Is Mgmex safe?

Business

License

Is Mgmex Safe or a Scam?

Introduction

Mgmex is a broker operating in the forex market, offering a platform for retail traders to engage in currency trading and other financial instruments. As the forex market is a complex and often volatile environment, traders need to exercise caution and conduct thorough evaluations before choosing a broker. The importance of assessing a broker's legitimacy cannot be overstated, as the financial implications of falling victim to a scam can be devastating. In this article, we will delve into a comprehensive analysis of Mgmex, focusing on its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks. Our investigation is based on multiple credible sources, including reviews and regulatory databases, to provide an objective assessment of whether Mgmex is safe for traders.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. A well-regulated broker is typically subject to stringent oversight, ensuring that it adheres to industry standards and protects clients' interests. Unfortunately, Mgmex currently lacks valid regulation, which raises significant red flags regarding its safety.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Not Verified |

The absence of regulation means that Mgmex is not held accountable by any recognized financial authority, which can lead to a lack of transparency and potential for fraudulent activities. Regulatory bodies such as the FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), and CFTC (Commodity Futures Trading Commission) enforce compliance with established standards, thereby enhancing investor protection. The lack of oversight from such authorities is a significant concern for potential clients, as it indicates that Mgmex may not be operating under the same scrutiny as regulated entities.

Moreover, the historical compliance of Mgmex is questionable, with several reviews labeling it as a suspicious broker. This lack of regulatory backing and the resulting opacity can severely compromise the safety credentials of Mgmex, making it imperative for potential investors to approach this broker with caution.

Company Background Investigation

To evaluate the credibility of Mgmex, it is essential to understand its company background, including its history, ownership structure, and management team. Mgmex appears to have limited information available regarding its operational history and ownership details. This lack of transparency raises questions about its legitimacy and the level of protection it offers to its clients.

The management team's background is another critical aspect of a broker's reliability. However, Mgmex does not provide sufficient information about its management or their professional experience. A competent management team with a solid track record in the financial services industry is often indicative of a trustworthy broker. Unfortunately, the absence of such information for Mgmex further complicates the assessment of its credibility.

Additionally, the level of information disclosure by Mgmex is notably insufficient. Clients are left in the dark regarding essential aspects such as the broker's operational practices, ownership, and customer service support. This lack of clarity can hinder potential investors from making informed decisions, reinforcing the need for greater transparency from Mgmex to establish trust within the market.

Trading Conditions Analysis

Understanding the trading conditions offered by Mgmex is vital for evaluating its overall cost structure and the potential risks associated with trading on its platform. Mgmex claims to offer competitive trading conditions, but the lack of transparency regarding fees and costs is concerning.

| Fee Type | Mgmex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates raises questions about the potential hidden costs that traders may encounter. Traders should be wary of any unusual or excessive fees that could significantly impact their profitability. The lack of clarity in Mgmex's fee structure may indicate an attempt to obscure the true cost of trading, making it essential for potential clients to conduct thorough research before engaging with the broker.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Mgmex's approach to client fund security is a critical factor in assessing its overall trustworthiness. A reputable broker typically implements measures such as segregated accounts to ensure that client funds are kept separate from the broker's operational funds, thereby protecting investors in the event of financial difficulties.

Unfortunately, Mgmex's lack of regulatory oversight raises concerns about its fund safety measures. Without proper regulation, there is no guarantee that Mgmex adheres to industry standards for safeguarding client funds. Additionally, the absence of information regarding investor protection mechanisms, such as negative balance protection or compensation schemes, further compounds these concerns.

Historically, brokers without robust fund safety measures have been known to engage in unethical practices, leading to significant financial losses for clients. Therefore, potential investors should carefully consider these factors before deciding to trade with Mgmex, as the risks associated with inadequate fund protection are substantial.

