Millennium Alpha 2025 Review: Everything You Need to Know

Summary: The Millennium Alpha review paints a concerning picture of this forex broker, highlighting significant regulatory issues and a lack of transparency. While it offers a variety of trading options, the overall consensus is that potential traders should proceed with extreme caution.

Note: This review addresses the different entities operating under the Millennium Alpha name, which can lead to confusion. It is essential to verify any claims with relevant regulatory bodies to ensure accurate and fair assessments.

Rating Overview

How We Rate Brokers: Our ratings are based on comprehensive research, user feedback, and expert analysis to provide a balanced overview of each broker's offerings.

Broker Overview

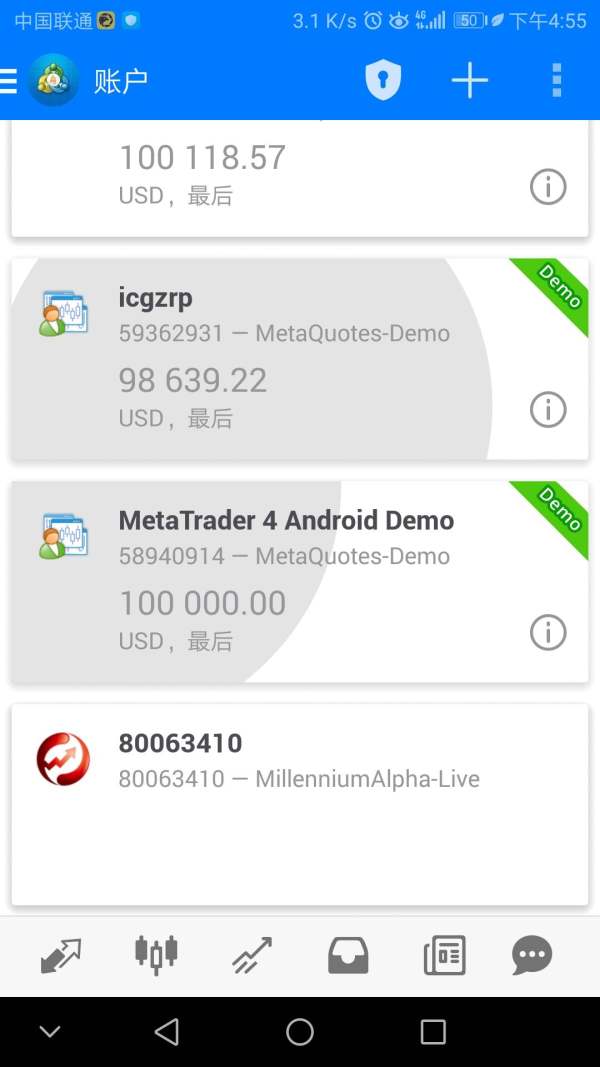

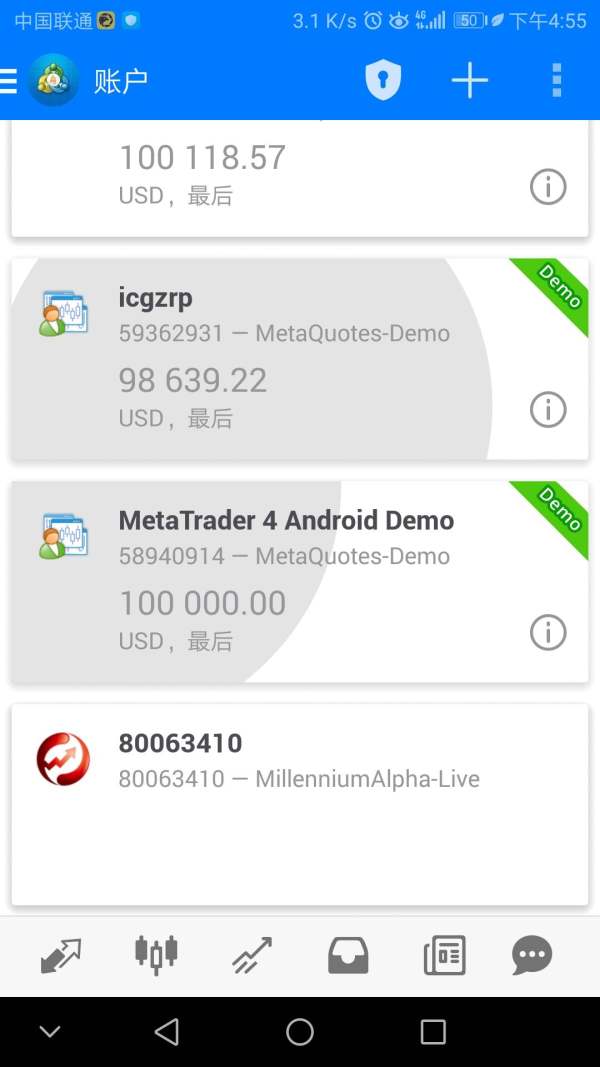

Founded in 2007, Millennium Alpha is an online trading platform that claims to be based in Australia. It positions itself as a forex broker offering various assets, including currency pairs, precious metals, and stocks. The platform primarily utilizes MetaTrader 4 (MT4), which is widely recognized in the trading community for its user-friendly interface and advanced trading tools. However, there are significant concerns regarding its regulatory status, as it claims to be regulated by the Australian Securities and Investments Commission (ASIC), a claim that is disputed and suspected to be a clone operation.

Detailed Analysis

Regulatory Areas: Millennium Alpha claims to operate under the regulatory frameworks of Australia and Malaysia; however, multiple sources indicate that it is unregulated and operates anonymously. No verification of its regulatory claims has been found in official registers, which raises red flags about its legitimacy.

Deposit/Withdrawal Currency/Cryptocurrency: The broker reportedly accepts various e-wallets for deposits, including Skrill and Neteller, but does not mention credit card options, which is a common practice among dubious brokers. This lack of transparency regarding payment methods is concerning.

Minimum Deposit: The minimum deposit requirement is stated to be $100, which is relatively low. However, given the broker's questionable reputation, this amount may not be worth the risk.

Bonuses/Promotions: There is little information available regarding bonuses or promotional offers, which is not uncommon for brokers with a lack of transparency.

Tradable Asset Classes: Millennium Alpha offers a range of tradable assets, including forex pairs, precious metals, and stocks. However, the quality and execution of trades remain questionable due to its regulatory issues.

