MGMEx 2025 Review: Everything You Need to Know

Executive Summary

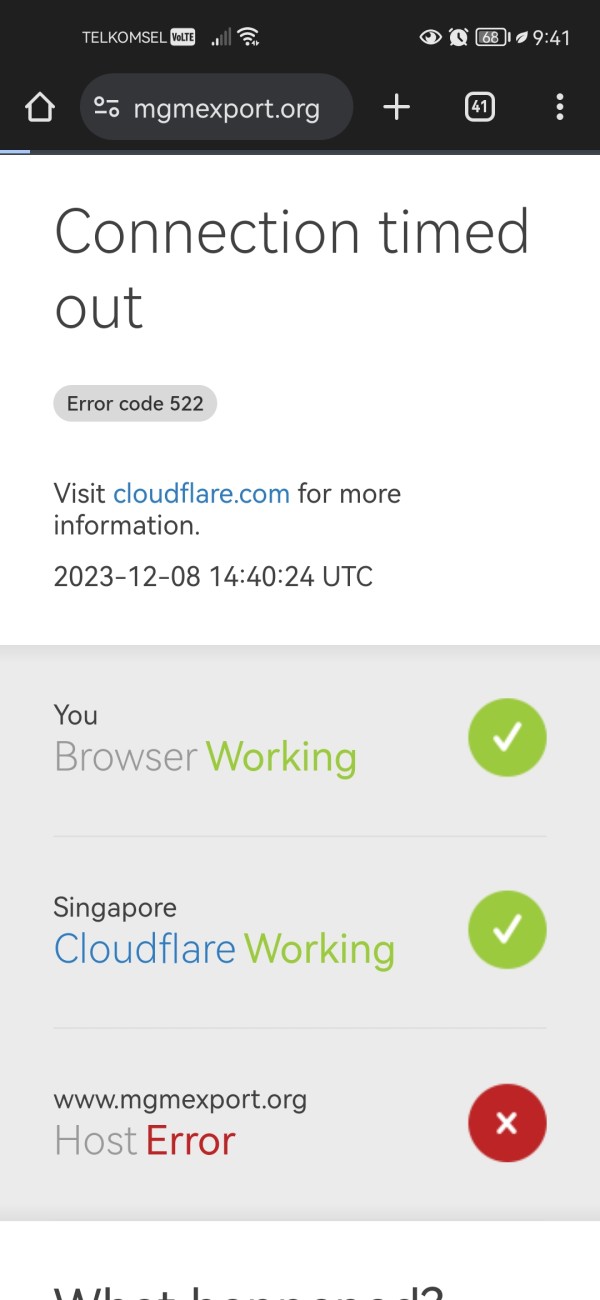

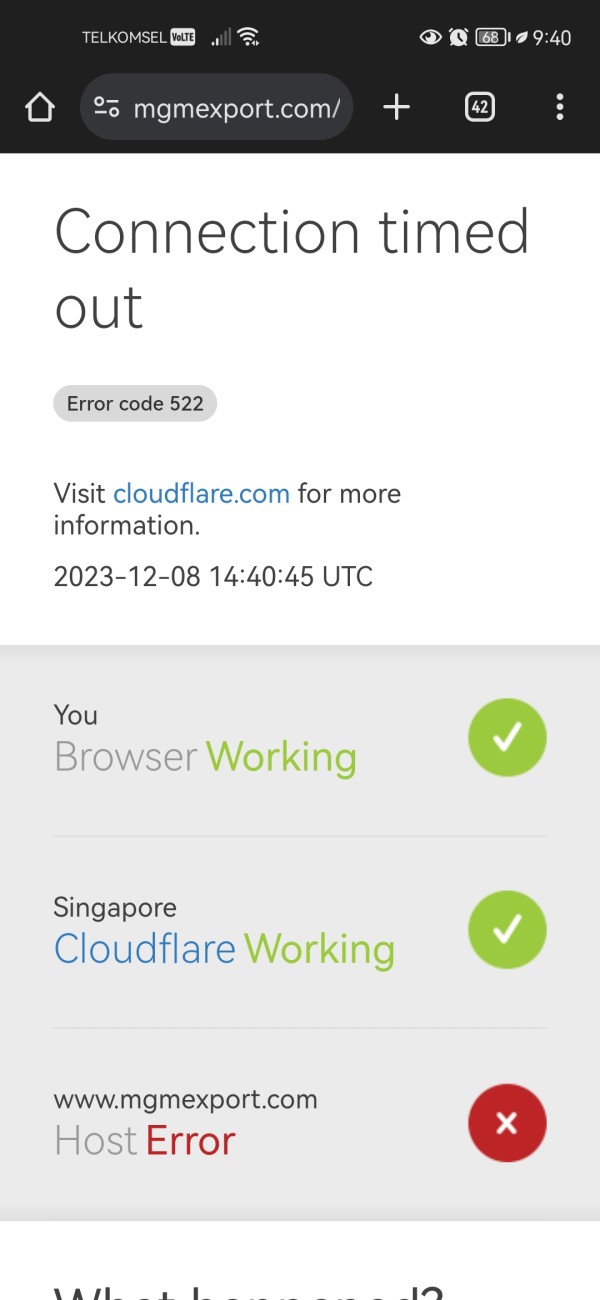

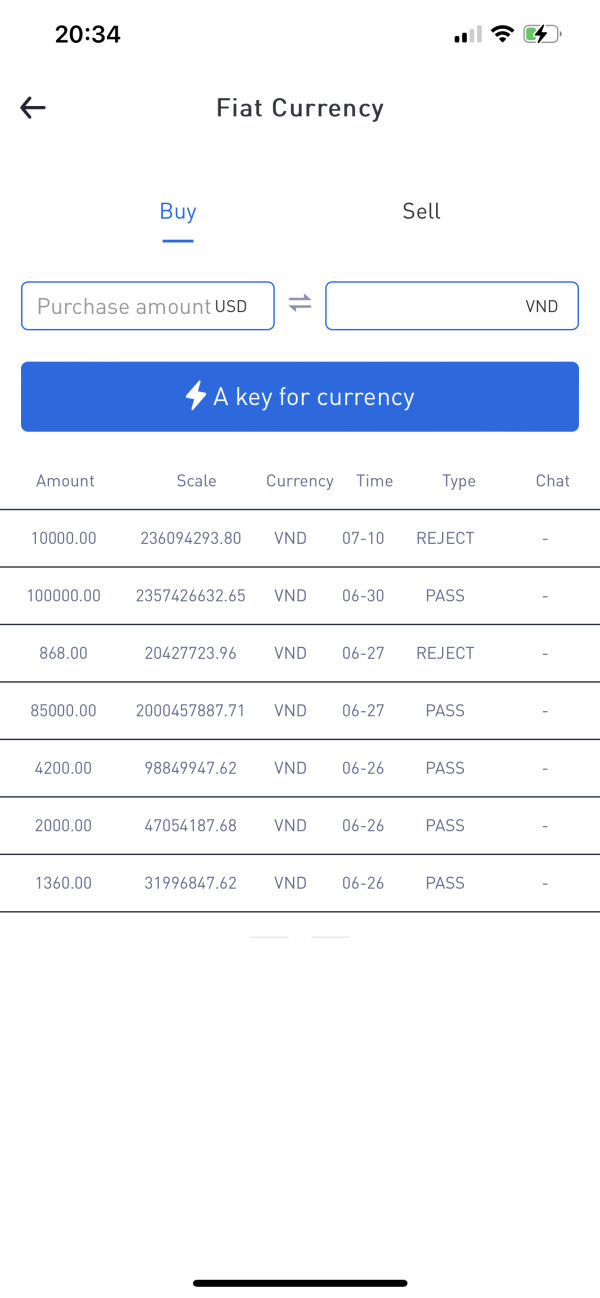

This mgmex review shows major concerns about this commodity futures trading company that started in 2018. Our deep analysis of user feedback and available information reveals that MGMEx presents a mixed picture for potential traders who want to invest their money safely. The broker offers some good features like proprietary trading platform support for MT4 and 24/7 online chat services, but serious red flags appear when we look at customer support quality and regulatory oversight.