Customer Experience and Complaints

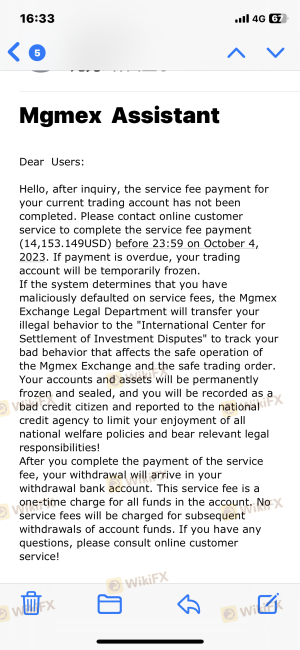

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews and testimonials from current and former clients can provide insights into the broker's performance and responsiveness to complaints. Unfortunately, Mgmex has received numerous negative reviews, raising serious concerns about its legitimacy.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | High | Poor |

| Misleading Advertising | Medium | Poor |

Common complaints include difficulties in withdrawing funds, inadequate customer support, and allegations of misleading advertising practices. These issues suggest that Mgmex may not prioritize client satisfaction or transparency, which are essential for building trust in the trading community.

For instance, one user reported experiencing significant delays in processing withdrawal requests, leading to frustration and distrust in the broker's operations. Another client expressed concerns about the lack of responsiveness from customer support, highlighting a pattern of neglect towards client inquiries and issues. Such complaints are indicative of a broader trend of dissatisfaction among Mgmex's client base, reinforcing the need for potential investors to exercise caution.

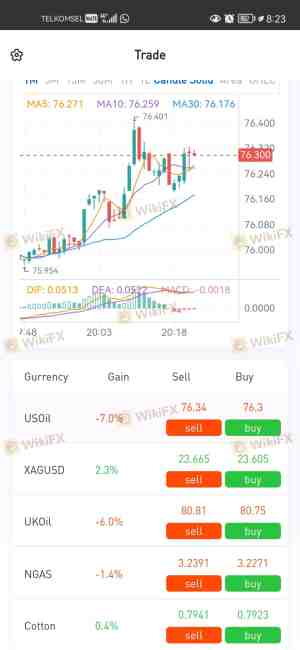

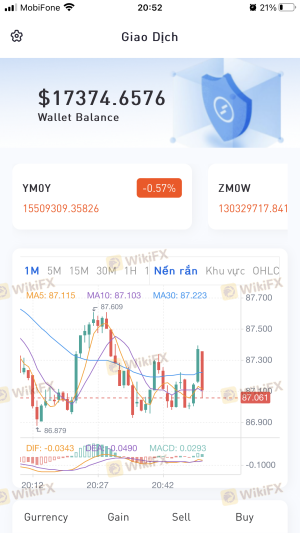

Platform and Execution

The trading platform is a vital component of any broker's offering, as it directly impacts the trading experience for clients. Mgmex presents itself as a user-friendly platform, but the performance and reliability of the platform are essential factors to consider.

While Mgmex claims to provide a seamless trading experience, there are concerns regarding order execution quality, slippage, and potential rejection of orders. Traders need to be aware of any indications of platform manipulation, as this can significantly affect trading outcomes. The lack of detailed information about platform performance and user experiences raises additional concerns about Mgmex's overall reliability.

Risk Assessment

Assessing the risks associated with trading on Mgmex is crucial for potential investors. The absence of regulation, unclear trading conditions, and negative client experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to client complaints. |

To mitigate these risks, potential clients should conduct thorough research, seek feedback from current users, and consider alternative brokers with established regulatory frameworks and positive client reviews. Engaging with well-regulated brokers can significantly reduce the likelihood of encountering issues associated with scams or inadequate customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mgmex raises significant concerns regarding its safety and legitimacy. The absence of regulation, coupled with negative client experiences and a lack of transparency in trading conditions, points to a high-risk environment for potential investors.

For traders considering engaging with Mgmex, it is essential to weigh the potential risks against the broker's offerings. Those who are risk-averse or new to trading should consider seeking alternatives that are well-regulated and have a proven track record of client satisfaction. Reputable brokers with robust regulatory oversight and positive user feedback can provide a more secure trading environment.

Ultimately, the question "Is Mgmex safe?" leans towards a cautious "no," and traders should exercise extreme caution when considering this broker for their trading activities.

Is Mgmex a scam, or is it legit?

The latest exposure and evaluation content of Mgmex brokers.

Mgmex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mgmex latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.