LBO Review 1

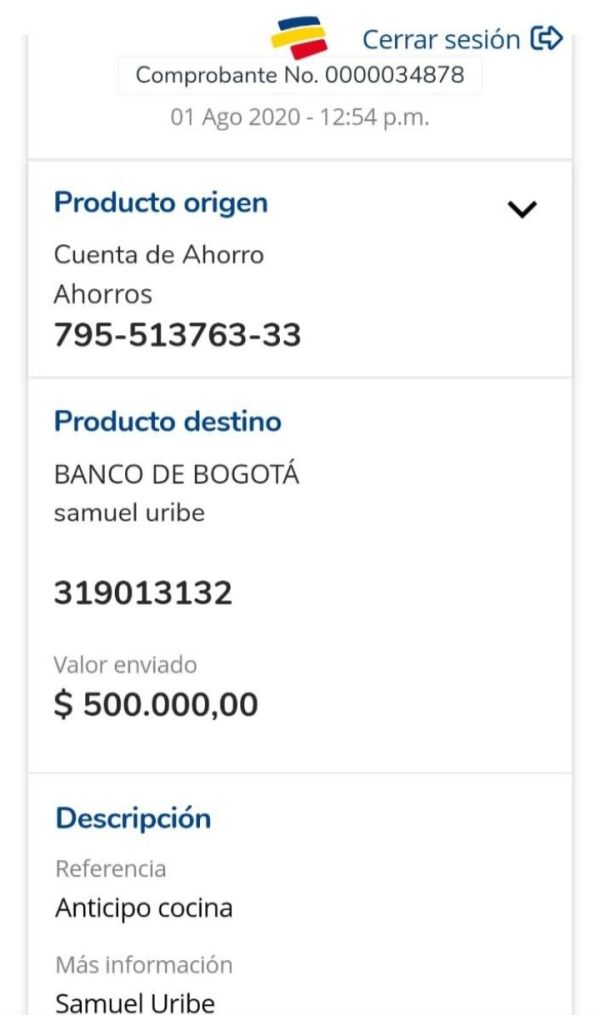

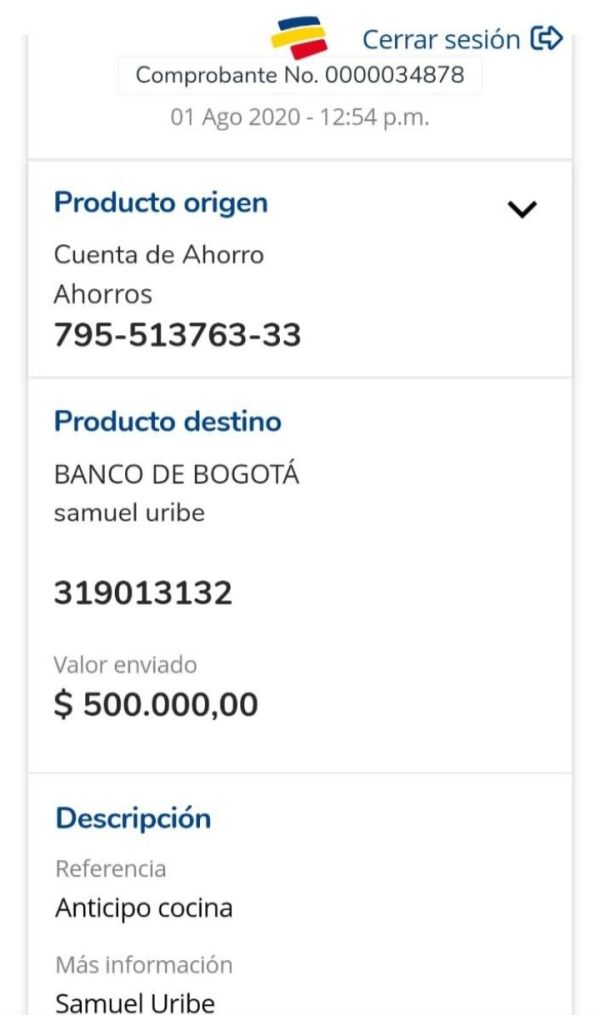

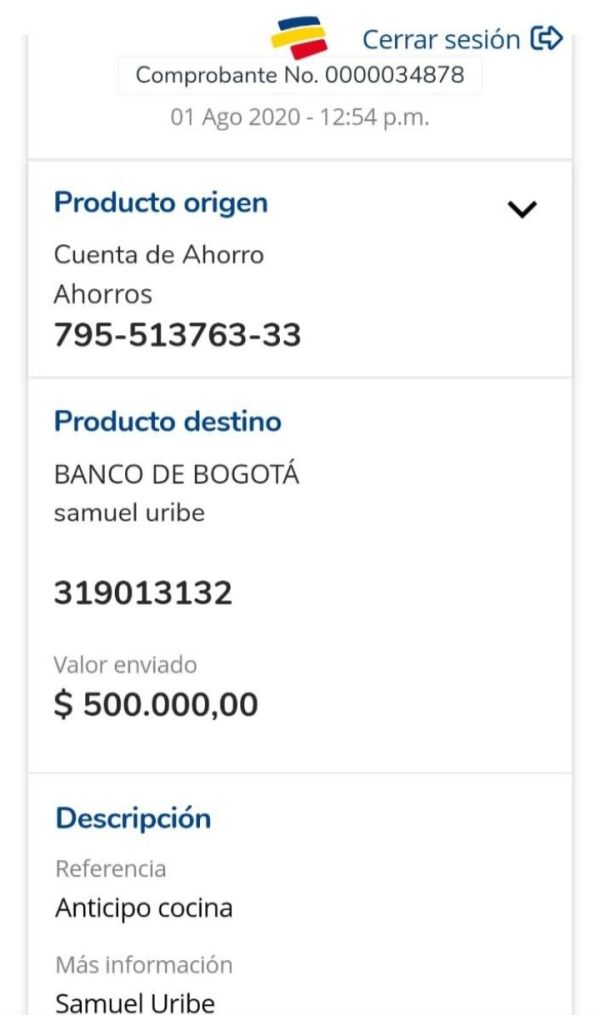

