Kufin 2025 Review: Everything You Need to Know

Kufin, an online trading platform established in 2021, has garnered attention for its diverse range of tradable assets and account types. However, the absence of regulatory oversight raises significant concerns about user safety and transparency. This review synthesizes various sources to provide a comprehensive understanding of Kufin's offerings, user experiences, and expert opinions.

Note: It is crucial to highlight that Kufin operates without regulation from recognized financial authorities, which can significantly impact user trust and safety. The information presented here aims for fairness and accuracy based on available data.

Rating Overview

We assess brokers based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

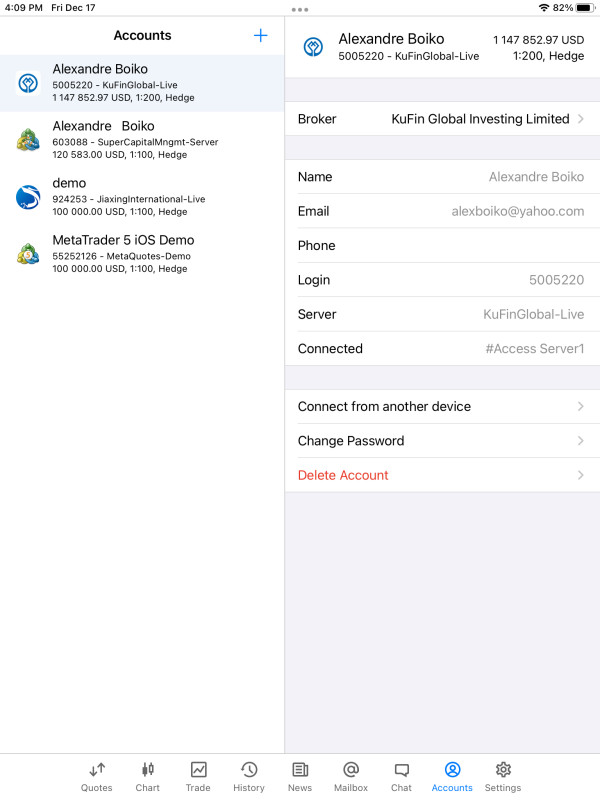

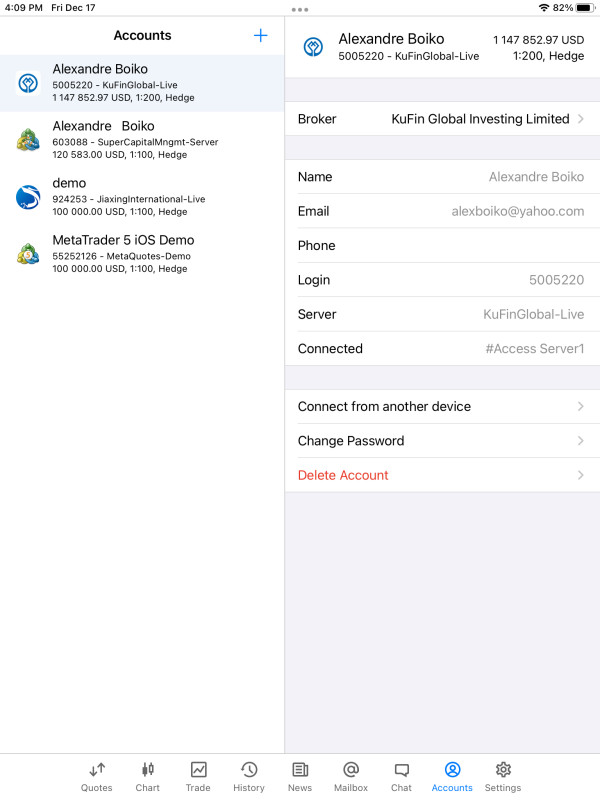

Kufin is operated by Kufin Global Investing Limited, headquartered in the United Kingdom. The platform primarily utilizes the MetaTrader 5 (MT5) trading platform, known for its advanced features suitable for both novice and experienced traders. Kufin offers a wide array of tradable assets, including stocks, ETFs, futures, options, forex, and CFDs. However, it is crucial to note that Kufin is not regulated by any major financial authority, which can pose risks for traders.

Detailed Breakdown

Regulatory Environment

Kufin operates without oversight from any recognized regulatory bodies, which is a significant drawback. According to various sources, including WikiFX, this lack of regulation can lead to inadequate protection for user funds and limited dispute resolution options. Traders are advised to exercise caution when dealing with unregulated brokers.

