Exfor 2025 Review: Everything You Need to Know

Executive Summary

Exfor is a new player in the forex brokerage world. This exfor review shows a broker with good customer service but problems with withdrawals and unclear rules. The broker gives you access to popular MetaTrader 4 and MetaTrader 5 platforms and says it removes commission fees through a subscription plan, though we don't have many details about this.

User feedback and industry reports suggest that Exfor works best for traders who want multi-asset trading with fast customer support. But the broker doesn't clearly show its regulatory information, and many users have trouble withdrawing money. User reviews always mention that the company helps quickly and responds fast to questions, but these good points are hurt by ongoing complaints about getting funds out.

The broker gets a neutral rating overall. This reflects both its new position in the market and its need to be more transparent in how it operates. Traders thinking about Exfor should carefully compare the broker's helpful customer service against the documented problems with fund access and regulatory clarity.

Important Notice

Regional Entity Differences: Exfor's regulatory status is unclear in different countries, and traders in various regions may face different levels of legal protection and operational standards. The lack of clearly shown regulatory oversight means that client protections may vary a lot depending on where you live and local financial rules.

Review Methodology: This evaluation uses available user feedback, industry reports, and public information. The assessment doesn't include direct testing or on-site checking of the broker's services and should be considered along with additional research before making trading decisions.

Rating Framework

Broker Overview

Exfor works as a forex and multi-asset broker that offers trading services across various financial instruments. While we don't know the specific founding year from available materials, the company says it focuses on technology and provides access to global financial markets. The broker's business model centers on offering different trading opportunities through established platforms while claiming to remove traditional commission structures in favor of subscription-based pricing.

The company's main focus includes forex trading, commodities like precious metals and energy products, and stock market instruments. According to available information, Exfor tries to stand out through its customer service approach and platform access, though detailed information about its corporate structure and operational history is limited in public documents.

Exfor provides trading access through the industry-standard MetaTrader 4 and MetaTrader 5 platforms, including mobile versions for trading on the go. The broker's asset coverage includes major and minor currency pairs, commodity markets such as gold, silver, and oil, as well as various stock instruments. However, specific regulatory oversight information is notably missing from available materials, which raises questions about the broker's compliance framework and client protection measures.

Regulatory Status: Available materials don't specify particular regulatory authorities overseeing Exfor's operations, which is a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: The broker offers various funding options with different processing times, though specific methods and timeframes aren't detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts aren't mentioned in accessible materials.

Bonuses and Promotions: Current promotional offerings aren't detailed in available information sources.

Trading Assets: The platform provides access to forex pairs, commodity markets including metals and energy products, and stock trading opportunities across multiple markets.

Cost Structure: While the broker claims to eliminate commission fees through a subscription model, specific spread information and detailed fee structures aren't clearly outlined in available materials.

Leverage Options: Maximum leverage reaches 1:100 according to available information.

Platform Choices: Traders can access MetaTrader 4 and MetaTrader 5 platforms, including mobile applications for both platforms.

Geographic Restrictions: Specific regional limitations aren't detailed in available materials.

Customer Support Languages: Supported language options aren't specified in accessible documentation.

This exfor review continues with detailed analysis of each rating dimension to provide complete insights into the broker's performance across key areas.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

Exfor's account conditions show a mixed picture with limited transparency about specific offerings. Available materials don't detail distinct account types or their particular features, making it hard for potential clients to understand what level of service they might receive. The absence of clearly stated minimum deposit requirements adds to the uncertainty around account access for traders with different capital levels.

The broker's leverage offering of up to 1:100 falls within industry norms but may be limiting for traders used to higher leverage ratios available elsewhere. Without detailed information about account opening procedures, verification requirements, or special account features such as Islamic accounts, potential clients lack crucial decision-making information.

The claimed removal of commission fees through a subscription model represents an interesting approach, though the lack of specific details about how this system works or its cost implications leaves traders unable to properly evaluate the financial benefits. This exfor review notes that the absence of complete account condition information significantly hurts the ability to assess the broker's competitiveness in this crucial area.

