Golden FX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Golden FX has emerged as a notable broker in the forex trading space, trained to attract experienced traders with its offerings. Established in 2018 and registered in St. Vincent and the Grenadines, this broker provides access to a breadth of financial instruments, including forex, cryptocurrencies, and commodities. However, it falls under the significant scrutiny of being unregulated, which introduces a myriad of risks for traders. Experienced traders, who may seek high leverage and lower trading fees, could be drawn in by the promises of substantial returns. Yet, the stark reality of unregulated operations, coupled with alarming reports about withdrawal issues and lack of transparency, suggests that the allure might come with perilous consequences. This review endeavors to dissect Golden FX's offerings while providing crucial insights into its operational risks.

⚠️ Important Risk Advisory & Verification Steps

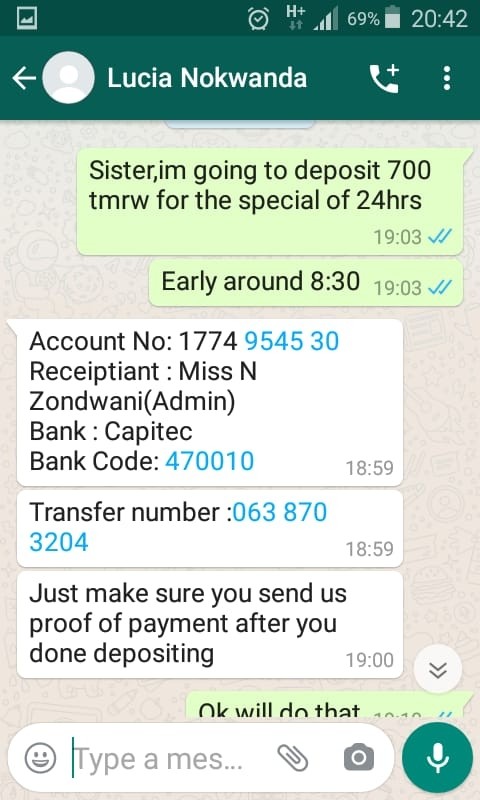

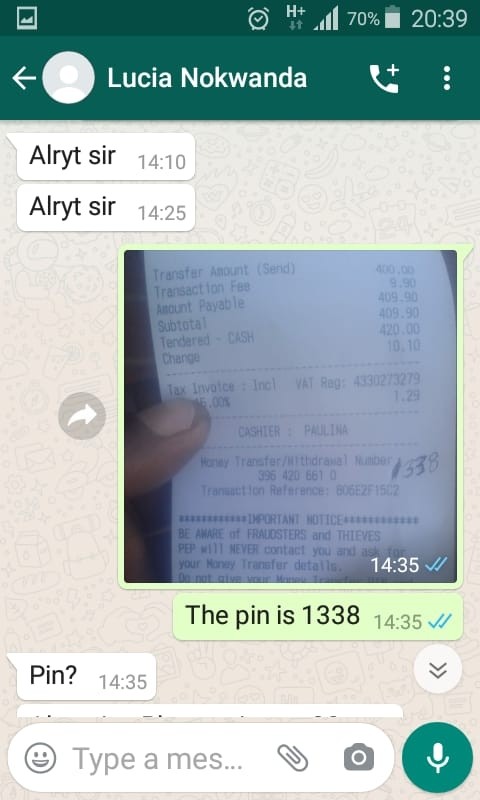

Caution: Trading with unregulated brokers, such as Golden FX, entails significant risks, including possible fraud, withdrawal issues, and complete loss of funds.

- Risk of Loss: When dealing with unregulated entities, there's no recourse to recover lost funds since they are not governed by financial authorities.

