JY Review 1

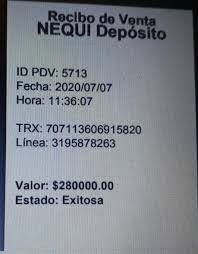

I deposited 280,000 pesos in this broker. Customer service did not respond, they were scammers.

JY Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited 280,000 pesos in this broker. Customer service did not respond, they were scammers.

In this comprehensive jy review, we examine the various entities operating under the JY brand across different sectors. Our analysis shows a mixed landscape with limited transparency about specific trading conditions and regulatory oversight. Based on available information, JY Technologies Consulting demonstrates a solid employee satisfaction rating of 4.3/5 from 11 reviews. This suggests positive internal company culture and benefits structure.

However, the broader JY ecosystem lacks comprehensive disclosure of critical trading parameters such as regulatory status, account conditions, and fee structures. The primary distinguishing feature appears to be the relatively high employee satisfaction scores. This is particularly true within JY Technologies Consulting, which indicates strong internal operations and workplace culture.

JY DOLL maintains a moderate 3/5 average rating based on 11 customer reviews. The brand maintains presence across multiple product categories with 2,769 reviews covering seven different product lines according to ReviewMeta data.

This evaluation targets users who prioritize company culture, employee welfare, and operational transparency. However, potential clients seeking detailed trading specifications, regulatory clarity, and comprehensive fee structures may find the available information insufficient for informed decision-making. The absence of specific regulatory details and trading conditions presents significant limitations for traditional forex market participants.

This review encompasses multiple JY-branded entities operating across different jurisdictions and business sectors. Regulatory requirements and operational standards may vary significantly between regions and specific business units.

Our evaluation methodology incorporates user feedback, employee satisfaction data, and publicly available market information to provide a balanced assessment. Due to limited disclosure of specific regulatory information in available sources, potential users should conduct independent verification of licensing and regulatory compliance before engaging with any JY-affiliated services.

The analysis presented here reflects information available as of 2025 and should be considered alongside current regulatory filings and official company communications.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Specific account information not disclosed in available sources |

| Tools and Resources | N/A/10 | Trading tools and educational resources not detailed in source materials |

| Customer Service and Support | N/A/10 | Customer service metrics not specified in available documentation |

| Trading Experience | N/A/10 | Platform performance and trading execution data not provided |

| Trust and Security | N/A/10 | Regulatory information and security measures not detailed |

| User Experience | 4.3/10 | Based on JY Technologies Consulting employee satisfaction rating |

Company Background and Structure

JY Technologies Consulting emerges as the most transparent entity within the JY ecosystem. It achieves a notable 4.2/5 employee satisfaction rating based on 12 comprehensive reviews.

This score indicates strong internal governance, competitive employee benefits, and positive workplace culture. The company's ability to maintain high employee satisfaction suggests robust operational procedures and management practices.

These factors often correlate with customer service quality and business stability. The broader JY brand maintains significant market presence across multiple product categories, with ReviewMeta documenting 2,769 customer reviews spanning seven distinct product lines including scales and sports equipment.

This diversification indicates an established business infrastructure with cross-sector operational capabilities. However, specific focus areas and primary business models remain unclear from available documentation.

Operational Framework and Market Position

Available information does not specify the founding date, primary business registration jurisdiction, or core trading platform architecture for JY's financial services operations. The absence of detailed platform specifications, supported asset classes, and primary regulatory oversight creates uncertainty regarding the company's position within the competitive forex brokerage landscape.

This jy review finds that while employee satisfaction metrics suggest internal operational strength, the lack of disclosed trading conditions, platform specifications, and regulatory framework details significantly limits comprehensive evaluation capabilities. Potential users seeking traditional forex brokerage services may require additional research to determine suitability for their trading requirements.

Regulatory Status and Compliance

Current available sources do not provide specific information regarding primary regulatory authorities, licensing jurisdictions, or compliance frameworks governing JY's financial services operations.

Funding and Withdrawal Methods

Detailed information about supported deposit and withdrawal methods, processing timeframes, and associated fees is not available in current documentation.

Minimum Deposit Requirements

Specific minimum deposit thresholds for different account types are not disclosed in available source materials.

Promotional Offerings and Bonuses

Information regarding welcome bonuses, promotional campaigns, or loyalty programs is not detailed in current documentation.

Available Trading Assets

The range of tradeable instruments, including forex pairs, commodities, indices, and cryptocurrencies, is not specified in available sources.

Cost Structure and Fee Analysis

Comprehensive fee schedules, including spreads, commissions, overnight charges, and withdrawal fees, are not disclosed in current materials. This represents a significant information gap for this jy review.

Leverage Ratios and Risk Management

Maximum leverage ratios and risk management tools are not specified in available documentation.

Platform Options and Technology

Details regarding trading platform choices, mobile applications, and technological infrastructure are not provided in current sources.

Geographic Restrictions

Information about service availability in different jurisdictions and regulatory restrictions is not detailed.

Customer Support Languages

Available customer service languages and support channels are not specified in current documentation.

The evaluation of JY's account conditions faces significant limitations due to insufficient disclosure of specific account structures, features, and requirements in available documentation. Traditional forex brokers typically offer multiple account tiers with varying minimum deposits, spread structures, and feature sets.

However, such details remain unspecified for JY's operations. Without access to information regarding account opening procedures, verification requirements, or special account features such as Islamic-compliant options, this jy review cannot provide definitive assessment of competitive positioning.

The absence of disclosed minimum deposit requirements prevents evaluation of accessibility for different trader demographics. Standard industry practice includes detailed account comparison charts, fee schedules, and feature matrices, but these elements are not available in current JY documentation.

