Itcs 2025 Review: Everything You Need to Know

Summary

This Itcs review looks at International Trade and Customs Specialists. ITCS is a service company that works as a nationally licensed customs broker in the United States. The company holds a National Permit and has legal permission to work as a U.S. customs broker, giving fast and reliable customs clearance services for both business and personal imports through all U.S. ports of entry.

ITCS shows a strong commitment to quality service delivery. The company focuses on security rules and compliance steps that help prevent crime and terrorism. As a real customs brokerage firm, ITCS serves clients who need professional customs clearance help, making it especially useful for businesses and people involved in international trade activities.

ITCS presents itself as a reliable partner for importers who want professional customs clearance services. However, employee satisfaction data from Glassdoor shows mixed workplace experiences, with the company getting a 2.9-star rating from staff members. This Itcs review gives a neutral assessment based on the company's regulatory standing and service offerings in the customs brokerage sector.

Important Notice

This evaluation looks specifically at ITCS as a customs brokerage service provider rather than a traditional forex broker. The company's work focuses on customs clearance services, and service quality may change depending on specific port locations and regional operational differences across the United States.

This Itcs review is based on publicly available information, company materials, and user feedback data. Our assessment method emphasizes objective analysis of the company's regulatory compliance, service offerings, and available performance metrics. Readers should note that ITCS operates mainly in the customs brokerage sector, which differs significantly from traditional financial trading services.

Rating Framework

Broker Overview

International Trade and Customs Specialists operates as a specialized service organization in the customs brokerage industry. The company has national licensing from U.S. regulatory authorities, allowing it to provide complete customs clearance services across all American ports of entry. ITCS has established itself as a legitimate player in the customs brokerage sector, focusing on both commercial and personal import requirements.

The company's business model centers on making smooth customs clearance processes for clients involved in international trade. ITCS emphasizes its commitment to quality service delivery while keeping strict security rules designed to prevent criminal activities and terrorism. This positioning shows the company's understanding of the critical role customs brokers play in national security and trade facilitation.

ITCS operates with proper regulatory permission and keeps the necessary permits to conduct customs brokerage business throughout the United States. The firm targets both commercial enterprises and individual importers who need professional help navigating complex customs regulations and procedures. This Itcs review notes that the company's focus on compliance and quality service delivery aligns with industry standards for licensed customs brokers.

Regulatory Jurisdiction: ITCS operates under national licensing as a U.S. customs broker, providing services across all American ports of entry with proper regulatory permission.

Deposit and Withdrawal Methods: Specific information about payment processing and fee collection methods is not detailed in available source materials.

Minimum Deposit Requirements: Minimum service fees and deposit requirements are not specified in the company's publicly available information.

Bonus and Promotions: No information about promotional offers or special incentives is mentioned in source materials.

Tradeable Assets: As a customs brokerage service, ITCS helps with the clearance of various imported goods rather than offering tradeable financial instruments.

Cost Structure: Detailed fee schedules and cost breakdowns for customs clearance services are not specified in available materials.

