Huitong 2025 Review: Everything You Need to Know

Summary: Huitong, a Hong Kong-based forex broker, has garnered mixed reviews from users and analysts alike. While it boasts a solid range of trading instruments and a user-friendly platform, concerns about customer service and withdrawal issues have been raised. Notably, the broker operates under varying regulatory frameworks depending on the region, which adds a layer of complexity for potential clients.

Note: It is crucial to be aware that Huitong operates as different entities in various regions, which may affect the services and protections available to clients. This review aims to provide a fair and accurate representation of Huitong based on available data.

Ratings Overview

How We Score Brokers: Our ratings are based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

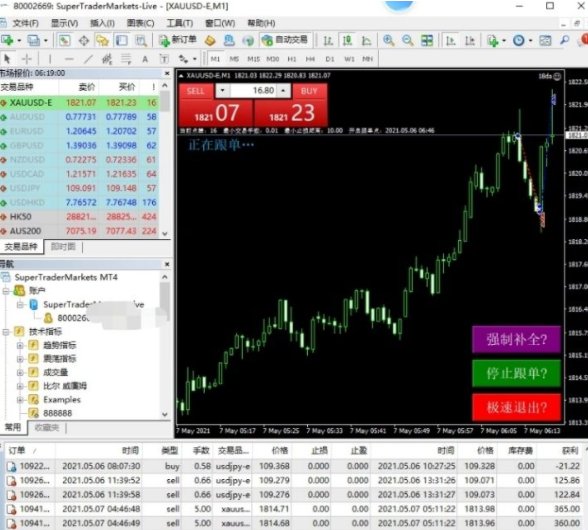

Founded in 2004, Huitong International Securities Group Limited operates primarily out of Hong Kong, with a strong focus on connecting Chinese investors to global markets. The broker offers a variety of trading platforms, including its proprietary SPTrader Pro and the widely-used MetaTrader 4 (MT4). Huitong provides access to a diverse range of asset classes, including forex, commodities, and indices. It is regulated by the Securities and Futures Commission (SFC) in Hong Kong, although there are questions about its regulatory status in other regions.

Detailed Section

-

Regulated Geographic Areas: Huitong is primarily regulated in Hong Kong by the SFC, holding licenses that include AAF 806. However, its regulatory status in Singapore under the Monetary Authority of Singapore (MAS) is less clear, as no specific license number is provided on its website.

