Icfd 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Icfd review examines a global forex and CFD broker that positions itself as part of the ICM Brokers network. ICM Brokers was recognized as the Best Global Forex Broker for 2023 by ForexDailyInfo.com. Icfd offers competitive trading conditions with zero pip spreads and leverage up to 1:500, making it particularly attractive to experienced traders seeking high-risk, high-reward opportunities.

The broker provides access to multiple asset classes including indices, shares, commodities, and cryptocurrencies. It has 18 years of experience in global financial markets backing its operations. With lightning-fast execution and deep liquidity across global markets, Icfd targets sophisticated traders who prioritize raw spread trading conditions and substantial leverage capabilities.

However, this review reveals significant information gaps regarding regulatory details, customer service quality, and comprehensive user feedback. Potential clients should carefully consider these issues before opening an account.

Important Notice

Due to limited publicly available information regarding specific regulatory frameworks, users in different regions should independently verify local compliance requirements for forex and CFD trading. The regulatory landscape varies significantly across jurisdictions. Traders must ensure their activities align with applicable laws in their respective countries.

This evaluation is based on available information summaries and does not include comprehensive user reviews or complaint data. Prospective clients should conduct additional due diligence before making investment decisions.

Rating Overview

Broker Overview

Icfd operates as part of the ICM Brokers network. It leverages 18 years of experience in global financial markets. The company has established itself as a specialized provider of forex and CFD trading services, focusing on delivering competitive trading conditions to international clients.

ICM Brokers received recognition as the Best Global Forex Broker for 2023. This indicates some level of industry acknowledgment.

The broker's business model centers on providing raw spread trading with zero pip spreads and substantial leverage options. Icfd serves multiple asset classes beyond traditional forex pairs, including indices, shares, commodities, and cryptocurrency instruments. This diversified approach allows traders to access various global markets through a single platform.

It potentially streamlines their trading operations and portfolio management strategies.

While specific founding details remain unclear from available sources, the broker's association with ICM Brokers suggests an established operational framework. However, this Icfd review notes that detailed information about corporate structure, specific regulatory compliance, and operational transparency requires further investigation by potential clients.

Regulatory Framework

Available information does not specify particular regulatory authorities overseeing Icfd's operations. This represents a significant concern for traders prioritizing regulatory protection and compliance verification.