The platform mainly targets investors who want commodity and currency trading opportunities. It positions itself as a complete trading solution that can handle all your trading needs. However, user feedback consistently shows dissatisfaction with customer support response times and service quality, which raises serious questions about how the broker operates day to day.

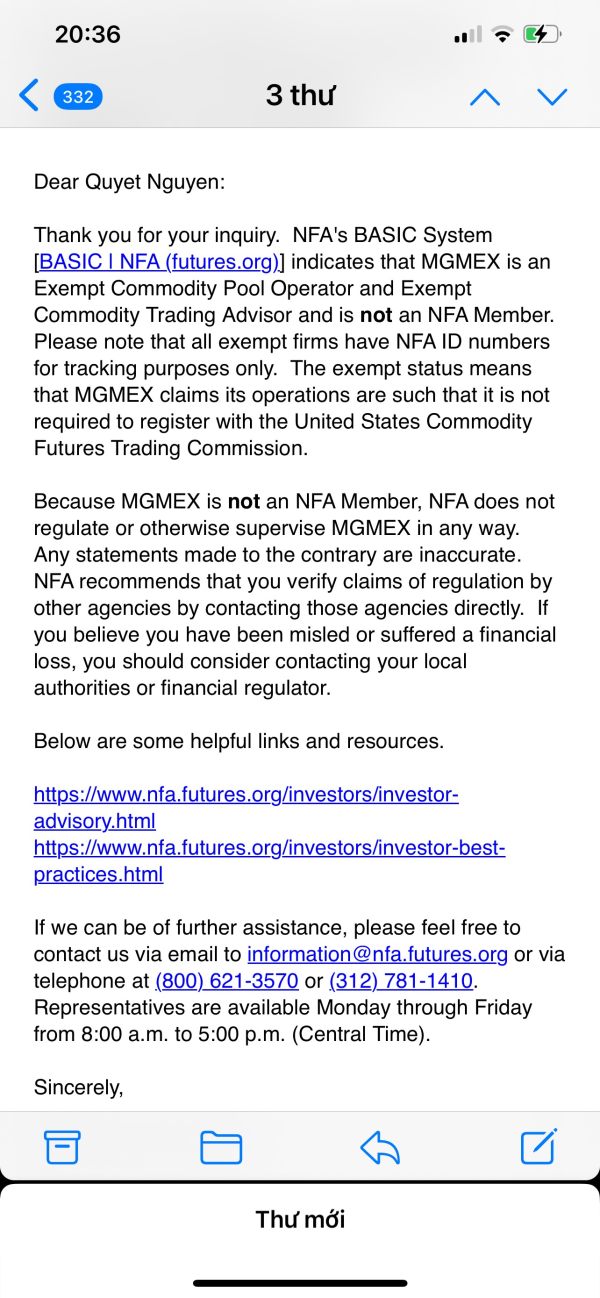

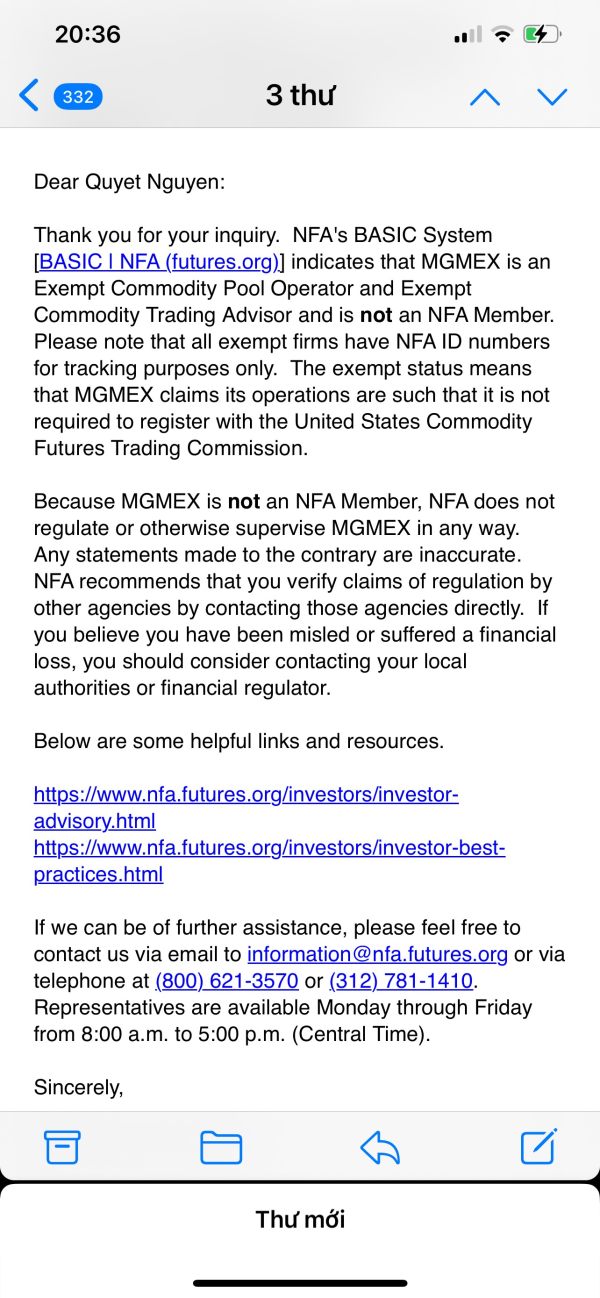

Most concerning is the clear lack of regulatory oversight. This poses significant risks for trader fund safety and dispute resolution when problems arise.

Given these findings, this mgmex review cannot provide a positive recommendation. This is especially true for risk-averse traders who prioritize security and reliable customer service above all else. The combination of unregulated status and poor customer support creates a challenging environment for serious traders who want to protect their investments.

Important Notice

This review is based on comprehensive analysis of publicly available information and user feedback collected from various trading forums and review platforms. Readers should note that regulatory information for MGMEx was not clearly specified in available sources, which may indicate potential regulatory gaps that traders should carefully consider before investing.

Our evaluation methodology incorporates multiple data sources including user testimonials, platform features analysis, and industry standard comparisons. This helps us provide an objective assessment that traders can trust when making decisions. Given the limited transparency regarding regulatory status, traders are strongly advised to conduct additional due diligence before engaging with this broker and risking their money.

