I-Access Review 1

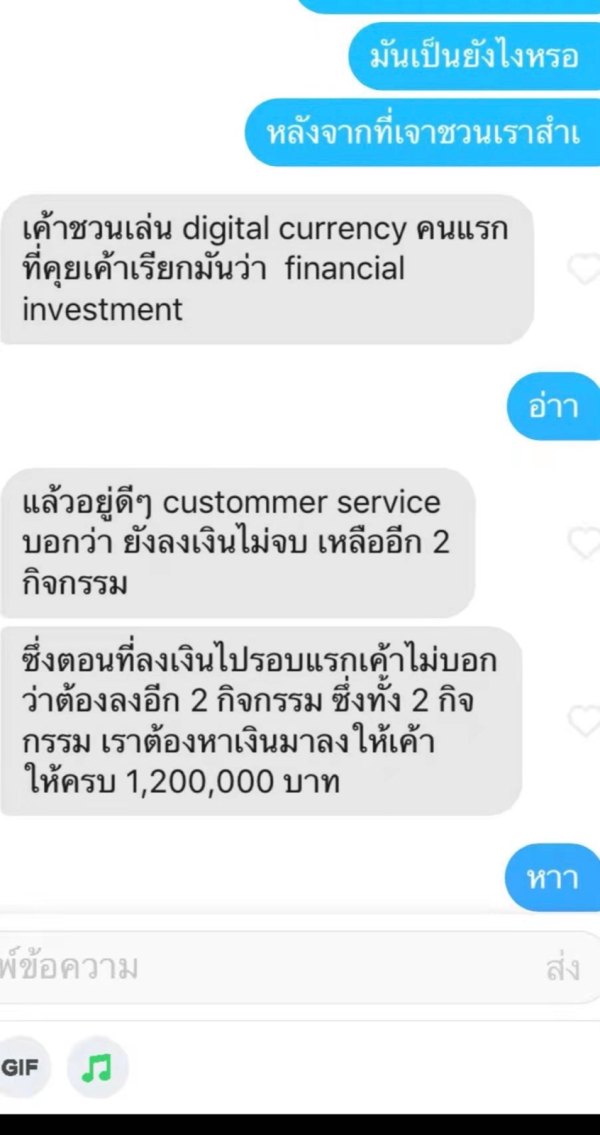

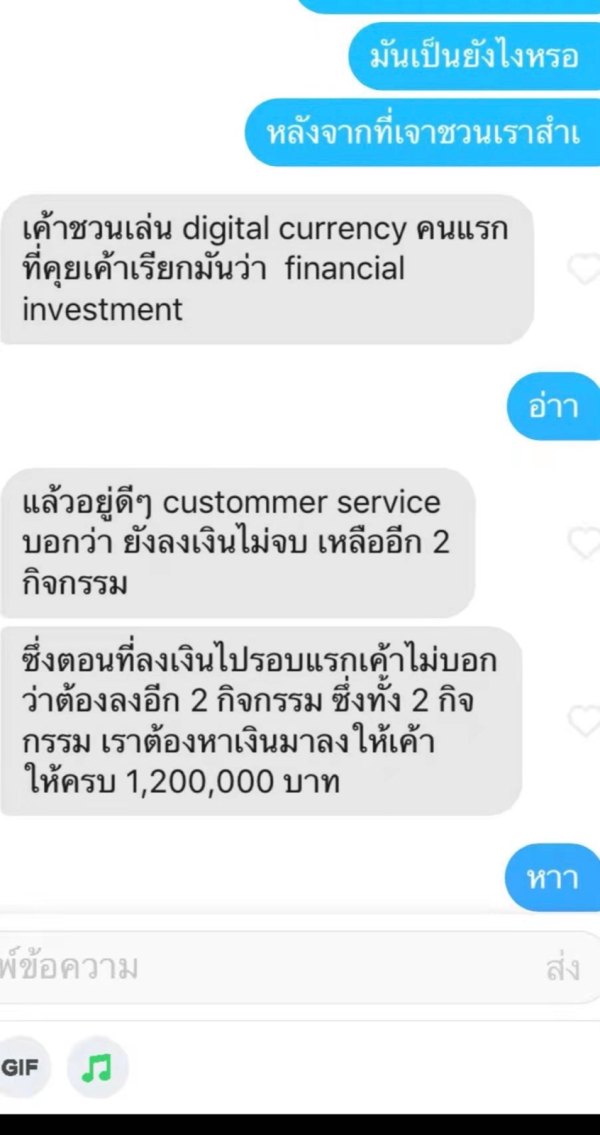

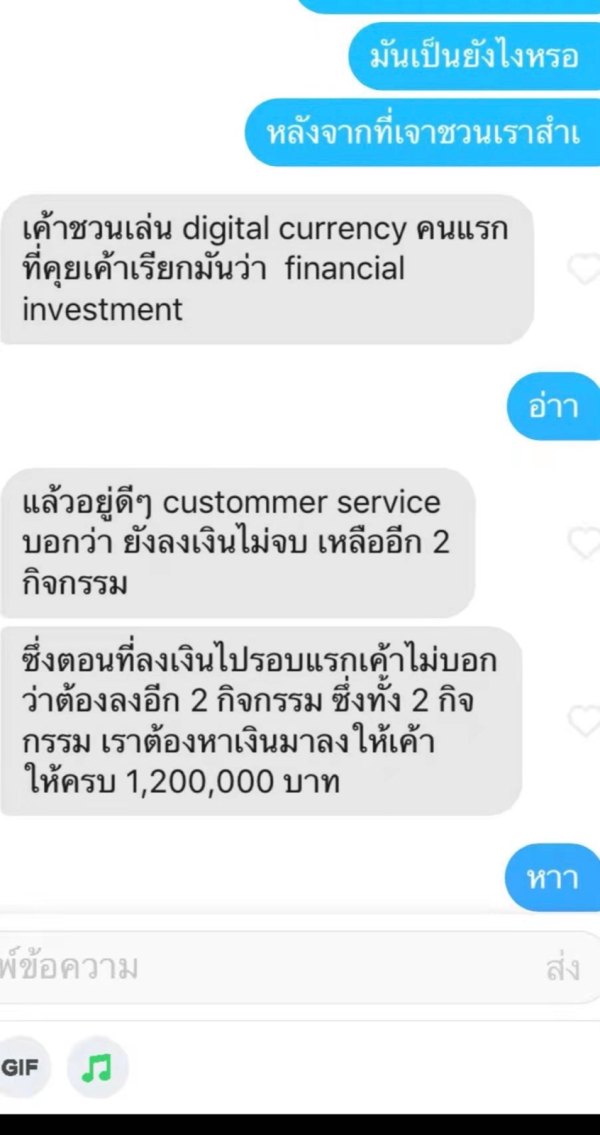

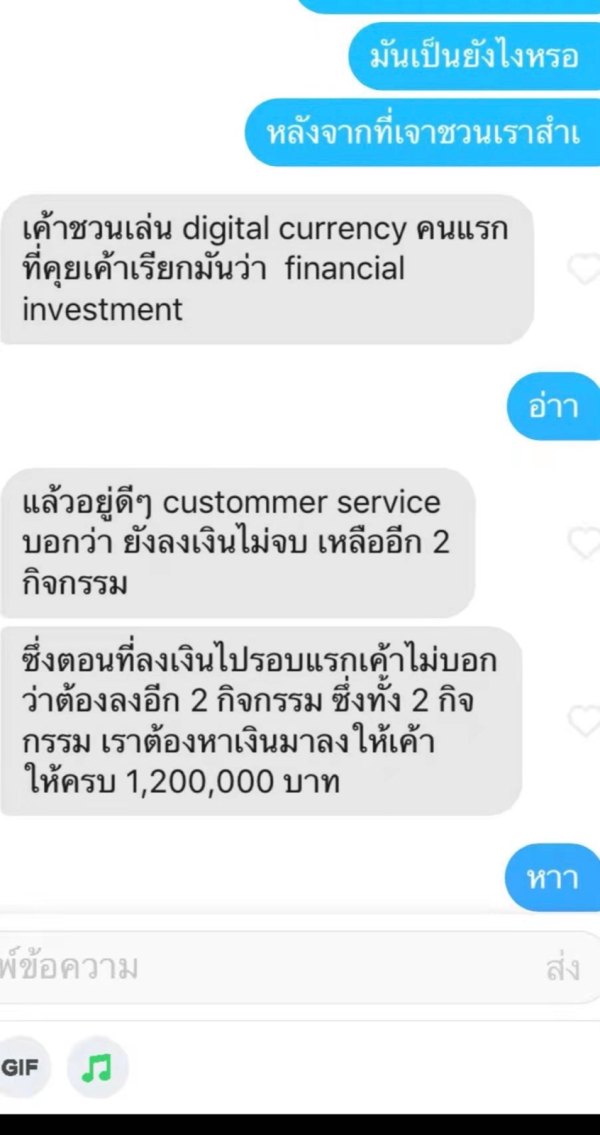

Someone asked me to invited my friend to invest together in order to make more profits. But the tax totalled 50% of the balance. How can I withdraw without profits?

