Guotai 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Guotai review examines one of China's established financial services companies. Guotai was founded in 1992 and has its headquarters in Shanghai, making it a veteran player in the Chinese financial market with more than three decades of experience. The company operates as a diversified financial institution. It offers asset management, wealth management, and corporate financing services to both individual and institutional clients across multiple sectors.

According to available user feedback, Guotai maintains a four-star rating on professional platforms like Glassdoor. This rating indicates generally positive client experiences and suggests that the company delivers satisfactory services to its customer base. The firm's extensive experience in financial services positions it as a significant player in China's financial sector. Guotai's business model encompasses various financial services, from traditional brokerage operations to sophisticated wealth management solutions that cater to diverse client needs.

The company's target demographic includes individual investors seeking professional financial guidance. It also serves corporate clients requiring comprehensive financing solutions and strategic financial planning services. With its established presence in Shanghai's financial district, Guotai has developed expertise across multiple financial sectors. This makes it a notable option for clients seeking diversified financial services in the Chinese market.

Important Notice

When considering Guotai's services, potential clients should be aware that the company operates across different business entities. These entities may be subject to varying regulatory frameworks across regions, which could impact service availability and terms for different client segments. Users should carefully review the specific regulatory environment applicable to their chosen services.

This review is based on publicly available information and user feedback collected from various sources. While we strive for accuracy, the information presented may have limitations due to the availability of detailed operational data, which means some aspects of the company's services may not be fully covered. Prospective clients are encouraged to conduct their own due diligence. They should also verify current terms and conditions directly with Guotai before making any financial commitments.

Rating Framework

Broker Overview

Company Background and Foundation

Guotai stands as a well-established financial services company with origins dating back to 1992. This makes it a veteran in China's evolving financial landscape with over three decades of operational experience in the market. Based in Shanghai, one of Asia's premier financial centers, the company has positioned itself as a comprehensive financial services provider. It caters to diverse client needs across multiple sectors and service categories.

Over its 33-year operational history, Guotai has developed expertise across multiple financial sectors. These include asset management, wealth management, and corporate financing solutions that serve both individual and institutional clients. The firm's business model centers on providing integrated financial services to both individual and institutional clients, which allows it to serve a broad spectrum of financial needs. This approach ranges from personal investment management to complex corporate financing arrangements that require specialized expertise and market knowledge.

The company's longevity in the market suggests a stable operational framework. It also demonstrates the ability to adapt to changing market conditions over several decades of operation in China's dynamic financial environment.

