Peak Markets 2025 Review: Everything You Need to Know

Executive Summary

This peak markets review shows major concerns about the broker's legitimacy and how it operates. Our detailed analysis from multiple sources and market research reveals that Peak Markets has been flagged as a potential scam operation, earning an overall negative assessment from industry watchdogs and user feedback platforms. The broker offers MetaTrader 5 WebTrader platform access that allows users to trade directly from their browsers. However, Peak Markets lacks proper regulatory oversight, which raises serious red flags.

Peak Markets presents itself as a multi-asset trading platform targeting users interested in forex, stocks, commodities, indices, and cryptocurrencies. The company was established on April 3, 2023, and has its headquarters in Saint Lucia, Istanbul, Turkey, but it has quickly gained negative attention from various review platforms and regulatory warning sites. Multiple sources, including Market Referee and Scam Helpers, have issued clear warnings about Peak Markets. These organizations advise potential clients to be extremely careful when considering this broker for their trading activities.

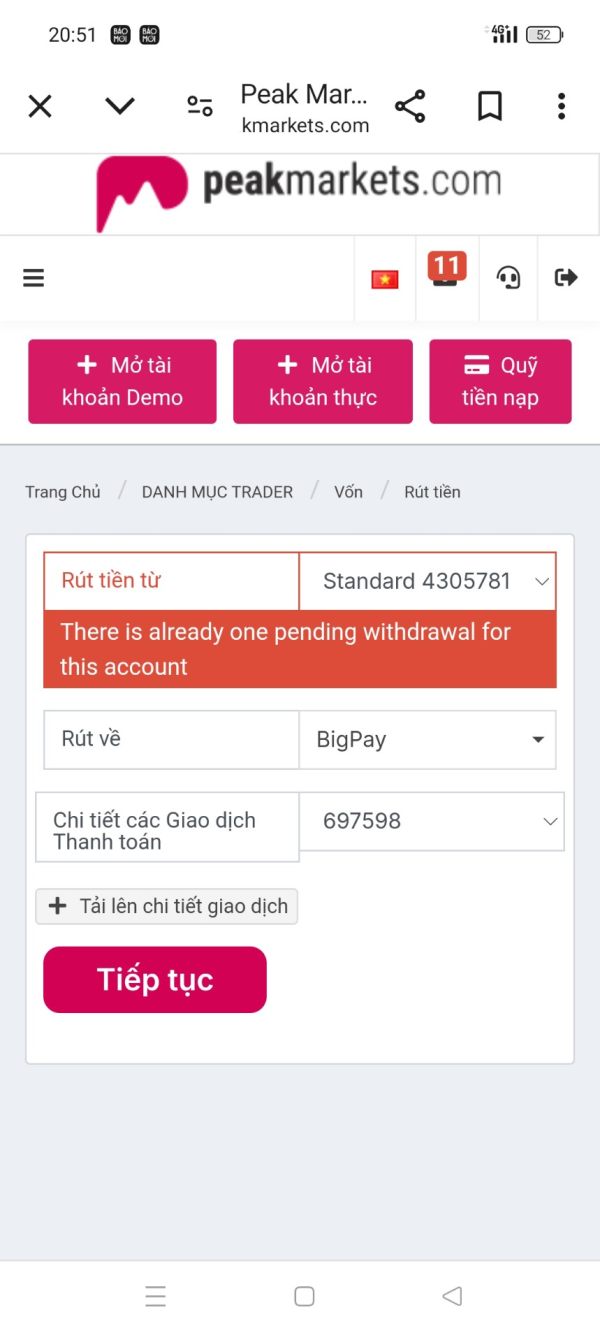

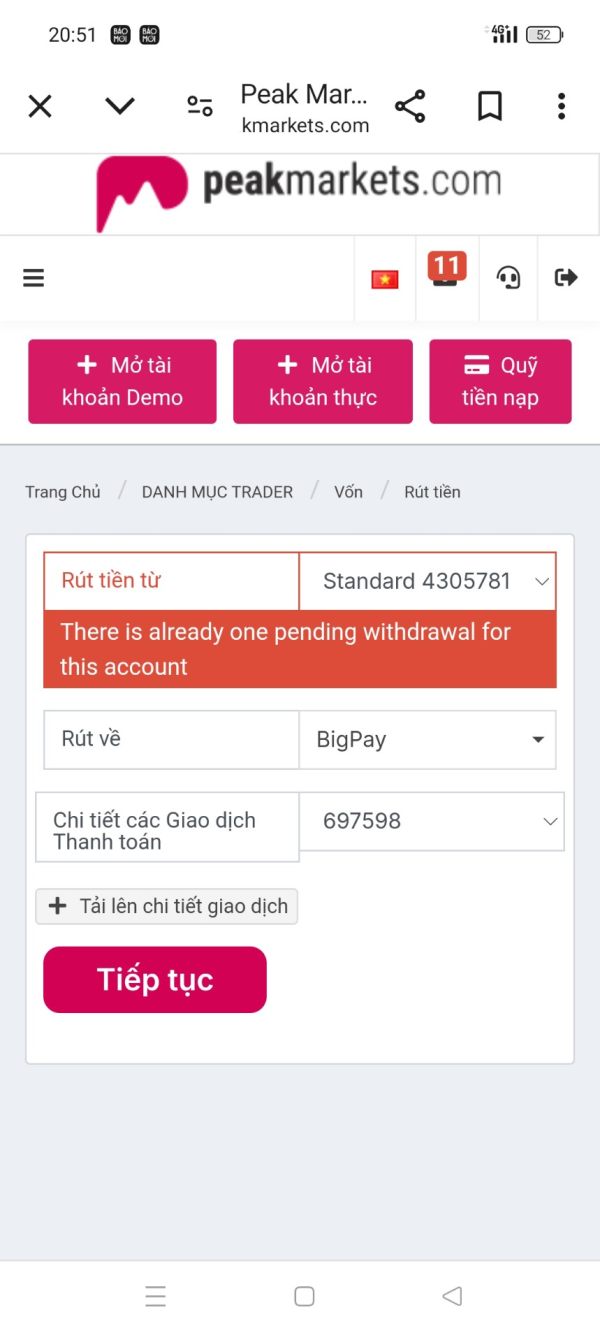

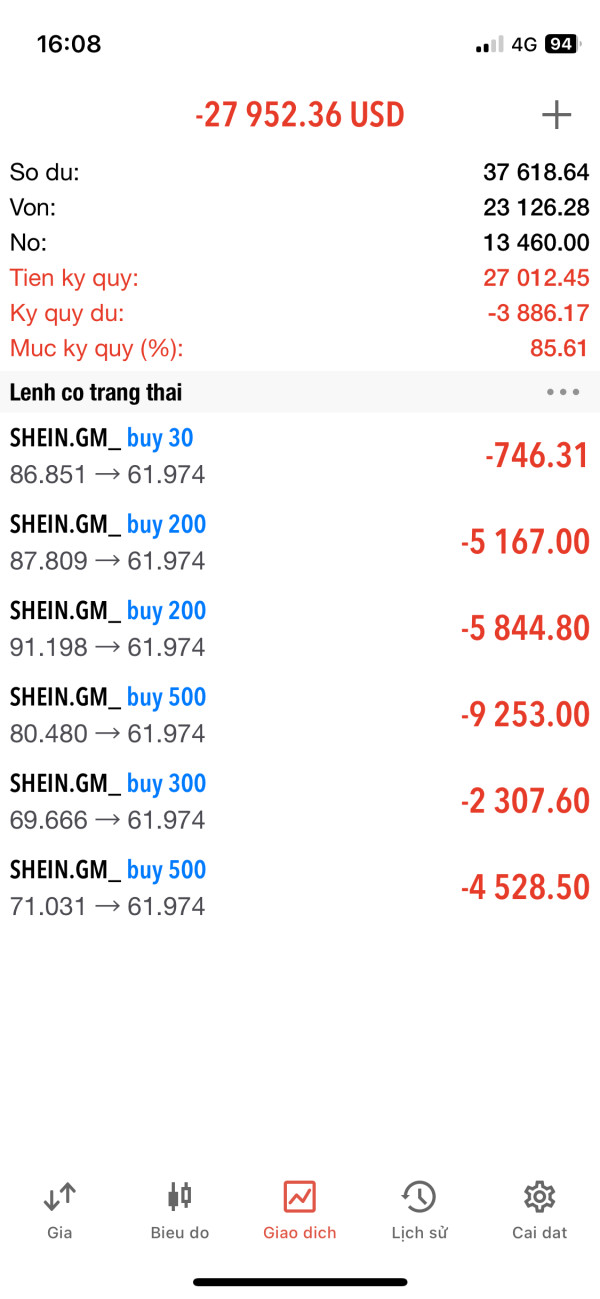

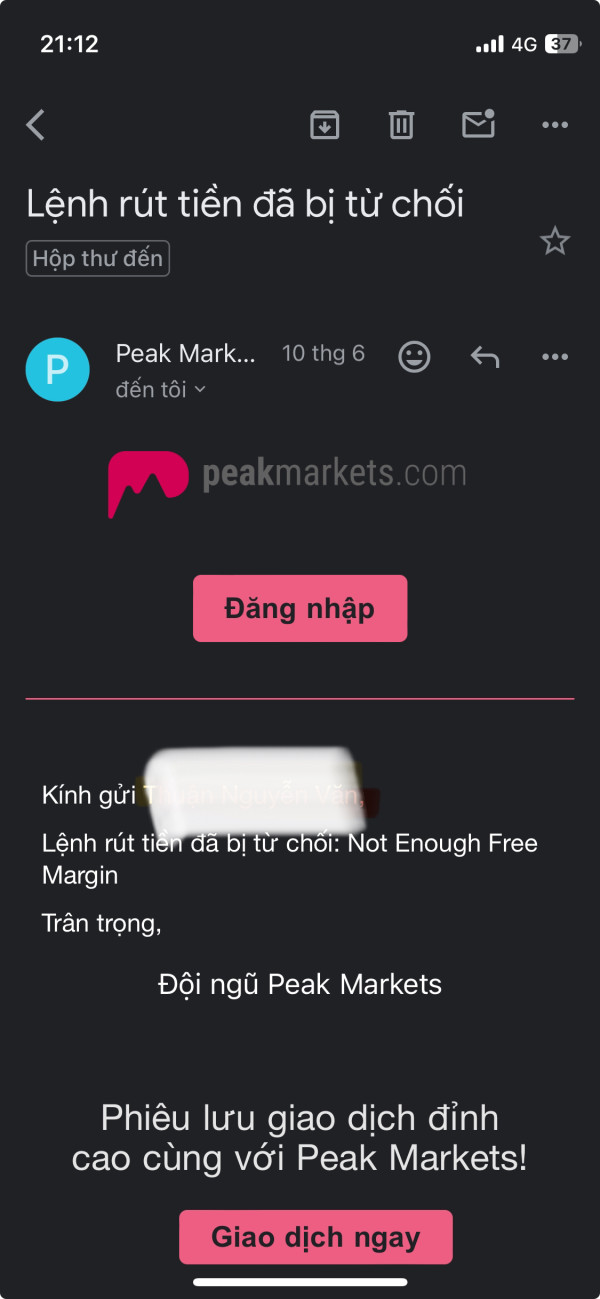

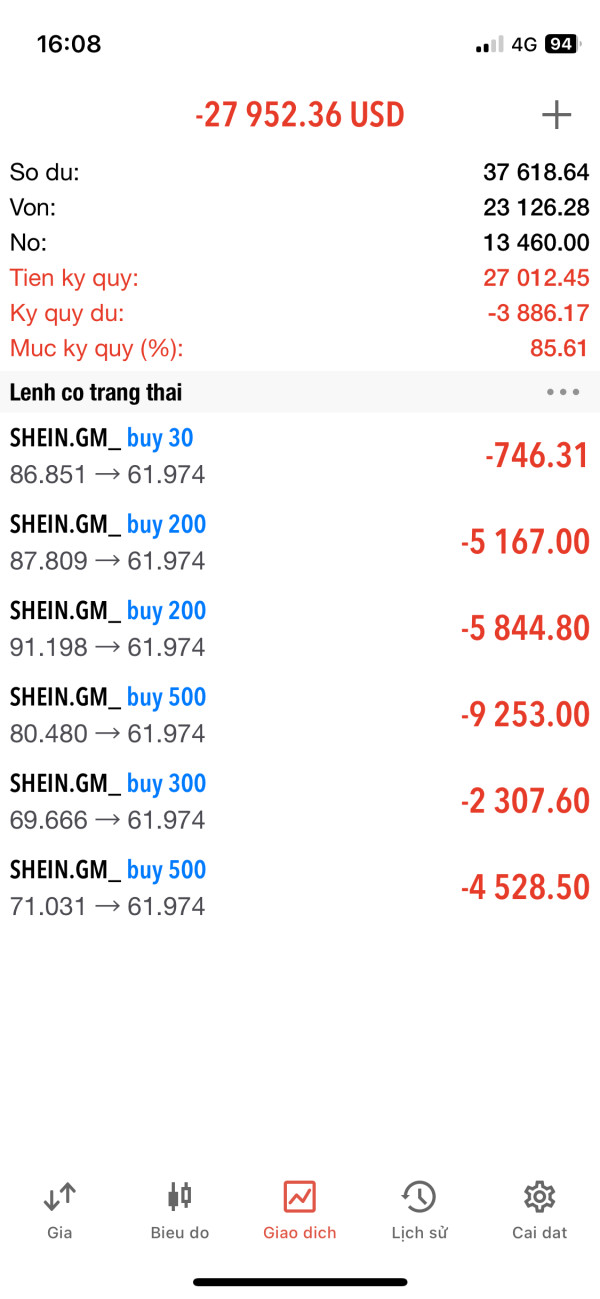

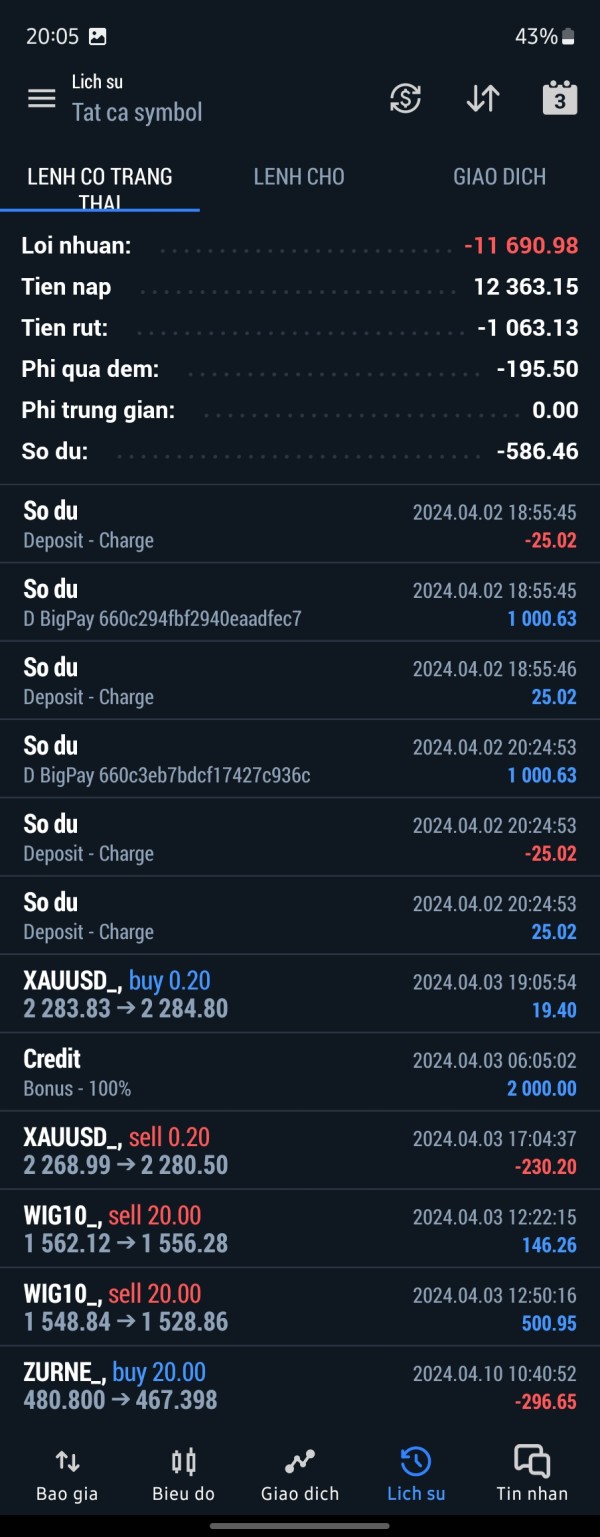

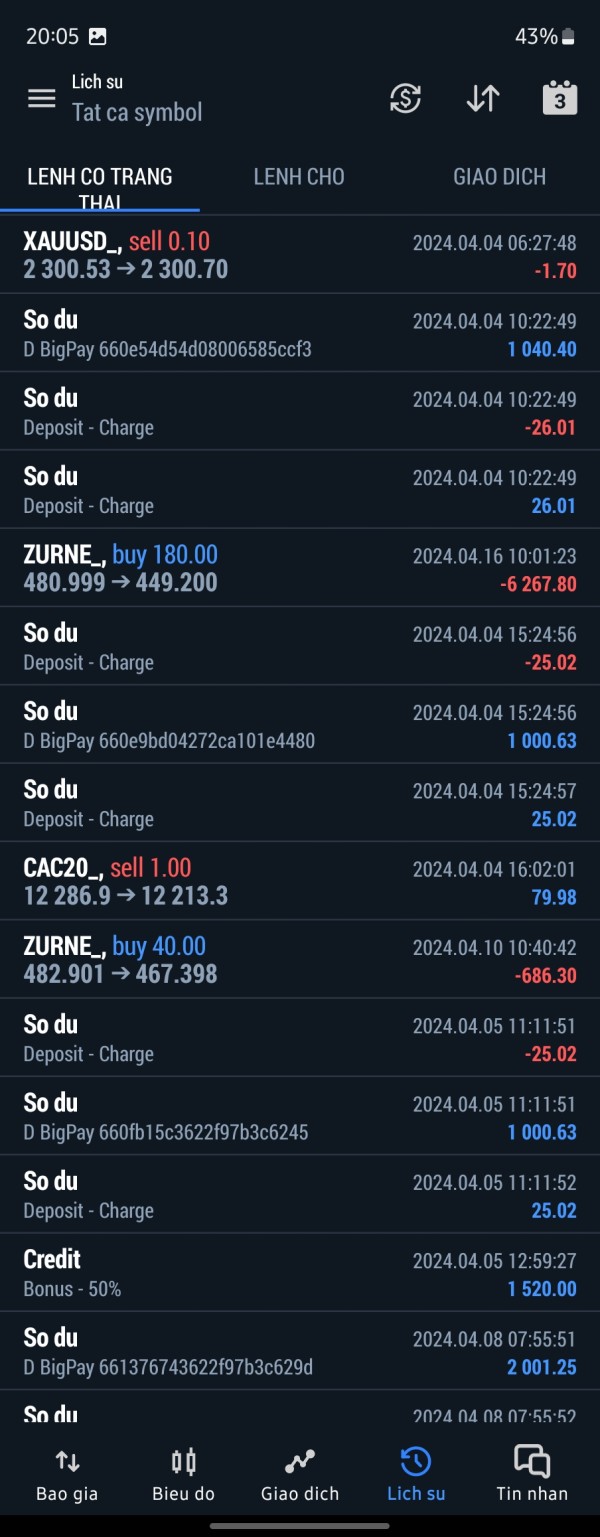

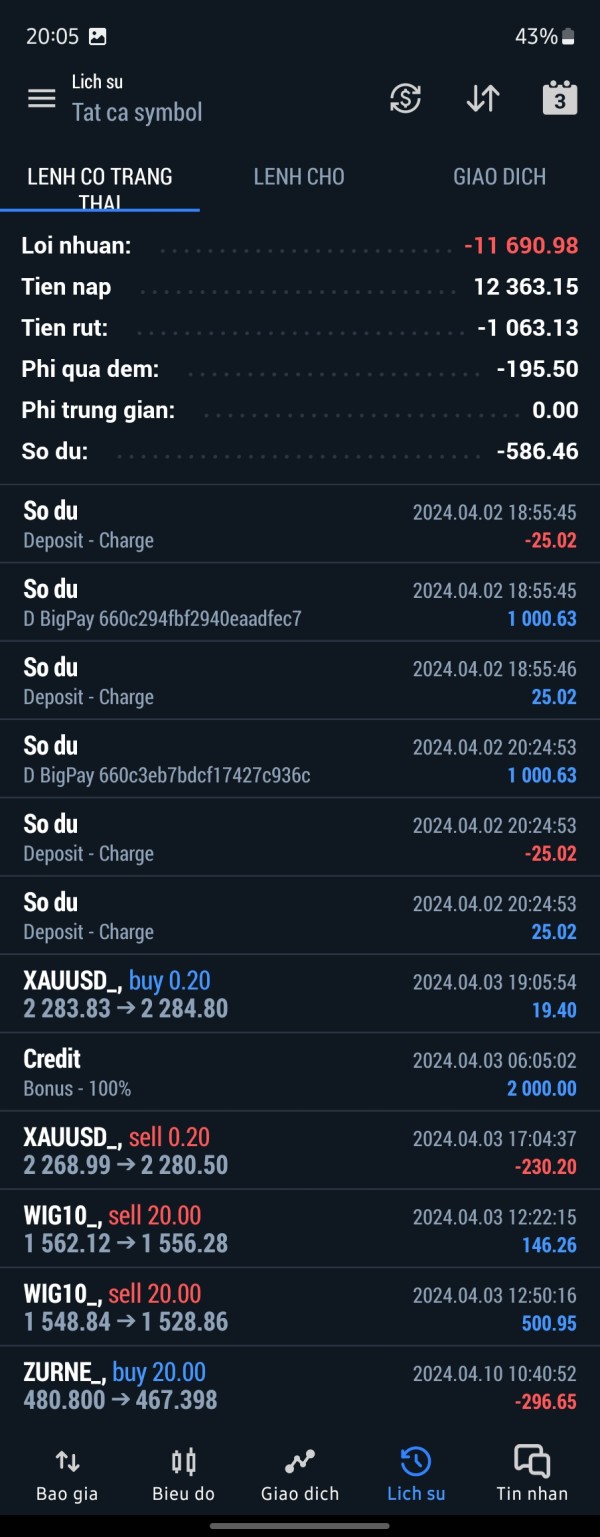

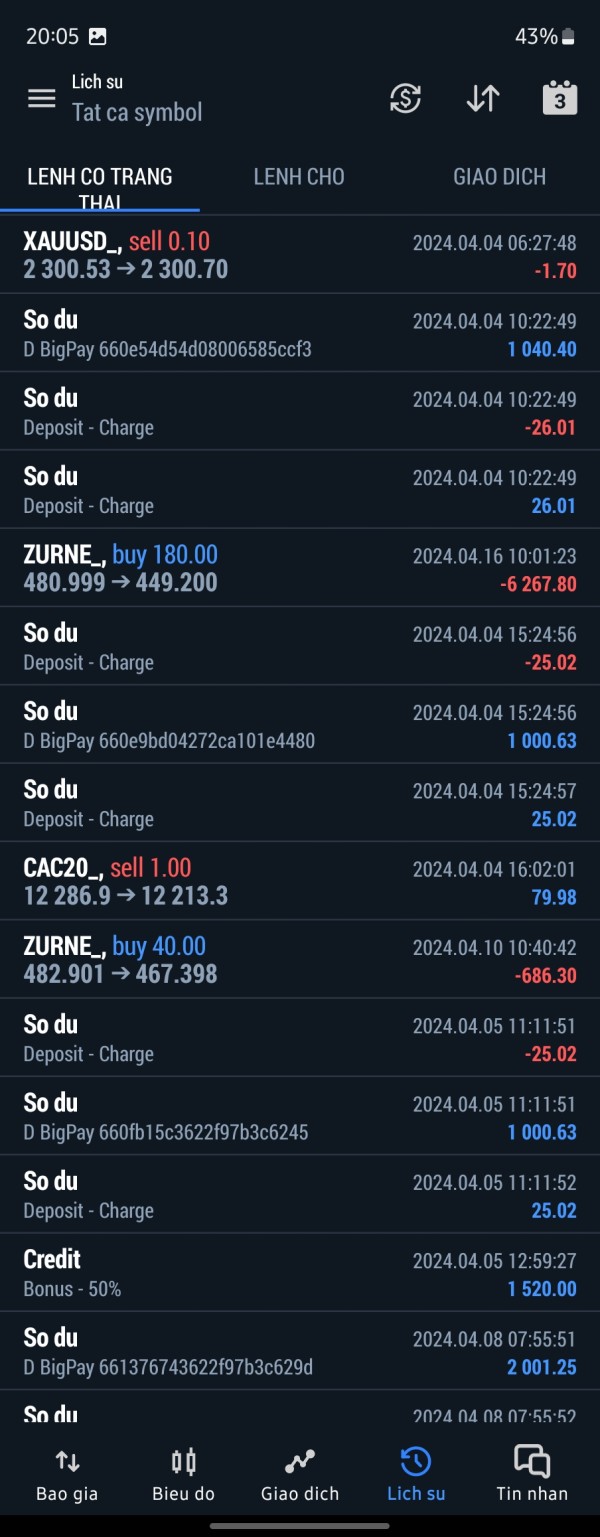

The main concern focuses on the broker's clear lack of legitimate financial services licensing and many reports of fund withdrawal problems experienced by users.

Important Notice

Regional Entity Differences: Peak Markets operates from multiple jurisdictions, but regulatory status remains unclear across all regions. The company's compliance framework appears inconsistent, with no verified regulatory authorization from recognized financial authorities. Traders should be particularly careful as regulatory protection may be entirely absent.

