Is INVESTOUS safe?

Business

License

Is Investous Safe or a Scam?

Introduction

Investous is a relatively new player in the forex market, having been established in 2018. It positions itself as a multi-asset broker offering a range of trading instruments, including forex, commodities, stocks, and cryptocurrencies. With the increasing number of online trading platforms, traders must exercise caution when selecting a broker. The consequences of choosing an unreliable broker can be dire, leading to loss of funds and a lack of recourse. This article aims to provide a thorough analysis of Investous, focusing on its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a comprehensive review of multiple sources, including regulatory filings, user feedback, and industry reports, to assess whether Investous is a safe option for traders.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy and trustworthiness. Investous claims to be regulated by the International Financial Services Commission (IFSC) of Belize and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies are responsible for overseeing broker operations and ensuring compliance with financial laws.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| IFSC | 000349 / 173 | Belize | Verified |

| CySEC | 267 / 15 | Cyprus | Verified |

The IFSC provides oversight for brokers operating in Belize, but it is often viewed as a less stringent regulator compared to those in Europe. CySEC, on the other hand, is known for its robust regulatory framework, including investor protection schemes. However, it is important to note that while Investous is regulated, the absence of a strong compensation fund for clients trading under the IFSC may raise concerns regarding investor protection.

Historically, Investous has maintained compliance with its regulatory obligations, but the quality of oversight can vary significantly between the two regulatory bodies. The lack of a strong regulatory presence in Belize can be seen as a potential risk factor for traders considering whether Investous is safe.

Company Background Investigation

Investous is operated by IOS Investments Limited, a company based in Belize, with its European operations managed by F1 Markets Limited in Cyprus. The broker has been in operation since 2018 but has garnered mixed reviews regarding its transparency and operational history. The management team behind Investous has experience in the financial services sector, but specific details about their backgrounds and qualifications are not readily available.

The broker's website claims to provide extensive information about its services, but some users have reported a lack of clarity regarding fees and withdrawal policies. This has led to questions about the overall transparency of the company. A broker's transparency is a critical factor for traders, as it can significantly impact their trust in the platform.

In summary, while Investous appears to be a legitimate broker with regulatory oversight, the opacity surrounding its management and operational practices raises questions about whether Investous is safe for traders.

Trading Conditions Analysis

Investous offers a variety of trading conditions, including multiple account types and a diverse range of trading instruments. The minimum deposit required to open an account is $250, which is relatively standard in the industry. However, the fee structure is where traders may find some concerns.

| Fee Type | Investous | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.3 pips | 1.0-1.5 pips |

| Commission Model | Commission-free | Varies |

| Overnight Interest Range | Varies | Varies |

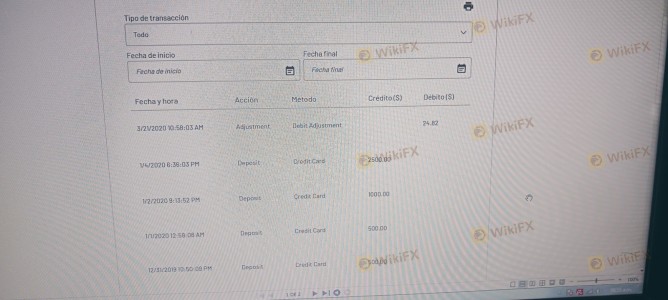

The spreads offered by Investous are on the higher end compared to industry averages, particularly for major currency pairs. Additionally, the broker imposes withdrawal fees that can add up, especially for clients using credit or debit cards, which can incur charges of up to 3.5%. The presence of high inactivity fees—up to €80 after one month—further complicates the cost structure, making it essential for traders to evaluate their trading frequency before choosing this broker.

While the commission-free model may seem attractive, the overall cost of trading could be higher than with competitors that offer lower spreads and more favorable withdrawal terms. This raises the question of whether Investous is safe for traders who are sensitive to trading costs.

Client Fund Safety

The safety of client funds is paramount for any trading platform. Investous claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of misuse.

However, the level of investor protection varies depending on the regulatory framework under which the broker operates. Clients trading under CySEC regulations benefit from an investor compensation fund that protects deposits up to €20,000 in the event of broker insolvency. In contrast, those trading under the IFSC may not have similar protections.

Despite these measures, there have been no reported incidents of fund mismanagement or security breaches at Investous, but the lack of a robust regulatory framework in Belize could be a concern for potential traders. Thus, while Investous appears to have mechanisms in place for fund safety, the overall regulatory environment may lead some to question whether Investous is safe.

Customer Experience and Complaints

Customer feedback is vital in assessing a broker's reliability. Reviews of Investous reveal a mixed bag of experiences. While some users praise the platform for its user-friendly interface and variety of trading instruments, others have reported issues with withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| High Fees | Medium | Unclear policies |

| Account Locking | High | Unresolved issues |

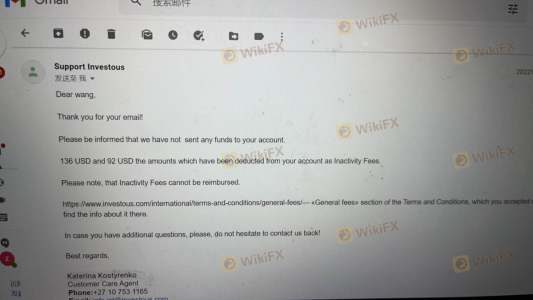

Common complaints include difficulties in withdrawing funds, with some users claiming that their accounts were locked after making deposits. In a few cases, traders reported that they felt pressured to deposit more funds to access their existing balances. These experiences raise concerns about the broker's practices and customer support responsiveness.

A few notable cases include users who reported being unable to withdraw their funds despite multiple requests, leading to frustration and claims of potential fraud. Such incidents contribute to the growing skepticism surrounding whether Investous is safe for traders.

Platform and Trade Execution

The trading platform offered by Investous includes both a proprietary web-based platform and the widely used MetaTrader 4 (MT4). While MT4 is known for its robust features and reliability, some users have reported that the proprietary platform lacks essential functionalities compared to competitors.

Order execution quality is another critical factor for traders. Reports indicate that while the platform generally performs well, there have been instances of slippage and delayed executions during volatile market conditions. Traders should be cautious and consider these factors when evaluating whether Investous is safe.

Risk Assessment

Using Investous comes with inherent risks, particularly due to its regulatory status and customer feedback. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Offshore regulation may lack robust protections. |

| Trading Costs | Medium | Higher spreads and fees compared to competitors. |

| Customer Service | High | Reports of slow response times and unresolved issues. |

| Fund Security | Medium | Segregated accounts, but limited protections under IFSC. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts when available, and consider starting with lower investment amounts until they are comfortable with the broker's practices.

Conclusion and Recommendations

In conclusion, while Investous presents itself as a legitimate broker with regulatory oversight, several factors warrant caution. The mixed reviews regarding customer service, high fees, and the potential for withdrawal issues raise questions about whether Investous is safe.

For traders seeking to engage with Investous, it is advisable to start with a small investment and maintain a close watch on trading conditions and account activities. For those who are risk-averse or seeking a more robust regulatory environment, considering alternatives such as brokers regulated by the FCA or ASIC may be a more prudent choice.

Ultimately, due diligence is essential in the world of forex trading, and potential clients should weigh the pros and cons carefully before committing to Investous.

Is INVESTOUS a scam, or is it legit?

The latest exposure and evaluation content of INVESTOUS brokers.

INVESTOUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INVESTOUS latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.