Is FinMaxwell safe?

Business

License

Is Finmaxwell A Scam?

Introduction

Finmaxwell is a forex broker that has emerged in the competitive landscape of online trading, offering a range of financial instruments including forex, commodities, and cryptocurrencies. As traders increasingly turn to online platforms for investment opportunities, it becomes crucial to assess the credibility and safety of these brokers. In an industry rife with scams and unregulated entities, evaluating a broker‘s legitimacy is essential for protecting one’s investments. This article aims to provide a comprehensive analysis of Finmaxwell, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a review of multiple credible sources and user feedback, ensuring a well-rounded perspective on the broker's safety and reliability.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its safety. A regulated broker is subject to strict oversight, which can provide a level of assurance to traders regarding the security of their funds and the integrity of the trading environment. In the case of Finmaxwell, the broker claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, upon further investigation, it appears that Finmaxwell is not listed on the FCA's registry, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | Not applicable | United Kingdom | Unverified |

This lack of valid regulation is a major red flag. The absence of oversight means that Finmaxwell is not obligated to adhere to industry standards that protect investors. Furthermore, several reviews have labeled Finmaxwell as an unregulated broker, reinforcing the notion that it may not be a safe option for traders. The importance of regulation cannot be overstated, as it serves as a safeguard against potential fraud and malpractice. Therefore, the question remains: Is Finmaxwell safe? Based on its regulatory status, the answer appears to lean towards "no."

Company Background Investigation

Understanding the company behind a trading platform is crucial for assessing its reliability. Finmaxwell operates under the name JP Maxwell Financial Management Ltd, but details about its ownership structure and history are scarce. The company claims to have its headquarters in the United Kingdom; however, various sources indicate that this information may be misleading. The lack of transparency regarding the companys actual location and operational history raises concerns about its credibility.

The management teams background is also an important factor in evaluating the broker's reliability. Unfortunately, there is limited information available about the qualifications and experience of the team leading Finmaxwell. A reputable broker typically provides detailed information about its management and operational strategy, which is often absent in the case of Finmaxwell. This lack of transparency further compounds the doubts surrounding the broker's legitimacy and safety. Given these factors, it is reasonable to question the safety of investing with Finmaxwell.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the trading conditions they offer, including fees, spreads, and commissions. Finmaxwell advertises competitive trading conditions, but a closer examination reveals potential issues. The broker's fee structure lacks clarity, which can lead to unexpected costs for traders.

| Fee Type | Finmaxwell | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Finmaxwell are higher than the industry average, which can significantly impact a trader's profitability. Additionally, the absence of a clear commission structure raises questions about hidden fees that may be applied during trading. Such practices can be indicative of a broker that is not fully transparent, further contributing to concerns about whether Finmaxwell is safe for traders.

Client Funds Security

The security of client funds is paramount when evaluating a forex broker. Finmaxwell's approach to fund safety is concerning, as it lacks clear policies regarding fund segregation and investor protection. Regulated brokers typically have measures in place to ensure that client funds are kept in separate accounts, safeguarding them against potential insolvency issues.

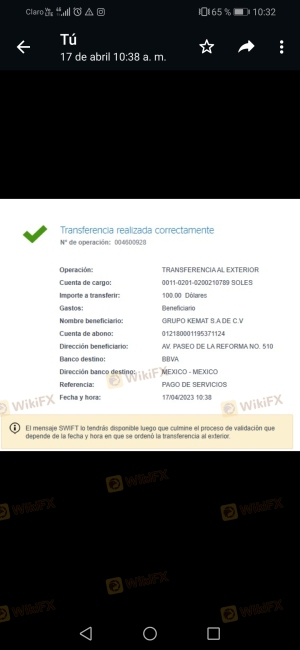

Moreover, without regulatory oversight, there is no guarantee that Finmaxwell adheres to best practices regarding fund management. Historical complaints from users indicate issues with fund withdrawals and lack of responsiveness from customer service. These factors collectively paint a troubling picture of Finmaxwell's commitment to client fund security. Thus, the question of whether Finmaxwell is safe remains highly questionable.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of Finmaxwell reveal a pattern of negative experiences, with many users reporting difficulties in withdrawing funds and receiving inadequate support from the company.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

Common complaints include inability to access funds, unresponsive customer service, and misleading promotional material. These issues suggest a lack of commitment to customer satisfaction and transparency, which are critical components of a trustworthy broker. For instance, one user reported waiting weeks for a withdrawal request to be processed, only to receive no response from the support team. Such experiences highlight the risks associated with trading through Finmaxwell and raise further doubts about its safety.

Platform and Trade Execution

The trading platform's performance is another crucial factor in evaluating a broker. Finmaxwell provides a web-based trading platform, but reviews indicate mixed experiences regarding its stability and execution quality. Users have reported issues with slippage and order rejections, which can adversely affect trading outcomes.

In addition, the absence of a demo account option limits opportunities for traders to familiarize themselves with the platform before committing real funds. This lack of transparency and user empowerment raises concerns about whether Finmaxwell is safe for inexperienced traders who may be vulnerable to market volatility.

Risk Assessment

Using Finmaxwell comes with a range of risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | High spreads and unclear fee structure. |

| Operational Risk | Medium | Reports of platform instability and withdrawal issues. |

Given these risks, it is advisable for potential clients to exercise extreme caution. Traders should consider alternatives that offer better regulatory oversight and clearer trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Finmaxwell is not a safe broker. Its lack of regulation, transparency issues, and negative customer feedback point to a high risk of fraud and poor trading conditions. For traders looking to invest, it is essential to prioritize safety and choose brokers that are well-regulated and have a proven track record of reliability.

If you are considering trading, we recommend exploring alternative brokers that are regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia. These brokers typically offer better protection for your funds and a more transparent trading environment. Ultimately, ensuring the safety of your investments should be your top priority.

Is FinMaxwell a scam, or is it legit?

The latest exposure and evaluation content of FinMaxwell brokers.

FinMaxwell Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FinMaxwell latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.