Review Methodology: This assessment is based on detailed analysis of user feedback, industry reports, regulatory warnings, and publicly available company information. Our evaluation puts user safety and regulatory compliance as the main factors in determining broker reliability.

Rating Framework

Broker Overview

Peak Markets entered the financial services landscape on April 3, 2023. The company established its headquarters in Saint Lucia, Istanbul, Turkey, and presents itself as a comprehensive trading platform offering access to multiple financial markets including forex, stocks, commodities, indices, and cryptocurrency trading. Despite its recent establishment, the broker has quickly attracted attention from industry monitoring organizations and user review platforms—unfortunately, much of this attention has been negative.

The company's business model centers around providing online trading services through web-based platforms. This approach eliminates the need for software downloads, but the absence of clear regulatory information and the rapid emergence of warning signals from industry watchdogs suggest significant operational and compliance concerns that potential users should carefully consider.

The broker's platform infrastructure relies on MetaTrader 5 WebTrader technology. This allows users to access trading functions directly through web browsers, which offers convenience but raises questions about the depth of trading tools and advanced features typically expected from established brokers. The company targets retail traders seeking exposure to diverse asset classes, but the legitimacy concerns overshadow any potential platform benefits.

According to available information, Peak Markets operates without verified regulatory oversight from recognized financial authorities. This represents a critical risk factor for potential clients, and this peak markets review emphasizes the importance of regulatory protection in forex and CFD trading, where client fund safety depends heavily on proper regulatory supervision.