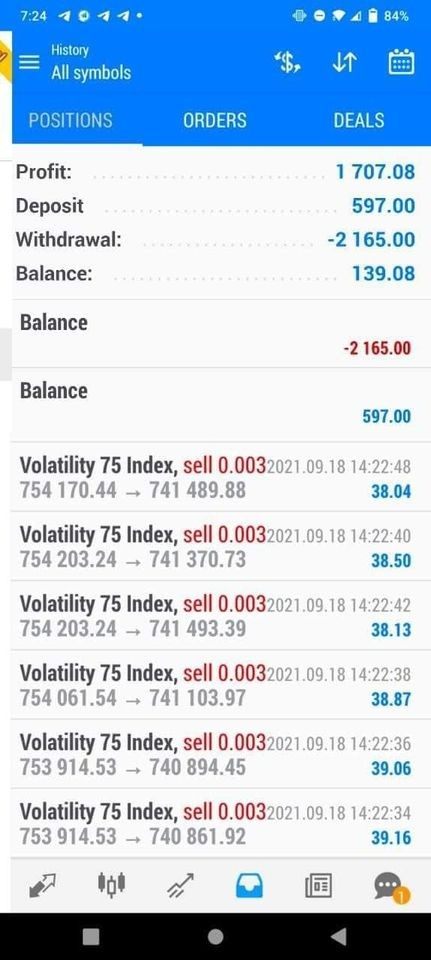

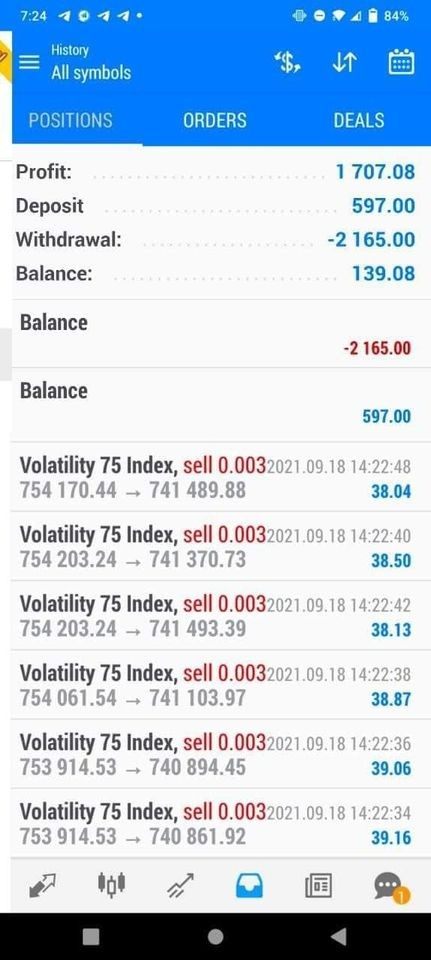

Deposit and Withdrawal Methods

Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements

Minimum deposit thresholds are not specified in accessible documentation. Prospective clients must contact the broker directly for account opening requirements.

Details about welcome bonuses, trading incentives, or promotional campaigns are not available in current information sources.

Tradeable Assets

Icfd provides access to multiple asset categories including indices, shares, commodities, and cryptocurrencies. This diversified offering allows traders to implement cross-asset strategies and portfolio diversification approaches.

Cost Structure

The broker advertises zero pip spreads. This represents a competitive advantage for high-frequency traders and scalping strategies. However, commission structures and other potential trading costs remain unspecified in available documentation.

Leverage Options

Icfd offers leverage up to 1:500. This provides substantial capital amplification opportunities for experienced traders. This high leverage ratio exceeds many competitors but also significantly increases risk exposure.

Specific trading platform details are not comprehensively covered in available information. This requires further investigation regarding MT4, MT5, or proprietary platform availability.

This Icfd review emphasizes the need for direct broker communication to clarify these essential operational details.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation reveals significant information gaps that impact the overall assessment. Without specific details about account types, minimum deposit requirements, or account opening procedures, it becomes challenging to provide a comprehensive evaluation of Icfd's account offerings.

The absence of information regarding Islamic accounts, VIP tiers, or specialized account features suggests either limited product diversification or insufficient public disclosure. Professional traders typically require detailed account specifications to make informed decisions about broker selection.

Account verification processes, document requirements, and approval timeframes remain unspecified in available sources. This lack of transparency regarding onboarding procedures may concern traders seeking efficient account activation.

The competitive zero pip spreads represent a positive aspect of account conditions, particularly for scalping strategies and high-frequency trading approaches. However, without comprehensive fee disclosure, traders cannot fully assess the total cost of account maintenance and trading activities.

This Icfd review recommends direct broker consultation to clarify account condition details before proceeding with registration.

Icfd's tools and resources evaluation reflects the broker's focus on CFD and forex trading across multiple asset classes. The availability of indices, shares, commodities, and cryptocurrency trading suggests a reasonably comprehensive instrument selection for diversified trading strategies.

However, specific information about trading tools, technical analysis resources, or research capabilities remains limited in available documentation. Professional traders typically require access to advanced charting tools, market analysis, and educational resources to optimize their trading performance.

The mention of "IFCM Trading Academy" in related materials suggests some educational framework exists. Specific content quality and comprehensiveness cannot be verified from available sources. Interactive forex education resources could benefit novice and intermediate traders seeking skill development.

Automated trading support, expert advisor compatibility, and API access details are not specified. This potentially limits algorithmic trading capabilities. Advanced traders often prioritize these features for strategy implementation and portfolio automation.

The absence of detailed research reports, market commentary, or analytical tools represents a notable gap in the broker's resource offering compared to full-service competitors.

Customer Service and Support Analysis

Customer service evaluation proves challenging due to limited information about support channels, response times, and service quality metrics. The absence of user feedback data prevents comprehensive assessment of actual service delivery performance.

Available sources do not specify supported communication methods, whether live chat, phone support, or email ticketing systems are available. Response time commitments and support availability hours remain unclear, which could impact traders requiring immediate assistance.

