Nacion Bursatil 2025 Review: Everything You Need to Know

Executive Summary

This nacion bursatil review looks at a stock broker in Argentina that worries many traders. WikiFX reports show that Nacion Bursatil works without proper rules from government agencies, which creates big risks for people who want to invest. The broker sells stocks, forex, and other trading tools. It calls itself a platform that handles many types of investments for people in Argentina.

The broker wants to attract traders who care about Argentine financial markets. These traders usually want access to different financial products like CEDEARs, ETFs, and foreign exchange. User reviews show mixed results, and many people worry about whether the platform is real and safe. The biggest warning sign is that recognized financial authorities do not watch over this broker properly.

Our research and user feedback show that Nacion Bursatil creates a high-risk environment for investments. People should think very carefully before they decide to use this broker.

Important Notice

Regional Entity Differences: Nacion Bursatil only works in Argentina and has no approval from international regulatory bodies. This limit hurts its reputation and legal status in other countries. Without proper government oversight, clients might have few options if they face disputes or money problems.

Review Methodology: We based this review on public information, user feedback from different sources, and searches of regulatory databases. The broker does not share much information, so some details are missing, which we point out clearly in this review.

Rating Framework

Broker Overview

Nacion Bursatil works as a financial services company in Argentina. It offers trading services for many types of investments including stocks, foreign exchange, and derivative products. The company says it provides a complete trading platform that gives Argentine investors access to both local and international financial markets. However, we could not find clear information about when the company started or detailed background about the corporation.

The broker focuses on helping people trade different financial instruments. It pays special attention to CEDEARs, ETFs, stocks, and forex markets. Even though it offers many trading products, the company does not clearly explain how it operates or how it manages its business. Public materials do not show enough details about these important areas.