Regulatory Status: Available sources do not specify any legitimate regulatory authorization from recognized financial authorities. This absence of regulatory oversight represents a significant concern for trader protection and fund security.

Deposit and Withdrawal Methods: Specific information about payment methods, processing times, and associated fees is not detailed in the available source materials. This raises transparency concerns that potential traders should carefully consider.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in the reviewed sources. This makes it difficult for potential traders to assess account accessibility and plan their trading capital allocation.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in the available information. However, unregulated brokers often use aggressive bonus schemes as attraction mechanisms to lure unsuspecting traders.

Tradeable Assets: The platform reportedly offers access to forex currency pairs, stock CFDs, commodity trading, major indices, and cryptocurrency instruments. This provides a diverse range of trading opportunities across multiple markets for users seeking varied exposure.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in the source materials. This limits transparency regarding the true cost of trading and makes it impossible to compare fees with legitimate competitors.

Leverage Ratios: Specific leverage offerings are not detailed in the available sources. Unregulated brokers often provide excessive leverage ratios that increase trading risks and can lead to rapid account losses.

Platform Options: The primary trading platform is MetaTrader 5 WebTrader, accessible through standard web browsers. This eliminates the need for software installation or mobile app downloads but may limit advanced functionality.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not provided in the available sources. This lack of clarity may indicate poor compliance with international trading regulations.

