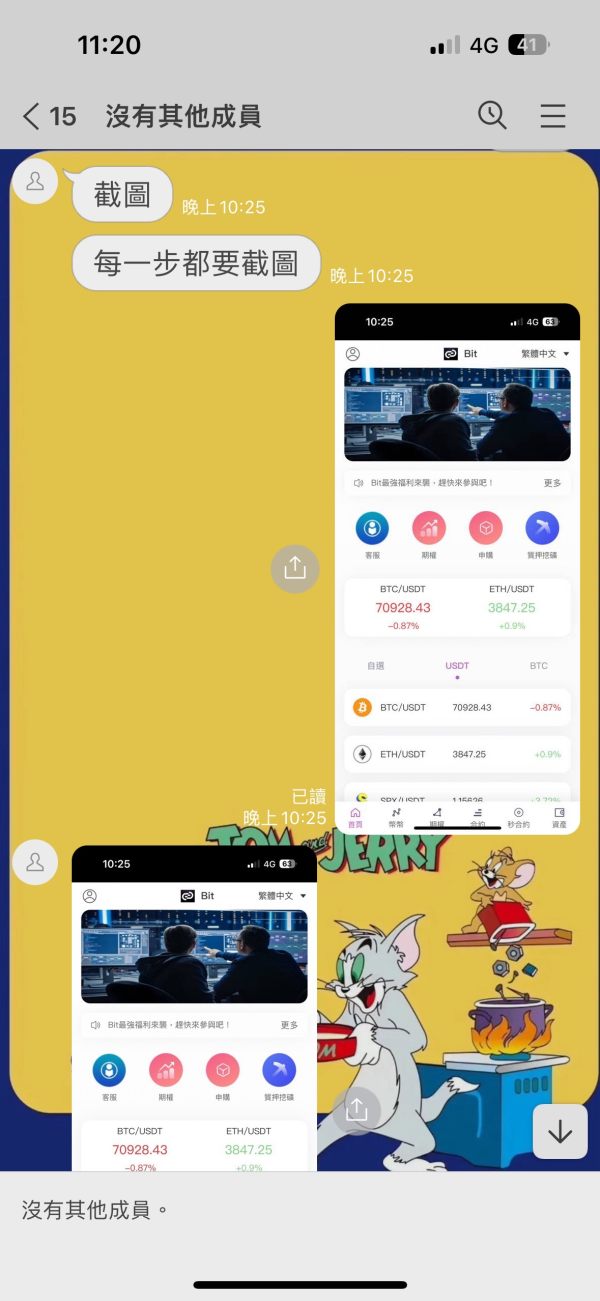

Founded in 2016 and headquartered in Japan, Bit Trade initially emerged as a straightforward cryptocurrency exchange. The company saw significant restructuring when it was rebranded as Huobi Japan in December 2018, following a majority acquisition by the Huobi Group. In February 2023, Bit Trade restored its original name while still maintaining its strategic partnership with Huobi, leveraging their advanced technology and security systems.

Bit Trade specializes in cryptocurrency trading, primarily facilitating transactions involving Bitcoin and Ethereum. The platform provides options for web and mobile trading, catering specifically to Japanese users with JPY transactions. Despite offering basic features like instant swaps and automated purchases, Bit Trade does not accommodate futures trading, which can deter more seasoned traders.

- Visit regulatory websites to ascertain its compliance status.

- Check the registration and the authority that supposedly supervises it.

- Research testimonials from existing users for insights on fund handling and withdrawal issues.

- Monitor the reviews on financial watchdogs to receive warnings from other traders.

