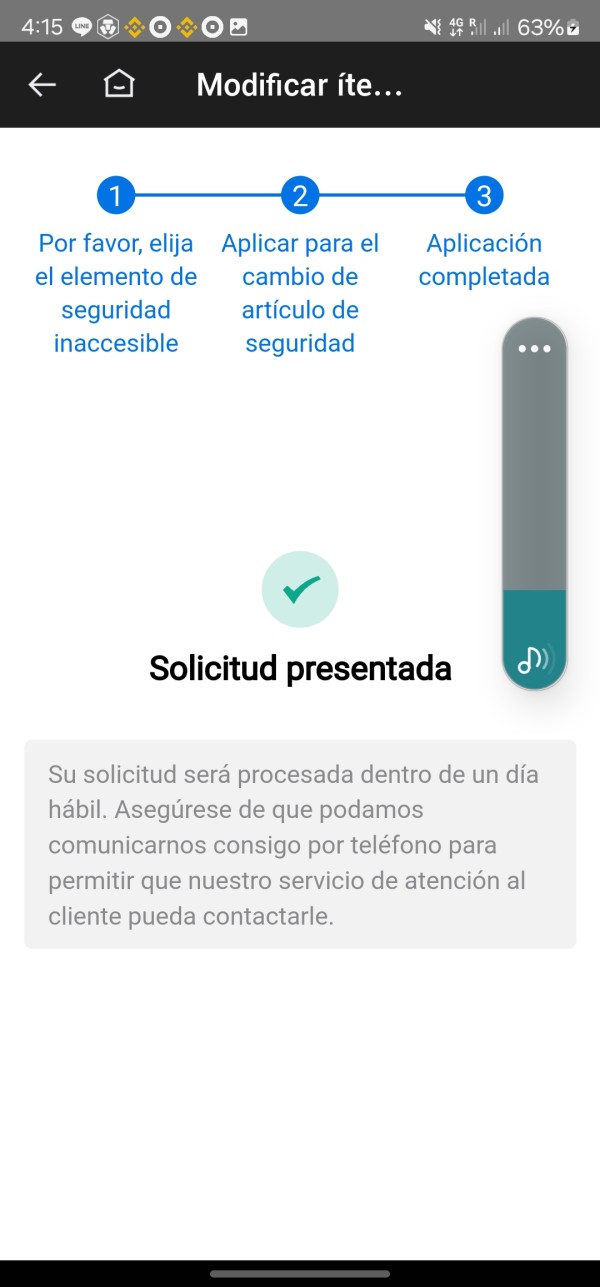

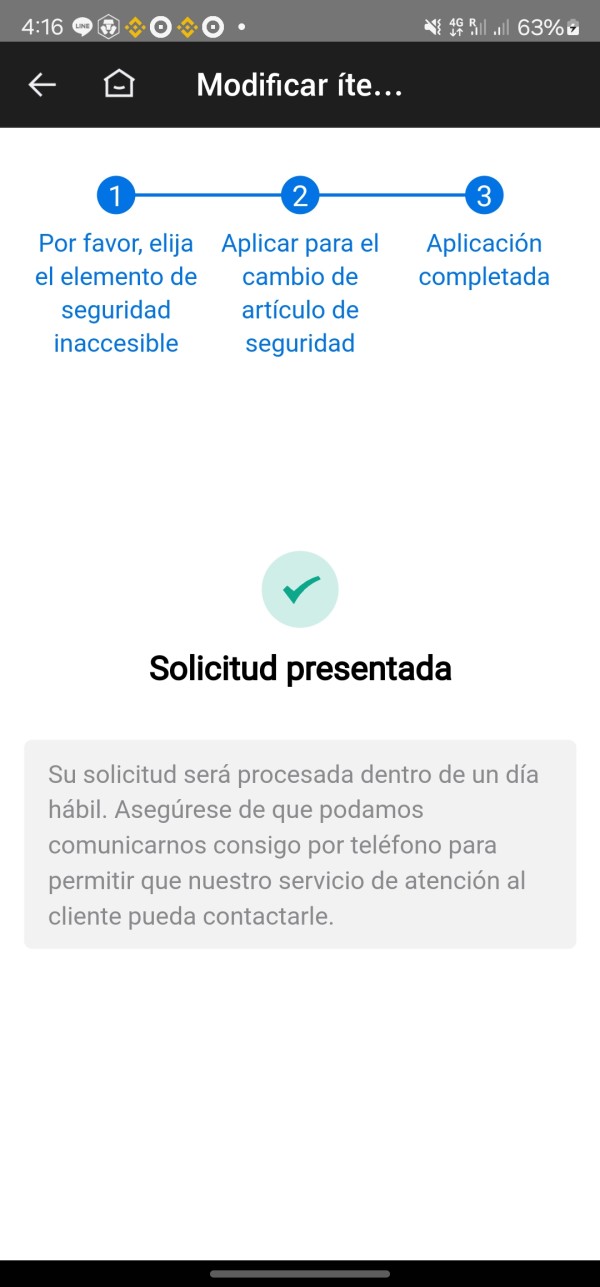

The platform does not provide visible information about support ticket systems, live chat availability, phone support, or email response timeframes. This lack of transparency regarding customer support capabilities is particularly problematic for cryptocurrency trading platforms, where users may need immediate assistance with account access, transaction issues, or security concerns.