I-Access Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Someone asked me to invited my friend to invest together in order to make more profits. But the tax totalled 50% of the balance. How can I withdraw without profits?

This comprehensive i-access review examines a broker operating in an increasingly complex cybersecurity landscape. Based on available information, i-access presents a neutral profile with limited publicly available details about their specific trading services and regulatory framework. The broker operates in an environment where initial access brokers and cyber threats are prevalent concerns for financial institutions, as evidenced by recent reports of ransomware attacks affecting various sectors including banking and financial services.

Without detailed information about account types, trading platforms, or specific regulatory oversight, potential clients should exercise caution when considering this broker. The lack of comprehensive public information about trading conditions, customer support quality, and regulatory compliance makes it challenging to provide a definitive recommendation. This i-access review aims to present available facts while highlighting areas where more transparency would benefit potential traders seeking reliable brokerage services.

This review is based on limited publicly available information about i-access. Due to insufficient data regarding specific regulatory entities across different jurisdictions, readers should independently verify all regulatory claims and trading conditions before making any investment decisions. The evaluation methodology relies on available sources, though comprehensive details about the broker's operations, licensing, and service quality remain limited in accessible documentation.

Cross-jurisdictional regulatory differences may apply. Potential clients should confirm which entity they would be trading with based on their geographic location. All information presented should be considered preliminary pending access to more detailed operational data.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Average |

| Tools and Resources | 4/10 | Below Average |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 4/10 | Below Average |

| Trust Score | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

i-access operates in a challenging market environment where cybersecurity concerns significantly impact financial services providers. The current landscape shows increased risks from ransomware attacks and cyber threats, with reports indicating that fraudulent emails designed to steal credentials pose ongoing risks to financial institutions. This context is particularly relevant when evaluating any brokerage firm's operational security and client protection measures.

The broker's establishment date, corporate background, and primary business model details are not clearly documented in available sources. Without access to comprehensive company information, including founding history and corporate structure, it becomes difficult to assess the broker's market positioning and operational experience. This lack of transparency raises questions about the firm's commitment to public disclosure and regulatory compliance standards.

Trading platform specifications, available asset classes, and regulatory oversight details remain unclear based on current information sources. The absence of detailed platform information, including supported trading instruments and execution models, limits potential clients' ability to evaluate whether i-access meets their specific trading requirements. This i-access review emphasizes the need for greater transparency in these fundamental operational areas.

Regulatory Jurisdictions: Specific regulatory information is not detailed in available sources. This raises concerns about oversight and compliance standards.

Deposit and Withdrawal Methods: Payment processing options and supported banking methods are not specified in accessible documentation.

Minimum Deposit Requirements: Entry-level funding requirements are not clearly stated. Available materials lack this basic information.

Bonus and Promotions: No information about promotional offers or bonus structures is available in current sources.

Tradeable Assets: The range of available trading instruments, including forex pairs, CFDs, and other assets, is not detailed. Accessible information lacks these specifications.

Cost Structure: Commission rates, spread information, and fee schedules are not provided in available documentation. This makes cost comparison difficult.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in current sources.

Platform Options: Trading platform choices and technological infrastructure details are not available. Accessible materials lack this information.

Geographic Restrictions: Service availability by region and jurisdictional limitations are not clearly documented.

Customer Support Languages: Multilingual support options are not specified. Available information lacks these details.

This i-access review highlights significant information gaps that potential clients should address through direct broker contact before making trading decisions.

The evaluation of i-access account conditions proves challenging due to limited available information about account types and their specific features. Without detailed documentation of account tiers, minimum balance requirements, or special account categories such as Islamic accounts, potential traders cannot adequately assess whether the broker's offerings align with their needs. This information gap represents a significant concern for transparency and client service standards.

Account opening procedures and verification requirements remain unspecified. The absence of clear information about documentation requirements, processing timeframes, and account approval criteria makes it difficult for potential clients to understand the onboarding experience. Additionally, no user feedback regarding account setup experiences is available in current sources.

Special features that might differentiate i-access accounts from competitors are not documented. Without information about account-specific benefits, trading tools, or service levels, this i-access review cannot provide meaningful comparisons with industry standards. The lack of detailed account condition information suggests potential clients should seek comprehensive details directly from the broker before proceeding.

Trading tool availability and quality assessment for i-access remains limited due to insufficient publicly available information. The absence of detailed descriptions about analytical tools, charting capabilities, and technical indicators makes it impossible to evaluate the broker's technological offerings against industry standards. Professional traders requiring sophisticated analytical resources would find this information gap particularly concerning.

