NAGA 2025 Review: Everything You Need to Know

Executive Summary

NAGA is an STP (Straight Through Processing) broker regulated by two Tier-1 regulatory authorities. The company aims to make financial markets accessible through simple trading solutions. This naga review presents a balanced assessment of the broker's offerings, revealing both strengths and areas for improvement.

The broker stands out through a diverse range of asset classes including forex pairs, stocks, indices, commodities, ETFs, cryptocurrencies, and futures. All assets are accessible through simplified trading platforms and tools. NAGA's approach focuses on making trading accessible to newcomers while providing sufficient functionality for intermediate traders seeking portfolio diversification.

However, our analysis reveals notable concerns, particularly regarding higher spreads that may impact trading profitability. Mixed user feedback regarding service quality also presents challenges. Commission structures start from €0.99, which positions NAGA in the mid-range cost category among retail brokers.

The platform primarily targets beginners seeking streamlined trading processes. It also serves intermediate traders looking to diversify their investment portfolios across multiple asset classes. With Tier-1 regulatory oversight providing enhanced fund security, NAGA presents a moderately reliable option, though traders should carefully consider the cost implications and service limitations before committing.

Important Disclaimers

Users across different regions may encounter varying regulatory conditions and service offerings due to NAGA's multi-jurisdictional structure. The specific terms, available instruments, and regulatory protections can differ significantly depending on your location and the NAGA entity serving your region.

This evaluation is compiled from user feedback, market information, and publicly available data. While we strive for objectivity, some assessments may contain subjective elements based on varying user experiences and market conditions. Potential traders should conduct their own due diligence and consider their individual trading requirements before making any decisions.

Rating Framework

Broker Overview

NAGA operates as an STP (Straight Through Processing) broker with a mission to make financial markets accessible. The company provides accessible trading solutions to retail investors. The broker positions itself as a bridge between traditional financial markets and modern trading technology, focusing on simplifying the trading process through intuitive platforms and comprehensive educational resources.

The broker's business model centers on providing direct market access while maintaining competitive trading conditions across multiple asset classes. By targeting both novice and intermediate traders, NAGA has developed a service structure that emphasizes ease of use without sacrificing the depth of features required for serious trading activities.

NAGA offers an extensive range of tradeable instruments including forex pairs, stocks, indices, commodities, ETFs, cryptocurrencies, and futures contracts. This diversification strategy allows traders to build comprehensive portfolios within a single trading environment. The broker operates under the oversight of two Tier-1 regulatory authorities, providing enhanced credibility and fund protection measures that distinguish it from less regulated competitors. This naga review examines how these regulatory frameworks translate into practical benefits for end users.

Regulatory Framework: NAGA operates under the supervision of two Tier-1 regulatory authorities. This ensures compliance with stringent financial standards and provides enhanced protection for client funds through segregated account structures and compensation schemes.

Deposit and Withdrawal Methods: While specific payment methods are not detailed in available documentation, the broker typically supports standard banking transfers and electronic payment systems common in the retail trading industry.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly specified in current documentation. This may create uncertainty for potential clients during the account opening process.

Promotional Offers: Current bonus and promotional structures are not detailed in available materials. This suggests either limited promotional activity or region-specific offerings that vary by jurisdiction.

Tradeable Assets: The platform provides access to forex currency pairs, individual stocks, market indices, commodity contracts, exchange-traded funds (ETFs), cryptocurrency instruments, and futures contracts. This offers comprehensive market exposure across traditional and digital asset classes.

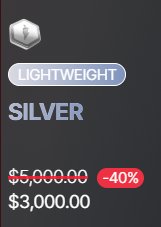

Cost Structure: Trading costs include spreads that users report as being higher than industry averages. This potentially impacts profitability for frequent traders. Commission structures begin at €0.99 per transaction, placing NAGA in the mid-tier cost category. The combination of spreads and commissions requires careful consideration for cost-sensitive trading strategies.

Leverage Options: Maximum leverage reaches 1:1000. This provides significant capital amplification opportunities while requiring appropriate risk management protocols from users.

Platform Selection: While specific platform details are limited in current documentation, NAGA provides simplified trading tools designed for accessibility. Advanced traders may find functionality limitations compared to institutional-grade platforms. This naga review notes the emphasis on user-friendly interfaces over advanced analytical tools.