Rating Framework

Broker Overview

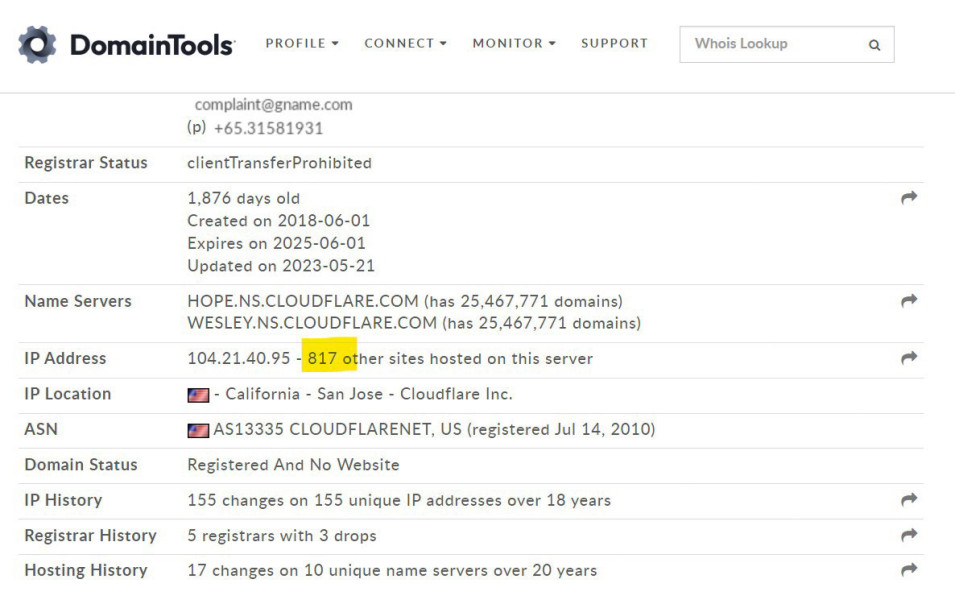

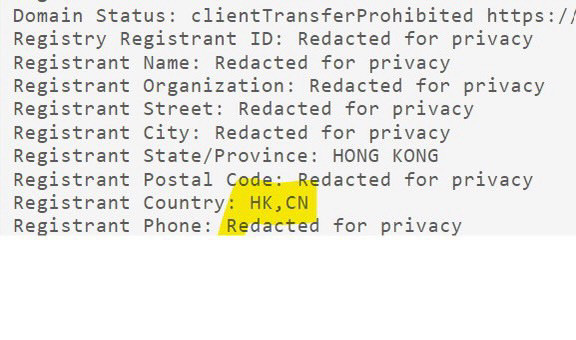

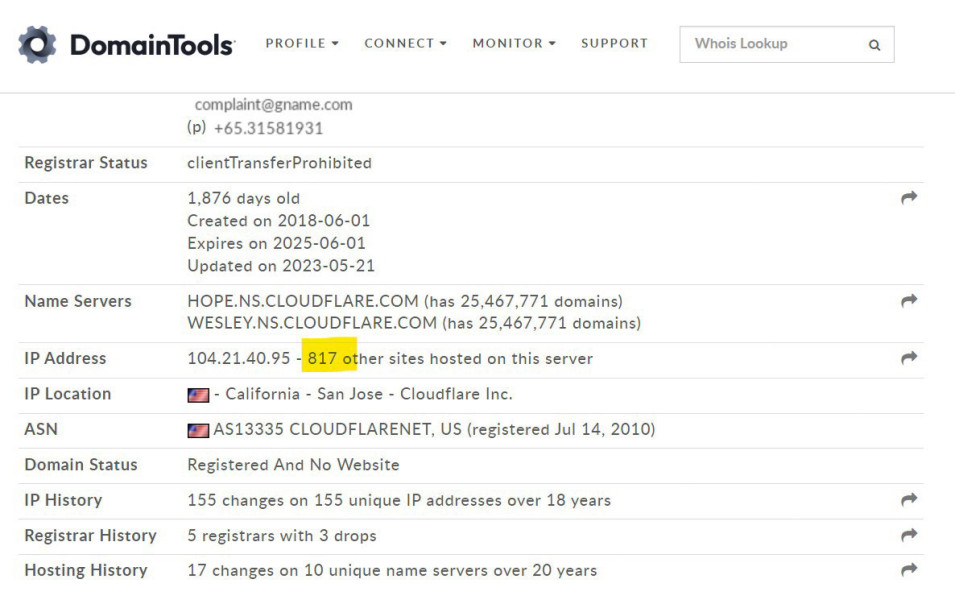

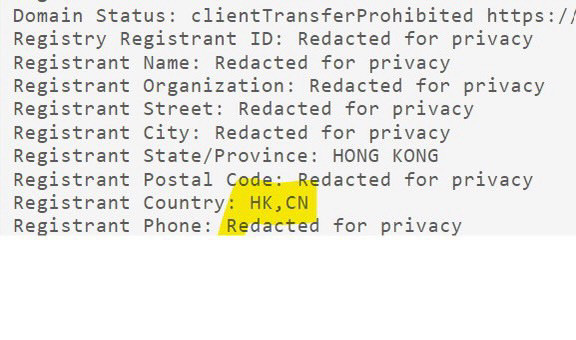

MGMEx emerged in the trading landscape in 2018 as a commodity futures trading company headquartered in the United States. The company positions itself as a specialized provider that focuses on commodity and currency trading services for investors who want access to these markets.

