Honor Global 2025 Review: Everything You Need to Know

Executive Summary

Honor Global presents a complex trading ecosystem that includes multiple entities with different rules and services. This Honor Global review shows that the broker works mainly through Hantec Markets, a regulated global CFD and forex broker offering over 2,650 instruments, along with ePlanet Brokers which operates under different regulatory conditions. Hantec Markets provides complete trading solutions including cryptocurrencies, stocks, commodities, and ETFs, backed by FCA and FSC licenses. The platform's best features include instant deposits, real-time AI tools, zero withdrawal fees, and negative balance protection, making it appealing for both new and experienced traders. However, the different regulatory landscape across different entities requires careful thought from potential clients. While Hantec Markets shows strong regulatory compliance and complete service offerings, the overall Honor Global structure presents both opportunities and challenges that traders must evaluate based on their specific needs and risk tolerance.

Important Notice

This Honor Global review is based on publicly available information and regulatory filings as of 2025. Traders should note significant differences between the various entities operating under the Honor Global umbrella. Hantec Markets Limited is authorized and regulated by the Financial Conduct Authority with FCA Reference Number 208159, while ePlanet Brokers LTD is registered in Fomboni, Island of Mohéli, Comoros Union, with IBC number HY00923038. These regulatory differences may significantly impact the level of protection and services available to clients depending on their jurisdiction and chosen entity. Our evaluation method includes regulatory compliance, user feedback, platform functionality, and industry standards to provide a complete assessment.

Rating Framework

Broker Overview

Honor Global operates through a network of entities that provide diverse financial services across multiple jurisdictions. The primary entity, Hantec Markets, has established itself as a regulated global CFD and forex broker with a complete suite of trading instruments. Hantec Markets holds licenses from both the Financial Conduct Authority and the Financial Services Commission, providing a solid regulatory foundation for its operations. The company focuses on delivering advanced trading technology combined with traditional financial services, targeting both retail and institutional clients seeking access to global markets.

The second major component, ePlanet Brokers, operates under different regulatory parameters, being registered in the Comoros Union with brokerage license number T2023372. This Honor Global review identifies that the platform specializes in providing high leverage trading opportunities, though specific details about their service offerings remain limited in available documentation. The dual-entity structure allows Honor Global to serve different market segments while maintaining compliance with varying regulatory requirements across jurisdictions.

Regulatory Jurisdictions: Hantec Markets operates under FCA and FSC regulation, providing strong oversight and client protection. ePlanet Brokers is registered in Comoros Union, which offers different regulatory standards and may impact client protections.

Deposit and Withdrawal Methods: Hantec Markets offers instant deposit capabilities with zero withdrawal fees, though specific payment methods are not detailed in available documentation. ePlanet Brokers' funding options remain unspecified in current materials.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly outlined in available documentation for either entity.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in accessible materials.

Tradeable Assets: Hantec Markets provides access to over 2,650 financial instruments including cryptocurrencies, stocks, commodities, and ETFs. ePlanet Brokers' asset coverage is not specified in available information.

Cost Structure: Hantec Markets features zero withdrawal fees as a key cost advantage. Specific spread and commission structures for both entities require direct inquiry for detailed information.

Leverage Ratios: ePlanet Brokers offers high leverage options, though specific ratios are not detailed. Hantec Markets' leverage terms are not specified in current documentation.

Platform Options: Specific trading platform details are not comprehensively covered in available materials, requiring further investigation for platform-specific features.

Regional Restrictions: Geographic limitations for services are not clearly specified in current documentation.

Customer Service Languages: Available language support options are not detailed in accessible materials.

This Honor Global review notes that while core service offerings are identified, many operational details require direct contact with the broker for complete information.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Honor Global's account structure reflects the dual-entity approach, with Hantec Markets offering multiple account types designed to accommodate different trading styles and experience levels. The account opening process appears streamlined, though specific details about minimum deposit requirements and account tiers are not fully documented in public materials. The regulatory backing from the FCA provides strong client protection for Hantec Markets accounts, including negative balance protection which prevents clients from losing more than their deposited funds.

The variety of account options suggests flexibility in meeting diverse client needs, from beginner traders to more sophisticated investors. However, this Honor Global review identifies that detailed account specifications, including spread structures, commission rates, and premium account benefits, require direct inquiry with the broker. The negative balance protection feature represents a significant advantage for risk management, particularly for newer traders who may be more susceptible to significant losses during volatile market conditions. While the account conditions appear competitive, the lack of detailed public information about specific terms and requirements limits the ability to make complete comparisons with other brokers in the market.