Customer Support Languages: Available support languages and communication channels are not specified in the reviewed materials. This peak markets review highlights the concerning lack of transparency in basic operational details that legitimate brokers typically provide clearly to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The available information regarding Peak Markets' account structure and conditions reveals a concerning lack of transparency. This opacity is characteristic of problematic brokers and should raise immediate red flags for potential traders. Without specific details about account types, minimum deposit requirements, or account features, potential traders cannot make informed decisions about their trading setup, and legitimate brokers typically provide comprehensive account information including different tier options, associated benefits, and clear fee structures.

The absence of detailed account information suggests either poor business practices or deliberate opacity designed to obscure unfavorable terms. Professional traders require clear understanding of account conditions including spreads, commissions, leverage options, and margin requirements before committing funds, but the lack of Islamic account information also indicates limited consideration for diverse trader needs.

Furthermore, without transparent account opening procedures or verification requirements, users cannot assess the legitimacy of the onboarding process. Established brokers provide clear documentation about required identification, proof of residence, and compliance procedures, while the information gap in this peak markets review reflects broader concerns about the broker's operational standards and regulatory compliance.

The absence of account condition details prevents proper evaluation of whether Peak Markets offers competitive terms compared to established brokers in the market.

Peak Markets offers MetaTrader 5 WebTrader as its primary trading platform. This provides basic functionality for executing trades across multiple asset classes, and the web-based approach eliminates software installation requirements and offers cross-device compatibility through standard internet browsers. This platform choice represents a reasonable foundation for basic trading activities, though it may lack advanced features available through dedicated trading applications.