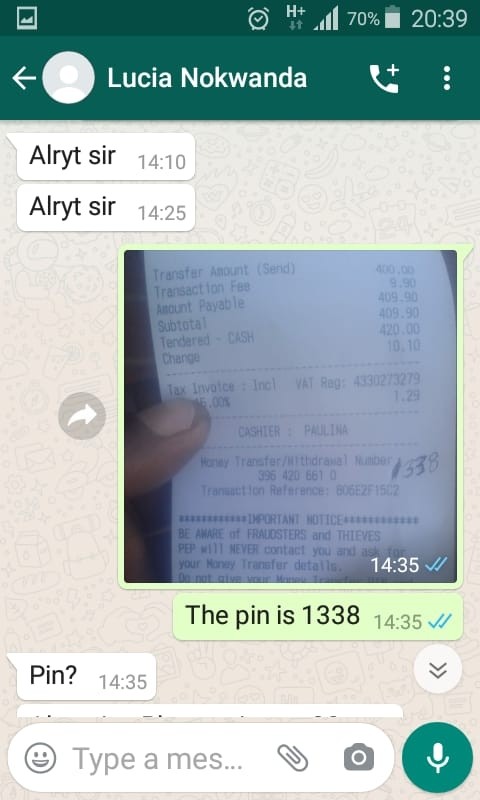

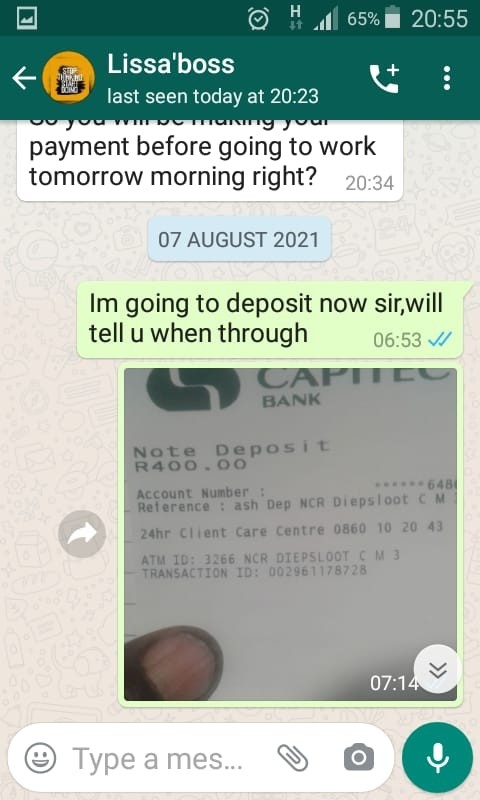

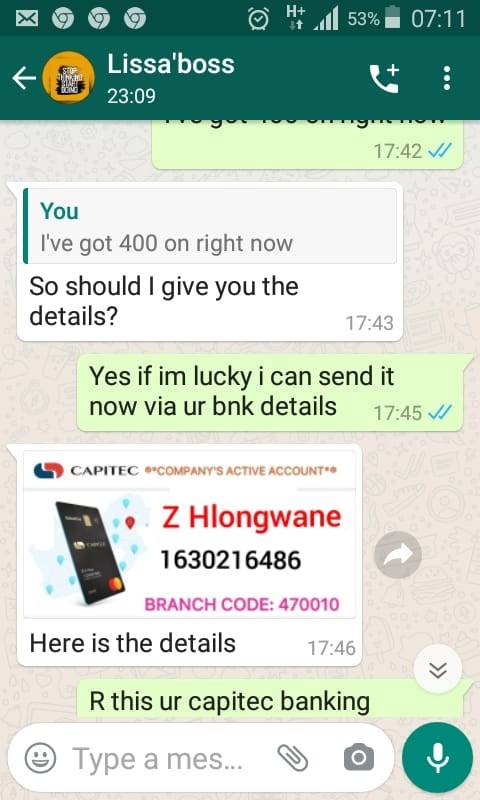

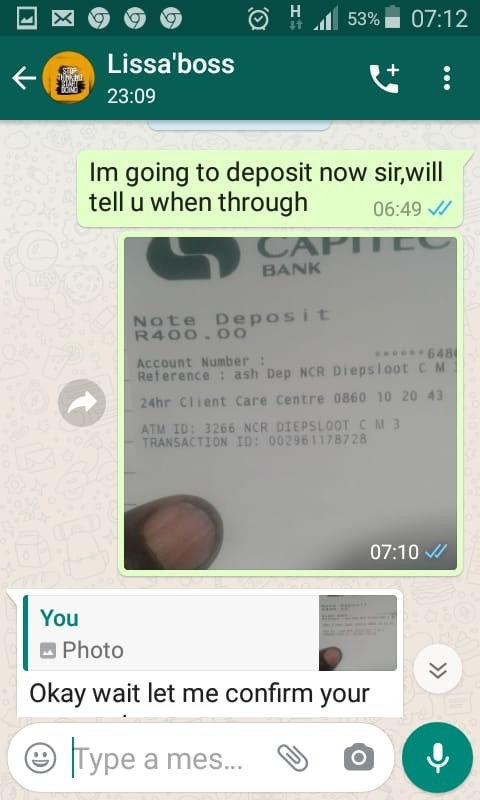

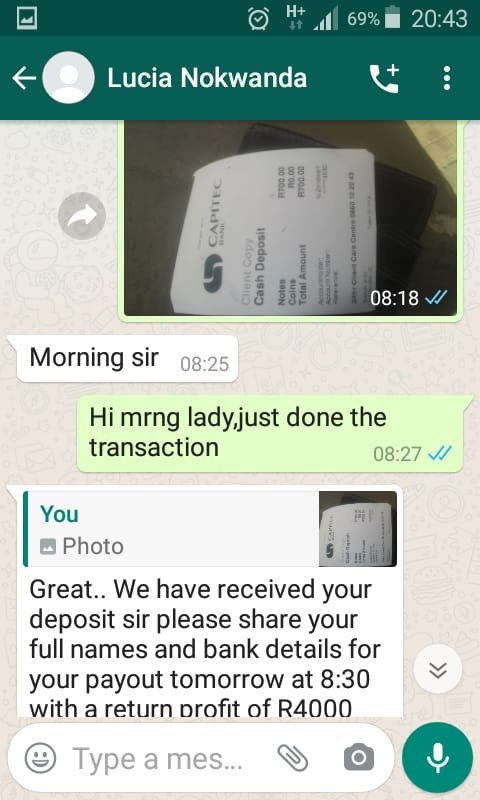

- Withdrawal Challenges: Multiple reports indicate that traders have faced delayed or completely blocked withdrawals, sometimes lasting for months without resolution.

- Action Steps:

- Research Regulatory Status: Verify any broker's regulatory status on platforms like the NFA's BASIC database or similar financial authority sites.

- Document Communications: Keep thorough records of all correspondence requesting fund withdrawals.

- Escalate Complaints: In case of issues, escalate complaints through proper regulatory bodies and consider possible chargebacks via credit providers if funds were deposited through them.

Rating Framework

Broker Overview

Company Background and Positioning

Golden FX operates as an unregulated forex broker founded in 2018. It is registered in St. Vincent and the Grenadines, a notorious location for brokers due to its lenient regulatory environment. This situation raises serious concerns for potential clients regarding safety and reliability. With little to no information about its ownership structure or operational history available, the anonymity surrounding Golden FX raises red flags that should not be overlooked.