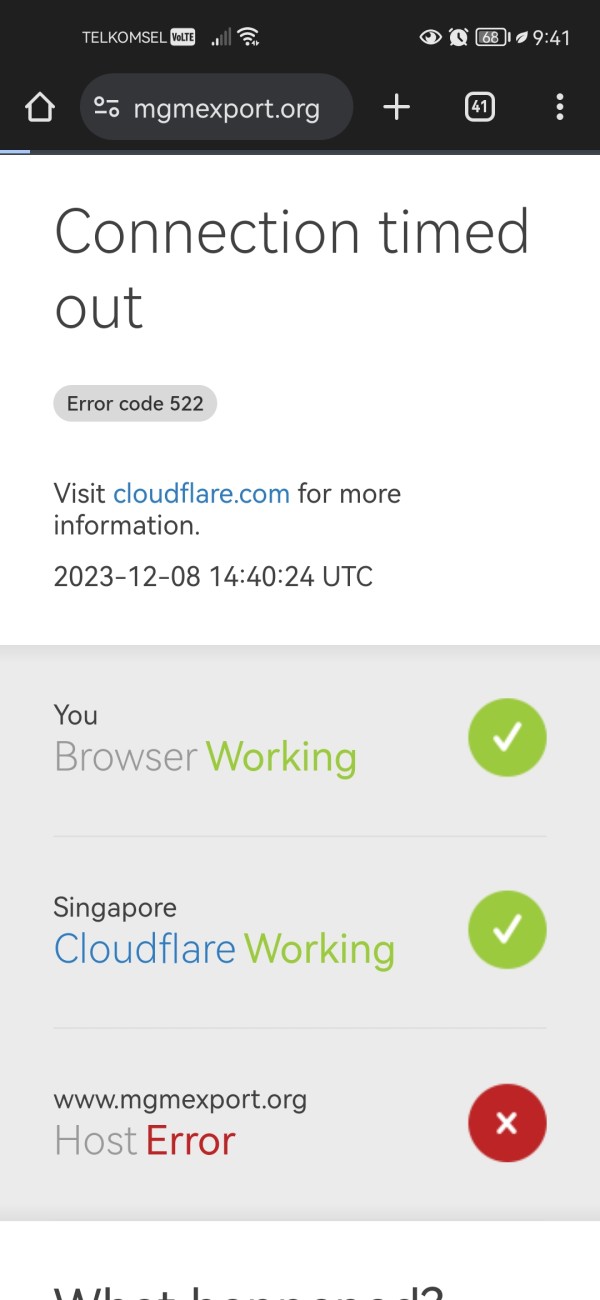

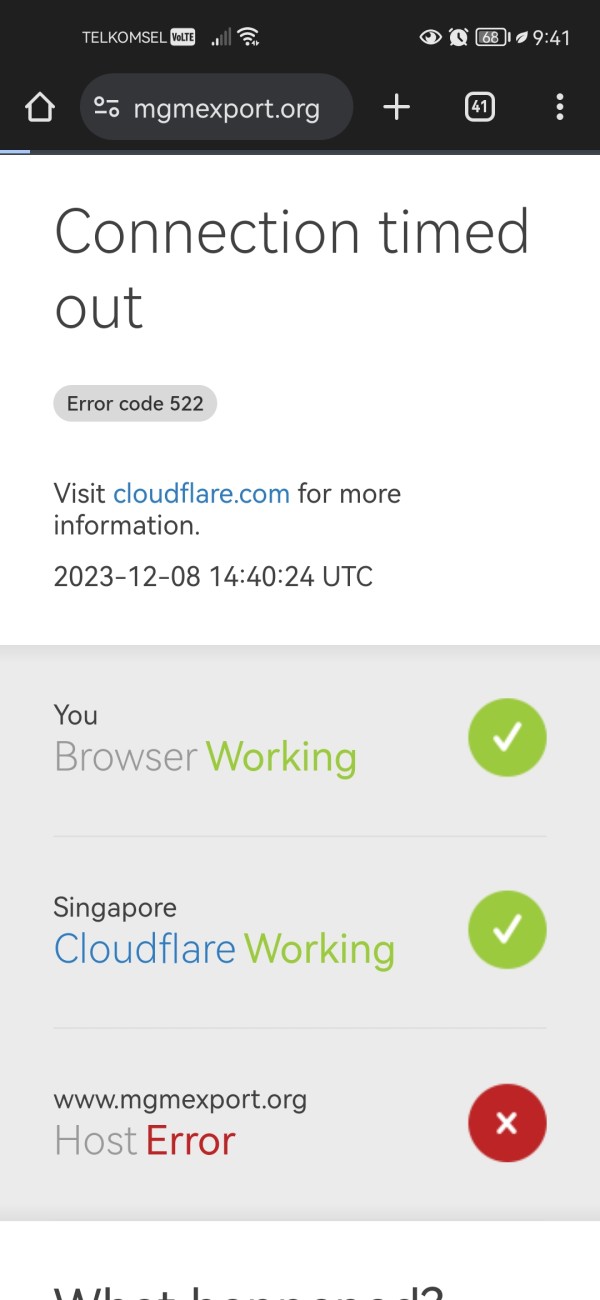

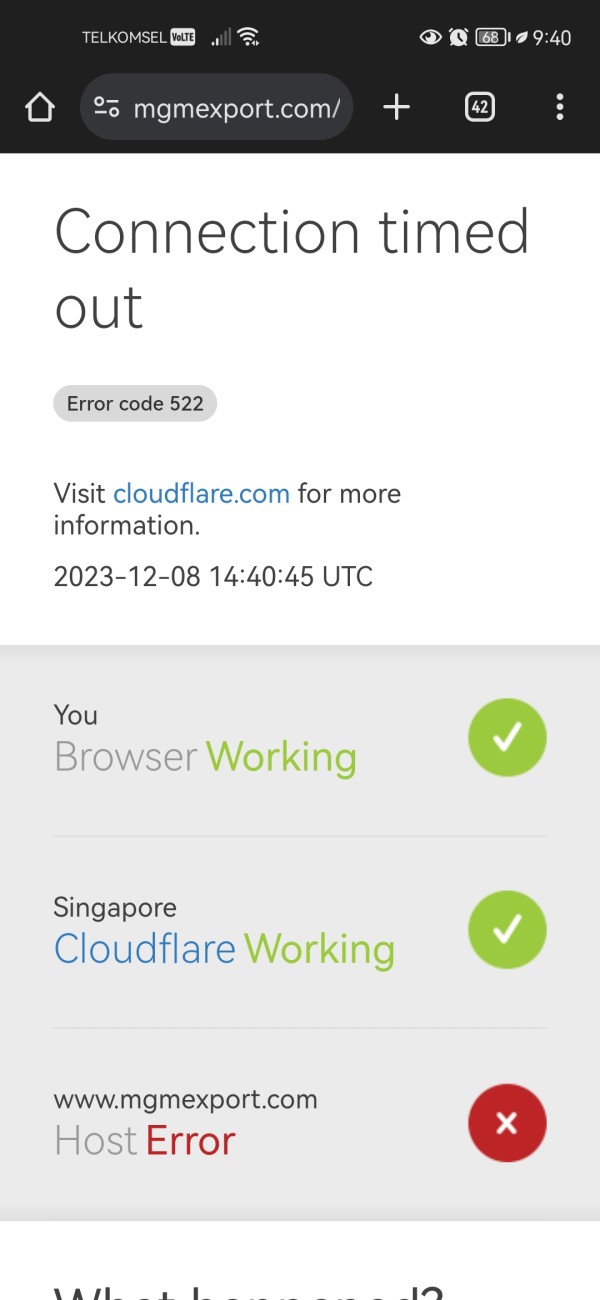

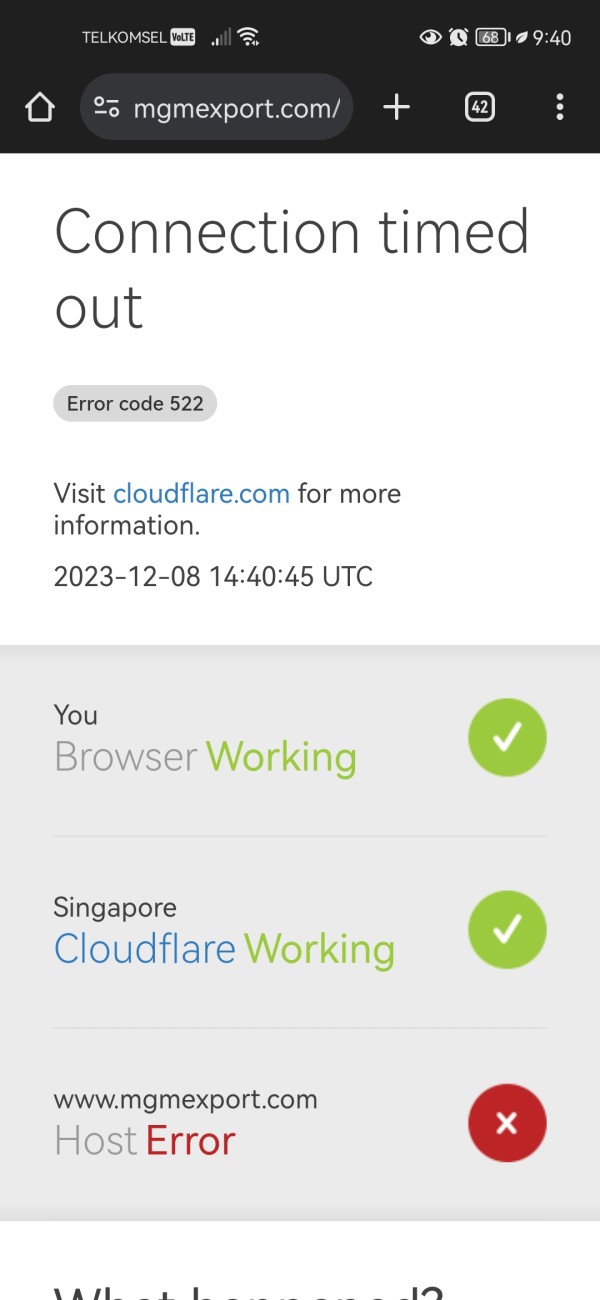

However, significant concerns arise from its operational model. MGMEx operates without apparent regulatory oversight, which industry experts consider a substantial red flag that should worry potential traders. The lack of regulatory supervision raises questions about fund safety, dispute resolution mechanisms, and adherence to industry standards that protect trader interests when things go wrong.

The broker's business model centers around providing access to commodity futures markets alongside currency trading opportunities. This mgmex review found that while the company offers legitimate trading services, the absence of regulatory backing creates an environment where potential fraud risks cannot be adequately mitigated by outside authorities. The company's transparency regarding its operational procedures, fund segregation practices, and risk management protocols remains limited based on available public information that we could find.

