PCM Review 1

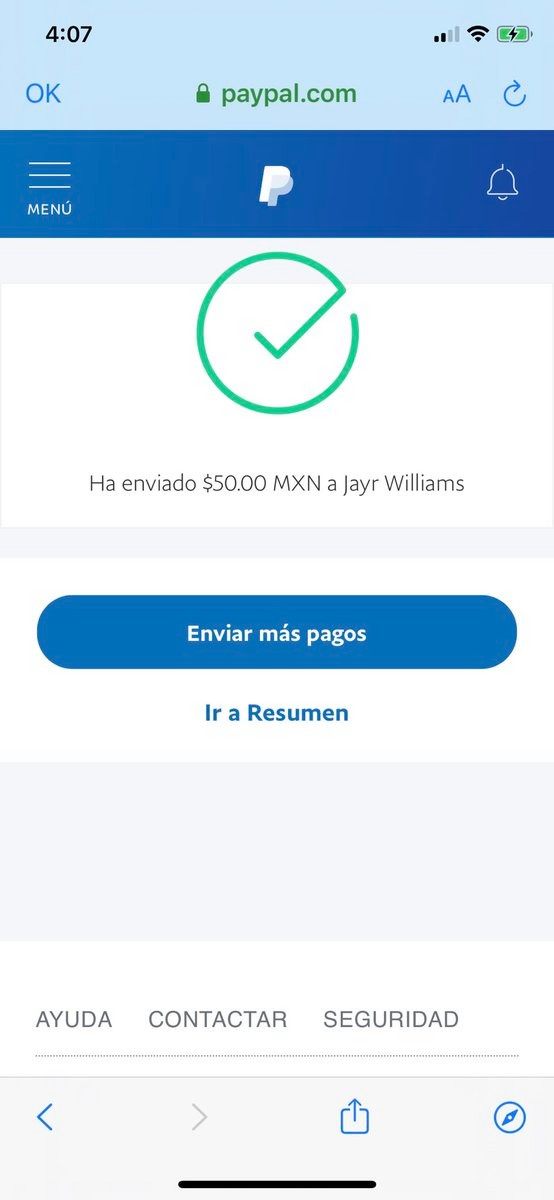

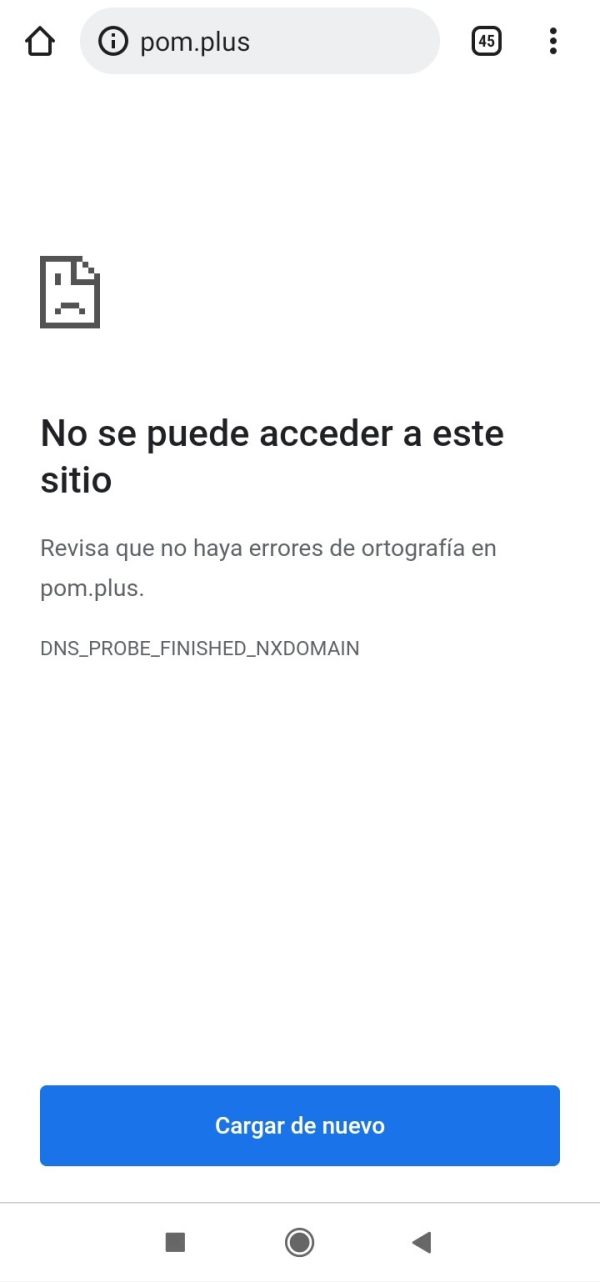

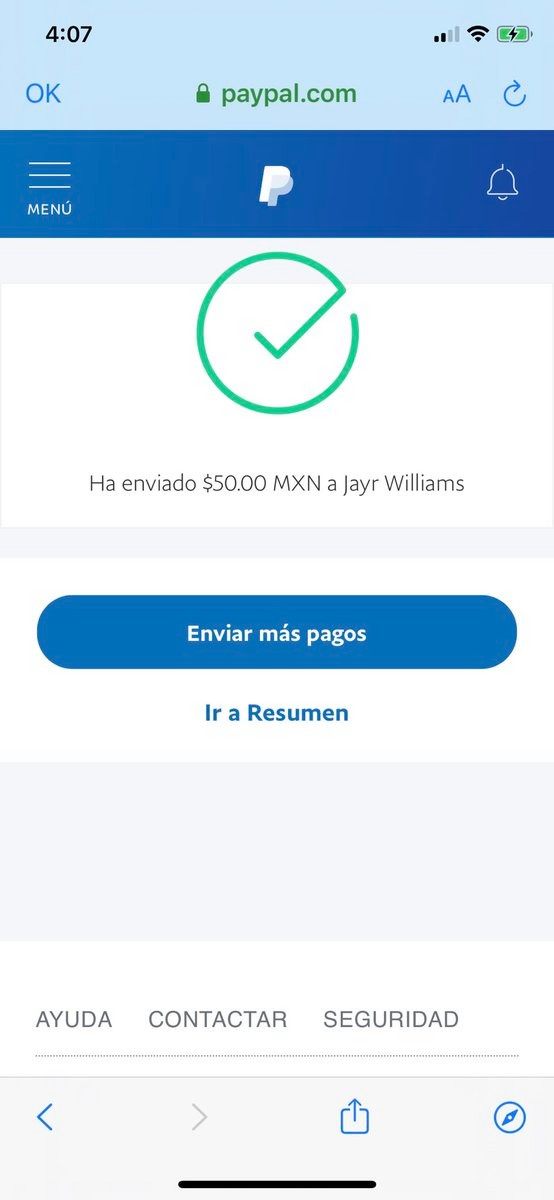

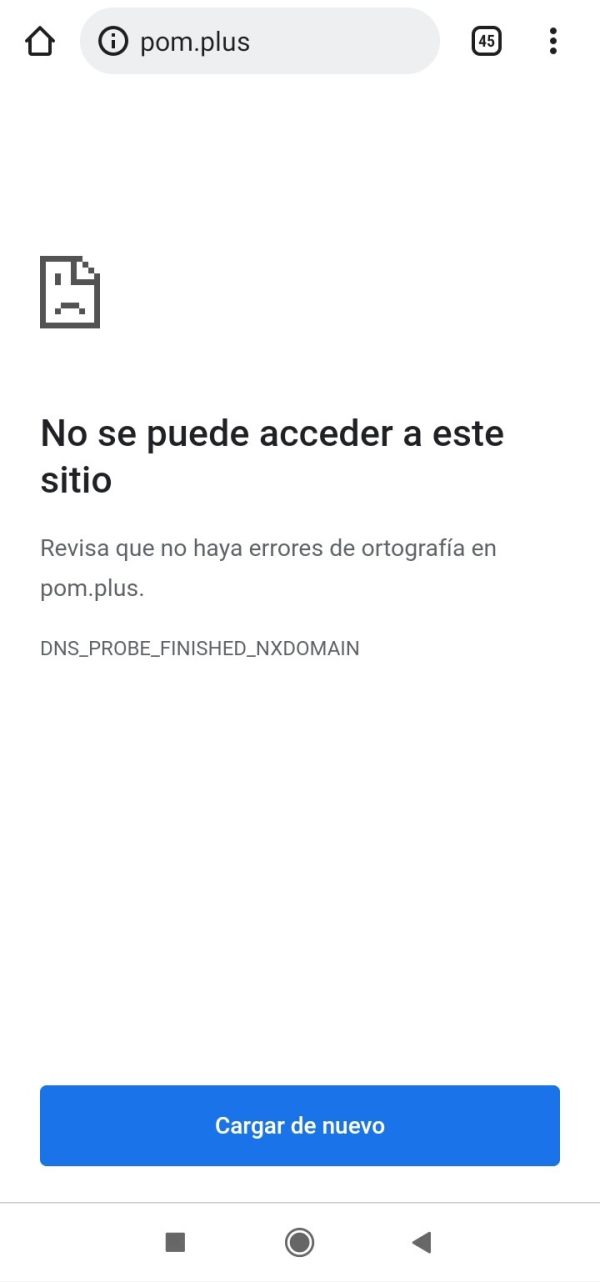

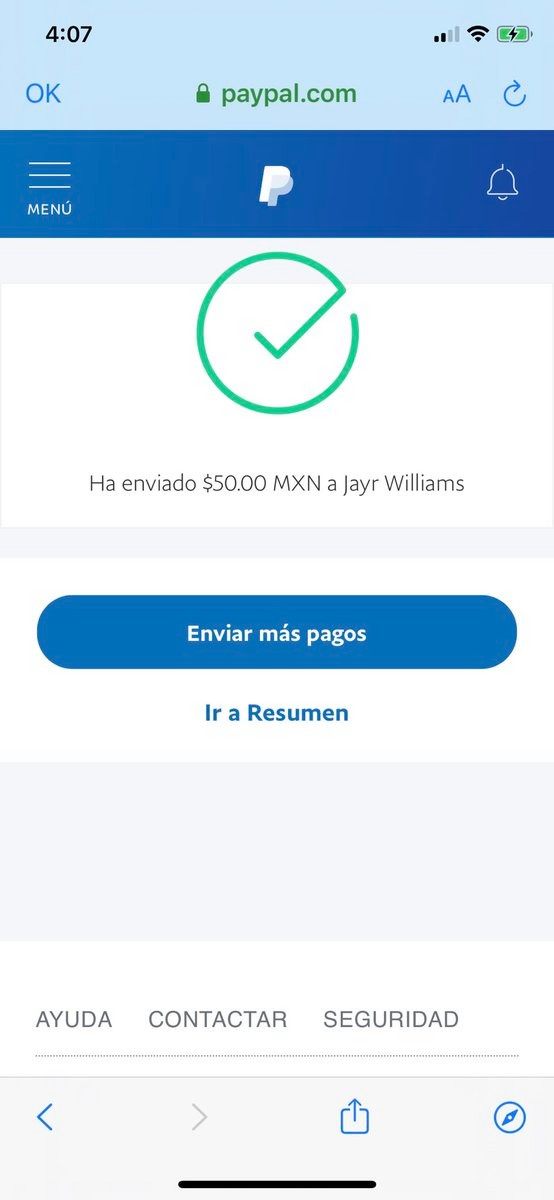

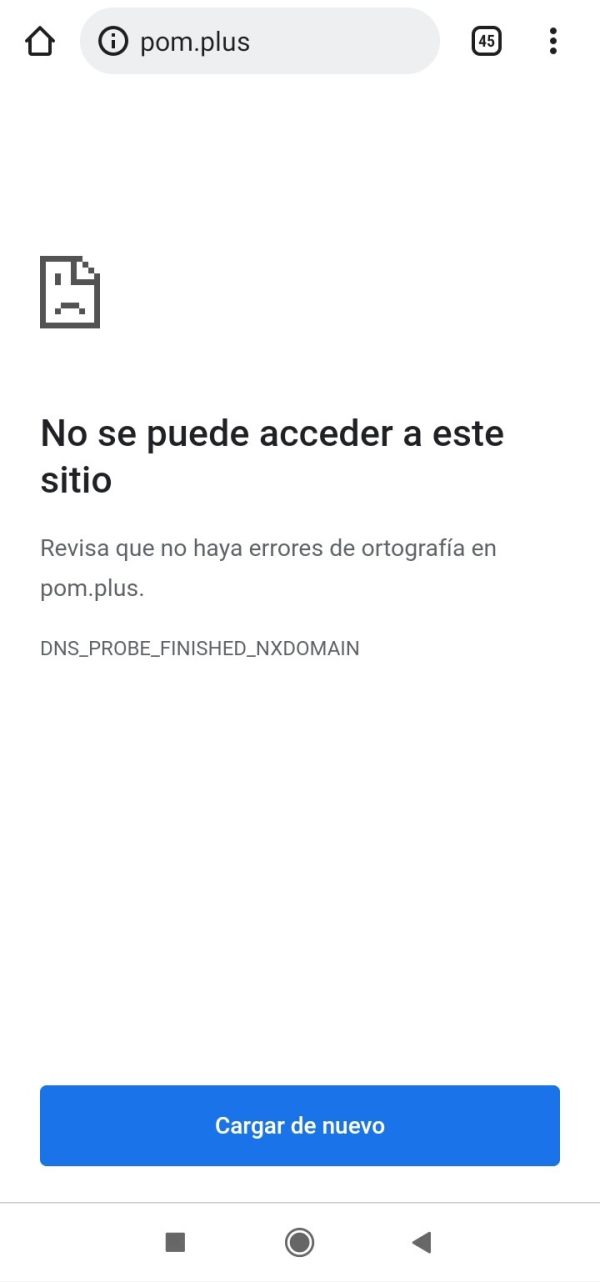

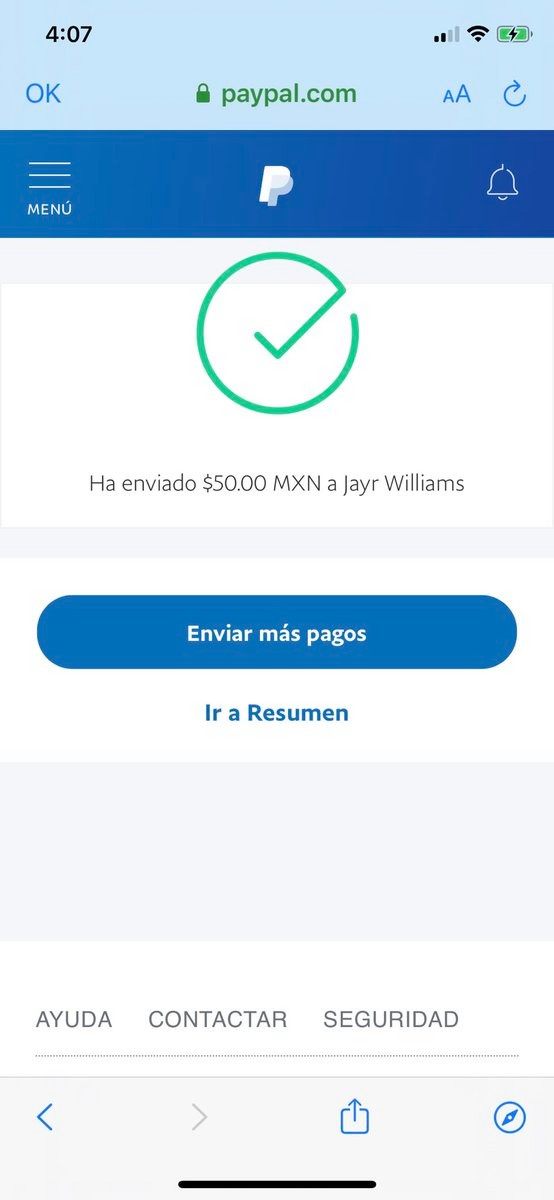

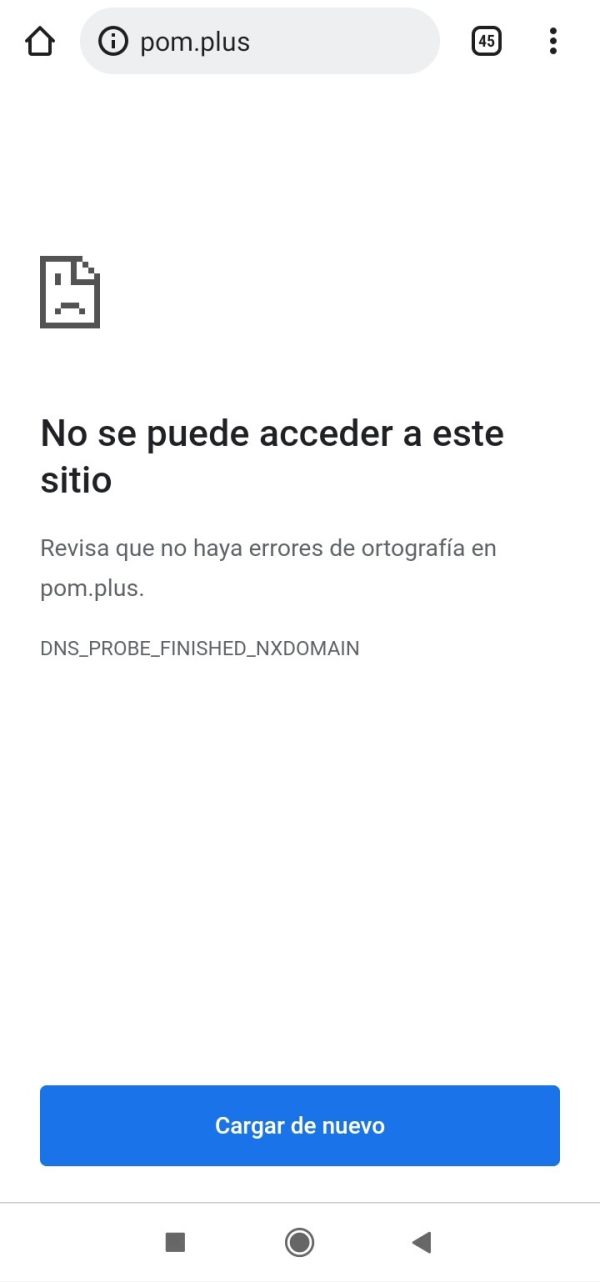

I deposited $50 and was blocked by them. I could not log in the website.

PCM Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I deposited $50 and was blocked by them. I could not log in the website.

This pcm review looks at PCM Brokers, a Dubai-based financial services company that started in 2007. The company has its main office in the United Arab Emirates and also has offices in Canada, the UK, and Mauritius. PCM Brokers works as a registered brokerage and clearing