Service Portfolio and Market Position

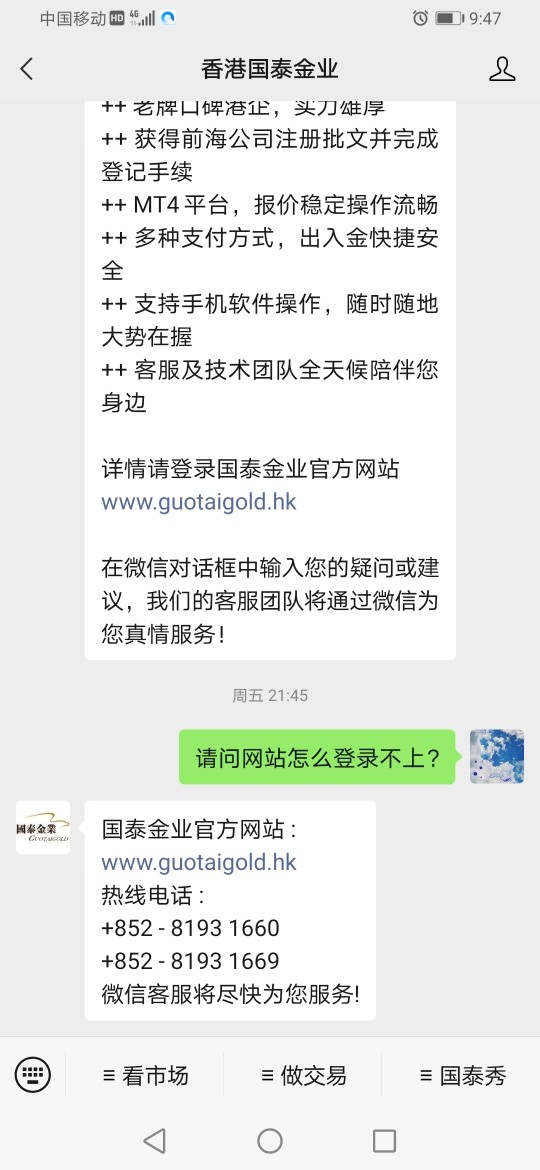

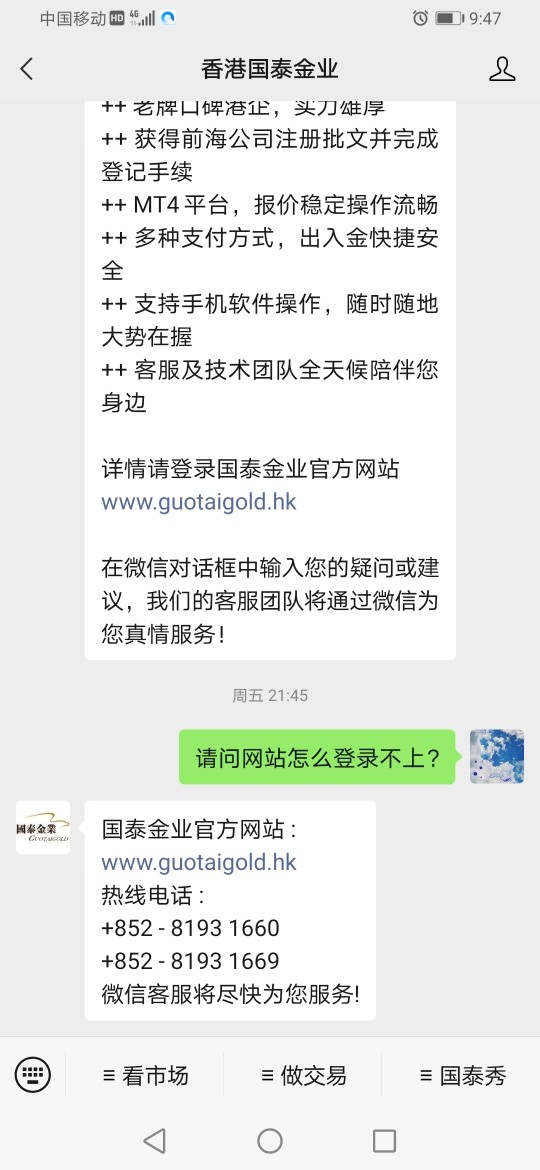

According to available information, Guotai operates through various business divisions. Guotai review sources indicate involvement in securities, futures, and international holdings that expand the company's service capabilities. The company's structure includes entities such as HK Guotai Junan International Holdings Ltd. This suggests a presence in Hong Kong's financial market alongside its mainland China operations, potentially expanding the firm's service capabilities and market reach.

The company's service offering appears to encompass traditional financial services while adapting to modern market demands. However, specific details regarding trading platforms, asset classes, and regulatory oversight are not comprehensively detailed in currently available information sources. This highlights the need for potential clients to seek additional clarification directly from the company.

Regulatory Environment: Current information sources do not specify the exact regulatory bodies overseeing Guotai's operations. As a Shanghai-based financial services company, it likely operates under Chinese financial regulatory frameworks.