Multi-language support information is not available, which may limit the platform's accessibility for international users. The absence of detailed FAQ sections, help documentation, or self-service resources in available materials suggests potential limitations in user support infrastructure.

Without available user feedback specifically addressing customer service experiences, it's challenging to assess the actual quality and effectiveness of HTX's support operations. The platform would benefit significantly from providing comprehensive information about its customer service capabilities and commitment to user support.

Trading Experience Analysis (Score: 6/10)

The trading experience on HTX appears to offer reasonable functionality through its proprietary platform. However, detailed information about platform stability, execution speed, and order processing quality is not fully available. The platform supports various cryptocurrency trading activities including spot trading, with additional services like staking and lending expanding the overall trading ecosystem.

Platform functionality appears to include both web-based and mobile access options, as indicated by the availability of mobile application downloads. However, specific information about platform uptime, server stability, trading execution speeds, and slippage rates is not detailed in available documentation.

The absence of detailed information about order types, trading interfaces, and platform customization options makes it difficult to fully assess the trading experience quality. Advanced trading features such as algorithmic trading support, API access, or professional trading tools are not clearly outlined in current materials.

User feedback regarding actual trading experiences, platform reliability, and execution quality is not readily available. This limits the ability to provide comprehensive assessment of real-world trading conditions. This htx review suggests that potential users should conduct thorough testing of platform capabilities before committing significant trading capital.

Trust and Regulation Analysis (Score: 4/10)

Trust and regulatory compliance represent the most significant concerns identified in this HTX evaluation. The absence of clear regulatory authority oversight information creates substantial uncertainty about the platform's compliance status and user protection measures.

Available documentation does not specify licensing from recognized financial regulatory authorities, insurance coverage for user funds, or compliance with established cryptocurrency exchange regulations. This regulatory transparency gap is particularly concerning given the importance of regulatory oversight in cryptocurrency trading platform selection.

The user trust score of 64, indicating moderate risk levels, suggests that users have expressed some concerns about platform reliability and trustworthiness. Without clear regulatory backing or comprehensive transparency about security measures, fund protection, and operational compliance, users face elevated risks when engaging with the platform.

The platform has experienced security incidents, including reported hacking events affecting HTX and associated services, which further impacts trust assessments. The absence of detailed information about security improvement measures, insurance coverage, or regulatory compliance efforts represents a significant limitation for risk-conscious traders.

User Experience Analysis (Score: 6/10)

HTX's user experience presents a moderate level of functionality, though comprehensive assessment is limited by available information. The platform appears to offer multi-device access through web and mobile interfaces, with features like QR code app downloads suggesting attention to user convenience.

Interface design and usability information is not detailed in available materials. This makes it difficult to assess the platform's accessibility for traders of different experience levels. The registration and verification process details are not fully outlined, though the platform does offer account creation functionality.

The absence of specific user feedback regarding interface design, navigation ease, and overall platform usability limits the ability to provide detailed user experience assessment. Information about common user complaints, satisfaction levels, or platform improvement initiatives is not readily available in current documentation.

Fund management experience, including deposit and withdrawal processes, transaction speeds, and fee transparency, requires further investigation as detailed information is not fully available. The platform would benefit from providing more transparent information about user experience elements and actively soliciting user feedback for continuous improvement.

Conclusion

HTX presents itself as a cryptocurrency trading platform with certain operational flexibility. This is particularly evident in its competitive broker commission structure reaching up to 65%. However, this htx review reveals significant information gaps that potential users must carefully consider, especially regarding regulatory oversight and comprehensive platform transparency.

The platform appears most suitable for users specifically seeking digital asset trading opportunities and broker partners interested in competitive commission structures. However, the moderate trust score of 64 and limited regulatory information suggest that HTX may be better suited for experienced cryptocurrency traders who can navigate platforms with higher risk profiles.

The primary advantages include commission flexibility and multi-service cryptocurrency offerings, while the main disadvantages center on limited regulatory transparency, insufficient customer support information, and gaps in detailed platform specifications. Potential users should conduct thorough due diligence and consider their risk tolerance before engaging with the platform.