Guor 2025 Review: Everything You Need to Know

In the realm of forex trading, Guor has emerged as a controversial player, garnering mixed reactions from users and analysts alike. This review aims to provide a comprehensive analysis of Guor based on various sources, highlighting its strengths and weaknesses, as well as user experiences that paint a vivid picture of what potential traders might encounter.

Note: It is crucial to be aware that Guor operates without valid regulatory oversight, which may significantly affect user experience and trustworthiness. The information presented here is gathered from multiple sources to ensure fairness and accuracy.

Ratings Overview

We assess brokers based on user feedback, expert opinions, and factual data.

Broker Overview

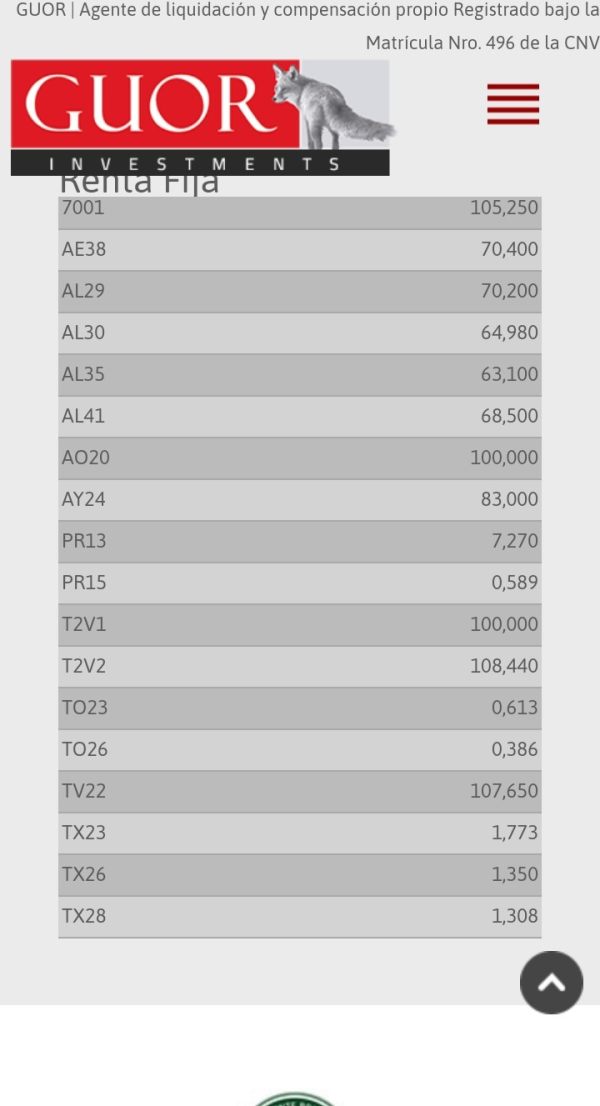

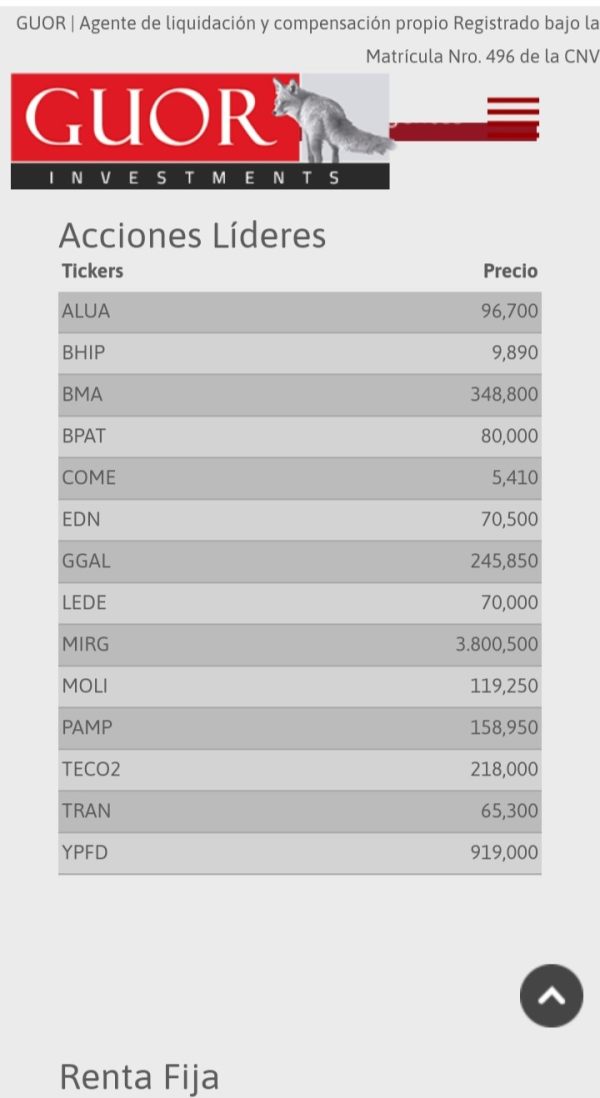

