Maunto 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive maunto review examines a broker that has generated mixed reactions among traders in the forex market. Maunto presents itself as an online trading platform offering commission-free trading and customer service support. The broker targets investors seeking flexible trading conditions across multiple asset classes. Maunto operates under the regulation of the Mwali International Services Authority (MISA), though specific licensing details remain limited in available documentation.

Maunto's key features include access to diverse financial instruments spanning forex, commodities, stocks, indices, cryptocurrencies, and precious metals. The platform emphasizes educational support and trading flexibility. A minimum deposit requirement of 250 USD makes it accessible to small and medium-sized investors. However, user feedback reveals a polarized experience, with some traders praising the customer service quality while others express dissatisfaction with certain aspects of the forex marketing approach.

According to Trustpilot ratings, Maunto maintains a 3-star rating. This reflects the divided user sentiment. The broker appears most suitable for traders seeking diversified financial instruments and those prioritizing customer support. Potential users should carefully consider the mixed reviews and regulatory framework before making investment decisions.

Important Notice

Regional Entity Differences: Maunto operates under the regulation of the Mwali International Services Authority (MISA). This may present regulatory differences compared to major financial jurisdictions. Traders should be aware that offshore regulation may offer different levels of investor protection compared to established regulatory frameworks in major financial centers.

Review Methodology: This evaluation is based on comprehensive analysis of available user feedback, publicly accessible information, and documented broker specifications. The assessment reflects information available as of 2025. Traders are advised to verify current conditions directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Maunto operates as an online trading services provider. It focuses on delivering multiple financial instruments alongside educational support for traders. The company positions itself as a broker offering flexible trading conditions, emphasizing commission-free trading opportunities across various asset classes. While specific founding details are not extensively documented in available materials, the broker has established a presence in the online trading space by targeting investors seeking diversified portfolio options.

The broker's business model centers on providing access to global markets through CFD trading. This enables clients to trade hundreds of financial instruments. Maunto emphasizes three core pillars in its service approach: education, flexibility, and security. The platform aims to equip traders with comprehensive trading instruments while maintaining flexible conditions to accommodate different trading strategies and risk management approaches.

Regarding trading infrastructure, Maunto offers access to forex, commodities, stocks, indices, cryptocurrencies, and precious metals. The broker operates under the regulatory oversight of the Mwali International Services Authority (MISA). Specific licensing numbers are not prominently featured in available documentation. This maunto review notes that the regulatory framework may differ from major financial jurisdictions, which potential clients should consider when evaluating the broker's suitability for their trading needs.

Regulatory Jurisdiction: Maunto operates under the regulation of the Mwali International Services Authority (MISA). This is an offshore regulatory body. This regulatory framework may offer different investor protection levels compared to major financial regulators in established markets.