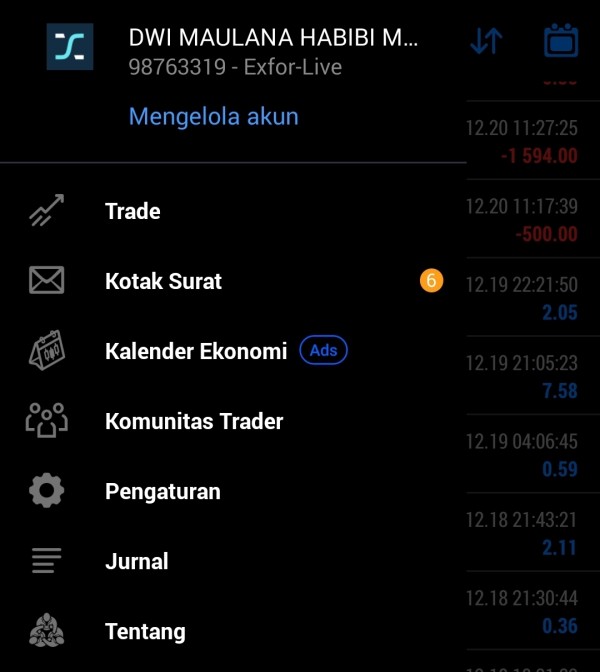

Exfor shows strength in providing established trading platforms, offering both MetaTrader 4 and MetaTrader 5 access including mobile versions. These platforms represent industry standards with complete charting tools, technical indicators, and automated trading capabilities that meet most traders' needs. The multi-asset support across forex, commodities, and stocks provides reasonable diversification opportunities for portfolio-minded traders.

However, available materials don't detail specific research and analysis resources, educational content, or proprietary trading tools that might set the broker apart from competitors. The absence of information about market analysis, economic calendars, or educational resources suggests either limited offerings in these areas or poor communication of available services.

The platform's support for automated trading systems and expert advisors through the MetaTrader ecosystem provides value for algorithmic traders, though specific performance data or unique features aren't highlighted in accessible materials. While the core trading infrastructure appears solid, the lack of detailed information about supplementary tools and resources prevents a higher rating in this category.

Customer Service and Support Analysis (8/10)

