Ahead 2025 Review: Everything You Need to Know

Executive Summary

This ahead review gives you a complete look at a trading company that works in financial services. Our review stays neutral because we don't have enough important information about rules and trading conditions. But some parts of how the company works give us clues about where it stands in the information technology industry.

Glassdoor data shows that AHEAD has an employee rating of 4.4 out of 5, which is much better than most companies. The company does really well in information technology. Management service workers rate it 30% higher than other companies they could work for. Gartner also gives AHEAD a 4 out of 5 rating, which means it does solid work in what it does.

The main users of this service seem to be traders who know a lot about information technology. This makes sense because the company does so well in this area. We can't give a clear recommendation because we don't have details about trading conditions, rules, or specific financial services. This ahead review must tell potential users to do more research before using the platform.

Important Disclaimers

This review uses limited information about AHEAD's trading services. The data we have doesn't tell us about different rule-making bodies in different places. We also don't know how the company works differently in different regions.

Our review method uses mainly user ratings and company information that anyone can find. But we're missing important details about who watches over the company, what trading conditions are like, and what financial services they offer. This makes our review less complete than we'd like it to be.

Rating Framework

Broker Overview

AHEAD works in both financial services and information technology, but we don't know when it started or much about its history. The company seems to focus on management services in information technology. It has very high ratings from employees who work there.

We don't know exactly how the company makes money or what its main focus is. But the high employee ratings suggest that it runs well inside the company. This could mean it gives good service to customers too.

We don't have details about the trading platform, what kinds of investments you can make, or who watches over the company. This ahead review has to use only the limited information we have. Most of this comes from employee satisfaction scores and general information about where the company fits in its industry.

Regulatory Jurisdiction: We don't have information about which government agency watches over this company, so we can't tell you about safety measures.