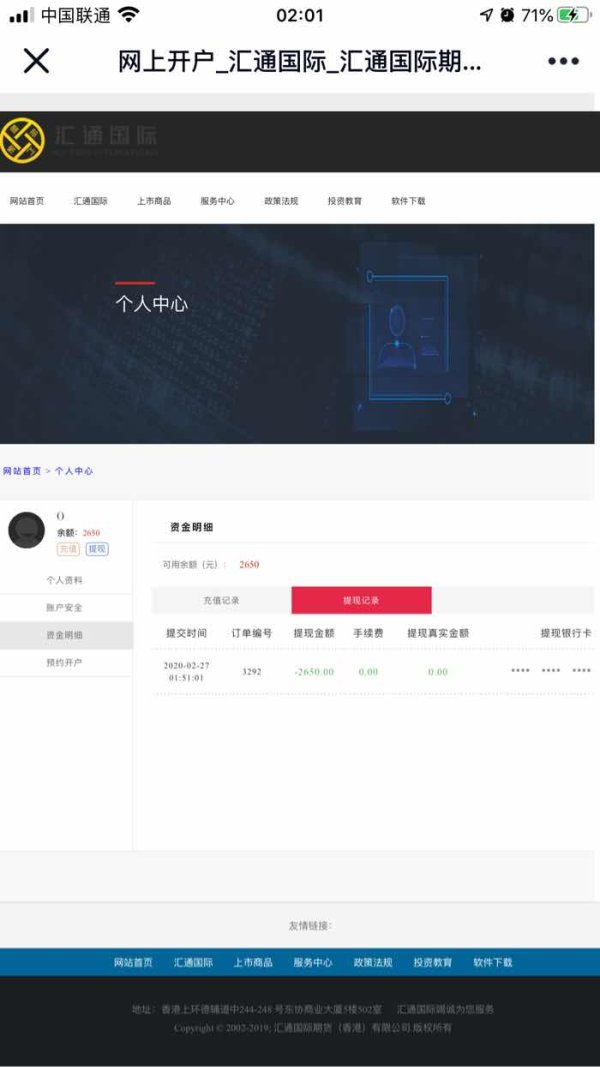

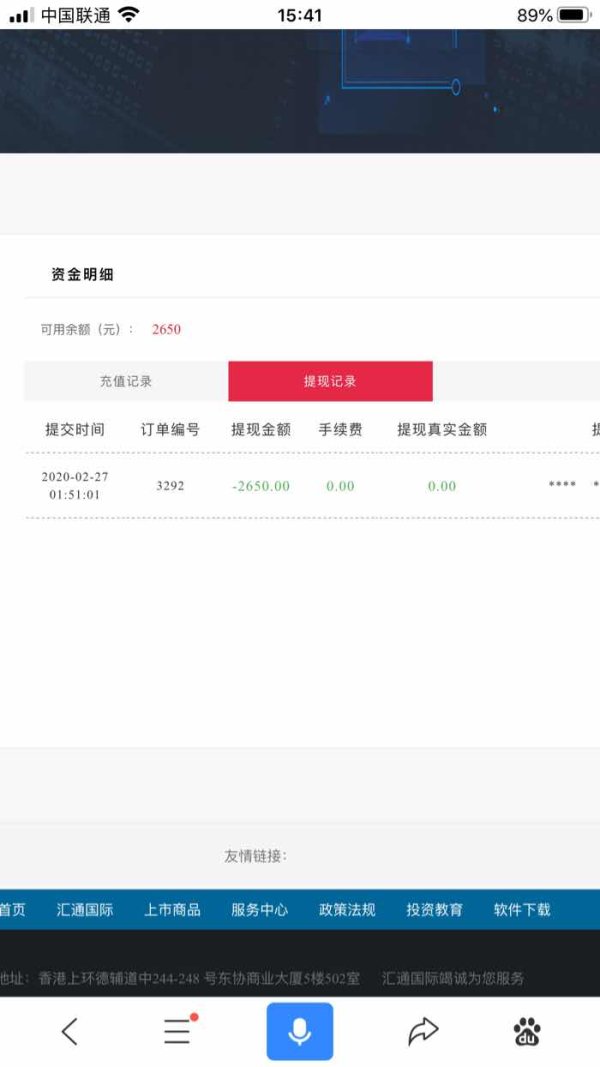

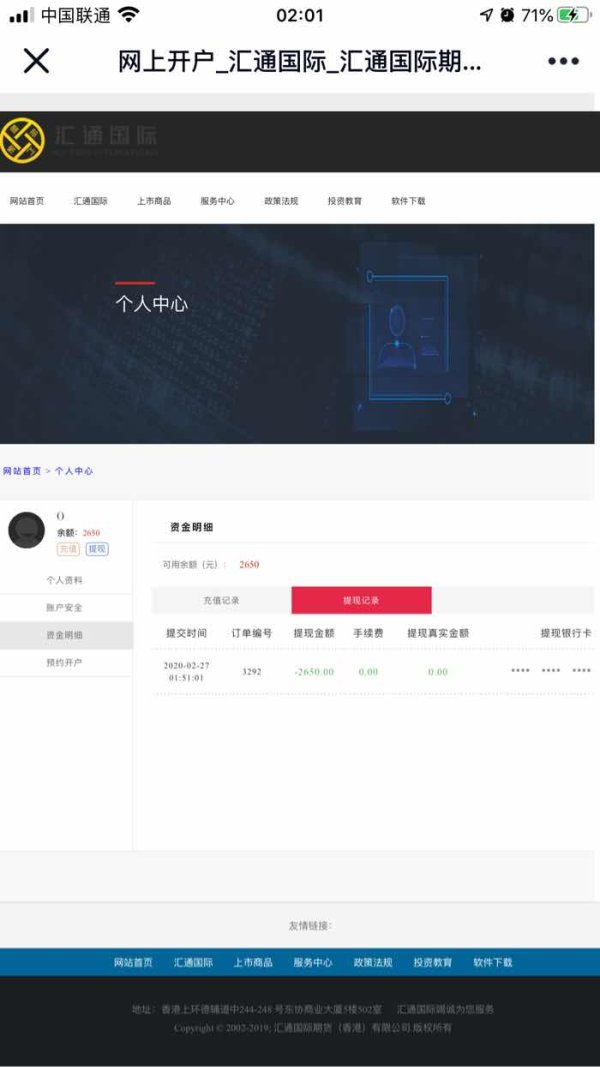

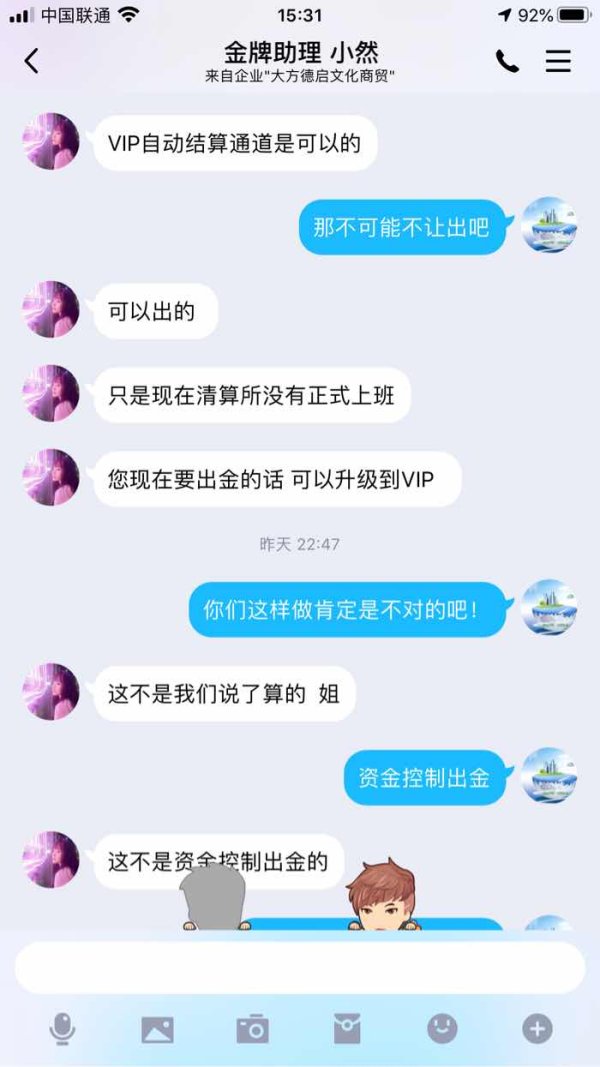

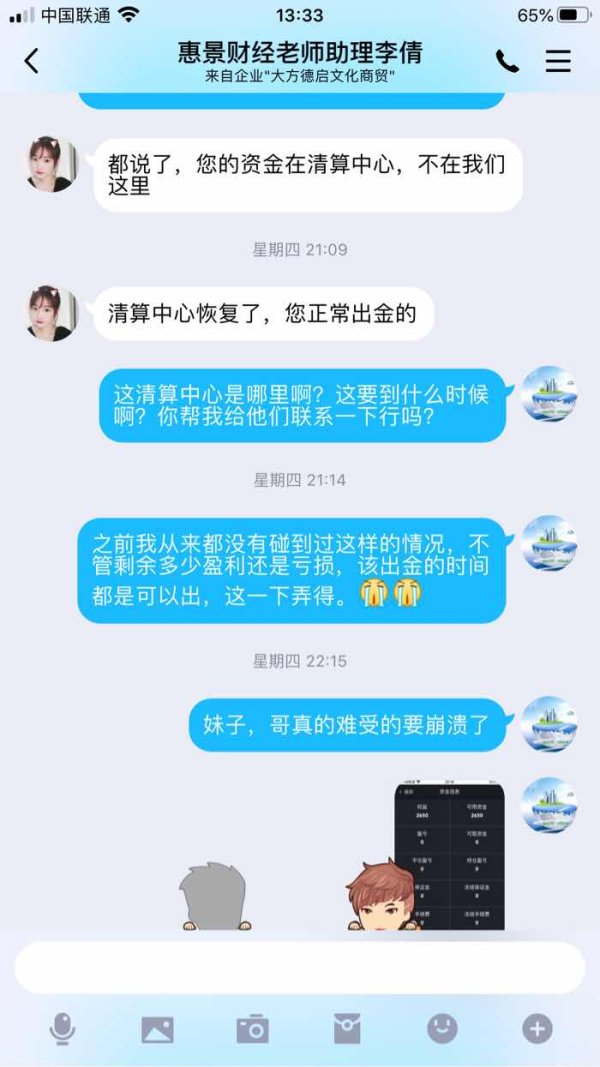

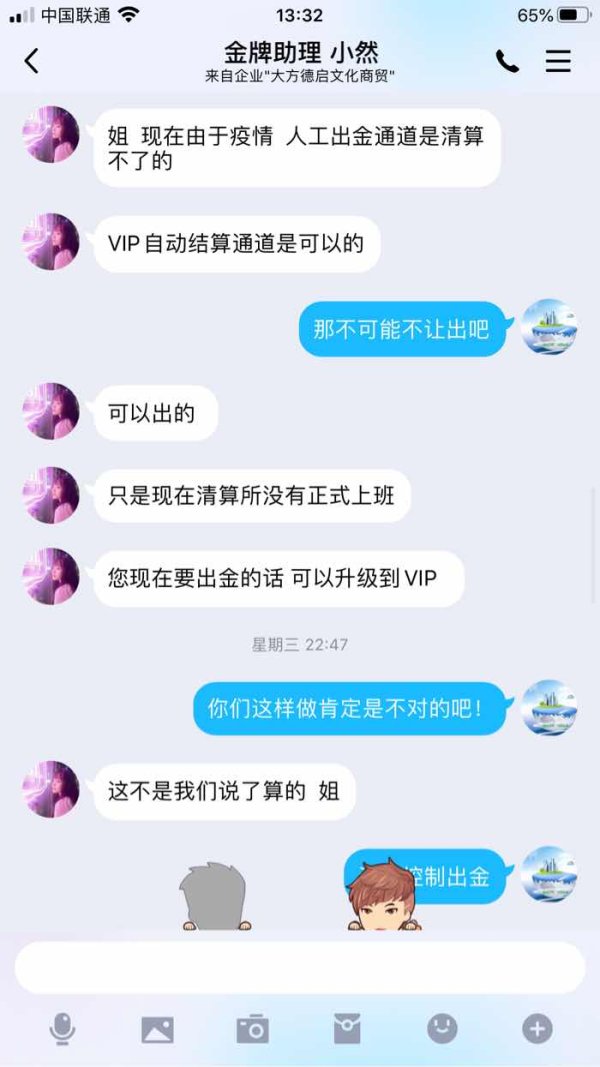

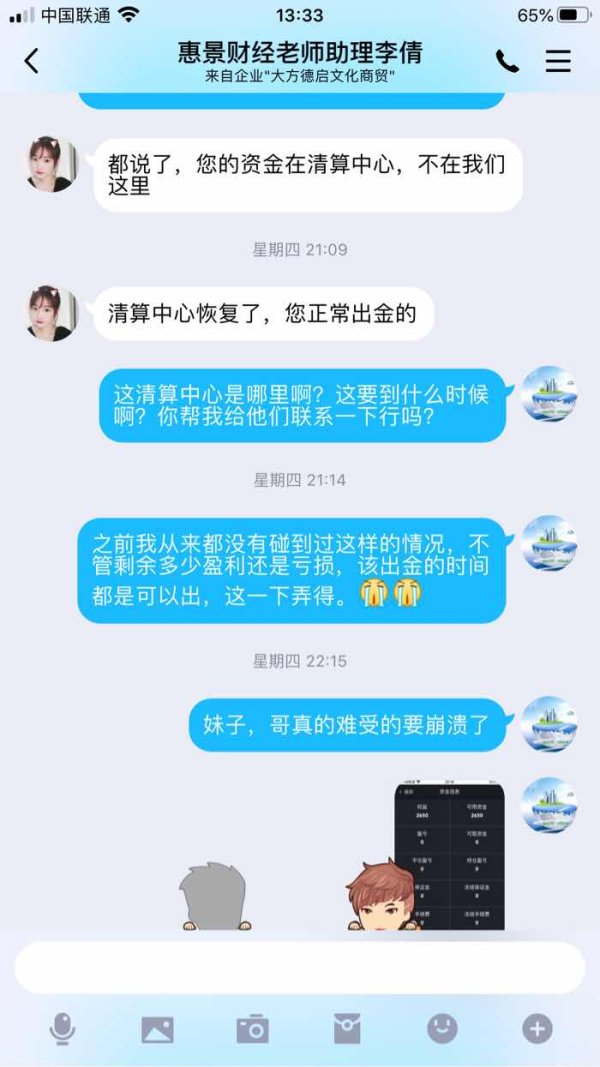

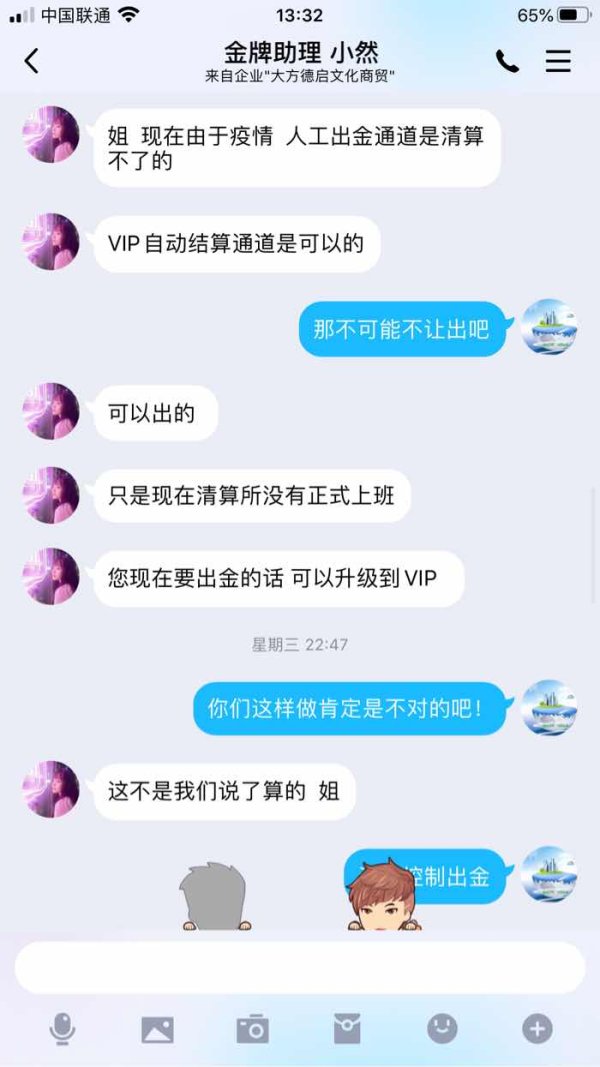

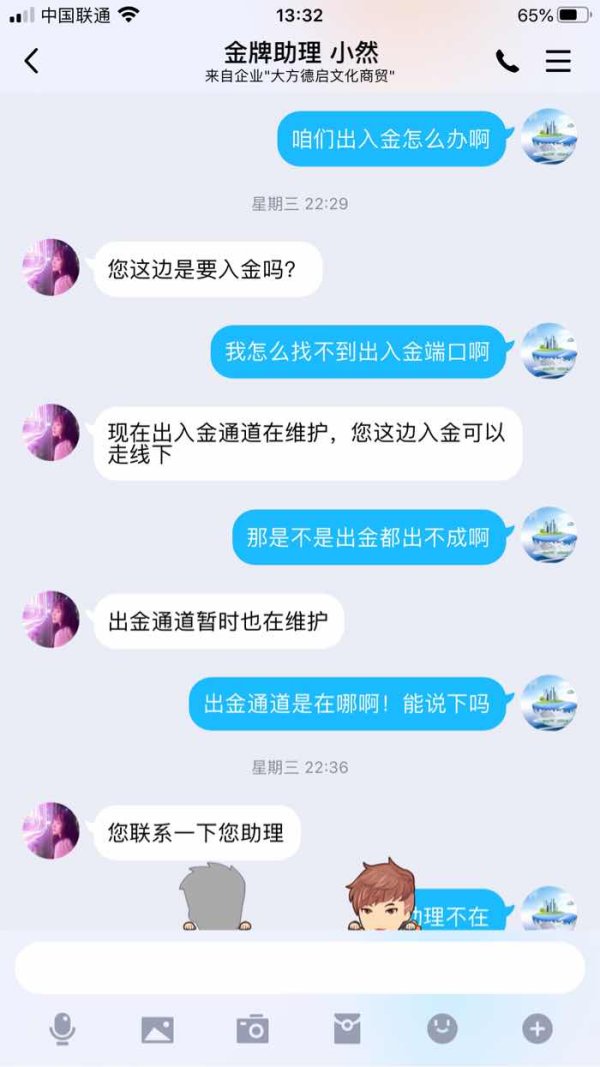

