Blackcore 2025 Review: Everything You Need to Know

Executive Summary

This Blackcore review shows a detailed look at a problem company in trading and supplements. Blackcore works mainly as a health supplement brand that targets male fitness fans with products like Blackcore Edge Max. Our research shows big concerns about whether their business is real, especially with "free trial scams" that many review sites talk about.

The company's trading services have serious warning signs. They have no rules watching over them and don't share clear information about how they work. Good brokers give clear details about their licenses, trading rules, and company setup, but Blackcore's trading part works without any rules we can find. This gives them a zero score in many areas we checked. This Blackcore review wants to give users the important facts they need to make smart choices about using this company.

Important Notice

This review uses public information and user reports from many websites. Blackcore doesn't share much about how they work, so we couldn't check some standard broker facts in normal ways. Our study uses data from supplement review sites, scam report websites, and limited company information. Readers should be very careful and do their own research before using any Blackcore services.

Rating Framework

Broker Overview

Blackcore has a confusing business identity that covers many areas without clear limits. The company mainly shows up as a health supplement business, especially with the Blackcore Edge product line. They market these as different types of fitness supplements like pre-workout formulas, post-workout recovery aids, testosterone boosters, and male enhancement products. This scattered marketing makes us question whether the company really knows any one area well.

The trading services linked to Blackcore seem to be a side business or possibly fake. This shows in the complete lack of regulatory information and clear operational details. Good forex brokers clearly show their regulatory licenses, company registration details, and full service lists, but Blackcore's trading division works in the shadows with no oversight from known financial authorities.

This Blackcore review found that the company's business plan seems to rely heavily on aggressive marketing tactics. They especially use "free trial" offers that many consumer protection sources have marked as possibly misleading. The lack of clear company structure, plus widespread user complaints about billing practices, means potential clients should be very careful with any Blackcore services.

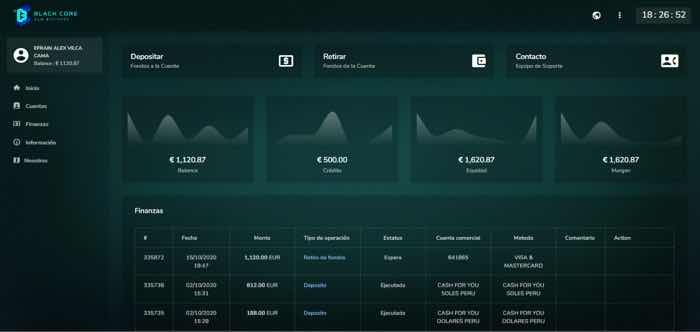

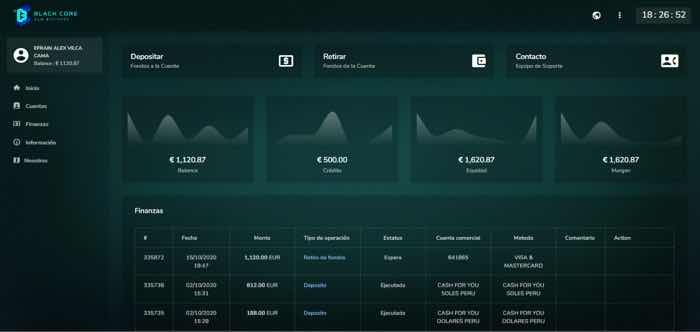

Regulatory Status: Our research found no proof of legitimate financial regulation for Blackcore's trading services. The company doesn't show up in any major regulatory databases, including those kept by the FCA, CySEC, ASIC, or other recognized authorities.

Payment Methods: Specific information about deposit and withdrawal methods for trading services wasn't available in accessible documents. Supplement purchases seem to process through standard credit card systems.

Minimum Deposit Requirements: No clear minimum deposit information has been published for trading accounts. This itself is a big warning sign for potential clients.

Promotional Offers: The company mainly promotes "free trial" offers for supplement products. These have been linked to unauthorized recurring charges according to multiple user reports.

Available Assets: Trading asset information isn't clearly specified in available materials. This contrasts sharply with legitimate brokers who prominently feature their instrument offerings.

Cost Structure: Fee schedules and trading costs remain undisclosed. This makes it impossible for potential clients to evaluate the economic viability of trading with Blackcore.

Leverage Options: No leverage information has been identified in our research. This is essential information that regulated brokers are required to disclose.

Platform Options: No identifiable trading platforms are associated with Blackcore's services. Established brokers offer MetaTrader, cTrader, or proprietary platforms.

Geographic Restrictions: Service availability by region isn't clearly documented. The company appears to target English-speaking markets primarily.

Customer Support Languages: Support appears to be primarily in English based on available documentation.

This Blackcore review reveals a concerning lack of transparency across all fundamental broker service areas.