However, the available sources do not detail additional trading tools, research resources, or educational materials that typically distinguish professional brokers from basic service providers. Market analysis, economic calendars, trading signals, and educational content are standard offerings from legitimate brokers that help traders make informed decisions, but the absence of information about these resources suggests limited value-added services.

Automated trading support, expert advisors, and advanced charting capabilities are not specifically mentioned in the available materials. Professional traders often require sophisticated analytical tools, backtesting capabilities, and algorithmic trading support that may not be available through this platform configuration.

The limited information about trading tools and resources reflects the broader transparency concerns identified throughout this evaluation. This makes it difficult to assess the platform's suitability for serious trading activities.

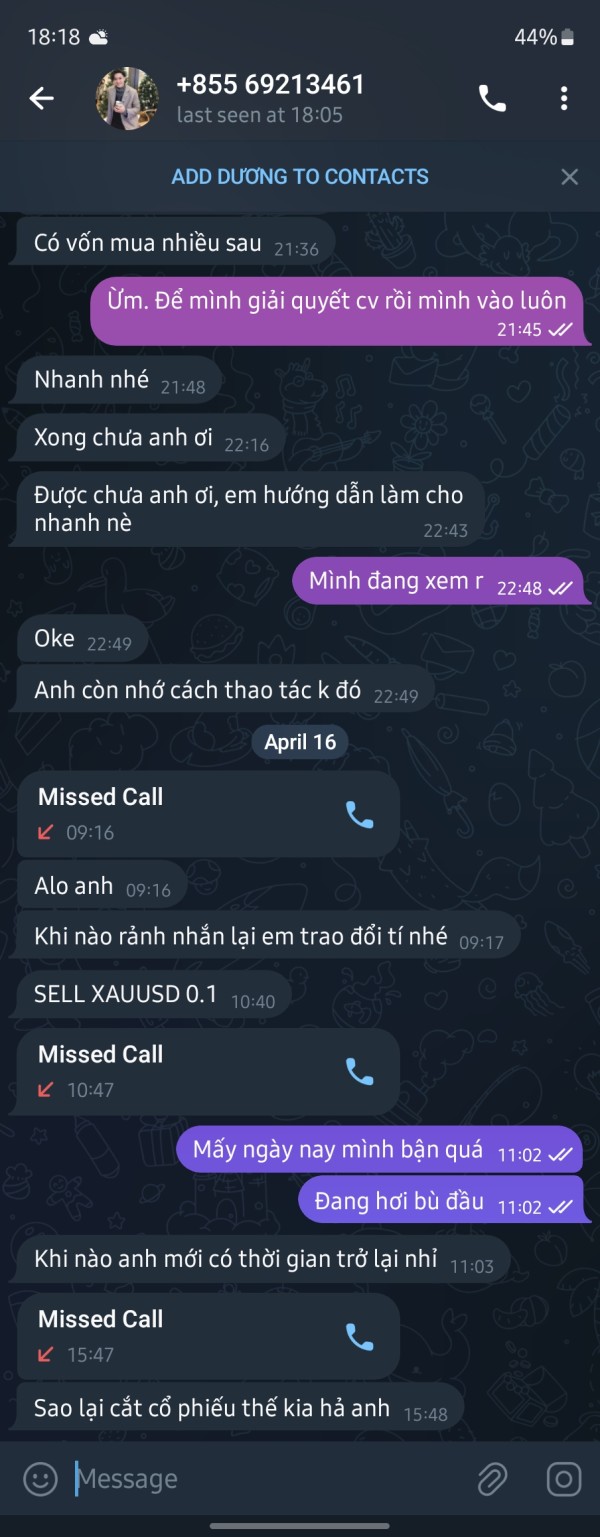

Customer Service and Support Analysis

Information regarding Peak Markets' customer service infrastructure, support channels, and service quality is notably absent from available sources. This lack of detail about customer support represents a significant concern, as reliable customer service is crucial for resolving trading issues, account problems, and technical difficulties that inevitably arise during trading activities.

Professional brokers typically provide multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. Response time commitments, support availability hours, and multilingual assistance are standard features that legitimate brokers clearly communicate to potential clients, but the absence of this information suggests either inadequate support infrastructure or deliberate concealment of poor service standards.