Regional Restrictions: Specific geographical limitations are not detailed in available documentation. However, regulatory compliance typically necessitates certain regional access restrictions.

Customer Support Languages: Multilingual support availability is not specifically documented. The broker's international presence suggests multiple language options.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

NAGA's account structure reflects a balance between accessibility and functionality. However, specific account type variations are not clearly documented in available materials. The absence of clearly stated minimum deposit requirements creates uncertainty for potential clients, particularly those with limited initial capital who need to understand entry barriers before beginning the registration process.

The commission structure starting at €0.99 per transaction positions NAGA in the middle range of retail broker pricing. It is neither exceptionally competitive nor prohibitively expensive. However, this cost must be evaluated alongside reported higher spreads, which compound overall trading expenses and may significantly impact the profitability of frequent trading strategies.

User feedback indicates mixed experiences with account opening procedures. Some traders report straightforward processes while others encounter delays or documentation requirements that extend onboarding timelines. The lack of detailed information about specialized account features, such as Islamic accounts for Sharia-compliant trading, limits appeal to specific trader demographics.

The combination of unclear minimum deposits, moderate commission rates, and higher spreads creates an account condition environment that serves average retail traders adequately. However, it may not satisfy either cost-conscious beginners or high-volume traders seeking institutional-grade pricing. This naga review finds the account conditions acceptable but not exceptional in the competitive retail trading landscape.

NAGA's approach to trading tools emphasizes simplicity and accessibility. This makes the platform particularly suitable for traders transitioning from complete beginners to intermediate skill levels. The broker provides fundamental analytical tools and market access features designed to support basic trading strategies without overwhelming new users with excessive complexity.

The platform's strength lies in its intuitive design philosophy. It prioritizes ease of navigation and essential functionality over advanced technical analysis capabilities. This approach serves the broker's target demographic well, as beginners benefit from streamlined interfaces that reduce the learning curve associated with modern trading platforms.

However, the emphasis on simplicity may limit appeal to advanced traders who require sophisticated analytical tools, algorithmic trading capabilities, or extensive customization options. The available documentation does not detail specific research resources, educational materials, or automated trading support, suggesting potential gaps in comprehensive trader development resources.

User feedback indicates appreciation for the straightforward tool design. Many traders note the reduced complexity compared to more feature-heavy competitors. The balance between functionality and usability appears well-calibrated for NAGA's intended market segment, though expansion of analytical capabilities could enhance the platform's appeal to developing traders seeking growth opportunities.