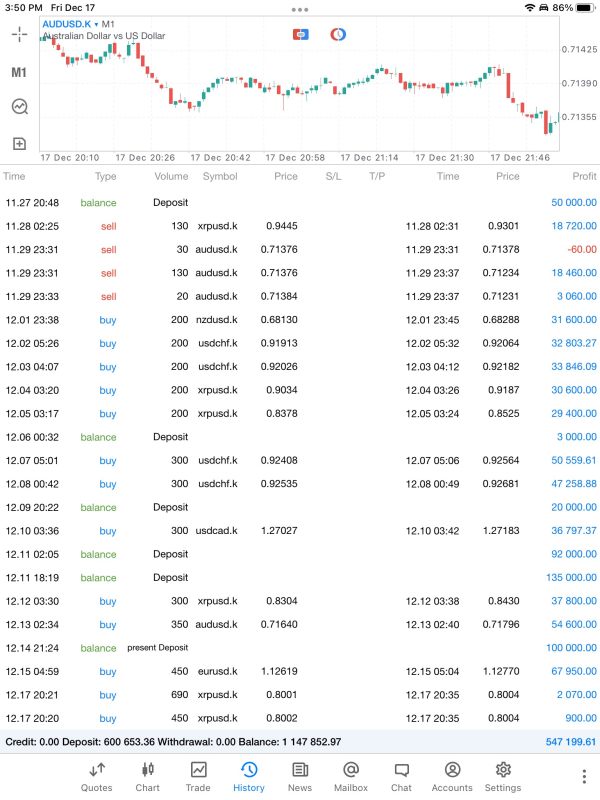

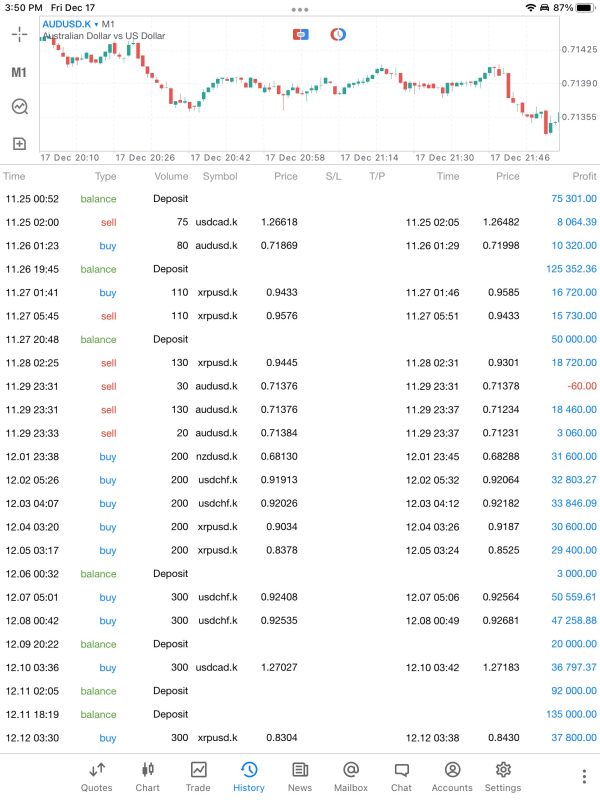

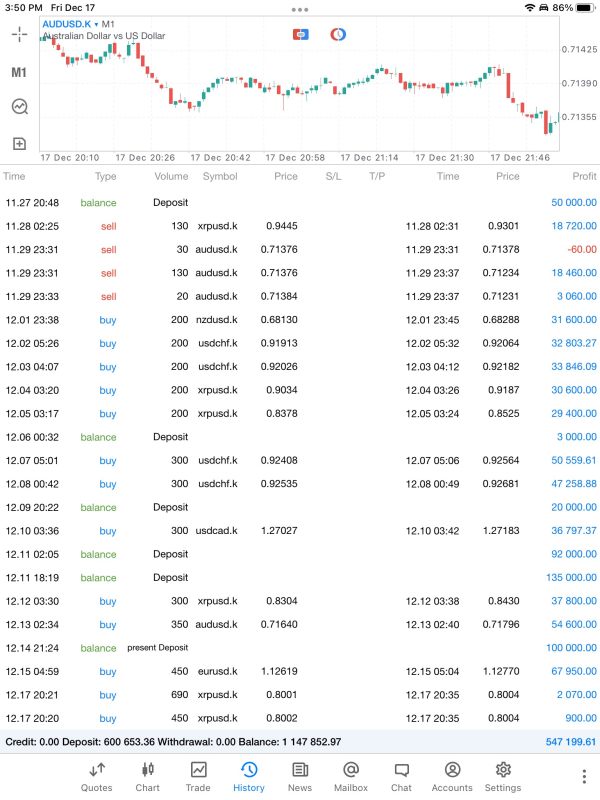

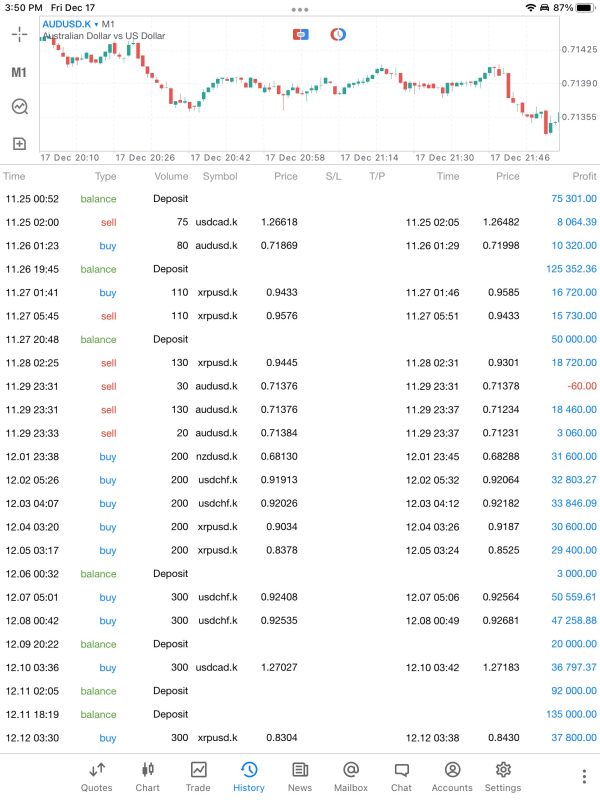

Deposit and Withdrawal Options

Kufin supports multiple deposit methods, including bank transfers, credit/debit cards, electronic payments, and cryptocurrencies. The minimum deposit requirement is generally set at $100, but this can vary based on the account type and funding method. However, there are concerns about the withdrawal process, as some users have reported difficulties in accessing their funds, which is a common red flag for unregulated brokers.

Kufin does not currently offer any bonuses or promotional incentives, which could be a drawback for traders looking for additional value. The absence of such offerings could indicate a focus on maintaining a straightforward trading environment, but it may also reflect a lack of competitiveness compared to other brokers.

Tradable Asset Classes

The platform offers a diverse range of tradable assets, including:

- Stocks: Ownership in publicly traded companies.

- ETFs: Funds that track specific indices or sectors.

- Futures and Options: Contracts for buying or selling assets at predetermined prices.

- Forex: Currency trading with significant risks and potential rewards.

- CFDs: Contracts for difference that allow speculation on price movements without owning the underlying asset.

Kufin's asset diversity is a positive feature, catering to various trading strategies and preferences.

Cost Structure