Research and educational resources are crucial for trader development and market analysis. The lack of information about market research, economic calendars, trading guides, or educational webinars suggests either limited offerings or poor communication of available resources. This absence of educational support information is particularly relevant for newer traders seeking comprehensive learning materials.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, remains unspecified. Without details about API access, third-party integration options, or proprietary automated trading tools, traders interested in systematic trading approaches cannot adequately evaluate the platform's suitability for their strategies.

Customer service evaluation for i-access faces significant limitations due to the absence of detailed information about support channels and service quality. Available sources do not provide specific details about contact methods, whether through live chat, phone support, or email ticketing systems. This lack of transparency about customer service accessibility raises questions about the broker's commitment to client support standards.

Response time expectations and service quality metrics are not documented. Without user feedback about support experiences or published service level agreements, potential clients cannot assess whether i-access maintains acceptable customer service standards. The absence of this fundamental information suggests inadequate public disclosure about client support capabilities.

Multilingual support options and operating hours for customer service remain unspecified in current sources. For international traders, language support and timezone coverage are crucial factors in broker selection. The lack of clear information about these service aspects represents another significant gap in available broker information that this i-access review must highlight.

Platform stability and execution quality assessment proves difficult due to limited user feedback and technical performance data in available sources. Without specific information about order execution speeds, slippage rates, or platform downtime statistics, traders cannot evaluate the technical reliability of i-access trading infrastructure. This absence of performance data is particularly concerning for active traders who require consistent execution quality.

Trading platform functionality and feature completeness remain unclear. The lack of detailed platform descriptions, including chart types, order management tools, and analytical capabilities, prevents meaningful evaluation of the trading environment. Additionally, mobile trading app availability and functionality are not documented in accessible materials.

Market execution conditions, including spread competitiveness and liquidity provision, are not detailed in available sources. Without information about execution models, whether market making or STP/ECN, traders cannot understand the trading environment they would encounter. This i-access review emphasizes that execution transparency is crucial for informed broker selection, yet such details remain unavailable in current documentation.

Regulatory oversight verification presents significant challenges due to the absence of clear regulatory information in available sources. Without specific details about licensing authorities, regulatory compliance standards, or oversight mechanisms, potential clients cannot adequately assess the broker's regulatory standing. This lack of regulatory transparency is particularly concerning given the current cybersecurity threats facing financial services providers.

Client fund protection measures and segregation policies are not detailed. The absence of information about client money handling, insurance coverage, or compensation schemes raises important questions about financial security. Given reports about cybersecurity threats targeting financial institutions, including ransomware attacks and data breaches, fund protection transparency becomes even more critical.

The broader context of cybersecurity risks in the financial sector includes reports of fraudulent emails designed to steal credentials and various ransomware attacks affecting financial institutions. However, specific information about i-access security protocols and protective measures is not available in current sources, limiting the ability to assess the broker's security posture.

Overall user satisfaction assessment remains challenging due to the absence of comprehensive user reviews and feedback in available sources. Without detailed user testimonials or satisfaction surveys, this i-access review cannot provide insights into actual client experiences with the platform. The lack of user-generated content about trading experiences, customer service interactions, or platform usability represents a significant information gap.

Interface design and platform usability evaluation cannot be completed without access to detailed platform demonstrations or user interface descriptions. The absence of information about navigation ease, customization options, and overall user interface quality prevents meaningful assessment of the trading experience. Additionally, registration and verification process feedback is not available in current sources.

Common user complaints or positive feedback patterns cannot be identified due to insufficient user review data. Without access to balanced user feedback covering both positive and negative experiences, potential clients cannot understand typical user experiences or recurring issues. This absence of user voice in available documentation suggests either limited client base or inadequate feedback collection and disclosure practices.

This i-access review reveals significant information gaps that limit the ability to provide a comprehensive broker evaluation. The absence of detailed information about regulatory oversight, trading conditions, platform capabilities, and user experiences raises concerns about transparency and public disclosure practices. While the broker may offer legitimate services, the lack of readily available information makes it difficult to recommend i-access without additional verification.

Potential clients should exercise particular caution given the current cybersecurity landscape affecting financial services. Threats including ransomware attacks and credential theft pose ongoing risks. The combination of limited public information and elevated industry security concerns suggests that thorough due diligence is essential before engaging with this broker.

For traders seeking reliable brokerage services, the information gaps identified in this review indicate that direct contact with i-access for comprehensive service details would be necessary. Regulatory verification and security measures should be confirmed before making any trading decisions.

FX Broker Capital Trading Markets Review