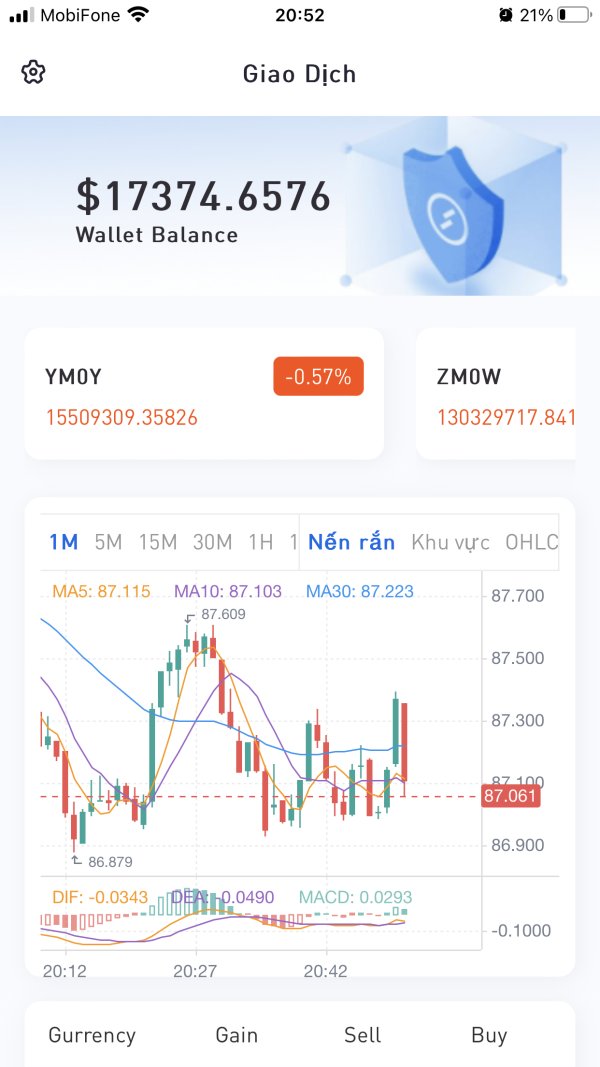

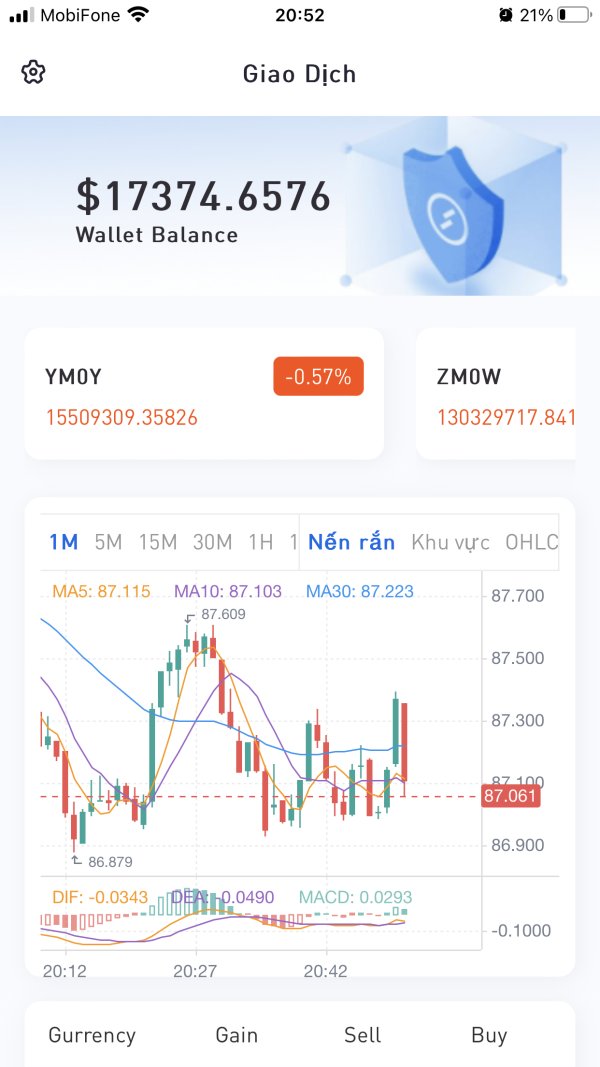

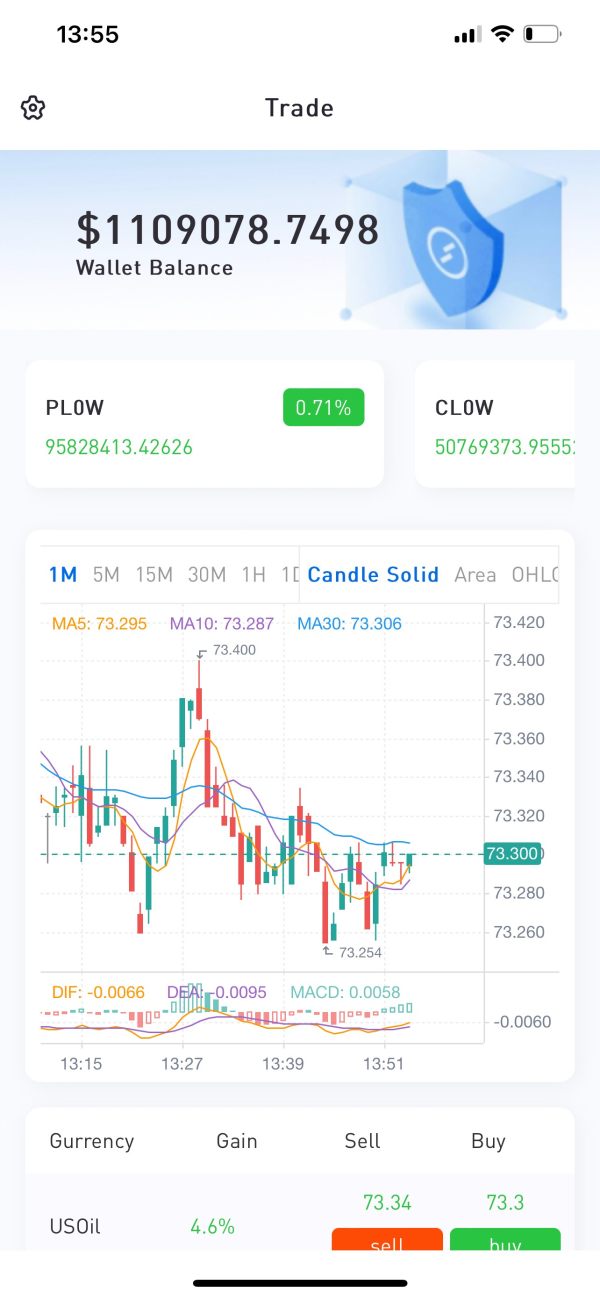

MGMEx operates through proprietary trading technology while simultaneously offering MetaTrader 4 platform access. This suggests an attempt to cater to both novice and experienced traders who have different needs and preferences. The platform supports commodity and currency trading, targeting investors specifically interested in these asset classes rather than stocks or bonds.

However, the combination of limited regulatory oversight and documented customer service issues creates a challenging proposition. This makes it difficult for traders who are seeking reliable, long-term trading partnerships to trust this broker with their money.

Regulatory Status: Available information does not specify clear regulatory oversight, which represents a significant concern for potential traders seeking protected trading environments.