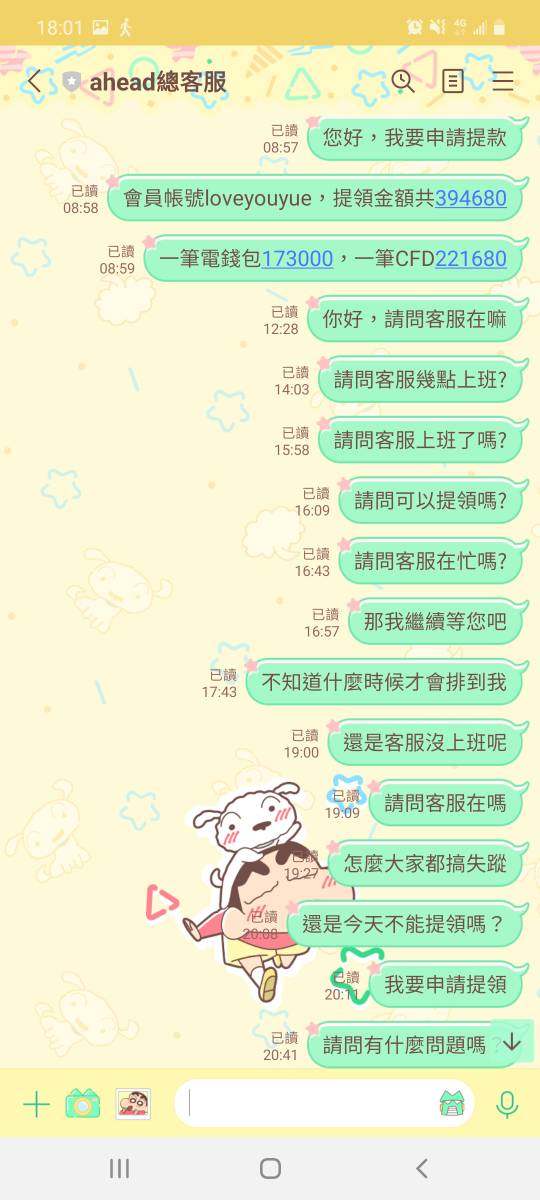

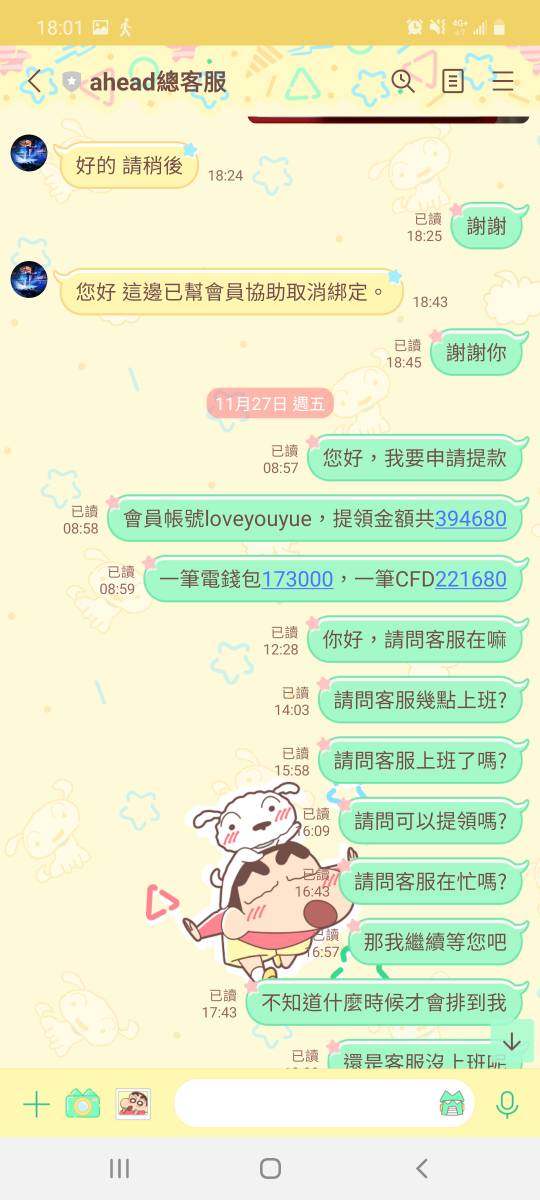

Deposit and Withdrawal Methods: The available documents don't tell us how you can put money in or take money out.

Minimum Deposit Requirements: We don't know how much money you need to start trading.

Promotional Offers: The documents don't mention any bonuses or special deals.

Tradeable Assets: We don't know what kinds of investments you can trade.

Cost Structure: Fee information, spread details, and commission costs aren't given in the documents we have, so we can't compare costs.

Leverage Ratios: The documents don't tell us about maximum leverage options.

Platform Options: We don't have details about different trading platforms or their technical features.

Geographic Restrictions: The documents don't mention which countries can or can't use the service.

Customer Service Languages: We don't know what languages the support team speaks.

This ahead review must point out that these missing pieces of information make it hard to give you a complete evaluation.

Detailed Rating Analysis

Account Conditions Analysis

We can't properly review AHEAD's account conditions because we don't have enough information. A good review would look at different account types, what features they have, how much money you need to start, and special accounts like Islamic accounts for religious reasons.

We don't have details about different account types, how to open accounts, or the rules you have to follow. This ahead review can't tell you which account might work best for different kinds of traders. We also don't know about minimum deposits, so we can't tell you if different types of investors can afford to start.

The documents don't explain how to open an account, what you need to prove who you are, or what papers you need. We also don't know about special account features like professional trading accounts or accounts that someone else manages for you.

Not having complete information about account conditions makes it hard to judge if AHEAD is right for potential users. You'll need to ask them directly to get the details you need to make a smart choice.

We can't review the trading tools and resources that AHEAD offers because we don't have the right information. A complete review would look at chart features, technical analysis tools, basic analysis resources, and automated trading support.

