Polonix 2025 Review: Everything You Need to Know

Summary: Polonix has established itself as a significant player in the cryptocurrency exchange market since its inception in 2014. While it offers a vast selection of cryptocurrencies and competitive trading fees, its history of security breaches and regulatory challenges raises concerns among potential users. The platform is particularly appealing for international traders, but U.S. residents are excluded from using its services.

Note: Its essential to recognize that Polonix operates under different entities depending on the region, which can affect user experience and regulatory compliance. This review aims to provide a fair and accurate assessment based on various sources.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's services.

Broker Overview

Founded in 2014, Polonix is a cryptocurrency exchange that has grown significantly, particularly after its acquisition by Circle in 2018. Initially based in the U.S., it has since moved its operations to the Seychelles, allowing for a more flexible regulatory environment. Polonix offers a proprietary trading platform equipped with advanced tools and supports a wide array of cryptocurrencies, making it an attractive option for traders. However, it is important to note that it does not offer fiat-to-crypto trading, which may deter new investors.

Detailed Insights

Regulatory Areas: Polonix is not available to users in the United States due to regulatory issues, including a significant settlement with the SEC for operating an unregistered exchange. The exchange has faced scrutiny in the past for its security practices, particularly after two major hacks in 2014 and 2020. As a result, it has implemented stringent security measures, including two-factor authentication and cold storage for the majority of its assets.

Deposit/Withdrawal Methods: Users can deposit cryptocurrencies into their Polonix accounts, but the platform does not support direct fiat deposits. Users can purchase cryptocurrencies using credit or debit cards through a third-party service, Simplex, which charges a fee ranging from 3.5% to $10 per transaction. Withdrawals are subject to network fees, which vary by asset.

Minimum Deposit: The minimum deposit to start trading on Polonix is $50, making it accessible for many traders. However, users must be aware that trading is primarily crypto-to-crypto, which may require prior investment in cryptocurrencies.

Bonuses/Promotions: Polonix offers a unique discount for users who pay trading fees in TRX (Tron), which can reduce fees significantly. However, specific promotional offers were not detailed in the sources reviewed.

