Is IronTrade safe?

Pros

Cons

Is IronTrade Safe or Scam?

Introduction

IronTrade has emerged as a notable player in the binary options trading market since its inception in 2019. Positioned as a platform that allows users to trade a variety of assets, including currencies, commodities, and cryptocurrencies, IronTrade claims to offer a user-friendly interface and competitive trading conditions. However, with the proliferation of online trading platforms, it is imperative for traders to carefully evaluate the legitimacy and safety of their chosen broker. An informed decision can prevent potential financial losses and enhance the trading experience.

This article aims to provide a comprehensive analysis of IronTrade, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The evaluation is based on a review of multiple sources, including user feedback, regulatory filings, and expert analyses, ensuring a balanced perspective on whether IronTrade is a safe trading platform or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any trading platform. A well-regulated broker typically offers a higher level of security for traders' funds and ensures compliance with industry standards. In the case of IronTrade, the broker claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines (SVG). However, it is important to note that the SVG FSA does not regulate binary options trading, raising concerns about the legitimacy of IronTrade's claims.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | Not Applicable | Saint Vincent and the Grenadines | Unverified |

The absence of a credible regulatory framework means that traders using IronTrade do not have the same protections as those trading with regulated brokers. This lack of oversight can lead to issues such as fund mismanagement and potential fraud, making it crucial for traders to be cautious. Furthermore, there have been numerous reports of users facing challenges withdrawing their funds, which is a significant red flag regarding the platform's reliability.

Company Background Investigation

IronTrade is purportedly owned by Rosco Solutions Ltd, a company registered in Saint Vincent and the Grenadines. However, details regarding its ownership structure and management team are scant. The companys lack of transparency raises questions about its operational integrity. Without a clear understanding of who is behind the platform, traders may find it difficult to trust IronTrade.

The companys history is relatively short, having been established in 2019, and it lacks a proven track record in the trading industry. This absence of experience, combined with its unregulated status, contributes to the perception that IronTrade may not be a trustworthy broker. Furthermore, the limited information available about the management team and their qualifications further exacerbates concerns regarding the platform's credibility.

Trading Conditions Analysis

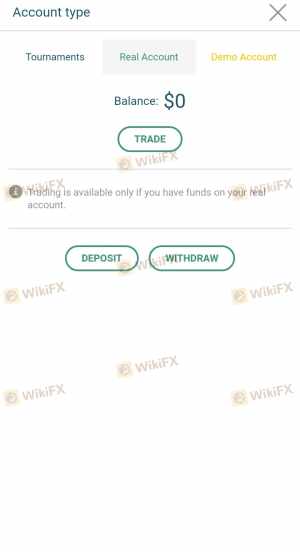

When evaluating a trading platform, the overall cost structure is a vital component. IronTrade advertises a low minimum deposit requirement of $10, which may appear attractive to new traders. However, the fee structure is not as straightforward as it seems. Traders should be aware of the potential for hidden fees and unfavorable trading conditions that could affect their profitability.

| Fee Type | IronTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Moderate |

| Commission Structure | None | Varies |

| Overnight Interest Range | Unknown | Varies |

The spreads on major currency pairs can be significantly higher than industry averages, which may erode potential profits. Additionally, the lack of transparency regarding overnight interest rates and other fees raises concerns about the overall trading costs associated with IronTrade. Traders should approach this broker with caution, particularly if they are looking for competitive trading conditions.

Client Fund Safety

Fund safety is paramount when choosing a trading platform. IronTrade claims to implement certain measures to protect client funds, but the lack of regulation means that these measures may not be as robust as those offered by regulated brokers. The absence of investor protection schemes and fund segregation practices poses significant risks for traders.

Moreover, there have been reports of clients experiencing difficulties in accessing their funds, with some users claiming that their withdrawal requests were delayed or denied altogether. This history of fund access issues raises serious concerns about the safety of client investments with IronTrade. Traders should be particularly wary of platforms that do not provide clear information about their fund protection policies.

Customer Experience and Complaints

User feedback is an essential indicator of a broker's reliability. A review of customer experiences with IronTrade reveals a troubling pattern of complaints, particularly concerning withdrawal issues. Many users have reported being unable to withdraw their profits, which is a significant concern for anyone considering trading with this platform.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Manipulation | High | Poor |

Common complaints include delays in processing withdrawals and claims of account manipulation, where users reported that their trading results did not reflect their actual performance. The company's response to these complaints has been criticized as inadequate, further diminishing trust in IronTrade. Such feedback highlights the importance of conducting thorough research before engaging with any broker.

Platform and Trade Execution

The performance of a trading platform is critical to a trader's experience. IronTrade offers a proprietary platform that is designed to be user-friendly. However, reviews indicate that the platform may not be as reliable as advertised. Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, there are allegations of potential platform manipulation, with some users claiming that the platform's algorithms may be designed to disadvantage traders. Such concerns are particularly alarming in the context of binary options trading, where timing and execution quality are crucial for success.

Risk Assessment

Using IronTrade involves several risks that traders should be aware of. The lack of regulation, combined with the reported withdrawal issues and negative customer feedback, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses significant risks. |

| Fund Access Risk | High | Difficulties in withdrawing funds reported by users. |

| Market Manipulation Risk | High | Allegations of platform manipulation and slippage. |

To mitigate these risks, traders should consider using regulated brokers that provide clear information about their operations and offer strong investor protections. It is also advisable to start with a demo account to test the platform's functionality before committing real funds.

Conclusion and Recommendations

In conclusion, IronTrade raises several red flags that suggest it may not be a safe trading platform. The lack of regulation, coupled with numerous complaints regarding fund withdrawals and potential platform manipulation, casts doubt on its legitimacy. Traders are strongly advised to exercise caution when considering IronTrade for their trading activities.

For those seeking a safer trading environment, it is recommended to explore alternative brokers that are well-regulated and have a proven track record of reliability. Overall, IronTrade should be approached with skepticism, and potential users should conduct thorough research before making any financial commitments.

Is IronTrade a scam, or is it legit?

The latest exposure and evaluation content of IronTrade brokers.

IronTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IronTrade latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.