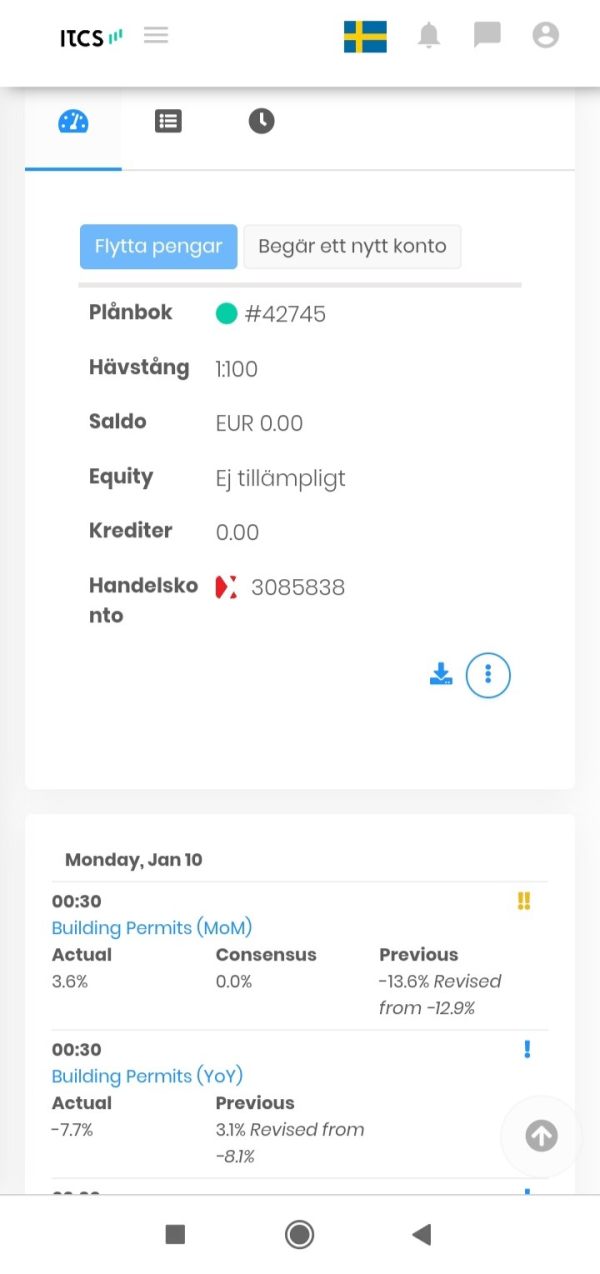

Leverage Ratios: Not applicable for customs brokerage services, as this is a financial trading concept.

Platform Options: Information about digital platforms or service delivery systems is not detailed in source materials.

Geographic Restrictions: Services appear to focus on U.S. customs clearance, with operations at all American ports of entry.

Customer Service Languages: Specific language support options are not mentioned in available company information.

This Itcs review notes that many traditional broker evaluation criteria do not directly apply to customs brokerage services, which focus on regulatory compliance and trade facilitation rather than financial trading.

Detailed Rating Analysis

Account Conditions Analysis

The available information does not provide specific details about account setup procedures, service agreements, or client onboarding processes for ITCS customs brokerage services. Traditional account conditions such as minimum deposit requirements, account types, and tier-based service offerings are not detailed in the source materials.

For customs brokerage services, client relationships typically involve service agreements that outline responsibilities, fee structures, and compliance requirements. However, the specific terms and conditions that ITCS offers to its commercial and personal import clients are not publicly detailed in the available information.

The company's focus on serving both commercial and personal import clients suggests some level of service customization, but without detailed information about account structures or client categorization systems, it's difficult to assess the comprehensiveness of their account condition offerings.

This Itcs review cannot provide a complete evaluation of account conditions due to insufficient publicly available information. Potential clients would need to contact ITCS directly to understand specific service terms, fee structures, and account setup requirements for their customs brokerage needs.

The source materials do not provide specific information about the technological tools, software platforms, or analytical resources that ITCS offers to its clients. Modern customs brokerage typically involves sophisticated tracking systems, compliance databases, and communication tools to manage the clearance process effectively.

Professional customs brokers often provide clients with access to shipment tracking systems, regulatory update services, and documentation management tools. However, the specific technological infrastructure and client-facing tools offered by ITCS are not detailed in the available information.

Educational resources, such as compliance guides, regulatory updates, or import/export training materials, are common offerings among established customs brokers. Yet no information about such educational support services is mentioned in the source materials for ITCS.

The absence of detailed information about tools and resources in this Itcs review reflects the limited publicly available data about the company's service delivery mechanisms and client support infrastructure.

Customer Service and Support Analysis

Specific information about ITCS customer service channels, response times, and support availability is not provided in the available source materials. Professional customs brokerage services typically require robust customer support due to the time-sensitive nature of customs clearance and the complexity of international trade regulations.