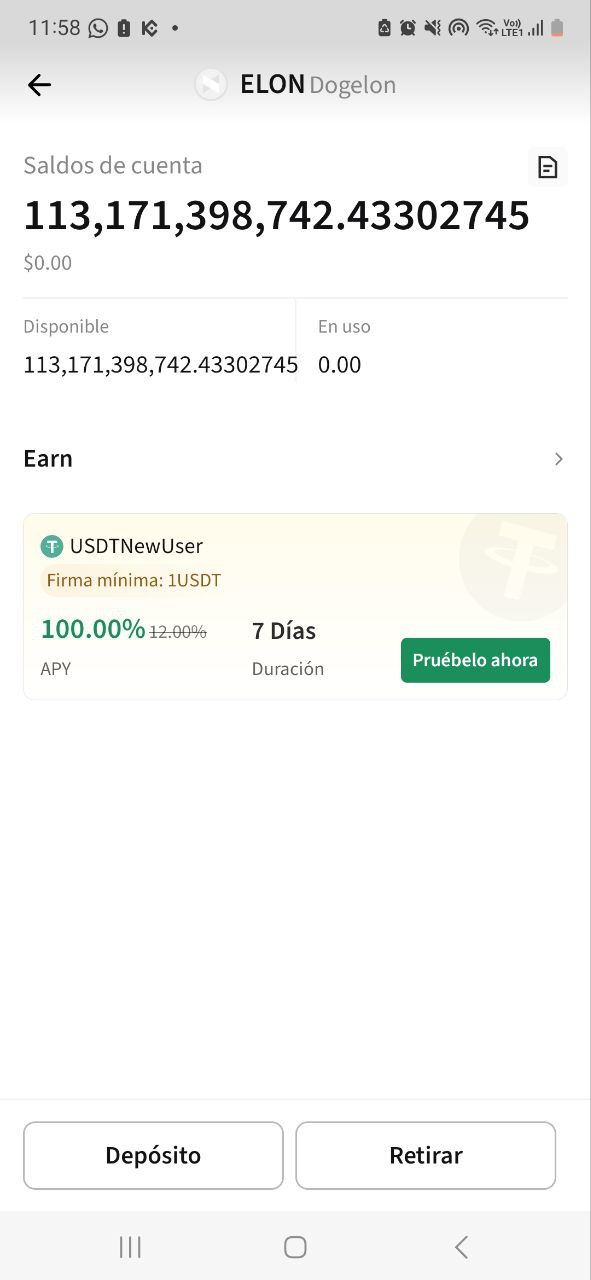

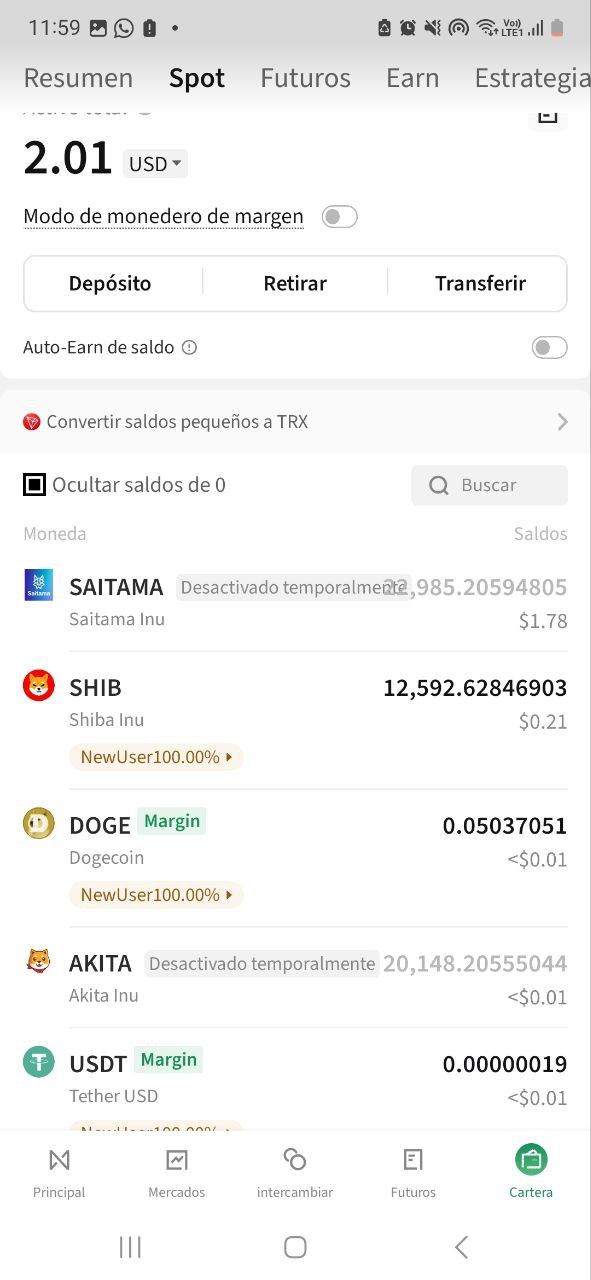

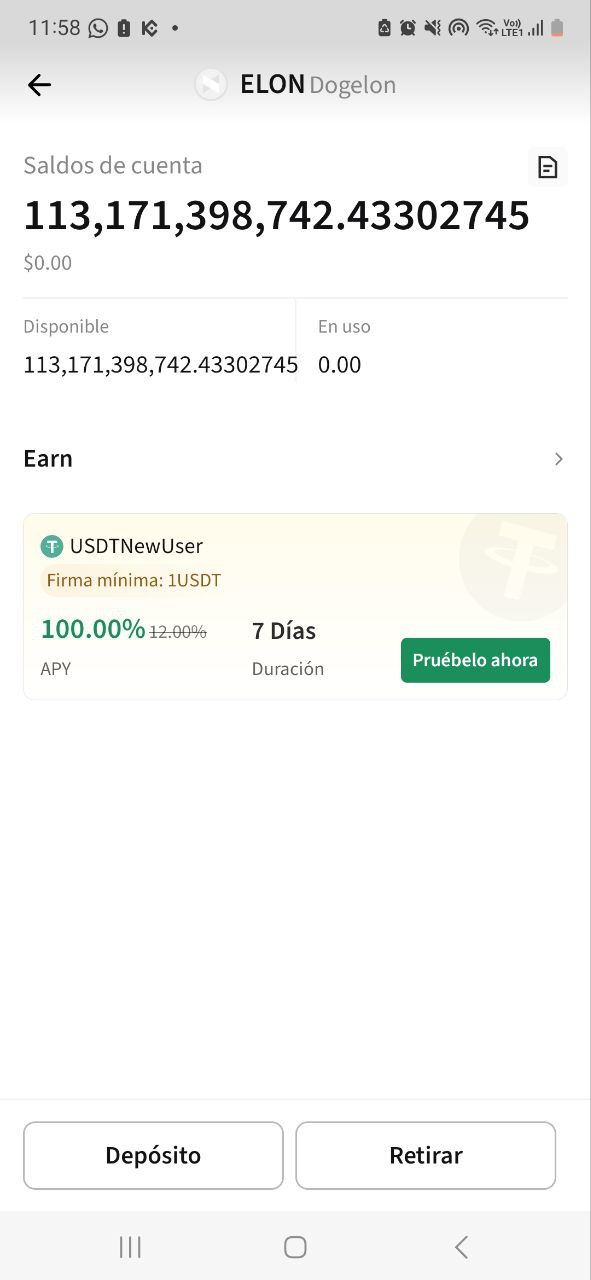

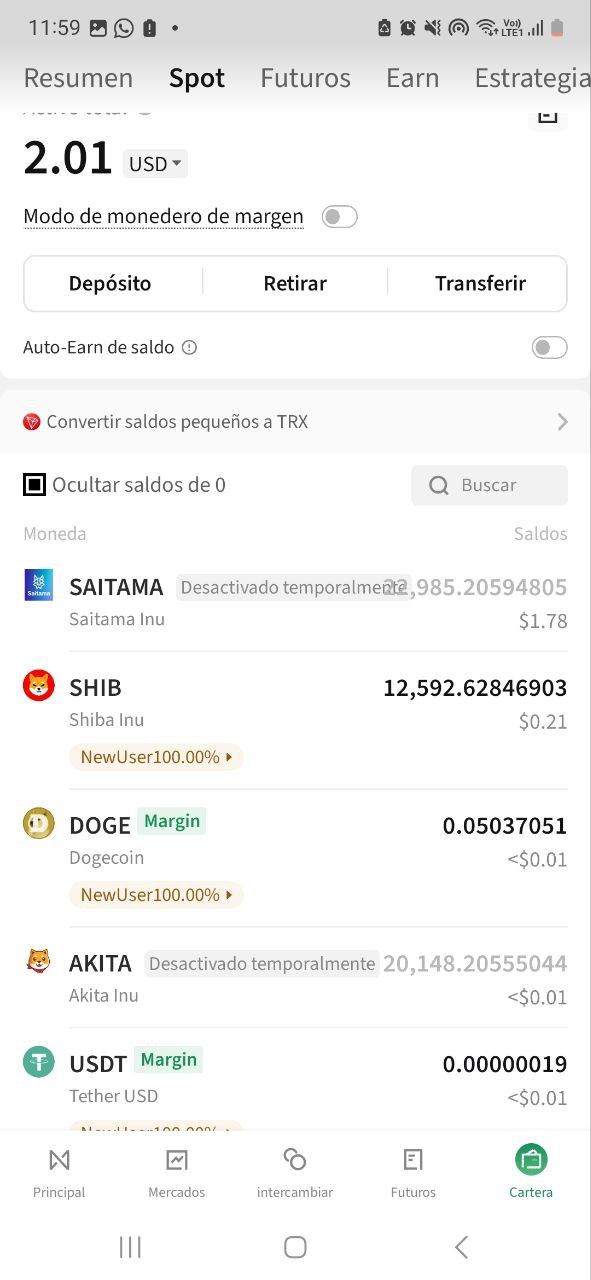

Asset Classes: Polonix supports over 400 cryptocurrencies, providing a diverse selection for traders. Notable assets include Bitcoin (BTC), Ethereum (ETH), and various altcoins. However, the platform does not offer any fiat currency trading pairs, limiting options for users looking to convert fiat to crypto directly.

Costs (Spreads, Fees, Commissions): Polonix employs a tiered fee structure, with trading fees starting at 0.155% for takers and 0.145% for makers. As trading volume increases, these fees can decrease significantly. While these rates are competitive compared to other exchanges, the costs associated with purchasing cryptocurrencies via Simplex can be high.

Leverage: Polonix offers margin trading with leverage up to 100x for certain futures contracts. However, U.S. customers are restricted from accessing margin trading due to regulatory compliance.

Allowed Trading Platforms: The primary platform for trading is Polonix's web interface, which is designed to be user-friendly but may appear cluttered to new users. A mobile app is available for both iOS and Android, although it lacks some advanced features found on the desktop version.

Restricted Regions: As mentioned, Polonix is not available to users in the United States and several other countries, including Iran, North Korea, and Syria. This restriction can limit its user base significantly.

Available Customer Service Languages: Polonix primarily offers customer support in English, with additional support in several other languages, including Chinese and Russian. However, the platform has received mixed reviews regarding the responsiveness and quality of its customer service.

Final Ratings Overview

Detailed Breakdown

- Account Conditions: Polonix offers tiered accounts that allow for a range of trading activities, but U.S. residents are excluded, limiting its accessibility.

- Tools and Resources: The platform provides a variety of trading tools and resources, including a mobile app and advanced charting options.

- Customer Service and Support: The customer service experience has been criticized for slow response times and limited direct support options.

- Trading Setup: Users report a generally positive trading experience, particularly with the availability of various cryptocurrencies.

- Trustworthiness: While Polonix has made significant improvements in security since its past breaches, its regulatory history raises concerns for some users.

- User Experience: The platform is user-friendly but may be overwhelming for beginners due to its extensive features and lack of fiat trading options.

In conclusion, Polonix remains a viable option for cryptocurrency trading, particularly for those outside the U.S. Its competitive fees and broad selection of assets make it appealing, but potential users should weigh the risks associated with its regulatory history and customer service reputation.