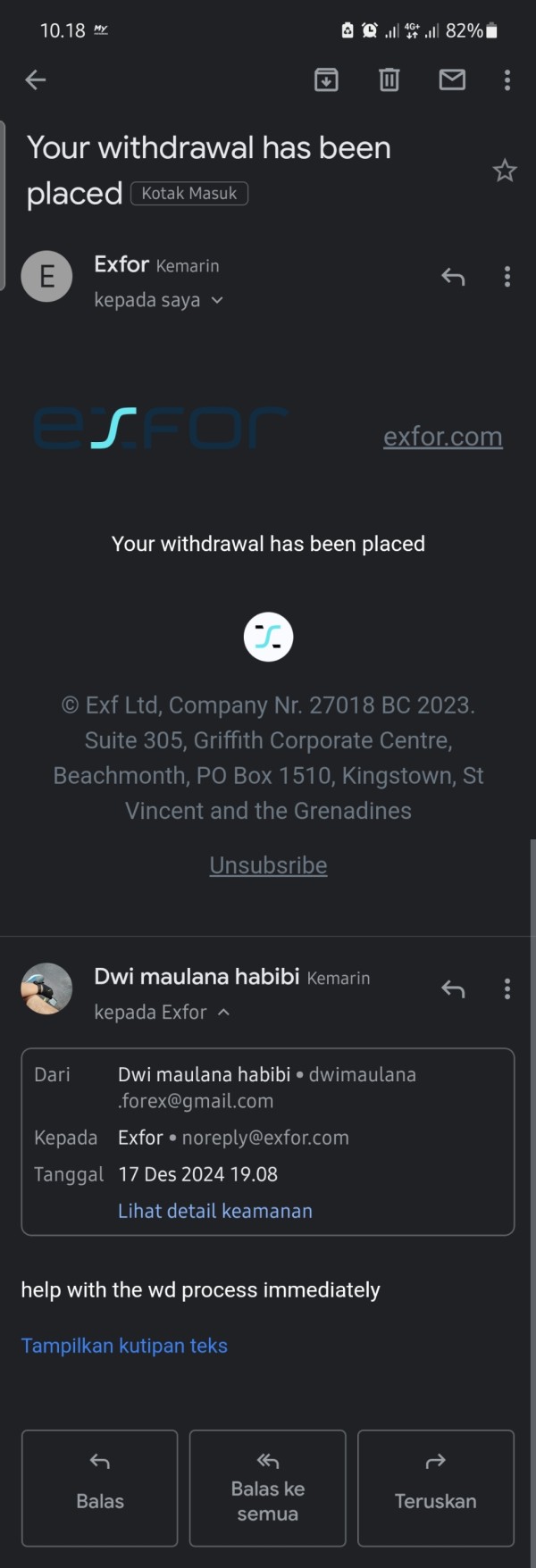

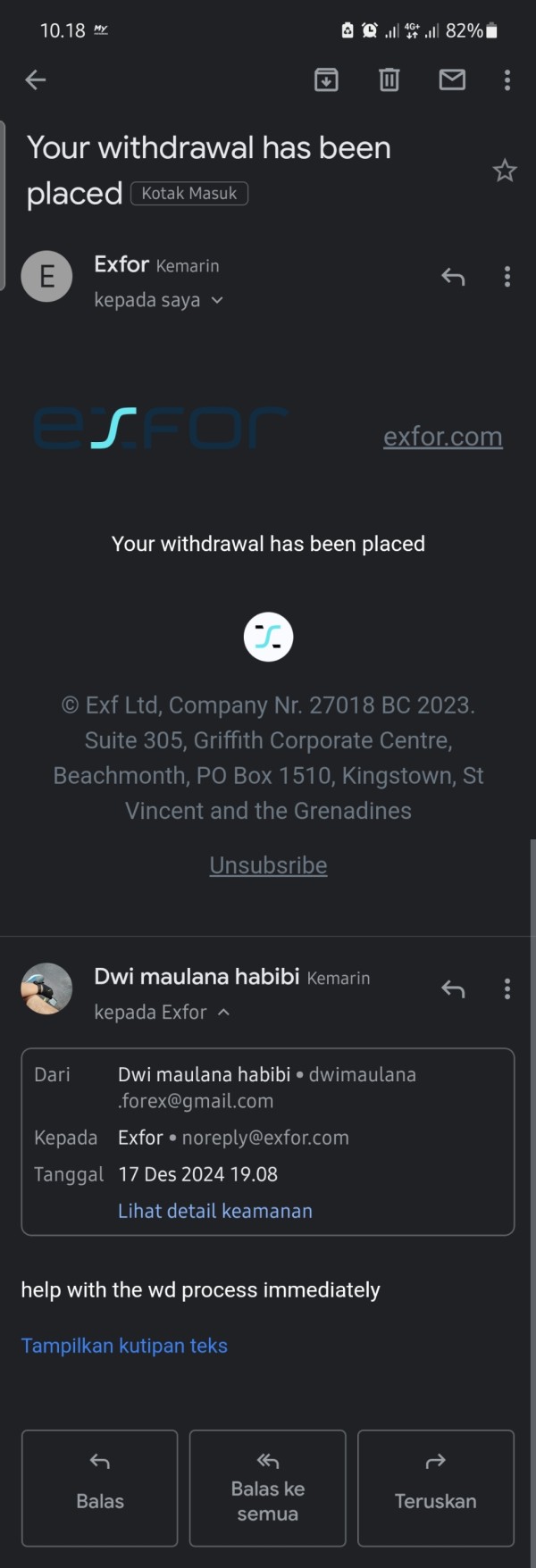

Customer service emerges as one of Exfor's strongest aspects based on available user feedback. Multiple sources consistently highlight the broker's quick response times and willingness to assist clients with their inquiries. This responsive approach to customer support represents a significant positive factor, particularly in an industry where communication delays can impact trading decisions and client satisfaction.

User testimonials specifically mention the company's demonstration of willingness to help, suggesting a customer-focused service philosophy. The rapid response capability indicates adequate staffing levels and potentially effective internal communication systems, which are crucial for maintaining client relationships in the fast-paced trading environment.

However, the effectiveness of customer service is somewhat undermined by persistent withdrawal issues that the support team appears unable to resolve satisfactorily. While the team responds quickly, the inability to address fundamental operational problems limits the overall service quality. Available materials don't specify support channel availability, operating hours, or multilingual capabilities, which would provide additional context for service accessibility.