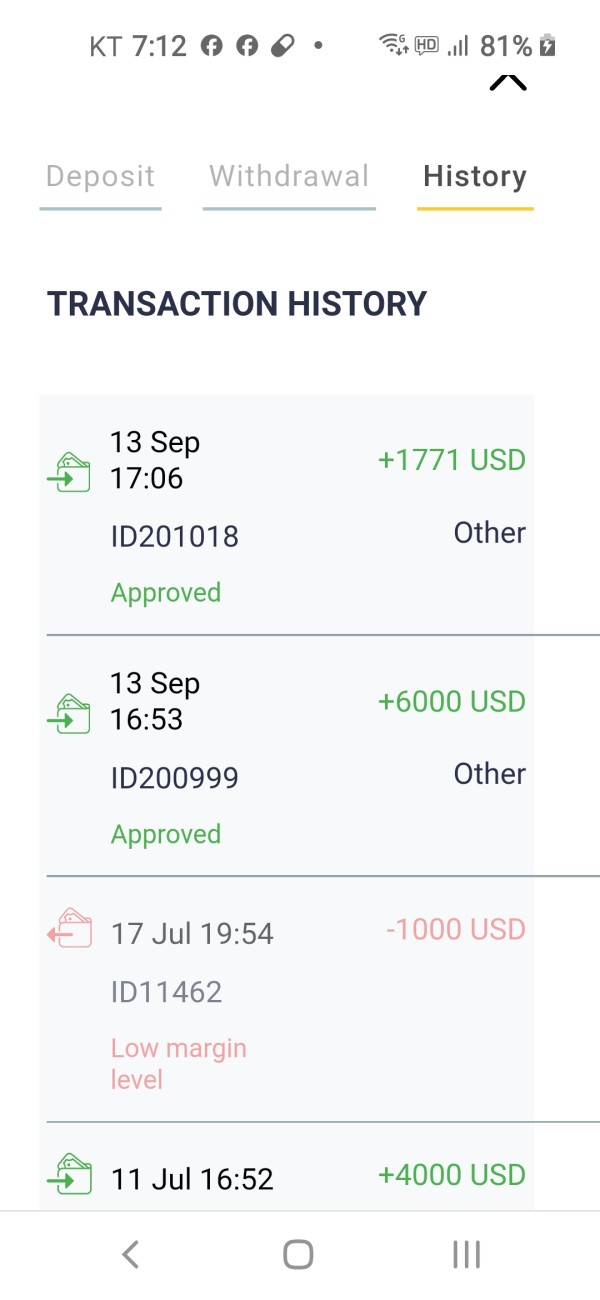

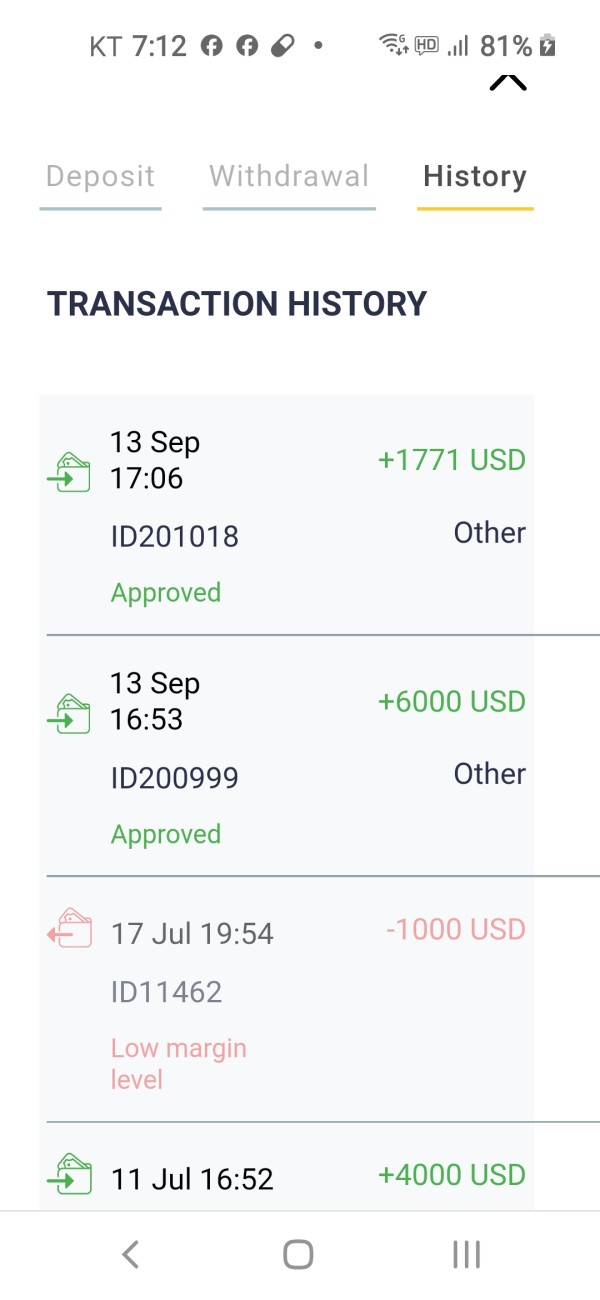

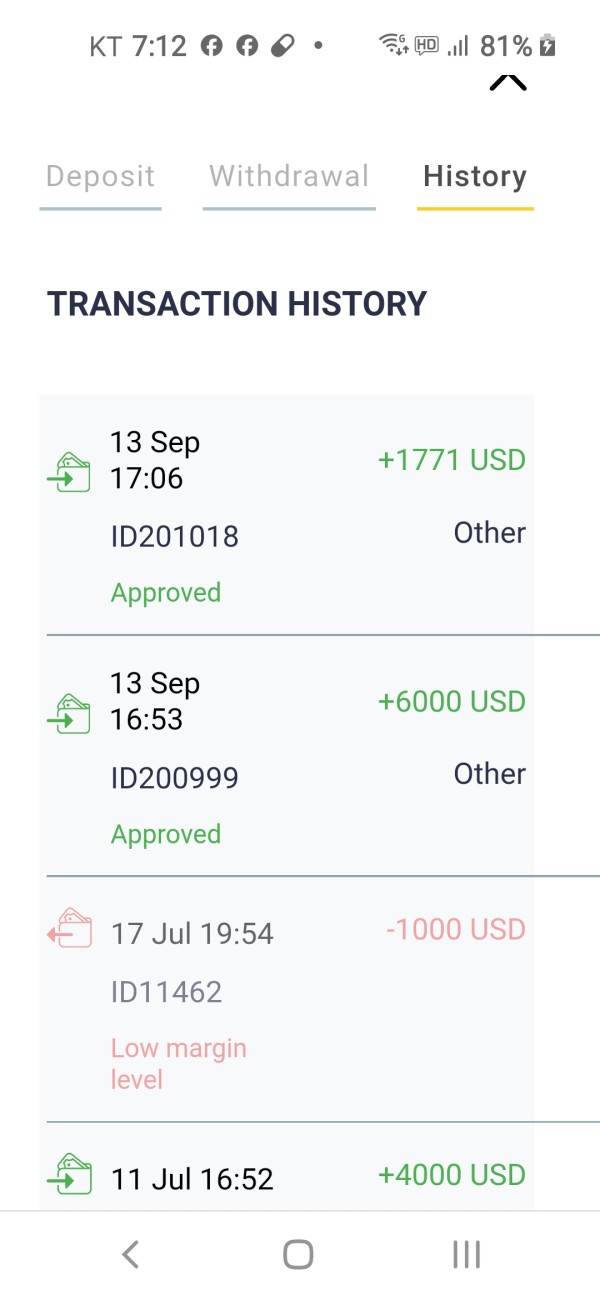

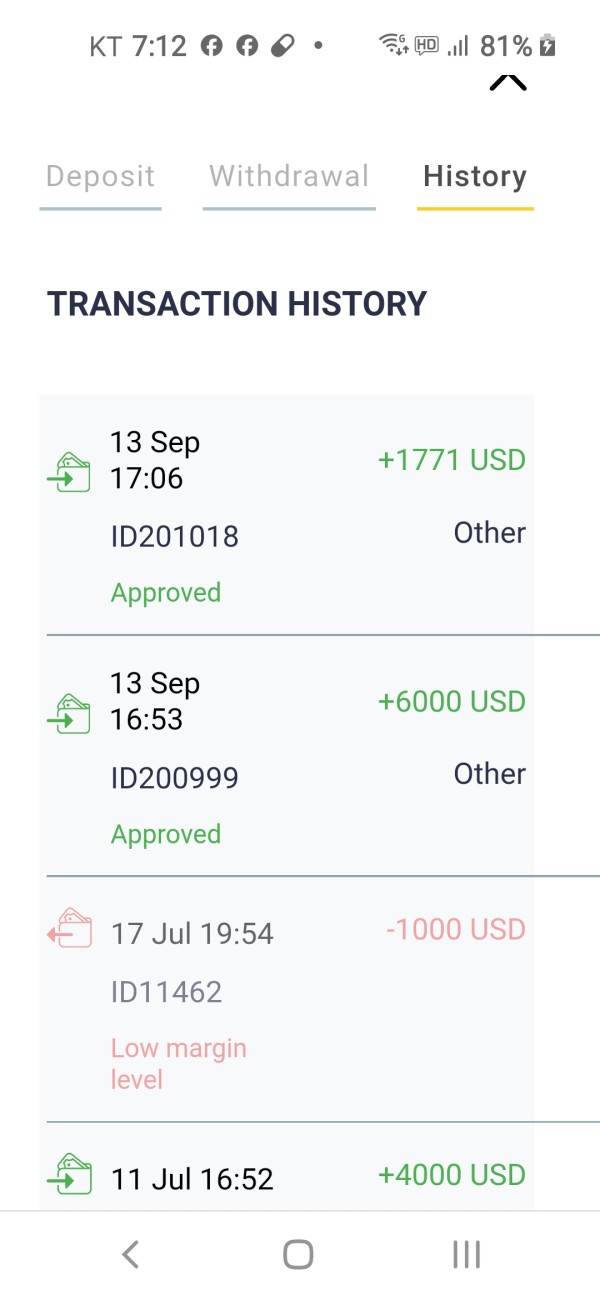

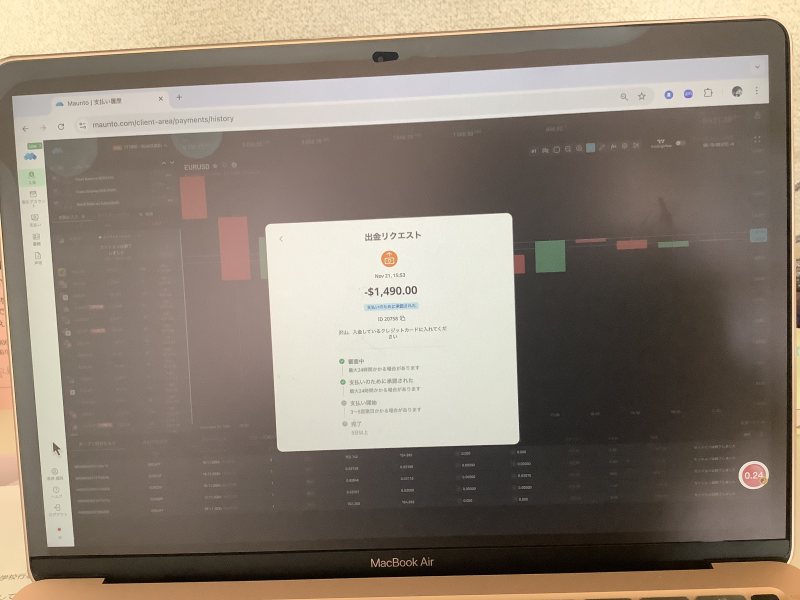

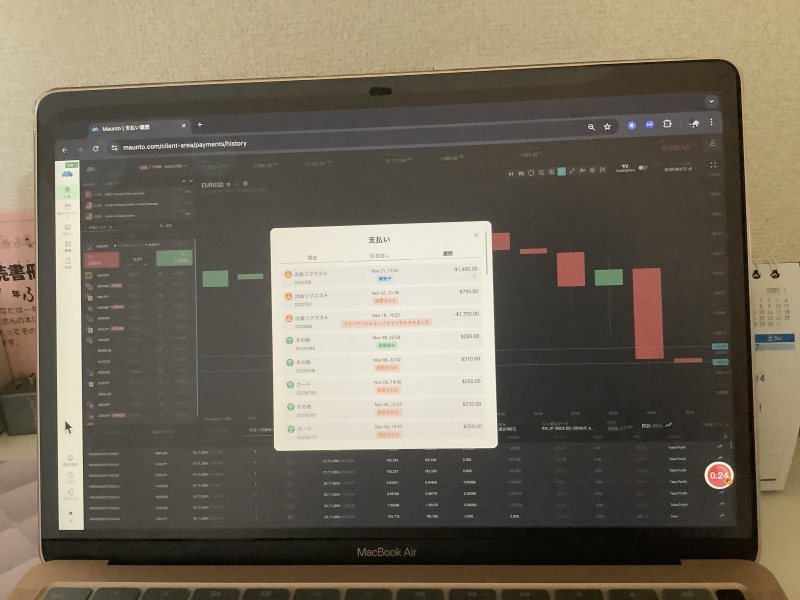

Deposit and Withdrawal Methods: The broker supports multiple funding options including credit/debit cards, wire transfers, and alternative payment methods (APMs). Supported currencies include EUR, USD, JPY, INR, and KRW. This provides flexibility for international clients.

Minimum Deposit Requirements: Maunto sets a minimum deposit of 250 USD or equivalent based on account currency. This makes the platform accessible to small and medium-sized investors seeking entry into global markets.

Bonus and Promotional Offers: Specific information regarding promotional offers and bonus structures is not detailed in available documentation. This suggests potential clients should inquire directly with the broker.

Tradeable Assets: The platform provides access to hundreds of CFDs across six major categories. These include forex pairs, commodities, individual stocks, market indices, cryptocurrencies, and precious metals, offering comprehensive market exposure.

Cost Structure: Maunto advertises commission-free trading. However, specific spread information and additional fee structures are not comprehensively detailed in available materials. Traders should verify current pricing before account opening.

Leverage Ratios: Specific leverage information is not extensively documented in available materials. This requires direct verification with the broker for current leverage offerings across different asset classes.

Platform Options: While the broker offers trading services, specific platform details and technology specifications are not comprehensively outlined in available documentation.