Hantec Markets demonstrates strong capabilities in trading tools and resources, offering over 2,650 financial instruments across multiple asset classes including cryptocurrencies, stocks, commodities, and ETFs. The platform incorporates real-time AI tools, representing a modern approach to trading technology that can assist both novice and experienced traders in market analysis and decision-making. This technological integration suggests a commitment to providing advanced trading capabilities that keep pace with industry innovations.

The breadth of available instruments provides traders with extensive diversification opportunities across global markets. However, specific details about research and analysis resources, educational materials, and automated trading support are not fully covered in available documentation. The AI tools integration indicates sophisticated technological infrastructure, though the specific functionalities and effectiveness of these tools would require hands-on evaluation. While the instrument variety and technological features suggest strong resource availability, the limited detailed information about educational support and research capabilities prevents a higher rating in this category.

Customer Service and Support Analysis (6/10)

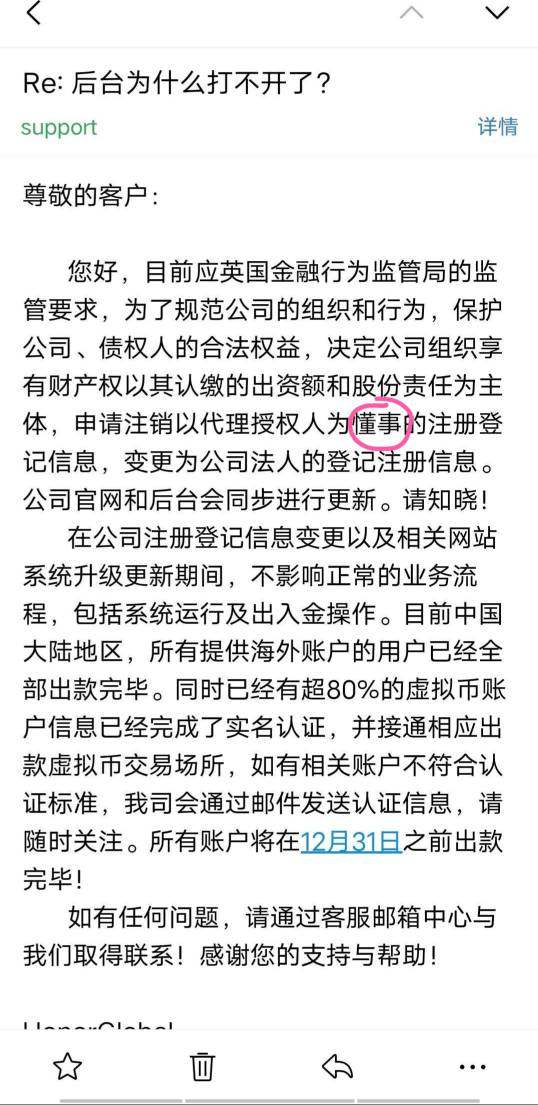

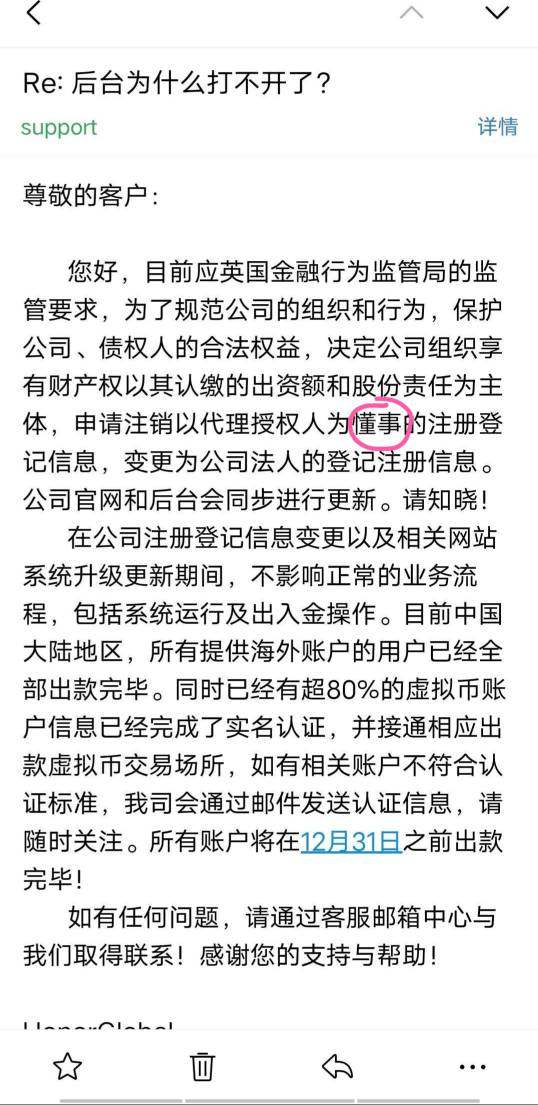

Customer service information for Honor Global remains limited in publicly available documentation, making complete evaluation challenging. The multi-entity structure potentially complicates support channels, as clients may need to navigate different service protocols depending on which entity they're working with. While regulatory oversight from the FCA for Hantec Markets suggests certain service standards must be maintained, specific details about response times, available support channels, and service quality metrics are not detailed in accessible materials.

The lack of complete information about multilingual support, 24/7 availability, and problem resolution procedures represents a significant gap in publicly available service information. For a broker operating across multiple jurisdictions and serving diverse client bases, clear communication about support capabilities is essential. Without detailed user feedback or official service level commitments available in public documentation, this Honor Global review can only provide a moderate rating based on the assumption that regulated entities maintain basic service standards. Prospective clients would need to directly evaluate support quality through initial interactions before making trading decisions.

Trading Experience Analysis (7/10)

The trading experience at Honor Global benefits from several technological advantages, particularly through Hantec Markets' real-time AI tools and complete instrument selection. The platform's instant deposit capabilities suggest efficient fund management systems that can enhance the overall trading experience. With over 2,650 available instruments, traders have access to diverse markets and can implement various trading strategies across different asset classes.

However, this Honor Global review notes that specific information about platform stability, execution speeds, and order processing quality is not detailed in available documentation. The AI tools integration represents a modern approach to trading support, potentially offering enhanced market analysis and trading insights. While the breadth of available instruments and technological features suggest a robust trading environment, the lack of detailed user feedback about platform performance, mobile app functionality, and overall trading conditions limits the ability to provide a higher assessment. The negative balance protection feature adds an important safety element to the trading experience, particularly valuable for less experienced traders.