Kufin employs a variable spread model, with typical spreads ranging from 1 to 2 pips for major currency pairs. However, the exact costs can vary significantly based on market conditions and asset classes. Additionally, commissions may apply, particularly for stock trades, which could affect overall trading costs. Transparency regarding fees is crucial, and users are encouraged to review the fee schedule carefully.

Kufin offers leverage of up to 500:1, which can amplify both potential gains and losses. The use of the MT5 platform enhances the trading experience with advanced features, but traders should be aware of the risks associated with high leverage.

Restricted Regions

Kufin's services may not be available in certain jurisdictions, particularly those with stringent regulatory requirements. This limitation can affect potential users and may restrict access to the platform for traders in specific regions.

Customer Support

Customer support for Kufin is primarily conducted via email, with many users reporting slow response times. This can be frustrating, especially when urgent issues arise. The lack of robust customer service options is a significant concern for traders who may require immediate assistance.

Conclusion

In summary, Kufin presents a mixed bag of offerings for traders. While the platform provides a wide range of tradable assets and utilizes the popular MetaTrader 5 platform, the lack of regulatory oversight raises substantial concerns about user safety and fund protection. Users should carefully evaluate the potential risks associated with trading through an unregulated broker. As highlighted in this Kufin review, exercising caution and conducting thorough research before engaging with the platform is essential.