Geographic Restrictions: Information regarding geographic limitations and restricted jurisdictions is not detailed in available materials.

Customer Support Languages: Specific language support details are not extensively documented. However, the broker provides contact options through email, phone, and website forms.

This maunto review emphasizes that several key details require direct verification with the broker due to limited comprehensive documentation in publicly available sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Maunto's account structure presents a mixed picture for potential traders. The broker's minimum deposit requirement of 250 USD positions it competitively for small and medium-sized investors. This creates an accessible entry point compared to brokers requiring significantly higher initial investments. This threshold aligns with industry standards for retail-focused platforms, demonstrating the broker's commitment to serving a broader investor base rather than exclusively targeting high-net-worth individuals.

However, the evaluation reveals significant gaps in account-related information. Specific account types, their distinct features, and associated benefits are not comprehensively detailed in available documentation. The absence of clear information regarding different account tiers, their respective advantages, and qualification criteria creates uncertainty for potential clients seeking to understand their options fully.

The account opening process details are similarly limited in available materials. This leaves questions about verification requirements, documentation needs, and timeline expectations. Additionally, specialized account options such as Islamic accounts for traders requiring Sharia-compliant trading conditions are not specifically mentioned in accessible documentation.

User feedback regarding account conditions shows mixed experiences. Some traders express satisfaction with the flexibility offered, while others indicate concerns about transparency and information availability. This maunto review notes that the limited detailed information about account structures represents a significant area where enhanced transparency would benefit potential clients.

The scoring reflects the reasonable minimum deposit requirement balanced against the lack of comprehensive account information. This results in a moderate rating that acknowledges both the accessibility and the information gaps present in the current offering.

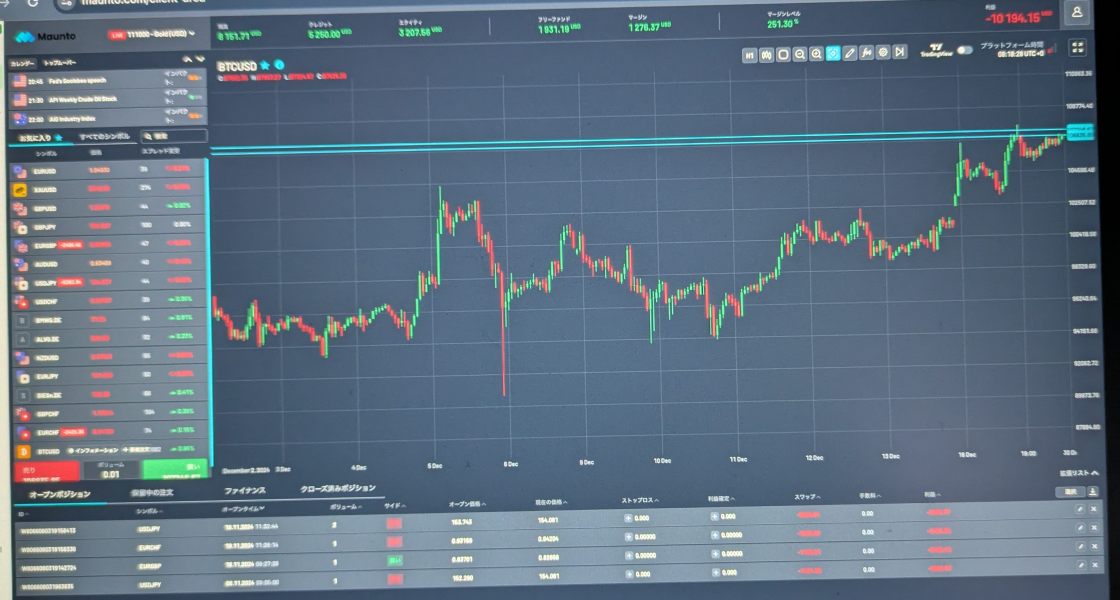

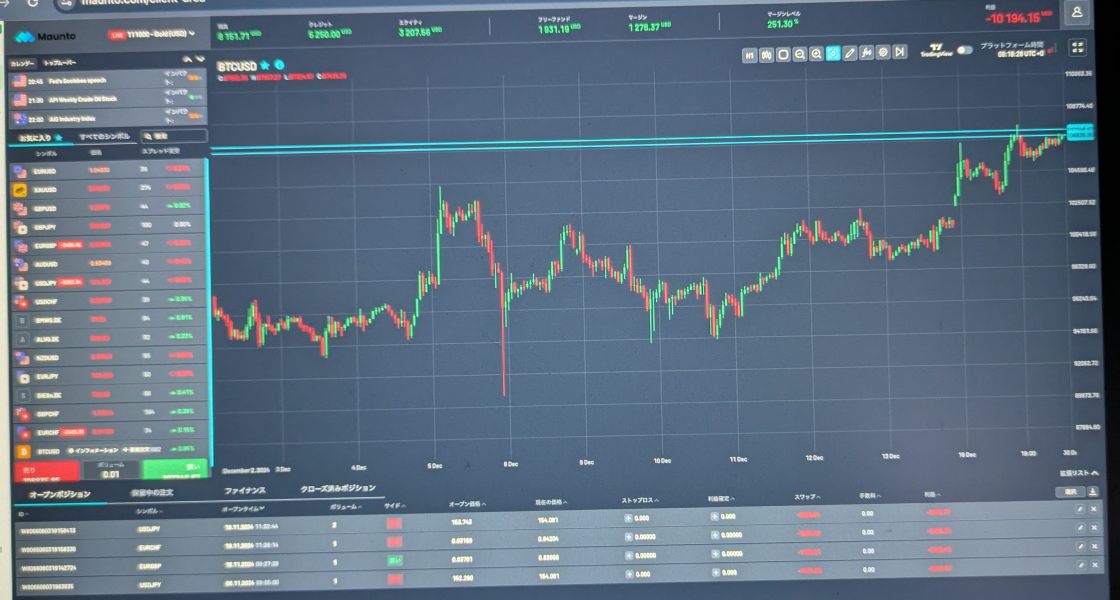

The tools and resources evaluation for Maunto reveals a broker with broad asset coverage but limited detailed information about specific trading tools and analytical resources. The platform provides access to hundreds of CFDs across six major asset categories. These include forex, commodities, stocks, indices, cryptocurrencies, and precious metals. This diverse offering suggests a comprehensive approach to market access, potentially satisfying traders seeking portfolio diversification across multiple asset classes.