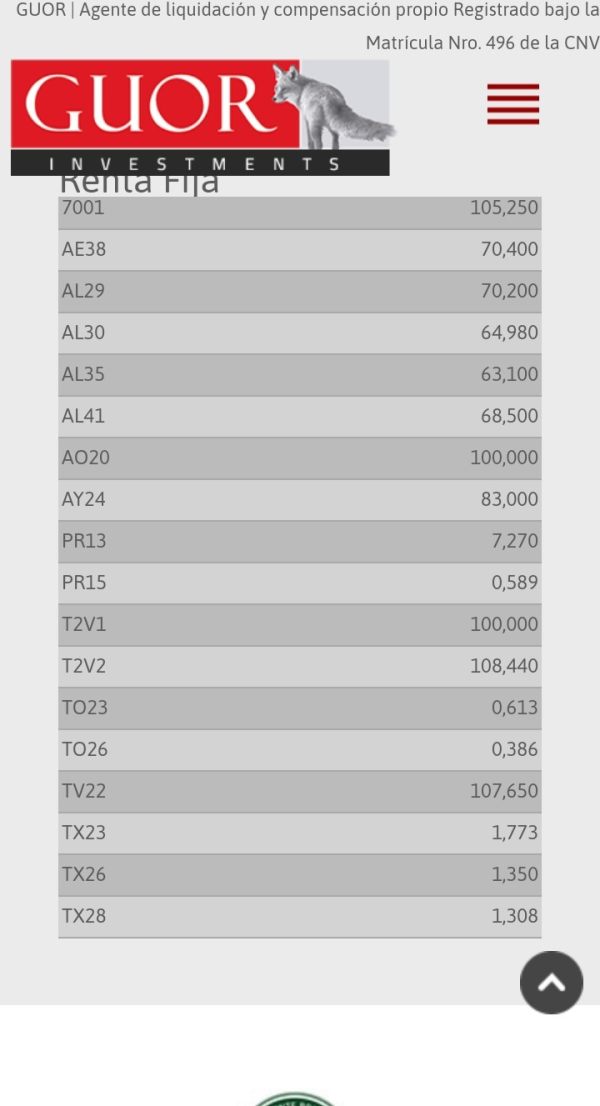

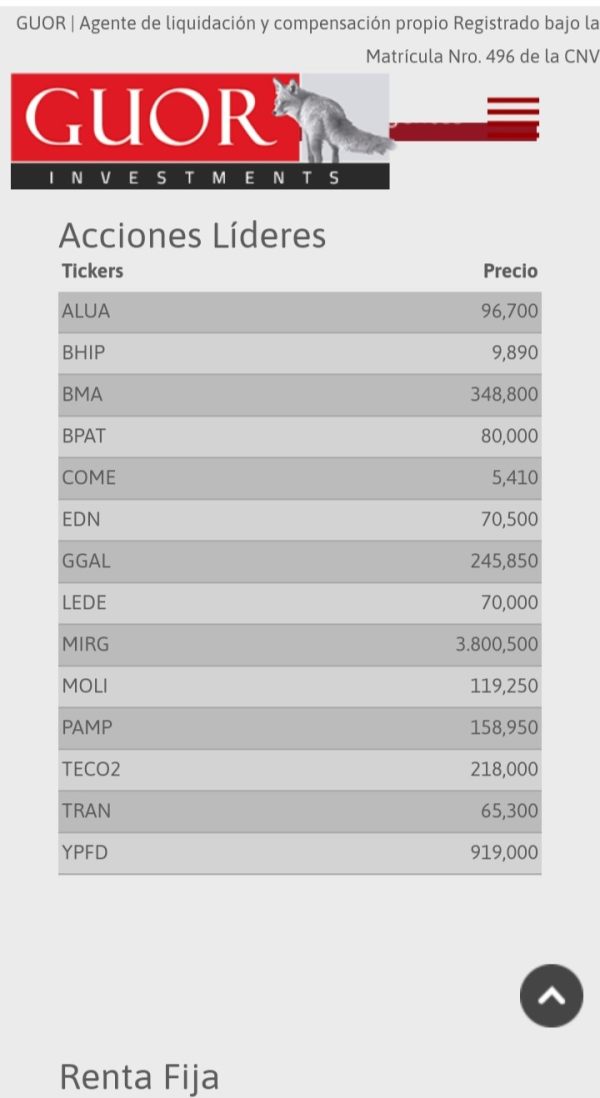

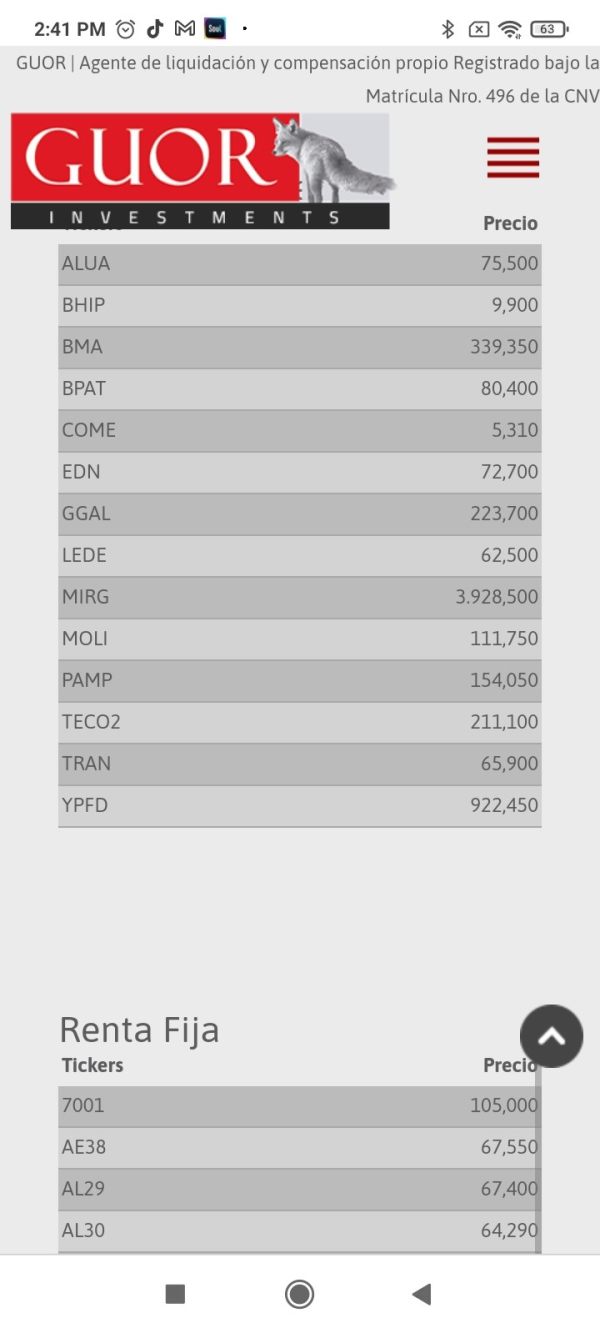

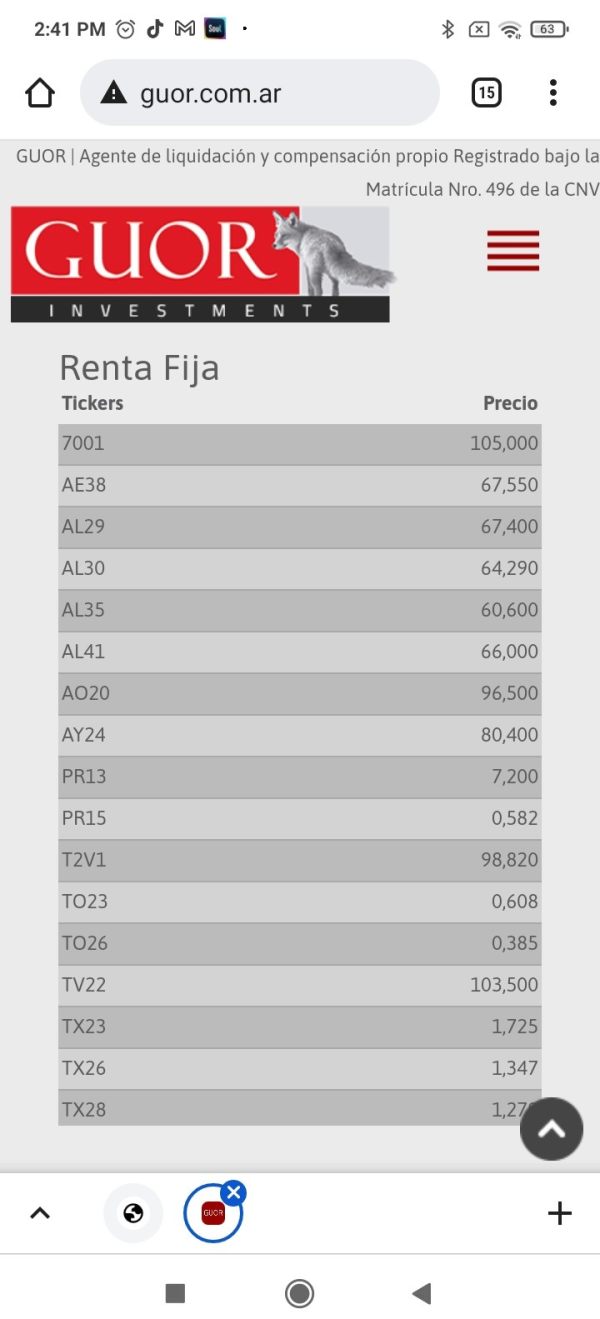

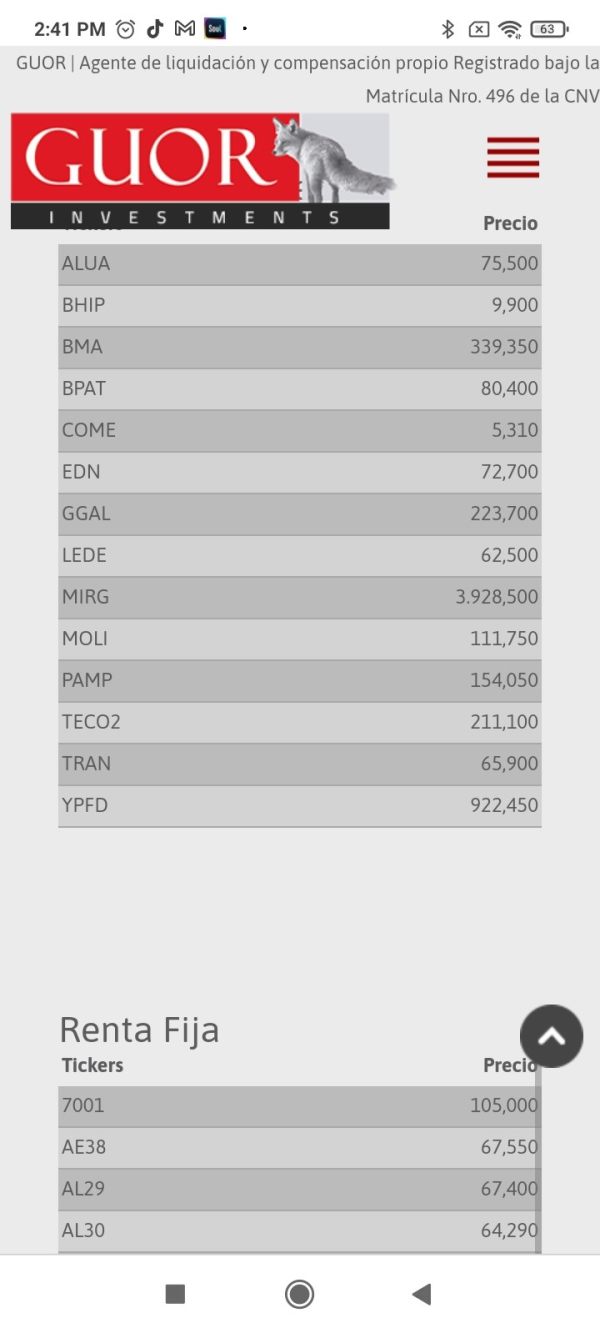

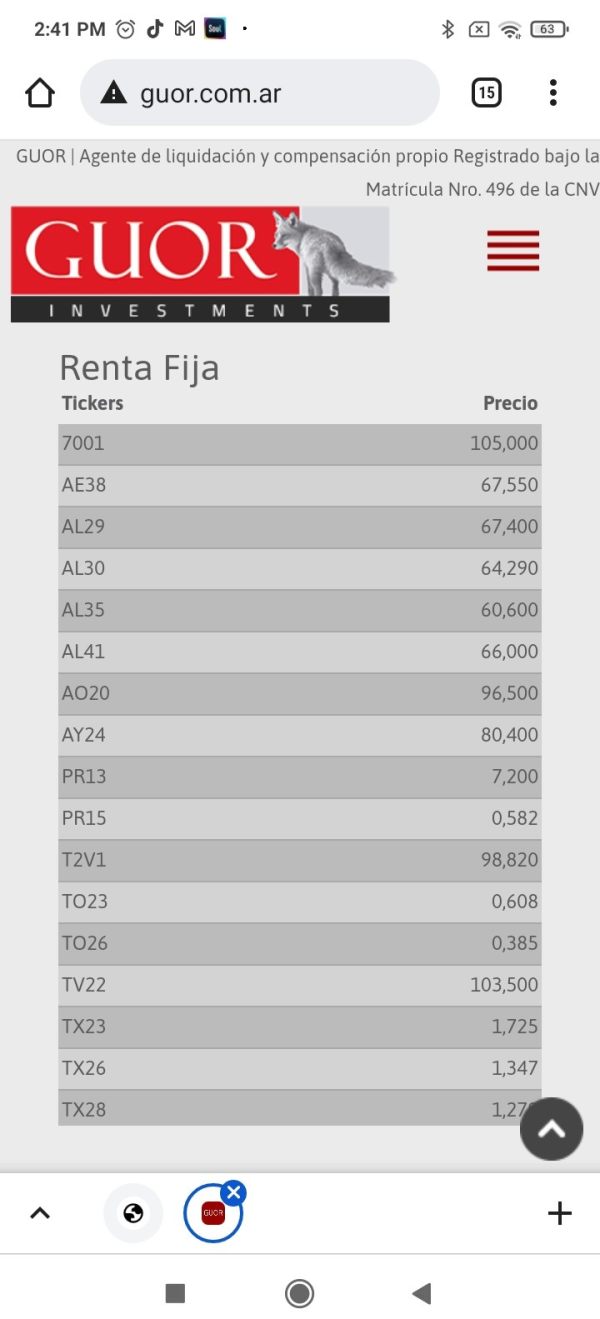

Guor Investments S.A., the entity behind Guor, operates primarily in Argentina and appears to have been active for a few years. However, it lacks any valid regulatory licenses, which raises significant concerns regarding its legitimacy. The trading platform is not specified in the sources, but traders are often directed to use popular platforms like MT4 or MT5. Guor claims to offer a range of trading assets, but specifics are lacking, further contributing to the uncertainty surrounding its operations.

Detailed Analysis

Regulatory Status and Geographic Reach

Guor operates without any recognized regulatory oversight. According to WikiFX, there is "no valid regulatory information," which poses a high potential risk for traders. This unregulated status is a significant red flag, as it implies that there is little to no consumer protection in place. The absence of regulatory authority can lead to issues such as withdrawal restrictions and potential fraud, as highlighted by multiple user complaints.