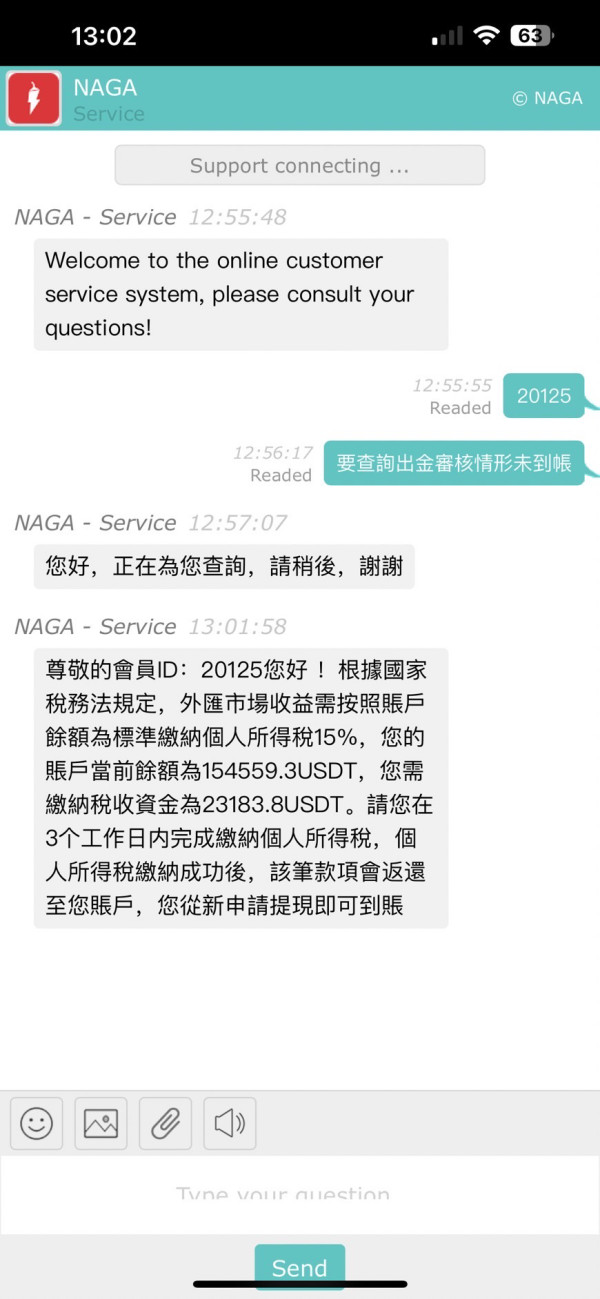

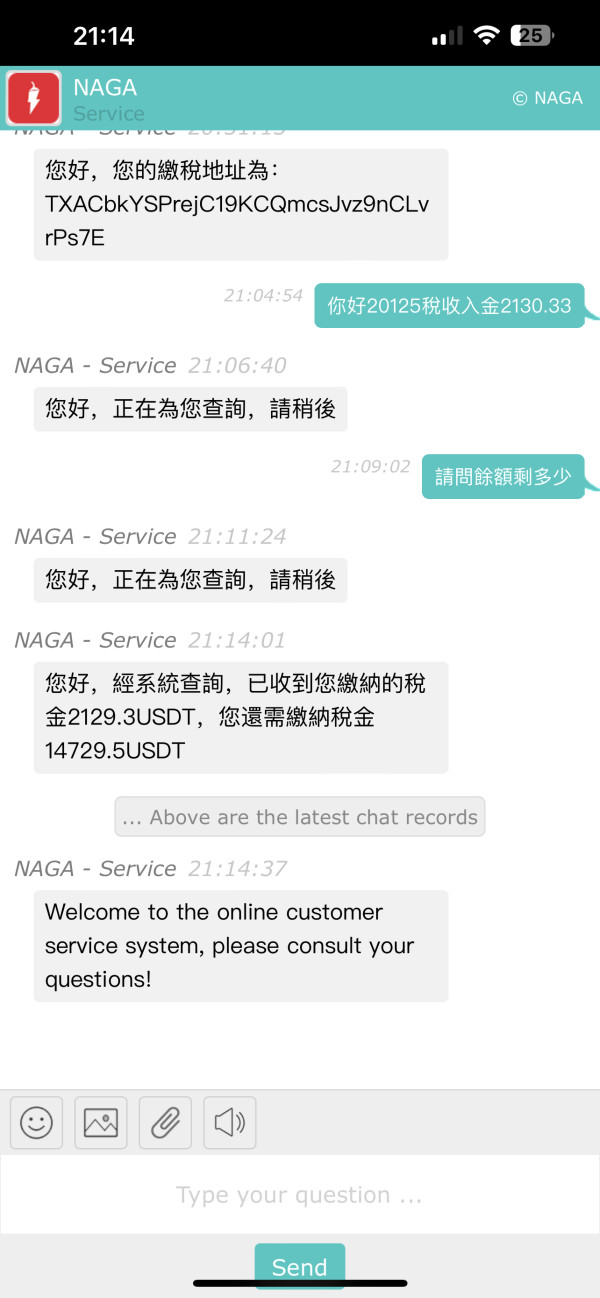

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a significant area of mixed user experiences for NAGA. Feedback indicates inconsistent service quality and response times that vary considerably depending on inquiry complexity and timing. The absence of detailed customer support channel information in available documentation suggests potential limitations in support accessibility options.

User reports indicate varying response times to customer inquiries. Some experience prompt resolution while others face extended delays that impact trading activities and account management efficiency. This inconsistency in service delivery creates uncertainty for traders who rely on responsive support for time-sensitive issues or technical difficulties.

The lack of specific information about multilingual support capabilities may pose challenges for international clients who require assistance in their native languages. Additionally, unclear support hours and channel availability can frustrate users attempting to resolve urgent trading-related issues outside standard business hours.

Service quality feedback reveals polarized experiences. Some users praise helpful and knowledgeable support staff while others report difficulties obtaining satisfactory resolutions to account or platform issues. This divergence in service experiences suggests inconsistent training or resource allocation within the customer support infrastructure, requiring improvement to meet professional service standards consistently.

