Executive Summary

This comprehensive ibm capital corporation review presents a challenging evaluation scenario. The broker currently holds a concerning user rating of 0 out of 1500 on WikiFX, indicating significant deficiencies in user satisfaction and overall performance. The lack of substantial user feedback and limited available information raises immediate red flags for potential traders considering this platform.

The evaluation reveals that IBM Capital Corporation operates with minimal transparency regarding its core trading conditions, regulatory status, and service offerings. While user reviews on platforms like Trustburn are purported to be based on personal experience without incentivization, the scarcity of detailed feedback and the absence of comprehensive operational information suggests this broker may not meet the standards expected by modern forex traders. Given the limited data available and the poor user rating, this broker appears unsuitable for both novice and experienced traders who require reliable service, transparent conditions, and robust customer support.

The evaluation methodology for this review relies heavily on available user feedback and cross-platform data analysis. Though the shortage of comprehensive information significantly limits the depth of assessment possible.

Important Notice

This review acknowledges significant limitations in available information about IBM Capital Corporation. The evaluation process has been constrained by the absence of detailed regulatory information, specific trading conditions, and comprehensive user testimonials. Different regional entities may operate under varying regulatory frameworks, though specific jurisdictional details are not available in current documentation.

The assessment methodology combines user reviews and feedback from multiple platforms, including WikiFX and Trustburn, to provide the most accurate evaluation possible given the information constraints. Readers should exercise particular caution when considering this broker due to the limited transparency and poor user satisfaction metrics.

Rating Framework

Broker Overview

IBM Capital Corporation presents a concerning profile in the competitive forex brokerage landscape. The company's establishment date, corporate background, and primary business model details are not available in current documentation, which immediately raises transparency concerns for potential clients. This lack of fundamental corporate information is highly unusual for legitimate forex brokers operating in today's regulated environment.

The absence of clear information regarding the company's operational history, management structure, and business philosophy suggests either a very new market entrant or a broker operating with minimal public disclosure. Most established forex brokers provide comprehensive corporate backgrounds, including founding dates, key personnel information, and business development milestones to establish credibility with potential clients. Regarding trading infrastructure and service offerings, specific details about trading platform types, available asset classes, and regulatory oversight are not documented in available materials.

This ibm capital corporation review must therefore rely primarily on user satisfaction metrics and limited feedback data. The lack of transparency regarding fundamental operational aspects such as platform technology, asset coverage, and regulatory compliance creates significant concerns about the broker's legitimacy and operational standards.

The absence of clear regulatory information is particularly troubling, as legitimate forex brokers typically highlight their regulatory status as a key trust-building element. Without documented regulatory oversight, potential clients cannot verify the broker's compliance with industry standards or assess the level of protection afforded to client funds and trading activities.