house that mainly serves the Middle Eastern market. The company follows rules set by the Securities and Commodities Authority in the UAE and the Financial Services Commission in Mauritius, which gives it a good foundation for following regulations.

PCM Brokers has more than ten years of experience in the industry. The company is a corporate member of the Dubai Gold and Commodities Exchange and Bourse Africa. However, user feedback shows mixed results, with some reports pointing to service problems that potential clients should think about. The broker's regulatory framework across different areas offers different levels of client protection, so traders need to understand which entity they are dealing with based on where they live and what they want to trade.

This pcm review uses information that anyone can find and user feedback from many sources. Readers should know that PCM Brokers works through different entities in the UAE and Mauritius, which may mean different regulatory requirements, client protection measures, and service offerings depending on where you live. The regulatory landscape in these regions may be very different from other major financial centers, which could affect how much investor protection you get.

Our evaluation method uses data that anyone can access, regulatory filings, and user testimonials. Since comprehensive operational details are hard to find, some parts of this review may show information gaps that potential clients should address by talking directly with the broker before making any trading decisions.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account terms and conditions not detailed in available sources |

| Tools and Resources | N/A | Trading tools and educational resources not specified in source materials |

| Customer Service | 5/10 | User feedback indicates service delivery challenges and maintenance issues |

| Trading Experience | N/A | Platform performance and execution quality data not available |

| Trustworthiness | 8/10 | Strong regulatory oversight from SCA and FSC, established since 2007 |

| User Experience | N/A | Comprehensive user experience data insufficient for accurate assessment |

PCM Brokers started in the financial services world in 2007. The company set up its main operations in Dubai, United Arab Emirates. As a registered brokerage and clearing house, the company has built its foundation on providing financial services mainly to the Middle Eastern market while expanding its reach through strategic office locations in Canada, the United Kingdom, and Mauritius. This geographical spread shows the broker's goal to serve a broader international clientele while keeping strong roots in the Gulf region.

The company's business model focuses on its role as a registered brokerage and clearing house. It puts special emphasis on serving institutional and retail clients in emerging markets. PCM Brokers has achieved corporate membership status with the Dubai Gold and Commodities Exchange and maintains an active presence on Bourse Africa, which shows its commitment to established financial market infrastructure. This pcm review shows that the broker's decade-plus experience in the industry has been built on navigating the regulatory landscapes of multiple jurisdictions.