The company's commitment to quality service, as mentioned in their materials, suggests an awareness of customer service importance. However, details about support channels such as phone availability, email response times, online chat options, or emergency contact procedures are not specified.

For customs brokerage services, effective communication is crucial during the clearance process, as delays or issues can result in significant costs for importers. The availability of knowledgeable support staff who can address regulatory questions and resolve clearance issues quickly is essential for client satisfaction.

Without specific information about customer service infrastructure and support policies, this evaluation cannot provide a detailed assessment of ITCS's customer service capabilities or quality standards.

Trading Experience Analysis

Since ITCS operates as a customs brokerage service rather than a financial trading platform, traditional trading experience metrics such as execution speed, platform stability, and order processing do not directly apply. However, the efficiency and reliability of customs clearance services can be evaluated using similar criteria.

The company emphasizes providing "efficient and reliable customs clearance" services, which suggests a focus on processing speed and service dependability. However, specific performance metrics such as average clearance times, processing accuracy rates, or client satisfaction scores are not provided in the available materials.

Professional customs brokerage requires attention to detail, regulatory compliance, and timely processing to avoid delays and additional costs for clients. The quality of the clearance experience depends on the broker's expertise, system efficiency, and ability to navigate complex regulatory requirements.

This Itcs review cannot provide a complete assessment of the service experience quality due to limited performance data and client feedback information in the available source materials.

Trust Score Analysis

ITCS demonstrates strong regulatory compliance credentials as a nationally licensed customs broker with proper permission to conduct business across all U.S. ports of entry. This regulatory standing provides a solid foundation for trustworthiness, as customs brokerage requires strict adherence to federal regulations and security protocols.

The company's emphasis on helping prevent crime and terrorism reflects its understanding of the security responsibilities inherent in customs brokerage operations. This commitment to security and compliance aligns with the regulatory expectations for licensed customs brokers and supports the company's credibility.

As a service organization operating under national licensing, ITCS is subject to regulatory oversight and compliance requirements that provide some level of consumer protection. The company's legal permission to conduct customs brokerage business indicates successful completion of licensing requirements and ongoing regulatory compliance.

However, the absence of detailed information about company history, financial stability, insurance coverage, or industry certifications limits the ability to provide a more complete trust assessment in this evaluation.

User Experience Analysis

Available user experience data is limited, with the primary indicator being a 2.9-star employee rating on Glassdoor for ITCS GROUP. This rating suggests mixed experiences among staff members, which may indirectly reflect on service quality and company operations, though employee satisfaction doesn't always correlate directly with client satisfaction.

The moderate employee rating indicates potential areas for improvement in workplace satisfaction, which could impact service delivery quality. Companies with higher employee satisfaction often demonstrate better customer service performance, making this metric relevant for overall service assessment.

Without specific client feedback, service quality surveys, or customer satisfaction data, it's challenging to provide a complete evaluation of the user experience for ITCS customs brokerage services. Client testimonials, case studies, or service quality metrics would provide better insight into actual user experiences.

The limited user experience information available restricts the ability to assess client satisfaction levels, service quality perception, or areas where ITCS excels or needs improvement in their service delivery.

Conclusion

This Itcs review presents ITCS as a legitimately licensed customs brokerage service with proper regulatory permission to operate across U.S. ports of entry. The company maintains compliance with national licensing requirements and demonstrates understanding of security protocols essential for customs brokerage operations.

ITCS appears most suitable for commercial enterprises and individual importers requiring professional customs clearance services. The company's focus on both commercial and personal imports suggests flexibility in serving different client types within the customs brokerage sector.

The main strength lies in regulatory compliance and legal permission, while the moderate employee satisfaction rating suggests potential areas for operational improvement. Limited publicly available information restricts complete service quality assessment, making direct consultation advisable for potential clients.