However, the assessment identifies significant gaps in specific tool documentation. Advanced trading tools, technical analysis capabilities, charting features, and automated trading support are not extensively detailed in available materials. The absence of information about research resources, market analysis tools, and educational materials limits the ability to fully evaluate the platform's analytical capabilities.

Educational resources, which Maunto emphasizes as a core component of their service offering, lack specific details about content quality, delivery methods, and comprehensiveness. While the broker mentions educational support, the actual structure, topics covered, and accessibility of these resources remain unclear from available documentation.

User feedback regarding tools and resources shows some dissatisfaction. Certain traders express concerns about the adequacy of available tools for their trading strategies. The lack of detailed information about trading platform features, including order types, risk management tools, and analytical capabilities, contributes to uncertainty about the platform's suitability for different trading approaches.

The moderate-low scoring reflects the broad asset coverage balanced against the significant information gaps regarding specific tools, resources, and educational offerings that are crucial for informed trading decisions.

Customer Service and Support Analysis (Score: 7/10)

Customer service emerges as one of Maunto's stronger aspects based on available user feedback. It earns the highest score among evaluated criteria. Multiple user reviews specifically highlight positive experiences with customer service quality, describing the support team as responsive and professional in addressing client concerns and inquiries.

The broker provides multiple contact channels including email, phone support, and website contact forms. This offers flexibility for clients seeking assistance. User feedback suggests that response times are generally satisfactory, with support staff demonstrating competency in addressing various account-related and trading questions. The emphasis on problem resolution and client satisfaction appears to be a genuine priority for the organization.

However, the evaluation identifies areas requiring clarification. Specific information about customer service hours, availability across different time zones, and language support options is not comprehensively documented. For international clients trading across global markets, understanding support availability during different trading sessions becomes crucial for effective problem resolution.

The quality of technical support for trading platform issues, account management assistance, and educational guidance shows positive indicators from user feedback. However, specific examples of complex problem resolution are limited in available documentation. Some users specifically commend the professionalism and expertise demonstrated by support staff in handling their concerns.

Despite the positive feedback, the scoring acknowledges that comprehensive customer service evaluation requires more detailed information about service level agreements, escalation procedures, and specialized support for different client segments. The strong user feedback supports the higher rating while recognizing areas where additional transparency would enhance client confidence.

Trading Experience Analysis (Score: 6/10)