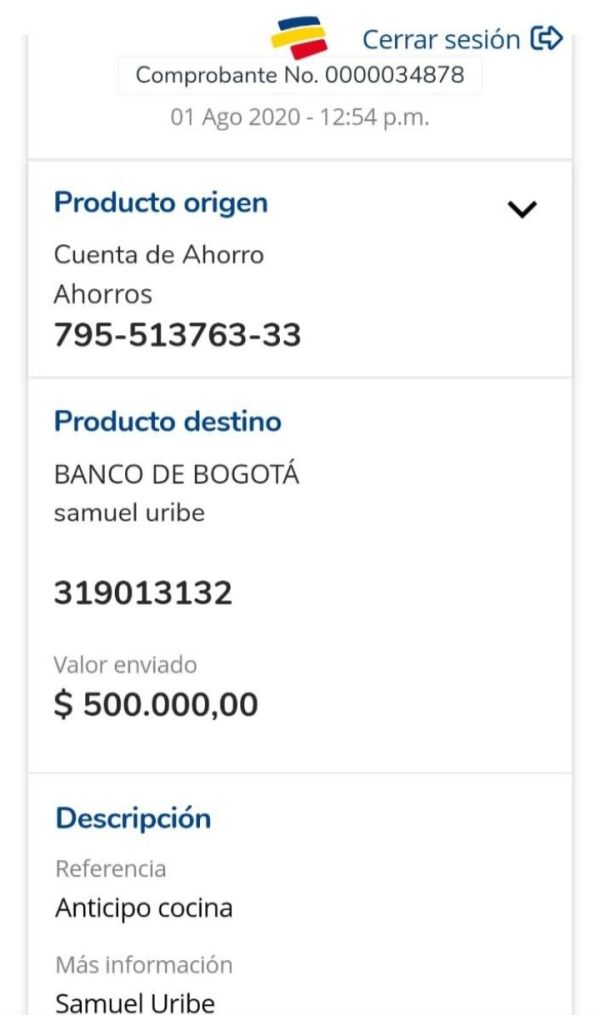

They stole 500,000 pesos from my and did not make me a millionaire as they promised. I was unable to withdraw.

