Zero Forex 2025 Review: Everything You Need to Know

Zero Forex, established in 2017, is a forex and CFD broker that has garnered attention for its competitive trading conditions and diverse asset offerings. However, user experiences and expert analyses present a mixed picture of its reliability and overall performance. This review will delve into the key features, pros, and cons of Zero Forex, helping potential traders make an informed decision.

Note: It is crucial to be aware that Zero Forex operates through multiple entities across different regions, which can significantly affect regulatory oversight and user experience. This review synthesizes information from various sources to ensure fairness and accuracy.

Rating Overview

We assess brokers based on user feedback, expert opinions, and factual data from credible sources.

Broker Overview

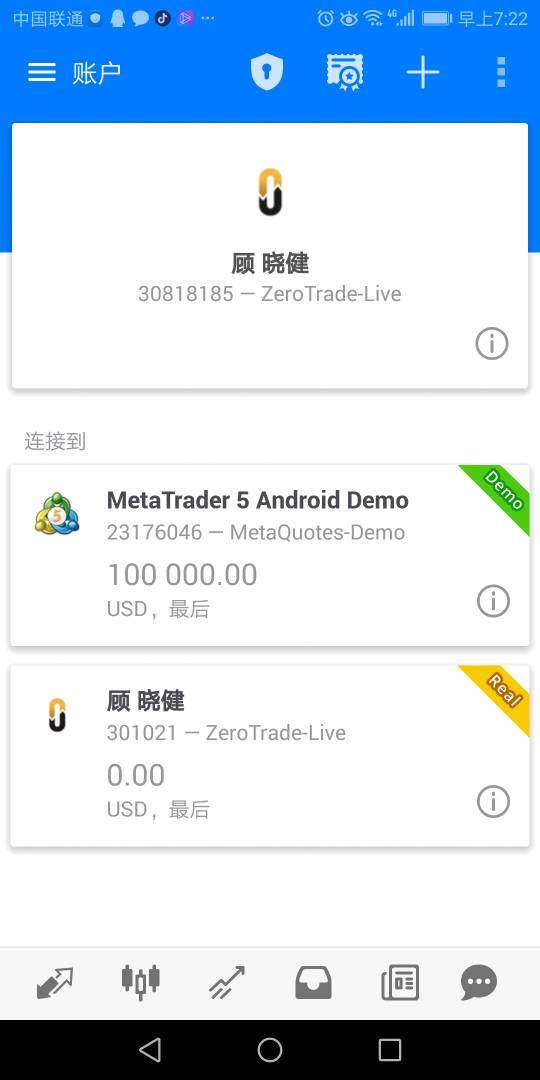

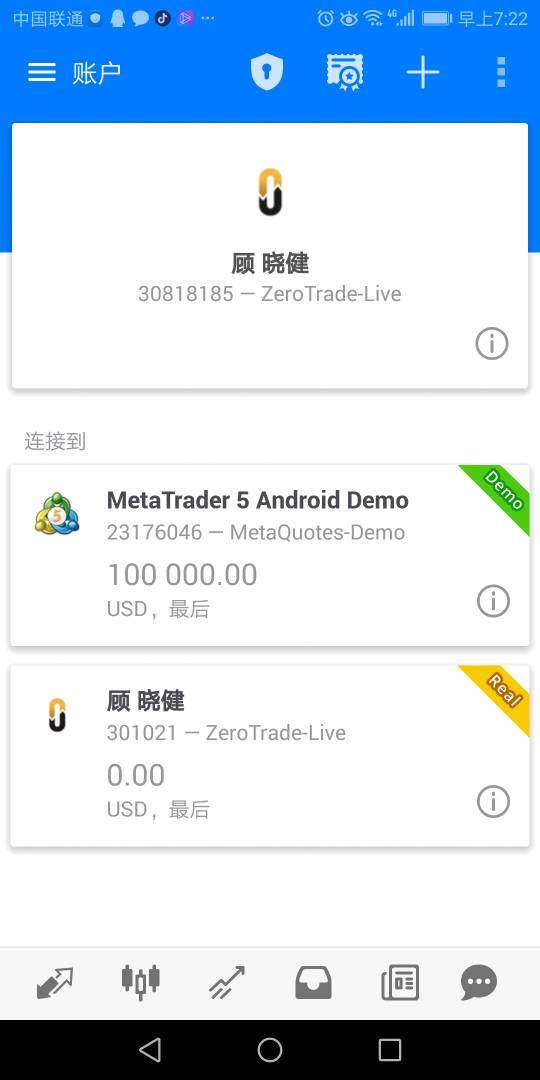

Zero Forex is a forex and CFD broker founded in 2017, primarily regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) in Mauritius. The broker offers trading on popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), allowing users to access a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Despite its appealing trading conditions, the broker has been scrutinized for its regulatory status and the quality of its customer support.

Detailed Analysis

Regulatory Regions

Zero Forex operates under the regulatory frameworks of ASIC and FSC. While ASIC is considered a tier-1 regulator, the FSCs oversight is less stringent, which raises concerns about the broker's overall trustworthiness. According to WikiFX, Zero Forex does not have its own valid regulatory license, which could expose traders to higher risks.

Deposit/Withdrawal Currencies and Cryptocurrencies

Zero Forex supports various deposit and withdrawal methods, including traditional banking options and e-wallets like Neteller and Skrill. The minimum deposit requirement is set at $100, which is relatively accessible for new traders. However, withdrawal fees can apply depending on the method used, with some sources indicating fees of around 1% for certain withdrawals.

Currently, Zero Forex does not offer any bonuses or promotional incentives, which is a common practice among many forex brokers. This absence might be disappointing for traders looking for additional value when opening an account.

Tradable Asset Classes

The broker claims to provide access to over 10,000 trading instruments. However, user reviews suggest that the actual availability of assets may be limited. The primary asset classes include forex (over 60 currency pairs), commodities, indices, and cryptocurrencies. This variety can cater to different trading strategies, but the actual execution and availability may vary based on market conditions.

Costs (Spreads, Fees, Commissions)

Zero Forexs spreads start from 1.0 pips for standard accounts and can be as low as 0.0 pips for its super zero accounts, which also incur a commission of $2.5 per side per lot. This pricing structure is competitive compared to other brokers in the industry. However, some reviews highlight that the overall costs can be higher than other brokers, especially when considering withdrawal fees and the lack of a clear fee structure.

Leverage

The maximum leverage offered by Zero Forex is up to 1:500, which can be attractive for experienced traders looking to maximize their trading potential. However, this high leverage also poses significant risks, particularly for novice traders who may not fully understand the implications of trading on margin.

Zero Forex primarily utilizes the MT4 and MT5 platforms, both of which are widely recognized in the trading community for their robust features and user-friendly interfaces. However, some users have reported issues with the mobile application, describing it as outdated and difficult to navigate.

Restricted Regions

Zero Forex does not accept clients from several countries, including the USA, Japan, and various others, which could limit its accessibility to potential traders in those regions.

Available Customer Support Languages

Customer support is available in multiple languages, including English, Portuguese, Korean, and several others. However, user reviews often cite inconsistent support quality, with some users experiencing delays and unhelpful responses.

Conclusion

In summary, the Zero Forex review indicates that while the broker offers competitive trading conditions and a diverse range of assets, there are significant concerns regarding its regulatory status, customer support, and overall trustworthiness. Potential traders should weigh these factors carefully and consider their own trading experience and risk tolerance before engaging with Zero Forex.

For those looking for a broker with solid regulatory backing and reliable customer service, it may be prudent to explore other options in the market.