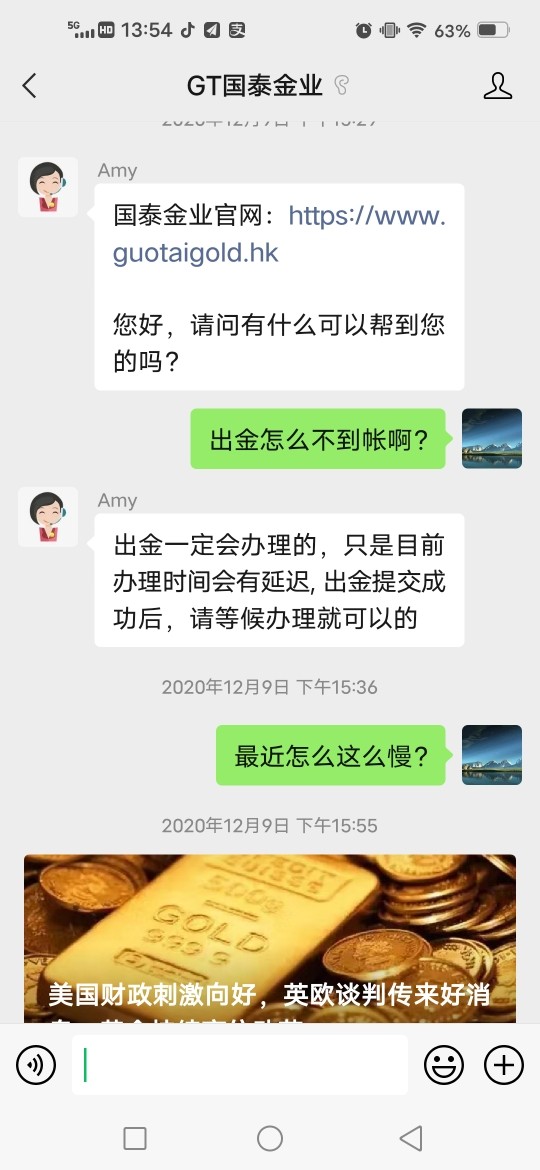

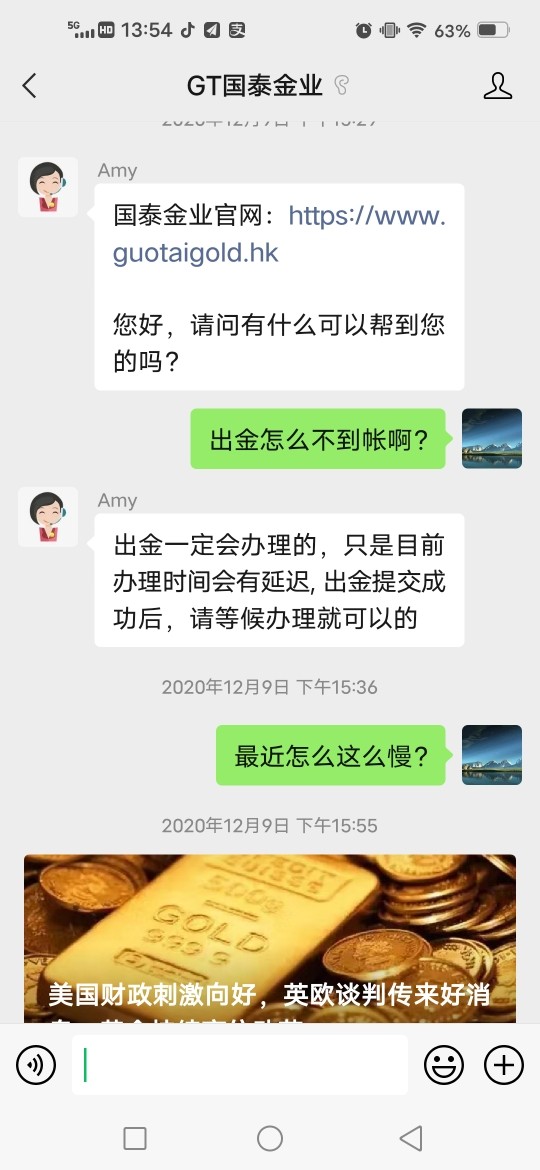

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options is not detailed in current information sources.

Minimum Deposit Requirements: The minimum deposit requirements for different account types are not specified in available materials.

Bonuses and Promotions: Details regarding promotional offers or bonus structures are not provided in current information summaries.

Tradeable Assets: While the company offers asset management services, specific information about tradeable instruments and asset classes is not comprehensively detailed in available sources.

Cost Structure: Detailed information about fees, spreads, and commission structures is not specified in current Guotai review materials.

Leverage Ratios: Information regarding available leverage options is not provided in current sources.

Platform Options: Specific details about trading platforms and technological infrastructure are not detailed in available information.

Regional Restrictions: Geographic limitations for services are not specified in current sources.

Customer Support Languages: Available language support options are not detailed in current information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Guotai's account conditions faces limitations due to insufficient detailed information in current sources. While the company offers various financial services including asset management and wealth management, specific details about account types are not comprehensively documented in available materials. The characteristics and associated benefits of different account categories also remain unclear from current sources.

Regarding minimum deposit requirements, the current Guotai review sources do not provide specific threshold amounts for different account categories. This information gap makes it challenging for potential clients to assess the accessibility of various service levels and determine which options might be suitable for their financial situation. Similarly, the account opening process is not detailed in available sources. Required documentation and verification procedures also lack specific information in current materials.

The absence of information about specialized account features suggests that potential clients would need to directly contact Guotai for comprehensive account condition details. This includes information about Islamic accounts or professional trader accounts that might be available but are not documented in current sources. This limitation in publicly available information highlights the importance of direct consultation with the company's representatives. Clients should seek to understand the full scope of account options and their respective terms and conditions before making decisions.

Assessment of Guotai's trading tools and resources is constrained by limited specific information in current sources. While the company's long-standing presence in the financial services sector suggests the availability of professional-grade tools, detailed specifications about trading platforms are not comprehensively documented. Analytical resources and technological capabilities also lack specific documentation in available materials.