LBO Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They stole 500,000 pesos from my and did not make me a millionaire as they promised. I was unable to withdraw.

This lbo review gives you a complete analysis of what seems to be a big challenge in the forex broker evaluation space. After we did extensive research and investigation, we must admit that LBO as a forex broker lacks enough publicly available information to conduct a thorough assessment. Unlike established brokers with detailed regulatory disclosures, trading conditions, and user feedback, LBO presents an information vacuum that raises immediate concerns for potential traders.

Our investigation reveals no concrete evidence of LBO operating as a legitimate forex brokerage platform. The absence of regulatory information, trading conditions, platform details, and user testimonials suggests either a very new entity with minimal market presence or potentially questionable operations. Without access to fundamental broker characteristics such as licensing details, spread structures, or customer support channels, we cannot provide the standard positive endorsement typically expected in broker reviews.

Given these limitations, our overall assessment remains highly cautious. Our recommendation scores reflect the substantial information gaps rather than verified negative experiences.

Regional Entity Differences: Due to the lack of comprehensive regulatory information about LBO, potential regional variations in services, licensing, or operational status cannot be verified. Traders should exercise extreme caution when considering any broker without clear regulatory oversight.

Review Methodology: This evaluation is based on available public information and standard industry research methods. The absence of verifiable data about LBO's operations significantly limits our ability to provide definitive assessments across key evaluation criteria.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 3/10 | No specific account information available |

| Tools and Resources | 2/10 | No trading tools or educational resources identified |

| Customer Service | 2/10 | No customer support channels documented |

| Trading Experience | 3/10 | No platform information or user experience data |

| Trust Factor | 1/10 | No regulatory information or licensing details |

| User Experience | 2/10 | No user reviews or testimonials available |

Company Background and Establishment

LBO's company background remains largely undocumented in available public records. Unlike established forex brokers that typically provide detailed corporate histories, founding dates, and management team information, LBO lacks these fundamental transparency markers. The absence of basic company information such as establishment year, headquarters location, or corporate structure raises immediate questions about the entity's legitimacy and operational status.

Without access to company registration details, business licenses, or regulatory filings, potential clients cannot verify LBO's legal standing or operational capacity. This information vacuum contrasts sharply with industry standards where reputable brokers prominently display their corporate credentials and regulatory compliance status.

Trading Platform and Business Model

The trading platform infrastructure and business model used by LBO remain unspecified in available documentation. Standard industry practice involves detailed disclosure of platform types, execution models, and technological capabilities. LBO's failure to provide this fundamental information prevents meaningful assessment of their service delivery capacity.

Additionally, the range of tradeable assets, supported currency pairs, and market access provisions cannot be verified. Without clear information about spreads, commissions, overnight fees, or execution policies, potential traders cannot make informed decisions about account suitability or cost structures.

Regulatory Compliance: No specific regulatory authorities or licensing jurisdictions have been identified for LBO operations. This lbo review cannot locate standard regulatory disclosures typically required for forex brokerage operations.

Deposit and Withdrawal Methods: Available funding options and withdrawal procedures remain unspecified in publicly accessible materials. Standard payment processing information is not documented.

Minimum Deposit Requirements: Specific minimum deposit thresholds for different account types have not been disclosed in available sources.

Promotional Offers: No current bonus structures, welcome packages, or promotional campaigns have been identified through standard research channels.

Asset Coverage: The range of forex pairs, commodities, indices, or other tradeable instruments offered by LBO cannot be verified through available information.

Cost Structure: Spread ranges, commission rates, overnight financing charges, and other trading costs remain undocumented in accessible materials.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes are not specified in available documentation.

Platform Selection: Trading platform options, mobile applications, and technological infrastructure details are not provided in standard disclosure materials.