Core Business Overview

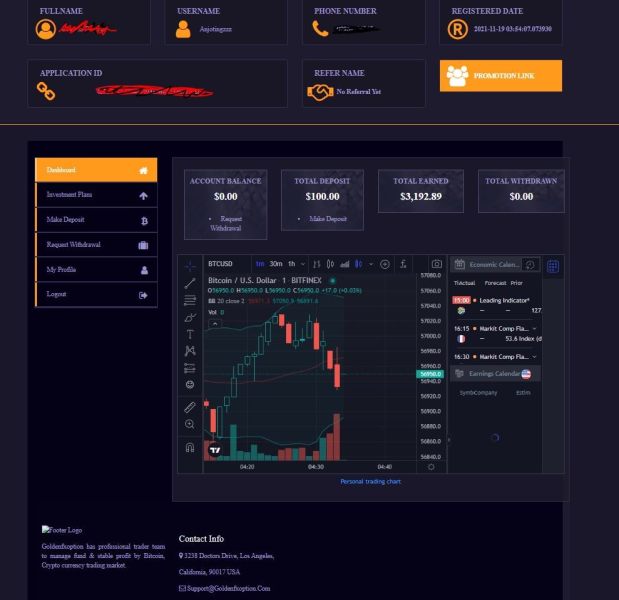

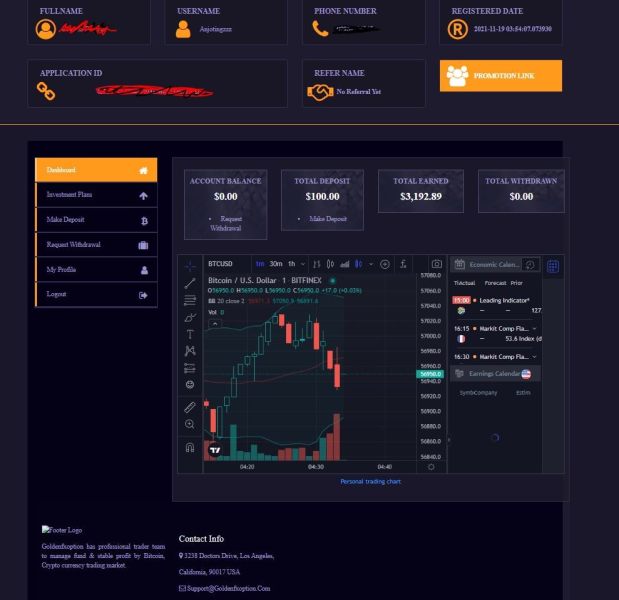

Golden FX offers traders access to an array of financial markets including over 40 forex currency pairs, commodities, indices, stocks, and cryptocurrencies. However, without the backing of formal regulatory authority, the broker's claims of legitimacy are deeply compromised. While it markets itself as a forex trading hub, the absence of oversight means that client funds and trading outcomes are at substantial risk.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The pursuit of safety in forex trading begins with an understanding of regulatory compliance and transparent business practices.

In examining the regulatory information conflicts surrounding Golden FX, it is clear there are significant discrepancies. While the brokerage claims to provide trading services, it operates without oversight from recognized financial authorities. According to multiple sources, the absence of any regulatory backing poses serious risks for traders. Unregulated brokers are notorious for potentially running scams, as there is no institution to hold them accountable.

Traders seeking to validate broker status should follow these steps:

- Visit the regulatory authority's website.

- Confirm the broker's registration details.

- Research any official warnings or complaints associated with the broker.

"I have opened an account recently with Golden FX. When it came time to withdraw funds from the earnings made, there was no response from the company."

Trading Costs Analysis

Understanding trading costs is essential for evaluating profitability potentials.