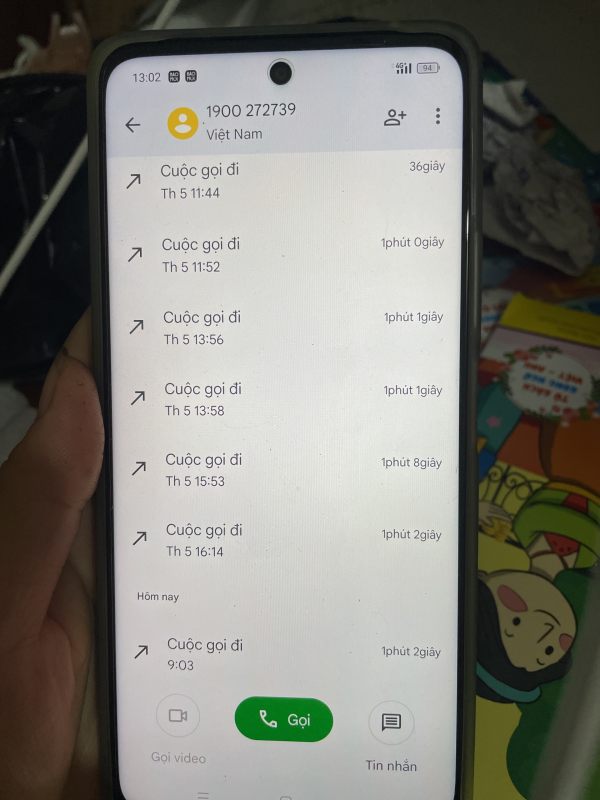

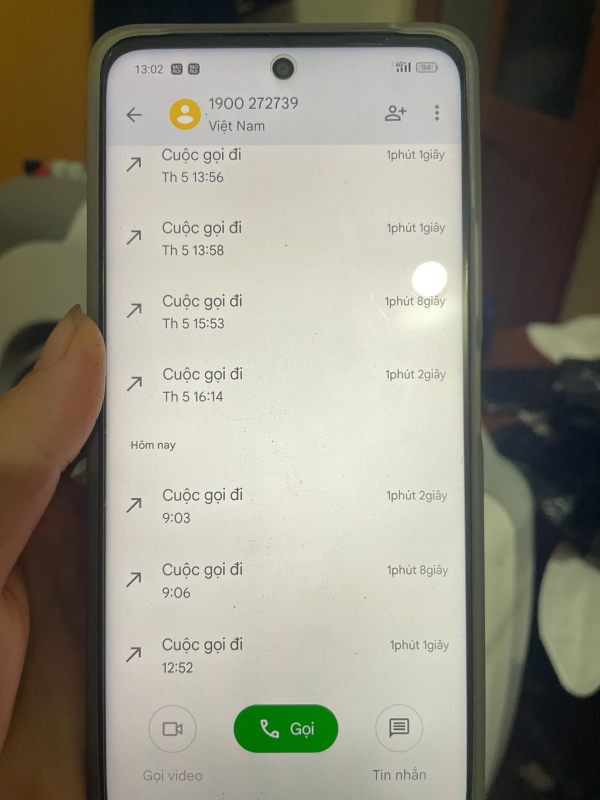

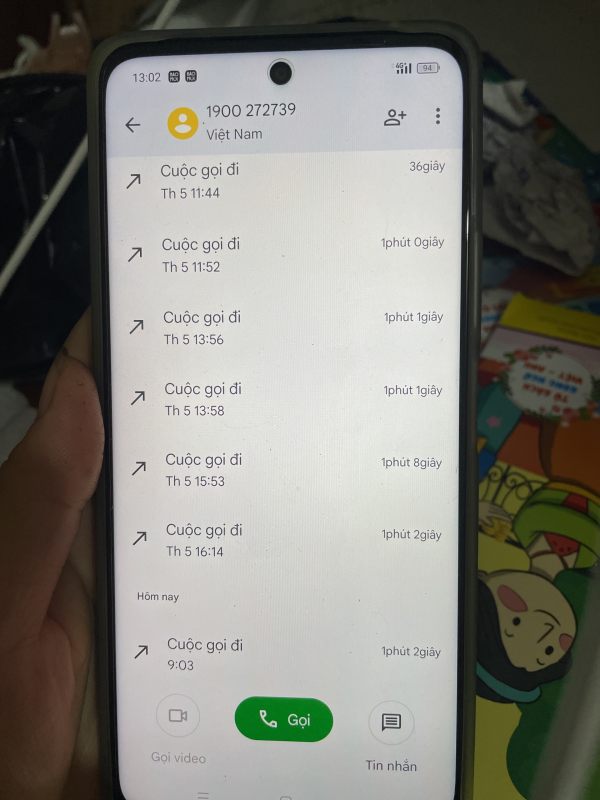

Without clear information about problem resolution procedures, escalation processes, or customer service quality metrics, potential users cannot assess their ability to receive assistance when needed. This is particularly concerning given the numerous warnings about fund withdrawal difficulties associated with Peak Markets operations.

The lack of customer service transparency aligns with the broader pattern of operational opacity that characterizes this broker. This pattern supports the negative assessments provided by industry warning platforms.

Trading Experience Analysis

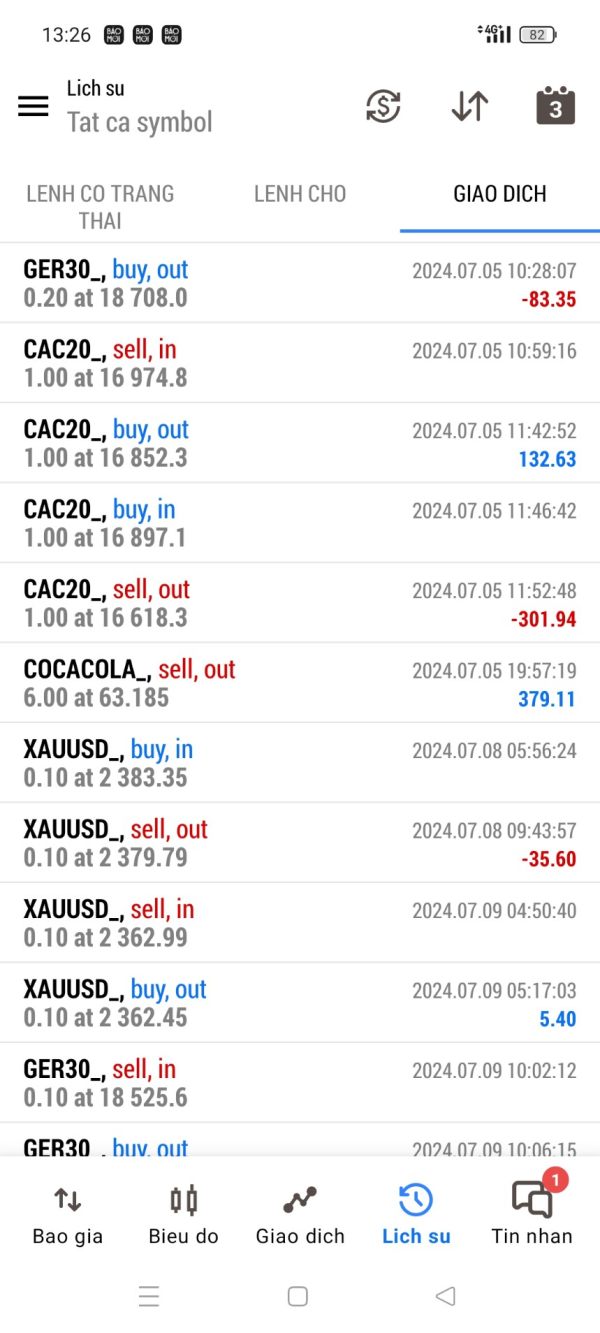

The trading experience evaluation for Peak Markets is significantly hampered by the lack of comprehensive user feedback and platform performance data in available sources. While the MetaTrader 5 WebTrader platform provides a familiar interface for traders experienced with MetaTrader products, specific performance metrics regarding execution speed, platform stability, and order processing quality are not documented.

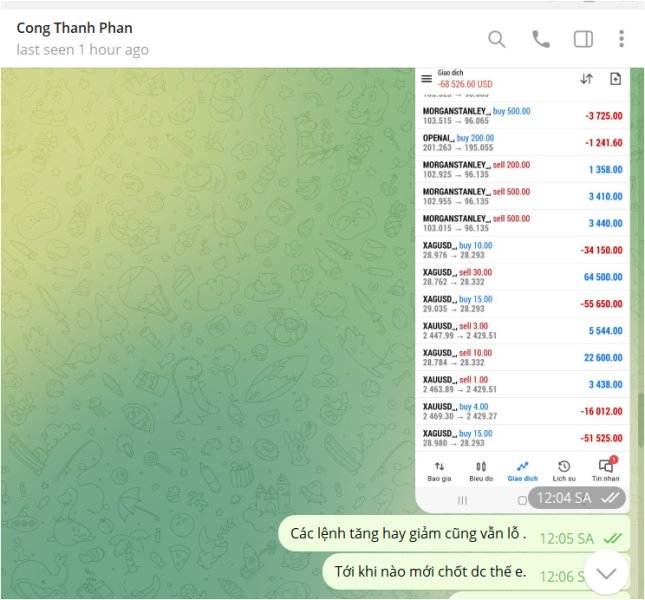

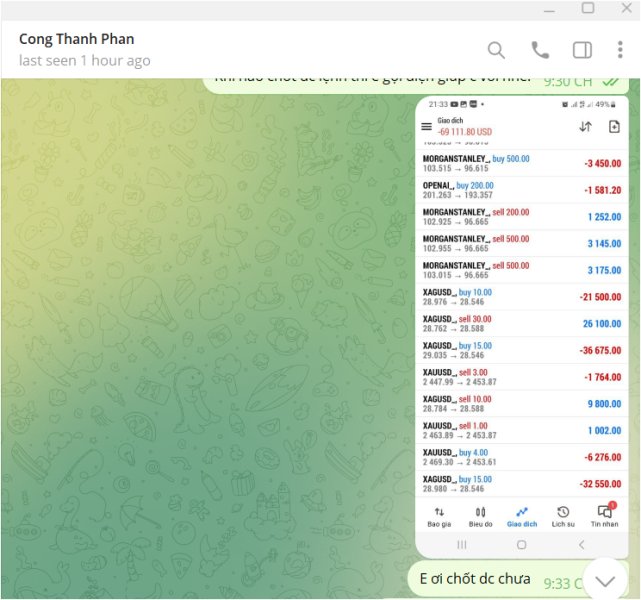

User reports about trading experience, platform reliability, and execution quality would typically provide insight into the practical aspects of trading with this broker. However, the absence of detailed user testimonials or independent performance evaluations makes it impossible to assess whether the platform meets professional trading standards.

Mobile trading capabilities, advanced order types, and trading automation features are not specifically detailed in the available information. Modern traders expect comprehensive mobile access, sophisticated order management, and reliable platform performance across different market conditions.