Learning resources are very important for traders who want to get better, but the documents don't mention them. This includes no information about online classes, tutorials, market analysis reports, or trading guides that users might be able to access.

Research tools and market analysis features help traders make smart decisions, but the documents don't mention these either. We don't know about real-time data, economic calendars, or expert analysis. This means potential users can't judge how good the platform's analysis tools are.

The documents don't mention automated trading support, including Expert Advisor compatibility or the company's own automated systems. This makes it hard to know if the platform works well for computer-based trading strategies.

Customer Service and Support Analysis

We can't completely review AHEAD's customer service because we don't have enough information. A standard review would look at what support options are available, how fast they respond, how good the service is, and whether they speak different languages.

The documents don't detail contact methods like live chat, email support, phone help, or social media support. This means we can't tell you how easy it is to get help when you need it.

We don't know what hours support is available, which is important for international traders in different time zones. The documents also don't mention how long you should expect to wait for help or what promises they make about service quality.

Quality measures like how often they solve problems on the first try, customer satisfaction scores for support services, or how they handle complicated problems aren't mentioned. This makes it hard to judge how good their service really is.

Trading Experience Analysis

We can't properly review the trading experience at AHEAD because we don't have enough platform information. A complete review would look at how stable the platform is, how fast trades happen, how well orders get filled, and whether mobile trading works well.

The documents don't give us platform performance information like uptime statistics, speed measurements, or system reliability data. This means we can't tell you about the technical quality or how stable the trading environment is.

Order execution quality details like slippage rates, how often quotes change, and fill rates aren't in the documents. These numbers are important for judging actual trading conditions and how they might affect your trading profits.

Mobile trading experience is becoming more important for modern traders, but the documents don't cover this. This ahead review can't tell you about mobile platform features, how complete they are, or how easy the smartphone or tablet trading interface is to use.

Trust and Reliability Analysis

We can't properly assess trust in AHEAD because the documents don't have regulatory information. A standard review would check regulatory licenses, fund safety measures, how open the operations are, and the company's reputation in the industry.

Details about regulatory oversight are crucial for trader protection and legal options, but the documents don't mention these. This is a big information gap for potential users who need regulatory assurance.

The source materials mention "Trading ahead" as a controversial practice in financial markets, where brokers make trades for themselves before filling client orders. This practice is illegal under U.S. securities law, but the available documentation doesn't connect this directly to AHEAD's operations.

Fund safety measures like segregated account policies, insurance coverage, or participation in compensation schemes aren't detailed in the materials. The documents also don't provide information about operational transparency indicators or third-party auditing.

User Experience Analysis

User experience evaluation for AHEAD shows good signs based on employee satisfaction data that we have. Glassdoor reports show a 4.4 out of 5 employee rating, which suggests good internal operations that might mean positive user experiences.

The company does really well in the information technology sector, with management service professionals rating it 30% higher than other employers. This shows operational skill that could help end users. But the documents don't have specific information about user interface design, platform ease of use, or client satisfaction numbers.

The documents don't explain registration and verification processes, which are important for the first user experience. They also don't detail fund operation experiences, including how deposits and withdrawals work.

The materials don't mention common user concerns or frequent complaint types, so we can't identify potential experience problems. User demographic analysis and satisfaction surveys specific to trading services aren't provided in the source documentation.

Conclusion

This ahead review ends with a neutral assessment of AHEAD because we're missing a lot of important information. Employee satisfaction ratings suggest the company runs well, but we don't have enough trading-specific information to give a clear recommendation.

The service might work well for traders who have information technology industry background, since the company does so well in this sector. But the lack of regulatory transparency, trading condition details, and specific financial service information creates big limitations for our evaluation.

The main good points include high employee satisfaction ratings and strong positioning in information technology services. But big disadvantages include not enough transparency about regulatory oversight, trading conditions, and specific service offerings that people need to choose a broker wisely.