Detailed Rating Analysis

Account Conditions Analysis

The account opening and management conditions for Blackcore show many red flags. These distinguish this entity from legitimate trading providers. Good brokers offer clearly defined account types with transparent terms and conditions, but Blackcore provides virtually no accessible information about trading account structures, verification requirements, or account management procedures.

This lack of transparency makes it impossible for potential clients to understand what they would be agreeing to before depositing funds. Standard industry practice requires brokers to clearly outline their account types, whether Standard, ECN, or VIP accounts, along with the specific benefits and requirements for each tier. Legitimate providers also detail their Know Your Customer procedures, document requirements, and account verification timelines.

Blackcore's absence of such fundamental information suggests either a lack of proper operational infrastructure or an intentional hiding of terms that might be unfavorable to clients. The minimum deposit requirements, typically a key factor in broker selection, remain undisclosed in available materials. This contrasts sharply with regulated brokers who prominently display their accessibility thresholds to help potential clients determine suitability.

The absence of Islamic account options, copy trading features, or other specialized account services further indicates limited institutional development. This Blackcore review found no evidence of the comprehensive account management systems that characterize professional trading environments.

The trading tools and educational resources typically expected from a professional broker appear to be completely absent from Blackcore's offerings. Instead of providing market analysis, economic calendars, or trading calculators, the company's resources focus exclusively on supplement-related content and marketing materials.

This fundamental misalignment between claimed trading services and actual resource provision raises serious questions about the company's capabilities and intentions. Professional trading environments require sophisticated analytical tools, real-time market data, and comprehensive educational materials to support client success. Established brokers invest heavily in research departments, technical analysis tools, and educational content creation.

Blackcore's resource library, by contrast, consists primarily of supplement promotional materials and lacks any identifiable trading-related educational content or market analysis capabilities. The absence of automated trading support, such as Expert Advisor compatibility or signal services, further distinguishes Blackcore from legitimate trading providers. Modern forex brokers typically offer integration with popular trading algorithms, copy trading platforms, and social trading networks.

The complete absence of such technological infrastructure suggests that Blackcore may not operate a genuine trading environment at all. This makes it a critical consideration for potential clients evaluating their options.

Customer Service and Support Analysis

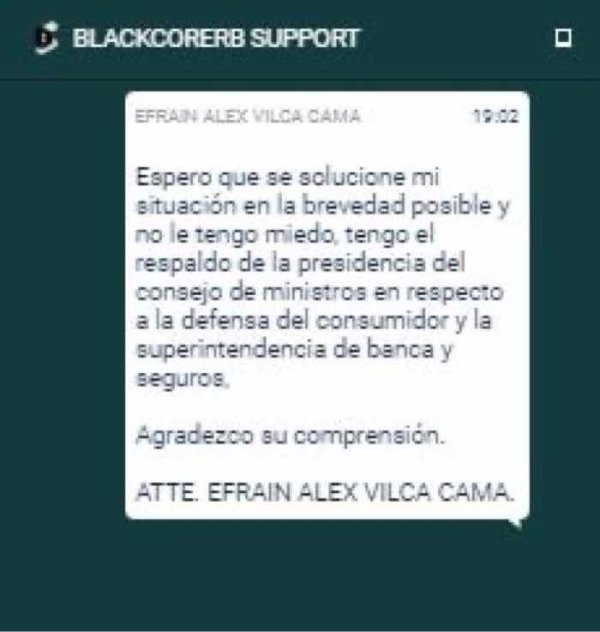

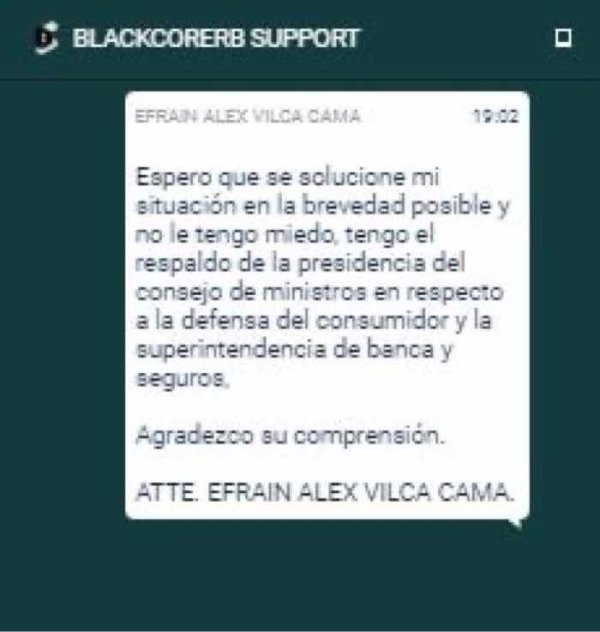

Customer service quality represents one of the most concerning aspects of the Blackcore operation. This is based on available user feedback and operational transparency. Regulated brokers must maintain specific customer service standards and complaint resolution procedures, but Blackcore appears to operate without such oversight.