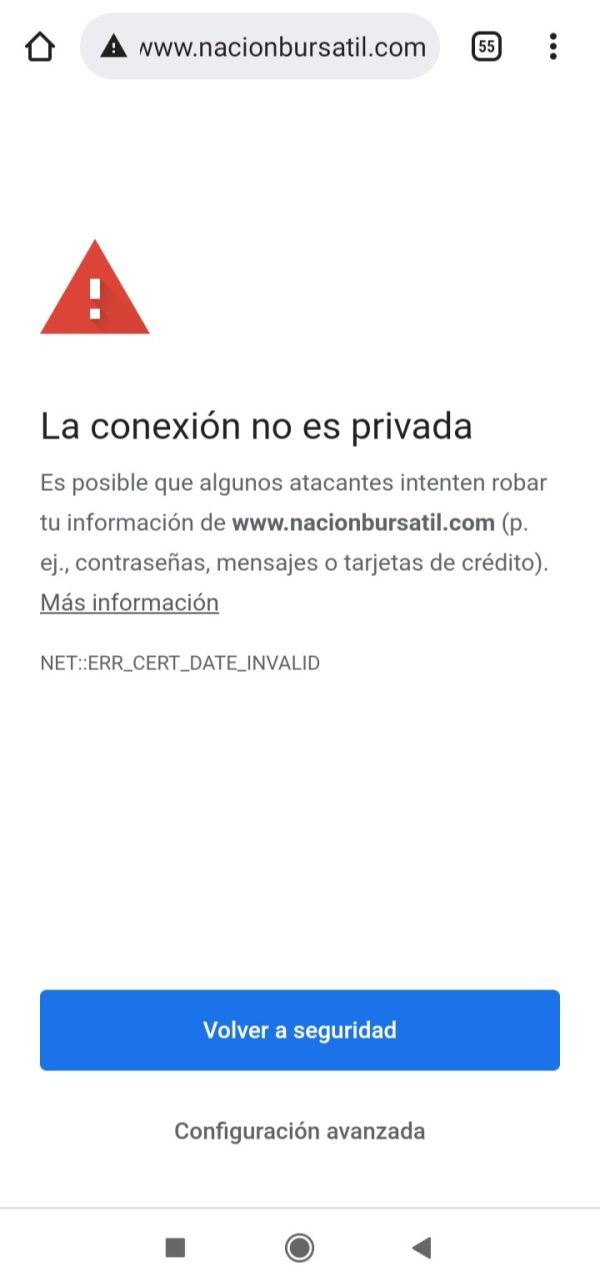

WikiFX reports say that Nacion Bursatil works mainly as a stock broker in Argentina but operates without proper supervision from recognized financial authorities. This nacion bursatil review shows that the platform has not clearly explained what trading technology it uses, whether it uses popular platforms like MetaTrader 4/5 or its own systems. The lack of clear government oversight creates big questions about how well it protects client money and follows operational standards.

Regulatory Status: Nacion Bursatil operates in Argentina without effective regulation from recognized financial authorities, as WikiFX database information confirms.

Deposit and Withdrawal Methods: Available sources do not give specific details about deposit and withdrawal methods.

Minimum Deposit Requirements: Available documentation does not specify the minimum deposit amount needed to open an account with Nacion Bursatil.

Bonus and Promotions: Current sources do not provide information about promotional offers, welcome bonuses, or trading incentives.

Tradeable Assets: The broker gives access to CEDEARs, ETFs, stocks, and foreign exchange markets. This provides traders with different investment opportunities across multiple asset classes.

Cost Structure: Commission rates and trading fees change depending on which financial product you trade. However, detailed fee schedules and cost breakdowns have not been shared completely.

Leverage Ratios: Available information does not detail specific leverage offerings and maximum leverage ratios available to clients.

Platform Options: Accessible sources have not clearly identified the specific trading platforms that Nacion Bursatil supports.

Geographic Restrictions: Trading services appear to be mainly limited to Argentine residents and may not be available to international clients.

Customer Support Languages: Current documentation has not specified available customer service languages.

This nacion bursatil review shows important information gaps that potential clients should think about when they decide if this broker fits their trading needs.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Nacion Bursatil gets a below-average rating for account conditions because it does not clearly explain account types, requirements, and features. Available sources do not give specific information about different account levels, minimum deposit requirements, or special account features that might be available to traders. This lack of clarity makes it hard for potential clients to understand what they can expect when they open an account.

Details about the account opening process are not easy to find, which creates concerns about the broker's transparency and customer onboarding procedures. Prospective clients cannot prepare properly for the account setup process because there is no clear information about verification requirements, needed documentation, or processing timeframes.

There is also no mention of specialized account options such as Islamic accounts for Muslim traders or professional accounts for experienced investors. The lack of detailed account condition information hurts the overall user experience significantly and makes it challenging for traders to make smart decisions about whether this broker meets their specific needs.

This nacion bursatil review shows that the lack of complete account information represents a major problem for potential clients who want transparency and clarity when they choose a broker.

Nacion Bursatil gets an average rating for tools and resources, mainly because it offers multiple financial products across different asset classes. The broker provides access to various trading instruments including stocks, forex, CEDEARs, and ETFs, which shows some level of product variety for traders interested in the Argentine market.

However, specific information about the quality and advanced features of trading tools remains unclear. Available sources do not completely document details about charting capabilities, technical analysis indicators, market research resources, and analytical tools. This information gap makes it difficult to judge whether the platform provides adequate tools for both beginner and advanced traders.

Available documentation does not mention educational resources, which are crucial for trader development. The lack of information about webinars, tutorials, market analysis, or trading guides suggests that the broker may not focus on client education and skill development.

Automated trading support and algorithmic trading capabilities are also not detailed, which may limit the platform's appeal to traders who rely on systematic trading strategies or expert advisors.

Customer Service and Support Analysis (5/10)

Customer service and support get an average rating because of mixed user feedback and limited information about support infrastructure. Available sources show that user experiences with customer service quality vary significantly, with some clients reporting satisfactory interactions while others express concerns about responsiveness and problem resolution.

