AFFX 2025 Review: Everything You Need to Know

Summary: AFFX, an unregulated forex broker, has garnered mixed reviews from users and experts alike. While it offers attractive trading conditions such as high leverage and a low minimum deposit, concerns about its lack of regulation and potential risks are prevalent.

Note: It is crucial to understand that the geographical variations of AFFX entities may influence user experiences and regulatory oversight. This review aims to provide a fair and accurate assessment based on various sources.

Rating Summary

How We Rate Brokers: Our ratings are based on an analysis of user experiences, expert opinions, and factual data regarding broker services.

Broker Overview

Founded in 2021, AFFX is operated by Asia Future Trading Corporation, based in Saint Vincent and the Grenadines. It provides access to a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies. The trading platform used is MetaTrader 5 (MT5), which is known for its advanced charting tools and user-friendly interface. However, AFFX lacks regulation from reputable authorities, raising concerns about the safety of traders' funds.

Detailed Breakdown

-

Regulatory Areas: AFFX is registered in Saint Vincent and the Grenadines, a location often associated with unregulated brokers. It has no valid regulatory information, making it a risky choice for traders.

Deposit/Withdrawal Currencies: The broker accepts various local banks for deposits and withdrawals, including KBank and SCB, but lacks broader payment options like wire transfers and popular e-wallets. The minimum deposit is as low as $15, making it accessible for new traders.

Bonuses/Promotions: AFFX offers a rebate plan of $3 per lot traded, which can attract new investors. However, the lack of a clear bonus structure may deter some traders.

Tradable Asset Classes: Traders can access a wide range of assets, including forex pairs, metals, indices, and cryptocurrencies. This variety allows for diversification in trading strategies.

Costs (Spreads, Fees, Commissions): The standard account features spreads starting from 2 pips with no commissions, while the ECN account offers spreads from 0.0 pips but charges a commission of $3 per lot per side. The costs can add up, particularly for traders using the ECN account.

Leverage: AFFX offers a maximum leverage of 1:400 across all account types, which can amplify potential profits but also increases the risk of significant losses.

Allowed Trading Platforms: The primary trading platform is MetaTrader 5, which supports both Mac and Windows operating systems. The platform is well-regarded in the trading community for its comprehensive features.

Restricted Regions: Traders from the United States, European countries, and several other regions are not permitted to open accounts with AFFX, limiting its accessibility.

Available Customer Service Languages: Customer support is primarily available in English, with limited resources for non-English speakers, which can be a drawback for international traders.

Rating Summary (Detailed)

-

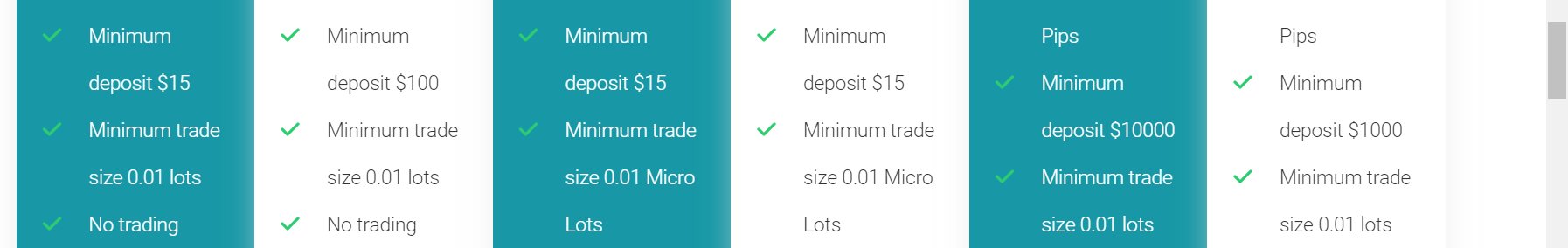

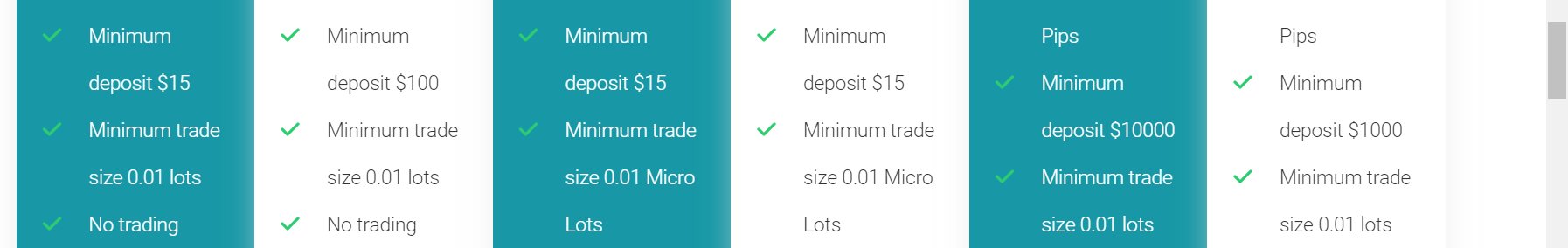

Account Conditions (5/10): AFFX offers various account types, including standard, social, ECN, and zero accounts, catering to different trading needs. However, the high minimum deposits for certain accounts may be a barrier for some traders.

Tools and Resources (4/10): The broker provides the MT5 platform, which is robust but lacks educational resources and tools that could benefit novice traders. This absence of support can hinder the learning process.

Customer Service and Support (3/10): While AFFX offers email support, the lack of live chat or phone support may frustrate users needing immediate assistance. The mixed reviews regarding responsiveness further contribute to this low rating.

Trading Setup (6/10): The trading experience is generally positive, with reports of fast execution and competitive spreads. However, the unregulated status raises concerns about the overall safety of trading with AFFX.

Trustworthiness (2/10): The lack of regulation and the potential for fund mismanagement significantly impact AFFX's trust rating. Users have expressed concerns regarding withdrawal issues and the broker's overall transparency.

User Experience (5/10): User experiences vary widely, with some traders praising the low deposit requirements and fast execution, while others report problems with withdrawals and customer support.

In conclusion, while AFFX presents some appealing features, such as high leverage and a low minimum deposit, the significant risks associated with trading with an unregulated broker cannot be overlooked. Prospective traders should carefully weigh these factors and consider more regulated alternatives before proceeding.