This results in numerous user complaints about support responsiveness and billing practices. The company's support infrastructure lacks the multi-channel approach expected from professional financial services providers. While legitimate brokers typically offer live chat, phone support, email tickets, and comprehensive FAQ sections, Blackcore's support appears limited and often unresponsive according to user reports.

The absence of clearly published support hours, response time commitments, or escalation procedures further indicates substandard service infrastructure. Most concerning are the recurring complaints about unauthorized billing and difficulty canceling services, particularly related to the "free trial" offers. Multiple user reports indicate that customer service representatives are either unavailable or unhelpful when clients attempt to resolve billing disputes or cancel unwanted subscriptions.

This pattern of poor support quality, combined with aggressive billing practices, suggests that customer service may be intentionally designed to frustrate rather than assist clients seeking to resolve issues or discontinue services.

Trading Experience Analysis

The actual trading experience offered by Blackcore cannot be properly evaluated due to the absence of an identifiable trading platform or verifiable trading environment. This represents perhaps the most significant red flag in our analysis, as legitimate brokers build their reputations on platform stability, execution quality, and trading environment transparency.

Without access to demo accounts, platform specifications, or execution statistics, potential clients have no way to assess the fundamental trading infrastructure. Professional trading platforms require substantial technological investment, regulatory compliance systems, and ongoing maintenance to provide the reliability that serious traders demand. The absence of platform information, execution speed data, or spread specifications suggests that Blackcore may not operate a genuine trading environment.

This contrasts sharply with established brokers who prominently feature their platform capabilities, execution statistics, and technological advantages. Mobile trading capabilities, which have become essential for modern traders, appear to be completely absent from Blackcore's service offerings. The lack of mobile apps, responsive web platforms, or mobile-optimized interfaces further indicates limited technological development.

This Blackcore review found no evidence of the comprehensive trading infrastructure that characterizes legitimate broker operations. This makes it impossible to recommend the platform for serious trading activities.

Trust and Regulation Analysis

The trust and regulatory analysis of Blackcore reveals the most alarming deficiencies in our entire evaluation. The complete absence of regulatory oversight represents an immediate disqualification for serious trading consideration, as regulation provides the fundamental consumer protections that make forex trading viable for retail clients.

Unlike legitimate brokers who operate under strict regulatory frameworks, Blackcore appears to function without any identifiable oversight from recognized financial authorities. Regulatory compliance requires brokers to maintain segregated client funds, submit to regular audits, maintain minimum capital requirements, and adhere to strict operational standards. The absence of such oversight means that client funds would lack the protections typically associated with regulated trading environments.

This creates an unacceptable risk profile for potential clients, regardless of other service characteristics. The widespread discussion of "free trial scams" associated with Blackcore products further undermines trust and suggests predatory business practices. Multiple consumer protection sources have flagged the company's billing practices as potentially deceptive, indicating a pattern of behavior that prioritizes revenue extraction over customer satisfaction.

Combined with the lack of regulatory oversight, these trust issues create a risk profile that makes Blackcore unsuitable for serious trading consideration. This leads to our lowest possible trust rating.

User Experience Analysis

The overall user experience with Blackcore appears to be predominantly negative based on available feedback and operational analysis. Established brokers invest heavily in user interface design, customer journey optimization, and satisfaction measurement, but Blackcore's user experience appears designed to maximize revenue extraction rather than client success.

The confusion surrounding the company's actual service offerings creates an immediately poor user experience that continues throughout the client relationship. User reports consistently highlight frustration with billing practices, particularly the difficulty of canceling services or obtaining refunds for unwanted charges. This pattern suggests that the user experience is intentionally designed to create barriers for clients seeking to discontinue services.

Such practices contrast sharply with regulated brokers who must maintain transparent cancellation procedures and fair billing practices under regulatory oversight. The absence of clear onboarding procedures, educational resources, or client success metrics further indicates a poor user experience design. Professional brokers typically invest in comprehensive client onboarding, ongoing education, and success tracking to build long-term relationships.

Blackcore's approach appears focused on short-term revenue extraction rather than sustainable client relationships. This results in the overwhelmingly negative user feedback that characterizes online discussions of the company's services.

Conclusion

This comprehensive Blackcore review reveals a concerning pattern of operational deficiencies that make the company unsuitable for serious trading consideration. The complete absence of regulatory oversight, combined with widespread user complaints about billing practices and poor customer service, creates an unacceptable risk profile for potential clients.

While the company may have some presence in the supplement market, its trading-related services lack the fundamental infrastructure and transparency required for legitimate financial services. The target demographic appears to be primarily male fitness enthusiasts who may be attracted to the supplement offerings, but the trading services present significant risks that outweigh any potential benefits. Our analysis strongly recommends that potential clients seek established, regulated alternatives for their trading needs rather than risking involvement with an unregulated entity that has generated numerous consumer complaints and operates without proper oversight.