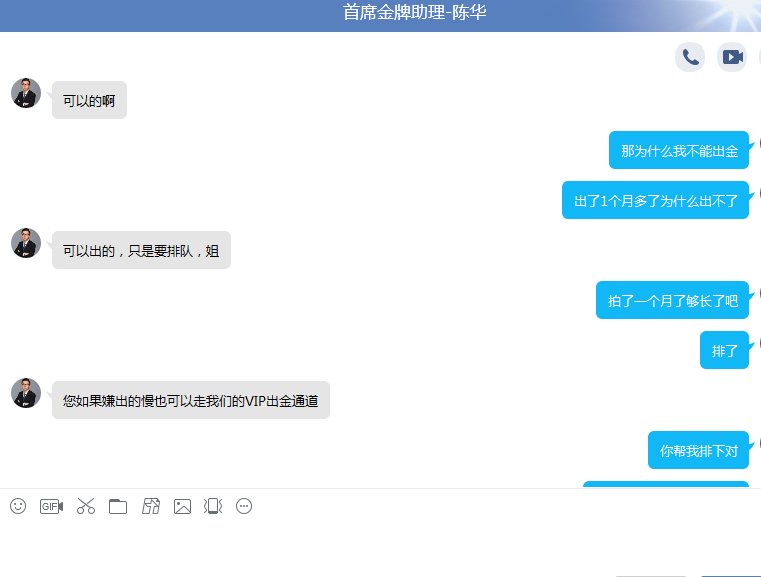

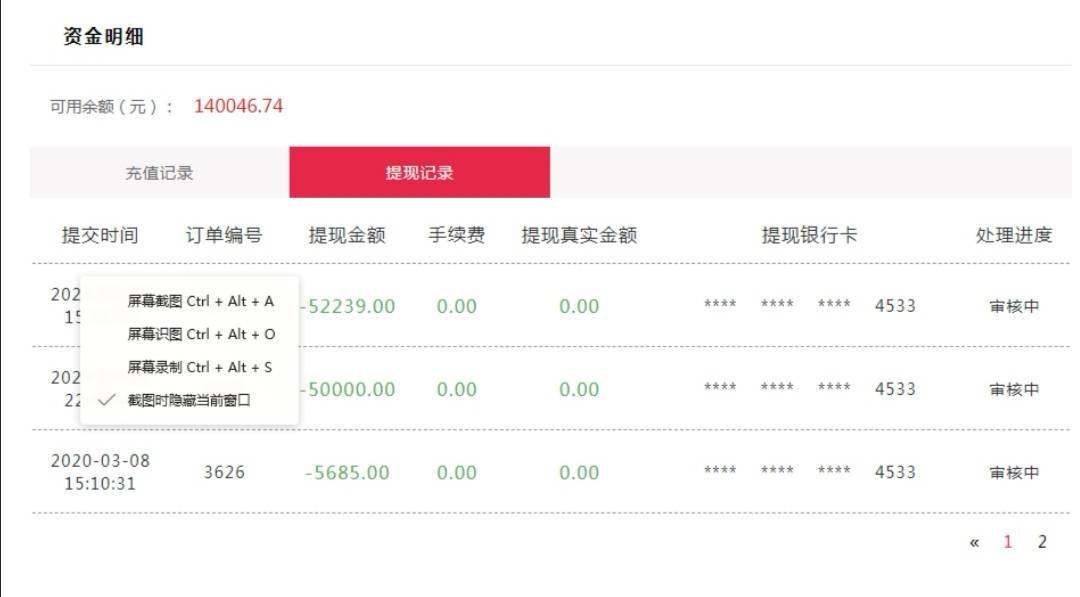

Deposit/Withdrawal Currencies: Clients can fund their accounts in USD, HKD, and SGD. However, the deposit and withdrawal process can be cumbersome, particularly for non-local clients, with reports of delays and lack of clarity regarding acceptable methods.

Minimum Deposit: Huitong has a notably low minimum deposit requirement of $0, making it accessible for traders of all budgets.

Bonuses/Promotions: There is limited information available regarding any ongoing promotions or bonuses offered by Huitong.

Tradable Asset Classes: Huitong provides a wide array of trading instruments, including currency pairs, commodities, indices, and futures, allowing for portfolio diversification.

Costs (Spreads, Fees, Commissions): The broker's fee structure varies depending on the asset class, with competitive spreads reported. However, specific details about commissions and additional fees are not always clearly outlined.

Leverage: Huitong offers leverage up to 1:50 on forex and metals, and 1:20 on CFDs, which can enhance trading opportunities but also increases risk.