Trading Experience Analysis (6/10)

The trading experience at Exfor centers around the proven MetaTrader platform ecosystem, which provides reliable order execution capabilities and complete trading tools. The availability of both MT4 and MT5 platforms allows traders to choose their preferred environment based on specific needs and familiarity, representing a positive aspect of the overall trading experience.

However, user feedback regarding specific trading conditions such as spread competitiveness, execution speed, and slippage rates is notably limited in available materials. The absence of detailed performance metrics or user testimonials about trading environment quality makes it difficult to assess how the broker performs during various market conditions or peak trading periods.

The multi-asset trading capability enhances the overall experience by allowing portfolio diversification within a single platform, though specific details about market depth, liquidity provision, or execution quality across different asset classes aren't well documented. This exfor review notes that while the fundamental trading infrastructure appears adequate, the lack of detailed performance information and user experience data limits confidence in the overall trading experience quality.

Trust and Security Analysis (4/10)

Trust and security represent significant concerns in this evaluation due to the notable absence of clear regulatory information. The lack of disclosed regulatory oversight creates uncertainty about client fund protection, dispute resolution mechanisms, and operational compliance standards. This regulatory opacity represents a major red flag for traders prioritizing security and legal protection.

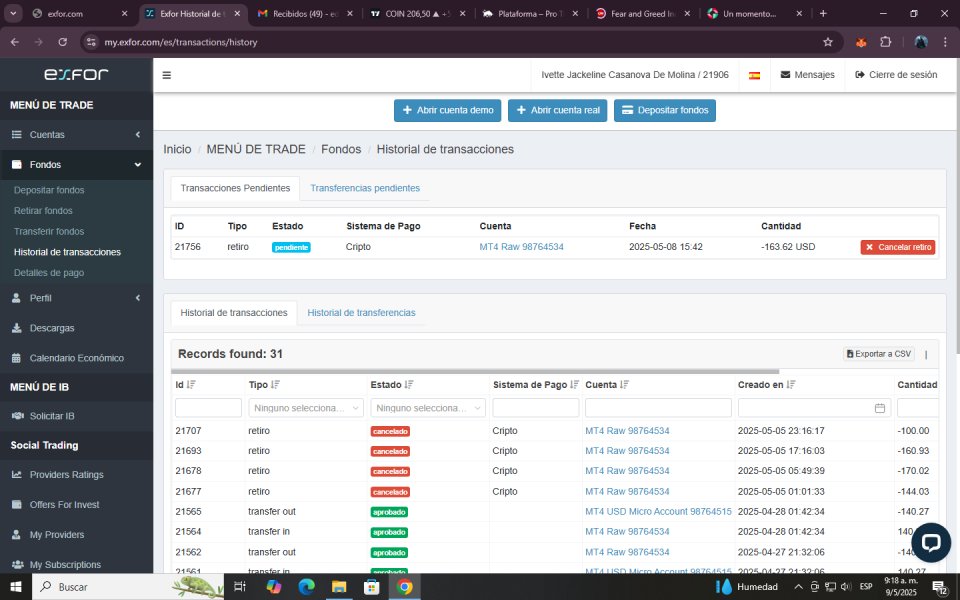

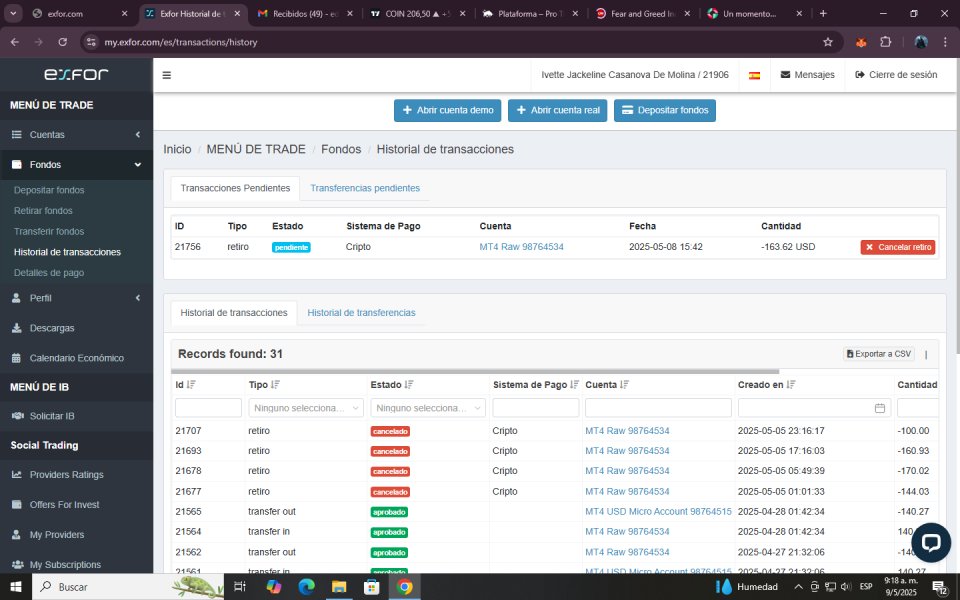

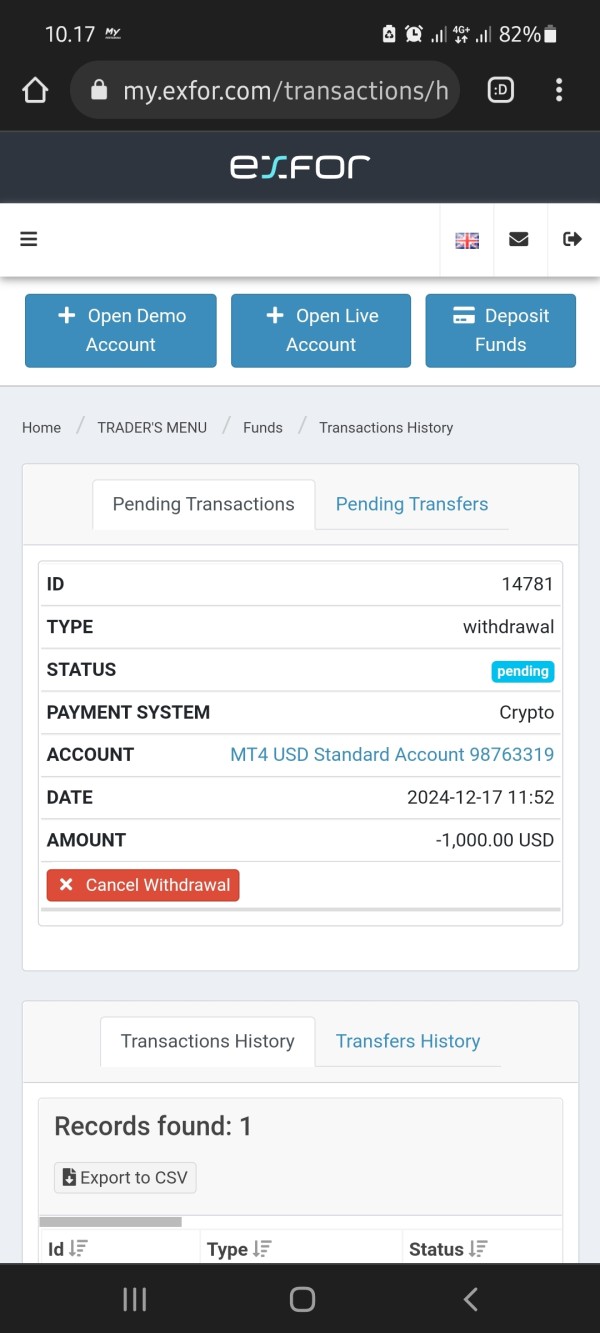

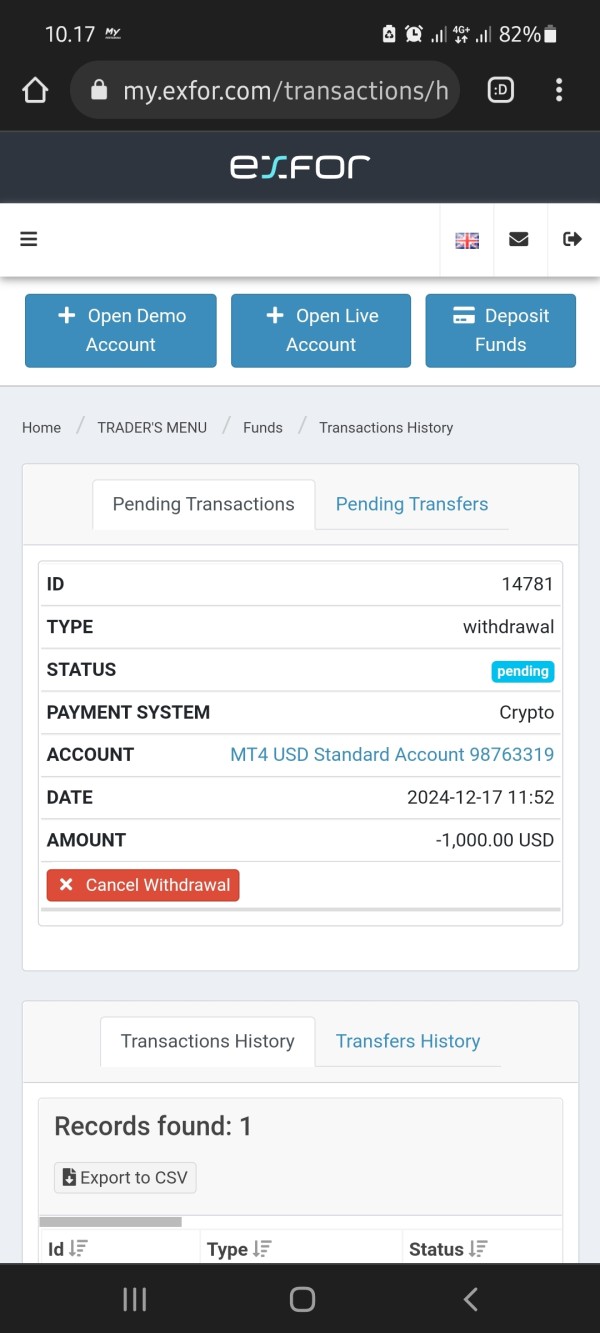

The documented withdrawal difficulties further compound trust concerns, as fund accessibility represents a fundamental aspect of broker reliability. When clients experience challenges retrieving their money, it raises questions about the broker's operational integrity and financial stability, regardless of other service quality aspects.

Available materials don't detail specific security measures for client fund segregation, data protection protocols, or insurance coverage that might provide additional client safeguards. The absence of third-party audits, regulatory reporting, or industry certifications leaves potential clients without standard verification methods for assessing broker trustworthiness. These combined factors necessitate a below-average rating in this critical evaluation area.

User Experience Analysis (5/10)

The overall user experience at Exfor reflects a balance between responsive customer service and operational challenges that impact client satisfaction. While users appreciate the quick response times from support staff, the persistent withdrawal issues create significant friction in the overall service experience and overshadow positive customer service interactions.

Available feedback doesn't provide detailed insights into interface design quality, account management ease, or platform navigation efficiency. The absence of complete user testimonials about registration processes, verification procedures, or general platform usability limits the ability to assess the complete user journey from onboarding through ongoing trading activities.

The primary user complaints center on withdrawal processing difficulties, which represents a critical pain point that affects overall satisfaction regardless of other service aspects. For traders seeking reliable fund access and transparent operations, these documented issues present substantial concerns. The broker appears most suitable for traders who prioritize responsive customer support and can tolerate potential withdrawal processing challenges, though this represents a significant limitation for most trading scenarios.

Conclusion

Exfor presents itself as an emerging forex broker with notable strengths in customer service responsiveness but significant weaknesses in operational transparency and fund processing reliability. While the broker's quick customer support response times and multi-platform access through MetaTrader 4 and 5 provide some value propositions, the documented withdrawal difficulties and absence of clear regulatory oversight create substantial concerns for potential clients.

The broker may appeal to traders who prioritize immediate customer service availability and multi-asset trading capabilities, particularly those willing to accept higher operational risks in exchange for responsive support. However, the combination of unclear regulatory status and withdrawal processing challenges makes Exfor a questionable choice for traders prioritizing security and reliable fund access.

Overall, this evaluation suggests that while Exfor demonstrates some positive service aspects, the significant operational and transparency concerns warrant careful consideration and potentially seeking alternative brokers with clearer regulatory standing and more reliable withdrawal processes.