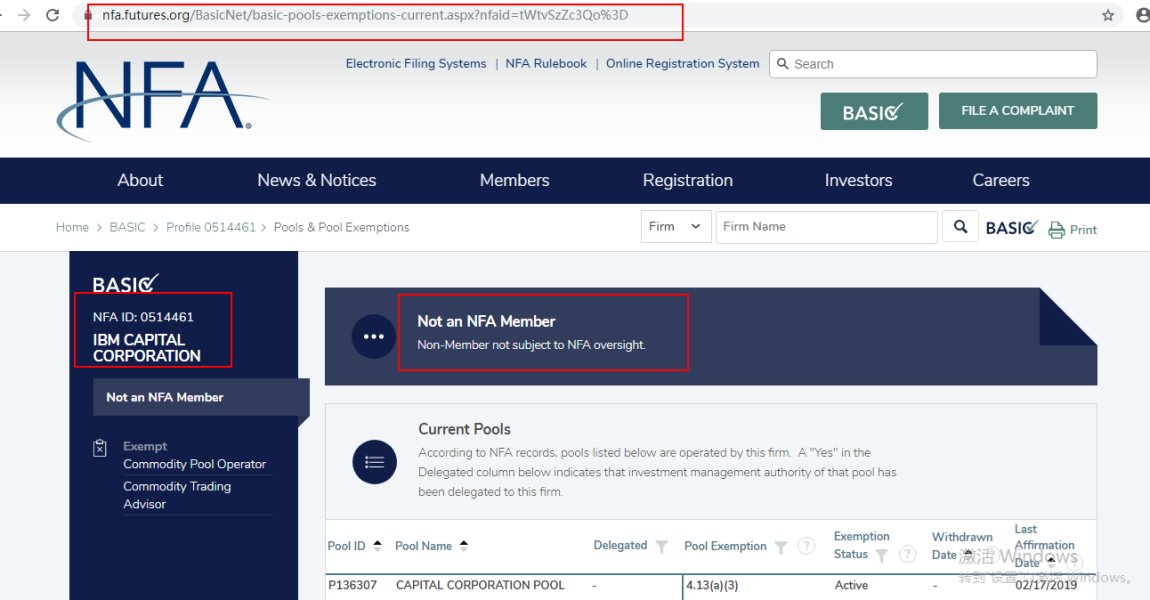

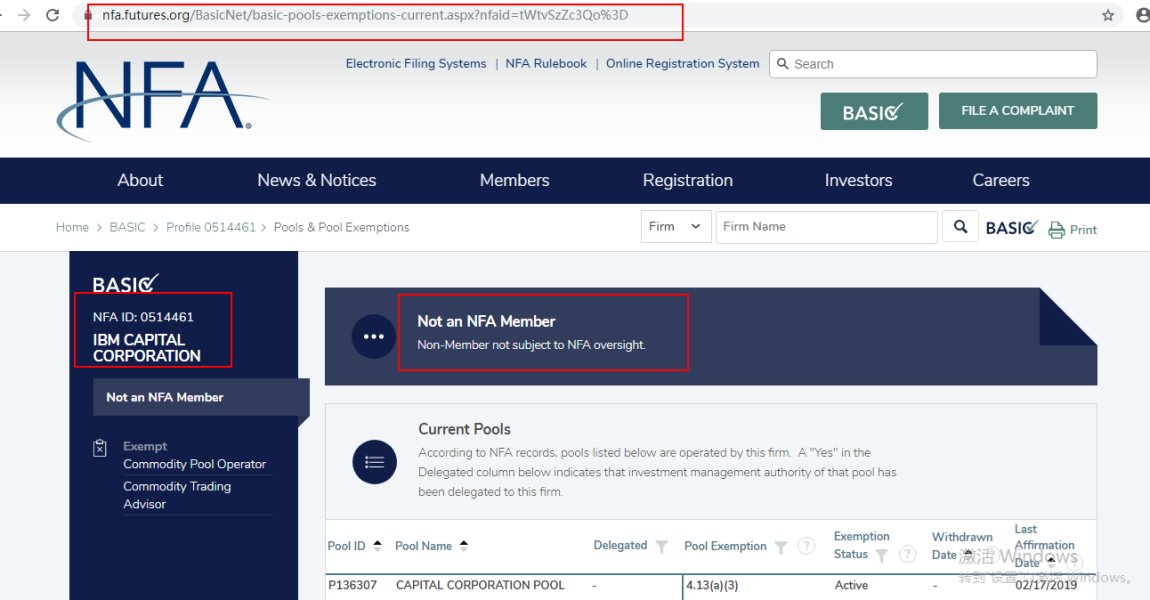

Regulatory Status

Regulatory information for IBM Capital Corporation is not available in current documentation. This represents a significant concern for potential traders seeking properly licensed and supervised brokers.

Deposit and Withdrawal Methods

Specific information regarding funding options, processing times, and associated fees for deposits and withdrawals has not been documented in available materials.

Minimum Deposit Requirements

Minimum deposit thresholds and account opening requirements are not specified in current documentation. This limits traders' ability to assess accessibility.

Details regarding promotional offers, welcome bonuses, or ongoing incentive programs are not available in the source materials reviewed.

Tradeable Assets

The range of available trading instruments, including forex pairs, commodities, indices, and other financial products, is not documented in current information sources.

Cost Structure

Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains unspecified in available documentation. This makes cost comparison impossible.

Leverage Options

Maximum leverage ratios and margin requirements across different asset classes are not detailed in current materials.

Information regarding trading platform options, whether proprietary or third-party solutions like MetaTrader, is not available in reviewed sources.

This ibm capital corporation review highlights the concerning lack of transparency across all fundamental trading parameters that informed traders require for decision-making.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of IBM Capital Corporation's account conditions faces significant challenges due to the absence of detailed information in available documentation. Account type variety, which typically ranges from basic retail accounts to professional and institutional offerings, cannot be assessed without specific broker disclosure. Most reputable forex brokers provide clear differentiation between account tiers, each with distinct features, minimum deposit requirements, and service levels.

Minimum deposit requirements represent a crucial factor for trader accessibility, particularly for newcomers to forex trading. However, IBM Capital Corporation has not provided clear information regarding entry-level funding requirements or progressive account structures. This lack of transparency prevents potential clients from understanding the financial commitment required to begin trading.

The account opening process, including documentation requirements, verification procedures, and timeline expectations, remains undocumented. Modern forex brokers typically streamline onboarding through digital verification systems while maintaining compliance with Know Your Customer and Anti-Money Laundering regulations. Special account features, such as Islamic accounts compliant with Sharia law, VIP services for high-volume traders, or managed account options, are not mentioned in available materials.

The absence of such information suggests either limited service offerings or inadequate marketing communication. This ibm capital corporation review cannot provide meaningful assessment of account conditions without fundamental operational details.

The assessment of trading tools and educational resources at IBM Capital Corporation is severely limited by the lack of available information. Modern forex brokers typically provide comprehensive analytical tools, including technical indicators, charting packages, economic calendars, and market sentiment indicators. Without documentation of such offerings, traders cannot evaluate the platform's analytical capabilities.

Research and analysis resources, including daily market commentary, weekly outlooks, and fundamental analysis reports, are essential components of professional forex services. The absence of information regarding such resources suggests either minimal research support or poor communication of available services. Professional traders rely heavily on quality market analysis to inform their trading decisions.