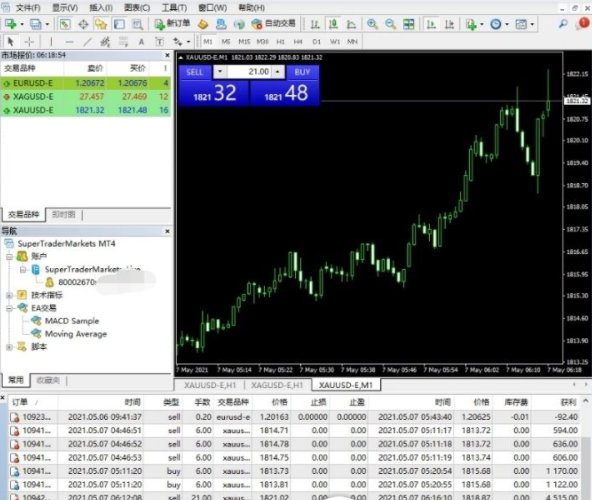

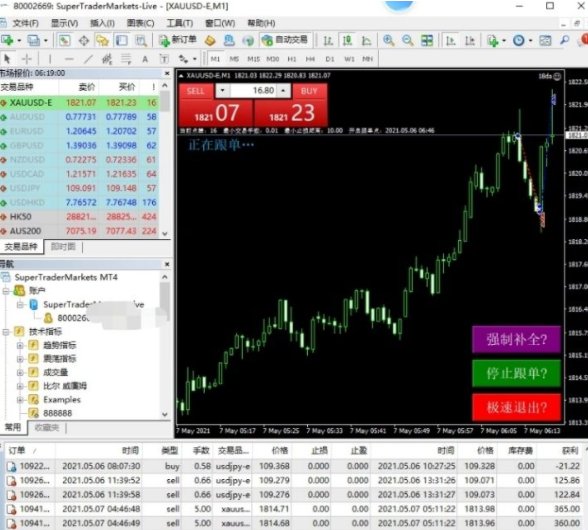

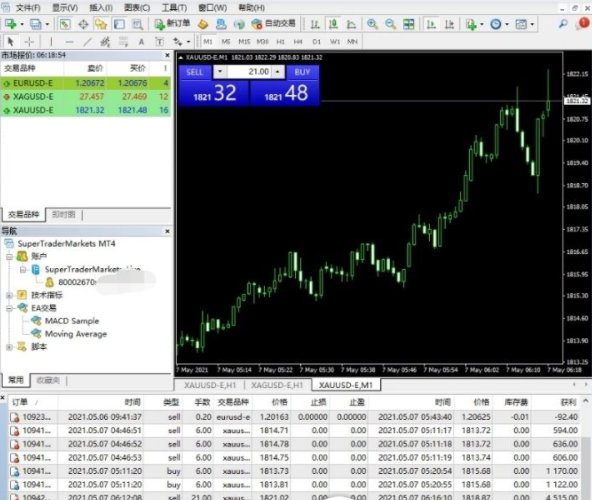

Allowed Trading Platforms: Clients can trade using Huitong's proprietary SPTrader Pro platform, MT4, and the HT Mobile app, catering to various trading preferences.

Restricted Areas: Huitong does not provide services to clients from certain regions, including North Korea, Iran, and Venezuela, due to regulatory and legal restrictions.

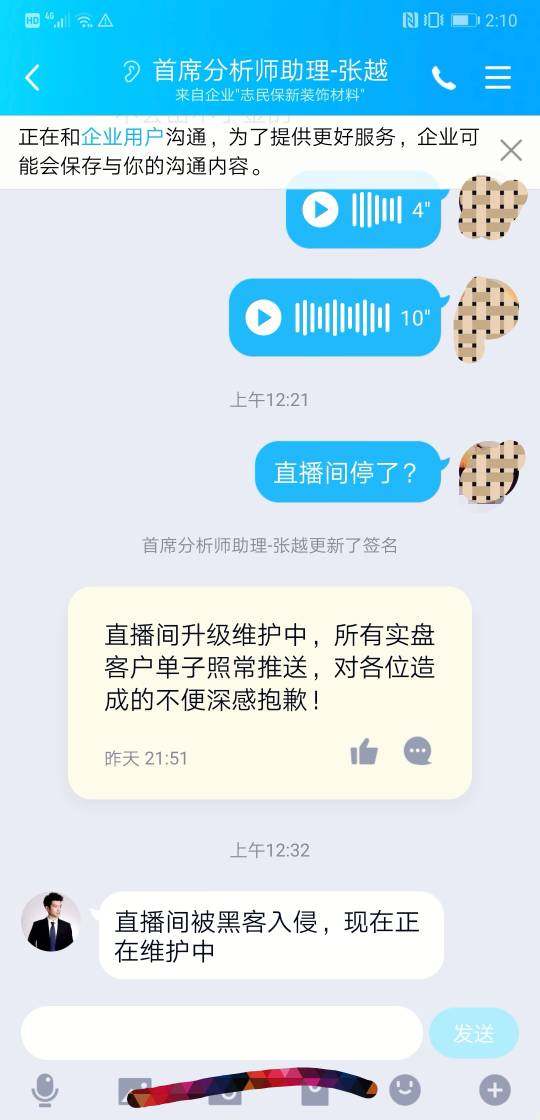

Available Customer Service Languages: Huitong offers customer support in English and Chinese, with assistance available via phone, email, and social media. However, user reviews indicate that response times can be slow, and there are complaints about the quality of support.

Ratings Overview (Detailed Breakdown)

-

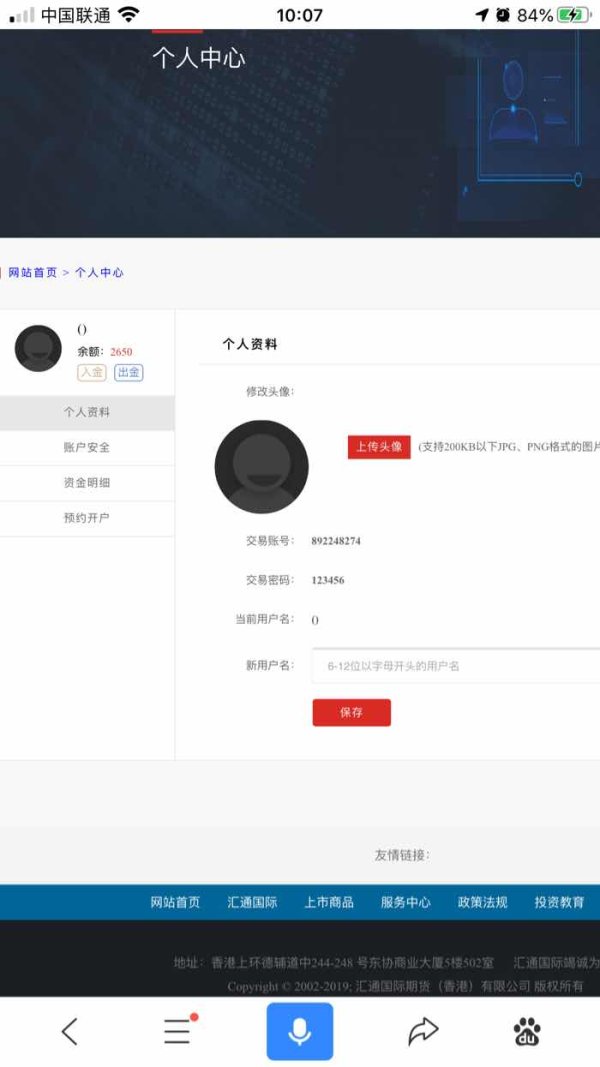

Account Conditions (6/10): Huitong's account conditions are generally favorable due to the low minimum deposit. However, the lack of clarity in the deposit and withdrawal processes can be a drawback for some users.