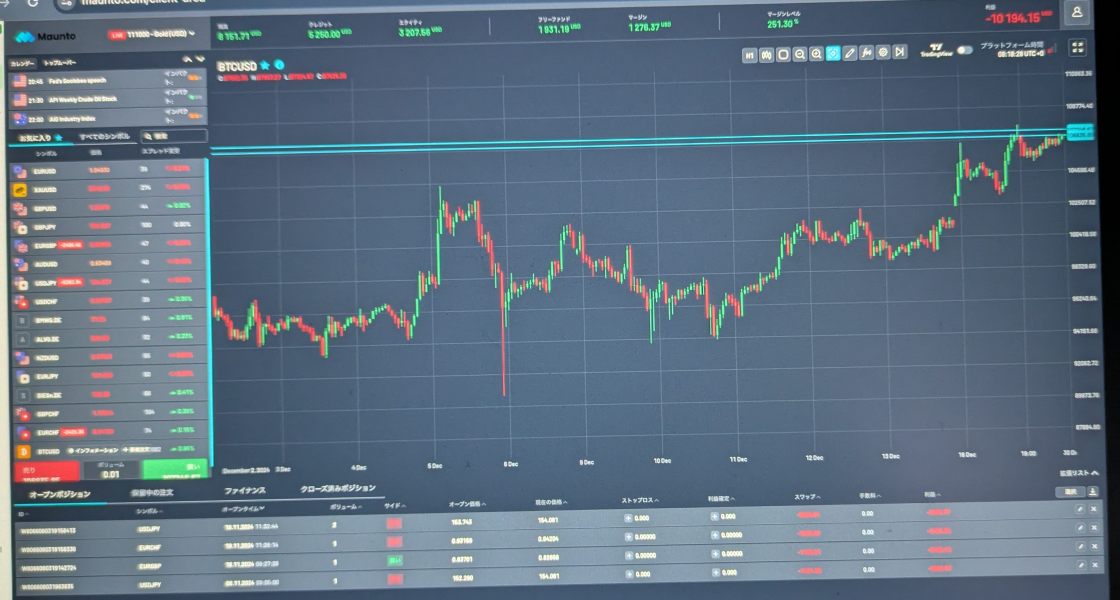

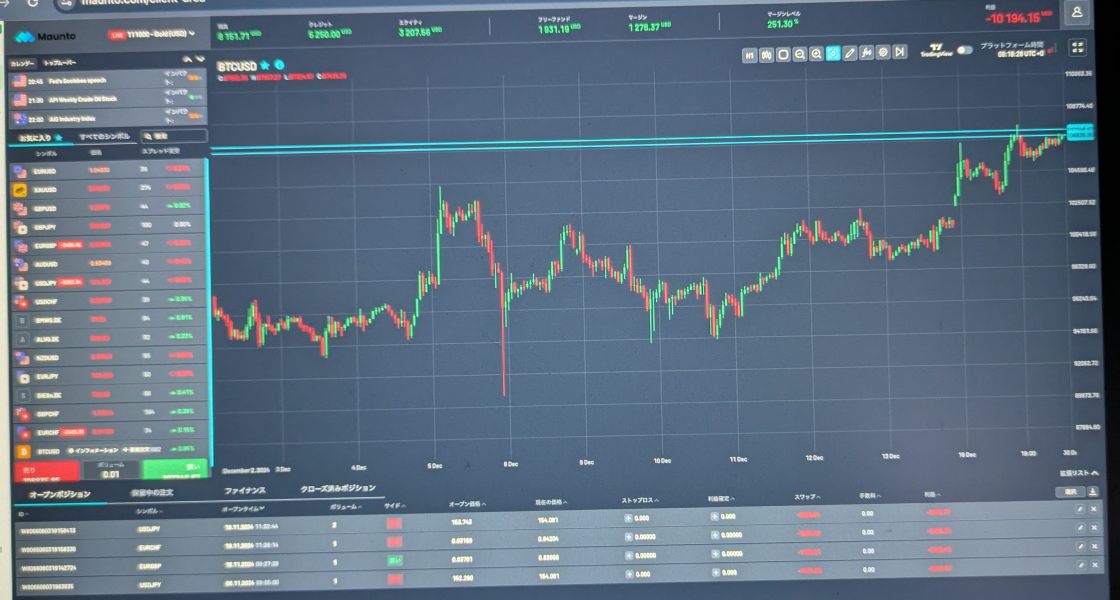

The trading experience evaluation for Maunto faces significant limitations due to insufficient detailed information about platform performance, execution quality, and technical capabilities. While the broker offers access to multiple asset classes and emphasizes flexible trading conditions, specific details about platform stability, order execution speed, and trading environment quality are not comprehensively documented in available materials.

Platform functionality assessment is hampered by the lack of detailed specifications about trading software, user interface design, and advanced trading features. Critical aspects such as order types available, risk management tools, and charting capabilities require direct verification with the broker rather than being clearly outlined in accessible documentation.

Mobile trading experience, which has become increasingly important for modern traders, lacks specific information about app availability, functionality, and performance across different devices and operating systems. The absence of detailed mobile platform specifications creates uncertainty for traders who rely heavily on mobile trading capabilities.

User feedback regarding trading experience shows mixed results. Some traders express dissatisfaction with certain aspects of their trading experience. However, specific details about the nature of these concerns are limited, making it difficult to assess whether issues relate to platform performance, execution quality, or other technical factors.

The moderate scoring reflects the uncertainty created by limited detailed information about core trading experience factors. This maunto review emphasizes that potential clients should thoroughly test the platform through demo accounts and direct communication with the broker to evaluate trading experience suitability for their specific needs and strategies.

Trust and Reliability Analysis (Score: 5/10)

Trust and reliability assessment for Maunto reveals several areas of concern that potential clients should carefully consider. The broker operates under regulation from the Mwali International Services Authority (MISA). This is an offshore regulatory framework that may provide different levels of investor protection compared to established financial regulators in major jurisdictions such as the FCA, ASIC, or CySEC.

The regulatory framework presents questions about dispute resolution mechanisms, compensation schemes, and oversight standards that clients might expect from more established regulatory environments. While MISA regulation provides some oversight, the specific protections and recourse options available to clients are not extensively detailed in available documentation.

Company transparency shows significant gaps. Limited information exists about company history, founding details, management structure, and financial stability indicators. The absence of comprehensive corporate information makes it challenging for potential clients to conduct thorough due diligence before committing funds to the platform.

Fund safety measures, segregation policies, and client money protection protocols are not extensively detailed in available materials. This creates uncertainty about asset security and protection standards. These factors are crucial for client confidence and regulatory compliance in the financial services industry.

User feedback reflects divided opinions about trustworthiness. Some clients express satisfaction while others voice concerns about various aspects of the service. The mixed user sentiment, combined with limited transparency about corporate structure and regulatory protections, contributes to the moderate-low trust rating.

The scoring reflects the need for enhanced transparency and clearer communication about regulatory protections, fund safety measures, and corporate governance to build stronger client confidence in the platform's reliability.

User Experience Analysis (Score: 6/10)

User experience evaluation for Maunto reveals a polarized landscape with both positive and negative feedback from the trading community. Overall user satisfaction shows significant variation, with experiences ranging from highly positive to notably negative. This creates an inconsistent picture of service quality and platform performance.

The registration and verification process details are not comprehensively documented. This leaves questions about account opening efficiency, required documentation, and timeline expectations. Clear information about onboarding procedures would help set appropriate expectations for new clients considering the platform.

Interface design and platform usability lack detailed documentation. This makes it difficult to assess the user-friendliness of the trading environment. Modern traders expect intuitive interfaces, efficient navigation, and responsive design across desktop and mobile platforms, but specific details about Maunto's interface quality are not extensively available.