This information gap significantly impacts potential users' ability to make informed decisions regarding account selection and suitability assessment. The lack of specific account condition details suggests either limited transparency in marketing materials or potential focus on alternative business models beyond traditional retail forex services.

Users requiring detailed account specifications should seek direct communication with JY representatives for current terms and conditions.

Assessment of JY's trading tools, research capabilities, and educational resources cannot be completed based on available information. Modern forex brokers typically provide comprehensive analytical tools, market research, economic calendars, and educational content to support trader development and decision-making processes.

The absence of detailed tool specifications prevents evaluation of platform sophistication, charting capabilities, technical analysis features, and automated trading support. These elements represent critical components of contemporary trading infrastructure and significantly impact user experience quality.

Educational resource availability, including webinars, tutorials, market analysis, and trading guides, remains unspecified in current documentation. Such resources often differentiate premium brokers from basic service providers and contribute substantially to trader success rates.

Without information regarding third-party tool integration, API access, or advanced trading features, potential users cannot assess platform suitability for their specific trading strategies and requirements. This represents a significant limitation for comprehensive broker evaluation.

Evaluation of JY's customer service infrastructure faces substantial limitations due to lack of disclosed support channels, response time metrics, and service quality indicators. The positive employee satisfaction rating of 4.3/5 for JY Technologies Consulting suggests potential for quality customer service delivery.

Employee satisfaction often correlates with customer service performance. However, specific information regarding support availability hours, communication channels, multilingual capabilities, and average response times remains unavailable.

These metrics represent fundamental service quality indicators that influence user experience and problem resolution efficiency. The absence of documented customer service policies, escalation procedures, or satisfaction surveys prevents comprehensive assessment of support quality.

Industry-standard practices include 24/7 support availability, multiple communication channels, and documented response time commitments. Without access to customer feedback specifically addressing service experiences, dispute resolution processes, or technical support quality, this analysis cannot provide definitive service quality assessment.

Users prioritizing responsive customer support should investigate current service standards through direct inquiry.

Platform stability, execution quality, and overall trading environment assessment cannot be completed due to insufficient technical performance data and user experience documentation. Modern trading platforms require evaluation across multiple dimensions including order execution speed, slippage rates, platform uptime, and mobile functionality.

The absence of disclosed platform specifications, supported order types, execution models, and latency statistics prevents comprehensive trading experience evaluation. These technical parameters significantly impact trading outcomes and user satisfaction, particularly for active traders and algorithmic strategies.

Mobile trading capabilities, cross-device synchronization, and platform reliability metrics remain unspecified in available documentation. Contemporary traders increasingly prioritize mobile functionality and seamless cross-platform experiences for flexible trading access.

Without user testimonials specifically addressing trading experience, platform performance during high volatility periods, or execution quality feedback, comprehensive assessment remains impossible. This information gap represents a significant limitation for traders evaluating platform suitability for their specific trading styles and requirements.

Assessment of JY's trustworthiness and security measures faces significant constraints due to limited regulatory disclosure and security protocol documentation. Trust evaluation typically encompasses regulatory compliance, fund segregation practices, insurance coverage, and transparent business operations.

The absence of specific regulatory authority information, licensing numbers, and compliance frameworks prevents verification of oversight and consumer protection measures. Regulatory supervision represents a fundamental trust factor for financial services providers and significantly influences user confidence levels.

Fund security measures, including client money segregation, insurance coverage, and banking relationships, remain undisclosed in available sources. These protections represent critical safety elements that distinguish legitimate brokers from unregulated operators.

Without documented regulatory filings, audit reports, or third-party security certifications, comprehensive trust assessment cannot be completed. The positive employee satisfaction metrics suggest internal operational integrity, but external validation through regulatory compliance verification remains unavailable for this review.

Overall user satisfaction assessment relies primarily on limited available feedback data, with JY DOLL achieving a moderate 3/5 rating from 11 customer reviews. However, this rating applies to product sales rather than financial services.

This limits direct applicability to trading platform evaluation. Interface design, navigation efficiency, registration processes, and account management functionality remain unassessed due to lack of specific user experience documentation.

Contemporary platforms require evaluation across usability, accessibility, and feature organization dimensions. The broader JY brand presence across multiple product categories with 2,769 total reviews suggests established customer interaction capabilities, though specific financial services user experience metrics are not available.

This diversification indicates operational experience but does not directly translate to trading platform quality assessment. Without detailed user journey analysis, onboarding process evaluation, or platform usability testing results, comprehensive user experience assessment cannot be completed.

Users prioritizing intuitive platform design and seamless account management should investigate current interface standards through demo accounts or direct platform testing.

This comprehensive jy review reveals a complex evaluation landscape characterized by limited transparency regarding core trading operations and regulatory framework. While JY Technologies Consulting demonstrates strong employee satisfaction metrics with a 4.3/5 rating, suggesting positive internal operations and workplace culture, the absence of detailed trading conditions, regulatory information, and platform specifications significantly constrains comprehensive assessment capabilities.

The evaluation indicates potential suitability for users who prioritize company culture, operational stability, and employee welfare indicators as proxy measures for service quality. However, traditional forex traders seeking detailed fee structures, regulatory clarity, and comprehensive platform specifications may find available information insufficient for informed decision-making.

Primary strengths include demonstrated employee satisfaction and established market presence across multiple business sectors. Significant limitations encompass regulatory disclosure gaps and absent trading condition specifications.

Potential users should conduct additional research and direct inquiry to obtain current operational details and regulatory compliance verification before making service commitments.

FX Broker Capital Trading Markets Review