Sources do not clearly document specific details about customer support channels, such as live chat, telephone support, email assistance, or help desk systems. This lack of transparency about support accessibility makes it difficult for potential clients to understand how they can reach assistance when they need it.

Response time information and service quality metrics are not available, which prevents a complete assessment of the broker's commitment to customer support excellence. The lack of detailed support hour information also raises questions about availability for clients who may need assistance outside standard business hours.

Available documentation does not specify multilingual support capabilities, which are particularly important for international clients or those preferring communication in languages other than Spanish.

Trading Experience Analysis (5/10)

The trading experience with Nacion Bursatil gets an average rating based on limited available information about platform performance and user feedback. Accessible sources do not completely document specific details about platform stability, execution speed, and overall trading environment quality.

Sources have not detailed order execution quality, including information about slippage rates, requote frequency, and fill rates. These factors are crucial for traders to understand the actual trading conditions they can expect when they place orders in various market conditions.

Platform functionality details, such as available chart types, technical indicators, drawing tools, and analytical capabilities, are not specified. This information gap makes it difficult to assess whether the trading environment meets the needs of different trader types and experience levels.

Mobile trading experience information is also lacking, which is increasingly important as traders seek flexibility to manage positions and monitor markets while away from desktop computers. The lack of mobile app details or mobile platform capabilities represents a significant information gap in this nacion bursatil review.

Trustworthiness Analysis (2/10)

Trustworthiness gets the lowest rating because of fundamental concerns about regulatory oversight and operational transparency. WikiFX information shows that Nacion Bursatil operates without effective regulation from recognized financial authorities, which represents a significant red flag for potential clients concerned about fund safety and regulatory protection.

The lack of proper regulatory supervision means that clients may have limited options in case of disputes, fund recovery issues, or operational problems. Regulatory oversight typically provides important protections including segregated client funds, compensation schemes, and standardized operational procedures.

Available sources suggest that company transparency regarding financial statements, management information, and corporate governance practices appears to be limited. This lack of transparency makes it difficult for potential clients to assess the broker's financial stability and operational integrity.

Available documentation does not mention industry recognition, awards, or positive third-party evaluations, which further impacts the broker's credibility within the financial services sector.

User Experience Analysis (4/10)

User experience gets a below-average rating because of concerns raised about the platform's legitimacy and safety measures. Available feedback suggests that user satisfaction varies considerably, with some clients expressing significant concerns about the broker's operational practices and reliability.

Available sources do not detail interface design and platform usability information, making it difficult to assess the quality of the user interface and navigation experience. User-friendly design is crucial for effective trading, particularly for less experienced traders who may struggle with complex or poorly designed platforms.

Registration and account verification processes are not clearly documented, which may create uncertainty for potential clients about what to expect during the onboarding experience. Clear and efficient onboarding processes are important for positive first impressions and user satisfaction.

Available information does not detail fund operation experiences, including deposit and withdrawal convenience, processing times, and fee transparency. These operational aspects significantly impact overall user satisfaction and platform usability.

Conclusion

This complete nacion bursatil review shows significant concerns about the broker's legitimacy and operational transparency. The most critical issue is the lack of effective regulatory oversight, which raises serious questions about client fund protection and dispute resolution mechanisms. The lack of detailed information about account conditions, trading platforms, and operational procedures makes these concerns even worse.

Nacion Bursatil appears unsuitable for traders seeking a regulated, transparent, and reliable trading environment. The broker may only be appropriate for very experienced traders who fully understand the risks associated with unregulated financial services and are specifically interested in Argentine market access.

The main problems include lack of regulatory protection, insufficient operational transparency, and limited available information about trading conditions. While the broker offers access to multiple asset classes, these potential benefits are significantly outweighed by the fundamental trust and safety concerns identified in this analysis.