PCM Brokers operates under the oversight of two primary authorities from a regulatory standpoint. The Securities and Commodities Authority in the United Arab Emirates and the Financial Services Commission in Mauritius provide this oversight. This dual regulatory framework gives the company operational flexibility while ensuring compliance with international financial services standards. However, specific details about trading platforms, asset classes, and comprehensive service offerings remain limited in publicly available documentation.

Regulatory Jurisdictions: PCM Brokers maintains regulatory compliance through dual oversight. The Securities and Commodities Authority in the UAE and the Financial Services Commission in Mauritius provide supervisory frameworks for different aspects of the company's operations.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available source materials. Potential clients need to contact the broker directly for payment processing options.

Minimum Deposit Requirements: The minimum deposit threshold for opening accounts with PCM Brokers is not specified in accessible documentation. This represents an information gap that prospective traders should clarify during the account opening inquiry process.

Bonus and Promotional Offers: Current promotional offerings are not detailed in available source materials. This includes welcome bonuses or ongoing trading incentives, suggesting either limited promotional activity or restricted public disclosure of such programs.

Tradeable Assets: The specific range of tradeable instruments is not comprehensively outlined in publicly available information. This includes forex pairs, commodities, indices, or other financial products, requiring direct broker consultation for asset availability details.

Cost Structure: Detailed information about spreads, commission structures, overnight financing charges, and other trading costs is not available in source materials. This makes it essential for potential clients to request comprehensive pricing schedules directly from the broker.

Leverage Ratios: Maximum leverage offerings and margin requirements across different asset classes are not specified in available documentation. This represents a critical information gap for risk assessment purposes.

Platform Options: Specific trading platform offerings are not detailed in accessible source materials. This includes proprietary solutions or third-party platforms like MetaTrader, requiring direct inquiry for platform availability and features.

Geographic Restrictions: Regional limitations or restricted jurisdictions for account opening and trading services are not specified in available documentation.

Customer Support Languages: The range of languages supported by customer service teams is not detailed in source materials. This comprehensive pcm review highlights the need for potential clients to verify service availability in their preferred language directly with the broker.

The evaluation of PCM Brokers' account conditions faces significant limitations due to the absence of detailed information in publicly available sources. This pcm review cannot provide a comprehensive assessment of account types, their respective features, or the differentiation between various service tiers that may be available to different client categories. The lack of specific information about minimum deposit requirements makes it challenging for potential clients to assess the accessibility of the broker's services relative to their trading capital.

Account opening procedures, documentation requirements, and verification processes remain undisclosed in available materials. This information gap extends to special account features that might cater to specific client needs, such as Islamic accounts for Shariah-compliant trading or institutional accounts with enhanced features. The absence of clear account condition details suggests that potential clients must engage directly with the broker to understand the full scope of available options.

Traders cannot make informed comparisons with other brokers in the market without specific information about account maintenance fees, inactivity charges, or other account-related costs. The regulatory framework provided by SCA and FSC oversight suggests that proper client agreements and terms of service exist, but the public availability of these documents for review prior to account opening remains unclear.

The assessment of trading tools and resources available through PCM Brokers encounters substantial limitations due to insufficient public documentation. Available sources do not provide details about the technical analysis tools, charting capabilities, or research resources that clients can access through the broker's platforms. This absence of information makes it difficult to evaluate the broker's commitment to providing comprehensive trading support to its clients.

Educational resources are not detailed in available materials, which are increasingly important for broker differentiation. The lack of information about webinars, trading guides, market analysis reports, or other educational content suggests either limited offerings in this area or restricted public disclosure of such resources. For traders who rely on broker-provided education and analysis, this represents a significant information gap.

Automated trading support remains unspecified in source materials. This includes expert advisor compatibility, API access, or copy trading features. The broker's technological infrastructure and innovation in trading tools cannot be adequately assessed without access to detailed platform specifications and feature lists. This limitation affects the ability to recommend the broker for traders with specific technological requirements.

Customer service evaluation for PCM Brokers reveals concerning elements based on available user feedback. Reports indicate instances of maintenance service failures, which raises questions about the broker's operational reliability and customer support effectiveness. These service-related challenges suggest potential gaps in the company's customer care infrastructure that could impact client satisfaction and problem resolution efficiency.