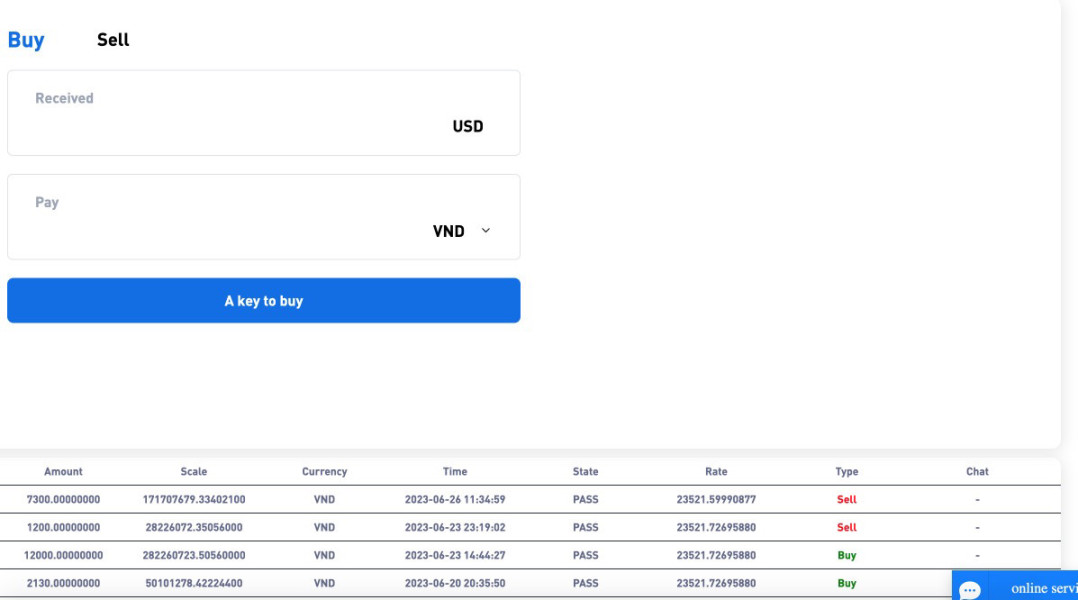

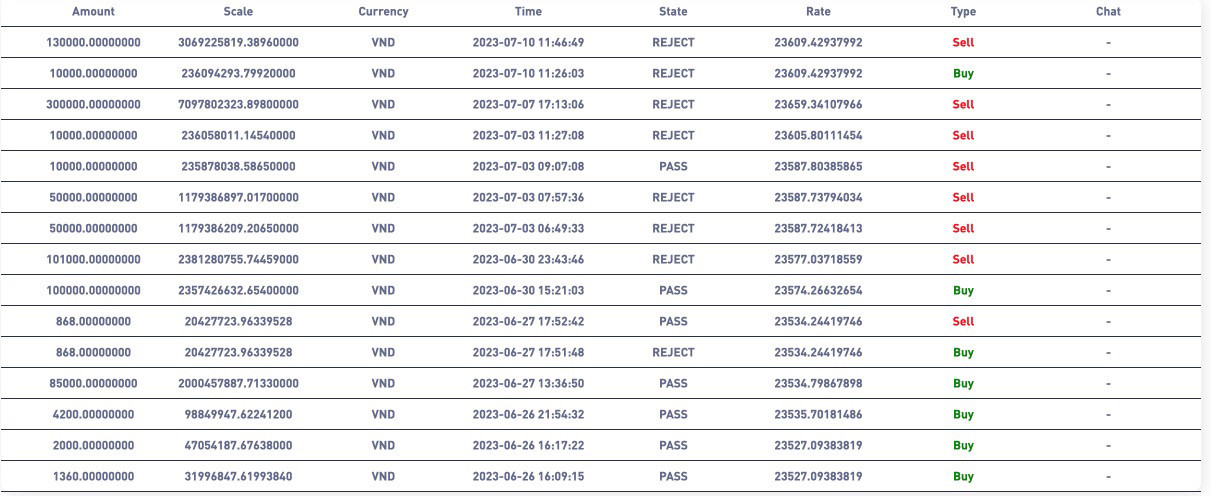

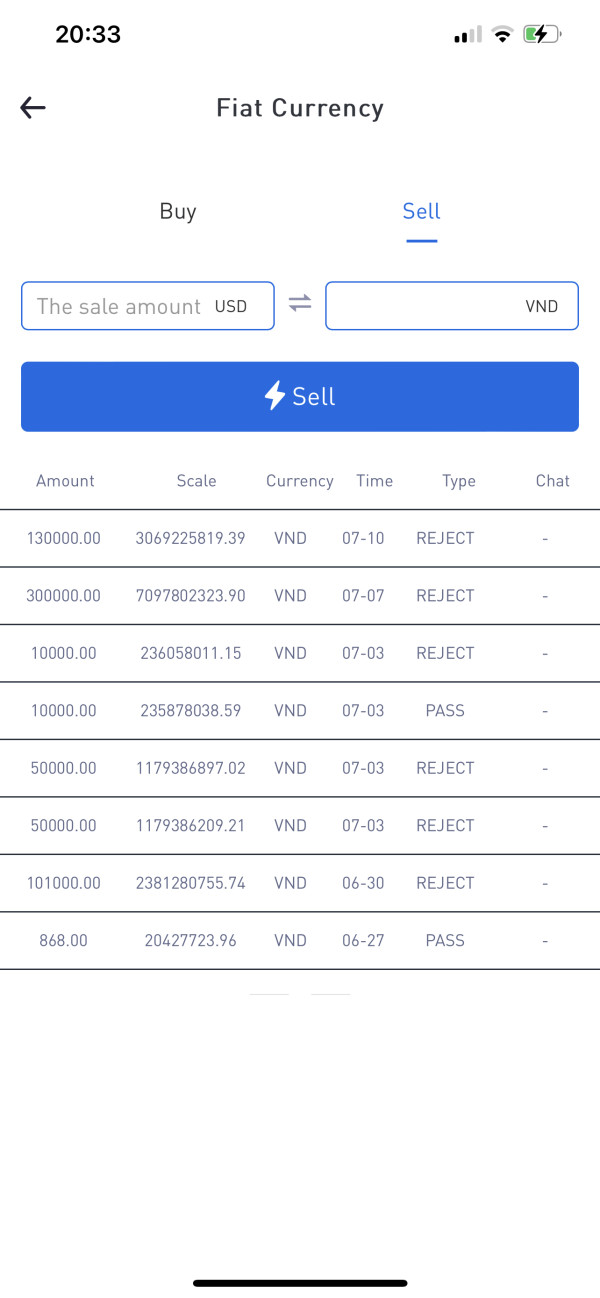

Deposit and Withdrawal Methods: Specific information regarding funding options was not detailed in available materials. This requires direct broker contact for clarification, which may be inconvenient for potential traders.

Minimum Deposit Requirements: Exact minimum deposit amounts were not specified in reviewed sources. This indicates potential transparency issues that should concern potential clients.

Bonus and Promotions: No specific promotional offers or bonus structures were mentioned in available information.

Tradeable Assets: The platform focuses on commodity and currency trading. It provides access to these specific market segments for interested investors who want to trade these assets.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not available in reviewed materials. This limits cost comparison capabilities for potential traders who want to understand their expenses.

Leverage Options: Specific leverage ratios and margin requirements were not detailed in available sources.

Platform Options: MGMEx provides both proprietary trading platform access and MetaTrader 4 support. This offers flexibility for different trader preferences and experience levels.

Geographic Restrictions: Specific regional limitations were not clearly outlined in available information.

Customer Service Languages: Language support details were not specified in reviewed materials.

This mgmex review highlights the significant information gaps that potential traders should consider. These gaps make it difficult to evaluate this broker option properly before investing money.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of MGMEx's account conditions proves challenging due to limited available information regarding account types, minimum deposit requirements, and specific features offered to different trader categories. This lack of transparency represents a significant concern for potential clients who want comprehensive understanding of their trading options before committing funds to any broker.

Industry standards typically require brokers to provide clear information about various account tiers, associated benefits, minimum funding requirements, and special features. These might include Islamic accounts for religious compliance or VIP accounts for high-volume traders. The absence of readily available account condition details suggests either poor marketing transparency or potential operational limitations that may impact trader experience in negative ways.

Without specific information about account opening procedures, verification requirements, or special account features, traders cannot adequately assess whether MGMEx meets their individual trading needs. This information gap particularly affects new traders who rely on clear account structure understanding to make informed decisions about where to invest their money.

The lack of detailed account condition information in this mgmex review necessitates direct broker contact for clarification. This may indicate operational inefficiencies or deliberate opacity regarding trading terms and conditions that should worry potential clients.

MGMEx demonstrates reasonable capability in trading tools and resources by offering both proprietary platform technology and MetaTrader 4 access. This dual-platform approach suggests recognition of diverse trader preferences, with proprietary systems potentially offering unique features while MT4 provides familiar functionality for experienced traders who already know how to use it.

The availability of MetaTrader 4 represents a significant positive aspect for this broker. This platform enjoys widespread industry acceptance due to its robust charting capabilities, extensive technical indicator library, and automated trading support that many traders rely on. However, specific details about the proprietary platform's features, capabilities, and unique advantages were not available in reviewed materials that we could access.

Critical gaps exist regarding research and analysis resources, educational materials, and market commentary that typically support trader decision-making. Professional trading environments usually provide economic calendars, market analysis, educational webinars, and trading guides to enhance trader capabilities and success rates over time.