Trust and Reliability Analysis (8/10)

Honor Global's trust profile is significantly strengthened by Hantec Markets' regulatory status under the Financial Conduct Authority, one of the world's most respected financial regulators. The FCA authorization with reference number 208159 provides substantial client protection and operational oversight. Additionally, the FSC licensing adds another layer of regulatory compliance, demonstrating commitment to maintaining proper operational standards across multiple jurisdictions.

However, the trust assessment becomes more complex when considering ePlanet Brokers' registration in the Comoros Union, which operates under different regulatory standards that may not provide the same level of client protection as FCA regulation. This dual-entity structure creates varying levels of regulatory protection depending on which entity clients engage with. The negative balance protection offered by Hantec Markets represents an important trust-building feature, protecting clients from excessive losses. While the FCA regulation provides strong credibility for a significant portion of operations, the mixed regulatory landscape across the Honor Global structure requires careful consideration by potential clients regarding their specific regulatory protection needs.

User Experience Analysis (6/10)

User experience evaluation for Honor Global is limited by the availability of detailed user feedback and interface information in public documentation. The platform appears designed to serve both new and experienced traders, suggesting an attempt to balance simplicity with advanced functionality. The instant deposit feature and zero withdrawal fees indicate attention to user convenience in fund management operations.

The real-time AI tools suggest modern interface design and advanced functionality that could enhance user experience through improved market analysis capabilities. However, specific information about interface design, navigation ease, registration processes, and mobile platform functionality is not fully available in current documentation. Without detailed user reviews or complete platform demonstrations, this Honor Global review cannot provide extensive insight into the day-to-day user experience quality. The multi-entity structure may also create complexity in user experience, as different entities may offer varying interface designs and service approaches. Potential users would benefit from direct platform evaluation to assess whether the user experience meets their specific trading needs and preferences.

Conclusion

This Honor Global review reveals a broker with significant strengths in regulatory compliance and instrument diversity, particularly through Hantec Markets' FCA-regulated operations and complete offering of over 2,650 financial instruments. The platform's technological features, including real-time AI tools and negative balance protection, demonstrate commitment to modern trading solutions and risk management. However, the multi-entity structure creates complexity in regulatory protection levels, and limited detailed information about many operational aspects prevents more definitive assessment.

Honor Global appears most suitable for traders who prioritize regulatory protection and instrument variety, particularly those working with Hantec Markets' FCA-regulated services. Both new and experienced traders may find value in the platform's technological features and broad market access, though careful consideration of the specific entity and regulatory framework is essential for making informed decisions.