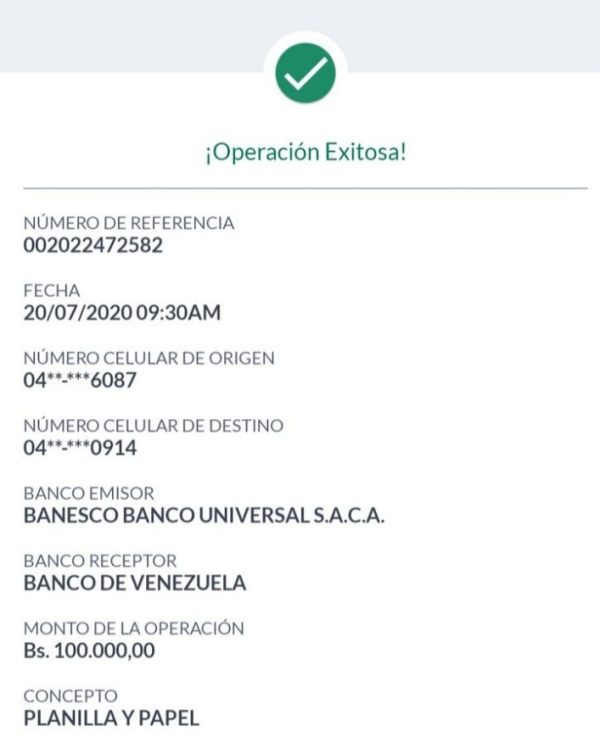

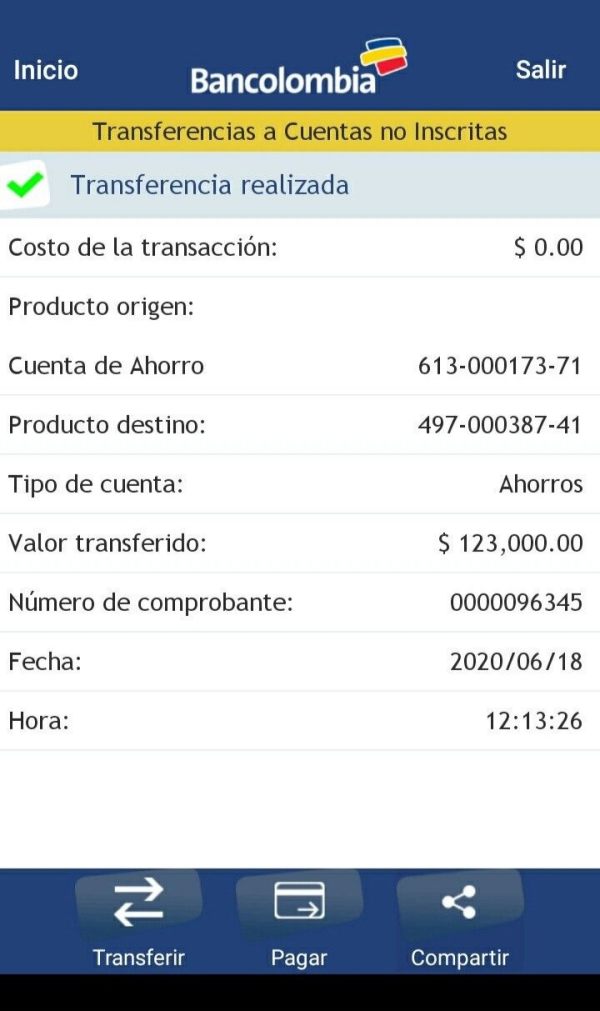

Deposit/Withdrawal Options

Details regarding deposit and withdrawal methods are sparse. However, it is reported that users face significant challenges when attempting to withdraw their funds. One user recounted a harrowing experience where they deposited a substantial amount but were unable to retrieve their earnings, citing that the broker deducted high fees and made withdrawal exceedingly difficult. This aligns with broader concerns about Guor's practices, as many users have reported similar issues.

The minimum deposit required to start trading with Guor is unclear from the available sources. There are no indications of promotional bonuses or incentives, which is often a tactic used by less reputable brokers to attract new traders.

Trading Costs and Leverage

The specifics regarding spreads, commissions, and leverage offered by Guor are not well-documented. However, the lack of transparency regarding trading costs is concerning, as hidden fees can significantly impact a trader's profitability. Many users have expressed frustration over unexpected costs, further eroding trust in the broker.

While Guor may offer popular trading platforms like MT4 or MT5, the user experience on these platforms is reportedly marred by poor execution and frequent issues. Users have complained about slippage and the inability to execute trades at desired prices, which can be detrimental in the fast-paced forex market.

Restricted Regions and Customer Support