Multi-language support capabilities are not detailed. This potentially limits accessibility for international clients. Given the broker's global positioning, comprehensive language support would be expected for effective customer service delivery.

The lack of user testimonials or service quality indicators makes it impossible to verify actual customer satisfaction levels or problem resolution effectiveness. Traders typically value responsive, knowledgeable support when technical issues or account problems arise.

Without specific information about account management services, educational support, or technical assistance quality, this evaluation relies primarily on industry standards rather than broker-specific performance data.

Trading Experience Analysis

The trading experience evaluation benefits from specific information about spreads and leverage. This provides concrete advantages for active traders. Zero pip spreads represent a significant competitive advantage, particularly for scalping strategies and high-frequency trading approaches where transaction costs directly impact profitability.

Leverage up to 1:500 offers substantial capital amplification opportunities. This enables traders to maximize position sizes with limited capital requirements. However, this high leverage also significantly increases risk exposure and requires sophisticated risk management strategies.

Lightning-fast execution and deep liquidity claims suggest robust technical infrastructure. Specific performance metrics or latency data are not provided. Professional traders typically require sub-second execution speeds and minimal slippage for optimal strategy implementation.

The multi-asset trading environment allows portfolio diversification and cross-market arbitrage opportunities. Access to indices, shares, commodities, and cryptocurrencies through a single platform can streamline trading operations and reduce operational complexity.

Platform stability, order execution quality, and mobile trading capabilities require further investigation as these factors significantly impact overall trading experience. This Icfd review notes that actual performance verification requires live trading experience or detailed technical specifications.

Trust and Security Analysis

The trust and security evaluation reveals concerning information gaps that significantly impact the overall assessment. The absence of specific regulatory information represents a major transparency concern for traders prioritizing regulatory protection and compliance verification.

While ICM Brokers received recognition as the 2023 Best Global Forex Broker, this industry acknowledgment provides limited insight into regulatory compliance or security measures. Professional traders typically require comprehensive regulatory disclosure and compliance verification.

Fund security measures, segregated account policies, and deposit protection schemes are not detailed in available information. These factors represent critical considerations for traders evaluating counterparty risk and capital protection.

The 18-year market experience claim suggests operational longevity. Specific performance during market stress periods or crisis management capabilities remain unverified. Historical stability does not guarantee future performance or regulatory compliance.

Without detailed information about negative event handling, dispute resolution procedures, or regulatory enforcement actions, traders cannot comprehensively assess the broker's reliability and trustworthiness. This represents a significant limitation for risk-conscious investors.

User Experience Analysis

User experience evaluation proves challenging due to the absence of comprehensive user feedback, satisfaction surveys, or detailed interface descriptions. Without actual user testimonials or complaint data, this assessment relies primarily on available feature descriptions rather than verified user experiences.

The target demographic appears to be experienced traders and high-risk tolerance investors, based on the high leverage offerings and zero spread positioning. This specialized focus may limit accessibility for novice traders seeking comprehensive educational support and guidance.

Registration and verification process details are not specified. This prevents assessment of onboarding efficiency and user-friendliness. Streamlined account opening procedures typically enhance user experience and reduce barriers to entry.

Interface design, platform navigation, and mobile accessibility features remain unspecified in available documentation. Modern traders expect intuitive interfaces and seamless cross-device functionality for optimal user experience.

The lack of user feedback regarding common complaints, feature requests, or satisfaction levels prevents identification of potential user experience improvements or recurring issues that might impact trading satisfaction.

Conclusion

This comprehensive Icfd review reveals a broker with competitive trading conditions, particularly appealing to experienced traders seeking zero pip spreads and high leverage options up to 1:500. The association with ICM Brokers and their 2023 industry recognition provides some credibility. The multi-asset trading environment offers portfolio diversification opportunities.

However, significant information gaps regarding regulatory compliance, customer service quality, and user feedback present notable concerns. The absence of detailed operational transparency may deter risk-conscious traders prioritizing regulatory protection and comprehensive disclosure.

Icfd appears most suitable for sophisticated traders with high-risk tolerance who prioritize competitive spreads and substantial leverage over comprehensive regulatory transparency. Prospective clients should conduct thorough due diligence and direct broker consultation before account opening to address the identified information gaps and verify operational details.