Geographic Restrictions: Specific country limitations or regional service availability cannot be confirmed through available sources.

Customer Support Languages: Available communication languages and support channel details remain unspecified.

The evaluation of LBO's account conditions proves challenging due to the complete absence of documented account specifications. Standard forex broker assessments typically examine multiple account tiers, each with distinct minimum deposit requirements, spread structures, and feature sets. However, this lbo review cannot locate any official documentation outlining basic account parameters.

Industry-standard account information includes details about demo account availability, live account variations, Islamic account options for Sharia-compliant trading, and professional trader classifications. The lack of such fundamental information prevents meaningful comparison with established brokers who typically offer transparent account structures with clearly defined terms and conditions.

Without access to account opening procedures, verification requirements, or documentation standards, potential clients cannot assess the practical aspects of establishing a trading relationship. The absence of minimum deposit thresholds, account maintenance fees, or inactivity charges further complicates any attempt at cost-benefit analysis for prospective traders.

Trading tools and educational resources represent critical components of modern forex brokerage services. Yet LBO provides no verifiable information about such offerings. Established brokers typically feature comprehensive trading calculators, economic calendars, market analysis tools, and technical indicators.

The absence of documentation regarding LBO's analytical capabilities raises questions about their service comprehensiveness. Educational resources, including webinars, trading guides, video tutorials, and market commentary, serve as important value-added services for traders at all experience levels. Without evidence of educational support infrastructure, potential clients cannot evaluate LBO's commitment to trader development and ongoing market education.

Advanced trading features such as automated trading support, API access, social trading capabilities, or copy trading platforms remain unverified. The lack of information about research partnerships, third-party analysis providers, or proprietary market insights further limits assessment of LBO's competitive positioning in the sophisticated tools and resources category.

Customer service infrastructure represents a fundamental aspect of forex brokerage operations. Yet LBO's support capabilities remain entirely undocumented. Standard industry practice involves multiple communication channels including live chat, telephone support, email ticketing systems, and comprehensive FAQ sections.

The absence of basic contact information raises immediate concerns about client support accessibility. Response time standards, multilingual support capabilities, and customer service hours typically receive prominent disclosure from reputable brokers. Without such information, potential clients cannot assess the practical aspects of receiving assistance with account issues, technical problems, or trading disputes.

Professional support services such as dedicated account managers, institutional client services, or specialized technical support remain unverified. The lack of customer service transparency contrasts sharply with industry leaders who typically provide detailed support infrastructure information and client communication protocols.

The trading experience evaluation requires detailed analysis of platform performance, execution quality, and overall user interface design. However, this lbo review encounters significant challenges due to the absence of platform demonstrations, user testimonials, or technical specifications. Standard assessments typically examine order execution speeds, slippage rates, and platform stability during high-volatility periods.

Mobile trading capabilities, including dedicated applications for iOS and Android devices, represent increasingly important aspects of modern trading experience. Without access to mobile platform information or cross-device synchronization capabilities, potential users cannot evaluate LBO's technological sophistication or user experience design.

Advanced trading features such as one-click trading, advanced charting packages, multiple order types, and risk management tools remain unverified. The absence of platform screenshots, feature demonstrations, or user interface examples prevents meaningful assessment of LBO's trading environment quality and functionality.

Trust factor assessment relies heavily on regulatory compliance, financial transparency, and industry reputation verification. Unfortunately, LBO's regulatory status remains unclear, with no identifiable licensing from major financial authorities such as the FCA, CySEC, ASIC, or other recognized regulatory bodies. This absence of regulatory oversight represents a significant concern for potential clients seeking secure trading environments.

Financial safeguards including segregated client accounts, deposit insurance coverage, and negative balance protection cannot be verified through available documentation. Reputable brokers typically provide detailed information about client fund security measures and regulatory capital requirements.

Third-party audits, financial reporting transparency, and industry association memberships remain unconfirmed. Without access to standard trust indicators such as regulatory compliance records, financial stability ratings, or industry recognition awards, potential clients cannot adequately assess LBO's reliability and long-term operational sustainability.