Educational resources represent a critical differentiator among forex brokers, particularly for novice traders. Comprehensive educational programs typically include video tutorials, webinars, trading guides, and interactive learning modules. The lack of documented educational offerings raises concerns about the broker's commitment to client development and success.

Automated trading support, including Expert Advisor compatibility, social trading features, and copy trading services, has become increasingly important in modern forex trading. Without clear information about automation capabilities, algorithmic traders cannot assess the platform's suitability for their strategies.

Customer Service and Support Analysis

Customer service evaluation for IBM Capital Corporation faces significant limitations due to insufficient information about support infrastructure and service quality. Modern forex brokers typically offer multiple communication channels, including live chat, telephone support, email assistance, and comprehensive FAQ sections. The absence of documented support channels raises immediate concerns about client service accessibility.

Response time expectations and service level agreements are crucial factors in customer satisfaction, particularly during volatile market conditions when traders require immediate assistance. Without documented service standards, potential clients cannot set appropriate expectations for support quality and availability. Service quality assessment typically relies on user testimonials, response time metrics, and problem resolution effectiveness.

The limited user feedback available for IBM Capital Corporation, combined with the poor overall user rating of 0/1500, suggests significant deficiencies in customer service delivery. Multilingual support capabilities are essential for international forex brokers serving diverse client bases. The absence of information regarding language support options limits the broker's appeal to non-English speaking traders and suggests potential communication barriers.

Trading Experience Analysis

The trading experience evaluation for IBM Capital Corporation is severely hampered by the lack of specific information about platform performance, execution quality, and user interface design. Platform stability and execution speed are fundamental requirements for successful forex trading, particularly during high-volatility periods when rapid order processing becomes critical. Order execution quality, including fill rates, slippage statistics, and requote frequency, directly impacts trading profitability.

Without documented performance metrics or user testimonials regarding execution quality, traders cannot assess the broker's operational reliability. Professional traders require consistent, fast execution to implement their strategies effectively. Platform functionality assessment typically covers charting capabilities, order types, risk management tools, and customization options.

The absence of detailed platform information prevents evaluation of whether the trading environment meets modern trader expectations and requirements. Mobile trading experience has become increasingly important as traders seek flexibility and constant market access. Without information about mobile platform availability, features, and performance, this ibm capital corporation review cannot assess the broker's mobile trading capabilities.

Trust and Reliability Analysis

Trust and reliability assessment for IBM Capital Corporation reveals significant concerns due to the absence of regulatory information and transparency measures. Regulatory licensing represents the foundation of broker trustworthiness, providing legal frameworks for operations and client protection. The lack of documented regulatory status immediately raises red flags about the broker's legitimacy and oversight.

Fund safety measures, including segregated client accounts, deposit insurance, and negative balance protection, are essential components of reliable forex brokers. Without clear information about client fund protection mechanisms, traders face uncertainty about their capital security and regulatory recourse options. Company transparency, typically demonstrated through regular financial reporting, management disclosure, and operational updates, appears limited based on available information.

Legitimate brokers maintain open communication about their business operations, regulatory compliance, and corporate developments. Industry reputation assessment relies on peer recognition, regulatory standing, and professional acknowledgments. The poor user rating and limited industry presence suggest minimal market recognition and potentially problematic operational standards.

User Experience Analysis

User experience evaluation for IBM Capital Corporation reveals concerning patterns based on available feedback data. The user rating of 0 out of 1500 on WikiFX represents an extremely poor satisfaction level, indicating widespread user dissatisfaction with the broker's services and operations. Such low ratings typically reflect serious operational deficiencies or service failures.

Interface design and usability assessment cannot be completed due to insufficient information about platform features and user interface elements. Modern traders expect intuitive, responsive platforms that facilitate efficient trading and portfolio management. The lack of detailed platform information suggests either minimal development investment or poor marketing communication.

Registration and verification processes significantly impact initial user experience, with streamlined procedures enhancing client onboarding. Without documented information about account opening requirements and timelines, potential clients cannot anticipate the complexity or duration of the setup process. Fund operation experience, including deposit and withdrawal efficiency, processing times, and fee structures, remains undocumented.

Smooth financial transactions are essential for positive user experience, and the absence of such information creates uncertainty about operational reliability.

Conclusion

This comprehensive ibm capital corporation review reveals significant concerns about the broker's transparency, operational standards, and user satisfaction levels. The user rating of 0 out of 1500 on WikiFX represents an extremely poor performance indicator that potential traders should seriously consider before engaging with this broker.

The extensive lack of detailed information regarding trading conditions, regulatory status, platform features, and service offerings suggests either a new market entrant with minimal operational disclosure or a broker operating below industry standards. The absence of fundamental transparency measures typically expected from legitimate forex brokers raises immediate red flags about operational legitimacy and client protection standards. Based on available evidence, IBM Capital Corporation appears unsuitable for both novice and experienced traders who require reliable service, transparent operating conditions, and robust customer support.

The primary advantages appear limited to user reviews being based on personal experience, while the significant disadvantages include lack of detailed trading condition disclosure, absence of regulatory information, and poor user satisfaction metrics.