Trading Experience Analysis (Score: 6/10)

The overall trading experience with NAGA reflects the broker's focus on accessibility and simplicity. However, this approach creates both advantages and limitations depending on trader sophistication and requirements. Platform stability and execution quality receive mixed reviews from users, indicating variability in technical performance that can impact trading outcomes.

User feedback regarding order execution reveals concerns about slippage and requoting during volatile market conditions. These issues can significantly affect trading profitability, particularly for scalping and short-term trading strategies. These execution issues, combined with reported higher spreads, create cost pressures that may discourage active trading approaches.

The simplified platform design facilitates easy navigation and basic trading functions. This makes it accessible for beginners while potentially limiting advanced traders who require sophisticated order types, advanced charting capabilities, or extensive customization options. The balance between simplicity and functionality appears calibrated for NAGA's target market but may not satisfy traders seeking comprehensive professional-grade features.

Mobile trading experience details are not extensively documented. However, the modern retail trading environment typically demands robust mobile functionality for traders requiring market access across multiple devices. The overall trading environment reflects NAGA's positioning as an accessible retail broker, though higher spreads and execution concerns impact the overall quality assessment in this naga review.

Trust Factor Analysis (Score: 8/10)

NAGA's regulatory standing represents one of its strongest attributes. Oversight from two Tier-1 regulatory authorities provides substantial credibility and fund protection measures that exceed many retail broker standards. This regulatory framework ensures compliance with stringent financial standards, segregated client account requirements, and compensation scheme participation that protects trader funds.

The Tier-1 regulatory oversight includes regular compliance audits, capital adequacy requirements, and operational transparency standards that significantly reduce counterparty risk for client funds. These protections provide substantial peace of mind for traders concerned about broker reliability and fund security, particularly in the volatile retail trading industry.

While specific fund safety measures beyond regulatory requirements are not detailed in available documentation, the regulatory framework itself provides comprehensive protection through established legal structures and oversight mechanisms. The absence of documented negative regulatory actions or significant compliance issues supports the positive trust assessment.

Company transparency regarding business operations, financial reporting, and regulatory compliance maintains acceptable standards. However, more detailed public disclosure could further enhance credibility. User trust feedback generally aligns with the strong regulatory foundation, with most traders expressing confidence in fund security despite concerns about service quality and trading conditions in other areas.

User Experience Analysis (Score: 6/10)

Overall user satisfaction with NAGA reflects the mixed nature of the broker's service delivery. Positive feedback about accessibility and simplicity is balanced against concerns about costs and service consistency. The platform successfully serves its intended demographic of beginning and intermediate traders seeking straightforward market access without excessive complexity.

Interface design and usability receive generally positive feedback. Users appreciate the reduced learning curve compared to more complex trading platforms. The streamlined approach to account management and trading functions supports efficient workflow for users focused on basic trading strategies and portfolio management.

However, user complaints about higher spreads represent a consistent theme in feedback. Many traders express frustration about cost impacts on trading profitability. These cost concerns, combined with mixed customer service experiences, create user experience challenges that affect overall satisfaction levels.

The registration and verification processes appear standard for retail brokers. However, specific details about timeline and requirements are not extensively documented. User demographic analysis confirms NAGA's success in attracting beginning and intermediate traders, though retention may be challenged by cost and service issues that encourage migration to competitors as traders develop greater sophistication and cost sensitivity.

Conclusion

NAGA presents a mixed proposition in the retail trading landscape. It combines strong regulatory oversight and accessible platform design with notable limitations in cost competitiveness and service consistency. The broker successfully fulfills its mission of making financial markets accessible for beginning and intermediate traders through simplified tools and diverse asset access, though higher spreads and inconsistent customer service create significant drawbacks.

The platform best serves traders prioritizing regulatory security and ease of use over cost optimization and advanced functionality. Beginning traders benefit from the reduced complexity and comprehensive asset access, while intermediate traders can utilize the platform for portfolio diversification across multiple markets. However, cost-conscious traders and those requiring premium customer service may find better alternatives in the competitive retail broker market.

NAGA's strengths lie in regulatory credibility, asset diversity, and user-friendly design. Its weaknesses center on higher trading costs and inconsistent service delivery. Potential users should carefully evaluate their priorities regarding cost versus convenience and regulatory security versus advanced functionality when considering NAGA as their trading platform choice.