The limited trading experience data available aligns with the overall pattern of information scarcity that characterizes this peak markets review. This raises questions about the broker's commitment to transparency and user satisfaction.

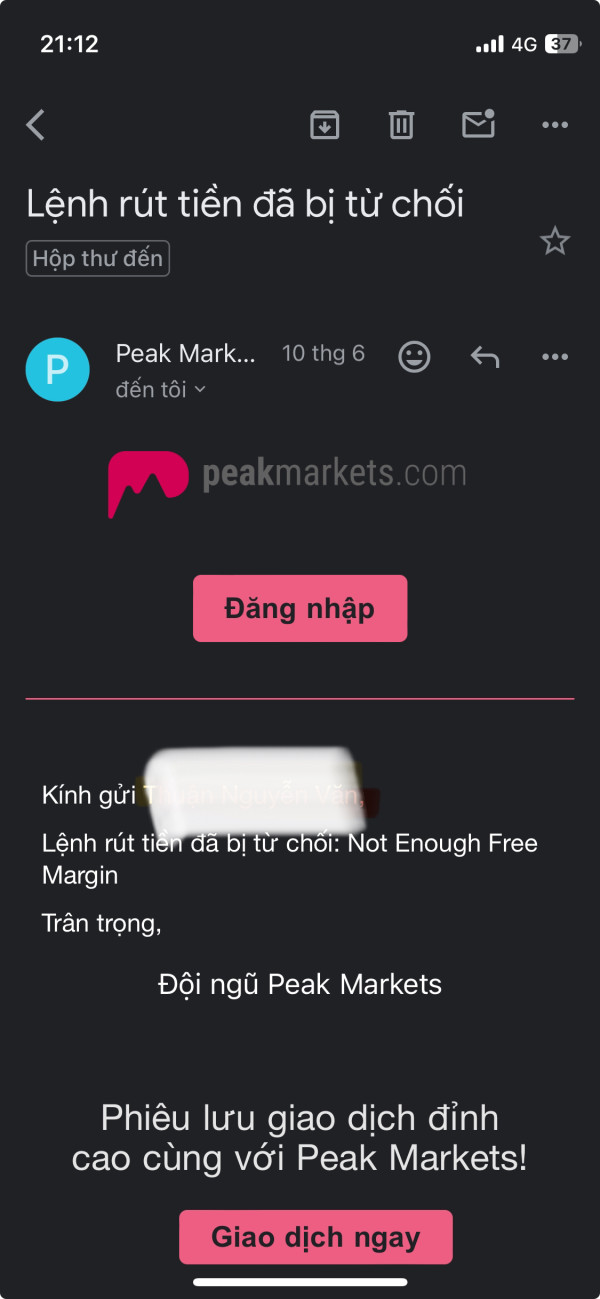

Trust and Safety Analysis

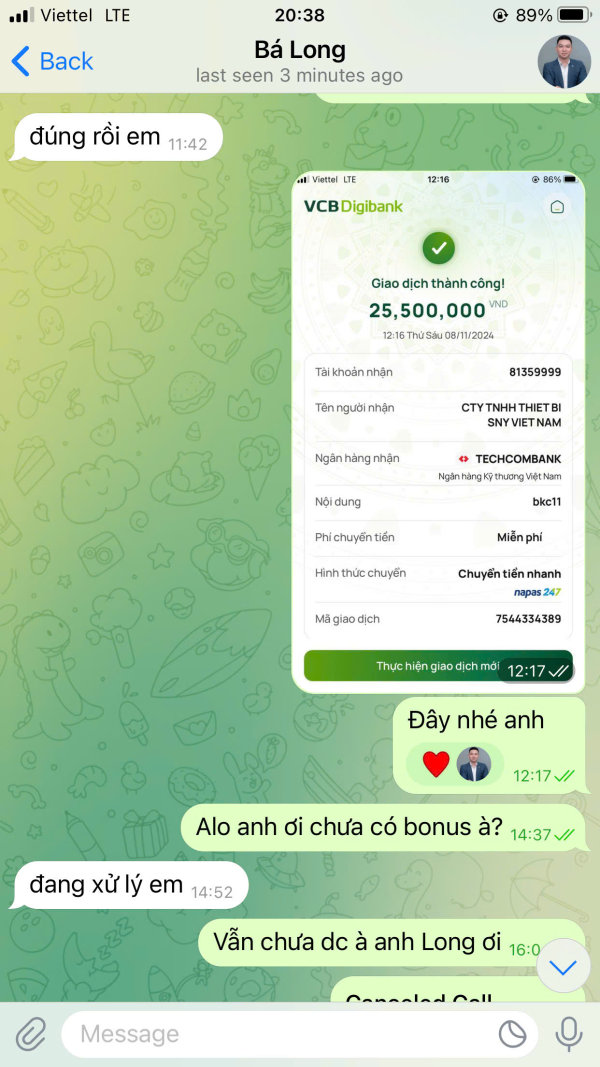

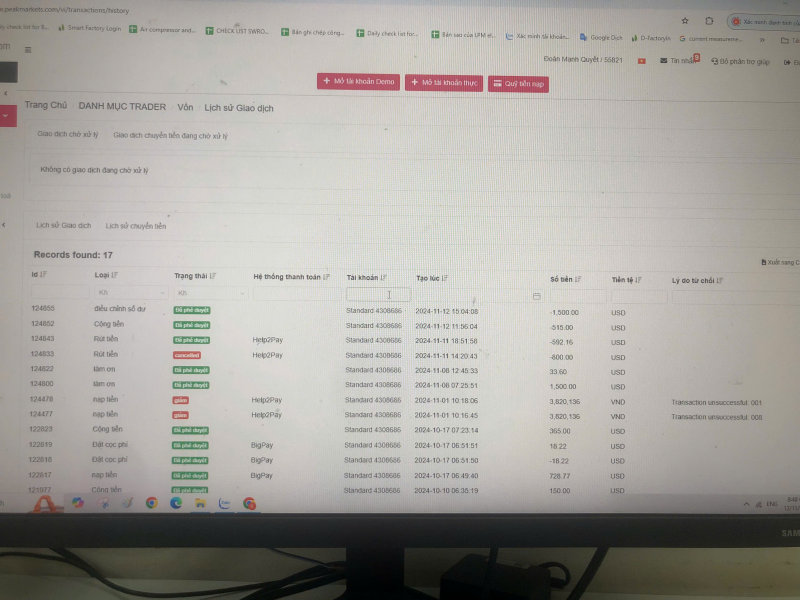

The trust and safety assessment for Peak Markets reveals the most concerning aspects of this broker evaluation. Multiple industry sources, including Market Referee and Scam Helpers, have issued explicit warnings about Peak Markets, identifying it as a potential scam operation, and these warnings specifically mention concerns about fund withdrawal difficulties and the absence of legitimate financial services licensing.

The lack of verified regulatory authorization from recognized financial authorities represents a fundamental trust issue. Regulatory oversight provides essential protections including segregated client funds, compensation schemes, and regulatory complaint procedures, but without these protections, traders have limited recourse if problems arise with their accounts or fund withdrawals.

The company's recent establishment in 2023, combined with immediate negative attention from industry watchdogs, suggests rapid identification of problematic practices. Legitimate brokers typically build positive reputations over time through consistent service and regulatory compliance, while problematic operations often generate warnings shortly after launching.

The convergence of multiple negative assessments from different sources provides strong evidence supporting the low trust rating assigned to Peak Markets in this evaluation.