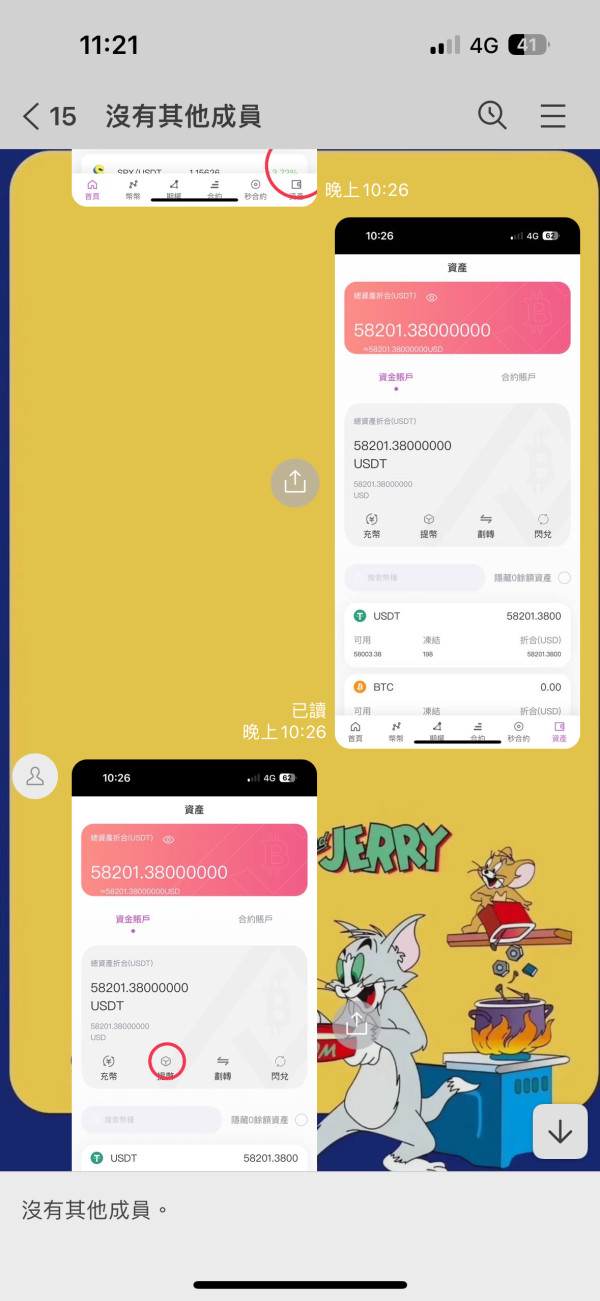

Users frequently express concerns over fund safety, highlighting withdrawal difficulties. The necessity of user-initiated verification only underscores the potential hazards of opting for such a platform. Reliable self-verification can mitigate some risks that come with trading here.

Trading Costs Analysis

Analytical Angle: The double-edged sword effect.

On the one hand, the platform boasts reasonable commission structures with fees as low as 0.1% for spot trading. This positions Bit Trade competitively in terms of trading costs, particularly for casual investors.

However, hidden fees surface frequently. Users have complained about withdrawal expenses that can catch traders off guard. For instance, **$30** withdrawal fee. This discrepancy can render trading less profitable and deter user retention in the long run. Understanding this cost structure is essential for traders to effectively navigate their investments on this platform.

Analytical Angle: Professional depth vs. beginner-friendliness.

Bit Trade's platform diversity is limited to basic trading. It provides mobile and web platforms but lacks advanced trading tools that seasoned traders seek. Therefore, while the platform is accessible for beginners, it may lack the sophistication required for in-depth trading strategies.

Moreover, the available tools do not support complex orders such as stop losses, which can limit the functionality for more advanced users. Feedback from users expresses frustration over a lack of options, indicating a significant gap in tool availability.

User Experience Analysis

Users have reported a mixed experience when utilizing Bit Trade, particularly regarding customer support. Although some users accessed positive assistance, others reported extended wait times and unaddressed complaints. Comments like these emphasize the inconsistencies within the support framework.

Customer Support Analysis

Overall, although there are some positive notes regarding engagement, many complaints highlight underwhelming service reliability, primarily focusing on delayed response times. Ensuring that queries are addressed promptly is crucial for enhancing trust and satisfaction among users.

Account Conditions Analysis

Bit Trade offers an attractive minimum deposit, starting at JPY 1,000 or BTC 0.0001, making it accessible for new traders. However, the limited range of account types can frustrate those looking for more customizable options. This factors into the platform's appeal for beginners rather than seasoned investors.

Conclusion

Bit Trade's platform may suit novice Japan-based traders drawn to its simplicity and low minimum deposit. However, the glaring lack of regulatory backing and a low trust score raises substantial red flags for potential users. Experienced investors seeking a robust trading environment may find the limited trading options and inadequate support unappealing. Ultimately, for those considering Bit Trade, a thorough self-verification process and caution in your investment strategy is advised. Always remember: your capital is at risk.