Is Millennium Alpha safe?

Pros

Cons

Is Millennium Alpha a Scam?

Introduction

Millennium Alpha is an online forex and CFD broker that claims to operate with a focus on providing a wide range of trading instruments, including currency pairs, precious metals, and indices. Established in 2007, the broker positions itself as a competitive player in the crowded forex market. However, the rise of online trading has also led to an increase in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article aims to provide a comprehensive analysis of Millennium Alpha, examining its regulatory status, company background, trading conditions, customer experience, and overall risks associated with trading on its platform. The evaluation is based on data gathered from various financial review sites and user feedback.

Regulation and Legitimacy

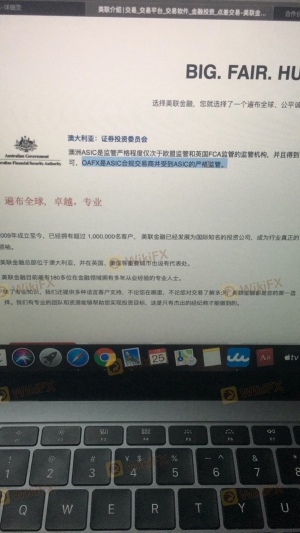

A broker's regulatory status is one of the most critical factors in determining its trustworthiness. Millennium Alpha claims to be regulated by the Australian Securities and Investments Commission (ASIC), but there are significant concerns regarding the legitimacy of this claim. The following table summarizes the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

Despite claiming to hold a license from ASIC, numerous reviews indicate that Millennium Alpha is not listed in the official registers of any recognized financial authority. This raises serious questions about its regulatory compliance and operational legitimacy. The lack of a verifiable license is a red flag for potential investors, as trading with unregulated brokers can lead to significant financial losses. Furthermore, the broker's website appears to be anonymous, which is commonly associated with scams. Thus, when asking, "Is Millennium Alpha safe?", the evidence suggests otherwise.

Company Background Investigation

Millennium Alpha was founded in 2007 and claims to be based in Australia. However, the lack of transparency surrounding its ownership structure and management team is concerning. Reliable brokers typically provide detailed information about their leadership, including professional backgrounds and relevant experience in the financial markets. In the case of Millennium Alpha, such information is either missing or difficult to verify. This opacity raises questions about the broker's accountability and operational integrity.

The management team's background is crucial in assessing a broker's credibility. Experienced professionals with a strong track record in finance can significantly enhance a company's reputation. Unfortunately, the absence of such information about Millennium Alpha leaves potential clients in the dark. Without clear insights into the company's history and management, traders may find it challenging to trust this broker. Therefore, when considering the question, "Is Millennium Alpha safe?", the answer leans toward caution due to its unclear corporate governance.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Millennium Alpha claims to offer competitive trading conditions, including a minimum deposit requirement of $100 and leverage up to 1:400. However, the broker's fee structure raises concerns.

The following table compares Millennium Alpha's trading costs with industry averages:

| Fee Type | Millennium Alpha | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies (typically $0 - $10 per lot) |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads and commissions is alarming. Traders should be able to access clear information about the costs associated with trading, as hidden fees can significantly erode profits. Moreover, the absence of a defined commission structure raises suspicions about the broker's practices. If a broker is unwilling to disclose its fee structure, it may be attempting to obscure unfavorable trading conditions, leading to the conclusion that "Is Millennium Alpha safe?" is a question that requires careful consideration.

Customer Funds Security

The safety of client funds is paramount when choosing a broker. Millennium Alpha claims to implement various security measures, including segregated accounts and investor protection policies. However, the broker's lack of clear regulatory oversight raises concerns about the effectiveness of these measures.

A thorough evaluation of Millennium Alpha's fund security policies reveals the following:

- Segregated Accounts: The broker does not guarantee the use of segregated accounts, which is a standard practice among reputable brokers to protect client funds.

- Investor Protection: There is no clear information on whether Millennium Alpha participates in any compensation schemes that would protect investors in the event of insolvency.

- Negative Balance Protection: It is unclear whether the broker offers negative balance protection, which is crucial for safeguarding clients from losing more than their initial investment.

Given the potential risks associated with trading with an unregulated broker, it is essential for traders to ask themselves, "Is Millennium Alpha safe?" The evidence suggests that the broker does not provide adequate safeguards for client funds.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of Millennium Alpha indicate a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer service.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common patterns in customer complaints include difficulties in withdrawing funds and unresponsive customer support. These issues can lead to frustration and distrust among traders, further underscoring the need for caution. A couple of notable case studies highlight these concerns:

- Case Study 1: A user reported being unable to withdraw funds for several months, leading to significant financial distress. The company's responses were vague and unhelpful, raising suspicions about its operational practices.

- Case Study 2: Another trader highlighted misleading promotional materials that promised high returns but failed to deliver, leading to a loss of trust in the broker.

- Order Execution Quality: Users have reported instances of delayed order execution, which can impact trading outcomes, especially in fast-moving markets.

- Slippage: Traders have noted that slippage can occur, particularly during high volatility, which can lead to unexpected losses.

- Platform Manipulation: While there are no concrete allegations of platform manipulation, the lack of transparency raises concerns about the broker's practices.

- Conduct thorough research on the broker.

- Consider trading with regulated alternatives.

- Test the platform with a demo account before committing funds.

Given these experiences, potential clients should seriously consider whether "Is Millennium Alpha safe?" The evidence points to a concerning pattern of negative customer experiences.

Platform and Execution

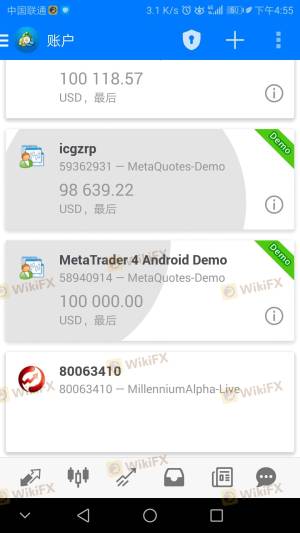

The trading platform's performance and execution quality are critical factors for traders. Millennium Alpha claims to offer the widely used MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools. However, user reviews suggest that the platform may experience stability issues, leading to concerns about order execution quality and slippage.

Several key aspects to consider include:

In light of these factors, the question "Is Millennium Alpha safe?" becomes increasingly relevant, as the potential for execution-related issues can significantly affect trading performance.

Risk Assessment

When considering Millennium Alpha, it is essential to evaluate the overall risks associated with trading on its platform. The following risk assessment summarizes key risk categories:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No verifiable regulation. |

| Fund Security Risk | High | Lack of proper safeguards. |

| Customer Service Risk | Medium | Poor response to complaints. |

| Execution Risk | High | Issues with order execution. |

To mitigate these risks, potential traders should:

In conclusion, the risks associated with Millennium Alpha are significant, leading to the conclusion that traders should approach this broker with caution.

Conclusion and Recommendations

After a comprehensive analysis of Millennium Alpha, it is evident that potential clients should be wary of engaging with this broker. The lack of verifiable regulation, transparency regarding trading conditions, and negative customer experiences all contribute to the conclusion that "Is Millennium Alpha safe?" is a question that leans heavily towards skepticism.

For traders seeking a reliable and secure trading environment, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia. Reputable alternatives include brokers like IG Markets and FP Markets, which have established track records and offer transparent trading conditions. Ultimately, traders should prioritize safety and regulatory compliance to protect their investments effectively.

Is Millennium Alpha a scam, or is it legit?

The latest exposure and evaluation content of Millennium Alpha brokers.

Millennium Alpha Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Millennium Alpha latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.