User Experience Analysis

User experience evaluation for Peak Markets is complicated by the limited availability of comprehensive user feedback and the predominance of negative warnings from industry sources. The available information suggests that users who have interacted with Peak Markets have experienced significant problems, particularly regarding fund withdrawals and customer service responsiveness.

The web-based trading platform approach may offer convenience for users who prefer browser-based access. However, without detailed user testimonials about interface usability, navigation efficiency, and overall satisfaction, it's impossible to assess the practical user experience quality, and professional traders require intuitive interfaces, efficient order management, and reliable platform performance.

Account registration and verification processes are not detailed in available sources. This prevents assessment of onboarding convenience and user-friendliness, while legitimate brokers typically provide streamlined but secure verification procedures that balance regulatory compliance with user convenience.

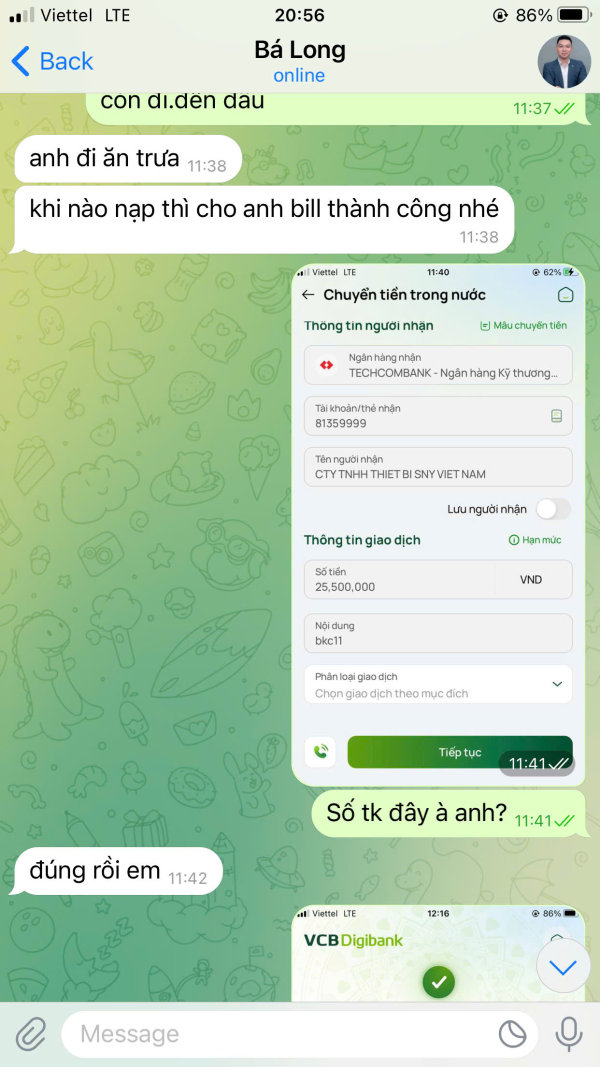

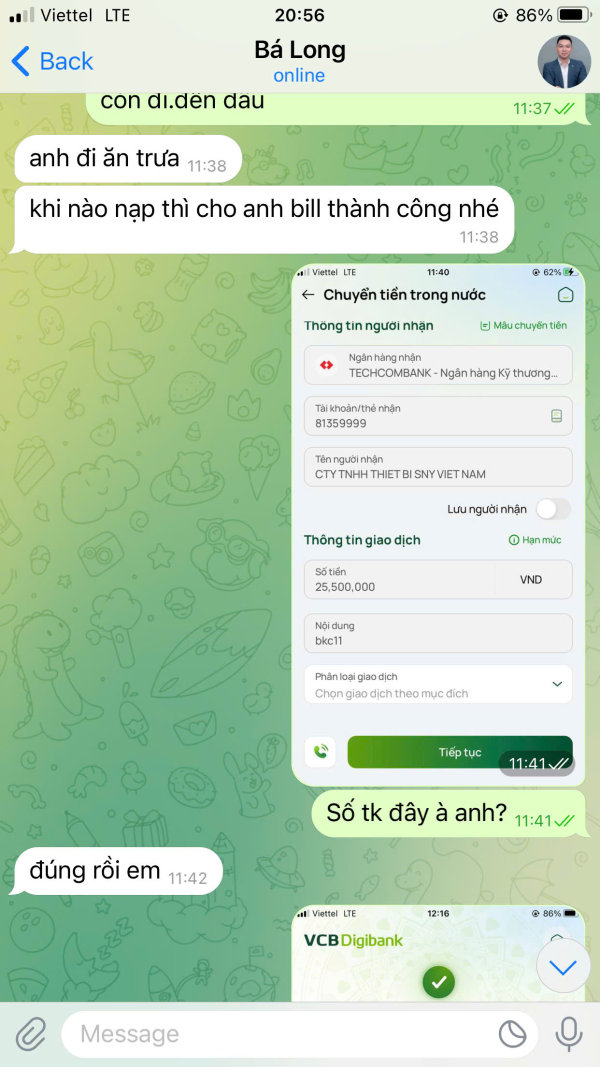

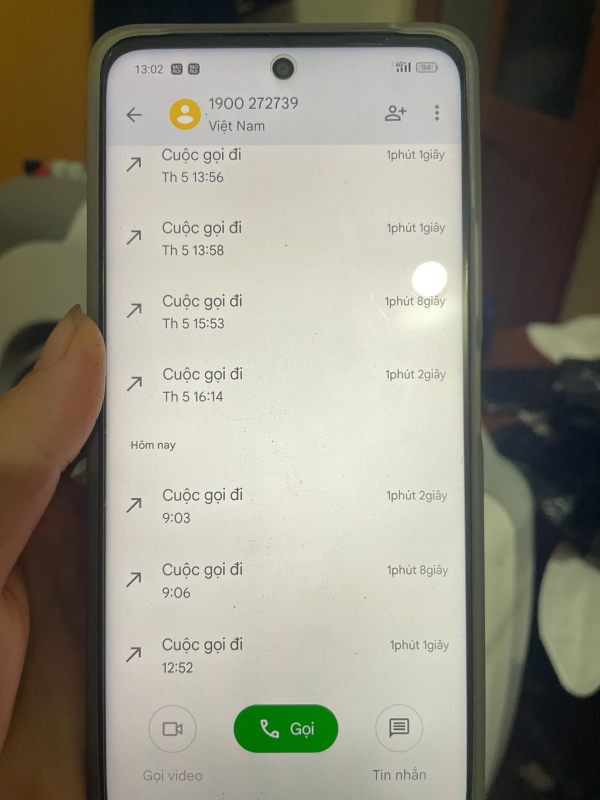

The most significant user experience concern involves the multiple warnings about withdrawal difficulties and potential fund loss. These reports suggest that users who deposit funds with Peak Markets may face significant challenges in accessing their money, representing the most serious possible user experience failure for a financial services provider.

Conclusion

This comprehensive peak markets review reveals significant concerns that strongly advise against using this broker for trading activities. Peak Markets has been widely identified as presenting scam risks by multiple industry monitoring organizations, with particular warnings about fund withdrawal difficulties and the absence of legitimate regulatory oversight.

While the broker offers MetaTrader 5 WebTrader platform access and claims to provide trading opportunities across forex, stocks, commodities, indices, and cryptocurrencies, these potential benefits are completely overshadowed by the fundamental safety and legitimacy concerns identified by industry experts.

We do not recommend Peak Markets for any type of trader. The combination of regulatory absence, multiple scam warnings, and lack of operational transparency creates an unacceptable risk environment for retail traders, and the primary advantage of web-based platform access cannot compensate for the substantial disadvantages including potential fund loss, withdrawal difficulties, and absence of regulatory protection. Traders should consider established, properly regulated brokers that provide transparent operations and verified client protections.