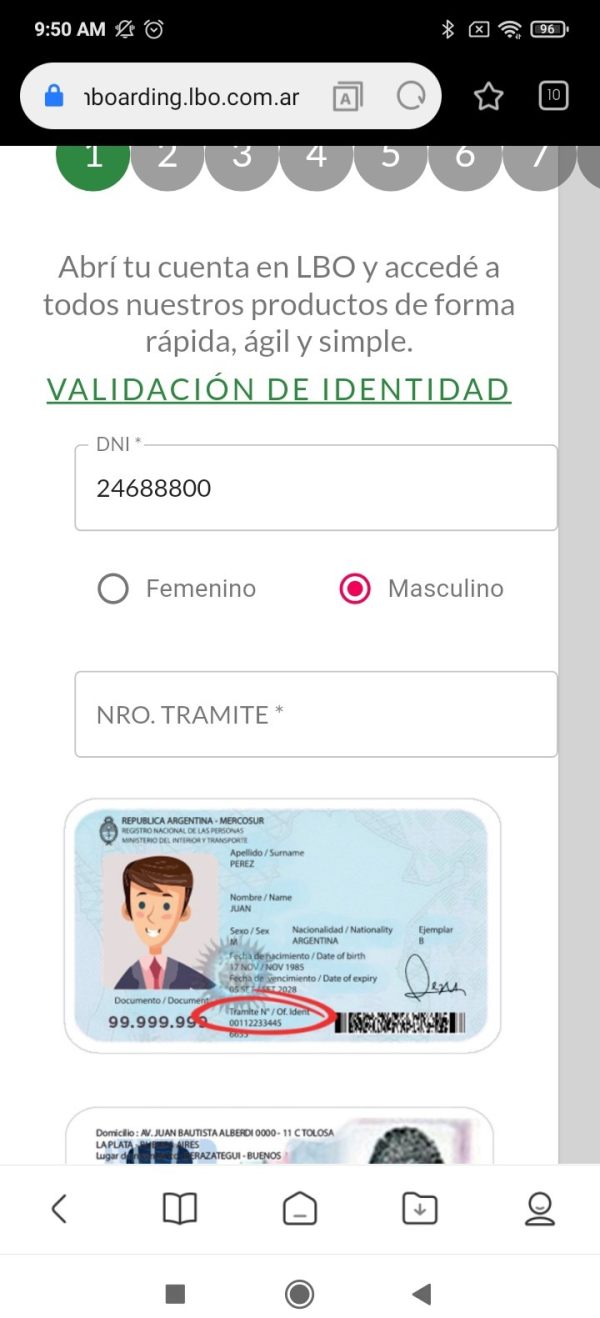

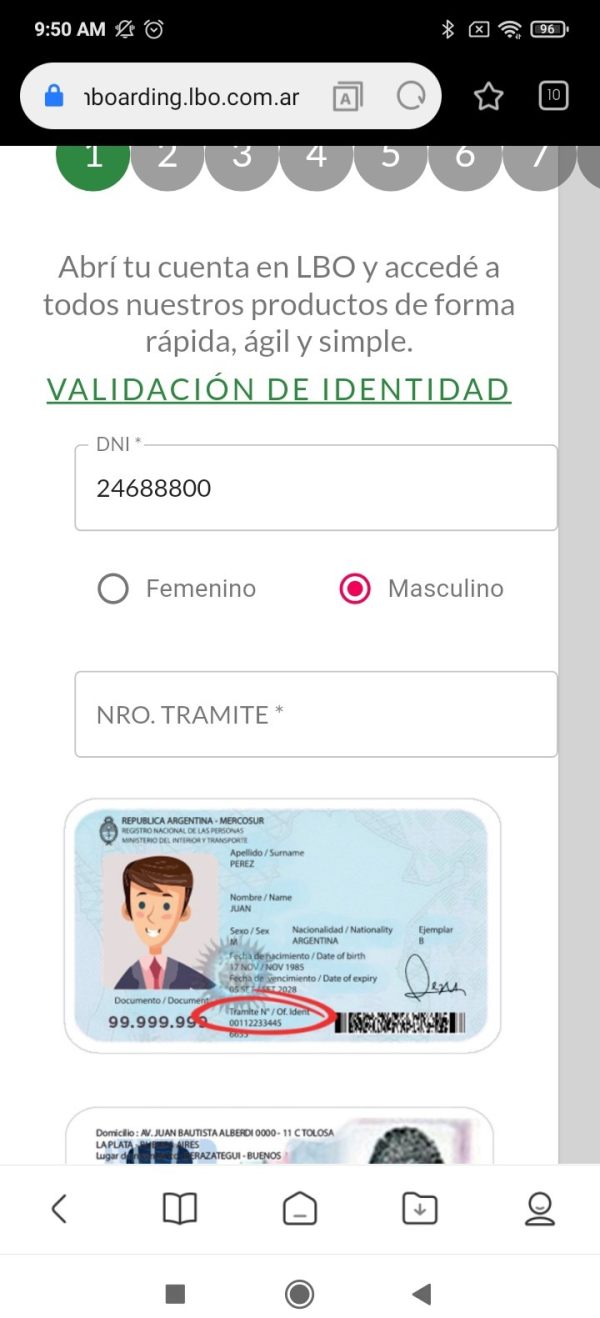

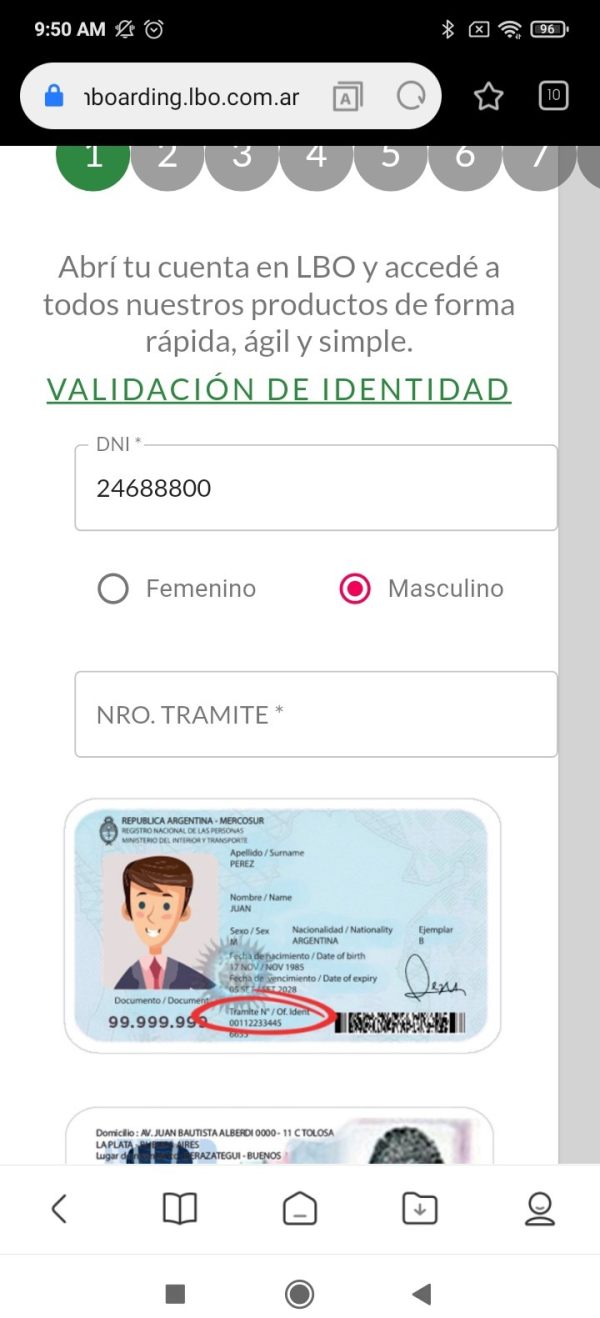

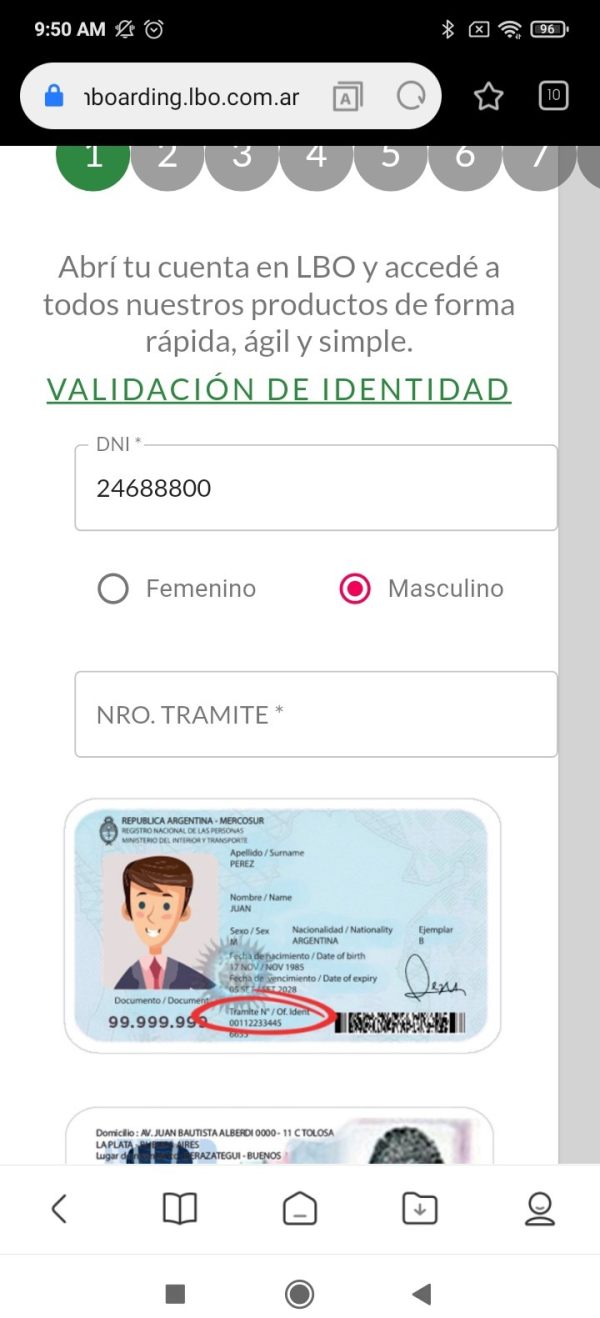

User experience evaluation typically incorporates feedback from active traders, platform usability assessments, and overall satisfaction metrics. However, the absence of verifiable user reviews, testimonials, or community feedback prevents comprehensive user experience analysis for LBO. Standard assessments examine registration processes, account verification procedures, and initial platform navigation experiences.

Interface design quality, learning curve considerations, and accessibility features remain unverified due to limited platform access and documentation. Professional traders often evaluate advanced feature accessibility, customization options, and workflow efficiency, none of which can be assessed without detailed platform exposure.

User onboarding experiences, including welcome processes, initial deposit procedures, and platform orientation support, cannot be evaluated due to information limitations. The absence of user-generated content, community forums, or social media presence further restricts insight into actual client experiences and satisfaction levels.

This comprehensive lbo review reveals significant challenges in evaluating LBO as a forex brokerage option due to substantial information gaps across all critical assessment areas. The absence of regulatory transparency, trading condition details, and user feedback creates an environment of uncertainty that cannot support positive recommendations for potential traders.

Given the lack of verifiable information about fundamental brokerage operations, we cannot identify specific user types who would benefit from LBO's services. The evaluation suggests that traders seeking reliable, transparent, and well-documented brokerage relationships should consider established alternatives with comprehensive regulatory oversight and proven track records.

The primary concerns identified include regulatory uncertainty, operational transparency limitations, and the absence of standard industry disclosures that enable informed decision-making for forex traders.

FX Broker Capital Trading Markets Review