Costs (Spreads, Fees, Commissions): Specific details on spreads and fees are not readily available, which is a common tactic used by brokers to obscure their actual trading costs. Potential traders should be wary of hidden fees that may arise.

Leverage: The broker claims to provide leverage of up to 1:400, which is significantly higher than what is typically allowed in regulated markets. This high leverage can be enticing but also increases the risk of substantial losses.

Allowed Trading Platforms: Millennium Alpha primarily offers the MetaTrader 4 platform, a popular choice among traders for its advanced features. However, the reliability of the platform may be compromised given the broker's overall dubious standing.

Restricted Areas: The broker does not provide clear information on restricted areas, but it is advisable for potential clients to check local regulations before engaging.

Available Customer Service Languages: Customer service options appear limited, which could pose challenges for traders seeking assistance. The lack of robust customer support is often a telltale sign of untrustworthy brokers.

Detailed Rating Breakdown

-

Account Conditions (2/10): The minimum deposit is low, but the lack of regulatory oversight significantly undermines the benefits of opening an account.

Tools and Resources (4/10): While the MT4 platform is a strong feature, the overall lack of educational resources and support diminishes its value.

Customer Service and Support (3/10): Limited customer support options can lead to frustration, especially for new traders seeking guidance.

Trading Setup (4/10): Although the trading platform is reputable, the underlying issues with the broker's legitimacy overshadow its capabilities.

Trustworthiness (1/10): The absence of credible regulation and transparency leads to a very low trust rating, indicating significant risks for potential clients.

User Experience (2/10): User reviews indicate a troubling trend of withdrawal issues and customer dissatisfaction, contributing to a negative overall experience.

Conclusion

In conclusion, the Millennium Alpha review suggests that this broker poses considerable risks for traders. While it offers an array of trading opportunities through its diverse asset classes and the MT4 platform, the severe regulatory concerns and lack of transparency are significant deterrents. Potential clients are strongly advised to conduct thorough due diligence and consider alternative, well-regulated brokers before making any trading decisions.

Traders should be cautious and prioritize safety by selecting brokers with reputable regulatory oversight to safeguard their investments.