The availability of research and analysis resources is not specifically detailed in current information sources. These resources are crucial for informed investment decisions but remain undocumented in available materials. Similarly, educational resources that could benefit both novice and experienced traders are not explicitly described in current sources. This creates a gap in understanding what learning and development support the company might provide to its clients.

Regarding automated trading support and advanced trading features, current sources do not provide specific information about these capabilities. The lack of detailed information about technological infrastructure makes it difficult to assess Guotai's competitive position in terms of trading technology. Tool quality assessment also faces limitations due to insufficient available data. Potential clients interested in specific tools or features would need to engage directly with the company for comprehensive information about available resources and technological capabilities.

Customer Service and Support Analysis

The evaluation of Guotai's customer service capabilities is limited by the absence of specific information about support channels in current sources. Availability and service quality metrics also lack documentation in available materials. While the company's four-star user rating suggests generally positive client experiences, detailed information about customer service infrastructure is not available for comprehensive assessment.

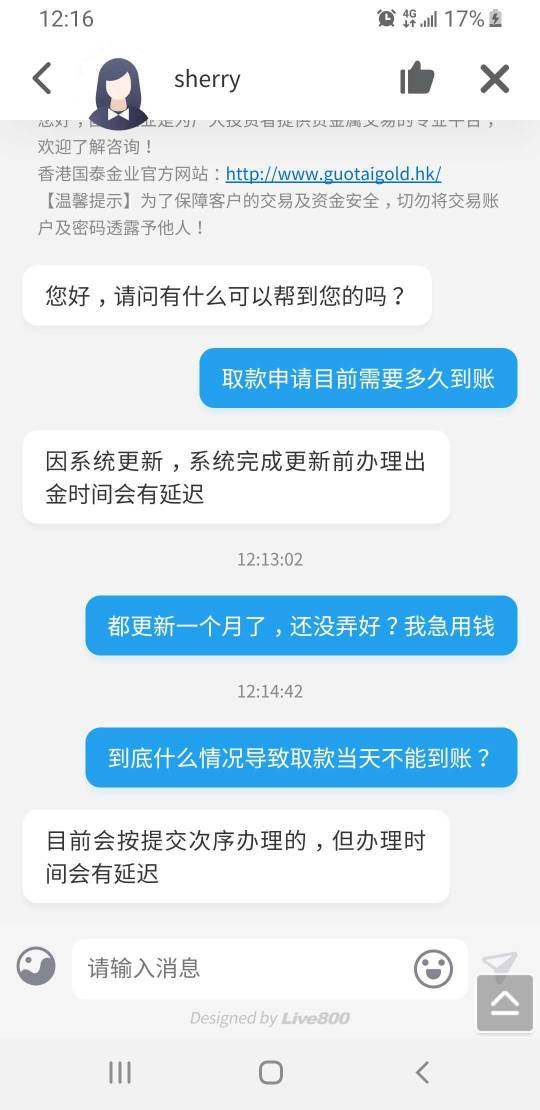

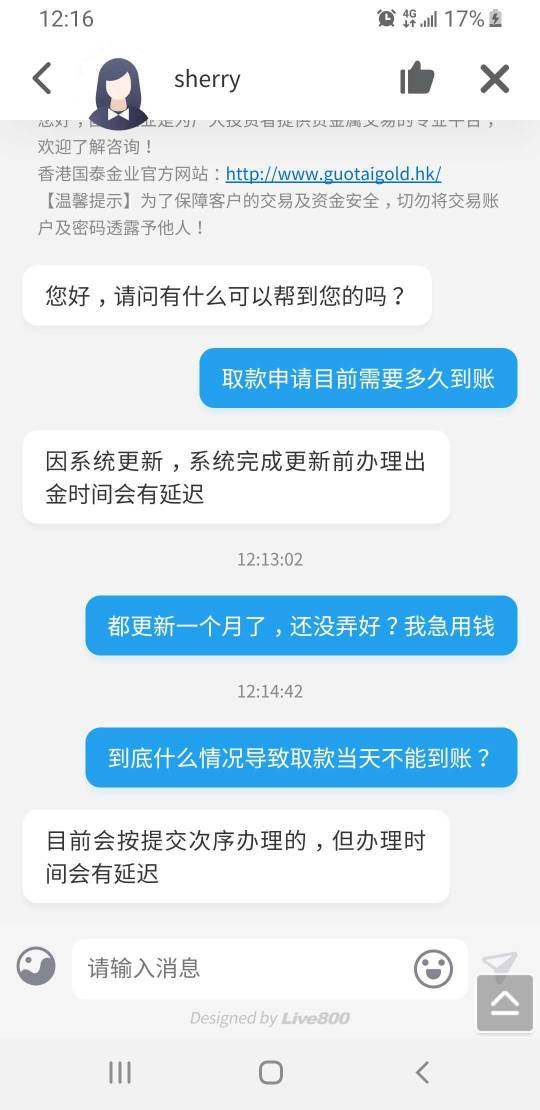

Response time metrics are not specified in current information sources. These metrics are crucial indicators of service quality but remain undocumented in available materials. Similarly, the availability of multiple communication channels is not detailed in current sources. Phone support, live chat, or email assistance options lack specific information about their availability and effectiveness.