The absence of detailed information about advanced trading tools, research resources, and educational support suggests potential limitations in comprehensive trader support. While platform availability represents a foundation for trading, the lack of supplementary resources may limit trader development and success potential in the long run.

Customer Service and Support Analysis

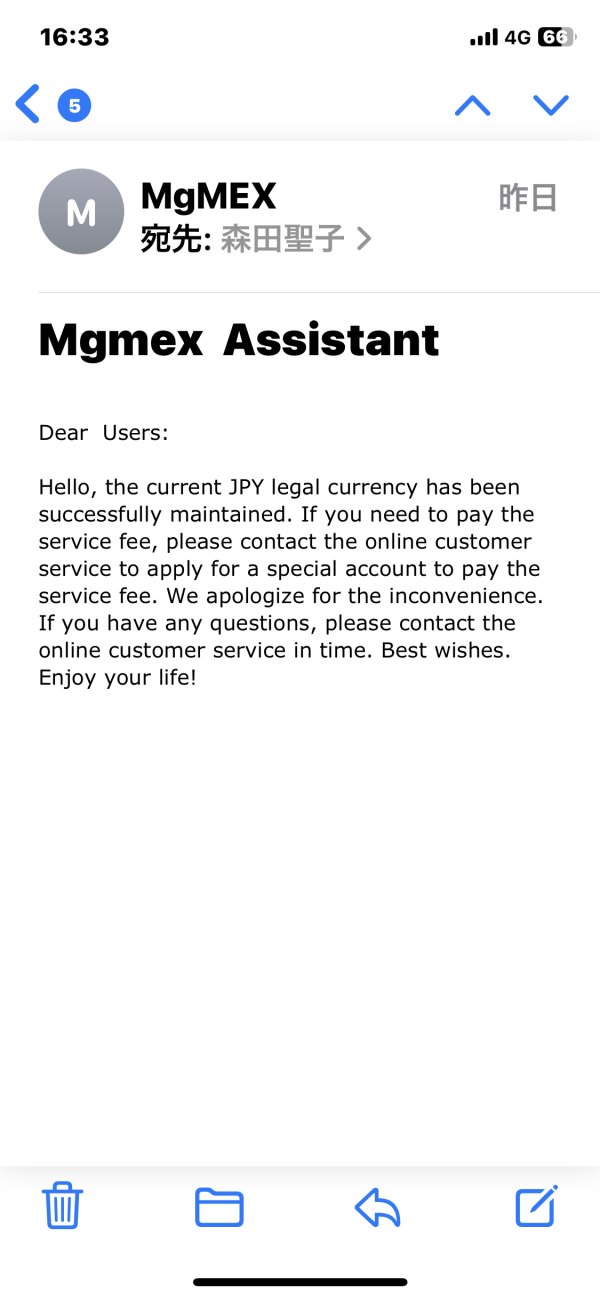

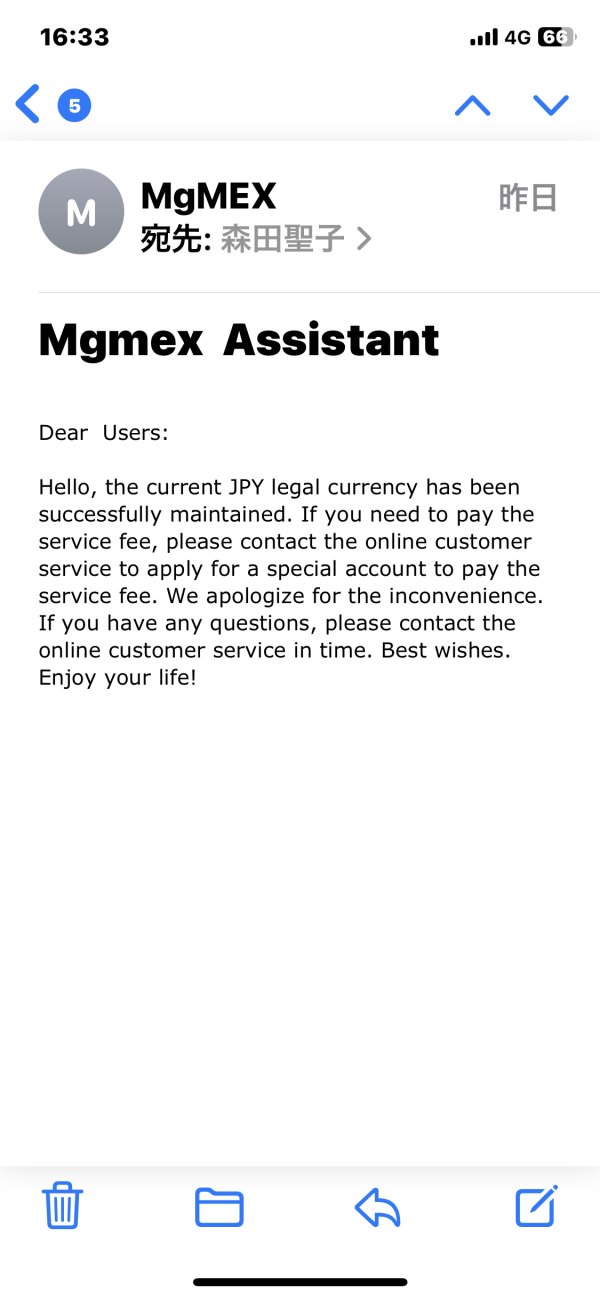

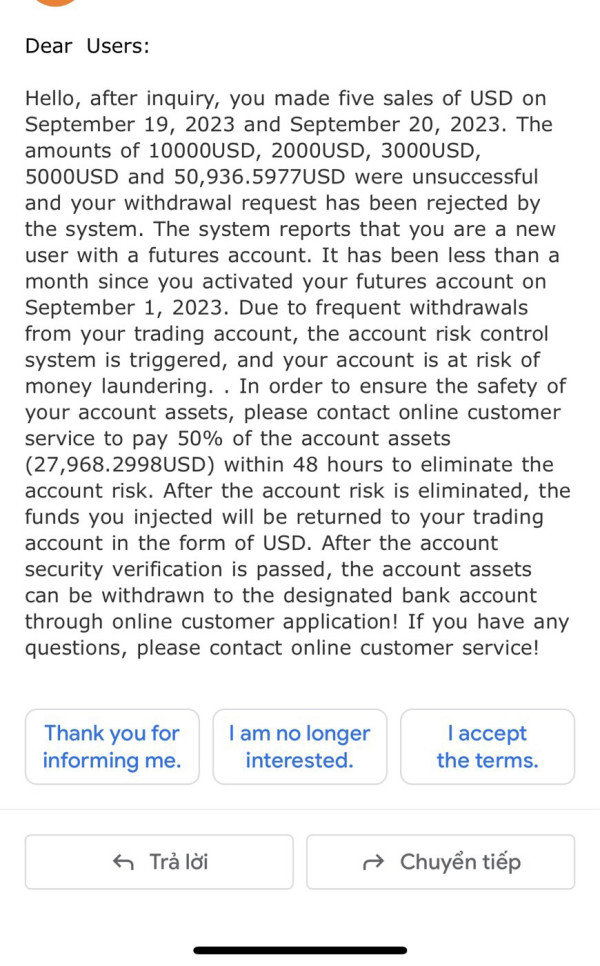

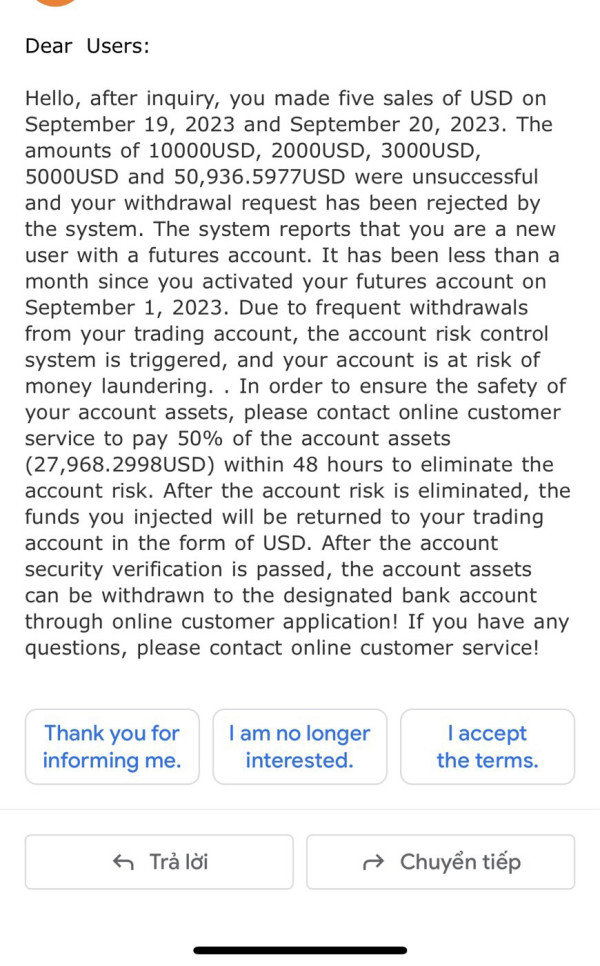

Customer service represents MGMEx's most significant weakness based on consistent user feedback expressing dissatisfaction with support quality and response times. Despite offering 24/7 online chat services, the actual service delivery appears to fall short of trader expectations and industry standards that most brokers try to meet.

User testimonials consistently highlight frustration with customer support responsiveness. This suggests that while chat services are technically available around the clock, the quality and efficiency of problem resolution remain problematic for users who need help. This disconnect between advertised availability and actual service quality creates significant concerns for traders who may require urgent assistance during market volatility when every minute counts.

The persistent negative feedback regarding customer service raises questions about staff training, resource allocation, and management commitment to client satisfaction. Professional trading environments require responsive, knowledgeable support teams capable of addressing technical issues, account problems, and trading inquiries efficiently without making customers wait for long periods.

The combination of 24/7 availability with poor service quality suggests systemic issues in customer support operations. These issues may impact trader confidence and satisfaction in ways that could affect their trading performance. These concerns become particularly critical during account funding issues, technical problems, or dispute resolution situations where prompt, effective support is essential for protecting trader interests.

Trading Experience Analysis

The trading experience evaluation for MGMEx remains limited due to insufficient specific user feedback regarding platform performance, order execution quality, and overall trading environment satisfaction. While the broker offers both proprietary platform and MT4 access, detailed performance metrics and user experience reports were not available in reviewed materials that we could examine.

Platform stability, execution speed, and order processing quality represent critical factors in trading experience assessment. Without specific user feedback about slippage rates, requote frequency, or platform downtime incidents, traders cannot adequately assess the technical reliability of MGMEx's trading infrastructure compared to other brokers in the market.

The availability of multiple platform options suggests potential flexibility for different trading styles and preferences. However, the lack of detailed performance feedback or technical testing data limits the ability to evaluate actual trading condition quality compared to industry standards that most professional traders expect.

Mobile trading capabilities, advanced order types, and trading tool integration represent additional factors that impact overall trading experience. The absence of comprehensive trading experience feedback in this mgmex review indicates either limited user base or potential reluctance to share detailed trading experiences, both of which raise concerns about broker performance and user satisfaction.

Trust and Security Analysis

Trust and security represent MGMEx's most critical weakness, primarily due to the apparent absence of regulatory oversight from recognized financial authorities. Regulatory supervision provides essential protections including fund segregation requirements, dispute resolution mechanisms, and operational standard enforcement that protect trader interests when problems arise.