Tools and Resources (7/10): The trading platforms provided, including MT4 and SPTrader Pro, are equipped with advanced features that cater to both novice and experienced traders. However, the absence of educational resources is noted.

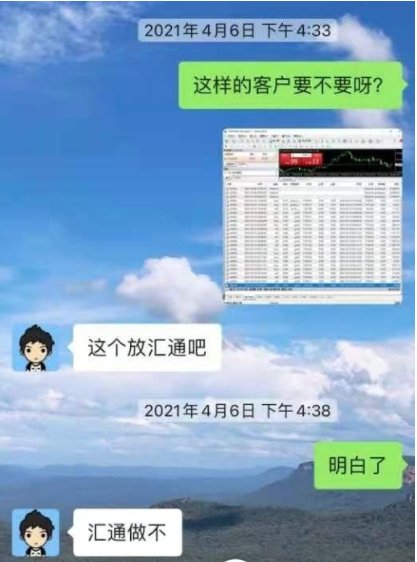

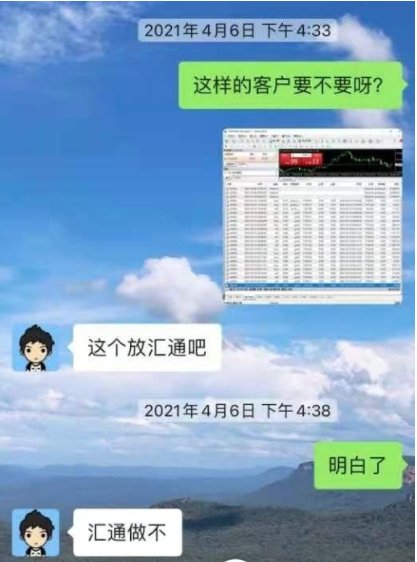

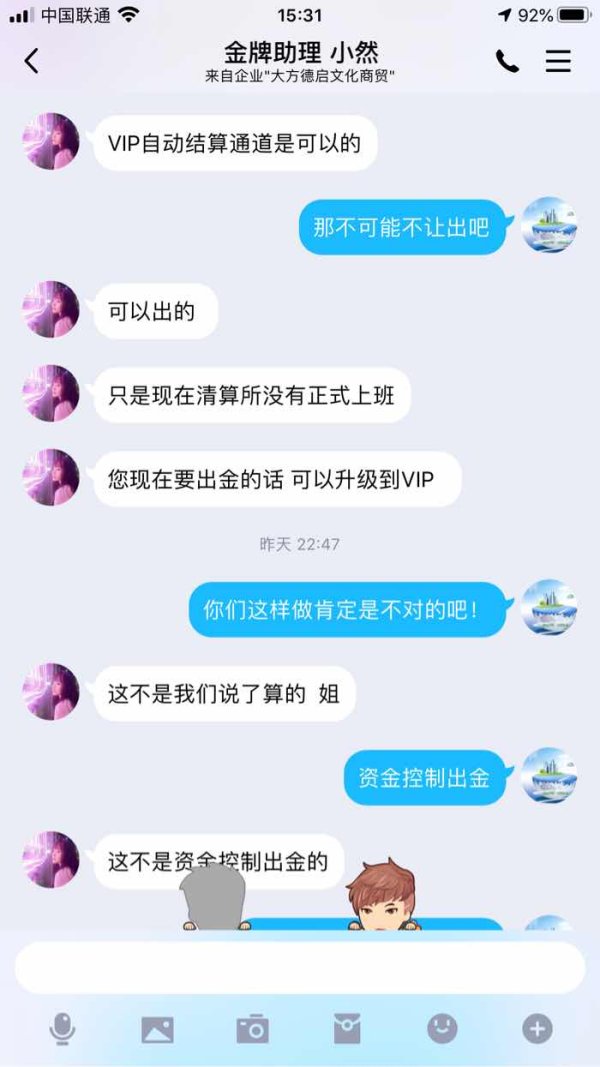

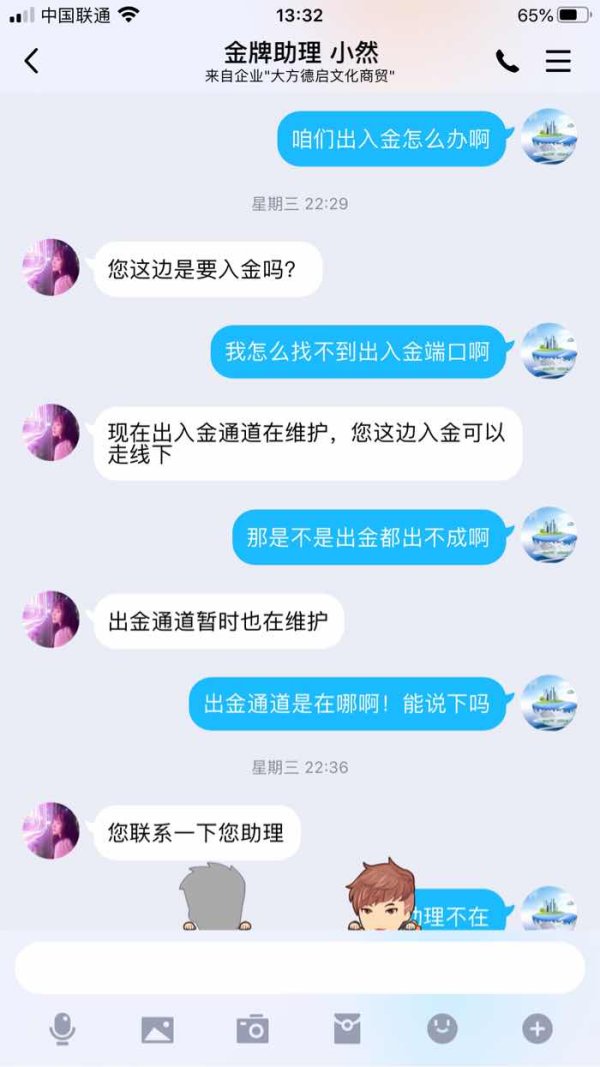

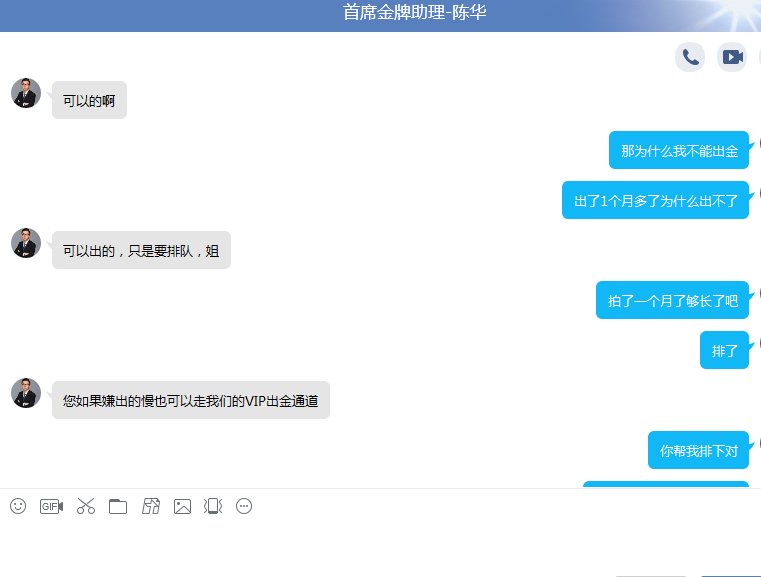

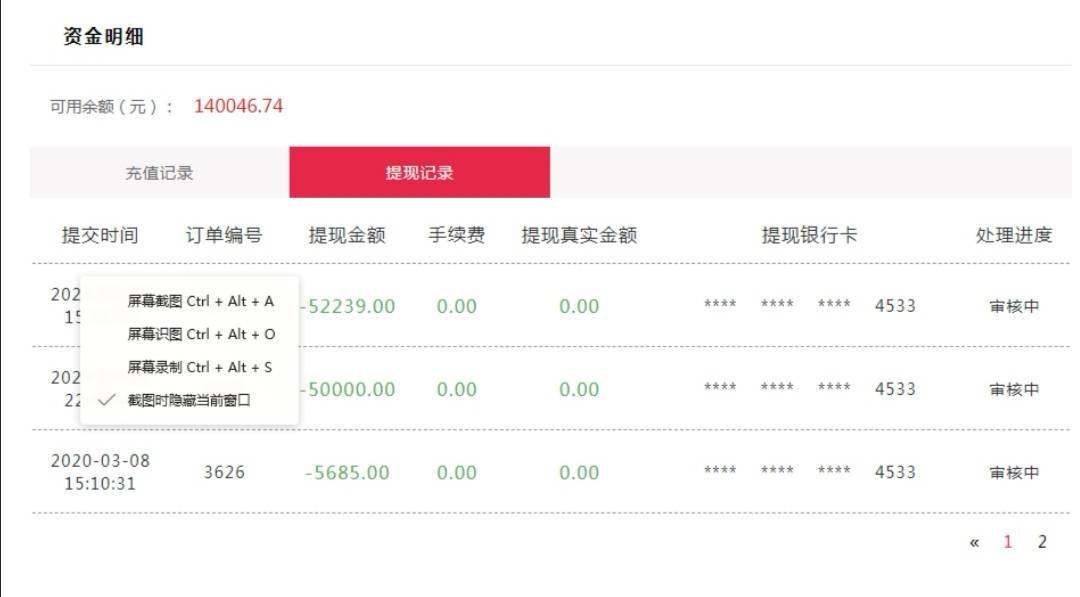

Customer Service and Support (5/10): While Huitong offers multiple channels for customer support, user feedback highlights long response times and inadequate assistance, particularly regarding withdrawal issues.

Trading Setup (6/10): The trading experience is generally positive, but users report challenges in navigating the broker's website and accessing essential information.

Trustworthiness (5/10): The mixed reviews regarding customer service and withdrawal issues raise concerns about Huitong's reliability. Furthermore, the lack of clear regulatory oversight in certain regions adds to the uncertainty.

User Experience (6/10): Overall, the user experience is satisfactory, but the complexities of the website and withdrawal processes detract from its usability.

Conclusion

Huitong presents a mixed picture for potential traders. While it offers a competitive range of trading instruments and platforms, concerns regarding customer service and withdrawal processes cannot be overlooked. The regulatory landscape adds another layer of complexity, as varying oversight in different regions may affect client protections. As always, potential clients should conduct thorough research and consider their options carefully before engaging with Huitong or any other brokerage.