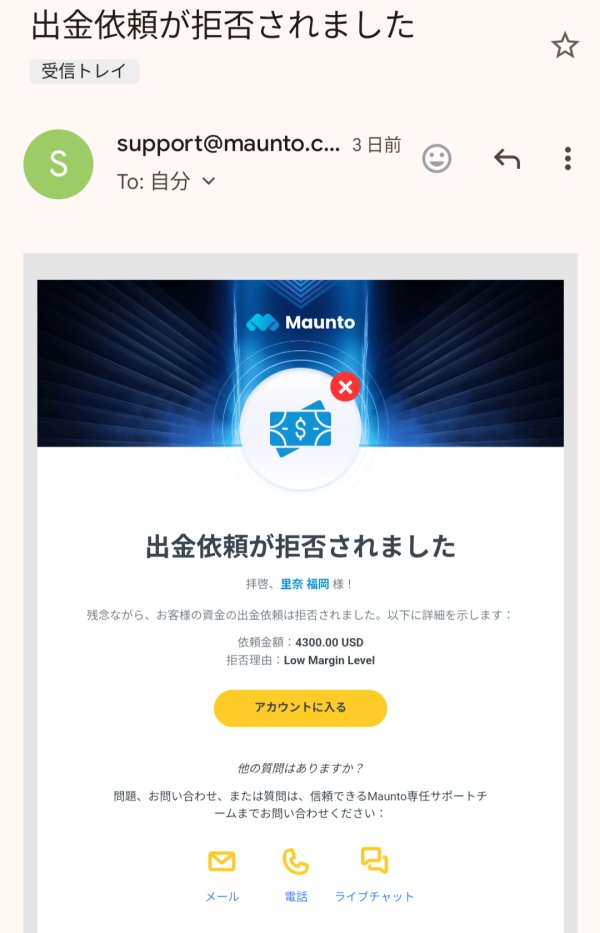

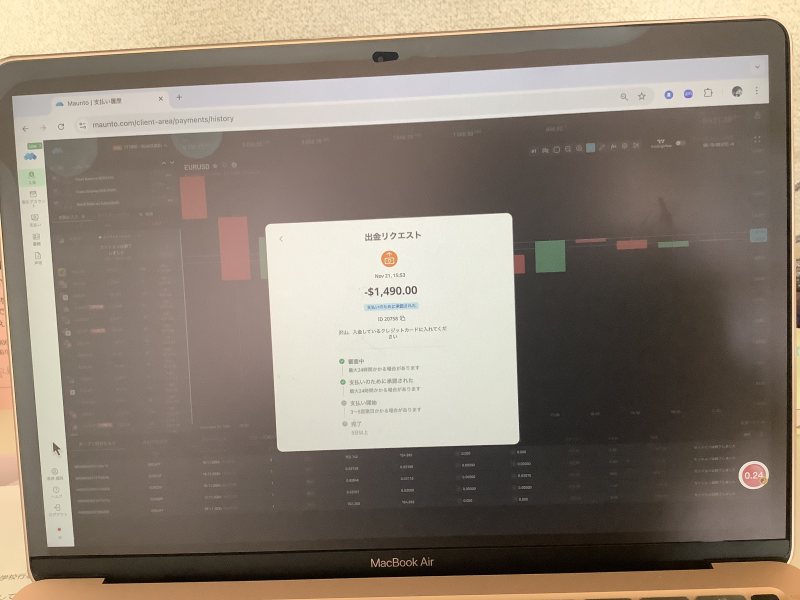

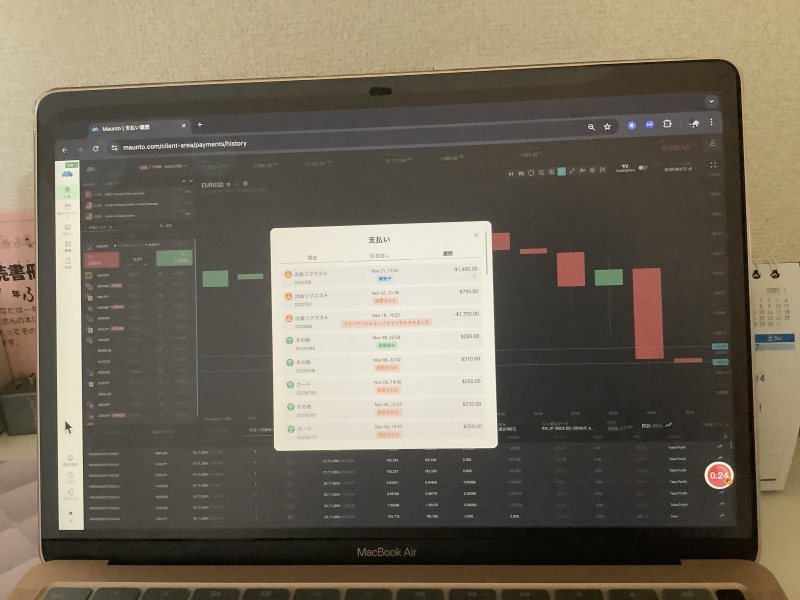

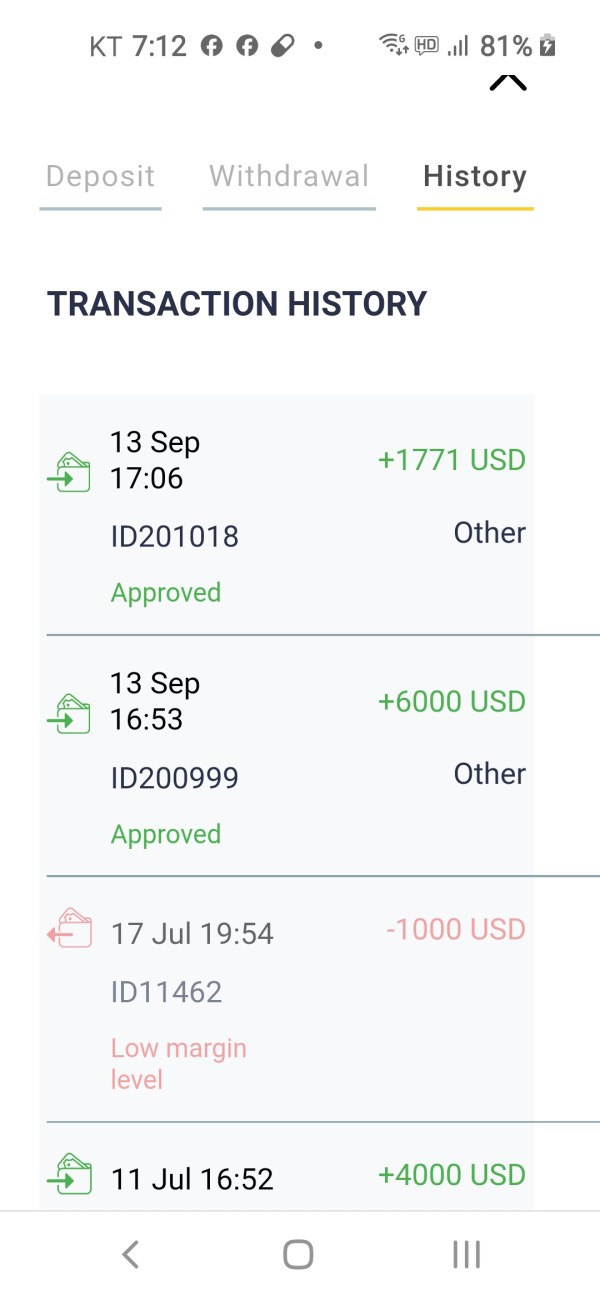

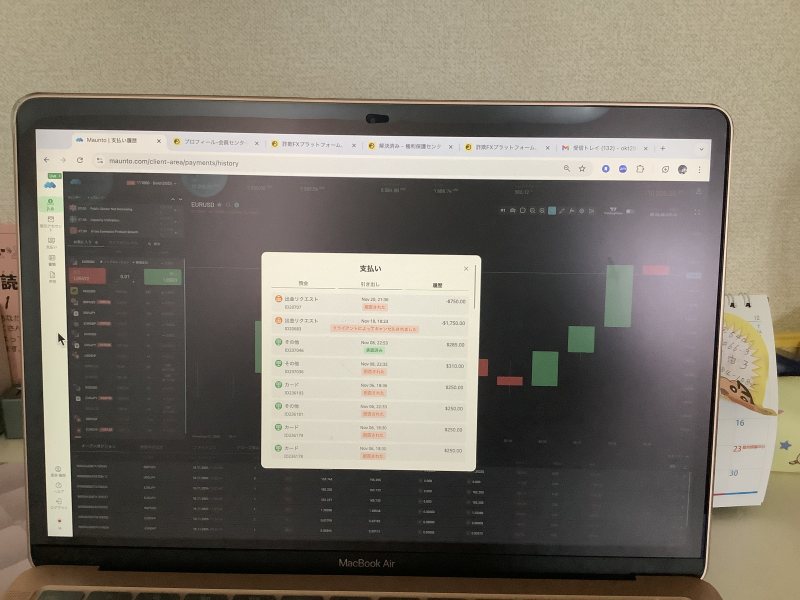

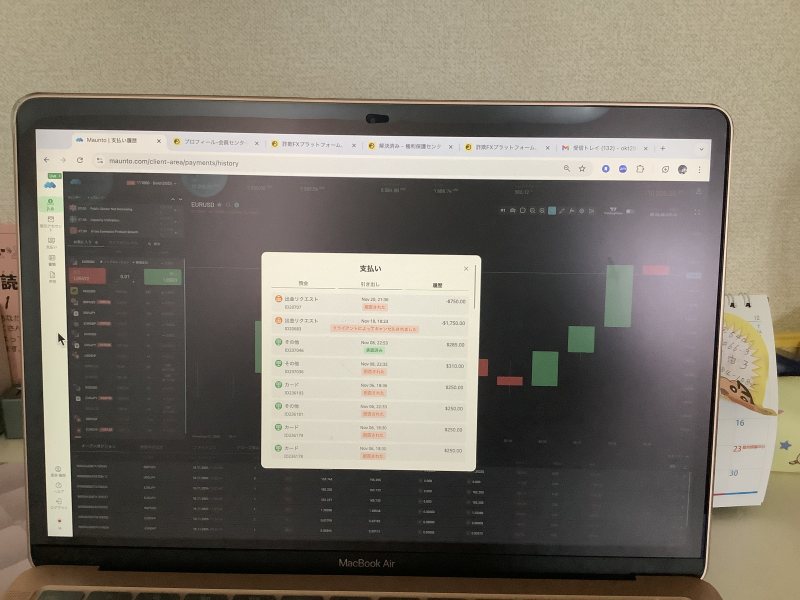

Fund management experience, including deposit and withdrawal processes, processing times, and fee structures, requires additional clarity. While the broker supports multiple payment methods and currencies, specific details about transaction processing efficiency and associated costs are not comprehensively outlined.

Common user complaints center around dissatisfaction with forex marketing approaches. This suggests that some clients feel the marketing practices do not align with their expectations or needs. This feedback indicates potential areas for improvement in client communication and service delivery approaches.

The moderate scoring reflects the mixed user feedback and limited detailed information about key user experience factors. Potential clients are advised to thoroughly research and potentially test the platform through demo accounts to evaluate whether the user experience meets their specific requirements and trading preferences.

Conclusion

This comprehensive maunto review reveals a broker with both strengths and areas requiring improvement. Maunto demonstrates particular competency in customer service, earning positive feedback from users who praise the responsiveness and professionalism of support staff. The commission-free trading model and reasonable minimum deposit of 250 USD create accessible entry points for small and medium-sized investors seeking diversified market exposure.

However, significant challenges emerge around transparency and information availability. Limited regulatory details, insufficient platform specifications, and gaps in corporate information create uncertainty for potential clients conducting due diligence. The offshore regulatory framework may not provide the same level of investor protection as major financial jurisdictions.

Maunto appears most suitable for traders prioritizing customer service quality and seeking access to diverse asset classes including forex, commodities, stocks, indices, cryptocurrencies, and precious metals. The broker may particularly appeal to investors comfortable with offshore regulation and those willing to conduct additional research to fill information gaps. However, traders requiring comprehensive transparency, detailed platform specifications, or major jurisdiction regulatory protection may find the offering insufficient for their needs.