The lack of regulatory backing eliminates crucial safeguards that traders typically rely on for fund safety and dispute resolution. Regulated brokers must maintain segregated client accounts, provide compensation schemes, and adhere to strict operational standards that unregulated entities can avoid without consequences.

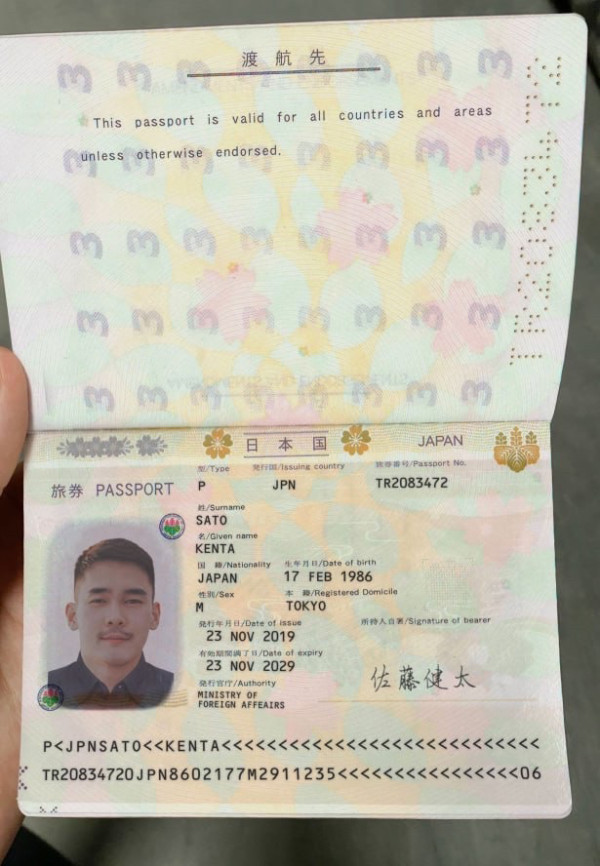

Company transparency regarding ownership structure, financial backing, and operational procedures appears limited based on available information. Professional trading environments typically provide comprehensive company information, regulatory compliance details, and clear operational transparency that builds trader confidence over time.

The potential for fraudulent activity increases significantly in unregulated environments where oversight mechanisms and accountability structures are absent. While MGMEx may operate legitimately, the lack of regulatory protection creates inherent risks that traders must carefully consider before committing funds to any trading activities.

User Experience Analysis

Overall user experience with MGMEx appears compromised primarily by customer service issues, though specific feedback regarding platform usability, interface design, and operational efficiency remains limited. The documented customer support dissatisfaction suggests broader operational challenges that may impact various aspects of user interaction with the broker.

User satisfaction typically encompasses multiple factors including platform ease of use, account management efficiency, funding process smoothness, and problem resolution effectiveness. The consistent negative feedback regarding customer support suggests potential systemic issues that may extend beyond isolated service interactions and affect the overall trading experience.

The target user profile appears to focus on traders seeking commodity and currency trading opportunities. However, the lack of comprehensive user experience feedback makes it difficult to assess whether MGMEx successfully serves this market segment compared to other brokers who specialize in similar trading opportunities.

Common user complaints center around customer service quality, though specific issues regarding platform functionality, funding processes, or trading experience were not detailed in available feedback. This limited feedback scope may indicate either a small user base or reluctance to share comprehensive trading experiences, both of which should concern potential traders.

Conclusion

This comprehensive mgmex review reveals significant concerns that outweigh the broker's limited positive features. While MGMEx offers proprietary platform technology and MT4 access alongside 24/7 chat availability, fundamental issues regarding regulatory oversight and customer service quality create substantial risks for potential traders who want to protect their investments.

The absence of regulatory supervision represents the most critical concern for anyone considering this broker. This eliminates essential protections that traders rely on for fund safety and dispute resolution when problems occur. Combined with persistent customer service issues, these factors create an environment unsuitable for risk-conscious traders seeking reliable, protected trading experiences that won't put their money at unnecessary risk.

MGMEx may appeal to traders specifically seeking commodity and currency trading access who accept higher risk levels in exchange for platform availability. However, the combination of unregulated status, poor customer support, and limited transparency makes this broker unsuitable for most traders who want to protect their investments.

This is particularly true for those prioritizing security and professional service standards above all other considerations.