Multi-language support capabilities are not specified in current sources. This information is particularly important for international clients who may require assistance in their preferred language. The absence of information about customer service hours further limits the assessment of Guotai's client support infrastructure. Regional support availability also lacks documentation in current materials. These information gaps suggest that potential clients should directly inquire about specific customer service features and availability when considering Guotai's services.

Trading Experience Analysis

The assessment of trading experience with Guotai faces significant limitations due to insufficient specific information about platform performance in current sources. Execution quality and user interface features also lack detailed documentation in available materials. While the company's established market presence suggests operational stability, detailed metrics about trading infrastructure are not available for thorough evaluation.

Platform stability and execution speed are not specifically documented in current Guotai review materials. These factors are critical for trading success but remain undocumented in available sources. Similarly, information about order execution quality is not provided in current materials. Slippage rates and platform uptime statistics also lack specific documentation, making it difficult to assess the technical quality of the trading environment.

The mobile trading experience is not detailed in current information sources. This aspect is increasingly important for modern traders who require flexible access to their accounts and trading capabilities. Features such as mobile app functionality are not specified in available materials. Cross-platform synchronization and mobile-specific trading tools also lack documentation in current sources. This lack of detailed trading experience information makes it challenging to assess Guotai's technological capabilities compared to other market participants.

Trust Factor Analysis

Evaluating Guotai's trustworthiness is complicated by limited specific information about regulatory credentials in current sources. Security measures and transparency practices also lack detailed documentation in available materials. While the company's 33-year operational history suggests stability and regulatory compliance, detailed information about specific regulatory authorizations is not comprehensively available for review.

Fund security measures are not specifically detailed in current information sources. Client fund segregation, insurance coverage, and deposit protection schemes lack documentation in available materials. These security features are crucial for client confidence but are not explicitly documented in current sources, creating uncertainty about the safety measures in place for client assets.

Corporate transparency is not specifically addressed in current sources. Financial disclosures, audit practices, and regulatory reporting lack detailed information in available materials. The handling of any past regulatory issues or negative events is also not documented in current sources. The absence of detailed trust-related information suggests that potential clients should seek comprehensive regulatory and security information directly from Guotai to make informed decisions about the company's reliability.

User Experience Analysis

The user experience evaluation benefits from some available feedback, with Guotai receiving a four-star rating on professional platforms like Glassdoor. This rating suggests generally positive user experiences, though specific details about interface design are not comprehensively detailed in current sources. Usability and client satisfaction factors also lack specific documentation in available materials.

Information about the registration and verification process is not specifically available in current sources. Required documentation, processing times, and user-friendliness of onboarding procedures lack detailed information in available materials. Similarly, details about the fund management experience are not documented in current sources. Deposit and withdrawal processes and their efficiency also remain unclear from available information.

Common user complaints or areas for improvement are not specifically identified in available information sources. The absence of detailed user experience metrics limits the comprehensive assessment of Guotai's user experience quality. Platform navigation ease, feature accessibility, and overall client satisfaction factors lack specific documentation in current materials. The available four-star rating provides a general positive indication but lacks the detail needed for thorough evaluation of the user experience quality.

Conclusion

This Guotai review reveals a financial services company with significant market experience and generally positive user feedback. The company's four-star rating provides evidence of client satisfaction, though the assessment faces limitations due to insufficient detailed information about specific trading conditions in publicly available sources. Account features and operational specifics also lack comprehensive documentation in current materials.

Guotai appears most suitable for clients seeking comprehensive financial services from an established institution. The company offers over three decades of market experience, which may appeal to clients who value stability and proven track records. The company's diverse service portfolio may appeal to both individual and institutional clients looking for integrated financial solutions. Asset management and wealth management services provide options for different client needs and investment objectives.

The main advantages include the company's long operational history and positive user ratings. These factors suggest reliability and client satisfaction over an extended period of market operation. However, the significant limitation lies in the lack of detailed publicly available information about trading conditions and fees. Specific service features also require additional clarification, which may require potential clients to engage directly with the company for comprehensive details before making informed decisions about using their services.