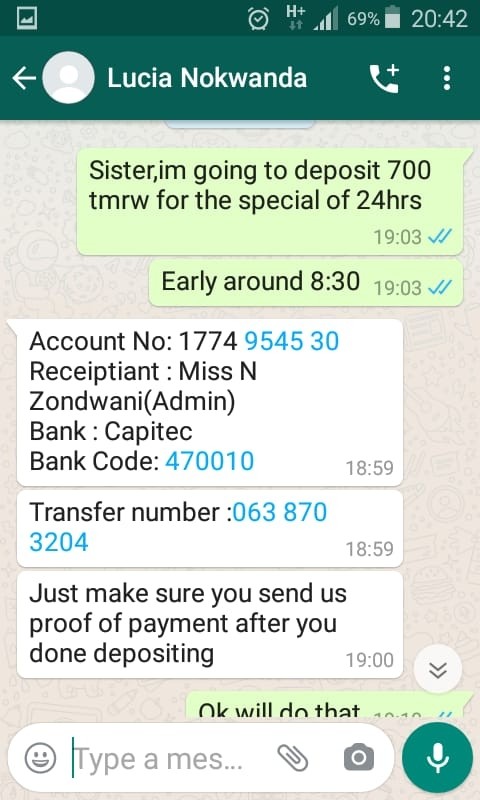

Golden FX advertises a competitive commission structure aimed at attracting traders. Upon further investigation, however, issues arise regarding transparency and hidden costs. Traders often find themselves subjected to unexpected fees.

Complaints from users reveal:

"Whenever I attempted to make a withdrawal, they would ask me to pay $30 in fees, claiming it was a standard processing requirement."

Nevertheless, while the trading fees might initially appear competitive, the "traps" of non-trading fees can severely undermine profit margins.

The trading platform's performance can greatly affect the overall trading experience.

Golden FX offers trading through both MT4 and its proprietary platform. While MT4 is renowned for its functionalities, reports from users indicate mixed experiences with execution speed and reliability.

"After experiencing several slippages when executing trades, I began to feel uneasy about the reliability of their platform," one trader noted.

Traders assessing Golden FX's platform must weigh usability against feedback from existing users to gauge anticipated operational performance.

User Experience Analysis

User experiences often paint a clear picture of a broker's reliability and service quality.

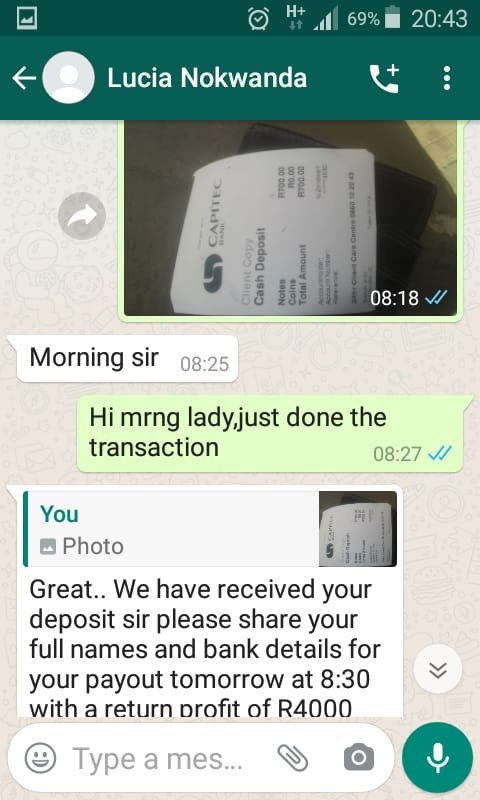

Reports indicate a trend of poor user experiences, particularly revolving around withdrawal issues. Users have expressed dissatisfaction with support responsiveness and clarity on trading conditions.

Many clients report:

"I became involved, seeing my account growth, but when I attempted to withdraw, I faced significant delays and misleading reasons for non-fulfillment."

Customer Support Analysis

Customer support should be a priority for any broker, yet Golden FX appears lacking.

Numerous complaints highlight slow response times and ineffective support channels when clients reach out for help regarding their accounts or withdrawal requests. Feedback indicates that calls often go unanswered, and support tickets remain open without resolution.

Conclusion

In closing, while Golden FX may offer a range of financial products and attractive leverage options, the numerous associated risks raise substantial concerns. The lack of regulatory oversight, prevalent withdrawal issues, and minimal transparency suggest that prospective traders should exercise extreme caution when considering this broker.

It is vital for traders—especially novices—to thoroughly evaluate their options and prioritize working with regulated brokers that ensure the safety of their investments while providing a fair trading environment.