The specific channels available for customer support are not detailed in accessible source materials. This includes telephone, email, live chat, or other communication methods. This information gap makes it difficult to assess the accessibility and convenience of reaching support representatives when assistance is needed. Response time expectations and service level agreements remain unspecified, creating uncertainty about support quality standards.

Multilingual support capabilities are not documented in available sources, which are crucial for an international broker serving diverse markets. Given PCM Brokers' presence across multiple jurisdictions including the UAE, Canada, UK, and Mauritius, the absence of clear language support information represents a significant service transparency gap. The reported maintenance service failures, combined with limited publicly available support information, contribute to the moderate rating assigned to this category.

The evaluation of trading experience with PCM Brokers faces substantial limitations due to the absence of detailed platform performance data and user experience reports in available sources. Platform stability, execution speed, and order processing quality cannot be adequately assessed without access to technical performance metrics or comprehensive user testimonials regarding trading conditions.

Order execution policies are not detailed in accessible documentation. This includes the handling of market orders, limit orders, and stop orders during various market conditions. This information gap affects the ability to assess whether the broker provides favorable execution conditions or maintains transparent order handling procedures that align with client interests.

Mobile trading capabilities and platform functionality across different devices remain unspecified in source materials. As mobile trading becomes increasingly important for active traders, the absence of information about mobile platform features, reliability, and user interface design represents a significant evaluation limitation. This comprehensive pcm review cannot provide adequate guidance on platform suitability without access to detailed trading environment specifications.

PCM Brokers demonstrates solid regulatory foundations through its oversight by the Securities and Commodities Authority in the UAE and the Financial Services Commission in Mauritius. These regulatory relationships provide a framework for operational compliance and client protection, contributing positively to the broker's trustworthiness profile. The company's establishment in 2007 indicates operational longevity that suggests business stability and market presence over more than a decade.

Specific client fund protection measures are not detailed in available source materials, however. This includes segregated account policies, deposit insurance coverage, or other safeguarding mechanisms. This information gap makes it challenging to assess the full extent of financial protection available to clients in various scenarios. The regulatory frameworks in the UAE and Mauritius may provide different levels of investor protection compared to other major financial centers.

The reported maintenance service failures mentioned in user feedback introduce concerns about operational reliability that could affect overall trustworthiness perceptions. While regulatory oversight provides a foundation for compliance, operational service quality issues suggest potential gaps between regulatory requirements and practical service delivery. The absence of detailed information about company financial reporting, management transparency, or third-party auditing further limits the comprehensive assessment of trustworthiness factors.

The evaluation of overall user experience with PCM Brokers encounters significant limitations due to insufficient comprehensive user feedback and detailed platform information in available sources. User satisfaction metrics, interface design quality, and navigation convenience cannot be adequately assessed without access to detailed user testimonials and platform demonstrations.

The registration and account verification process is not detailed in accessible documentation, which significantly impacts initial user experience. New client onboarding procedures, document submission requirements, and verification timelines remain unspecified, making it difficult to assess the convenience and efficiency of starting a trading relationship with the broker.

Fund management experience lacks detailed documentation in available sources. This includes the ease and speed of deposits and withdrawals. The reported maintenance service failures suggest potential operational challenges that could negatively impact user experience, particularly regarding service reliability and problem resolution. Without comprehensive user feedback encompassing positive and negative experiences, this review cannot provide a balanced assessment of typical user satisfaction levels.

This pcm review reveals PCM Brokers as an established financial services provider with over a decade of industry experience and solid regulatory foundations through SCA and FSC oversight. The broker's presence across multiple jurisdictions including the UAE, Canada, UK, and Mauritius indicates international ambitions and operational diversity. However, significant information gaps regarding trading conditions, platform features, and comprehensive service offerings limit the ability to provide a complete assessment.

The broker appears most suitable for traders seeking financial services in the Middle Eastern region. This is particularly true for those comfortable with the regulatory frameworks provided by UAE and Mauritius authorities. The company's corporate memberships with DGCX and Bourse Africa suggest institutional credibility and market access capabilities.

Key strengths include regulatory compliance and operational longevity, while notable weaknesses encompass limited public information transparency and reported service delivery challenges. Potential clients should conduct thorough due diligence and direct consultation with the broker to address the information gaps identified in this review before making trading decisions.

FX Broker Capital Trading Markets Review