Guor appears to have a limited geographical reach, primarily focusing on Latin America. However, it lacks a robust customer support system. Users have reported long response times and inadequate assistance when issues arise. One user mentioned that their inquiries went unanswered, which is a significant concern for traders who require timely support.

Summary Ratings

Detailed Breakdown

-

Account Conditions: With a score of 2, Guor's account conditions are deemed unfavorable, especially given the lack of regulatory oversight and transparency.

Tools and Resources: Scoring 3, the tools available to traders do not meet industry standards, with many users reporting issues with execution and functionality.

Customer Service and Support: The score of 1 reflects a significant gap in customer service, with users frequently left without assistance when they encounter problems.

Trading Experience: The trading experience is rated at 2 due to frequent execution issues and a lack of clarity regarding trading costs and conditions.

Trustworthiness: With a score of 1, Guor is viewed as a high-risk broker due to its unregulated status and numerous user complaints regarding fund withdrawal and transparency.

User Experience: Scoring 2, user experiences are predominantly negative, with many reporting difficulties in accessing their funds and receiving adequate support.

In conclusion, Guor presents a concerning option for forex traders in 2025. The lack of regulation, coupled with numerous user complaints about withdrawal difficulties and poor customer service, paints a troubling picture. Potential traders are advised to exercise caution and consider more reputable, regulated brokers for their trading activities. Always prioritize due diligence and ensure that any broker you choose has a solid regulatory framework and positive user feedback.